Welcome to the dawn of a new era, where technology takes a giant leap forward, transforming the way we interact, create, and invest. In this digital revolution, an exciting phenomenon has emerged, promising to redefine the very fabric of the internet: Web3.

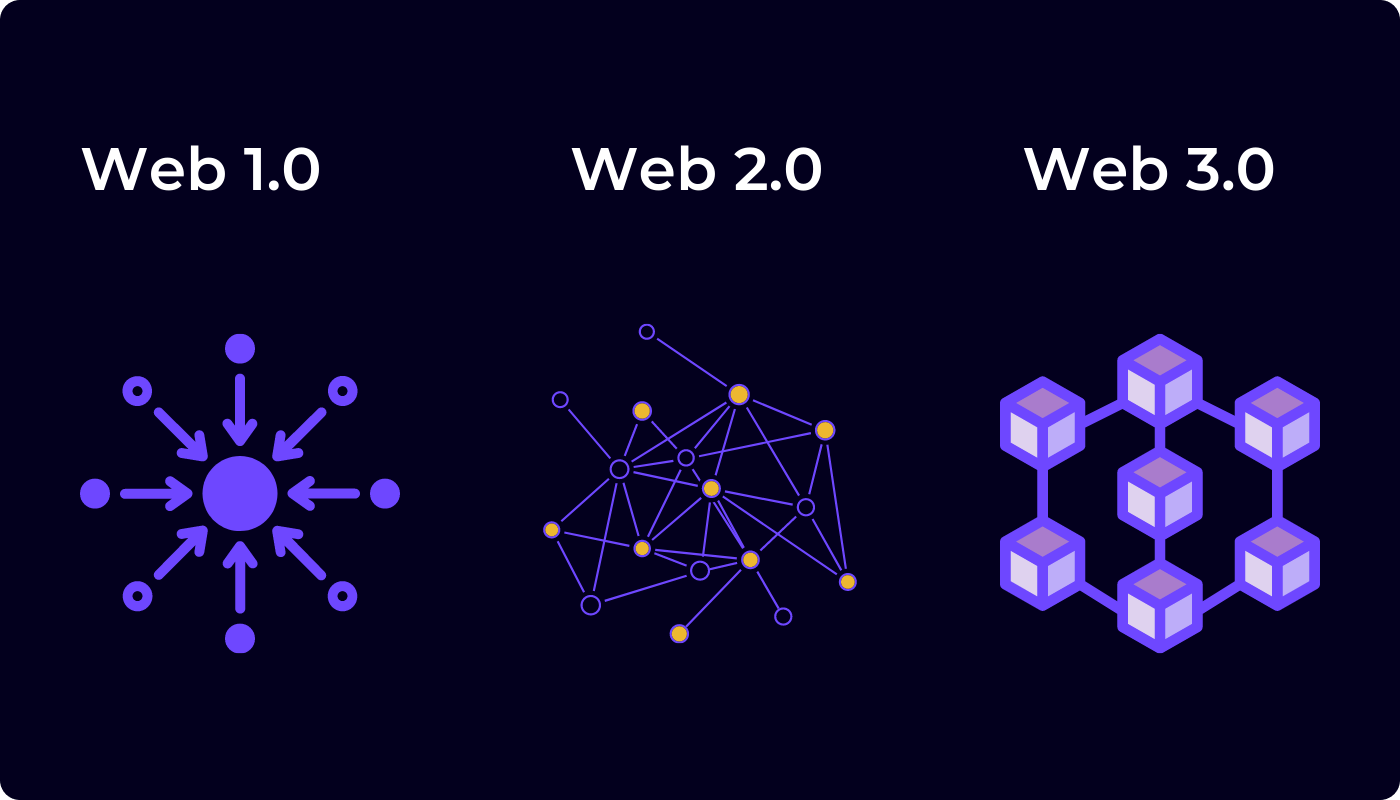

Web3 represents a paradigm shift, marking the evolution from static, centralized websites to dynamic, decentralized platforms powered by blockchain technology and digital assets. It envisions a future where individuals truly own their own data and digital identities, where transparency, trust, and security reign supreme. But what exactly is Web3, and why should you consider it as an investment opportunity?

Today, we want to highlight the essence of Web3 and unveil its incredible potential. We’ll touch on the core concepts driving this transformative movement and shed light on the best companies poised to capitalize on the Web3 trend. Additionally, we’ll discuss the future prospects of Web3 and the risks that accompany such groundbreaking innovation.

So, if you’re ready to seize the reins of the digital revolution and unlock a world of exciting investment possibilities, fasten your seatbelts and join us as we uncover the path to successful Web3 investing.

