Dear (Future) Impact Investors:

If you have had the “pleasure” of spending any time around 23-year-old consultants in recent years or spoke with that guy on Twitter who is an “investment strategies” expert, you will have heard these terms being thrown around.

ESG and impact investing are the latest entrants in the crowded field of financial buzzwords meant to get investors excited about throwing money into a sector. Now, often, these terms are thrown around interchangeably by investors who are trying to describe a unique investment approach that can reap a generous financial return.

Before we dive into the world of these investments and investment strategies, I will first define the terms for you (you are welcome).

A Quick (and Fun) Little Lesson…

Impact Investing and Impact Investments: This refers to a style of investing that attempts to generate financial returns while also having a positive impact on social and environmental standards. Thus, an investor who engages with an investment strategy in the impact investing space would align their investment decisions with their values by supporting businesses and organizations that reflect those values and the specific goals associated with them.

Impact investing is often confused with Socially Responsible Investing (SRI), which is a bit more broad and includes impact investing among its strategies. SRI strategies will actively make investment decisions to align with certain values or engage in shareholder activism to change how a company operates. Impact investing is seen as a subset of Socially Responsible Investing.

ESG Investing (Environmental, Social, and Governance Investing): Refers to an evaluation criterion of investment decisions that integrates environmental, social, and governance factors along with traditional financial analysis. If you want to learn a bit more about why you should care, we got you.

This may involve assessing portfolio companies on their business practices from a social standpoint or assessing a company based on the environmental outcomes the operations would result in.

