Nuclear power and nuclear energy fuels can change the world and help solve an impending energy crisis. The resource, in turn, provides unique investment opportunities for those looking to bet on it. Nuclear stocks provide investors a chance to participate in an economy otherwise reserved for scientists and those quant guys in Patagonia vests on Wall Street.

But no fear, I will be your guide! First, I will break down what nuclear energy is exactly and how, as a commodity, it has been and can be traded.

Next, I will give you (for free, no less) two stocks that are behemoths in the sector and break them down a bit for you.

Lastly, we will look at some smaller cap outfits and, again, dig into them a bit and outline a case for them.

But first, let’s break down the source of nuclear power before foraying into securities.

Nuclear Power

The history of nuclear energy began in the early 20th century, with the discovery of the energy and power of splitting the atom when developing bombs (the infamous Manhattan Project we should all know). The result of this effectively ended WWII.

From there, we decided Nuclear energy would be great to use to power things, and that is its purpose to this day.

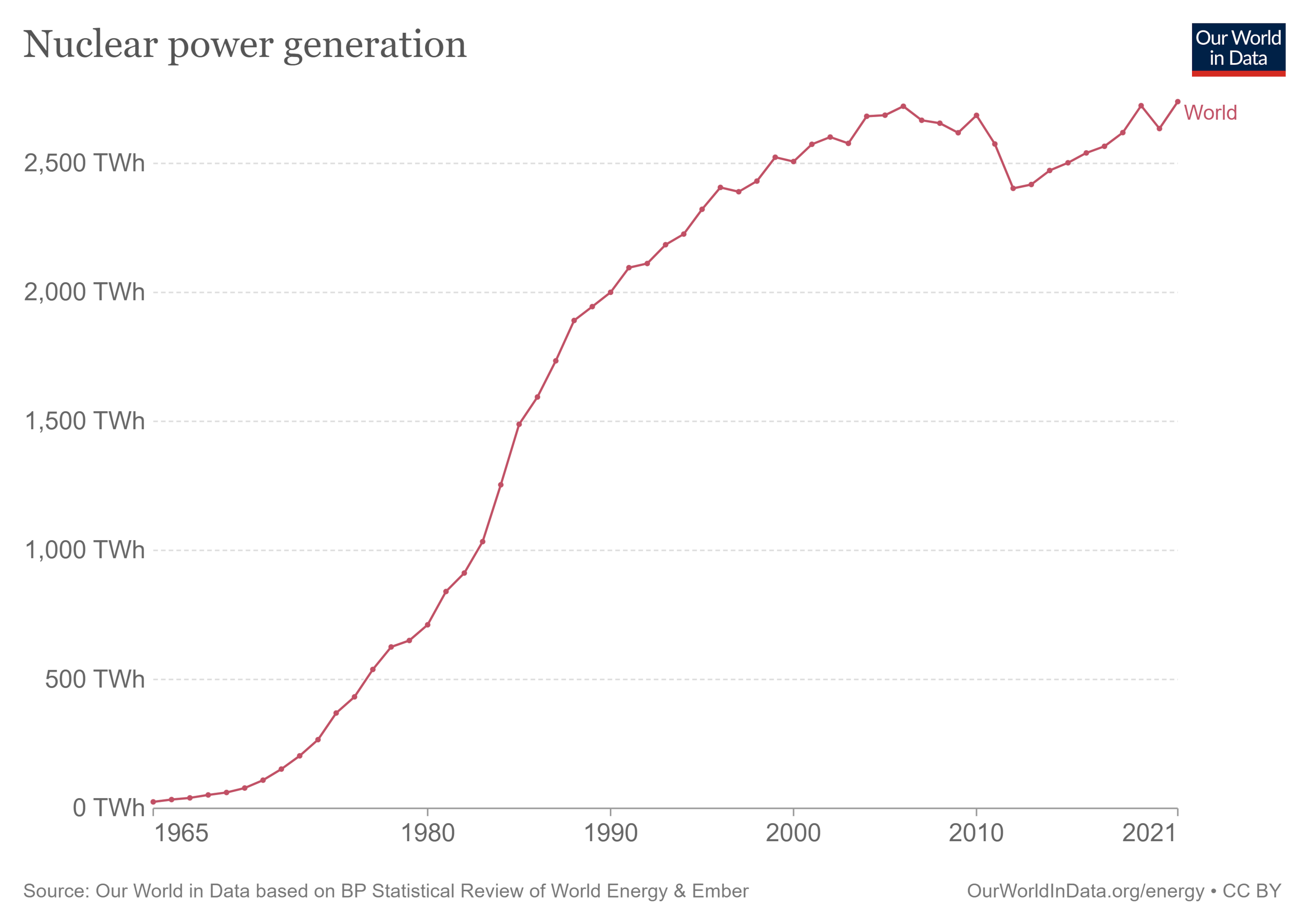

Currently, the world gets over 60% of its energy from burning fossil fuels. With an increased focus on the future of our planet and the climate (specifically the reduction of carbon emissions), the need for nuclear fuel is growing.

