Image Source: 10 Top Crowdfunding Sites: Fund Your Vision in 2023 | Shopify Canada

Everybody wishes they could go back thirty years to invest in companies like Nvidia or Amazon. These companies have returned well over 1,000% since they were founded, giving early investors eye-popping returns and creating lasting wealth for their families and loved ones.

The problem, however, is that investing in any company before they started trading on a public stock exchange wasn’t always possible for the majority of individual investors.

Traditionally, to invest in private companies, one would have to be an angel investor, partner with venture capital firms, or have an inside track with an entrepreneur who is looking to raise capital.

However, today is a different story.

Now, with the development of equity crowdfunding platforms, investors, regardless of their net worth or portfolio size, can invest in early-stage companies that don’t yet trade on public markets.

Today, we will be giving you a detailed step-by-step guide on how to invest using equity crowdfunding sites, if using these sites is even worth it, all the risks you will need to be aware of, and some tips to utilize before making your first equity crowdfunding investment.

Rules for Investing with Equity Crowdfunding Platforms

:max_bytes(150000):strip_icc()/GettyImages-82880353-064135cb483940ff9230420d095b6d31.jpg)

Image Source: SEC Filings: Forms You Need To Know | Investopedia

Before we dive into how to invest in equity crowdfunding, investors first need to understand what equity crowdfunding is, whether they’re eligible to invest in equity crowdfunding opportunities, and whether or not it’s even worth it.

What is Equity Crowdfunding?

Equity crowdfunding is a way for retail investors to invest in startups before they become publicly traded. This process is facilitated through crowdfunding platforms that present private companies to investors who can pick and choose which firms they want to fund.

In exchange for their capital, investors will receive an equity stake in the private firm.

Who Can Invest Through an Equity Crowdfunding Platform?

The short answer is, almost any investor will be eligible to invest through equity crowdfunding platforms. However, the Securities and Exchange Commission (a financial industry regulatory authority) has set investment limits depending on which type of investor you are:

Accredited Investors:

Historically, equity investments were reserved primarily for accredited investors—who are people that have a net worth of over $1 million, excluding the value of one’s primary residence, or an income of over $200,000 each year for the last two years (or $300,000 with a spouse).

Non-Accredited Investors:

A non-accredited investor, on the other hand, is an individual who does not meet the income or net worth thresholds required for accredited investor status—specifically, a non-accredited investor would have less than $1 million in net worth excluding their primary residence or an annual income below $200,000 (or $300,000 with a spouse).

Is Equity Crowdfunding Investing Worth It?

Equity crowdfunding investing presents a unique blend of opportunities and risks.

