Have you ever wondered what it would be like to have wealth beyond your wildest dreams?

Have you ever wondered what it would be like to have wealth beyond your wildest dreams?

Well, this reality may not be as far off as you think.

Growth investing is a strategy that combines investments in excellent businesses with emerging trends.

Rather than searching maturing markets like traditional banking or railways, growth investors seek out the hottest opportunities to make the most bang for their buck.

But this isn’t a get-rich-quick scheme whatsoever.

To be a successful growth investor, you must be willing to go against the crowd, while staying patient, and waiting for the best opportunities to arise.

After all, it is your money, and we’re not in the game of taking losses.

That is why in this growth investing and stocks beginners guide, we will teach you real-world strategies that are proven to be successful.

In this article, we break down:

- What is growth investing;

- The different types of growth investments;

- Which is better, value or growth investing;

- How to find growth stocks;

- And how to pick them.

What is Growth Investing?

Do you enjoy investing in stocks that outperform the market?

How about owning companies that are capitalizing on emerging trends?

If you answered yes to both of these questions, then growth investing is for you.

Growth investing is an investment strategy that focuses on companies expected to grow and generate above-average returns compared to their industry peers or the broader market.

As such, growth investors tend to favor smaller or younger companies with this strategy because they often accomplish the largest leaps during their early years of operations.

Not only that but many of these smaller businesses are destined to be the next generation of mega-corporations, dominating the future economic landscape.

Of course, Tesla ($TSLA) and Apple ($AAPL) had to start somewhere.

As a growth investor, you will want to consider five key metrics when evaluating growth stocks’ likeliness of success: historical and future earnings growth; profit margins; returns on equity (ROE); and the value of the business.

This is because these metrics are a good indication of financial health and whether or not the business/ your investment will succeed in the future.

But we will touch on this more, later.

Understanding Growth Investing

At a fundamental level, growth investing is about maximizing your returns on invested capital.

While this may seem like an obvious objective for all investors, additional factors come into play when determining which investment strategy is best for you; these include your age, wealth, and overall risk appetite.

In other words, every investor has different needs and goals when it comes to investing.

So if you have a greater appetite for risk and retirement isn’t approaching, then an aggressive growth strategy may be the perfect approach for you.

To learn more about how to invest in Growth Stocks during a recession click on this link.

Different Types of Growth Investments

Now that we’ve covered some considerations before investing in the stock market, it is time to dive into the different kinds of growth investments available in the market today.

At Edge Investments, we are focused primarily on the three growth investment strategies that are likely to produce the most value for investors.

These three strategies are small-cap stocks, penny stocks, and venture capital.

Each offers unique opportunities for investors and learning how to incorporate them into your portfolio may help produce astronomical results in the process.

Let’s explore each of them further.

What is a Small-cap Stock?

The first type of growth investing is small-cap stocks.

