Biotech penny stocks have become a popular investment option for those seeking to put money in biotechnology’s dynamic and ever-evolving field. These securities, usually priced at less than $5 per share, offer the potential for significant returns but also come with high risk.

Adding the biotech sector to your portfolio via biotech penny stocks is an acceptable way to dip your toes into modern medicine’s many developments and breakthroughs.

This article explores the concept of biotech penny stocks and how our selected top picks in this field utilize their competitive advantages. Whether you’re a seasoned investor or just starting, this guide will provide valuable insights into the exciting world of the best biotech penny stocks.

Biotechnology and Trading Penny Stocks

The biotechnology sector is focused on developing and commercializing products and services based on biological and genetic processes. This includes biopharmaceuticals, genomics, sustainable development, medical devices, and livestock vaccines.

Companies from this sector use advanced technologies to develop new treatments and therapeutic products for various diseases and medical conditions. With the potential to significantly impact healthcare, this sector has recently experienced notable growth.

What Are Biotech Penny Stocks?

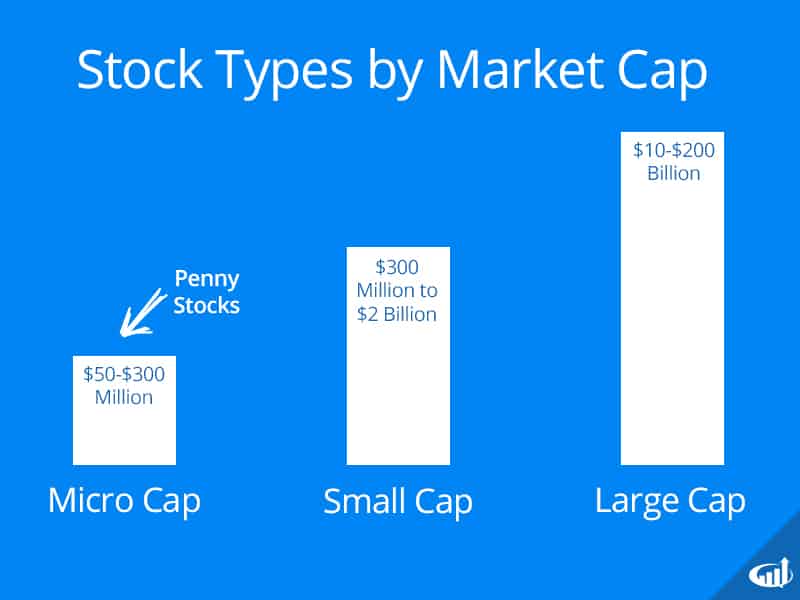

Biotech penny stocks are common stocks from the biotechnology sector. They have a relatively low share price, usually under 5$, and are generally issued by small-cap or micro-cap companies.

Due to the industry’s emerging growth, investors have garnered an interest in the rapidly growing companies within the sector. Finding the right biotech penny stock involves assessing the pros and cons of trading these securities.

To learn more about how to leverage penny stocks in your portfolio, check out this video.

Advantages and disadvantages of biotech penny stocks:

Some advantages to buying into biotech via penny stocks include the following:

- Low Cost: Biotech penny stocks are generally priced under $5, making them accessible to investors who may not have large amounts of capital to invest.

- High Growth Potential: Typically, penny stocks are issued by small up-and-coming companies with the potential to experience rapid growth, generating substantial returns to investors.

- Active Trading: Due to their low price and volatility, biotech penny stocks can offer opportunities for active traders to buy and sell frequently, generating profits from short-term price movements.

Some risks associated with biotech penny stock investing include:

- Limited liquidity: micro-cap biotech companies often have low trading volumes and limited liquidity, so buying or selling shares at a favourable price can be difficult.

- Volatility: Both penny stocks and the biotech sector can be highly volatile. Share prices often fluctuate widely in response to news or rumours.

- High risk of loss: Given the above risks, trading biotech penny stocks can be highly speculative and can result in significant losses for investors.

Finding a biotech penny stock that is right for you!

Biotech companies in the early stages of drug development or clinical trials are usually traded at low prices due to their rapid price fluctuations.

These biotech stocks are susceptible to manipulation, hype and extreme volatility, but what are the best biotech penny stocks?

Here we will dive into some of the top biotech penny stocks to better understand their growth potential.

To access the penny stock market, check out online brokers and trading platforms like Fidelity.