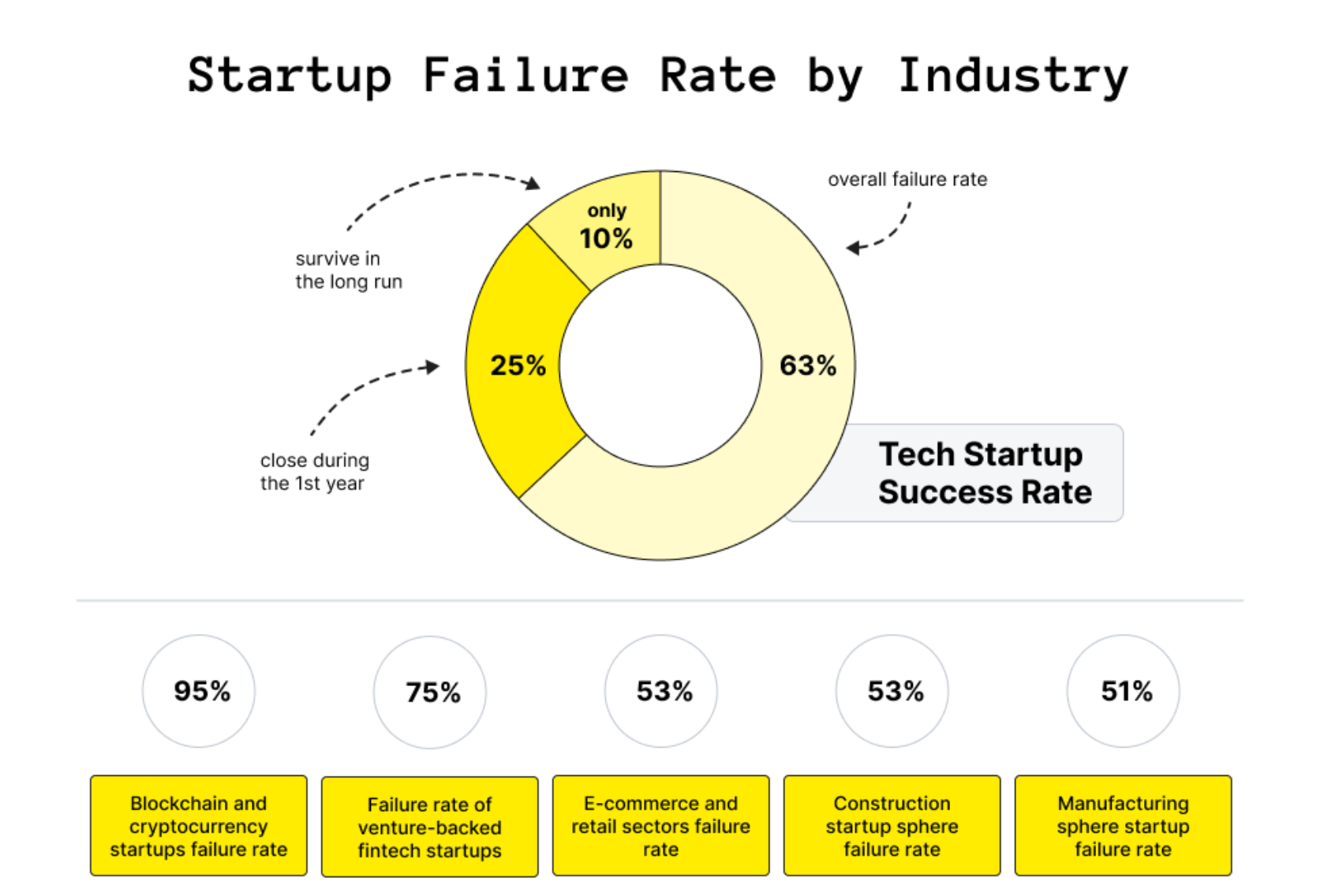

It is a well-known fact that the startup landscape is harsh, with 25% of tech startups failing within their first year and only a select 10% staying alive over the long term (see picture below).

This stark reality underscores the high-risk nature of investing in early-stage companies. The volatility inherent in such investments means that while some investors may experience exceptional gains, many others will realize substantial losses.

Image Source: Startup Failure Rate by Industry | UpSilonit

Despite these risks, equity crowdfunding has shown that it can be a lucrative investment avenue for those who choose wisely and have a bit of luck on their side. SeedInvest, a leading equity crowdfunding platform, has successfully channeled over $465 million into more than 275 security offerings.

Below are some examples of companies that have provided significant returns to their early crowdfunding investors:

- Heliogen: This innovative company utilized a “side by side” Reg CF – Reg D offering to raise $1.6 million at a $20 million pre-money valuation in 2017. Just four years later, Heliogen went public with a valuation of $2 billion, signaling a massive win for early investors.

- Knighscope: Having raised capital through multiple offerings on SeedInvest, Knighscope’s IPO in 2022 yielded an impressive implied internal rate of return (IRR) of 55% to early investors.

- Trust Stamp: Backed by more than 2,700 investors, Trust Stamp’s Reg A+ offering of $6.5 million produced an IRR of around 90%, demonstrating the high-yield potential of successful equity crowdfunding ventures.

- Shelf.io: Starting with a modest $475,000 raised in a Reg D offering, Shelf.io’s subsequent $52 million Series B round provided an exit opportunity for several SeedInvest investors, with an approximate IRR of 95%.

- PetDesk: This company’s trajectory from a Reg D raise in 2016 to an acquisition resulted in a rewarding 75% IRR for its investors.

These examples highlight the substantial rewards that can be gained from equity crowdfunding.

However, they are not the norm but rather the outliers showcasing what is possible when things go right. It is crucial to remember that these are exceptional cases, and not all private firms will generate significant returns.

Investors must enter the equity crowdfunding space with their eyes wide open, acknowledging the heightened risk and understanding that past performance is not indicative of future results.

Step-by-Step Guide for Equity Crowdfunding Investing

Now, it’s the moment you’ve all been waiting for.

Below is the only guide you’ll need if you’re looking to get started in investing in equity crowdfunding opportunities through online platforms.

Step 1: Self-Assessment

Understand Your Investor Status:

- Determine whether you are an accredited or non-accredited investor.

- Assess your risk tolerance, investment goals, and how much you’re willing to invest.

Step 2: Platform Selection

Choose an Equity Crowdfunding Platform:

- Compare various platforms based on their track record, user interface, customer service, and type of offerings.

- Register and create an account on the platform of your choice.

There are numerous equity crowdfunding platforms where potential investors can earn their equity stake. Here’s a brief list of some popular ones:

- SeedInvest: Offers a range of startups for investment, focusing on highly vetted opportunities.

- StartEngine: One of the largest equity crowdfunding platforms in the U.S., hosting a wide variety of startups.

- WeFunder: Provides a diverse array of funding opportunities, from tech startups to small businesses.

- Republic: Allows investments in startups, real estate, video games, and crypto.

- Crowdcube: Based in the UK, Crowdcube is a leading investment crowdfunding platform that allows investments in European startups.

- Indiegogo’s Equity Crowdfunding: Known for reward-based crowdfunding, Indiegogo also offers equity crowdfunding for a variety of startups.

- Fundable: Focuses on small businesses and offers both reward-based and equity crowdfunding options.