Uranium Exploration

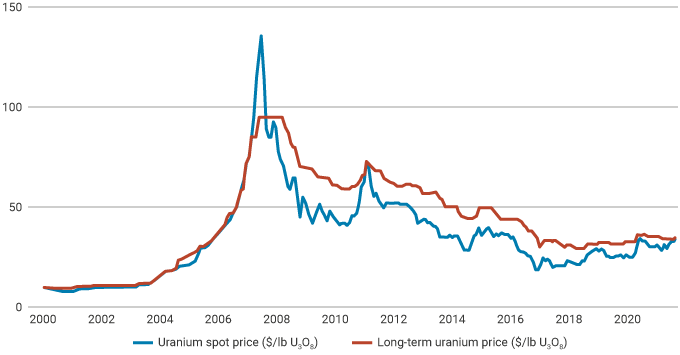

Typically when we speak of nuclear power in an investment sense, we are referring to the costs involved in mining, enriching, and converting uranium, the main input in nuclear power. Uranium exploration and the associated one fluctuates depending on a variety of factors, with the market typically being assessed by looking at the price of uranium (the spot price)

Recent developments include:

- In 2020 an agreement was signed between USA and Russia, extending a 5-year import agreement (The Suspension Agreement, limiting imports).

- The COVID-19 pandemic disrupted this market by displacing mining activities and supply chains.

- By the end of 2022, the uranium sector had accumulated 11.4% losses (a recession can be a good time to invest).

- Most experts agree that the market is poised for a long bull run.

- Supported by a Western focus on energy security due to the war-induced fluctuations of oil prices

- Period of long-term support for the resource through 2023

- Uranium supply and production will be uncertain soon, creating a robust market.

According to a report by Sprott Asset Management, “upward price pressure will cascade down to the uranium spot price in 2023,”

There is expected growth and opportunity for people looking to invest in the sector, especially for investors looking for the best nuclear energy stocks.

The Best Nuclear Energy Stocks

The nuclear energy sector is dominated by Cameco Corp (TSX: CCO) (NYSE: CCJ) and BWX Technologies (NYSE: BWXT), companies with a combined market cap of over $19B. This is as close to a “traditional” investment as you will make in the space.

Cameco Corp. (TSX: CCO) (NYSE: CCJ)

433.86M Shares Outstanding | $25.00B Market Cap

Cameco Corp., from northern Saskatchewan (created in 1987), is the world’s largest publicly traded uranium company. The company is involved in uranium and fuel services. This includes exploration, mining, and milling, as well as the general buying and selling of uranium. Their fuel services division is involved with refining, converting, fabricating, and buying and selling. Cameco then sells uranium and fuel services globally to nuclear facilities (like nuclear reactors).

As an investor, here is what you should keep in mind:

- Despite the slow price movement of the uranium spot price, it is well known that once it starts to move, it does so at a breakneck pace

- Most investors wait for a security of supply event, it is then that money begins to pour in.

- An investor can take advantage of this by taking a longer view as opposed to attempting to time the inevitable price increase of the resource and, in turn, the stock price.

- Insider ownership of the company has slid, with some insider sell-offs in 2023 ($1.05 M last twelve months)

- The large share of institutional ownership of the stock (72.36%) can pose a risk as these institutions can affect the stock price in an instant and are typically quite sensitive to any perceived weaknesses (like QoQ losses)

- Most analysts expect the earnings to grow by 194.59% this year, with the stock price enjoying even larger growth

BWX Technologies (NYSE: BWXT)

91.51M Shares Outstanding | $7.00B Market Cap

An American supplier of nuclear components and fuel to the USA, this company started trading in July 2015 on the NYSE.

The company has a long history dating back to days as a subsidiary of the U.S. Government.

Here is what you should keep in mind:

- This is likely not a growth stock, as it is currently pretty fairly valued compared to industry peers (PE Ratio of around 31.52 is pretty in line with the industry).

- Earnings over the next few years are expected to grow 5.46%

- Currently pays out dividends that yield 1.20%%, which are more than covered by earnings

- Debt to Equity ratio sits at 1.54, but has been declining over recent years

Smaller Nuclear Energy Stocks

Among the smaller-cap energy stocks to buy, a few stand out as a stock poised for explosive growth in the future. The best nuclear energy stocks to watch include Skyharbour Resources (TSXV: SYH) (OTCQX: SYHBF), Centrus Energy Corp (NYSE: LEU), Lightbridge Corporation (NASDAQ: LTBR), Nexgen Energy Resources (TSX: NXE), Denison Mines Corp (TSX: DML) (NYSE: DNN).

This is where investors around the world can really look to make money.