Biotech Stocks To Add to Your Watch List

Entera Bio LTD. (NASDAQ: ENTX)

Entera is a clinical-stage, a global company focused on the oral delivery of therapeutic proteins. They are based in Israel and are known for their innovations in the swallowable tablet market.

Currently, they are developing daily tablet protein and peptide tablets designed for an injection-free lifestyle for patients with chronic illnesses.

Harvard Health Publishing says that 25% of Americans fear needles. This puts Entera in a critical position to fulfill this treatment need in the sector.

Entera also boasts no long-term debt, allowing them lots of financial flexibility.

Their earnings per share have grown from $-2.49 to $-0.37 over the years; however, they have yet to generate positive net income and earnings per share data due to being at such an early stage in their development.

At $0.65 per share, Entera’s low debt and competitive advantage through injection-free solutions makes them adequate to research further and possibly invest in.

Vascular Biogenics LTD (NASDAQ: VBLT)

Vascular Biogenics is a clinical-stage biopharmaceutical company at the forefront of the biotechnology industry based in Israel. They are working on developing treatments for cancer and other inflammatory diseases.

VBL Therapeutics presents many potential benefits and drawbacks for investors. On the positive side, VB-601, the company’s lead drug candidate, has shown great promise in treating preclinical models for rheumatoid arthritis and inflammatory bowel disease.

Their lack of debt reduces their bankruptcy risk, and they have produced positive clinical data for several products in various stages of development, indicating their potential efficacy and safety.

However, there are also potential downsides to investing in VBL Therapeutics. The company has not experienced remarkable growth since 2012, and its net income is declining. Additionally, VBL faces stiff competition from larger, established companies with more resources and brand recognition.

VBL’s low share price of around 17 cents and the potential for their lead candidate, VB-601, makes them worthy of adding to the watch list.

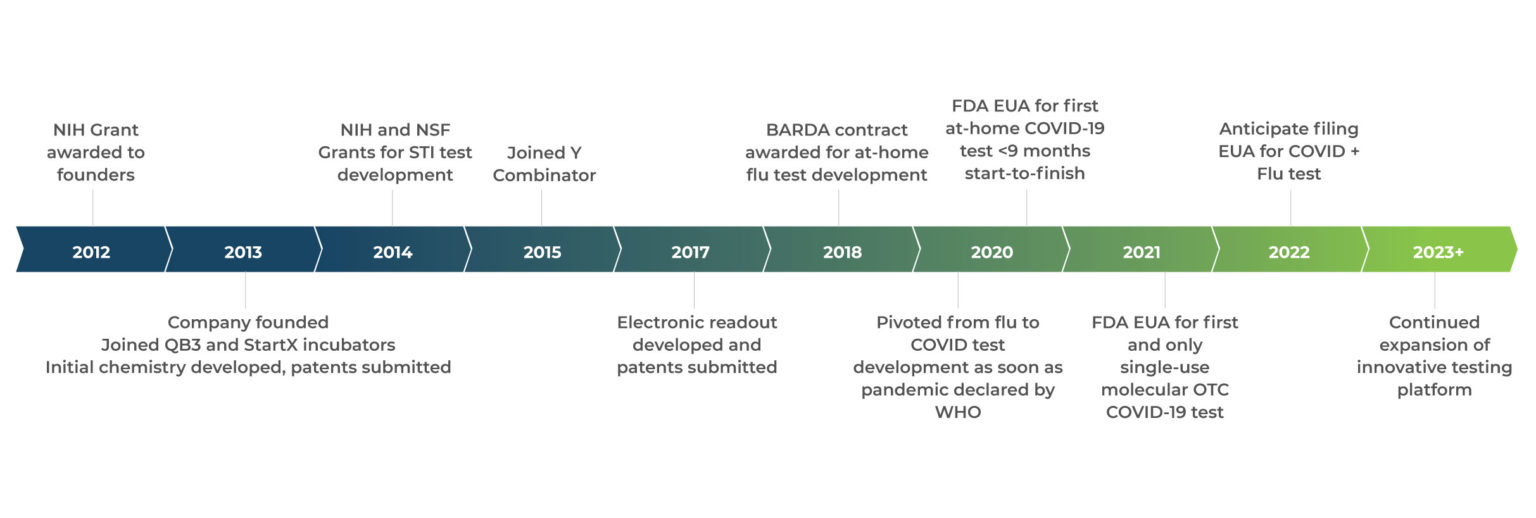

Lucira Health (NASDAQ: LHDXQ)

LHDX is a cutting-edge leader in COVID-19 testing and at-home diagnostics.

