Among the complicated mess of financial instruments that make up the financial world (inhabited by a few too many financial advisors, honestly), there is a unique asset that is gaining popularity with retail investors and institutional investors alike.

That hot new asset would be the Bitcoin ETF. As such, this article will cover and explain to you this concept and the context it lives in. We will cover:

- What is a Bitcoin ETF?

- Why Investors opt for Bitcoin ETFs

- Some Interesting Bitcoin ETFs

What is a Bitcoin ETF?

Now, I am not going to waste your time explaining the intricacies of Bitcoin or blockchain companies (as in the technical mechanics, you can learn more here). I’ll only focus on the concept of Bitcoin ETFs.

First, ETFs

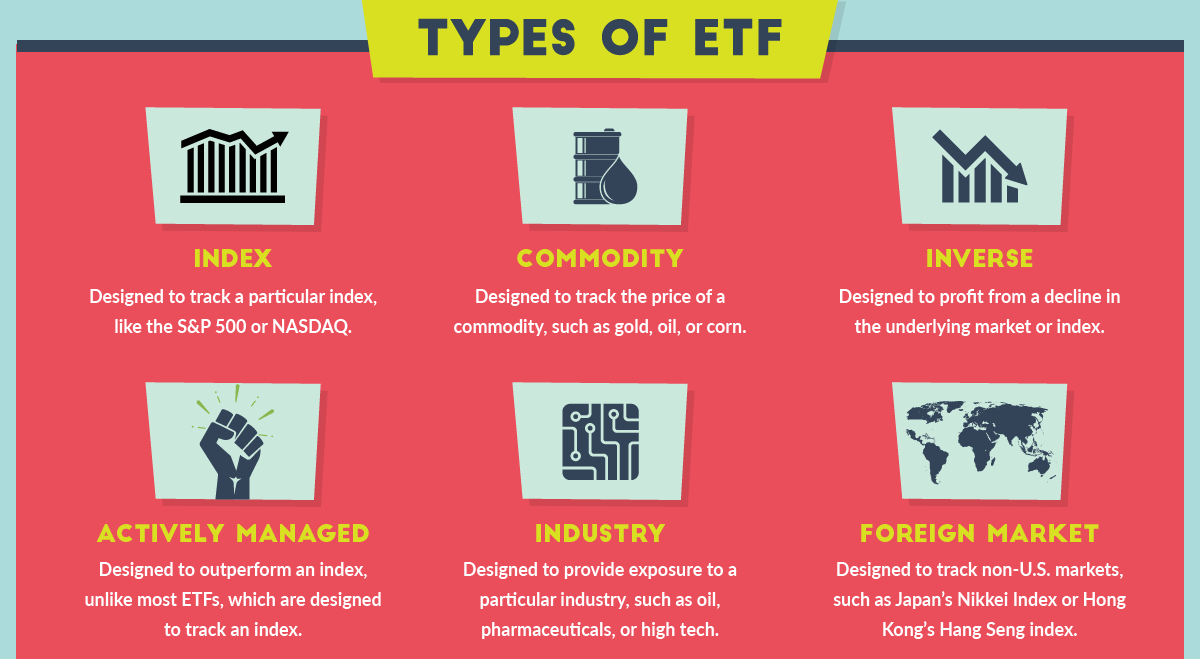

ETF is shorthand for Exchange Traded Fund. Exchange Traded Funds represent an investment product (traded on, you guessed it, an exchange).

An Exchange Traded Fund (ETF) typically contains a basket of assets (sometimes defined by asset class, sometimes region, and almost every other way you can slice the pie) bundled together, tracking the performance of a specific index, sector, commodity, asset class, etc. (trust me, it gets much more needlessly complicated).

ETFs explained | iShares – BlackRock

Now, similar to stocks, investors can purchase and sell these securities (typically, Security and Exchange Commission approved; such diligent people).

