Image Source: Why Should You Own Cybersecurity Stocks in Your Investment Portfolio? | Analytics Insight

For decades, the global economy has been transitioning online.

First, came the internet, which opened the world up to a connected place where consumers could find information, order things online, and interact with people across the globe. The next digital revolution came from the cloud, where businesses are now moving their entire operations into a digital warehouse. And while this has greatly increased efficiency and lowered costs, it has also opened up businesses to a variety of cyber breaches.

Today, we have two major transitions. The first was a byproduct of the global pandemic. As quarantines forced people to stay inside, businesses pivoted to work-from-home initiatives, which allowed economies to keep functioning, however it also provided another avenue for hackers to gain digital entry. The other trend is the proliferation of cryptocurrency, which although shows promise for a variety of use cases, has become a favourite amongst hackers, as crypto enables criminals to receive payment from their illegal efforts in a secure and anonymous way.

All this, has made innovative cybersecurity companies as a downright necessity in today’s world.

However, with cybersecurity stocks reaching all time highs and as more companies enter the field, has left many investors wondering if they’re too late to invest in the industry.

Today, were going to be going over why the cybersecurity industry is only just beginning its growth trajectory, the economic cost of cyber attacks today, and highlight some of the best cybersecurity stocks investors should be targeting as we move forward.

The Rise of Cyber Breaches

Image Source: Why General Counsel Needs to Play an Active Role in Data Breaches | DiliTrust

The escalating threat of cyber attacks is exerting an increasing economic and social toll. According to Acronis (a cybersecurity software company) global ransomware attacks are expected to cost a whopping $30 billion in 2023.

Similarly, IBM is reporting the total costs of a ransomware attack is averaging $4.5 million per incident, including additional expenses like legal and consulting fees, system upgrades, and regulatory fines.

George Kurtz, CEO of CrowdStrike, offers a grim outlook on the the ability for companies to protect themselves from digital threats, stating, “The current environment is probably one of the worst I’ve seen.”

He goes on to highlight the significant increase in the speed of hacking over the past 18 months, with average “breakout time” – the time it takes for hackers to start moving across corporate systems after breaching security – to be just 79 minutes, with top hackers able to penetrate systems in as little as 7 minutes.

The unfortunate reality is that cyber attacks are becoming a constant in corporate life. Sophos, another cybersecurity software firm, notes that an estimated 72% of companies with over $5 billion in annual revenue have been targeted in the past year alone.

Finally, Chainalysis, a crypto data firm, estimates that hackers could potentially collect $1 billion in ransoms this year, surpassing the total for 2018 through 2020 combined.

