In the 18th century, famous investor, nobleman, and banker Baron Rothschild said the now very famous quote, “buy when there is blood in the street, even if the blood is your own.”

Hopefully, the above quote provides a timely reminder of having the courage to buy stocks in the middle of market turmoil, as buying when others are selling is a proven strategy for achieving long-term financial success.

And now, with the current collapse of Silicon Valley Bank, four-decade-high inflation, and the fastest interest rate tightening campaign in the US since the 1980s, there is definitely some blood running up and down Wall Street.

However, there is no return without risk, and right now could potentially be a great time for long-term investors to buy solid companies at a discounted rate. Knowing what the future holds is impossible, though proper risk management and a willingness to take risks when others are fearful could potentially lead to outsized investment returns for investors.

With this in mind, we’ve identified 10 high-risk, high-reward stocks that have the potential to pay off handsomely for investors in the coming quarters and years:

- Virtu Financial (VIRT)

- Toast (TOST)

- Yalla Group (YALA)

- Direct Digital Holdings (DRCT)

- Farfetch (FTCH)

- Mogo (MOGO)

- Atomera (ATOM)

- IonQ (IONQ)

- Upstart (UPST)

- Datadog (DDOG)

1.) Virtu Financial (VIRT)

Virtu Financial is a tech-focused financial services firm that enables clients to trade on various venues across countries and in multiple asset classes, including global equities, ETFs, foreign exchanges, futures, fixed-income assets, cryptocurrencies, and other commodities. Additionally, the company offers an impressive analytics platform providing a range of pre-and post-trade services, data products, and compliance tools for clients to invest, trade, and manage risk across markets.

Virtu has seen its share price decline significantly in 2023 due to increased scrutiny of market-making trading firms, as well as the current turmoil over banking stocks. However, Virtu benefits greatly from both increased volatility (which is almost a certainty in 2023) and the large increase in retail day traders looking for low cost trading options.

Today, the company trades at 0.77 times sales with a market cap of only $1.67 billion. Considering Virtu is profitable, has total cash of over $7 billion, and has relatively little debt of $3.75 billion, Virtu has multiple favorable tailwinds as we move further into 2023 and is at an attractively valued price for investors to consider.

2.) Toast (TOST)

Toast is driving the digital revolution in the restaurant industry, which has historically been characterized by low profit margins and operational inefficiencies. More specifically, Toast is offering a full technology suite to its customers, helping make their restaurant businesses more profitable and efficient.

And unlike its competitors, such as Square or Clover, which provide universal platforms, Toast is entirely concentrated on the restaurant sector. At present, approximately 74,000 restaurants, accounting for about 9% of the estimated 860,000 eateries in the United States, use Toast’s offerings. Toast generates revenue by charging a percentage of each transaction it handles and selling its software services through a subscription service.

Opinions expressed from analysts show that Toast is expected to incur a net loss of approximately $600 million from 2023 to 2025, followed by net profits in 2026. Management anticipates achieving EBITDA profitability in 2023, while Wall Street predicts a narrow full-year EBITDA loss combined with modest gains in the second half of the year. Revenue is projected to rise from $2.7 billion in 2022 to $6.7 billion in 2026, indicating substantial growth potential for Toast.

As more restaurants use Toast’s payment readers to handle transactions, profit margins are expected to increase, as the company has a strong network effect and the ability to achieve profitability with scale.

As Toast’s customer base expands, the cost of acquiring new clients is expected to decrease relative to overall sales, and the average revenue per user could grow over time as restaurants adopt additional services.

The biggest risk for Toast investors comes from the company not delivering on a profitable business in the coming years, as well as the potential for an incoming recession by the end of 2023. If consumer spending declines too rapidly, it could lead to new restaurants being put off from implementing new software like Toast’s, stalling their growth and potentially leading to cash-flow problems.

3.) Yalla Group (YALA)

Yalla is working towards becoming the preferred social media platform in the Middle East. More specifically, the company offers a voice-centric social networking and entertainment platform allowing users to play games, instant message friends, shop online, and more.

What makes Yalla attractive is the company’s strong financials, as well as its proven ability to continuously build out its platform in ways that resonate with its customer base.

