Image Source: BOTZ And NVDA: Are AI Stocks A Good Long-Term Investment? | Seeking Alpha

The question of whether or not AI is a good investment is best answered by looking at the past performance of companies who have focused on the development of artificial intelligence.

The chart below shows the incredible performance of many AI stocks since the beginning of 2023. Popular names like Nvidia, AMD, Microsoft, and Crowdstrike have seen their share prices soar well over 100% off the fact that these firms are at the epicenter of developing new AI technology.

Since ChatGPT and its large language models took the world by storm back in November of 2022, investors and companies alike have focused aggressively on how machine learning and various AI tools can be leveraged to cut costs, drive efficiency, and increase profits.

In other words, AI has absolutely been a good investment in 2023, as companies continue to leverage this new tech.

Looking forward, however, investing in AI companies presents considerably more risk. With share prices already climbing to all-time highs, investors are right to question whether there is any upside left in this niche.

To help our readers understand whether investing in the AI market will be right for them moving forward, today we will be doing a quick deep dive into the current state of the AI space, what catalysts remain that will drive new stock market gains for AI stocks, present some stocks for readers to consider, discuss the risks of investing in artificial intelligence right now, and overall, answer the question of whether or not AI is a good investment today.

The Future Economic Impact of AI

Image Source: AI’s disruptive economic impact, an India check | Civilsdaily

The future economic potential of AI is perhaps greater than many realize. New and developing AI infrastructure is set to have a significant impact on not only how companies conduct their business, but the overall size of the world economy.

To show just how impactful AI systems will be on the world economy moving forward, we’ve broken out the changes expected from AI as the technology continues to develop.

Accelerating Global Economic Growth

According to an Accenture study covering 12 developed economies (including Canada and the US), AI is poised to significantly accelerate global economic growth.

By 2035, AI could potentially double annual growth rates in these economies, which collectively account for a substantial portion of global economic output. This growth is expected to be fueled by a marked increase in labor productivity, possibly up to 40%, as AI introduces more efficient workforce time management.

Furthermore, the emergence of a ‘virtual workforce’ through intelligent automation will bring new problem-solving capabilities and learning mechanisms. AI’s role in spurring innovation across various sectors will also be crucial, paving the way for new revenue streams.

