Our investment choices take on newfound significance in a world grappling with climate upheaval, social inequities, and ecological decline. Enter sustainable investing, a financial strategy that seeks to generate healthy returns and aims to impact the planet and society positively.

This approach has been gaining momentum in recent years as investors around the globe recognize the importance of aligning their financial goals with their values.

Growth In Sustainable Investments | Earth

What Is Sustainable Investing?

Sustainable investing, also known as socially responsible investing (SRI), ethical investing, or impact investing, is an investment strategy that goes beyond traditional financial metrics.

When selecting investments, it considers environmental, social, and governance (ESG) factors. These factors encompass a wide range of issues, such as climate change, human rights, labour, ethical business practices, and corporate ethics.

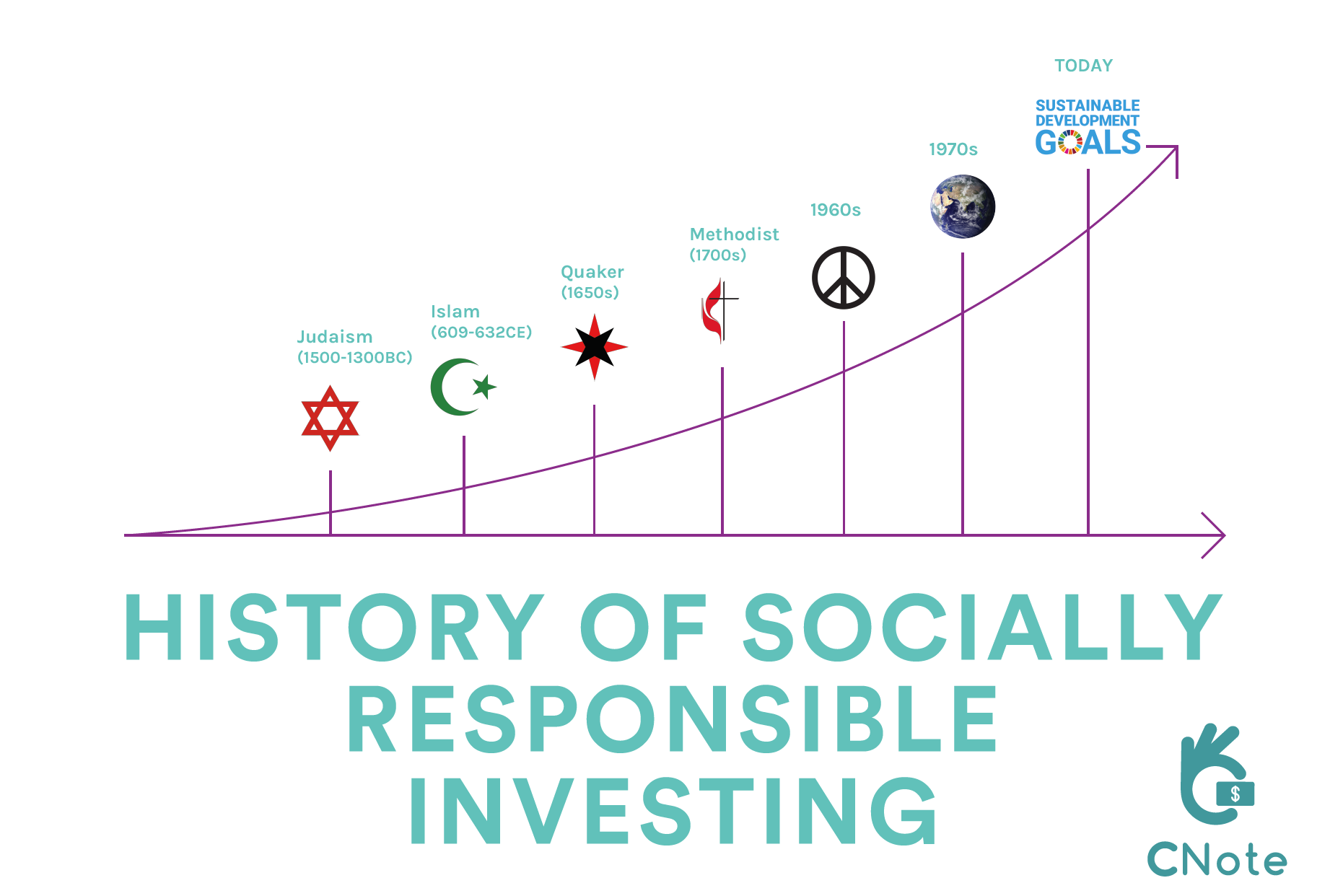

History Of SRI | CNote

The primary goal of sustainable investing is to support companies and initiatives that contribute positively to society and the environment while avoiding those that have a detrimental impact.

This approach allows investors to align their portfolios with their personal values and beliefs, reflecting a broader commitment to a more sustainable and equitable world

Why Sustainable Investing Matters

There are three main reasons why sustainable investments are important:

#1 Environmental Impact

Sustainable investing supports businesses and projects that prioritize sustainability and environmental responsibility. By allocating capital to green initiatives, such as renewable energy, clean technology, and conservation efforts, investors can contribute to the fight against climate change.

#2 Social Responsibility

Beyond the environment, sustainable investing promotes social justice and ethical business practices. It directs capital towards companies prioritizing fair labour practices, diversity and inclusion, and community engagement, fostering a more equitable society.

