In the grand tapestry of finance, threads of various hues and textures interweave. Amidst this vibrant array, long-term investing is a uniquely strategic approach.

This form of investing is akin to a seasoned gardener patiently nurturing a seedling, understanding that true beauty and strength take time to unfold. It’s not about the adrenaline rush of quick wins or the allure of momentary trends. Instead, it’s about the art of patience, the science of foresight, and the wisdom of endurance.

Long-term investors are like sagacious chess players, thinking several moves ahead. They invest directly into companies for what they are today and what they can become years, even decades later.

This requires a deep understanding of a company’s fundamentals, industry, and the broader economic landscape.

Long-Term Investments | Glossary

The short-term oscillations of the stock market do not sway these investors; they are the quiet observers, the thinkers who see beyond the immediate horizon. In a world where the present often overshadows the future, long-term holding is a testament to the enduring power of vision and resilience.

It’s an approach that asks us to consider the fleeting moments and the legacy of our financial decisions.

Long-Term Investing in the Stock Market

Long-term holding for stock market returns is akin to a nautical journey through a vast ocean guided by endurance and strategic foresight.

Investopedia defines this approach as a “strategy that entails holding investments for more than a full calendar year.”

Unleashing The Bulls | Economic Times

It involves selecting stocks or mutual funds with potential growth over many years, focusing on companies with solid fundamentals and a vision for future returns. It requires a mindset that views investing as a marathon, embracing patience, discipline, past performance, and the ability to see beyond short-term market fluctuations.

Central to this method is the power of compounding, where reinvested earnings generate their returns, potentially leading to exponential growth in investor returns over time.

Investing for the long term also involves thoughtful equity portfolio construction and diversification, balancing risk and return according to individual goals and tolerance. This approach is about picking winning stocks and understanding and growing with the market through strategic, long-term planning.

If you are unsure whether or not now is the time to invest for the long haul, check out our video here to learn more about the current conditions of the stock market.

Why Use A Long-term Investment Strategy

Adopting a strategy for the long term can offer several significant benefits, making it an appealing approach for many investors:

Compounding Returns

One of the most potent advantages of adopting a long-term holding strategy is the benefit of compounding capital gains. When you reinvest the returns from your investments, you earn returns on your returns, leading to exponential growth over time. This effect becomes more potent the longer you stay invested.

:max_bytes(150000):strip_icc()/compounding.asp-final-11c1b77f605d4ed0a317f0cf32c73b3f.png)

Compounding Interest | Investopedia

Reduced Impact of Market Volatility

Short-term market fluctuations can be stressful and lead to impulsive decision making. A long-term perspective allows investors to ride out the highs and lows of the market, as history shows that markets tend to increase in price over a longer period.

Lower Transaction Costs

Frequent trading can incur significant costs, including brokerage fees and taxes, affecting your returns. Buying the same stock with plans to hold well into the future typically involves fewer transactions, reducing these costs.

Benefit from Economic Growth

Economies tend to grow over long periods, increasing corporate earnings and stock values. Long-term buyers are well-positioned to benefit from this growth.

Time to Recover from Downturns

Investing long-term provides the time for financial markets to recover from market downturns. Historically, while markets have experienced declines, they have generally rebounded and continued to grow.

Less Time-Consuming

Unlike active trading, which requires constant market monitoring and decision-making, long-term buying on the market requires less frequent intervention once an initial investment strategy is set.

Time Consumption | Forbes

Capitalizing on Dividends and Interest

Long-term assets, especially those dividend-paying stocks, can provide an additional income stream. Over time, reinvesting these earnings can significantly contribute to the growth of your investment.

Emotional Trading

Long-term strategies can be less stressful as they avoid the emotional rollercoaster associated with the short-term perspective of constantly reacting to business news and events.

Strategic Investment Choices

A long-term investor encourages thorough research and consideration before making investment choices, focusing on investments’ fundamental value and potential rather than short-term trends.

A long-term strategy is about looking beyond the immediate noise and focusing on the bigger financial picture and future results, which can lead to positive results and greater financial growth and stability over time.

