Building a well-balanced portfolio is an understated element of achieving financial success. During times of economic uncertainty, or as whole industries experience bouts of both growth and decline, investors must ensure they are properly protected from the various risks the financial world brings.

Investing in negatively correlated stocks, industries, and other asset classes is one of the most effective ways to balance risk mitigation with investment gains, as this strategy helps to ensure you’re not overly exposed to any one sector or area of the stock market.

However, building a properly diversified portfolio with assets that are truly negatively correlated can be more challenging than many expect.

That’s why today we’ll be giving our readers everything they need to know to understand what makes a stock or other asset negatively correlated, what the advantages of negative correlation are, and provide some examples for investors to research further.

When stock markets go up, many investors forget about building a risk-adjusted portfolio as they don’t see the need to invest in assets that hold negatively correlated patterns with each other. However, when downturns (inevitably) happen, those who took the time to build a portfolio with inversely correlated assets will be able to find investing success regardless of market conditions.

What is Negative Correlation in Finance?

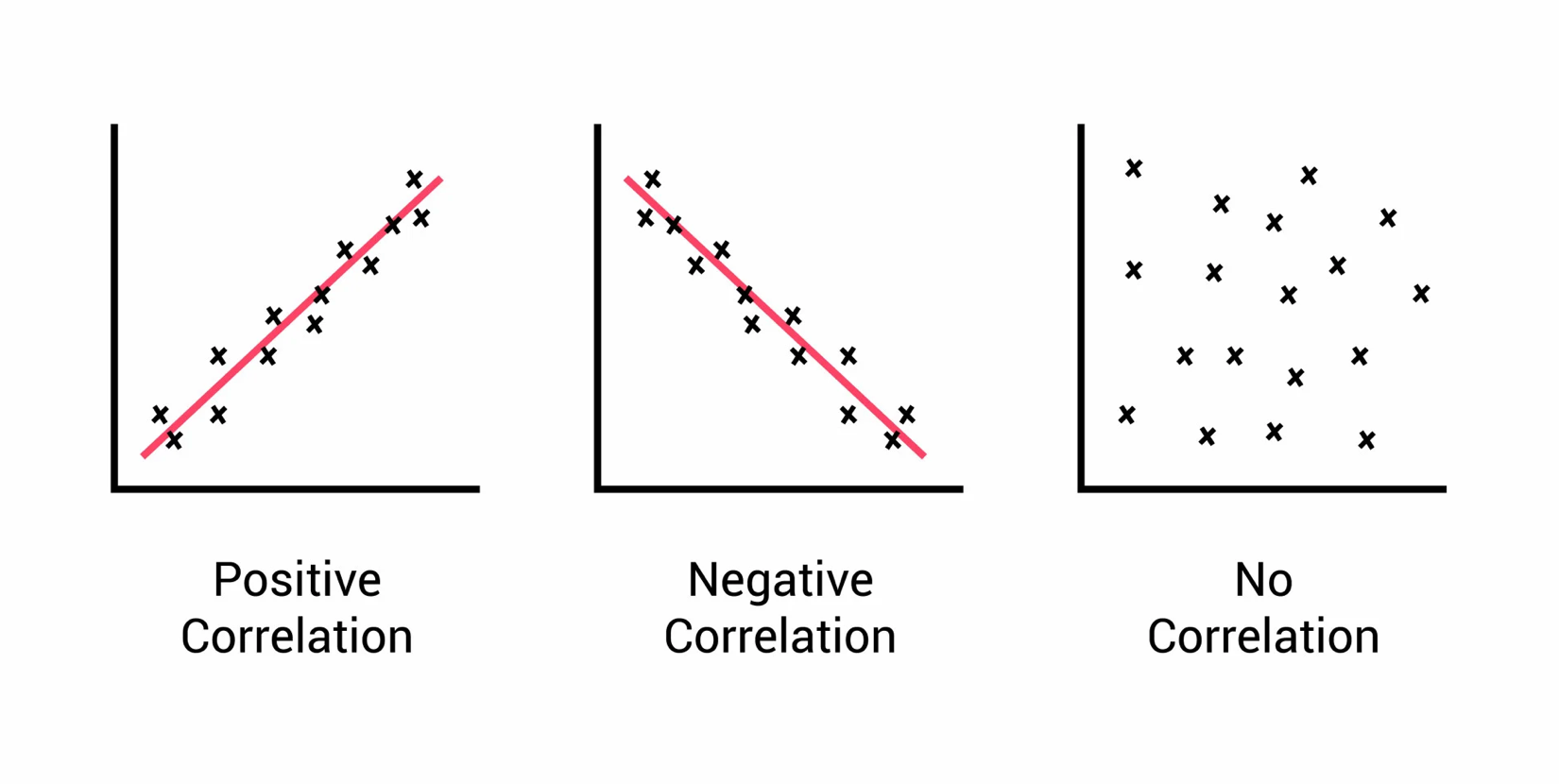

In finance, correlation is a statistical measure that quantifies the relationship between two variables, such as the prices of two stocks. A correlation coefficient will range from -1 to +1, with values of -1 indicating a perfectly negative correlation, values of +1 indicating a perfectly positive correlation, and values of 0 indicating no correlation at all.

Strong negative correlation, therefore, occurs when the prices of two stocks move in opposite directions. When one company’s stock price goes up, the other goes down, and vice versa.

Below are graphical representations of a perfect positive correlation, perfect negative correlation, and no identified correlation.

Why is Negative Correlation Important for Investors?

Understanding negative correlation is important for investors because it enables them to manage risk and diversify their portfolios. Holding negatively correlated assets can help mitigate the impact of market volatility and provide a potential hedge against losses.

A good example of failing to invest in negatively correlated assets is the recent downturn in the technology sector. Throughout the global pandemic, tech stocks soared based on their importance to a digital economy and the robust growth they achieved quarter over quarter. However, as economies began to reopen, the reliance on these firms’ products and services began to diminish, leading to slowing growth for companies that also had sky-high valuations. Ultimately, this led to a strong sell-off of tech stocks within the last year, and investors who failed to properly diversify undoubtedly suffered significant losses.

