Before buying shares in a company, investors should make sure they understand the difference between common and preferred stock, as well as the advantages and disadvantages between the two, so they can decide which investment option best fits their personal financial goals.

Today we’re going to look at what common and preferred stock is, the main similarities and differences between the two, and discuss the factors investors should consider before buying either.

Overview of Common Stock

A common stock, or common shares, represents ownership in a company. For shareholders who own common stock, this means they are entitled to a portion of a company’s profits (through common stock dividends) and hold voting rights on specific company matters.

These common shares represent the most popular form of stock ownership amongst investors. They are also the most common type of shares companies issue when they begin trading on major stock exchanges.

Typically, investors who own common stock receive one vote per share, which they can use to voice their opinion on important company decisions such as appointing board members, compensation packages of senior executives, and whether or not a company performs acquisitions or mergers.

In short, common stock is the most common method for investors to own shares in a company. As an owner of common shares, investors gain the right to a company’s profits through dividend payments, as well as the right to vote at scheduled shareholder meetings regarding choices management could make.

Before investors pull the trigger on investing in common stock, they should first understand the pros and cons associated with these types of shares.

Pros of Common Stock

Shareholders Have Voting Rights

Being common shareholders gives investors voting rights allowing them to voice their opinion on important company matters.

Right to Company Profits

Shareholders of common stock may receive a quarterly dividend payment from companies that decide to return profits to shareholders.

Simple to Purchase

Common stock is the most popular form of investing and offers retail investors a simple process to follow when investing in the stock market.

Potential for Unlimited Returns

When a company does well, its common stock will appreciate in value much more than preferred shares, making it the ideal investment choice for long-term investors.

Cons of Common Stock

Higher Risk

Owning common stocks means investors will have to manage significantly more volatility when compared to preferred stock. And while this presents the potential for higher returns, it also means investors have greater risk.

Unpredictable Dividend Payments

Shareholders of common stock don’t have first rights to recurring dividend payments and are paid only after preferred shareholders.

Below Preferred Shareholders

As mentioned above, common stockholders are below preferred shareholders in terms of priority. This means dividend payments and the rights to a company’s profits first go to preferred stockholders. Should a company limit its dividend payments or begin to struggle financially, common stock holders may not receive any form of payment.

Overview of Preferred Stock

Preferred stock (also called preferred shares) functions as a cross between common stock and bonds.

More specifically, preferred shares have fixed dividend payments and a fixed redemption value. Meaning owners of preferred stock will receive predetermined dividend payments, which are usually much higher than dividends paid out to common stockholders. Additionally, whereas a dividend payment to common stock shareholders may be reduced or skipped entirely, owning preferred stock ensures investors will receive an agreed-upon dividend amount.

Preferred stock also has a set redemption price (also called par value) which is the price a company may pay to preferred stockholders if they want to purchase the preferred shares back from an investor. This redemption value acts very similar to a bond holder receiving payment at the maturity of a bond.

Finally, owning preferred stock also comes with a term sheet outlining what will happen in specific events, such as a set liquidation preference. This term sheet is one of the biggest differentiators between common and preferred shares and gives owners of preferred shares first rights to a company’s profits or assets should a company be sold or go bankrupt.

Preferred stock comes with different variations, or types, investors can choose to purchase, each with their own advantages and disadvantages. The most common types of preferred shares include:

- Adjustable-Rate Preferred: The dividend payout for adjustable-rate preferred shares is subject to changes based on current interest rates in the market. This means that the dividend rate is not constant and behaves more similarly to floating-rate debt instruments.

- Cumulative Preferred: When the issuer is unable to make the promised dividend payment, the dividend is postponed to a future date, and the unpaid dividends accumulate. These accrued dividends must be settled before any common stock dividends can be paid.

- Non-Cumulative Preferred: In contrast to cumulative preferred stock, unpaid dividends on non-cumulative preferred shares do not accrue. This gives the issuer greater flexibility, as they can choose when to resume paying dividends to these shareholders.

- Convertible Preferred: The conversion functionality enables the owner of preferred shares to convert them into common shares, with the quantity of common shares received being dictated by the conversion ratio, which references the number of common shares issued for every preferred share.

- Non-Participating Preferred: Non-participating preferred shares refer to shares that entitle shareholders to receive only a fixed-rate dividend without any entitlement to the residual profits that common shares may receive.

- Callable Preferred: Issuing companies have the option to redeem callable-preferred shares at a predetermined price and date, and as compensation for the reinvestment risk that investors may face, they typically receive a call premium. This reinvestment risk refers to the possibility of having to search for another company to invest in, which may offer lower returns.

- Participating Preferred: The participating preferred feature is most relevant for companies that are privately owned. Further, it allows the holder to receive both dividend payments and a predetermined percentage of the remaining proceeds allocated to common shareholders, which can also be referred to as a “double dip.”

Pros of Preferred Stock

Significantly Reduced Volatility

Because a preferred stock acts more like a bond than a common share, the volatility of the investment is considerably lower. Investors who have a lower risk tolerance and want to enjoy the benefits of being a partial owner in a company yet still enjoy the security of a fixed interest rate and payment will find preferred stocks offer a much better fit than common stock.