Explaining Web 3.0 (and why Should you Invest in it)

What is Web 3.0: A Simple Explaination | Coinmonks

Web 3.0, the decentralized web, is poised to revolutionize the internet as we know it. It represents a transformative leap from the current Web 2.0 landscape, where centralized entities govern online activities and wield control over user data. Web3 introduces a host of cutting-edge technologies, including blockchain, smart contracts, unique digital assets, and decentralized applications (dApps), to create a more open, secure, and user-centric digital ecosystem.

The building blocks of Web3 lie in the principle of decentralization. Unlike the traditional web, where power and authority are concentrated in the hands of a few big companies, Web3 redistributes control and ownership to individual users. Through the use of blockchain technology, data is stored across a network of computers, ensuring transparency, immutability, and resistance to censorship. This shift empowers individuals by allowing them to truly own their digital identities, data, and assets (like digital art), eliminating the need for intermediaries and enabling direct peer-to-peer interactions.

Investing in Web3 offers compelling reasons for both financial and philosophical considerations. From a financial standpoint, Web3 presents a vast array of investment opportunities driven by the demand for decentralized services and applications. As more users embrace the principles of Web3, innovative companies are emerging to build the infrastructure, protocols, and applications that will shape the decentralized future. By strategically investing in these forward-thinking projects, you position yourself to potentially reap significant financial rewards as Web3 adoption continues to gain momentum.

Further, investing in Web3 aligns your investments with privacy, security, and user empowerment values. The current internet landscape is plagued by concerns over data breaches, privacy violations, and the dominance of centralized entities. Web3 offers a solution by enabling users to have full control over their personal information and digital assets.

Moreover, Web3 transcends industry boundaries, with transformative implications across finance, supply chain management, healthcare, gaming, and more sectors. Investing in Web3 allows you to tap into multiple sectors poised for disruption, diversifying your investment portfolio and potentially benefiting from the growth of various Web3 applications.

That said, it’s important to acknowledge the risks associated with Web3. The Web3 ecosystem is still in its early stages, and market volatility and uncertainty are prevalent. Regulatory challenges, scalability limitations, and technological hurdles pose risks that investors must carefully evaluate.

Web3 is the paradigm shift of the future towards a truly decentralized, user-centric internet.

Investing in Web3 provides an opportunity to participate in a groundbreaking movement that offers financial potential and strives to build a more inclusive, secure, and empowering digital future.

Best Ways to Invest in Web3

Now that we’ve discussed the transformative world of Web3 and recognized its immense potential, the next crucial step is understanding how to invest in this groundbreaking movement effectively.

With the decentralized web gathering momentum, a multitude of investment avenues have emerged, offering unique opportunities for those looking to capitalize on the Web3 revolution.

Shopify (SHOP)

Benefits of Shopify for an Online Print Shop | GRAPHICS PRO

While Shopify may appear as a stalwart representative of the Web2 era, the e-commerce platform provider is actually making significant strides toward embracing the future of Web3. In fact, Shopify has already laid the groundwork for a fully functional Web3 experience, supporting several key components:

Through collaborations with third-party partners and app developers, Shopify customers can seamlessly accept cryptocurrency payments. The platform supports a wide range of crypto tokens, including popular options like Bitcoin and dollar-based stablecoins, enabling users to transact in various digital currencies.

In addition, Shopify has integrated Non-Fungible Tokens (NFTs) into its ecosystem, offering diverse applications for store owners. Within the Shopify platform, users can mint NFTs and associate them with digital or physical assets, thereby facilitating unique and exclusive sales opportunities. Some brands even leverage the tokengate feature, granting access to exclusive events for those who own specific NFTs from a designated series.

Furthermore, by securely storing NFTs in supported digital wallets, Shopify enables users to log in to their accounts without the need for traditional passwords, face scans, or fingerprint readers. This streamlined authentication process enhances convenience and security while aligning with the principles of Web3.

While building a Web3 store on Shopify may entail some additional considerations, the platform already offers practical solutions for users. Over time, as Web3 adoption progresses, Shopify, with its rapidly expanding ecosystem, is expected to refine and streamline its features, transforming into a fully integrated Web3 solution.

Despite Shopify’s stock trading at premium valuations of 12 times sales and 110 times earnings, the company’s track record justifies these price levels. With a compound annual average growth rate of 53% over the last five years, Shopify has consistently demonstrated its ability to adapt and evolve in the dynamic e-commerce landscape. As it continues to embrace Web3 and cater to the demands of the future, Shopify remains a compelling investment opportunity, even at its current expensive share prices.

Microsoft (MSFT)

Microsoft Unveils a New Look | The Official Microsoft Blog

For Microsoft the journey into the Web3 world begins with its renowned Azure cloud computing platform. Azure, a global network of computing assets, serves as a prime example of the decentralized concept. While Microsoft operates and maintains the service, the apps and services deployed on Azure can seamlessly reach every corner of the world, benefiting from nearby data centers with low-latency network access.