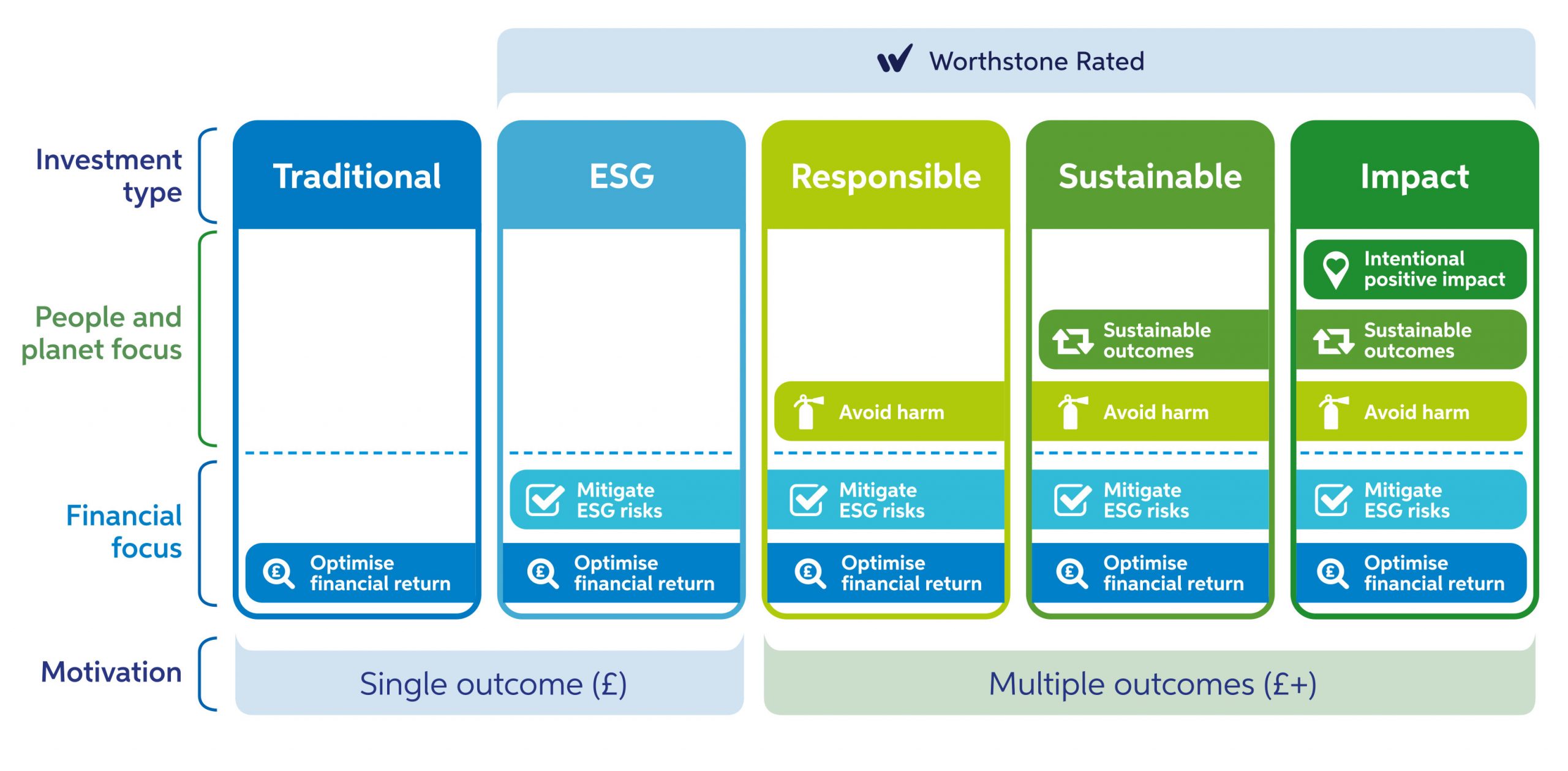

Source: Worthstone | ESG vs impact

Let’s Talk Responsible Investing

This article (now that we are all on the same page…or I guess screen) will cover:

- The differences between impact investing and ESG investing

- The similarities between impact investing and ESG investing

- Why investors should care

Impact Investing vs ESG Investing: Similarities

Although both investment strategies, as we discussed, are not the same for an investor, there are some key similarities that are key discussion points.

A Desire for Positive Change

Both of these strategies (in terms of investment decisions) are concerned with weaving fiduciary duty/investor financial gains with the incorporation of values-driven desires for positive social impact.

Funds that specialize in one or more of these investments reflect their investors in that they wish to support companies that are concerned with providing positive outcomes at a societal level.

A Vision For the Future

Both ESG and impact investing stress a long-term view. This is due to the long tail effects of things like negative environmental effects, social missions/visions, and the lessening of the focus on aggressively high returns.

As well, the companies that these funds (learn a bit more about what a “fund” might mean) would be concerned with undertake projects, missions, and operations that seek to reap benefits for the world as a whole further in the future.

For example, fighting climate change is not something that can be done in the short term. In the same vein, the social challenges faced by the world today require solutions over an extended period of time. This is interesting in that it attracts a cross-section of progressive and long-term investors.

Source: Unsplash | Building Covered in Plants

Stakeholder Variance

ESG investing and impact investing are driven largely by coordinated efforts between various groups of stakeholders.

Among these stakeholders are investors (retail and institutional investors), VC Funds, companies, governing/regulatory bodies, and nonprofits.

Non-financial Metrics

Impact investing and ESG investing heavily take into consideration return/success metrics that are not solely traditional returns.

Both strategies have the associated investment managers take into account non-financial factors when evaluating investment opportunities. This relates to the mission-driven approach of both of these strategies in which any and all profits/returns must (in a best-case scenario) come from a responsible source (responsible such that it aligns with the funds’ vision and values).

Impact investing explicitly seeks to generate positive social or environmental outcomes, while ESG investing considers environmental, social, and governance factors in the investment decision-making process.

Risks & Risk Mitigation

From a certain perspective, companies involved in sustainable operations (environmentally, socially, or otherwise) may represent a resilient investment for investors.

Companies that are built with environmental, social, and governance concerns are better equipped to weather long-term storms.

Impact Investing vs ESG Investing: Differences

Investments that sit in these two respective categories also feature some key differences. As such, it is important for investors to know them to (a) mitigate risk, (b) invest ethically for the particular issue they are concerned with, to have greater investor impact, and (c), from a personal finance standpoint, it allows investors to invest with funds that align with their return objectives.

The Verbiage

While we have been referring to both of these terms as strategies, that is not entirely true (stick with me here).