Dollar Cost Averaging

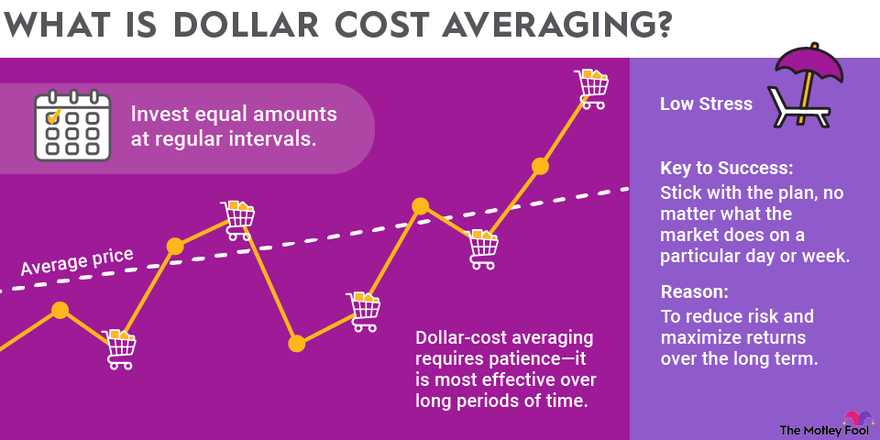

Dollar-cost averaging (DCA) is a strategic approach that fits seamlessly into long-term philosophy.

Forbes explains DCA as “a strategy to manage price risk when buying stocks, exchange-traded funds (ETFs) or managed funds. Instead of purchasing shares at a single price point with dollar cost averaging, you buy in smaller amounts at regular intervals, regardless of price.”

At its core, DCA involves regularly investing a fixed amount of money into a particular investment, regardless of the market’s ups and downs. This strategy is particularly effective for long-term investors for several reasons.

The beauty of DCA lies in its simplicity and power to reduce the impact of market volatility. By investing a consistent amount at regular intervals – say, monthly or quarterly – you buy more shares when prices are low and fewer when prices are high. Over time, this can lead to an average annual return and a lower average cost per share, as you’re not trying to time the market for the ‘perfect’ entry point.

What is Dollar-Cost Averaging? | The Motley Fool

For long-term investors, DCA offers a disciplined and emotion-free approach to building wealth. It aligns well with the long-term investment ethos, which emphasizes steady growth and the avoidance of impulsive reactions to short-term market fluctuations. Additionally, this approach can be particularly advantageous for those who might not have a large sum to invest initially, allowing them to build their assets over time gradually.

In essence, DCA serves as a tool to help investors stay committed to their long-term investment strategy, avoiding the pitfalls of market timing and reducing the stress of making investment decisions based on market conditions. It’s a method that underscores the long-term investor’s belief in consistent, disciplined investment as a path to financial growth and stability.

Benefits of long-term investing

The long-term strategy offers several benefits but also comes with inherent risks. Understanding these can help investors make informed decisions aligned with their financial goals and risk tolerance.

Here are some of the benefits associated with the long-term approach:

Compounding Returns: Over time, the returns earned on investments can be reinvested to generate their returns, a process known as compound interest. This positive return can lead to significant growth in the value of assets over the long term.

Reduced Impact of Market Volatility: This strategy allows individuals to ride out the market’s short-term fluctuations.

Opportunity for Recovery: In the case of market downturns, long-term investments have more time to recover. This is particularly important when dealing with market cycles and economic downturns.

Lower Transaction Costs: Long-haul investing typically involves fewer buy and sell transactions, which means lower brokerage fees and tax costs.

Emotional Stability: Investors can avoid the emotional stress of frequent trading by focusing on long-term capital gains and not reacting to short-term movements.

Emotional Stability | Linkedin

Benefit from Economic Growth: Over extended periods, the economy’s growth can positively influence corporate earnings and, consequently, stock prices.

If you’d like to learn more about the benefits of long-term investing, click here.

Risks of Long-Term Investing

Here are some of the risks of investing in the long term:

Market Risk: The risk that the price of investments will decrease due to market factors. Over an extended period, various economic, political, and social events can impact the market.