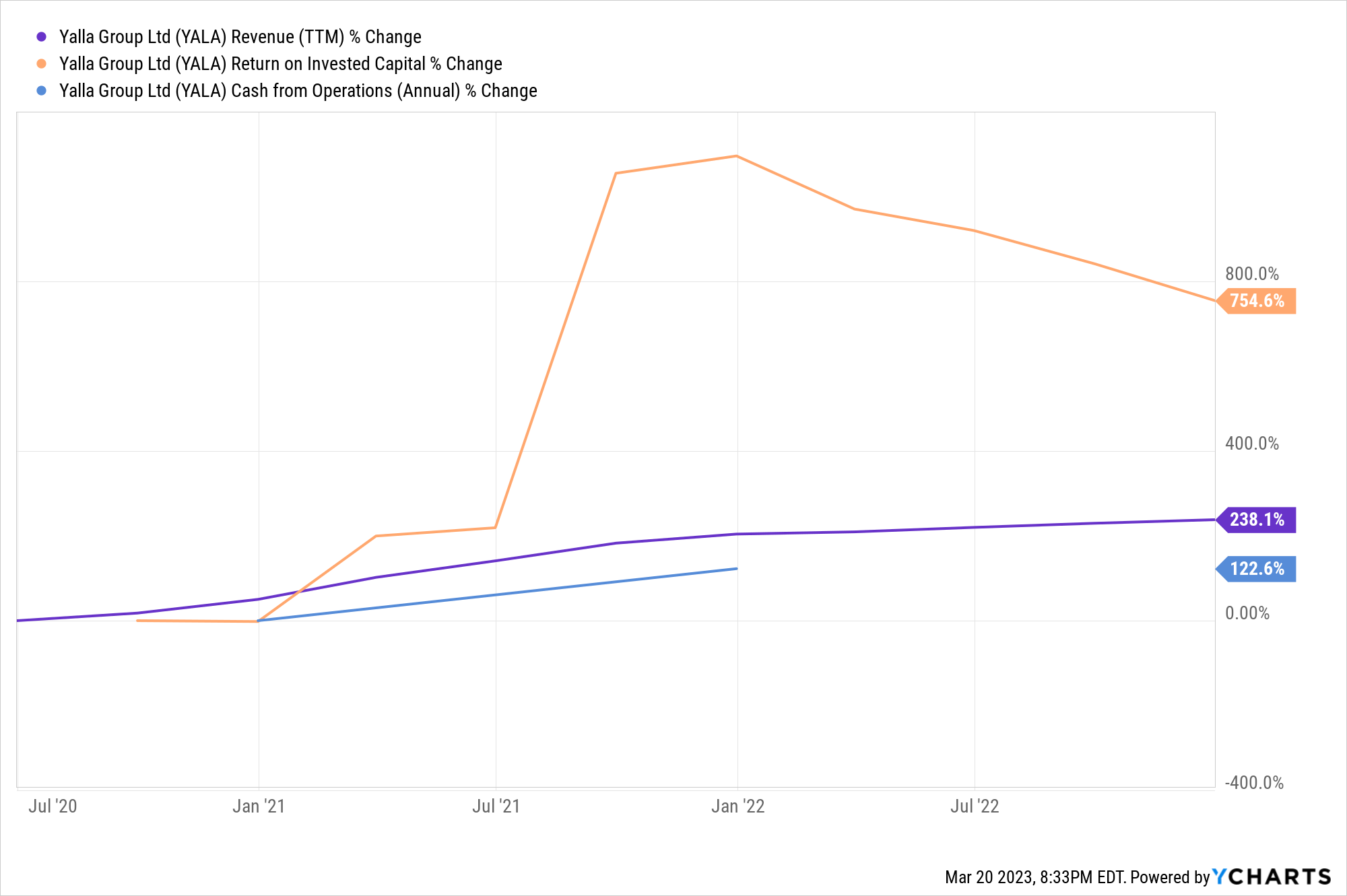

The chart below shows Yalla’s revenue has increased by 238% in the last 3 years, along with its return on invested capital (with a 754% improvement), and cash from operations (with a 122% improvement) over the same time period. All of this gives Yalla a stock price with an attractive valuation and plenty of upside from current levels.

When it comes to investment risk, in the past year Yalla is showing that the current macroeconomic challenges has begun to affect the company’s ability to continue to grow its revenue. Recession worries have limited consumers’ willingness to spend on the platform, which in turn has led to Yalla pulling back on its expansion plans.

Yalla has strong network effects and enviable scalability, which makes them a great potential stock pick, but investors should be prepared for high volatility as Yalla continues to navigate an uncertain near term environment.

4.) Direct Digital Holdings (DRCT)

Direct Digital Holdings is a pure play on the digital advertising market.

Now, there are certainly other options within the adtech space, however DRCT offers investors an interesting investment opportunity based on their niche focus on underserved and less efficient ad markets.

A list of risky stocks with considerable growth potential wouldn’t be complete without Direct Digital Holdings, as the company operates in a highly competitive industry, yet is valued at an astoundingly low price-to-sales ratio of 0.20.

DRCT has a market cap of only $14 million but will do over $70 million in revenue in 2023. The ad market has experienced a stark slowdown since interest rates have begun to rise and the company will have to continuously find new value offerings to differentiate themselves from the competition. If the company can do this successfully, DRCT could be a great strong buy opportunity for aggressive investors.

