Pursuing supreme growth can be tempting for any investor, and with the prospect of generating higher returns than the market, and retiring faster, it makes sense why one might want to at least take a crack at this strategy before it’s all said and done.

But as Seth Klarman says,

“people who chase growth, inevitably lose.”

That is because they dismiss the most important piece to investment; the price you pay.

No matter what type of asset you buy, price always determines whether it was worthwhile. If you overpay for something, it will eventually correct, and you will be stuck owning something worth less than what you bought it for.

Therefore, if you wish to beat the market, and retire earlier, the key is not high growth, but disciplined spending.

In the case of growth investing, this means ignoring the hype surrounding high-growth companies and instead focusing solely on your entry point.

In this article, we will explain how to value a growth stock, when to buy them, and how to find the best growth stocks to achieve your dream of superior returns.

What are Growth Stocks?

Growth stocks are a type of stock that is predicted to grow at a faster pace than the overall stock market.

These businesses can achieve this because they tend to reinvest all of their earnings back into the company with the hopes of expanding their market share and competitive position more quickly.

As such, you will often see a high price-to-earnings (P/E) ratio with growth stocks as investors anticipate that the company’s growth in market value will far outweigh its current earnings over the long run.

Though true in some instances, an investor should be aware that a high price-to-earnings ratio does not imply superior performance, nor does it mean that the company will achieve its perceived market value.

Therefore, it’s better to define growth stocks by how the company plans to use its earnings, rather than by how high its market cap valuation or price-to-earnings multiple is.

For perspective, a company that would be considered not a growth stock is one that is pursuing a less growth-intensive strategy like deploying dividends or buying back stock.

This could be a blue chip or cash cow company that is already in the mature stage of its business cycle, and longer requires its earnings to grow.

If you think of growth stocks like this instead, then it means that there are moments when their price-to-earnings or market valuation is lower.

Ultimately, growth stocks are simply businesses that are hoping to grow quickly in the foreseeable future.

To learn more about the advantages and disadvantages of investing in different growth stocks, check out this article.

Why Assign Value to Stocks?

It’s crucial to assign value to stocks because it’s a reflection of the perceived worth of the underlying company and will help you to determine whether a business is a worthwhile investment or not.

So, rather than thinking of stocks as a piece of paper that you trade, the best way to approach investing is by treating it as if you were going to buy the whole company outright.

In doing so, you start to think more like the owner of a company, rather than a trader or speculator hoping to bank on short-term swings in the stock price.

As a business owner, you will focus solely on business fundamentals, including the company’s financial health, its earnings and revenue growth potential, the stability of its management and leadership, and its competitive position within its industry.

Not only that, but you may also want to consider external factors such as the overall market conditions and general economic trends.

By treating your investments like a business owner would, a company’s worth becomes clearer, meaning that you will make more sound investment decisions, and avoid falling victim to over-speculative hype.

Because, in the end, a company will always return to a stock price and market cap that reflect its true worth.

Avoid Overvalued Stocks

Under the assumption that we can value companies effectively, an investor can use that information to form a disciplined investment strategy that avoids overpaying for stocks and capitalizes on undervalued opportunities.

Investing in overvalued stocks is risky for an investor because it means that the company is trading above its worth and will eventually come back down to earth.

Going back to what we mentioned earlier, this would mean that an overvalued growth stock is one whose price-to-earnings multiple far exceeds what is justifiable.

As such, it’s better to wait until its P/E ratio returns to reality before investing.

Otherwise, the business may never meet your expectations of price, or it will fail to reach those values for a long time.

In those instances where you believe a stock is overpriced, the smart thing to do is to go hunting for other opportunities or wait patiently for the stock price to correct.

Using the wise words of legendary investor Howard Marks, “It’s not what you buy. It’s what you pay for it that determines whether something is a good investment.”

So how do you know when a growth stock is overvalued or undervalued?

Let’s discuss this now.

To learn more about what makes a stock overvalued or undervalued, check out this article.

How to Value a Growth Stock

Valuing growth stocks can be a bit more challenging than traditional value stocks because they often don’t have cash flows and tend to rely more heavily on future growth prospects.

For this reason, an investor must assume that there is a higher margin for error and a lower likelihood of reaching your valuation.

Though there are many explanations for why this is the case, the most common ones are that growth stocks are typically in their early stages, meaning that they have fewer years under their belt, which means less predictability and greater uncertainty than more established businesses.

That being said, there are a few ways to measure the value of growth stocks without having to lean on financial data or historical performance.

Here are a few of the most common methods to value a growth stock.

Price-to-Earnings (P/E) Ratio

We have touched on the P/E throughout the article, but to ensure we cover our basis, we will mention it once last time (sorry, not sorry).