Securities, which again tend to be tied to an objective, mission, outcome, or strategy such as:

- Commodity ETFs

- Currency ETFs

- Sector ETFs

- Equity ETFs

- Fixed Income ETFs

Keep in mind, these can be further split, divided, and specialized even more with a plethora of financial levers and tools some quant thought up in a back office somewhere.

ETF Types | Visual Capitalist

Nevertheless, you get the idea.

Now, back to Bitcoin ETFs

Bitcoin ETFs tend to be built such that they track the value of Bitcoin and/or are pools of assets related to Bitcoin.

Typically, and most attractively, these tend to be traded on traditional exchanges and can be bought via your friendly neighborhood brokerage account.

How does a Bitcoin ETF work?

A Bitcoin ETF works pretty analogously (in general) to traditional ETFs, as it tracks the current market price of Bitcoin (and, as such, moves in unison with Bitcoin like some sort of paired dance). At the simple level here, we are describing a Spot Bitcoin ETF, which holds actual Bitcoin as opposed to possessing derivatives that are tied to the price of Bitcoin.

As you can see, it can start to get really complicated as the underlying digital assets are further abstracted from the actual Bitcoin.

Bitcoin ETFs vs. the traditional ETF

A Bitcoin ETF (and any crypto ETF) is not completely analogous to a traditional ETF. You will not receive partial dividends like some ETFs (due to the decentralized nature of Bitcoin and, thus, a Bitcoin ETF).

Also, the management fees associated with Bitcoin ETFs are a bit different than the management fees of traditional ETFs. Normally, the fee may be tied to something like the complexity of the product and whether or not it is actively managed or passively managed.

With Bitcoin ETFs, there is an additional layer that entails a portion of the management fees going towards the purchase and storage of the Bitcoin that makes up the ETF in question.

Bitcoin futures contracts & Bitcoin futures ETFs

Speaking of complicated, let’s talk Bitcoin futures contracts and (in turn) Bitcoin futures ETFs.

Essentially, a futures contract is (at its simplest) a bet between investors on the asset’s future price. The first Bitcoin futures contracts hit the wider market in 2017 via the Chicago Mercantile Exchange.

If you then put it together…a Bitcoin Futures ETF is an exchange traded fund that holds Bitcoin futures contracts. It then sells those shares to investors, hedge funds, your cousin, etc. They are then traded on a mainstream exchange like your everyday traditional stocks.

Bitcoin Futures Trading – Bitcoin.com

As far as investment vehicles go (specifically an investment vehicle in the Bitcoin space), the mechanism here is pretty simple.

These ETFs are created by purchasing a bunch of futures contracts and then putting them together in a fund, typically managed by an asset management firm.

How we got here: A Spot Bitcoin ETFs history

Bitcoin ETFs did not just appear out of thin air. Rather, it was a painstaking process of government lobbying, negotiating, and all that fun stuff that got us to the first spot ETF tied to Bitcoin and, thus, the price of Bitcoin.

Typically, the Securities and Exchange Commission stood in the way of this style of exchange traded fund.

The Winklevoss twins were the first to take a crack at it in 2018, which saw the Securities and Exchange Commission routinely deny their application for a spot Bitcoin ETF (due to the wild nature of Bitcoin’s price and the threat of nefarious price engineering.

Then, in stepped BlackRock in 2023, when they decided to file an application for a Bitcoin ETF, a move that shocked the financial world.

By October of that year, Grayscale Investments, who owned Grayscale Bitcoin Trust, managed to get a ruling in their favor as they were attempting to turn their Bitcoin Trust into a Bitcoin ETF.

Grayscale Bitcoin ETF | Yahoo! Finance

Now, entering 2024, the SEC ended up approving a plethora of these exchange traded funds tied to Bitcoin.

Here is a timeline (for your ease, of course):

July 2013 | The first Bitcoin ETF is proposed via a filing from the Winklevoss twins.

June 2018 | The Winklevoss twins have a second Bitcoin ETF proposal turned down by the SEC.