Step 3: Exploration

Explore Investment Opportunities:

- Browse through the listed opportunities, filtering by industry, stage of growth, investment terms, and funding goals.

- Utilize platform tools and resources to aid in your search.

Step 4: Due Diligence

Conduct Thorough Research:

- Dive into the details of companies that catch your interest.

- Review their business plans, financial statements, use of funds, team background, and the terms of investment.

- Look for third-party analysis or get professional advice if necessary.

Step 5: Regulation Review

Understand Regulations and Limits:

- Familiarize yourself with SEC regulations regarding equity crowdfunding, especially Regulation Crowdfunding (Reg CF) and Regulation A+ (Reg A+).

- Know the investment limits applicable to you.

Step 6: Risk Assessment

Evaluate the Risks:

- Consider the startup’s risks, including market competition, execution risk, and the longer-term liquidity risk of your investment.

- Acknowledge the possibility of losing your entire investment.

Step 7: Engage

Interact with the Company:

- Use the platform’s features to ask questions and engage with the company’s founders or representatives.

- Attend webinars or Q&A sessions if available.

Step 8: Investment Decision

Make Your Investment Decision:

- If you decide to invest, determine the amount that aligns with your investment strategy.

- Follow the platform’s process to make a commitment, which usually includes an online form and digital signature.

Step 9: Transaction

Complete the Investment Transaction:

- Transfer funds as directed by the platform, which may involve a bank transfer, credit card, or other methods.

- Keep records of all transactions and communications.

Step 10: Post-Investment

Monitor Your Investment:

- After investing, monitor the company’s progress through updates provided by the crowdfunding platform or directly from the company.

- Stay informed about any additional rounds of funding or exit opportunities.

Step 11: Reporting and Taxes

Stay on Top of Reporting and Taxes:

- Keep track of any financial reports or updates from the company, as they may affect your investment’s value.

- Report your investment and any returns in your tax filings according to your local regulations.

Step 12: Exit Strategy

Consider Your Exit Options:

- Understand that private equity investments are typically long-term and illiquid.

- Consider potential exit strategies, such as a public offering, acquisition, or secondary market sale, bearing in mind any holding period requirements.

The most important thing to remember when beginning your equity crowdfunding journey is that unlike angel investors or venture capitalists, you won’t have direct access to these companies or their leadership teams. Rather, you will be investing through a funding portal and the information these companies present online.

Considering this, make sure you take your time when looking at potential investment opportunities and realize these investments will be inherently volatile and longer-term in nature.

Equity Crowdfunding Risks

Image Source: What are the Risks of Crowdfunding? | Google

Equity crowdfunding offers an attractive, albeit high-risk avenue for investing in startups and early-stage companies. While the potential for high returns is evident, the risks are considerable and must be carefully weighed. Here are some of the key risks associated with equity crowdfunding:

- High Failure Rate of Startups: As previously highlighted, a significant percentage of startups fail within their first year, and long-term survival rates are low. The risk of total investment loss is a fundamental reality in startup investing.

- Illiquidity: Investments in private companies through crowdfunding are not traded on a public stock exchange, making them highly illiquid. This means that investors may find it challenging to sell their shares and may be required to hold their investment for an extended period, often several years.

- Dilution: If a company raises additional capital after an initial crowdfunding round, the value of earlier investments may be diluted if new shares are issued. This can affect the ownership percentage and potential returns for early investors.

- Lack of Information: Compared to public companies, startups do not have to adhere to the same level of reporting and transparency. This can make it difficult for investors to fully assess the company’s ongoing financial health and business prospects.

- Regulatory Risks: Changes in regulations related to equity crowdfunding, securities, or the specific industry sector the startup operates in can have profound effects on the potential success of the investment.

- Fraud Risk: While crowdfunding platforms conduct due diligence, there is always a risk of fraud or misleading information from the companies seeking investment.

- Valuation Uncertainty: Startups are often pre-revenue or at an early stage of generating revenue, making it difficult to establish a fair market value for the company. Overvaluation can lead to poor investment returns.

Understanding and acknowledging these risks is crucial for any investor considering equity crowdfunding. It is advisable for investors to not only conduct thorough due diligence but also to diversify their investments to spread the risk and only invest capital that they are prepared to have locked in for the long term or potentially lose.

While the allure of being part of the next big success story is strong, the high-risk nature of equity crowdfunding cannot be overstated.

Final Thoughts

Investors should enter the equity crowdfunding space with a clear-eyed view of the risks, a commitment to thorough due diligence, and a strategy that includes diversification to mitigate potential losses.

It’s also important for investors to have realistic expectations about the liquidity of their investments and to be prepared for a long-term commitment without a guaranteed exit.

In essence, equity crowdfunding is not for everyone. It suits those who are willing to support innovation with the knowledge that they are venturing into a high-risk, potentially high-reward domain.

For those who choose to participate, it offers the exciting possibility of being part of a company’s journey from its early stages through to maturity and, possibly, to a successful exit, all while contributing to the broader entrepreneurial ecosystem.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.