The P/E ratio is the most commonly used multiple for investors as it compares the current stock price to the company’s yearly earnings per share.

Investors use this multiple to measure how many years it will take for them to earn back the principal from their initial investment, assuming that all earnings were paid as a dividend.

For example, if you bought one share of Company X for $20 and its earnings per share from last year was 50 cents, meaning that at a P/E of 40, it would take 40 years to get back the principal of your original investment.

As you can see, for a high P/E ratio to make sense, an investor’s expectations of earnings growth must be met, or it may turn out that you overpaid for the stock.

If you think that a high P/E, like 40, is unsustainable over the long term, then this is a good indication that the company’s current market price is overvalued in relation to its earnings.

So, to get a more accurate calculation of what a growth stock is worth, you can use its industry’s historical average P/E or the historical average P/E of the stock market.

According to Finasko, the average price-to-earnings ratio of the S&P 500 since 1981 has been 21.92.

This implies that anything below a P/E of 21.92 means that the stock is undervalued, and anything above it is overvalued; though, in many instances, it is better to use a stock’s industry average instead because it is more accurate to that market.

Price-to-Sales (P/S) Ratio

Since many growth companies have yet to turn a profit, it may be difficult to rely on the P/E ratio alone.

Instead, many investors turn to the price-to-sales ratio next.

This ratio compares the current stock price to the company’s yearly revenue per share.

The P/S ratio is particularly useful for growth companies in industries like biotechnology and artificial intelligence because they have high growth potential but may not be profitable quite yet.

Remember, in certain circumstances, being unprofitable isn’t necessarily a bad thing, as it means that the company is trying to increase its market share quickly through heavy reinvestment, which is reflected by strong sales growth.

But be very careful, because if a business isn’t profitable for an extended period, it may result in them going under if they don’t have the funds to keep their project rolling.

Like with the P/E ratio, a low P/S in relation to its industry or the stock market, implies that the company is undervalued.

On the other hand, a high P/S means the opposite.

For those wondering, the average S&P 500 P/S ratio since 2001 is 1.68 (Multpl)

Enterprise Value-to-Revenue (EV/Revenue) Ratio

As an alternative to the price-to-sales ratio, you may want to consider using the EV/Revenue ratio, which compares the company’s enterprise value (market capitalization plus debt minus cash on hand) to its revenue.

This multiple is useful for companies that have high growth potential and a lot of debt because it helps take into account the level of debt a company has in the valuation.

In this case, the less debt a company has, the better, as it will help lower the growth company’s EV/Revenue multiple.

Aside from that, it follows the same valuation rules as the other two in that an undervalued stock will have a low multiple, while an overvalued stock will have a higher one.

Discounted Cash Flow (DCF) Analysis

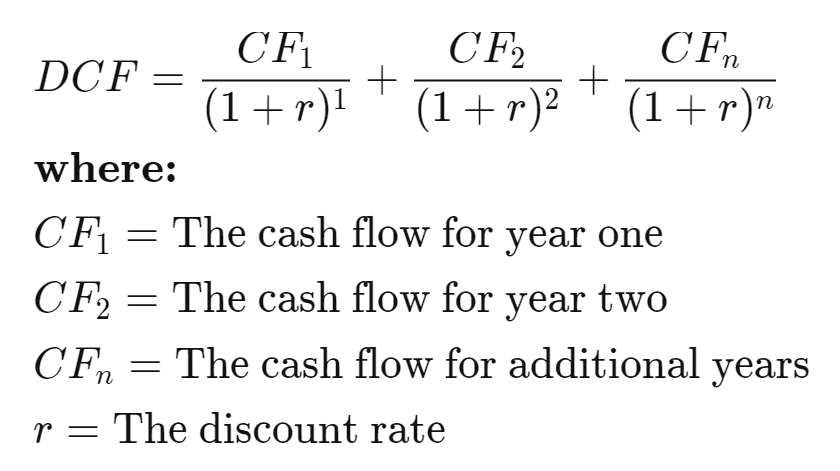

Last but not least, an investor can use a discounted cash flow analysis to determine the intrinsic value of a growth company.

Personally, this is our favorite method because it removes the stock price and market cap from the equation, which can sometimes skew the valuation if investor sentiment is high or low, depending on the market conditions.

To conduct a DCF, an investor projects the company’s future cash flows and then discounts them back to the present value to arrive at a market value estimate that is in line with its intrinsic value.

Overall, it’s a more complex method because it takes into account additional factors like interest rates, growth rates, and free cash flow, but it can provide a more accurate valuation for growth stocks, especially if the company is expected to generate significant future cash flows.

