So you’ve been in the investing game for a while now and have successfully built an investment portfolio that even Warren Buffett would be proud of.

But after one of the longest bull runs in history and the stock market reaching record highs, you start to grow concerned over investor sentiment and the possibility of the markets being in bubble territory.

Despite this, financial media moguls like Jim Cramer are encouraging you to “BUY! BUY! BUY!” while inside your head, all you can think about is “SELL! SELL! SELLING!”

So what do you do?

Well, to begin, it is time for you to learn that the stock market is an emotional being that often swings from joy to pain and back again.

Once you understand that, you will realize that every once in a while, there are opportunities to make a killing when stocks are undervalued and moments to avoid disaster when stocks are overvalued.

After all of that, not only will you keep the good times going, but you will also protect yourself from falling victim to FOMO or FUD again.

In this article, we explain how to tell if stocks are overvalued, what is the intrinsic value of a stock, how to spot overvalued stocks and more.

If you are concerned about overpaying for stock or business, then continue reading below.

What is the Intrinsic Value of a Stock?

To start, we will want to discuss the intrinsic value of a company because it is necessary to distinguish between the stock price or market cap of stock and the true worth of the business.

In this case, the intrinsic value of a stock is the perceived or calculated worth of a company based on an analysis of its financial and economic fundamentals.

To determine what a business’s stock is worth, an investor will consider various financial metrics, including its revenues, earnings, assets, liabilities, cash flows, growth prospects, and the overall industry and market conditions.

As you can see, there are a ton of considerations that go into assessing the intrinsic value of a company, meaning that it is unlikely that you will arrive at the same conclusion as another investor.

In other words, the intrinsic value is a highly subjective measure and can vary greatly depending on your assumptions and methodology for determining it.

However, the important thing to remember when calculating intrinsic value is that the goal is not to be spot on, but rather to figure out a price point that seems feasible and reasonable to you.

In doing so, you will now be able to assess whether a stock is overvalued or undervalued in relation to what it is currently trading at.

The Irrational Exuberance and Mania of Economic Cycles

As we mentioned earlier, the stock market is an emotional place filled with joy and pain.

While mostly efficient, every once in a while, it chooses to swing from a period of manic euphoria, like the Dot Com Bubble, to a period of deep depression, like the Great Recession.

Though each stock market bubble or crash is different, it may be surprising to a few of you that all market booms and busts are a product of the same root cause…

Humans.

Above all else, humans dictate the irrationality of markets.

As an inherently emotional species, we are susceptible to feelings of jealousy, fear, greed, etc., and investors are no exception.

For this reason, we often fall victim to our emotions which leads us to make poorly calculated decisions like overpaying for a stock that other investors made millions on, or selling off a business we thought was doomed when in actuality, it was evolving.

Whatever the reason and no matter the moment in history, our species as a whole has failed to control our emotions, and as a result, a lot of money has been won and lost in the markets.

That being said, for those of us who do our best to ignore emotions and instead focus on the fundamentals, it is often the case that those investors will find greater success in the long run because we continue to think rationally in whatever market environment.

As Warren Buffett once said,

“The most important quality for an investor is temperament, not intellect.”

Want to learn how to invest during a market crash or recession? Check out this article here.

What Does Overvalued Stock Mean?

With all the important considerations out of the way, it is time to discuss what it means for a stock to be overvalued or undervalued.

First, a stock is considered overvalued when its current market price is higher than its intrinsic value.

As we mentioned earlier, there are many considerations at play when valuing a stock, but a good benchmark to start with is when a stock is trading near or at all-time highs.

In some cases, there may be some businesses that have additional room to grow, but more often than not, this is a strong indication that an asset is overvalued.

Take 2021, for example.

After experiencing one of the most significant stock market crashes in history, stock prices quickly recovered following drastic stimulus measures implemented by federal governments around the globe and their central banks.

In doing so, stocks quickly recovered their losses and even surpassed their previous highs.

While this may be a positive sign on the surface, the reality is that overvalued stock prices are unsustainable, meaning that the market will eventually correct as asset prices come back down to earth; and they did just that in 2022.