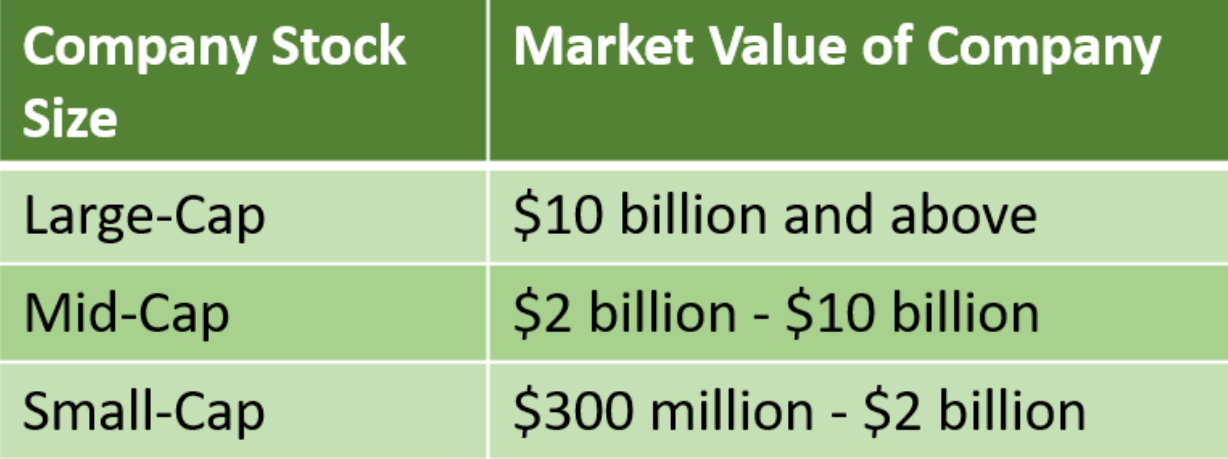

A small-cap stock is a publicly traded company that has a market capitalization between $300 million and 2 billion dollars.

While the number of small-cap stocks changes quickly, there are easily thousands of them to invest in at any given time.

In fact, the MSCI World Small Cap Index has 4,525 small caps as of September 2022.

Although the number of small-cap companies is certainly impressive, it is also important to be aware that not all of these stocks are bound to be winners.

But that is the beauty of capitalism and why we want to help you find the best small-cap stocks for your portfolio.

In general, small-cap investors are those wanting to be ahead of the pack by investing in winning companies before the rest of the market finds out.

In doing so, they generate superior returns because they can buy in cheap and reap the full benefits of a company realizing its potential.

Not only that, but it presents small investors with an opportunity to make more meaningful investments because they gain a larger stake in the company and can enjoy the journey alongside other established investors.

If you are curious about how to be a successful small-cap investor, check out our article, “How to Find Small-Cap Stocks to Invest In”

What is a Penny Stock?

The second type of growth investing is penny stocks.

Like small-cap investors, penny stock investors are those hunting for superior growth opportunities well before anyone else discovers them.

When they do so successfully, the return on investment is likely to grow past 10x, 20x, or even 100x.

This is because they are buying into a company trading for less than 5$ per share, according to Investopedia, and eventually, turn into multi-billion corporations, sometimes trading for more than $1000 per share (think Google or Amazon pre-stock splits).

For more context, a penny stock or micro-cap company is any publicly traded business that trades below a market capitalization of $300 million.

Given the size of these companies, there are often additional risks associated with them, but it all depends on the business itself and its economic outlook.

If you are curious, the most common risks associated with penny stocks include illiquidity, a limited track record, and lack of business information due to the number of years they’ve been listed as a publicly traded company.

To learn more about overcoming these risks and successfully trading penny stocks, check out our article, “How to Make Money with Penny Stocks”

What is Venture Capital

The third type of growth investing is venture capital.

Unlike small-caps and penny stocks, venture capital is in a realm of its own because it deals with private startups looking to scale quickly.

For those unfamiliar with venture capital, it is very similar to what you see on ABC’s Shark Tank, where early-stage companies seek cash to help them grow and reach broader markets.

For the most part, venture capital has been limited to affluent investors, investment banks, and other financial institutions.

But with investing hitting the mainstream and going online, new opportunities are arising for smaller, retail investors to take a shot at these high-growth companies.

For those wanting to explore opportunities in venture capital, check out the Canadian Investment Funds Standards Committee for more information.

What is Value vs. Growth Investing

There may be no greater rivalry in investing than the one between value investors and growth investors.

While some argue that the key to investing success is strong earnings growth and emerging trends, others say that buying stocks at a discount to value is even more important.

But what you may not know is that these two investment strategies have a lot more in common than most people think.

If you can combine both strategies, then you are likely to generate even better returns than you would if had just stuck to one of them.

Since we already covered growth investing and stocks at large, it is time to discuss value investing more and how you can use both of these investment strategies to create unparalleled success.

What is Value Investing?

Invented by the legendary investor Benjamin Graham, and his investment partner David Dodd, value investing is an investment strategy that involves buying stocks that are believed to be trading for less than what they are worth.