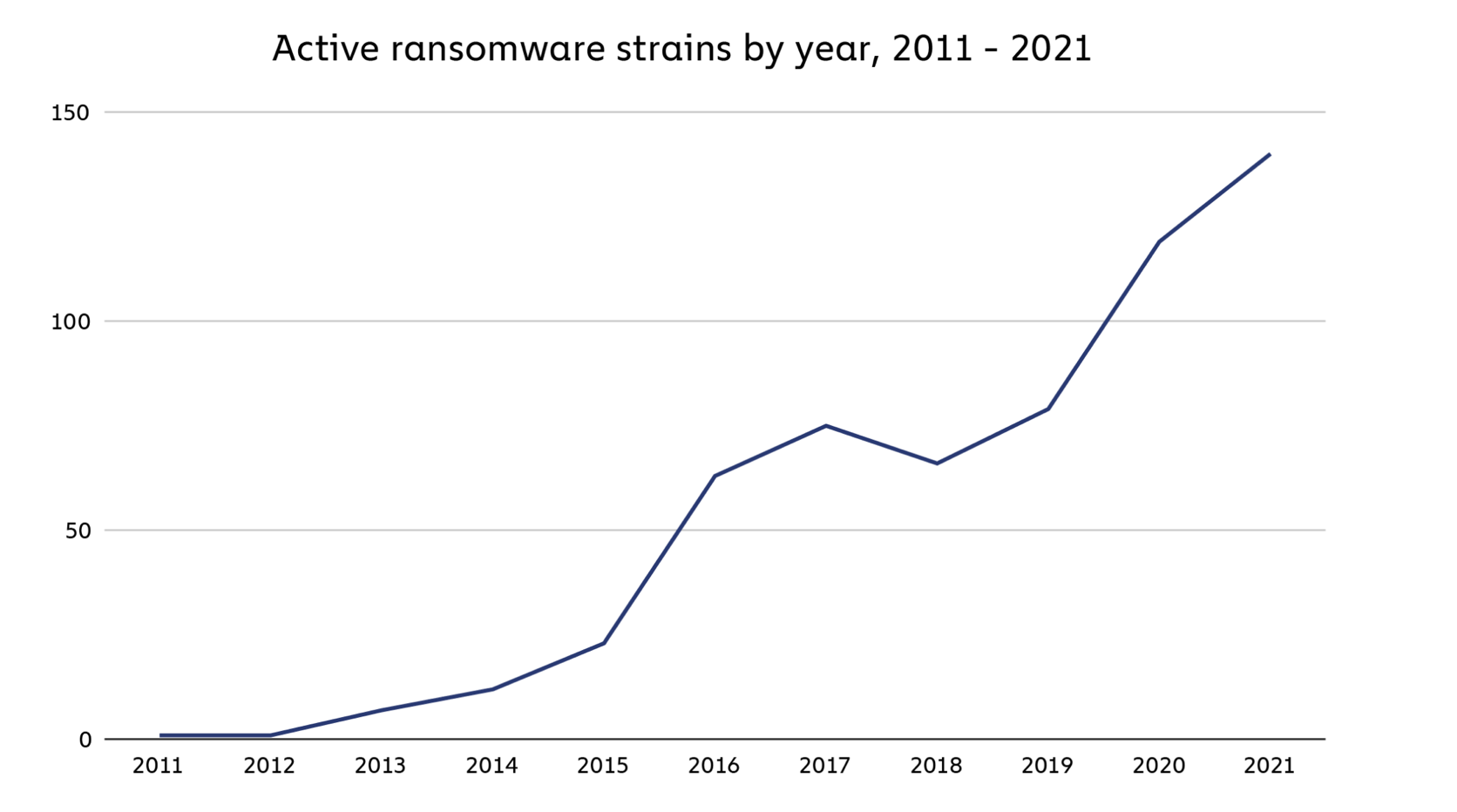

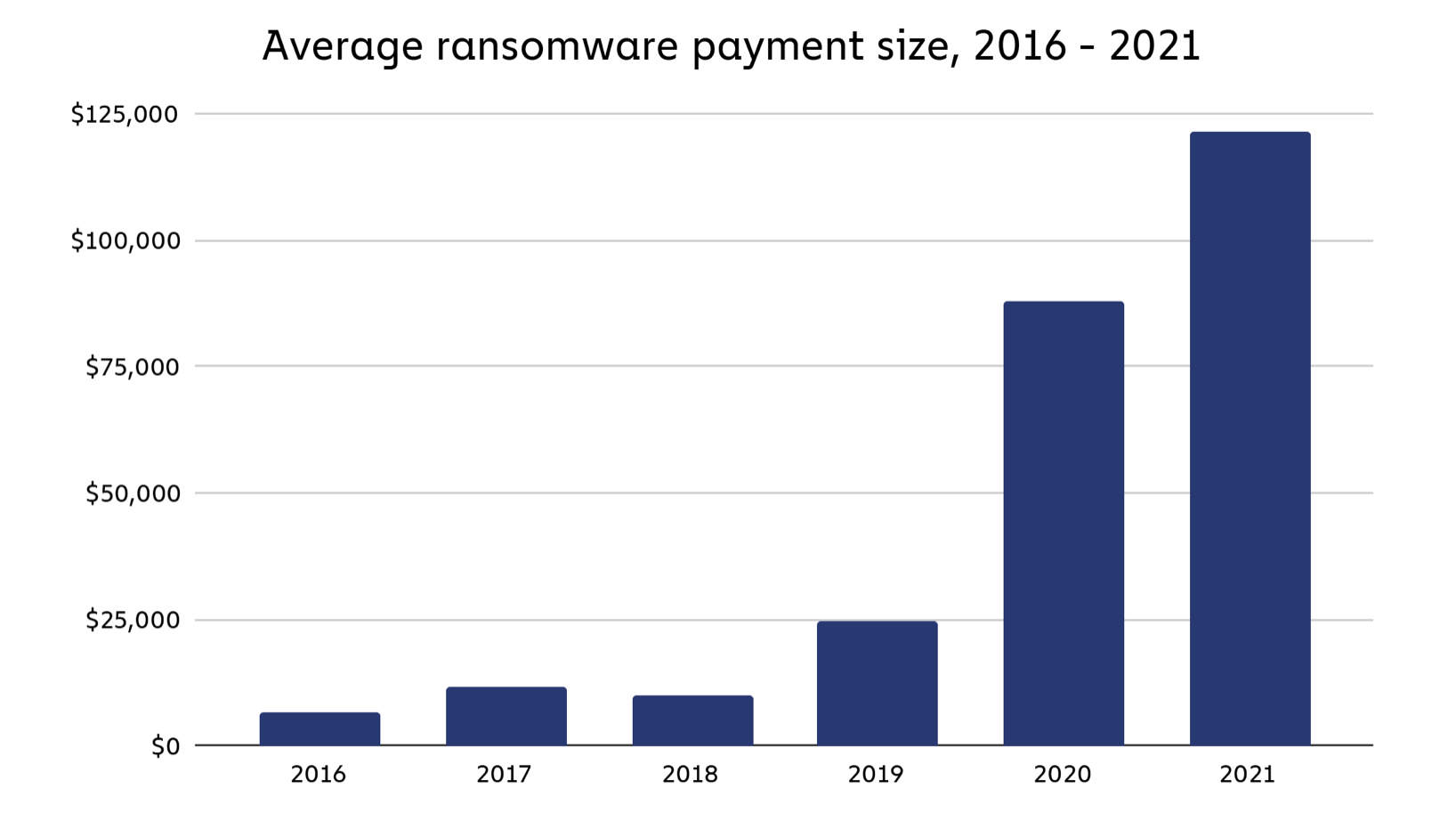

The two charts below further emphasizes the growing problem of cyber attacks, showing the almost exponential increase in active ransomware strains from 2011 to 2021. And the average payment to ransomware attackers since 2016 to 2021.

These charts paint a grim picture for businesses as they continue to use cloud computing solutions, as well as other digital based systems that are vulnerable to various cyber attacks.

Image Source: Active ransomware strains by year, 2011 – 2021 | Chainanalysis

Image Source: Average ransomware payment size, 2016 – 2021 | Chainanalysis

The silver lining to the current epic rise in cyber attacks, is the opportunity it presents to investors in finding top tier companies focusing on important trends such as cloud security, data center security, zero trust security, and endpoint security.

All these elements are becoming the forefront of the cybersecurity industry, and as we will look at in the next section, will become pockets of the sector where growth will continue to rise at an impressive rate.

Cybersecurity Market Future Outlook

Research firm Piper Sandler recently released their 2024 enterprise spending report. In this report, the firm surveyed close to 100 Chief Information Officers (CIO) to understand their budgeting priorities for technology in the upcoming year, focusing on different vendors and market sectors.

The report highlighted that security is becoming a top priority among technology purchasers. The Chief Information Officers emphasized the increasing severity of cyber breaches and the potential for more stringent government regulations.

The survey also revealed that a significant majority, nearly 90% of the CIOs, are planning to allocate more funds to security measures next year. Notably, about one in five of these respondents indicated their intention to boost their security spending by over 25%.

This report is a great barometer for the short term outlook of the cybersecurity industry. Especially amidst a backdrop of economic uncertainty and some technology companies reporting recent layoffs.

In short, cybersecurity appears to be an industry that will not experience a slowdown (regardless of where the economy goes), as businesses prioritize protecting their critical data from hackers.