5.) Farfetch (FTCH)

Farfetch Limited and its subsidiaries are responsible for operating a luxury fashion industry platform across the globe, specifically in the United States, United Kingdom, and other international markets. The company’s operations are divided into three segments: Digital Platform, Brand Platform, and In-Store.

Near term, analysts expect the high end fashion industry to go through a period of consolidation; meaning Farfetch has the opportunity to grab significant market share as they continue to prove themselves as one of the leading firms within the high end marketplace economy.

In addition, there is a good chance Farfetch is undervalued at current levels, with a market cap of only $1.83 billion and total revenue of $2.32 billion.

Risk wise, Farfetch is operating in an industry with multiple new players looking to establish themselves. The company will have to fight for each percent of market share they grab, and will have to prioritize innovation to stay ahead of their competitors.

Should they be able to do this, Farfetch could have Goliath-sized gains in store as the company has incredible leverage in a fast emerging market to capitalize on.

6.) Mogo (MOGO)

Mogo is working toward building a comprehensive financial platform for retail investors to apply for a loan, get a credit card, as well as buy and sell stocks, cryptos, and other assets. Mogo has seen its share price decline by almost 75% within the last year, due to changing financial conditions and a stock market that is punishing companies that aren’t yet profitable.

Despite this, Mogo offers a unique offering and is quickly becoming one of the few completely digital financial institutions within Canada. The company has proven nimble and fiscally responsible in times of uncertainty, and has essentially unlimited growth verticals as they continue to build out their product offering and onboard new users. This is also a company that could be a potential acquisition target from a larger financial company – which would send Mogo’s shares rocketing higher.

7.) Atomera (ATOM)

Atomera is perhaps best reserved for the most aggressive investors who realize the true innovation and opportunity the company presents.

A pre-revenue company that is working on building next generation technology in how semiconductors are designed. The company’s lead technology is the Mears Silicon Technology, which is a thin film of reengineered silicon that can be applied as a transistor channel enhancement to CMOS-type transistors – or in other words – a potentially game changing improvement to how current semiconductors are designed and operate.

Atomera presents considerable risk, as the company has essentially zero cashflow, revenue, or proof of concept in the real world. It is a pure and simple play on the future of microchips which offers a high-reward, high-risk stock for investors to consider.

8.) IonQ (IONQ)

IonQ is a quantum computing company working on applying this new technology to the cloud. The tech firm has limited revenue and is still working toward putting their technology in a position that can help other companies solve problems, increase efficiencies, and reduce costs.

The potential in IonQ is the reality of quantum computing potentially changing how almost every industry operates. From cybersecurity, mathematics, supply chain problems, and more, all these industries could be improved or changed by quantum computers. This makes analyzing IonQ’s target market difficult. However, it also shows the incredible upside the company offers if its technology proves correct.

9.) Upstart (UPST)

During the pandemic, Upstart was the darling stock of Wall Street, as the company showed immense promise in changing the way banks provided loans to consumers.

More specifically, Upstart has built a proprietary AI system that considers over 1,000 different variables to assess someones creditworthiness. In turn, this would allow banks to issue more loans to more people who have a higher likelihood of repaying their loans on time and in full. And considering the consumer loan market can reach up to the trillions (when considering mortgages, auto loans, personal loans, and more), Upstart has a mammoth sized market to work with.

However, looking at Upstart’s stock price, investors are probably wondering what’s going on. (Upstart has gone from an all time high of over $400 a share to around $14 a share today.)

Well, the current interest rate heavy environment has shown the flaws in Upstart’s business model and has even required the company to hold loans on their balance sheet (this is a noticeable difference from their original business model, as Upstart was first designed to only facilitate the loan – not actually be accountable for the amount if a consumer fails to pay).

Upstart is perhaps the most high-risk, high-reward stock on this entire list, given their large market size and game changing AI, combined with an extremely unfavorable macro environment. For aggressive investors willing to take on high risk stocks, Upstart may be a perfect candidate.