Known as the intrinsic or book value, it is argued that every business has a specific value associated with them that reflects the financial strength and economic outlook of the company.

As such, Graham argues that every so often, there are wonderful opportunities to buy businesses for a major discount on what they are worth.

Another way of thinking about it is like purchasing a brand-new car when it is selling at a 20%, 30%, or 50% discount.

In doing so, you become an owner for less, meaning that you save more and protect your downside better since the stock is already deemed undervalued.

In addition, value investors expect that these stocks will eventually return to their intrinsic value, regardless of whether it was overvalued or undervalued at the time.

The only question is, how long will it take to do so?

What is better: Growth Stocks or Value Stocks?

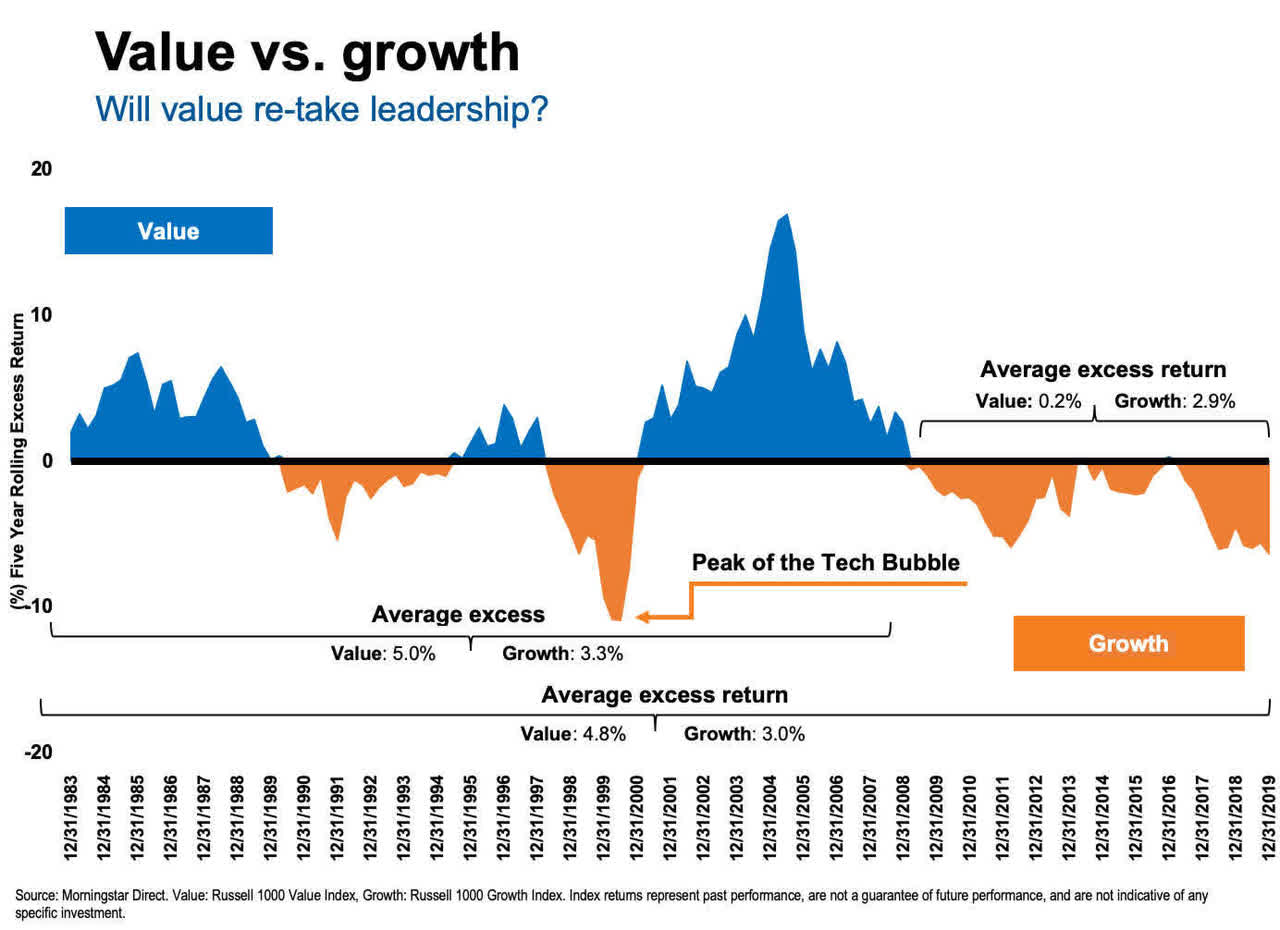

Historically, growth stocks and value stocks have traded inversely to one another, with growth stocks performing best during bull markets, and value stocks performing best during bear markets.

That being said, under regular assumptions, growth stocks and value stocks are distinguished as two different asset classes when in actuality they can be one and the same.

For example, if Meta ($META), a high-growth company, is valued at $300 per share, but is currently trading at $130 per share, this would imply that the business is undervalued and will eventually reach its appropriate valuation sometime in the future.

Under these circumstances, Meta would be considered both a growth and value stock because it is growing quickly from a fundamental level, but it is also being priced at discount at the same time.

Fortunately, this is the ideal situation for us as investors because it means that we have the opportunity to buy excellent, high-growth stocks for less than what they are actually worth.

It is like buying a Lamborghini for $100,000 and knowing that you’ll eventually be able to sell it for $500,000 when the market realizes it has made a mistake.

In general, you never want to overpay for stocks as investors because the price of a company will always return to its real value in the long run.

Since that is the case, it is better to behave like a value investor when investing in growth stocks because you’ll avoid overhyped and overvalued companies more often.

In other words, why not get the best of both worlds while building your portfolio?

Growth Investing Strategy 101

Now that we covered some important factors about growth stocks, it is time to finally put our words into action with our growth investing strategy.

