I know when I say the words “cyber security,” your eyes probably glaze over, and you imagine a slightly nerdy guy, maybe droning on about cloud security, cloud computing, and complaining about major data breaches. But, I am here to tell you that the business of online security can also be a good investment.

Recent years have borne witness to an exponential surge in cyber threats (blame increasingly connected devices, the proliferation of credit card data online, open digital systems, and numerous others), with projected global costs of cybercrime expected to blow past a staggering $6 trillion annually. Underscoring the importance of cybersecurity in the contemporary online landscape. As such, the cyber security sector is seeing an influx of innovative businesses and organizations, investors, and other catalyst moments.

Now, since COVID-19, cyber security spending has just gone crazy, boosting demand for more software, infrastructure, and technology around the industry. This increased demand has led to the flooding of investors into the sectors, making it one of the best post-pandemic performing areas. If you’re wondering how to invest in cyber security, you’re not alone.

Let’s Talk Cyber Security

So today, we will break the industry down for the savvy investor. Specifically, we will cover:

- Is Cybersecurity a Good Investment?

- How to Analyze Cybersecurity Stocks

- The Best Cybersecurity Stock to Invest In

Whether you are a Buffet disciple or a chronic Reddit user, this article will have something for you.

Is the Cybersecurity Sector a Good Investment?

Everyone’s favorite megabank, Morgan Stanley, has been backing the industry for a long time. They, too, echo the sentiment that the industry is heading into favorable conditions for its proliferation. What tailwinds are all the experts seeing? Well…

- Robust demand for security services

- The sheer amount of data and broad exposure it represents for companies

- The growing sophistication of cyber threats and hackers

The Case for Cyber Security Growth

Data protection has never dominated company concerns more than it does today. Cyberattacks will cost businesses over $10T by 2025 (which is over a 300% increase from 2015).

As such, cybersecurity spending by organizations has soared to about $150B (2021 estimate), representing per annum growth of over 12%. This would lead one to assume that maybe this market is becoming saturated or the problem has mostly been fixed. Well, dear investor, I have good news for you…there is plenty of runway left.

A recent survey found that 40% of observed malware had never actually been seen before. Attacks are evolving and remain dynamic, meaning the industry must evolve continuously. The current gap between the serviced market and the unserviced market is massive and is still growing, and growing demand points to opportunities for investors.

The global cybersecurity total addressable market may reach $1.5 trillion to $2.0 trillion, approximately ten times the size of the vended market. | McKinsey & Company

Now, I should mention that the under-penetration of these cybersecurity solutions by organizations points to likely underfunded and unsupported internal security leaders. As an investor, keep an eye on how global companies are investing in cybersecurity and the technology around it.

How to Analyze Cybersecurity Stocks

So, how do you analyze cyber security stock? What are the tools you should lean into when making a judgment? (Unless you are a “YOLO” trader, in which case, go ahead and skip this part).

Assess the Industry Landscape

Start by understanding the broader cybersecurity landscape. What are the prevailing trends and challenges? Keep an eye on regulatory changes, emerging threats, and technological advancements that would push the sector forward. Keep in mind you also need to be prepared and always be scanning for coming headwinds.

Company Fundamentals

Examine the financial health of the cybersecurity companies you like and companies that dominate the sector. Key financial metrics like revenue growth, profitability, and debt levels are crucial indicators of company stability and growth potential.

Market Position

Investigate a company’s position in the cybersecurity market and its competitive advantage (is it use of artificial intelligence (don’t worry, we got you covered on that one), superior endpoint security, robust network protection, etc.). As well, do they offer unique solutions or hold patents that set them apart? Are they leaders in specific cybersecurity niches?

The next thought here should revolve around assessing the market value of the company against its software peers.

Technological Edge

The cybersecurity market is changing quickly due to the inevitable march of technological innovation. Companies that are investing in digital transformation in a measured way are poised for success.

Evaluate the underlying technology of the company and how it plans to remain competitive. Is it innovative, does it have integration capabilities, and is it scalable to meet growing cybersecurity risks (e.g., ransomware attacks are steadily growing and becoming more sophisticated)?

Client Base

Take a look at the market for the service. Are they serving high-profile clients in sectors like finance, healthcare, or government, where cybersecurity efforts are invested in? As well, is that client base financially robust? How often are they suffering data breaches, and how many use cases of access management do they encounter?

Growth Projection(s)

Let’s turn to the company’s growth prospects. Are there acquisitions on the horizon? Are they looking at partnership integrations? Is there any growth in that direction?

A company’s growth trajectory can significantly impact its stock’s performance because, at the end of the day, price movement is largely based on sentimentality around growth.

Management Team

Seasoned executives with a history in the cybersecurity landscape can be a strong indicator of potential. Does the management team have experience navigating the seas of a bear market or know how to orchestrate capital deals? These things all inform an investor about a company.

Valuation

Let’s get into the nitty gritty numbers, and as such, let’s talk ratios.

Compare key valuation metrics like price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio to industry averages. As well, look at industry benchmarks as a guide post. You are looking for undervalued picks (which we can teach you more in detail).

Risk Analysis

Identify and evaluate risks specific to the cybersecurity sector, such as a data breach, regulatory changes, or scaling startups in the cybersecurity market. Understanding and mitigating these risks is massive.