Impact on Global GDP

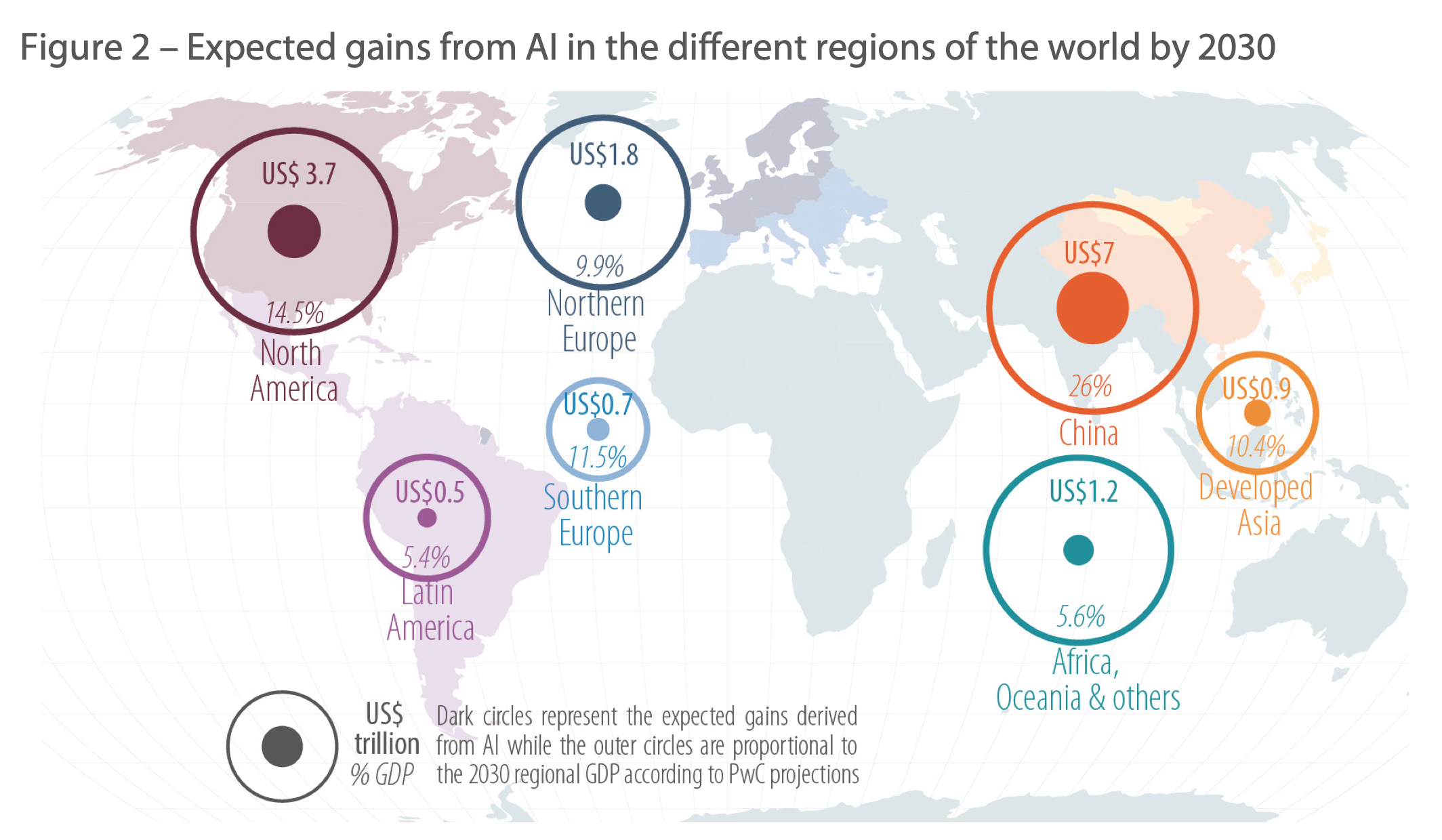

PricewaterhouseCoopers (PwC) estimates that by 2030, the global GDP could grow by up to 14% – equivalent to about US$15.7 trillion – due to AI’s accelerating development and adoption.

This growth will largely be driven by the vast data generated from the Internet of Things (IoT), which will enhance both the standardization and personalization of various products and services. AI’s economic impact will manifest primarily through significant productivity gains in capital-intensive sectors such as manufacturing and transport. This will involve the automation of routine tasks and extensive use of technologies like robots and autonomous vehicles. Additionally, AI will augment existing workforces, leading to improved productivity and enabling employees to focus on more stimulating/high-value activities.

The figure below shows the findings from a research report from PWC showing the expected economic growth of various economies worldwide as artificial intelligence transforms how industries perform their work. Some of the biggest beneficiaries include North America and China. However, as the visual shows, artificial intelligence will likely have a significant impact throughout the entire world as economies (regardless of how developed they are) begin to adopt this technology in new and innovative ways.

Image Source: The macroeconomic impact of artificial intelligence | PwC

AI’s Impact on Jobs and Productivity

A 2016 study by Analysis Group, funded by Facebook, indicates that AI will have both direct and indirect positive effects on jobs, productivity, and GDP.

Directly, AI will help increase revenue and employment in sectors developing or manufacturing AI technologies. And indirectly, a broader increase in productivity is anticipated in sectors using AI to optimize business processes and decision-making. The combined effect of these influences could result in economic gains of about US$1.49-2.95 trillion over the next decade.

Clearly, the future economic potential of AI is vast, promising significant growth and productivity enhancements across various industries and parts of the world.

While the path will certainly include challenges, particularly in labor markets, the overall economic outlook of AI’s integration is highly positive, bringing a new era of growth, as well as further stock market gains for investors, as more and more companies leverage AI applications.