Receive Dividends Before Other Investors

Simply put, preferred shareholders are a higher priority to a business than common shareholders. In the event of a company being acquired or its assets being liquidated, preferred shareholders will have first rights to any dividend payments or cash generated from the sale of assets.

Dividend Amount is Set

Not only do preferred stockholders get to receive their dividends before common shareholders, they also get fixed payments the business agreed to pay them regardless of the performance of the company. More specifically, a company’s board has the option to reduce or cut the dividend payment for common shareholders. However, owning preferred shares means management is obligated to pay these shareholders the agreed-upon amount.

Cons of Preferred Stock

No Voting Rights

Owning preferred shares means you won’t get to voice your opinion or approve major corporate decisions. Unlike common stock shareholders, owning preferred stock means you won’t have voting rights.

limited Capital Gains

An advantage of preferred shares is the reduced volatility investors must endure. However, this also means their shares are less likely to increase in value, leading to smaller capital gains. Investors willing to accept more risk and/or invest for a long period (5-10 years or more) may struggle with the limited investment returns associated with preferred stock.

Not Every Company Offers Preferred Stock

Companies aren’t required to issue preferred shares and may only have common stock available on major exchanges.

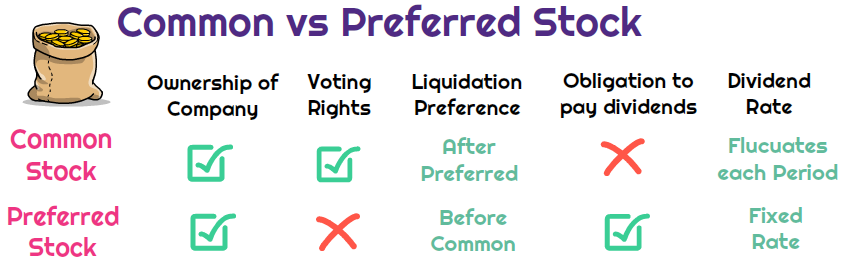

Differences Between Common and Preferred Stock

When making the comparison of common stock vs. preferred stock, it boils down to four main differences.

First, common stock gives investors the ability to vote on important company decisions. Deciding on whether or not a company acquires another firm or will be acquired by another firm can significantly impact the success of a business. Preferred shareholders will be at the whim of management and common stockholders’ decisions and will have zero input into the direction of a company.

Secondly, preferred shares are perhaps more similar to a bond than common stock. Owning preferred shares means shareholders will receive a fixed payment in the form of a dividend that is agreed upon between the company and the buyer. Further, because preferred stock has a predetermined redemption price and date, investors may sell their shares back to the company at a later date.

Thirdly, the returns investors can expect when deciding between common and preferred stock differ substantially. More specifically, common shares hold the potential for far greater returns than preferred stock.

Because common shares don’t have set dividend payments, investors expect their investment to pay off by the stock reaching higher and higher prices. Essentially, common stock holds unlimited upside potential.

However, with the ability to achieve a higher return also comes with higher risk and more volatility. Preferred stocks, on the other hand, offer investors more security and significantly less risk than common stock. However, the capital gains associated with this type of stock are limited.

Finally, the last defining factor between common and preferred shares is who typically purchases them. Common shares are usually purchased by retail investors on public financial markets, as well as by employees of a company, as part of their compensation package.

Preferred stocks are more often issued to angel investors and other institutional investors. Receiving preferred stock drastically reduces the risks for these larger financial institutions while still allowing them to earn a respectable return for their clients.

Most Important Considerations When Choosing Between Common Stock and Preferred Stock

The decision between purchasing preferred and common stock largely comes down to each individual investor’s risk tolerance and financial goals.

Investors who are willing to take on higher levels of risk and are more interested in earning their return through capital gains as opposed to dividends will most likely be better off purchasing common shares.

Conversely, investors who have a shorter investment time horizon, are looking to limit their risk, and want to know what their total return on investment will be, should focus their portfolio on preferred shares.

The good news is ownership of preferred and common shares doesn’t have to be mutually exclusive, and investors may wish to balance their portfolio by purchasing both common and preferred stock.

A common strategy amongst investors is to purchase preferred shares with different dates of maturity. By doing this, investors will ensure a respectable return, as well as a steady inflow of cash which they can then use to purchase common stock in various companies.

Final Word

While common and preferred stock share similarities, there are also some key differences investors should be aware of.

Common stock is the most popular type of shares investors purchase and is characterized by providing owners voting rights, as well as the ability to achieve higher returns through share price appreciation.

Preferred stock is more common amongst large financial institutions and provides a safer investment option for investors by providing set dividend payments and the ability for companies to repurchase those shares at a later date. However, the returns an investor can achieve through preferred stock is limited.

Comparing common vs. preferred stock is a valuable exercise for investors, so they can understand the opportunities and pitfalls of each. Neither type of stock is superior to the other, though each has noticeable differences that will make one type of share better suited to each individual investor.

Before buying either, make sure to understand your own financial goals, so you can make the best decision for you.