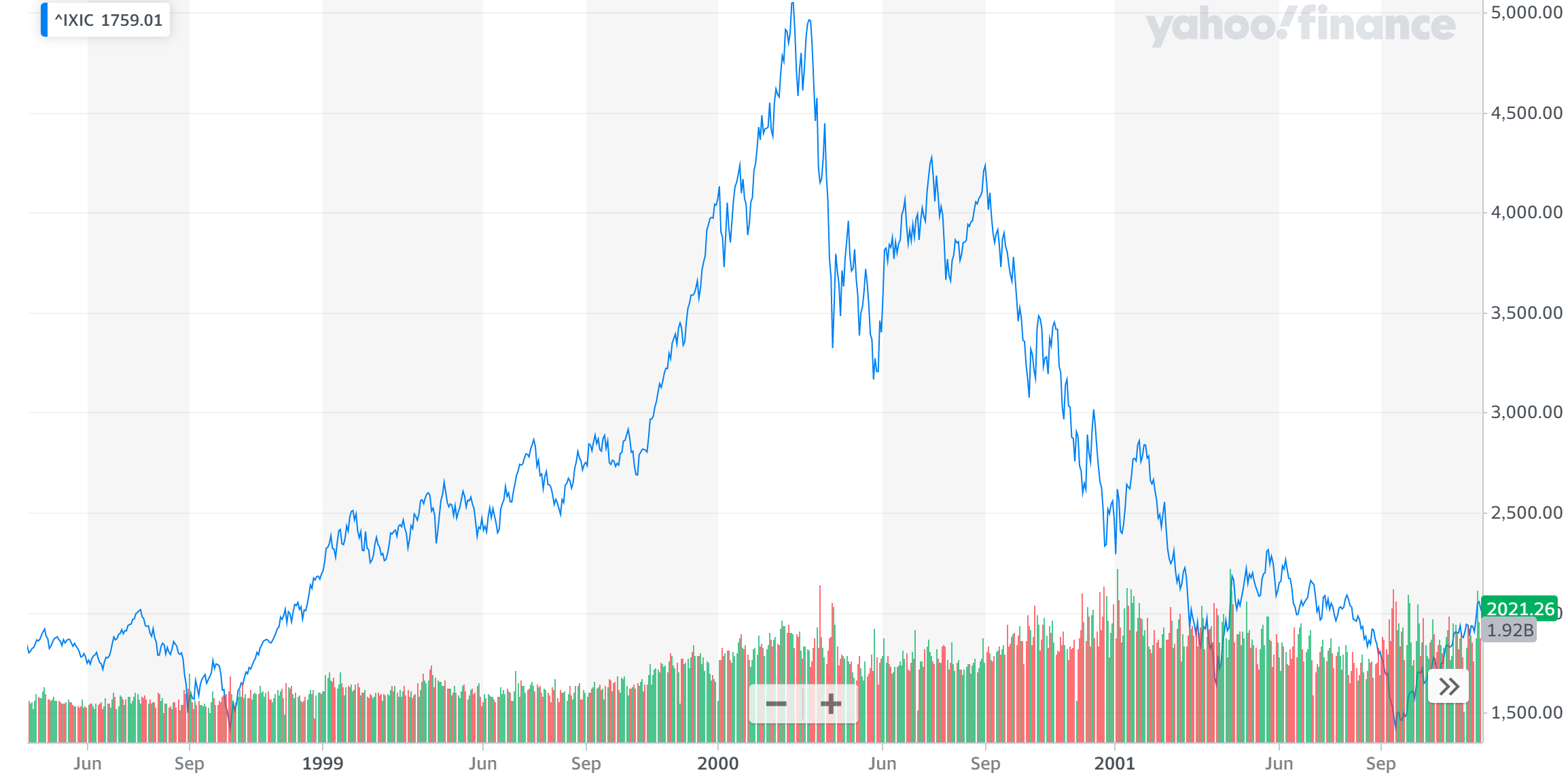

To highlight this overvaluation in another example, think back to the Dot Com bubble of the late 1990s and early 2000s.

During that period, investors were snatching up anything and everything that had to do with the internet.

Though there were some winners early on who experienced massive gains, most of the investors who purchased stocks in that time frame and held them throughout the turn of the millennium experienced catastrophic losses as they overpaid for their assets.

To put this into perspective, if you bought stocks at the bubble’s peak in 1999, it took nearly 14 years for the market to recover to those all-time stock market highs and break even.

Now that is a long time to wait!

So, how do you know whether a stock is overvalued or not?

We will touch on this question more later, but at its most basic level, it all comes down to the fundamentals of business.

If a stock is earning less than $100 million per year in revenues, and it has yet to turn a profit but is still trading at a market capitalization of $10, $20, or $50 billion, it is unlikely that that business deserves to be valued at the price, even if its economic seem favorable.

Therefore, during these periods, it is better to sit patiently and wait for the price of the stock to return to reality, rather than to overpay for a business.

As the legendary investor Howard Marks would say when talking about a successful investment,

“It is not what you buy, it is what you pay.