Finally, one other benefit of prioritizing negatively correlated assets in one’s portfolio is they can also create opportunities for investors to profit from market inefficiencies. If an investor identifies two stocks that are negatively correlated but have similar fundamentals, they may be able to generate alpha (investment return) by buying one stock when it’s undervalued and selling the other stock when it’s overvalued.

How is Correlation Calculated?

To calculate the correlation coefficient between two assets, we need to determine the covariance between the two assets and divide it by the product of their standard deviations.

The formula for calculating correlation is:

Correlation = Covariance / (Standard Deviation of Asset 1 x Standard Deviation of Asset 2)

Covariance is a measure of how two variables move together, and it is calculated by taking the average of the product of the deviations of each variable from its mean.

The standard deviation is a measure of how spread out the data is, and it helps to normalize the covariance calculation.

For example, if we want to calculate the correlation between two stocks, we would first gather the historical price data for both stocks and calculate their daily returns. We would then use the formula above to calculate the correlation coefficient between the two.

It’s important to note that correlation does not imply causation and a high correlation between two assets does not necessarily mean that one asset causes the other to move. It only indicates that there is a statistical relationship between the two assets. Additionally, correlation coefficients can change over time, and they may not capture all the factors that influence the performance of the assets being compared. Therefore, it’s important to use correlation as one of several tools for portfolio diversification and risk management.

Advantages of Investing in Negatively Correlated Assets

Investing in negatively correlated stocks can offer several benefits for investors. Here are some of the key advantages:

- Risk management: As we’ve already discussed, holding negatively correlated stocks can help manage portfolio risk. During market downturns, negatively correlated stocks can act as a hedge against losses, potentially reducing the impact of market volatility in one’s portfolio. Investors diversifying their portfolios with assets that move in opposite directions effectively spreads risk and enhances portfolio performance.