September 2020 | The Bitcoin ETF is first seen listed on traditional exchanges, specifically the Bermuda Stock Exchange.

October 2021 | The first American-listed Bitcoin ETF hits the market. The ProShares Bitcoin Strategy ETF, being that ETF, does not hold Bitcoin on the balance sheet. Rather, it tracks the price of Bitcoin using associated underlying asset(s).

June 2023 | The Securities and Exchange Commission decides to approve BITX from Volatility Shares, marking a win for leveraged Bitcoin Futures ETFs.

August/October 2023 | Europe gets its first Bitcoin ETF. Across the pond, a court ruling forces the SEC to reconsider the application from Grayscale Investments to convert a Bitcoin Trust into a spot Bitcoin ETF.

January 2024 | The SEC sees where the wind is blowing and decides to give approval for several spot Bitcoin ETFs (which was falsely announced earlier than intended due to a compromised social media account).

SEC false announcement from compromised account | X.com

Why Investors Opt for Bitcoin ETFs

There is the very obvious elephant in the room: a Bitcoin ETF gives investors exposure to Bitcoin’s price and allows them to partake in the market without having to be on a cryptocurrency exchange.

Investors see risk in Bitcoin

The average investor tends to be rather risk-averse and (specifically), in the case of institutional investors, may be restricted on what they may invest in. As such, assets sold on cryptocurrency exchanges and/or any analogous crypto market are too risky and complex for most.

The risk

Along with this, the cryptocurrency market has continually been inundated with overzealous coverage of cases of market manipulation, fraud, and a variety of other criminal behaviors.

Cryptocurrency Exchanges | Forbes.com

Essentially, there are massive concerns over the lack of investor protection for someone hoping to jump into companies involved in the crypto market. Especially since investing in Bitcoin (and other crypto assets) often means operating outside of the jurisdiction of central banks and whatever associated exchange commission would normally apply and provide a sort of safeguard.

The complexity

Further, buying Bitcoin can prove to be quite complex for most people.

The process of buying Bitcoin traditionally involves going onto a cryptocurrency exchange, having a wallet (which involves things like private keys), and then making a purchase in the face of significant price volatility.

Not to mention the headache of tax planning. As your Bitcoin goes through a bit of capital appreciation and you sell off those assets, then convert to your local currency, and then withdraw, accurately allocating all this (tax-wise) is often daunting and murky at best.

As you can see, trading Bitcoin and trying to actually invest in Bitcoin can prove to be daunting for a multitude of reasons.

So, how does an investor gain exposure to Bitcoin while being aware and comfortable with its often wild price movements? (The price of Bitcoin has proven to be much more volatile than that of traditional equities.)

So why invest in Bitcoin ETFs?

A Bitcoin ETF, again, can help investors gain exposure to a market they may not be able or willing to otherwise be in.

You, as a savvy but busy investor, can invest in a Bitcoin ETF without really having to understand how Bitcoin works or even understand the underlying asset involved. The investor does not have to create an account on a cryptocurrency exchange and does not need to know or store private keys to ensure access to their holding. In short, like most ETFs, regardless of the underlying asset, it is easy and convenient.

As well, like other ETFs, a Bitcoin ETF can have multiple assets in it—including traditional equities.

Obviously, the upshot for the investor is a sort of diversification process here. Being able to flex this diversification muscle is key for investors of Bitcoin exchange traded funds.

Drawbacks of Bitcoin ETFs

As far as exchange traded funds go, Bitcoin ETFs (including Bitcoin Futures ETFs) are pretty robust. However, investors may be cautious of a few things.

Valuation accuracy

Like any other ETF, Bitcoin exchange traded funds attempt to track the value of the multiple holdings it has. Now, unless you are talking about pure spot Bitcoin ETFs, in which all the fund’s assets are used to buy the cryptocurrency, the movement of Bitcoin prices may not be accurately represented in the Bitcoin ETF.

Cryptocurrency market participation

As a Bitcoin ETF tracks the price of Bitcoin and is not analogous to holding Bitcoin, there are limitations on cryptocurrency exchange participation.