Are you wondering why growth stocks are down? Check out our recent YouTube video where Kev explains what is going on.

What Does Undervalued Stock Mean?

On the other hand, an undervalued stock is a company that is trading below its intrinsic value.

These types of businesses often land in this situation when market sentiment shifts towards a more fearful attitude, and investors en masse choose to sell their stocks because they believe that the market conditions are worsening in the near future.

Furthermore, a stock may become undervalued if its business fundamentals are declining or the company reports negative news with its investors (ex. The Chipotle Contamination Crisis), but these are not always the same.

For these reasons, it may feel like this is the worst time to buy because everything is pointing toward stock prices declining further.

However, for those savvy investors willing to stomach the short-term volatility, this is typically the perfect time to buy because it creates an opportunity to invest in stocks trading at a discount to what they are truly worth.

By investing in stocks when they are undervalued, not only do you protect your downside risk because the price has already fallen, but you are also setting yourself up to capitalize on larger gains when the sentiment changes or the market realizes that they overreacted.

Regardless of whether it takes one month or two years to recover, the underlying assumption is that over the long run, your investment will reach its intrinsic value eventually, and you will be the one laughing when it’s all said and done.

In the end, it always comes down to the fundamentals of the business and whether investors are considering risk appropriately, and how accurately they are valuing a company.

And hopefully, you can take advantage of the opportunity when the moment arrives.

How to Spot an Overvalued Stock?

As we’ve said throughout this article, the best way to spot an overvalued stock is to analyze the company and its fundamentals.

If its stock price seems unreasonably high in relation to how the business itself is performing, then it is likely overvalued and will return to its intrinsic value over time.

To value a stock, there are multiple approaches and possibly an infinite number of ways to determine what a business is worth.

However, one of the common ways investors value stock is by using ratios like a stock’s price to earnings, price to book value, enterprise value to earning before interest, taxes, depreciation, and amortization (aka EBIDTA), and others.

While these are often useful tools for comparing similar businesses, they also are limited in some capacity for one particular reason, that being price.

Since all of these ratios take into account the current share price or market value as part of their analysis, it means that they inherently involve human behavior as an underlying factor, given that it is people buying and selling stocks.

This can sometimes result in irrational pricing, like during a bubble, which ultimately leads to an investor overpaying even though a particular stock may be trading at a lower ratio than its peers.

To mitigate the effects of human emotion, a more effective way to value a company is using fundamental analysis such as a discounted cash flow model that only takes into account the underlying fundamentals of a business, like revenues, net income, and free cash flow.

To be fair, this method also has some limitations of its own, but we will touch on that shortly.

Valuing a Stock using Fundamentals

Valuing a stock using fundamentals is a great way to focus solely on business performance, rather than basing the value of a company on price and human emotion.

By using a Discounted Cash Flow model, an investor is figuring out the present value (what something is worth today) of a company by discounting its expected future cash flows back to the present day.

To do so, an investor must first determine the annual free cash flows of a stock by searching the company’s financial statements and then grow it into the future using a realistic growth rate, based on the historical growth of the business, while also taking into account its expectations of growth over the next couple of years.

Then, an investor must determine a discount rate that covers all associated business risks, as well as any market risks that may exist.

Typically, most investors use the Risk-Free Rate, from US Treasury bond yields, as their go-to discount rate because it is an effective measure of the opportunity cost between investing in a riskier asset, like stocks, and the nearly guaranteed return provided by the risk-free bond.

NOTE: The Risk-Free Rate is assumed to be the yield on a US Treasury bond since the risk of default on these bonds is considered to be close to zero; the only way for a US Treasury bond to be risky is if the US government happened to go bankrupt.

Under these conditions, the only reason for a stock to be considered a worthwhile investment is if it provides a return on investment that is higher than the yield offered by the sovereign bond.

If not, it is best to just buy the government bond.

To illustrate this, we will use a simplified example whereby we project the free cash flows of Company X five years into the future at a growth rate of 10%, then discount it by the current 5-Year Treasury yield of 3.81% (as of February 6, 2023).

Keep in mind that this is only a simple example and that Discounted Cash Flow models usually incorporate more information like dividend payments, earnings growth, earnings yield, and more.

As you can see, if we assume that Company X earned $1 billion in FCF last year, and we projected those annual cash flows at a growth rate of 10% per year, then based on a discount rate of 3.81%, we would determine that Company X is worth $6.97 billion today.

Once we have the present value or intrinsic value of the company, we can then compare it to Company X’s market capitalization to determine whether the business is being overpriced or undervalued by the market.

In this case, if Company X’s current stock price was trading at a market value of $8.5 billion, then we would consider it to be overvalued and not a worthwhile investment.