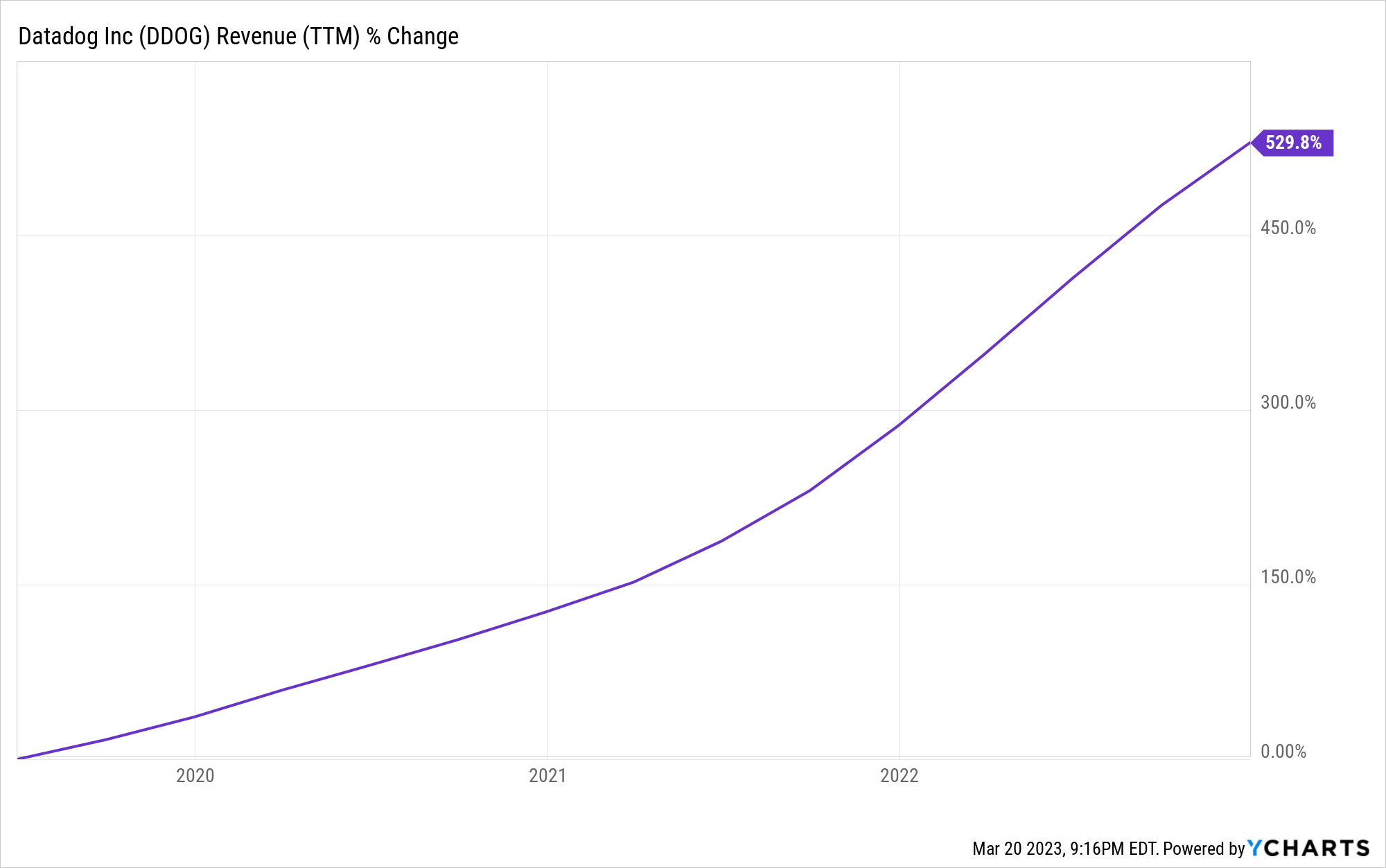

10.) Datadog (DDOG)

Datadog’s performance has been stellar quarter after quarter, year after year. The company operates a security, data analytics, and observability platform, giving its users unique insights into their entire technology stack.

On a 5-year time frame, Datadog has grown their revenue over 500%. But along with this stellar performance comes an extremely high valuation – Datadog currently trades for over 2,000 times earnings.

Clearly, Datadog offers something companies want, as their customer base, net recurring revenue, and margins continue to grow at eye-popping numbers each quarter.

The risk with DDOG comes from its incredibly high valuation, meaning if the company fails to deliver on consistent above-average growth, it will likely cause a sharp decline in the company’s share price.

Final Word

Today, we’ve compiled a list of 10 high-risk, high-reward stocks for investors to contemplate.

Consider picking a few stock picks to research further, or alternatively, investors can start with smaller positions in each company listed above to limit their risk exposure and spread their bets across multiple potential multi-baggers.

Each of these firms is disrupting traditional industries or expanding into entirely new ones, and while it’s likely not every stock listed above will work out, investors ought to allocate a portion of their portfolio to high-risk, high-reward stocks that have extremely bright futures.

However, regardless of how you decide to invest in these high-risk, high-reward stocks, you should ensure you have a diversified investment portfolio to properly limit your risk. Because while the potential for significant gains is undoubtedly attractive, investors must also acknowledge the high level of risk associated with these stocks. As such, it’s critical to spread investments across multiple equities and even different asset classes to minimize overall risk exposure.