Mainly, the investor will be unable to trade that asset for any other cryptocurrencies that may have piqued their interest (seeing as the investor does not actually own any Bitcoin despite holding the ETF in question).

Ownership (lack thereof)

Going off of the last point above, Bitcoin ownership has long been thought of as an alternative or hedge to traditional markets, central banks, etc.

That said, a Bitcoin ETF means that you lose some of the key features of Bitcoin ownership, like the privacy provided by the blockchain.

Fees, fees, fees

Like almost any other ETF, management fees tend to be high and can include layered fees as well. This is due to the ease to the investor as, often, the investment manager is working in the backend managing the ETF, so the investor does not have to think or know about its intricacies.

:max_bytes(150000):strip_icc()/layeredfees.asp-Final-2290a7a951334fa490440414307a8c5c.jpg)

Layered Fees | Investopedia.com

Interesting Bitcoin ETFs

As far as an exchange traded fund goes, Bitcoin ETFs tend to be more interesting (even salacious, if I may be so bold) compared to other ETFs. Luckily for you, we have gathered some ones you may want to take a look at.

VanEck Bitcoin Strategy ETF (XBTF)

This particular Bitcoin strategy ETF boasts over $63M AUM, utilizing a Bitcoin futures strategy. With an inception date in 2021, this is an actively managed fund that has a mix of Bitcoin futures and then Cash & Cash Equivalents.

The structure of this asset is such that it is more tax efficient than most (being a C-corp) as it is not required to distribute long-term capital gains as dividends out to investors.

Bitcoin ETF Tax Rules: CCN.com

As such, investors can generally keep a pretty high amount of invested capital in the fund while lowering taxable distributions.

$XBTF Daily Chart | Yahoo! Finance

ProShares Bitcoin Strategy ETF (BITO)

This Bitcoin Futures ETF was the first to be approved in American markets, now having out $1.4B AUM and an expense ratio of 0.95%. It is wildly popular among investors (most likely enjoying some first-mover advantage in the U.S.

Simply put, this fund has a simple strategy: hold Bitcoin futures contracts, along with a bit of treasuries and cash.

$BITO Weekly Chart | TradingView

ProShares Short Bitcoin ETF (BITI)

ProShares Short Bitcoin ETF is the only SEC-approved ETF that is inverse trading Bitcoin. To be more specific, this is an inverse Bitcoin futures ETF, returning the inverse of the S&P CME Bitcoin Futures index one day at a time.

The mechanism involves the seller paying the buyer if the price of the futures contract goes down and vice versa.

With an expense ratio of 0.95% and AUM of $55M, this is a robust and unique diversification tool for an investor.

$BITI Weekly Chart | TradingView

Valkyrie Bitcoin Strategy ETF (BTF)

Staying in the realm of Bitcoin futures ETFs, Valkyrie Bitcoin Strategy ETF is another solid option. Boasting AUM of $35M and an expense ratio of 1.20%, this fund attempts to spend as close to 100% of net assets on Bitcoin futures contracts (the rest going to more liquid and fixed-income assets like government securities and bonds).

$BTF Weekly Chart | TradingView

Wrapping up (finally)

Essentially, whether we are talking about Bitcoin futures ETFs, Bitcoin inverse ETFs, Bitcoin spot ETFs, etc., it is clear that the financial markets are warming up to this new asset as a mainstay in the investor psyche (learn more about the crypto-expansion).

As more products hit the market and investor interest is piqued, there will be incredible opportunities for investors to partake in a unique asset class without some of the consternation that comes with cryptocurrency and the associated exchanges.

At the end of the day, not everyone wants to load up a portfolio full of blue chip equities and mutual funds. Indeed, Bitcoin ETFs offer a new diversification strategy that can be robust and lucrative.

As always, do your own research (we can help) before investing, remember that past performance is not always an indicator of future performance, and lastly, this does not constitute investment advice.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.