Investing in 2022 was challenging, to say the least. Inflation soared, and interest rates crept upwards, putting strong downward pressure on financial markets.

Growth stocks, which outperformed during the pandemic, were soon the biggest losers in almost every investor’s portfolio.

This underperformance of growth equities doesn’t necessarily mean investors should shy away from these assets as we enter 2023. However, it does mean we (as prudent investors) should better define our investment objectives and strategize on how to allocate our capital.

A great way to invest in high-growth equities while also mitigating the risk associated with investing in higher growth/higher risk assets is to focus on aggressive growth mutual funds.

What is an Aggressive Growth Mutual Fund?

To begin, let’s first define what a mutual fund is.

A mutual fund is a type of investment vehicle that’s managed by a professional fund manager whose job is to make investment decisions and maximize returns for investors.

Mutual funds collect money from multiple different investors and invest this pooled capital into various asset classes like stocks, bonds, cryptocurrencies, and/or money market indexes.

An aggressive growth mutual fund, then, is an investment vehicle that targets investments that are showing promising revenue and earnings growth.

Fund managers of aggressive growth funds usually focus on companies that are leveraging cutting-edge technology and operating in a large and growing industry.

These growth funds take on higher risk than other mutual funds and, in return, have an investment objective of achieving an above-average return.

Why Invest in Aggressive Growth Funds?

The goal of any growth fund is to return value to shareholders through capital appreciation.

However, an aggressive growth fund isn’t for everyone, as this investment style carries significantly greater risk than other investing opportunities. More specifically, a growth fund invests mainly in stocks that are newer companies that have yet to prove they can be profitable on a consistent and long-term basis.

These firms are often characterized by higher valuations, are utilizing a new technology that has yet to be proven feasible, and are taking greater risks than other companies to achieve above-average growth.

So why invest in an aggressive growth fund? There are multiple reasons why right now presents an excellent opportunity for growth-focused mutual funds:

High Return

Simply put, growth funds present a significant opportunity for investors to earn an above-average return by targeting businesses that are showing signs of extreme growth potential.

Whereas other investment styles may focus on companies that provide dividends or whose share price is more stable, growth funds are searching for businesses that will achieve exponential growth in the coming years, which in turn provides greater returns for investors.

Hands-off Investing

Another benefit to investing in an aggressive growth mutual fund is that you won’t have to worry about making investment decisions yourself. A professional money manager will perform the research and allocate your capital for you.

Growth Stock Valuations Reduced

Right now could be an opportune time for long-term investors to add beaten-down growth stocks to their portfolios, as the valuations of these companies have dropped significantly throughout 2022, leading to very attractive entry points for investors.

When it’s all said and done, the most important thing to remember when considering investing in a growth fund is to keep a long-term mindset. Understand that your investments will be more volatile than the total stock market index and be comfortable with taking on more risk.

There are numerous different growth funds to choose from in today’s market, and understanding the key differences between these funds is critical before deciding to invest.

With this in mind, we’ll break down the key elements to consider when deciding which aggressive growth mutual fund is right for you.

How to Choose the Right Aggressive Growth Fund For You

When making any investment decision, extensive due diligence should be conducted. And when looking at choosing the right aggressive growth mutual fund, there are three main considerations investors should be aware of:

1.) Investing Style

As previously mentioned, the goal of any growth mutual fund is capital appreciation. However, how a fund accomplishes this goal can be very different.

Some mutual funds will invest solely in technology stocks, whereas others will emphasize consumer staples. Some will invest with a time horizon of 10 years, whereas others will make decisions based on only a few months.

Understanding the focus and style of the aggressive growth fund you’re considering is extremely important before allocating your capital.

Make sure that the investment style aligns with what you’re comfortable with and matches your investing time horizon.

2.) Fees

All mutual funds make money by charging fees to clients.

Understanding this fee structure and associated expense ratio is critical before investing.