Externally, compare their handling to that of a software peer. How do they handle those risks compared to the organizations that you, as a super smart investor, are interested in?

Stay Informed

Finally, stay updated on the latest cybersecurity news and market developments. This sector evolves rapidly, and being well-informed is key to making smart decisions.

The Best Cybersecurity Stocks to Invest in

With the incessant proliferation of cybersecurity threats and the growth of the cybersecurity industry around these bad actors, there is an opportunity for an investor to participate in the boom of a critical industry in the modern world (the password from middle school isn’t cutting it for online security anymore).

As such, we are going to take a look at some companies that investors can consider investing in. As with all investments, you, as the investor, should assess your level of risk tolerance and do your own research before investing in cybersecurity stocks (which, as savvy investors, I am sure you know).

CrowdStrike Holdings Inc. (NASDAQ: $CRWD)

CrowdStrike Holdings is a household name in the cybersecurity sector that has been (in short) rather chaotic as a stock over the past year.

We are talking about a company founded over 10 years ago (in 2011) that IPO’d in 2019. The company uses cloud security, artificial intelligence, and endpoint security orchestration to fight cyber threats. One of their key differentiators is their ability to give organizations real-time threat analysis.

Their cloud-native approach to the business has allowed them to scale and pivot quickly. It also allows their client base to get solutions on the fly in a traditionally slow-moving industry. As almost every company moves to being cloud-first, this is a key advantage.

In addition, they adopted an AI (don’t worry, we can teach you about AI) and Machine Learning approach much earlier than the majority of the field, letting them respond, detect, and action threats much quicker and in real-time.

Now, all this doesn’t mean the company is not facing some challenges.

Key Highlights for Investors

- Slowed workload growth is set to put downward pressure on the company’s net retention rate

- Clients, in a familiar story, want to be paying upfront annual payments, which would inevitably cut into their free cash flow

- Revenue has grown by over 40x over the last 7 years

- The company has a net $2.14B net cash position

Cisco Systems Inc. (NASDAQ: $CSCO)

Cisco Systems has been around for a long while, since the 90s, and has a history as a supplier of network-building hardware to large companies.

During and after the pandemic, the company pivoted to focus less on office data networks (due to the rise of remote work). Instead, Cisco Systems has refocused on next-generation enterprise networks that seem to be a mix of on-premise data centers and a cloud-based infrastructure.

The company boasts a competitive video conferencing platform in Webex, building out 5G wireless networks and subscription-based software and services.

Key Highlights for Investors

- A sizeable amount of revenue growth has come via acquisitions (companies like ThousandEyes, IMImobile, and Duo Security)

- Investors should keep an eye on company margin improvements due to software sales revenue growth

- In Q3, earnings were up 15% from the year prior

- Revenues rose to $14.6B (QoQ growth of 14%)

Palo Alto Networks (NASDAQ: $PANW)

Founded in 2005, Pal Alto Networks provides advanced and comprehensive cyber security protection for organizations.

Specifically, they provide next-generation firewall protection, advanced threat protection, cloud security, network security, endpoint protection, and security management. With this broad swatch of services, the company is a consistent leader in the cybersecurity sector, having the appropriate infrastructure and expertise.

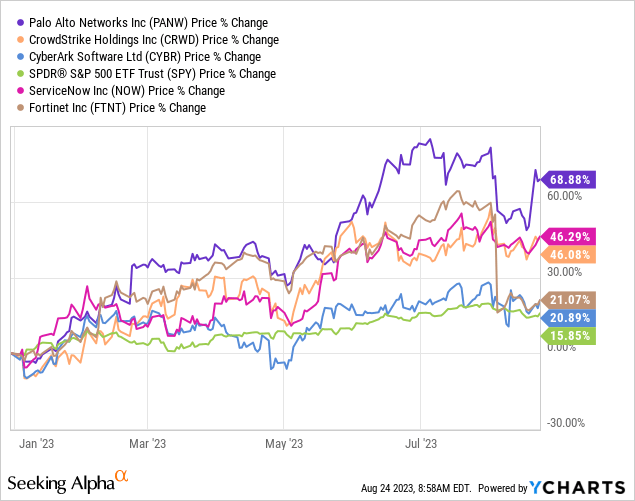

Currently, the company is outperforming its peer group and the S&P 500 YTD as investment into cybersecurity surges. This boom is expected to keep surging as AI represents brand-new threats to their clients despite fears of cost-cutting economy-wide.

PANW YTD vs S&P 500 and Peer Group | Seeking Alpha

The company’s key offerings of SASE, Cortex, and Prisma Cloud are expected to drive revenue growth to respond to these brand-new threats.

Key Highlights for Investors

- QoQ revenue growth of 11.7% to $1.95B

- 12 Qs of back-to-back growth

- Adjusted free cash flow margins of over 35%

- Expansion of Cortex and robust go-to-market strategy

A Final Word

Cybersecurity spending has far outpaced pre-COVID levels as organizations face a shifting and growing threat landscape. As far as investments go, this means that this may be a good time to place an investment in these security solutions. Organizations are facing threats much more sophisticated than the standard ransomware attacks we are all used to; new vulnerabilities are being exposed that utilize deep fakes, AI, and such technology.

As such, cybersecurity stocks are poised to experience rapid growth and high demand.

When researching cybersecurity stocks, do your own research and invest at your own risk. This does not constitute investing advice.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.