While impact investing is an investment strategy that has a specific “North Star” to be reached via investor capital, ESG means and refers to a framework for portfolio building, such that said portfolio hits certain metrics on a scorecard (often).

Now, if we really dive into the weeds here (which we will kill with environmentally friendly weed-killer, of course), ESG investing is a tool for analyzing a risk-to-reward ratio for a targeted investment or investments.

Fiduciary Scrutiny (yeah, don’t worry, I will explain)

Let’s use an example here: an impact fund or an impact investor typically deals with an investment in which a specific entity or asset has explicitly stated that it will incorporate impact metrics with financial performance.

Now, an ESG Investment (undertaken by some transacting party like an investment manager) has to apply specific ESG principles in a way that aligns with existing fiduciary duty to the client. They are bound by this, as opposed to using an inner sense of right and wrong when building or managing a portfolio.

How They Deal With Risks

In terms of risk (mitigation) vs. opportunity, a relationship that often carries a negative correlation pattern, the vast majority of the impact market seeks to maximize both simultaneously (which is, of course, difficult).

The idea is to find an impact investment that is already trying to mitigate key risks the investors are concerned with (note, we are talking of non-financial risks here, like environmental impact from dubious commercial practices or working to an ethical supply chain).

The ESG-compliant pathway(s) try to do one or the other. Risk mitigation or opportunity. You (because you are smart and ethical) might use social and governance ESG to analyze past performance and company activity that may give rise to issues down the road. On the other end, you could also use the ESG factors to deeply measure company investment into an entity that is actively involved in solving some sort of identified problem.

A Message to the Investors

Recently, we have seen both impact investing and ESG investing come onto the finance scene. Specifically among retail investors, they allow individuals to align their personal values with robust returns (hopefully).

Increasingly, the world is beginning to (finally somehow) realize that how we make money also matters due to the finite nature of resources and the fact that dollars can have both a direct and measurable impact in protecting said resources. At the same time, the world is increasingly concerned with the social conditions of individuals and how the markets interact in compounding or reversing said conditions.

I know we all speak numbers here, so let’s dive into some sustainable investing stats (let’s get nerdy):

- Total global investments into clean energy are on track to hit USD 1.7T (solar set is on pace to overtake oil production as well (this is out of USD 2.8T energy investments expected in 2023).

- According to Navex Global, 88% of companies trading on the public markets have some sort of ESG initiative in some capacity.