Keep in mind that DCF analysis is highly subjective, meaning that every investor is likely to arrive at a different price.

However, the goal of a DCF is not to reach the precise intrinsic value of a company, but rather to give you a better understanding of what the business is worth based on its cash flows.

All-in-all, growth investors should use all of these valuation techniques, and others, to arrive at the most accurate assessment of what a growth stock is worth.

Characteristics of Good Growth Stocks

Now that we have covered how to go about valuing growth stocks, it’s time to put it all together by figuring out what makes a good growth company.

Here are four characteristics of a good growth stock:

1. A Strong Management Team

If you look at some of the most successful growth companies of all time, there is often one thing in common.

An experienced and motivated management team.

As the common saying goes, your company is only as great as its people.

For early-stage companies like growth stocks, this is even more true because you need them to create a culture of resilience and excellence before setting up the foundation for success.

At the highest level, a company requires its management team to be decisive, charismatic, and accountable.

Without these characteristics, it will be difficult to motivate employees in the early stages of the business when the company is seeing limited results and has yet to establish a dominant position in the marketplace.

Furthermore, a management team must be highly skilled at capital allocation, which means being comfortable with making tough decisions like how to maximize company returns, and whether it should be cutting costs or pursuing new projects.

If a management team does so recklessly without much consideration for the long-term consequences, it often results in the downfall of the business, thus hurting its employees and shareholders in the process.

However, when you find a growth company with a leadership team that possesses these favorable characteristics, it’s a good sign that you have stock destined for success.

2. Strong Sales & Earnings Growth

Above all else, a growth stock has to be making money.

If a company has yet to earn a dollar for its efforts, it’s best to move on for the time being.

Though a company without revenues may look promising, the unfortunate truth is that its product or service has yet to demonstrate its worth, meaning that you, and not even the company, can predict how valuable it will be.

Instead, focus on growth stocks with strong sales growth, and possibly earnings as well.

Money is the lifeblood of all companies, and if a business can produce cash by itself, it means that it is no longer dependent on external funding to do so; this is especially important during periods of economic underperformance, such as in a recession or stock market crash.

As you explore a business’s revenue streams and earnings potential, consider whether they can grow these sustainably in the future.

If they can, it means that they are well on their way to more profitable opportunities and maybe even a few competitive advantages of their own

To determine whether a company is effectively growing its revenues and earnings, simply look at its financial statements to see how they have performed in recent years and quarters.

Ideally, you want to see both of these financial metrics trending upward year-over-year.

3. An Industry with High Growth Potential

The last thing we want to do as growth investors is to invest in a business or industry that’s already on the way down.

Sure, there may be a few opportunities to squeeze a few puffs out of the ol’ cigar butt, but ultimately our goal is to find companies that are destined to deliver superior returns over the long run.

To find these high-growth companies, search for them in industries with high growth potential.

Some of the hottest high-growth markets include:

- Biotech and Life Sciences: 13.9% CAGR, 3.87 Trillion Market by 2030

- Semiconductors: 12.2% CAGR, $1.38 Trillion Market by 2029

- Electric Vehicles: 22.5% CAGR, $1.11 Trillion Market by 2030

- Computer Software: 11.9% CAGR, $1.17 Trillion Market by 2030

- Artificial Intelligence: 37.3% CAGR, $1.72 Trillion Market by 2030

4. A Commanding Market Share

When all is said and done, we want a business that dominates its market.

As a growth investor, our goal is to generate superior returns. To do so, you have to invest in stocks that are the best in the biz. Sometimes this means finding a company that is almost, if not already, a monopoly.

Sure, as a customer, you may want optionality and fair competition, but as an investor, the more money you can make, the better (as long as it is ethical, of course).

Take Google, for example, they own 92.9% of the search engine market (StatCounter) as a result of intelligent decision-making and superior value, though, this may be coming to the end with the introduction of ChatGPT and Microsoft’s Bing.

While it may seem unfair that they have this position, the reality is that it achieved the top spot because customers preferred its product over another competitor.

Like in any market, the business that offers the most value will, and as investors, we want to capitalize on investment opportunities like these.

Final Thoughts

Growth stock investing can be one of the best investment opportunities you make during your career.

But it can also be one of the worst if you fail to take into account what a business is worth and whether or not it is fundamentally as strong as it seems.

Therefore, to be a successful growth investor, it takes a disciplined investment strategy that prioritizes value over growth, even if it means waiting for a stock to be undervalued.

If you do, you will reap the unlimited rewards that come with buying an exceptional business at a discounted price, for there is no greater feeling as an investor than finding a company that is being underestimated by the market, yet is destined to deliver superior results.