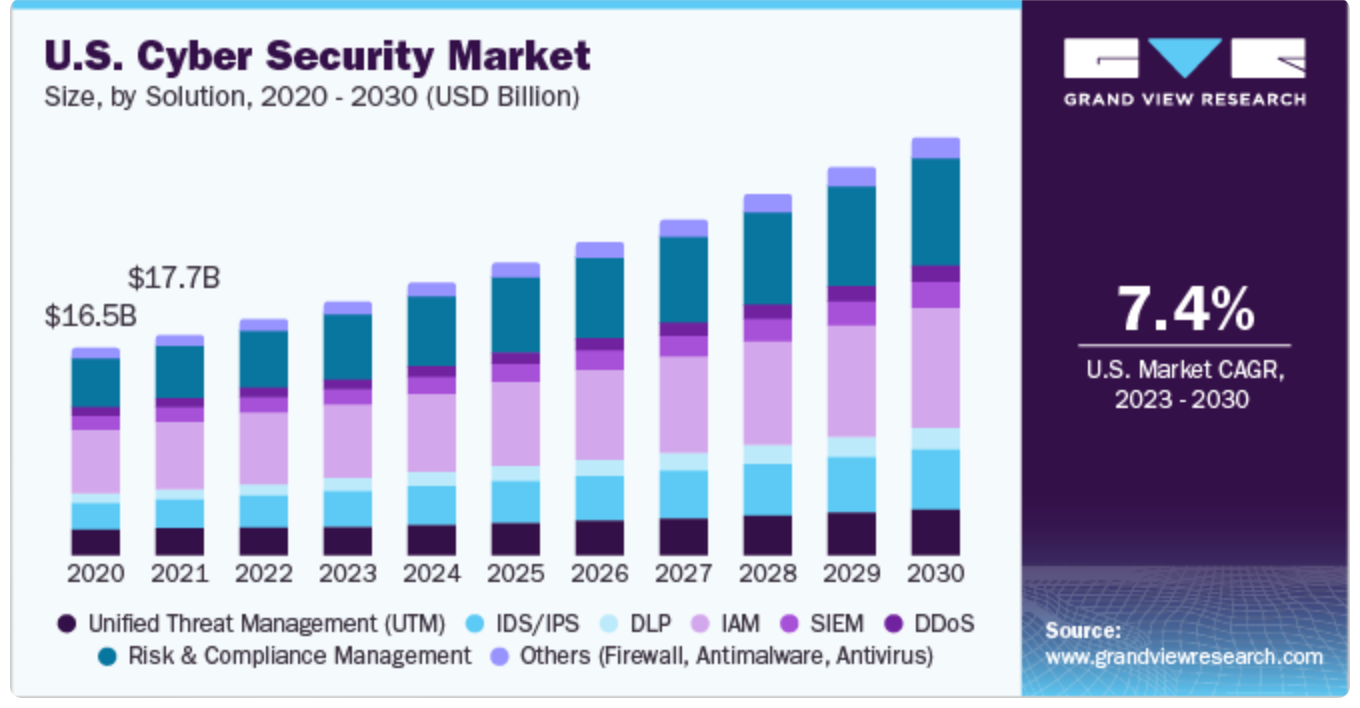

Longer term, and the outlook shows even more promise. The chart below shows the estimated industry growth estimate from 2021 to 2030.

With an expected annualized growth rate of nearly 8%, the sector will hit $500 billion by 2030. More specifically, endpoint security and protection against unauthorized access will be key focal points as the industry evolves.

Image Source: U.S Cyber Security Market Expected Growth | Grandview Research

In other words, cybersecurity, in both the near and long term, has great potential as firms realize the importance of investing into the digital infrastructure that will stop and detect security breaches.

Meaning, that while cybersecurity stocks have seen their share prices rise significantly in recent years, the opportunity to invest within the industry still looks promising.

4 Best Cybersecurity Stocks (and 1 ETF)

Knowing the industry is growing is one thing, however finding the right companies that are capitalizing on current trends is another.

Below, we have highlighted four companies (of varying market caps) and 1 ETF for investors to consider, on the basis of these firms standing at the forefront of providing a security platform that will protect their users from sophisticated cyber attacks.

Crowdstrike Holdings (CRWD)

Image Source: CRWD Stock Price and Chart — NASDAQ:CRWD | TradingView

Crowdstrike stands at the tipping point of two major trends in today’s world, cybersecurity and artificial intelligence.

The company created its Falcon Platform which enables them to identify and block known and unknown threats by analyzing and correlating billions of events in real-time. The platform’s cloud-based architecture also allows for rapid deployment and scalability, making it suitable for organizations of all sizes.

One of CrowdStrike’s key innovations is its use of the “Threat Graph,” a sophisticated graph database that processes, correlates, and analyzes vast amounts of data from millions of sensors deployed worldwide. This database provides comprehensive threat intelligence, enabling the platform to identify patterns and indicators of cyber attacks more efficiently.

CrowdStrike also focuses heavily on endpoint detection and response (EDR). The Falcon platform continuously monitors and records all activities at endpoints, allowing security teams to detect, investigate, and respond to threats in real-time. This capability is crucial for identifying and mitigating advanced persistent threats (APTs) and insider threats.

In the companies most recent quarter, Crowdstrike reported a revenue of $786 million and an adjusted profit of 82 cents per share.

More importantly, the company now anticipates full-year revenues to be about $3.05 billion, with adjusted profits expected to be between $2.95 and $2.96 per share. This is a notable increase from its second-quarter forecast, which predicted revenues in the range of $3.03 billion to $3.04 billion and adjusted profits between $2.80 and $2.84 per share.

Their third quarter saw a 35% year-over-year increase in annual recurring revenue, reaching $3.15 billion, with $223.1 million of this being newly added revenue in the quarter.

The company has a solid balance sheet, manageable debt levels, and incredible free cash flow. Pair this with upward revisions for the coming calendar year and Crowdstrike should continue to lead the industry higher.

Palo Alto Networks (PANW)

Image Source: PANW Stock Price and Chart — NASDAQ:PANW | TradingView

Palo Alto Networks, is another major player in the industry, offering a wide range of security products and services designed to protect enterprises, service providers, and government entities from cyber threats. To give a brief overview of what Palo Alto does best, below is a snapshot of the major services they offer:

- Next-Generation Firewalls (NGFWs): These are cornerstone products of Palo Alto Networks, providing network security by allowing or blocking network traffic based on a defined set of security rules. Their NGFWs are known for their ability to identify and control applications, users, and content, not just IP addresses and ports.