In this section, you will learn how to find growth stocks and how to pick them, plus the best investment platforms for investing in growth stocks.

How to Find Growth Stocks?

Searching for the best growth stocks to invest in is a fun and exciting journey.

Although it certainly requires some time and patience, your hard work will be rewarded when you discover a company that is growing spectacularly and you invest in it well before the rest of the world finds out.

To do so, an investor should be open to as many resources as possible because it will often sharpen their perspective and introduce them to new investment opportunities along the way.

Here are the best investment resources for finding growth stocks:

-

Growth Stock Indexes and ETFs

Indexes and ETFs are excellent places to begin your hunt for growth stocks because the stocks are already picked out for you, based on a set of criteria, and you simply have to choose which growth stocks are most attractive to you.

Not only that but if picking individual stocks isn’t your thing, growth ETFs are an awesome strategy for passive investors who don’t want to do all of the dirty work required for analyzing individual stocks.

Here are the top five of the best growth and ETFs available in the market today:

iShares Core S&P US Growth ETF ($IUSG)

iShares Morningstar Growth ETF ($ILCG)

Vanguard Growth ETF ($VUG)

Invesco QQQ Trust ($QQQ)

iShares Russell 1000 Growth ETF ($IWF)

-

High Growth Markets

Another effective method for finding valuable growth stocks is by exploring emerging markets where there is expected to be a lot of demand or large investments in the coming years.

These markets can be anything from semiconductors, decentralized finance, biotech, virtual reality, and more.

A good benchmark for determining whether or not a market is high-growth is to evaluate its forecasted market size and the rate of growth that it is likely to achieve over a certain period.

Typically, a market that is growing in the double digits, or greater than 10% per year, is a sign that it is a growth market because it means that there are still many more years of profits before things start to slow down.

To find various growth markets, including their forecasted annual growth rates, check out research websites like Grandview Research, and Globenewswire, to facilitate your search.

It is important to note that market forecasts aren’t always accurate, but they do help an investor understand what other analysts and investors are thinking.