Usually, funds will charge either front-end or back-end “load fees,” which can get as high as 8.5% in some cases. Other funds will have lower fees but higher management expenses.

Make sure to research the associated fees and expense ratios an aggressive growth fund has before investing.

3.) Fund Manager & Past Performance

Past performance is not an indication of future results. However, when looking at potential aggressive growth funds, it’s important to look at past results, who is managing the fund, where their experience comes from, and many other factors like expected volatility or periods of unusual inflows or outflows.

In the past, some money managers whose funds performed poorly would rename their growth fund in order to distract investors from their previous poor performance.

That’s why investors should ensure they perform proper research on not only the performance of the growth fund but also on who will be responsible for managing their money.

3 Aggressive Growth Mutual Funds to Invest In

Now that we have a better understanding of aggressive growth mutual funds, let’s take a look at 3 potential growth funds for investors to consider.

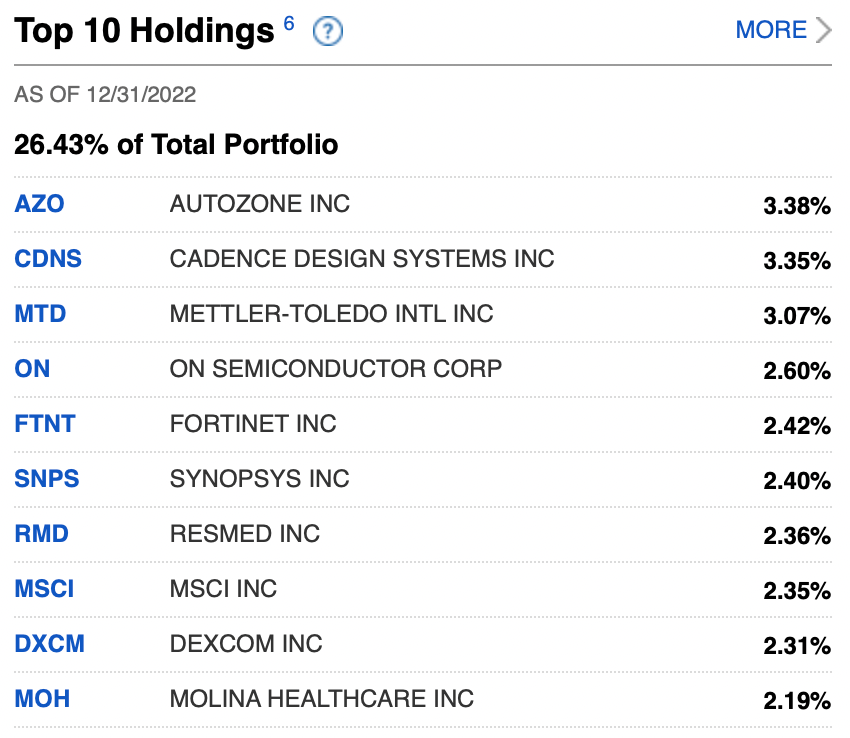

1.) Fidelity Growth Strategies Fund (FDEGX)

This aggressive growth fund invests primarily in common stocks of domestic and foreign issuers that management believes offer potential for accelerated earnings or revenue growth.

FDEGX has an expense ratio of 0.84 and a 10-year performance of 11.47%.