Their goal is to provide home diagnostic testing to cut the hassles of booking appointments, empowering people with diagnostic tools that give results within minutes.

Lucira Health‘s technology platform enables the company to make accurate, reliable, and easy-to-use diagnostic tests for various infectious diseases, including COVID-19.

LHDX is currently at a 9.5 million market cap; its trailing revenue is 212.13 million, which is substantial for a smaller company. However, their earnings per share data show a downward trend over the past years.

Lucira Health faces extreme competition from companies developing and marketing similar products, such as Abbott Laboratories (ABT).

Their low share price of 21 cents makes them a good candidate for investors looking to diversify their holdings for a small sum. Still, their lack of a competitive advantage leaves them vulnerable against competitors.

All-in-all keeping an eye on Lucira Health could bring some surprising opportunities for accelerated returns.

Ardelyx Inc (NASDAQ: ARDX)

Ardelyx has emerged as a trending penny stock over the past few months. They are pioneers of the biotech industry who focus on new biological mechanisms and pathways to make drugs for patients with unmet medical needs.

The FDA committee recently endorsed their kidney disease drug candidate and proposed its approval, drastically changing the speculations of many investors.

Looking in the past year shows Ardelyx’s share prices significantly increased from approximately $0.50 in June 2022 to surpassing $4.00 in the current quarter, leaving their market cap at $929.71 million.

Revenues for their 2022 annual report showed an increase approximately five times higher than the previous year.

Their fourth-quarter earnings per share for 2023 concluded on a positive note, standing at $0.03, which marks a significant improvement from the $-0.31 reported in the corresponding period of 2021.

The recent quarter may have spiked ARDX’s stock price; however, looking deeper into their financials shows they have not yet had a positive year for earnings growth.

Ardelyx’s formidable growth over the past year makes them an interesting penny stock to add to your watchlist.

Agenus Inc (NASDAQ: AGEN)

Agenus Inc. is a biotech penny stock specializing in developing and commercializing innovative immunotherapies and cancer treatments.

They were founded in 1994 and are headquartered in Lexington, Massachusetts. The company focuses on empowering the human immune system to fight various cancers and diseases via therapeutic pathways.

Agenus has a broad portfolio of immunotherapies in various stages of development, including checkpoint inhibitors, vaccines, cell therapies, and antibodies.

Their competitive advantage lies in their proprietary technology platforms, which enable the discovery, development, and manufacturing of innovative immunotherapies and cancer treatments.

However, Agenus Inc. operates in a highly competitive market with many other companies working on similar products. If they cannot compete effectively against larger, better-funded companies with more resources, their share price may be at risk.

A quick look into AGEN’s financials shows their revenues and incomes are quite volatile. While they generate positive revenue, their overall income has been negative for quite some time.

Over the past year, Agenus has almost tripled their revenues, showing significant promise for growth.

At the low-end price of $0.76 per share, AGEN’s growth in the past year makes them a top penny stock prospect to add to your watch list.

Bio Delivery Sciences International Inc. (NASDAQ: BDSI)

BioDelivery Sciences International, Inc. (BDSI) is a specialty pharmaceutical company that develops and commercializes innovative products for treating pain and other central nervous system (CNS) disorders.

BDSI’s portfolio of products includes BELBUCA®, used for treating chronic pain, and Symproic®, a treatment for opioid-induced constipation.

Their ability to develop and commercialize innovative products based on their proprietary drug delivery and formulation technologies positions the company as a pain and CNS disorder market leader.

Like most other biotech stocks, their competitive advantage relies heavily on intellectual property and clinical trials.

In the past three years, their earnings before income tax (EBIT) boasts extreme growth of almost 300%. Their trailing P/E ratio is a low 6.82, possibly indicating they are undervalued and could grow more.

Overall, BDSI shows significant promise for growth. However, their competitive advantage is relatively weak compared to other biotech companies.

At a 6$ share price, keeping an eye on BDSI is a solid course of action moving forward.

iBio Inc. (NYSE: IBIO)

The recent interest in AI stocks has allowed iBio to stand in the limelight due to their use of plant-based technology to develop and manufacture vaccines, antibodies and other proteins.

It’s important to note that iBio has not disclosed any specific AI initiatives or partnerships, so the extent to which they use AI in their operations is unknown. It’s possible that iBio could leverage AI in various aspects of its research and development processes.