When researching a growth market, always consider multiple industry reports to gain a clearer idea about where stocks in that market are headed.

Use a Stock Screener

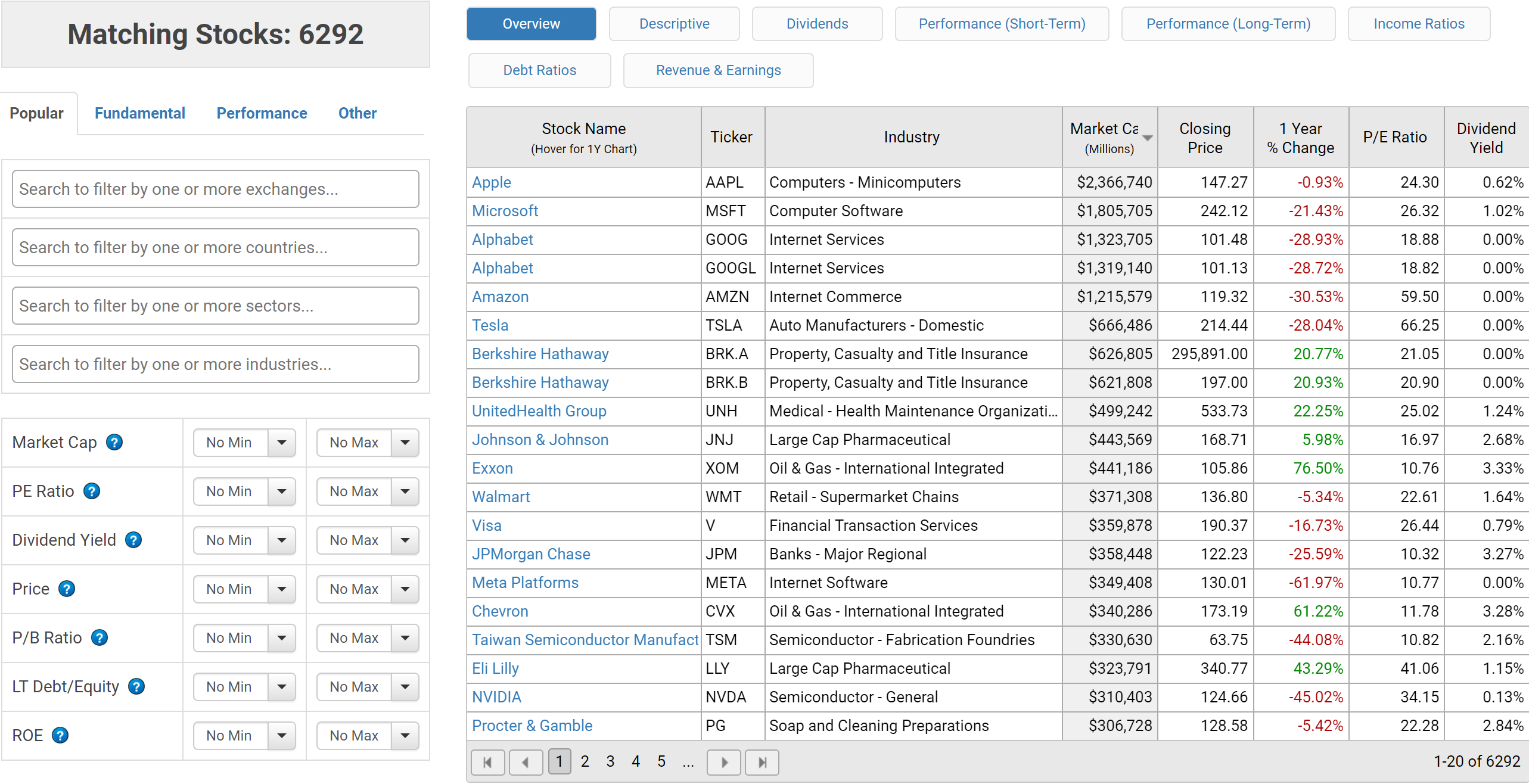

Last, but certainly not least, stock screeners are an amazing tool for discovering growth stocks to invest in because they help sort the diamonds from the rough.