Azure’s extensive toolkit includes specific features designed to support decentralized Web3 functions. For instance, the blockchain-as-a-service toolkit and the Confidential Consortium Framework align with the ideals of Web3 development, providing decentralized authentication systems and infrastructure.

Microsoft, having kick-started the personal computer market five decades ago, has proven its resilience through numerous market evolutions. Microsoft has adapted and thrived from transitioning to graphical user interfaces to connect PCs to the global internet. While the company may have missed the boat on mobile computing, it successfully refocused its efforts on productivity apps and robust server systems. As we stand on the brink of the Web3 future, Microsoft Azure stands as a global platform for many leading players in this emerging market.

As the second-largest stock in terms of market cap, Microsoft’s shares command a premium valuation, trading at 36 times earnings and 12 times sales. However, Microsoft has consistently found ways to justify its premium valuation. With its strong track record, there is little reason to believe that the Web3 future would hinder Microsoft’s decades-long winning streak. As the company continues to embrace and evolve within the Web3 landscape, Microsoft Azure positions itself as a powerful enabler for the transformative potential of this emerging era.

AMD (AMD)

AMD Ryzen™ Threadripper™ Desktop Processors | AMD

Even in a decentralized computing system, hardware plays a vital role, and Advanced Micro Devices emerges as a key player in this domain. AMD boasts an extensive portfolio of processors that cater to various computing needs. Its Ryzen desktop chips and EPYC server solutions offer high-powered and cost-effective solutions for a wide range of general computing tasks. Meanwhile, its Radeon graphics processors excel in complex number-crunching scenarios, making them suitable for advanced artificial intelligence (AI) training rigs and other high-performance computing applications.

These products form crucial components in the Web3 machinery. As automation replaces hands-on human involvement in many Web3 functions, AI takes center stage. AMD’s hardware offerings are well-suited for AI training and low-cost general computing, which are essential in the Web3 ecosystem.

While the market for Web3 hardware is competitive, AMD does not need a monopoly to thrive. As the market expands to accommodate multiple successful hardware providers, AMD is well-positioned to join the ranks of the industry leaders. Notably, the recent acquisition of Xilinx for $50 billion has bolstered AMD’s position as a leading provider of specialized embedded chips for specific purposes. With this powerful asset, AMD is primed to seize business opportunities in a Web3 world. The Internet of Things, a manifestation of Web3 ideals, is another area where Xilinx has been a trailblazer for years.

As the world steadily moves towards a Web3 future, it becomes evident that this transition is not limited to new and emerging companies alone. Established tech giants like Shopify, Microsoft, and AMD are actively leveraging their resources and capabilities to adapt to and benefit from this monumental shift. They are integrating Web3 features, developing blockchain-friendly infrastructure, and building powerful hardware to support decentralized computing.

These industry leaders are not merely preparing for the future; they are actively shaping it. As an investor, closely monitoring these developments presents significant opportunities in the rapidly evolving Web3 landscape. By staying informed and attuned to the strategies and advancements of companies like AMD, one can position themselves to capitalize on the transformative potential of Web3.

The Future of Web3

The metaverse and Web3 are all the rage, but the law is stuck at Web1 | Nelson Mullins

Web3, as a style of application architecture, is not limited to a specific set of standards or protocols. This flexibility allows Web3 to take on a diverse range of forms, extending well beyond the realms of decentralized finance, crypto lending platforms, and metaverse dApps. While these areas currently dominate the Web3 landscape, there are numerous other sectors that hold great potential for Web3 integration.

Social networks, for example, could leverage Web3 principles to create decentralized platforms where users have full control over their data, privacy, and online identities. Games could utilize Web3 technology to enable true ownership and interoperability of in-game assets, revolutionizing the gaming experience. Direct publishing platforms could empower content creators by removing intermediaries and providing fair compensation through transparent monetization models. Marketplaces of all kinds, from e-commerce to decentralized exchanges, could adopt Web3 to enhance trust, eliminate fraud, and foster peer-to-peer transactions.

The future success of Web3 will heavily rely on user participation and engagement. The most impactful Web3 projects will be those where users are not passive consumers but active members of a vibrant community. By being motivated to contribute their own content, provide feedback, and engage in collaborative decision-making, users will play a crucial role in shaping the direction and growth of Web3 applications.

From an investment perspective, approaching Web3 with an open mind is essential. While it is still early in the development of Web3 projects, there is significant potential for substantial profits by identifying and investing in winning projects. However, it is crucial to be aware of the regulatory landscape surrounding cryptocurrencies and blockchain technology. Changes in regulations could impact the funding, governance, and overall viability of Web3 dApps, potentially affecting the demand and prices of associated tokens. As an investor, it is important to exercise caution and carefully assess the risk-reward profile of Web3 investments within the context of your portfolio.