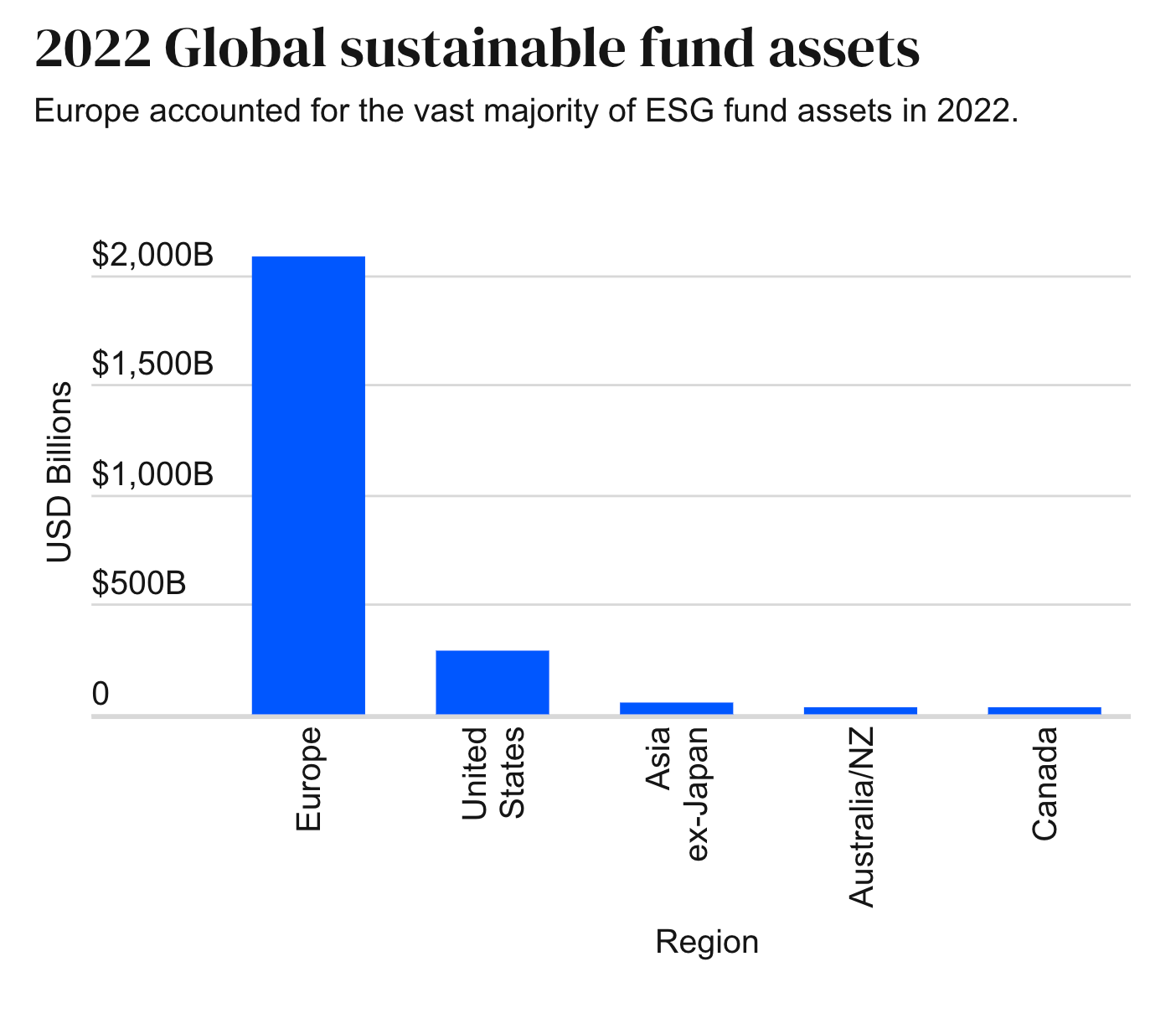

- In 2022, Europe was responsible for the overwhelming weight of sustainable investing assets.

Source: Morningstar Sustainable Fund Flows: Q4 2022 in Review

- It should still be noted that something like 46% of investors still perceive a lack of comprehensive data for ESG investments.

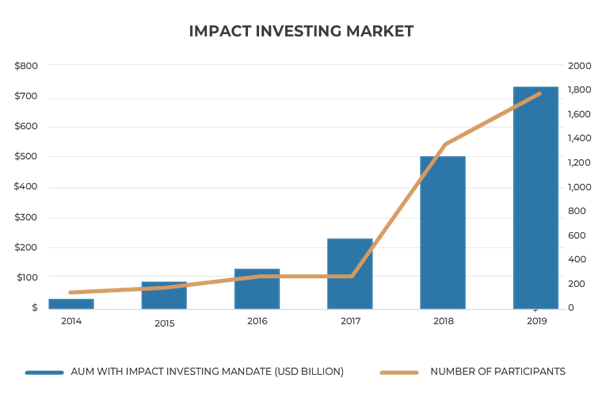

- The impact investing sector is on pace to hit USD 950B by 2027, growing at a CAGR of 17.8%.

Source: Intuition | What is impact investing? Market size, measurement, and the future

Ok, now what?

Ok, savvy investor, you’ve made it thus far (congrats). I am not trying to dictate a worldview down to you, nor am I evangelizing a specific strategy or framework. No, I am equipping you with modern tools for a modern investor (please note, this is not investment advice; do your own research).

This is not me telling you not to invest in fossil fuels or liquidate that position in that dubious defense tech ETF (don’t worry, I won’t tell anyone). Rather, both ESG and impact investing should be something that an investor might consider to diversify in a unique and growing way. And who knows, you might be able to make a killing doing it, too (you might want to understand the economic climate first, which we can help you with).

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.