- Cloud Security: Palo Alto Networks provides comprehensive cloud security solutions, including Prisma Cloud, which offers visibility, data security, threat detection, and compliance management across various cloud environments like AWS, Azure, and Google Cloud Platform.

- Secure Access Service Edge (SASE): This integrates networking and network security services into a single cloud-delivered service, combining SD-WAN capabilities with network security functions.

Financially, Palo Alto is as strong as ever. The company has revenue and market cap of $7.21 billion and $94 billion, making this a large cap stock with a pricey valuation.

However, with year-over-year revenue growth of 20%, operating cash flow of $3 billion, and an operating margin of near 12%, this cybersecurity stock has the market positioning and business model to return impressive value to shareholders in the coming years.

Sentinel One (S)

Image Source: Sentinel One – Why Security Matters. | Pund-IT

SentinelOne, established in 2013, is a relatively new player in the cybersecurity field, specializing in autonomous endpoint protection.

It distinguishes itself with an AI-driven Endpoint Protection Platform (EPP) that addresses increasingly sophisticated cyber threats. The company’s appeal as an investment lies in its innovative technology that utilizes advanced machine learning and AI for real-time threat detection and response, reducing the need for manual intervention.

This model is similar to that of Crowdstrike, however, differs through the amount of human intervention needed. Crowdstrike’s system relies on AI and machine learning to identify threats and escalate them to a human analyst for further investigation. SentinelOne on the other hand, aims to remove the human element from this process, relying entirely on machine learning and AI response to stop breaches.

SentinelOne, is yet to be profitable on a consistent basis, though is growing revenue at over 40% year-over-year. The company is certainly showing promise in becoming a leader in AI-focused protection, though the business model is not producing free cash flow (yet).

However, with a small debt load of only $22 million and cash on hand of almost $800 million, SentinelOne is a great small cap stock for investors to consider that also has a solid balance sheet.

Cisco Systems (CSCO)

Image Source: CSCO Stock Price and Chart — NASDAQ:CSCO | TradingView

Cisco Systems is the largest company on this list in terms of market cap with a valuation of over $200 billion. From an investment perspective, Cisco offers less volatility and greater market presence then the other companies on this list.

Founded in 1984, the company has built a long list of fortune 500 companies they call customers and have also developed a wide array of different products.

The company has revenue of $58 billion, a return on assets of over 10%, and a profit margin of 23%, making it a great addition to a portfolio that is looking to round out high growth companies with a firm that already has an established presence in the space.

Looking to the companies future, Cisco is working quickly to improve their AI offerings, as well as focusing on cloud computing security for large organizations.

While some may see Cisco as a company that has already experienced the majority of its growth, with new offerings and the cybersecurity industry continuing to develop into new areas, this mega cap firm could see new life in the years ahead as they leverage their current customer base for new cybersecurity offerings.

Global X Cybersecurity ETF (BUG)

Image Source: ARKK: Tech ETF Investment Prospects: ARK Innovation ETF (ARKK) and Global X Cybersecurity ETF (BUG) | Stock News

The Global X Cybersecurity ETF (BUG) represents an excellent choice for investors seeking exposure to the cybersecurity industry without the complexity and risks associated with individual stock picking.

This ETF provides a diversified portfolio of companies specifically within the cybersecurity sector, offering a broad investment in cybersecurity.

Below are the top holdings of the ETF:

- CrowdStrike Holdings Inc Class A (CRWD) — 6.72%

- Gen Digital Inc (GEN) — 6.66%

- Zscaler Inc (ZS) — 6.43%

- Palo Alto Networks Inc (PANW) — 6.11%

- Check Point Software Technologies Ltd (CHKP) — 5.54%

- Trend Micro Inc (4704.T) — 5.17%

- SentinelOne Inc Class A (S) — 4.90%

- Varonis Systems Inc (VRNS) — 4.88%

- Fortinet Inc (FTNT) — 4.73%

- Qualys Inc (QLYS) — 4.70%

Key Takeaway

The reality of today is that cybersecurity is becoming one of the most important industries in the world.

Global security spending is locked in for an impressive growth rate as companies continue to prioritize protecting their critical data and information.

Companies like Crowdstrike, Palo Alto, SentinelOne, and Cisco offer investors a nice blend of growth with reduced volatility.

And despite the fact many of these companies have seen their share price rise dramatically in 2023, the importance and strength of their business models show they will still be great investments in the years ahead.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.