On the other hand, if Company X was trading at a market value of $5.5 billion, then the stock would be considered undervalued and a worthwhile investment because the market price would eventually reach $6.97 billion once again.

While the DCF model is an effective tool, it is important to acknowledge that it has limitations of its own.

For one, they are highly subjective because each investor will use a different growth rate and discount rate depending on their underlying assumptions and investment goals.

Secondly, a DCF only works when a business has positive cash flows, meaning that it is quite difficult to calculate the intrinsic value of a stock that has yet to turn a profit; this is often the case with smaller companies like penny stocks.

When you come across stocks like this, your best bet is to stick with the comparables method.

With that being said, we still recommend the DCF approach as it allows you to eliminate human emotion when valuing stocks and is a more accurate depiction of what a business is worth.

For those curious, here is the DCF formula we use to determine the present value of a business; note that the growth rate is already included within the CF portion of the formula.

What Are the Main Types of Valuation Ratios?

There are many types of valuation multiples available to investors, and even though they have some limitations, they are still a great way to compare companies trading in a similar market.

Here are a few of the most commonly used:

Price-to-earnings Ratio (P/E)

The price-to-earnings ratio is the most commonly used valuation ratio and is calculated by dividing the current share price of a company by its earnings per share (EPS).

Generally, the P/E ratio is used to assess the value of a company’s stock and to compare it to other stocks in the same industry.

In this instance, a higher P/E ratio typically indicates that investors are willing to pay more for each dollar of earnings, while a lower P/E ratio may indicate that the stock is undervalued.

Price to Sales Ratio(P/S)

Similarly, a stock’s P/S ratio measures the value of a company’s stock price compared to its revenue per share by dividing the market capitalization by its total revenue over a certain period, usually 12 months.

A low P/S ratio indicates that the stock is undervalued relative to its sales, while a high P/S ratio suggests that the stock is overvalued.

Price to book Ratio (P/B)

The P/B ratio compares a company’s stock price to its book value.

Book value, or shareholders’ equity, is an accounting measure of a company’s net worth, calculated as total assets minus total liabilities.

The best way to think about it is as the capital that remains for shareholders after the company has paid back all its debts and liabilities to lenders.

In this case, a low P/B ratio indicates that a company’s stock is undervalued relative to its net worth, while a high P/B ratio suggests that the stock is overvalued.

Enterprise Value to EBITDA Ratio (EV/EBITDA)

The EV/EBITDA ratio is used to compare a company’s value to its operational profitability.

Enterprise Value is calculated by adding a company’s market cap and debt, minus its cash on hand, whereas EBITDA is a company’s earnings before interest, taxes, depreciation, and amortization.

Like the other valuation ratios mentioned, a lower multiple would be considered to be undervalued, while a higher ratio suggests that the company is overvalued.

How to Trade Overvalued Stocks

You may be wondering, if a stock is overvalued, why not short-sell the company instead so that you can profit on the sell-off when it happens?

For those unfamiliar, short selling is an options trading strategy that involves an investor borrowing shares of stock from another investor, selling them on the open market, and then buying them back at a lower price to return to the original lender and pocket the difference as profit.

Though it may seem like an effective strategy on the surface, the reality is that short-selling a stock can result in a loss with unlimited potential if the stock price rises instead of falling, while only offering a maximum return of 100% on the decline.

Therefore, we would highly recommend that you avoid shorting stocks unless you have an advanced trading strategy or an abundance of capital at your disposal.

Otherwise, you may end up losing more can afford and possibly end up going bankrupt if you fail to close the trade on time.

If the Game Stop, AMC, or Bed Bath & Beyond short squeeze debacles are any indication of what can happen when you decide to short a stock, then it is probably best to stick to the classic buy low, sell high strategy instead.

Are you unsure how much money to invest in growth stocks? Check out this article here.

Final Thoughts

Knowing when a stock is overvalued or undervalued is highly advantageous for an investor.

Although it does require some time and effort to truly understand whether a business is overpriced, in the end, the blood, sweat, and tears will pay off when you start to realize far superior investment returns.

Because not only will you make smarter investment decisions, but you will also improve your temperament as you avoid succumbing to the emotions of the market.

All-in-all, investing is a game with a lot of complexity and uncertainty.

However, if you simplify your process and stick to being patient by only buying undervalued stocks and selling overvalued stocks, the game becomes a lot easier and more profitable.

To highlight this, I will leave you off with one final quote from another legendary investor…

“One of the best rules anybody can learn about investing is to do nothing, absolutely nothing unless there is something to do.” – James Rogers