By adding filters like Market Cap Size, Return on Equity, Revenue Growth, and more, growth investors can find investments that better align with their portfolio objectives.

In addition, a stock screening tool is helpful for investors because it compares stocks within the same industry, meaning that you can determine which company is most likely to succeed based on its financial strength and value relative to its competitors.

To begin screening for stocks, Macrotrends.net offers an effective stock screening tool with a wide variety of filters to choose from.

Mess around with it for a while and decide which filters are most appropriate for you.

For more information on the specific criteria we use at Edge Investments, check out our article, “What is a Small-Cap”.

How to Pick Growth Stocks to Invest In

So you have found a few growth stocks to your liking and now it is time to decide which of them is your best option as an investor.

To do so, an investor should ask themselves these four questions when analyzing any business:

Factor 1: Do I understand the business?

When it comes to investing, ignorance isn’t bliss.

If you are unable to understand what the company is or does, then it is difficult to tell where it will succeed in the future or if it is undervalued/ overvalued at that time.

The easiest way to determine whether or not you understand a business is to try and describe the company in a few simple sentences.

If you are unable to do so successfully, then it is probably best that you toss that stock in the Too Hard pile and move on to the next one.

Don’t be discouraged if this happens often.

It is better to invest in companies that you are confident in and easily understand than those you invest in based on speculation.

Because when the going gets tough, and the market starts to tumble, there is nothing more reassuring than knowing that your money is safe and that the business is capable of overcoming any challenges headed its way.

Factor 2: Is the business growing?

“Numbers don’t lie. Women lie, men lie, but numbers don’t lie.” – Max Holloway

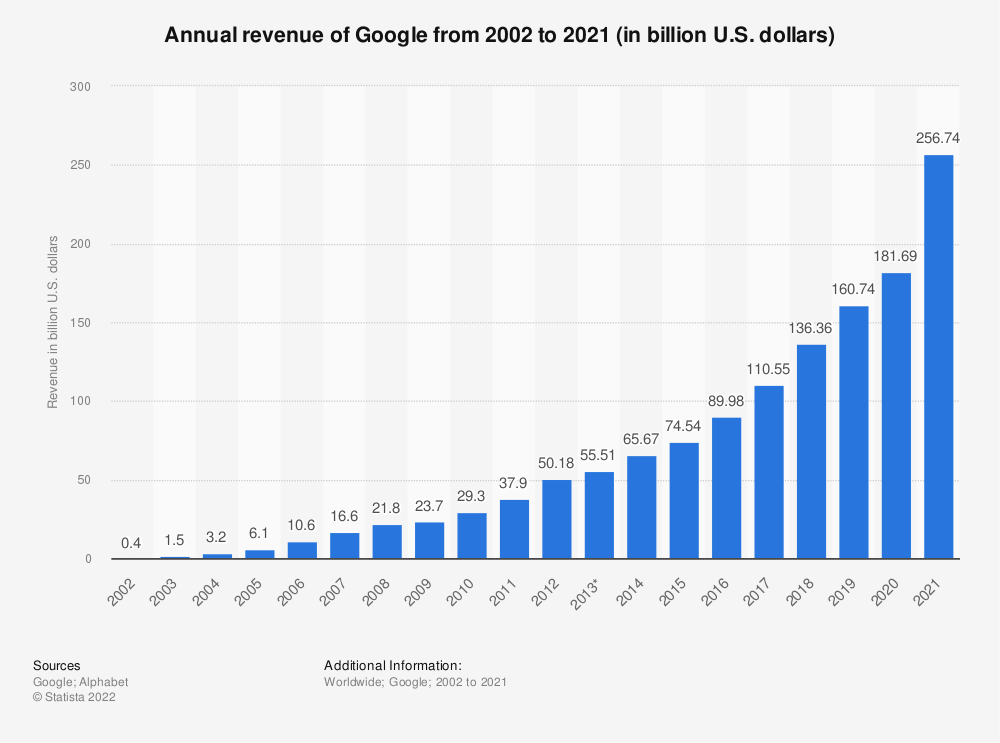

Financial statements are an investor’s best friend because they reveal all the juicy details about a business like where it earns its money and whether the management is using its capital effectively to produce consistent earnings growth.