Catalysts in the Artificial Intelligence Industry

Image Source: The Military Dangers of AI Are Not Hallucinations | FPIF

The AI industry is continuously being shaped by various catalysts, each playing a pivotal role in its evolution and application across different sectors.

And when looking to participate in AI investing, understanding the key trends that will drive the industry forward is incredibly important.

Below, we’ve highlighted 2 of the top trend’s investors will be able to capitalize on.

2023 (was) The Year of AI System Performance – 2024 (will be) The Shift to Memory Capacity

In 2023, a significant focus was placed on enhancing AI system performance. This trend emphasized improving processing speeds, algorithm efficiency, and the overall capabilities of AI models. The demand for high-performing AI systems grew as applications became more complex and data-intensive. This advancement was not just about speed but also about enabling AI systems to handle increasingly complex tasks more effectively.

The year 2024 will witness a shift in focus towards the memory capacity of AI systems. As AI chips grow in power, the need for larger memory capacity to support these advanced chips will become crucial. This trend stems from the complexity of AI tasks requiring extensive data processing and storage, highlighting the need for enhancing memory capacity to maintain efficiency and effectiveness in sophisticated AI models.

This bodes well for memory-focused companies (don’t worry we’ll go over some in the next section) who specialize in creating the infrastructure needed for AI semiconductors to handle functions that utilize high memory usage.

AI Coming Directly to Consumer PCs

A notable trend (that has yet to develop fully) is the integration of AI capabilities directly into consumer PCs. This development will make AI more accessible to the average consumer, transitioning from being primarily a cloud-based or enterprise-focused technology to one that will be available to consumers regardless of whether they are connected to the cloud.

AI in personal computers is expected to enhance performance in everyday tasks, offer more personalized experiences, and introduce new functionalities that were once limited to high-end computing.

Top AI Stocks Right Now

So far, we’ve demonstrated how AI will continue to drive economic growth, as well as highlight some key catalysts that will support additional AI development in various industries.

Now, we will shift our focus to the companies best positioned to gain from artificial intelligence as the catalysts above continue to play out. You will notice some familiar names that we have already talked about in other Edge Investments articles, as well as some new companies that should benefit greatly as AI continues to improve.

Micron Technology (MU)

Image Source: MU Stock Price and Chart — NASDAQ:MU | TradingView

Micron Technology, a leader in the memory and storage solutions industry, is becoming increasingly vital in the AI space. As AI systems demand higher memory capacity, Micron’s role in providing the necessary hardware makes it a key player. The company’s innovations in memory and storage are essential for supporting advanced AI applications, from data centers to edge computing.

Company Summary:

- Industry: Semiconductors

- Market Cap: $86 billion

- Revenue: $16 billion

- Debt: $14 billion

- Cash Balance: $9 billion

- Profit Margin: -42.47%

Lam Research (LRCX)

Image Source: LRCX Stock Price and Chart — NASDAQ:LRCX | TradingView

Lam Research, known for its semiconductor processing equipment, is instrumental in the manufacturing of the chips used in AI technologies. The company’s equipment plays a crucial role in the production of increasingly complex semiconductor devices. As the demand for more powerful and efficient AI chips grows, Lam Research’s products will become even more significant.

Company Summary:

- Industry: Semiconductors

- Market Cap: $99 billion

- Revenue: $15 billion

- Debt: $5 billion

- Cash Balance: $5 billion

- Profit Margin: 25.08%

Palantir Technologies (PLTR)

Image Source: Palantir Reports Its Fourth Consecutive Quarter of GAAP Profitability; GAAP EPS of $0.03 | Business Wire

Palantir Technologies specializes in big data analytics, an essential component of AI. The company’s platforms are designed for complex data environments, enabling large-scale analysis and decision-making. Palantir’s growing role in government, military, and enterprise data analysis, along with its expanding AI capabilities, makes it a high-potential stock in the AI domain.