#3 Financial Returns

Contrary to the misconception that sustainable investing sacrifices returns, numerous studies have shown that ESG-conscious portfolios can perform just as well, if not better, than traditional investments over the long term. This suggests that sustainable investing can offer competitive financial gains while also aligning with ethical and sustainable principles

ROI | Investopedia

6 Sustainable Investing Strategies

Green investing strategies encompass a variety of approaches that allow investors to align their financial goals with their values and contribute to a more sustainable and responsible future. Here, we’ll introduce six key sustainable investing principles and practices:

Negative Screening

In the context of investing sustainably, negative screening is a strategy where investors intentionally exclude certain industries, sectors, or companies from their investment portfolios based on predefined criteria.

This approach is used to align investment choices with specific ethical, social, or environmental values, and it is sometimes referred to as “ethical exclusion” or “exclusionary screening.” The goal of negative screening is to avoid investing in activities or businesses that are considered harmful or ethically wrong by the investor.

Negative Screening | Linkden

Negative screening is just one of the various strategies employed in sustainable investing to align investment choices with ethical and sustainability goals.

It complements other approaches like positive screening (favouring companies with strong ESG performance) and engagement with companies to drive positive change. Ultimately, the choice of strategy depends on the investor’s values, objectives, and the impact they want their investments to have on the world.

Positive Screening

Positive screening is a fundamental strategy that many sustainable investors use; it involves selecting investments based on predefined criteria that promote ESG criteria, thereby aligning portfolios with ethical and sustainability principles.

Unlike negative screening, which excludes certain industries or companies, positive screening focuses on actively including businesses that excel in ESG performance, such as renewable energy. If you’d like to learn more about analyzing stocks in the renewable energy sector, click here.

This approach encourages and supports companies and initiatives that positively impact society, the environment, and corporate governance.

Positive screening is a sustainable investing strategy that contributes to a more responsible and sustainable global economy. It complements other approaches like negative screening (avoiding investments in harmful industries) and shareholder engagement (actively participating in dialogues with companies to drive change).

ESG Investing

ESG investing, in the context of sustainable investing, refers to the systematic and deliberate incorporation of environmental, social, and governance (ESG) factors into the investment analysis and decision-making process.

When evaluating investment opportunities, the strategy aims to assess and integrate these non-financial considerations alongside traditional financial metrics.

ESG investing seeks to enhance the risk assessment and potential returns of investments by considering their impact on environmental sustainability, social responsibility, and corporate governance practices.

Want to learn more about the importance of ESG investing? Check out our post here.

ESG Investor | Visual Capitalist

ESG integration is seen as a way to promote sustainable and responsible investing while still aiming for competitive returns. It acknowledges that a company’s financial performance is intertwined with its approach to environmental, social, and governance issues. By incorporating ESG factors into investment analysis, investors seek to make more informed investment decisions that align with their values and contribute to a more sustainable and equitable future.

Thematic investing

According to Charles Schwab, Thematic investing involves targeting specific themes or trends related to environmental, social, or governance (ESG) issues and constructing investment portfolios around these themes. It allows investors to focus on areas that align with their sustainability goals and values while also potentially benefiting from the growth and impact associated with those themes.

Thematic Investing | Winvesta

Investors using this strategy have a more direct and focused impact on sustainability issues beyond the broader ESG integration strategies that consider a wide range of factors. However, it’s essential for investors to carefully assess both the potential returns and risks associated with their chosen themes and to stay informed about developments in those areas.

Sustainable Sector Investing

Sustainable sector investing, also known as sector-specific or industry-focused sustainable investing, involves targeting specific sectors or industries that are deemed to have a positive environmental, social, or governance (ESG) impact or align with sustainability goals.

This approach allows investors to own sustainable funds and build portfolios around industries they believe contribute to a more sustainable and responsible future while aiming for substantial returns.

Sustainable sector investing provides investors with a focused and targeted approach to sustainable investing, allowing them to support specific industries that resonate with their values and objectives. It’s a way to directly impact sustainability issues and contribute to positive change within sectors aligned with sustainability goals.

Impact Investing

Impact investing is an investment approach that seeks to generate both income and positive, measurable social or environmental impacts.

Impact Investing | CNote

Unlike traditional investing, where the primary goal is to maximize financial returns, impact investing prioritizes investments that aim to make a difference in addressing societal or environmental challenges. This approach aligns financial objectives with a commitment to creating meaningful and measurable change in the world.

Impact investing has gained significant traction in recent years as investors increasingly recognize the potential to combine financial success with positive societal and environmental outcomes. It represents a growing movement toward more responsible and purpose-driven investing that seeks to create a better, more sustainable future while generating returns for investors.

If you’re looking for an impact investment that focuses on plant-based products, check out our video on The Very Good Food Company.

Invest Sustainably

If you’re considering sustainable investing, here are some steps to get started:

Define Your Values

Clarify your sustainability priorities. Are you more concerned about environmental issues, social justice, or corporate governance? Knowing your values will help guide your investment choices.

Research and Education

Familiarize yourself with ESG criteria and sustainable investment options. Many online resources and financial advisors can provide valuable information.

Review Your Portfolio

Assess your current investments to determine if they align with your sustainability goals. You may need to reallocate or divest from certain assets.

Seek Professional Advice

If you’re unsure where to begin or want personalized guidance, consult a financial advisor specializing in sustainable investing.

Investing For A Better Future

In essence, sustainable investing is more than a financial strategy; it is a potent tool for shaping a better world through social responsibility and environmental impact.

Investing in companies and initiatives through methods like negative and positive screening, ESG analysis, impact investing, sustainable sector strategies, or thematic investing offers the opportunity to foster a more sustainable and just global landscape, all while potentially reaping competitive financial rewards.

Sustainable practices encourage us to make investment choices that resonate with our values, fostering a future that is not only financially rewarding but also more sustainable and equitable. So, as you embark on your journey of sustainable investing, remember that this path is not just about maximizing profits; it’s about maximizing positive impact, a win-win approach that allows you to invest in a brighter world for both yourself and future generations.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.