- Diversification: Negatively correlated stocks can help investors achieve portfolio diversification. By adding negatively correlated assets to the portfolio, investors can reduce the portfolio’s overall risk and exposure to any single stock or sector. This can help balance the portfolio and will help reduce the impact of unforeseen events.

- Alpha generation: Negative correlation can create opportunities for investors to generate strong alpha. By identifying two stocks that are negatively correlated but have similar fundamentals, investors can potentially profit from market inefficiencies on a regular basis.

- Reduced drawdowns: Holding negatively correlated stocks can help reduce drawdowns, which are the peak-to-trough declines in the value of a portfolio. During market downturns, negatively correlated stocks can help offset losses in other parts of the portfolio, potentially reducing the overall drawdown. This can help preserve capital and improve the overall performance of the portfolio over time.

In summary, investing in negatively correlated stocks can offer several advantages for investors, including risk management, diversification, alpha generation, and reduced drawdowns. By understanding the concept of negative correlation and how to identify stocks that move in opposite directions, investors can drastically improve the performance of their portfolios while simultaneously limiting their risk.

Investing in Negative Correlation Examples

So far, we’ve covered why investing in negatively correlated securities is a benefit, though, in practice, it can be harder to find actual investment opportunities that hold true negative correlation.

Further, investors can find negatively correlated assets across various sectors, stocks, and asset classes. In this section, we’ll explore some examples of negatively correlated assets that investors can research further.

Healthcare and Consumer Discretionary

Healthcare stocks, such as those in the pharmaceutical or biotech industries, are often negatively correlated with consumer discretionary stocks. During an economic downturn, healthcare companies tend to perform better as consumers prioritize healthcare spending over discretionary spending. Conversely, during an economic expansion, consumer discretionary companies tend to perform better as consumers have more disposable income.

US Treasuries and US stocks

US Treasuries, especially long-term bonds, are often negatively correlated with US stocks. During a market downturn, investors tend to seek the safety of Treasuries, causing their prices to rise while stock prices fall. Oppositely, during a market upswing, investors usually favor stocks over bonds, causing Treasuries to underperform.

Gold and the US Dollar

Gold and the US dollar are often negatively correlated. When the US dollar is weak, gold tends to rise as investors seek a hedge against inflation and currency depreciation. On the other hand, when the US dollar is strong, gold may underperform as investors flock to other more growth-oriented assets.

Real Estate and Commodities

Real estate and commodity markets operate independently of each other, making them two industries that are regularly negatively correlated. Real estate is often a sustainable investment during times of economic decline, as consumers always require accommodations. During times of economic growth, commodities, such as copper or lithium, see prices appreciate as demand for these raw materials increases significantly.

Emerging Market Stocks and US stocks

Emerging market stocks can perform well during global economic expansion, while US stocks may outperform during a US economic expansion. A slowdown in one region can lead to a shift in investor sentiment towards the other region, leading to securities in certain parts of the world to under or over-perform at different times.

The Bottom Line

Investing in negatively correlated stocks and assets can provide a valuable diversification strategy for investors looking to manage risk and improve portfolio performance. By identifying assets that move in opposite directions, you can easily reduce the impact of market volatility on your portfolio.

However, it’s important to note that the level of diversification and the specific assets chosen will depend on an investor’s goals and risk tolerance. Some investors may choose to focus on a smaller number of highly negatively correlated assets, while others may prefer to spread their investments more widely across a range of negatively correlated stocks and asset classes.

Ultimately, a well-diversified portfolio should be tailored to an investor’s specific needs, goals, and risk tolerance. While investing in negatively correlated stocks and assets can be a valuable strategy, it should not be the only factor considered in portfolio construction. Other factors, such as asset allocation, investment style, and individual stock selection, should also be taken into account.

In conclusion, investing in negatively correlated assets can be a great investment strategy for managing one’s risk and improving overall performance. However, determining which assets are truly negatively correlated can be more complex than many investors realize. The above examples provide a starting point for investors to conduct their own research, and while no two assets are perfectly correlated with one another, focusing on negatively correlated securities is an important part of achieving investment success.