While it is valuable to understand what a business does, being able to read financial statements puts a growth investor on another level because it gives them insight into where the business is now and where it will be headed.

When looking at financial statements, consider the following numbers:

- Revenue: the money received after providing a good or service.

- Net Income: the money retained after all expenses are paid for.

- Profit margins = (Revenue-Net Income)/ Revenue

- Shareholder Equity: The assets owned by shareholders after all liabilities are paid for.

- Free Cash Flow = Operational Cash Flows – Capital Expenditures

- Return on Shareholder Equity = Net Income/ Shareholder Equity

If all of these metrics are positive and growing consistently, then this is a strong indication that the company is doing well fundamentally and is likely to do so in the future.

Since there are so many uncertainties in investing and it is difficult to predict where the market is headed or what will happen next, having reliable financial outcomes and lots of cash is an effective way to overcome any turmoil that may ensue.

Not to mention that it makes it easier to value a company as well.

Factor 3: Who is the management team?

As of today, and at least for the foreseeable future anyways, humans run the growth companies that we intend to invest in.

Therefore it is necessary to evaluate the top dogs in a company and determine whether they are honest and hard-working people or conniving fraudsters.

While you may never have the opportunity to interact with them directly, there are ways to navigate around this obstacle and learn more about who you are working with.

The first place you should go is the business’s annual reports.

Within them is a trove of information laid out, often by the CEO, or another higher-up, explaining how the business performed in the previous year, plus the objectives they’ve laid out for this upcoming year.

From the annual reports, you can derive whether these leaders are accountable for their mistakes, realistic with their assessments, and committed to the goals they’ve set out to do.

By coupling this report with the financial statements, you can determine if they deliver on their promises or if they are just selling you the dream.

But most importantly, you will have the opportunity to learn if they are people of integrity or not.

To support this management assessment, an investor should determine how much ownership the leadership has of the company.

If they have a large portion of their net worth tied to the business, this is a promising sign because it means that they are aligned with investors and likely to be in it for the long haul.

On the other hand, if their personal stake is worth pennies, then this should be a major red flag because they may be in it for the fat pay check at the end of the year.

It is always worthwhile conducting your due diligence on a management team because they are ultimately responsible for your money while you are invested in the company.

Question 4: How much is it worth?

The last and most important thing to do when making an investment decision in a growth stock is to determine how much the company is worth.

You never want to overpay for a business because as mentioned earlier, the price of the stock will always return to its intrinsic value eventually.

Therefore, it is crucial that you give a business a reasonable valuation, and provide yourself with a margin of safety to protect yourself from any errors you may make along the way.

For more context, a margin of safety is a concept invented by Benjamin Graham that advice an investor to buy below the intrinsic value, to mitigate any unforeseeable risks along the way

In doing so, you set yourself up for the best chance of success because the downside to investing is limited.

To value a company, there are two common strategies:

- The Discounted Cash Flow model forecasts future cash flows and discounts them back to the present day.

- The Comparable Approach which compares similar companies to one another and you look for the cheapest one based on the lowest P/E, P/S, EV/EBITDA, and P/BV ratios.

For simplicity sake, it is best, to begin with, the comparable approach because all of these ratios are easily accessible on a website like Yahoo Finance

After you gather all of the ratios on the comparable businesses, determine which one is the strongest financially and purchase it when the company’s ratios are trading lower than the others.

While it may not happen often, waiting for opportunities like these improves your likelihood of success drastically because you are buying a wonderful business at a discount compared to the rest.

It pays to be patient when investing.