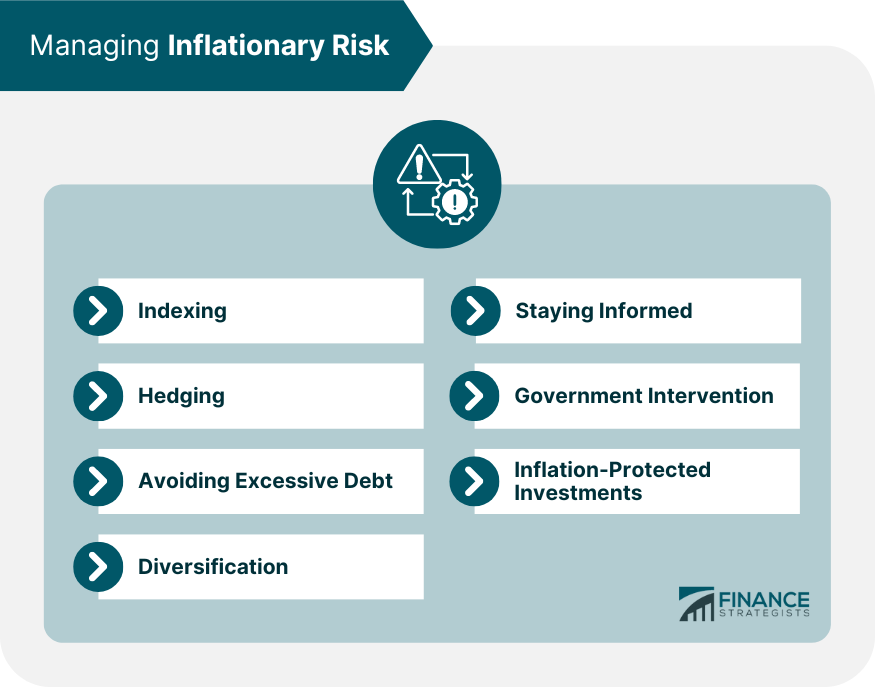

Inflation Risk: The risk that inflation will erode the purchasing power of returns. Over time, if the investment’s return does not outpace tax rate and inflation, it can lead to a loss in real terms.

Inflationary Risk | Finance Strategist

Opportunity Cost: Money invested long-term is tied up and cannot be used for other potential investment opportunities that may arise.

Liquidity Risk: Some long-term investments may lack liquidity, making it challenging to sell them without significantly impacting their price.

Company or Sector-Specific Risks: Investing in specific companies or sectors for the long term carries the risk of unforeseen events negatively impacting those areas.

Regulatory and Political Risks: Changes in government policies, regulations, or political instability can affect investment markets and sectors.

Technological and Market Changes: Over a long period, technological advancements and changes in consumer behavior can render certain industries or companies less profitable or obsolete.

Invest In The Long-Term

Buying long-term stocks is an approach that values patience, foresight, and resilience, mirroring the careful nurturing of a garden or the strategic moves in a game of chess. It’s about focusing on the potential future value of stocks and investments rather than short-term fluctuations. Strategies like dollar-cost averaging play a crucial role in this approach, offering a disciplined way to build wealth while reducing the impact of market volatility.

Short-Term Pain for Long-Term Gain | Modern Money

While the benefits of investing over a more extended period include compounding returns, lower transaction fees and costs, and alignment with significant financial goals, it’s essential to acknowledge the risks involved. These include market and inflation risks and the potential for economic and sector-specific changes. This investment strategy calls for a holistic understanding of its rewards and risks. For investors who are expanding their own strategy for financial gain, check out our blog post to discover six sustainable investing strategies to add to your bag!

Ultimately, long-term investing transcends mere financial tactics; it embodies a commitment to a vision that looks steadfastly toward the future. This approach paves the way for significant growth and stability, rewarding those who approach their financial journey with patience and strategy. As you broaden your investment horizons, consider embracing long-term investment strategies as a key to growing your wealth and deepening your understanding and knowledge of the intricate world of investing.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.