The future of Web3 is a realm of infinite possibilities, with applications spanning various sectors. From a Web3-based personal savings account to next generation crypto mining, there is no limit to the applications this tech can offer society.

As an investor, staying informed, adaptable, and mindful of regulatory dynamics will enable you to navigate the evolving Web3 landscape, identify promising opportunities, and make confident decisions that align with your risk tolerance and investment objectives.

Risks of Web 3.0

The Growing Cybersecurity Concerns are Threatening Web 3.0 | Analytics Insight

While Web 3.0 holds tremendous promise and potential, it is important to acknowledge and understand the risks that accompany this emerging paradigm. As with any transformative technology, Web 3.0 presents unique challenges that must be navigated to ensure its successful integration and adoption.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies and blockchain technology remains in flux. Governments and regulatory bodies are grappling with how to address the decentralized nature and potential risks associated with Web 3.0. Changes in regulations, such as stricter compliance requirements or bans on certain activities, could impact the viability and growth of Web 3.0 projects, creating uncertainties for investors and businesses operating in this space.

- Security Vulnerabilities: Web 3.0 introduces new security considerations. The decentralized nature of Web 3.0, while providing enhanced privacy and autonomy, can also expose vulnerabilities. Smart contract bugs, hacks, and vulnerabilities in decentralized applications (dApps) can result in significant financial losses and reputational damage. It is crucial for developers and users to prioritize robust security measures, conduct thorough audits, and follow best practices to mitigate these risks.

- Scalability and Interoperability: As Web 3.0 continues to evolve and attract more users and applications, scalability and interoperability challenges may arise. Blockchain networks often face scalability issues, resulting in slow transaction speeds and high fees. Additionally, the lack of standardized protocols and interoperability between different blockchain networks can hinder seamless communication and data transfer. Overcoming these challenges will require ongoing technological advancements and collaborative efforts within the Web 3.0 community.

- User Adoption and Education: The success of Web 3.0 relies on user adoption and engagement. However, the concept of decentralized systems, cryptocurrencies, and blockchain technology can be complex and unfamiliar to many individuals. Educating and onboarding users to Web 3.0 applications may pose challenges in terms of user experience, usability, and trust-building. Overcoming these barriers will require user-friendly interfaces, intuitive designs, and educational initiatives to empower individuals and encourage widespread adoption.

- Market Volatility and Speculation: The cryptocurrency market, which underpins much of Web 3.0, is known for its volatility and speculative nature. Price fluctuations in cryptocurrencies can be significant and driven by various factors, including market sentiment, regulatory announcements, and macroeconomic events. Investors in Web 3.0 projects must be prepared for potential price volatility and carefully assess the underlying fundamentals and long-term prospects of the projects they choose to invest in.

Navigating these risks requires a combination of vigilance, due diligence, and a long-term perspective. It is essential for investors to maintain a diversified portfolio, practice proper asset management, and realize that the Web3 trend will undoubtedly experience some setbacks as tech companies, the global cryptocurrency market, and general consumers develop, interact, and adopt this revolutionary asset class.

By acknowledging these risks and proactively addressing them, stakeholders can work together to build a resilient and thriving Web 3.0 ecosystem that harnesses the transformative potential of decentralized technologies while mitigating the challenges that come with them.

Key Takeaway

Big tech companies that are already using Web3 | Blue Manakin

Web 3.0 represents a fundamental change in how we interact, transact, and create value on the internet. Its decentralized architecture, powered by blockchain technology and other digital assets, opens up a world of possibilities across various sectors, including finance, social networks, gaming, and marketplaces. As an investor, understanding and embracing the potential of Web 3.0 can offer exciting opportunities for growth and innovation.

However, it is important to approach Web 3.0 with a balanced perspective, considering both its promises and risks. While Web 3.0 empowers individuals, challenges such as regulatory uncertainty, security vulnerabilities, scalability issues, and market volatility must be navigated. Managing expectations, performing your own research, and evaluating risk tolerance are crucial aspects of successfully navigating the Web 3.0 landscape.

To invest in Web 3.0, consider companies that are at the forefront of Web 3.0 adoption, such as Shopify, Microsoft, and Advanced Micro Devices. These companies are actively integrating Web 3.0 features into their platforms, building blockchain-friendly infrastructure, and leveraging their resources to adapt to the changing digital landscape.

As the future of Web 3.0 unfolds, user participation will be a key driver of its success. The most impactful Web 3.0 projects will thrive when users actively engage in community-building, contribute content, and provide feedback. By embracing Web 3.0, individuals can shape the future of the Internet and participate in a decentralized ecosystem that values autonomy, transparency, and collaboration.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Braxia stock and are compensated by Braxia for Investor Relations Services. Edge Investments and its owners reserve the right to buy and sell shares in Braxia without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright ©️ 2023 Edge Investments, All rights reserved.