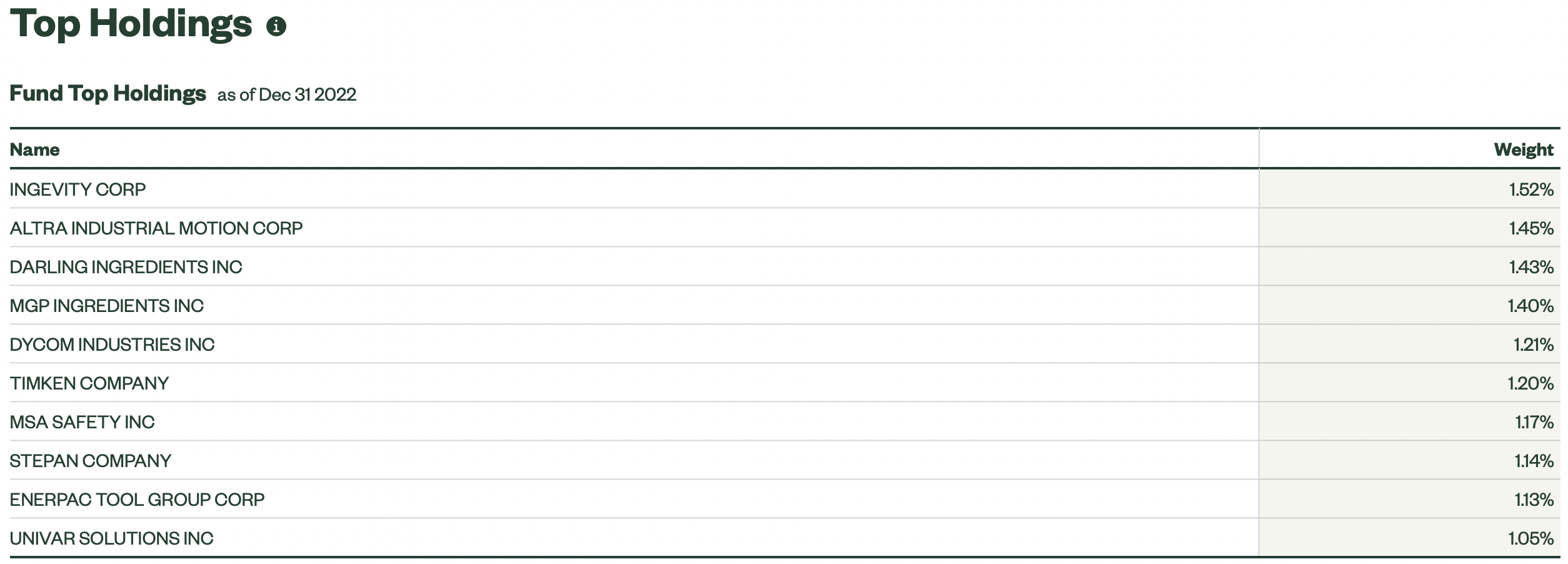

2.) State Street Institutional Small-Cap Equity Fund (SSQSX)

The State Street Small-Cap Fund is an aggressive growth fund with a different management style compared to other traditional growth funds.

More specifically, this growth fund uses a multi-sub-adviser investment strategy that combines high growth, value, and core investment management styles.

The Fund invest around 80% of its assets in equity securities of small-cap companies.

The investment adviser will allocate the fund’s assets among the sub-advisers to maintain exposure to a combination of investment styles but may also have larger allocations to certain sub-advisers based on its assessment of the potential for better performance.

SSQSX has an expense ratio of 1.04 and a 10-year performance of 8.46%.

3.) Carillon Eagle Mid Cap Growth Fund (HAGAX)

Started in August 1998, this fund is managed by Heritage Asset Management. Eagle Asset Management serves as the sub advisor to the fund.

This mutual fund typically invests at least 65% of its total assets in equity securities of companies that may have significant high growth potential. The fund doesn’t limit itself to investing in specific sectors or industries. Instead, they will invest capital where they see the most opportunity.

HAGAX has an expense ratio of 1.03 and a 10-year performance of 11.99%.

Final Word

Aggressive growth funds are great for investors who are willing to take on more risk, have a longer investing time horizon, and are willing to ride out periods of high volatility.

However, before choosing a growth fund, investors should understand the fund management structure, associated fees, fund holdings, and past performance.

Unfortunately, not every aggressive growth fund is made equal, which makes it essential for investors to perform proper research before investing.

Here we’ve provided a short list of potential aggressive growth funds to help investors begin their research and find the investment style that’s right for them.