Company Summary:

- Industry: Software

- Market Cap: $37 billion

- Revenue: $2 billion

- Debt: $236 million

- Cash Balance: $3 billion

- Profit Margin: 6.93%

NVIDIA Corporation (NVDA)

Image Source: NVIDIA Stock Chart — NASDAQ:NVDA Stock Price — TradingView

NVIDIA is a powerhouse in AI, primarily known for its graphics processing units (GPUs) that are crucial for AI computing. The company has been at the forefront of AI hardware and software, providing the necessary processing power for machine learning and deep learning applications. NVIDIA’s continued innovation in AI and its expanding ecosystem of AI tools and software make it a top stock in the AI industry.

Company Summary:

- Industry: Semiconductors

- Market Cap: $1.2 trillion

- Revenue: $44 billion

- Debt: $11 billion

- Cash Balance: $18 billion

- Profit Margin: %42.10

Advanced Micro Devices (AMD)

Image Source: AMD Drivers and Support | AMD

Advanced Micro Devices has been gaining ground in the AI market with its high-performance computing and graphics technologies. The company’s processors and GPUs are becoming increasingly popular for AI and machine learning tasks, thanks to their efficiency and power. AMD’s strategic partnerships and focus on AI-driven technologies will continue to drive its growth in this sector.

Company Summary:

- Industry: Semiconductors

- Market Cap: $218 billion

- Revenue: $22 billion

- Debt: $2 billion

- Cash Balance: $5 billion

- Profit Margin: 0.94%

Each of these companies represents a unique aspect of the AI industry, from hardware and data analysis to AI application development. Their stocks are not just investments in companies but in the future of AI technology.

As with any investment, potential investors should conduct thorough research and consider their investment goals and risk tolerance when deciding whether or not these AI stocks are right for them.

Risks When Investing in an AI Stock

Investing in stocks related to AI can be rewarding, but like all investments, it comes with its own set of risks.

Understanding these risks is crucial for investors to make informed decisions.

Here are some key considerations:

Regulatory Risks

As AI becomes more integrated into society, regulatory scrutiny increases. Governments and international bodies are working to establish frameworks around data privacy, ethical use of AI, and security. Changes in regulations can impact AI companies’ operations, profitability, and ability to develop the technology further.

High Valuations and Speculation

Many AI stocks are valued based on future growth potential rather than current earnings, leading to very high valuations. This speculative nature can make these stocks more sensitive to market sentiment and prone to overreaction, both positive and negative.

Complexity of AI Technologies

The complexity of AI technologies can be a double-edged sword. While it drives innovation, it also means that investors may find it challenging to fully understand the technologies and their potential. This lack of understanding can lead to misjudging the risks and potential of AI investments.

Global Competition and Geopolitical Risks

The AI sector is subject to global competition, with significant advancements and investments coming from various countries. Geopolitical tensions or trade policies can (and will) impact the global AI market, affecting companies’ ability to operate across borders.

Investing in AI stocks requires a nuanced understanding of the technology, the market, and the unique challenges of the sector. While the potential for growth is significant, the risks are equally noteworthy.

Investors need to carefully evaluate these factors and consider diversification to mitigate risks associated with investing in this exciting field.

Conclusion: Is AI a Good Investment?

Evaluating whether AI is a good investment requires balancing its transformative potential against the inherent risks. AI’s integration across various sectors promises substantial economic growth and revolutionary changes in industries like healthcare, finance, and manufacturing. However, this potential comes with challenges such as technological complexity, high valuations, and geopolitical uncertainty.

For investors, a diversified approach and a long-term perspective are key. Investing in a mix of AI-specific stocks and companies incorporating AI into their operations can mitigate some of the risks.

While immediate returns will no doubt be variable and volatile, the most significant gains are likely to emerge as AI technologies mature and become more integrated into global economies and daily life.

In short, AI presents a compelling investment opportunity, but it requires careful consideration of the risks and a commitment to staying informed about this rapidly evolving industry. With a balanced strategy and an understanding of the sector’s challenges, AI can be a good investment, offering both financial returns and a chance to contribute to a technology that is reshaping our world.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.