Their financial data shows a downward trend of earnings per share data and net income. This indicates that iBio has not produced reasonable growth in the past three years.

However, given the potential benefits that AI can bring to the biotech industry, it’s possible that iBio could leverage AI in the future to improve its research and development processes.

iBio is currently trading at around $0.28 per share; prospects for growth are mainly speculative due to the recent interest in AI stocks, so adding them to your watchlist could bring significant opportunities in the future.

vTv Therapeutics Inc (NASDAQ: VTVT)

vTv Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on developing treatments for chronic diseases, such as Alzheimer’s disease, diabetes, and cancer.

The company’s pipeline includes drug candidates targeting various pathways, including developing small molecule drug candidates, peptide therapeutics, and biologics.

It’s important to note that the vTv’s drug candidates are still in clinical progress, and regulatory approval or commercial success is not guaranteed.

Their focus on developing treatments for chronic diseases and its proprietary drug discovery platform (TTP Translational Technology) positions vTv as a potential leader in the biopharmaceutical industry.

vTv’s trailing earnings per share is currently -$0.23; however, it has grown from -0.59 over the past three years.

Their revenues are on a downward trend, sitting at just $9 thousand in the TTM.

At the low cost of $0.40 per share, adding vTv to your watchlist is reasonable for someone looking to diversify without much capital.

Ampio Pharmaceuticals (NYSE: AMPE)

Ampio Pharmaceuticals is a biopharmaceutical company developing novel therapies to treat prevalent inflammatory conditions.

The company focuses on developing medicines to treat diseases with limited treatment options.

Ampio Pharmaceuticals’ competitive advantage lies in its specialization in developing novel therapies to treat prevalent inflammatory conditions.

Additionally, Ampio has a unique approach to drug creation, which involves repurposing existing drugs to treat new indications.

This approach allows the company to rapidly advance drug candidates through clinical development processes, potentially reducing the time and cost associated with traditional drug development.

AMPE was founded in 2010 and currently has a market cap of 2.15M, making them a micro-cap penny stock. Their financials show no revenues in the past three years and negative earnings per share data.

Ampio Pharmaceutical’s approach to advancing new drugs by repurposing old ones gives them a good advantage over their competitors.

At only $2.85 a share, it is reasonable to keep an eye on Ampio until they can produce meaningful progress toward selling a new product.

MediciNova Inc (NASDAQ: MNOV)

MediciNova Inc. is our final biotech penny stock focusing on developing and commercializing innovative therapies to treat unmet medical needs. The company’s primary focus areas include treating neurological disorders and fibrosis-related diseases.

Their drug candidates target various conditions, including multiple sclerosis, drug addiction, asthma, and fibrotic diseases such as idiopathic pulmonary fibrosis.

MediciNova is headquartered in California and was founded in 2000. The company has a collaborative research agreement with the National Institutes of Health (NIH) and is actively pursuing partnerships with other pharmaceutical companies to advance its drug candidates.

MediciNova faces competition from established pharmaceutical companies as well as smaller biotech firms. The company’s revenue and stock price may be affected if its drugs cannot compete effectively with its competitors.

Trailing earnings per share data is currently negative (-$0.26), and their overall financials do not show great promise.

Medici has yet to produce any new products. Thus, they have not yielded any form of revenue since their conception.

At only $1.90, if MNOV can create a drug for any of its target conditions, it could prove to be a significant and fast-growing company. Adding MediciNova to the watchlist until they can achieve a profitable product is the best course of action for this biotech penny stock.

Analyze, Diversify, Invest

Investing in biotech stocks has the potential for high returns for more risk. The growing healthcare industry poses many opportunities, so diversifying your portfolio via stocks or penny stocks in the biotech industry is a viable way to enter the industry.

Whether or not it suits your investment philosophy is up to you and your goals. If you need help figuring out how to spend your capital, check out our post on choosing what to invest in.

Top biotech stocks like Entera Bio LTD and Vascular Biogenics LTD have excellent growth ability, but it is crucial to conduct due diligence to maximize their investment potential. Many of the penny stocks above do not have any profitable products, so adding them to your watchlist until they can further their research and progress is optimal for investors who do not want to incur too much risk.

It would be best to exercise caution by researching and analyzing biotech penny stocks before investing.

Overall, diversifying your investment portfolio can be done in many forms, including, penny stock investing. Leveraging the growth of the biotech industry and penny stocks is a high-risk, high-reward strategy to grow your income.