Skyharbour Resources (TSXV: SYH) (OTCQX: SYHBF)

170.08M Shares Outstanding | $88.44M Market Cap

Skyharbour has a comprehensive portfolio related to exploration in the Athabasca Basin region in central Canada. The company is well positioned via:

- 24 total projects, 10 of which are drill ready

- Over 518,000 hectares of mineral claims

- Their 100% acquisition in the Moore Uranium Project, which is an advanced staged exploration property

- Strategic joint ventures with industry-leader Orano Canada Inc. (Preston Project) and Azincourt Energy (East Preston Project)

- Several active option partners like Valor Resources, Basin Uranium Corp., etc.

The company also enjoys a noteworthy investor base that includes stalwarts such as Denison Mines Corp. (TSX: DML), Sprott Uranium Miners ETF (URNM), Global X Uranium ETF (URA), as well as insider and management ownership.

Some key things to look at are:

- In their case, the best measure of health is information related to current liquidity, solvency, and planned property expenditures

- Future success hinges on the discovery of relevant minerals and how economical it is to develop these properties (production is capital heavy, like any natural gas)

- As of Q1 2023, the balance sheet possessed a cash balance of $3.09 million compared to $4.60 million as of March 31, 2022

If you’d like to learn a little more about Skyharbour Resources, check out our exclusive interview with the CEO here.

Centrus Energy Corp (NYSE: LEU)

14.81M shares outstanding | $850.33M Market Cap

Centrus is among the nuclear energy stocks specializing in supplying nuclear fuel and servicing utilities worldwide. The company has a long-term order book until 2030 (protecting them from the costs of uranium production), consistently innovating to reduce costs and create tailored products and services with cutting-edge technology.

They do this for advanced nuclear reactors and others in the energy, aerospace, chemical, and defense sectors. This company is one of the most innovative energy stocks to buy today.

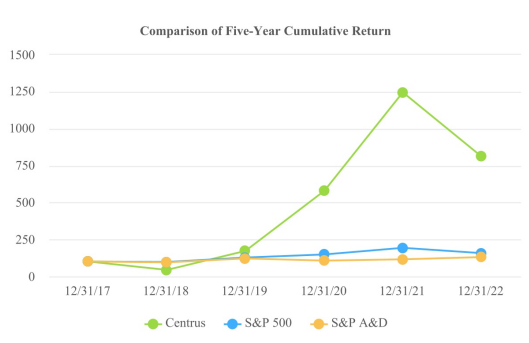

Compared to the S&P Index and the S&P Aerospace and Defense (A&D) Index, the stock has outperformed over the last five years, which is generally a good sign.

The order book gives clear visibility on the significant portion of revenue for the next three years, consisting of the following:

- Low-Enrich Uranium (LEU) accounts for 80% of total revenue as of December 2022

- International sales accounted for 50% of the income of the LEU segments (since 2020)

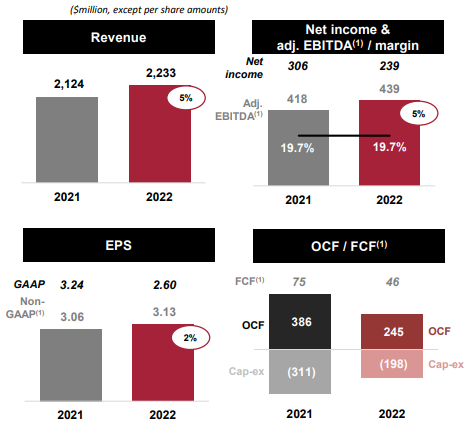

Centrus’ financial highlights are robust and encouraging compared to other small-cap energy securities listed. Some key stats include:

- YoY Operating Income = -31.73%

- YoY Basic Earning per Share = -34.91%

- YoY Total Assets = +11.75%

Lightbridge Corporation (NASDAQ: LTBR)

12.93M Shares Outstanding | $55.22M Market Cap

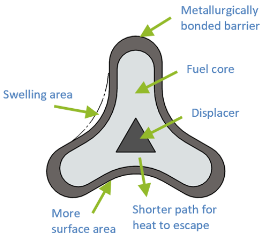

Lightbridge, based in Virginia, USA, deals in fuel technologies for solving energy, climate, and security problems. They specialize in working on current and future reactors. Their proprietary energy fuel operates at about 1,000 degrees Celsius, cooler than standard fuels.

They have invented and validated the technology in a research reactor with plans to test it under commercial reactor conditions (similar to those in nuclear power plants).

Their focus on small modular reactors (SMRs) will improve the unit economics of power and load following when included on grids generating electricity with renewables. Lightbridge Fuel will:

- Provide SMRs with all the benefits their technology brings to large reactors

- Produce more power in SMRs than traditional energy fuels

- Help decarbonize sectors currently powered by fossil fuels

With this company, some key things to take note of include:

- Lightbridge’s latest financials paint a picture of a responsible and robust company, establishing it as one of the best nuclear and energy stocks to buy

- $29.24 million cash on hand

- Strong insider ownership

NexGen Energy Resources (TSX: NXE) (NYSE: NXGEF)

491.99M Shares Outstanding | $2.945B Market Cap

NexGen Energy, which started trading in April 2011, uses responsible mining practices, optimizing mine life while implementing industry-leading environmental and social management frameworks in exploration activities.

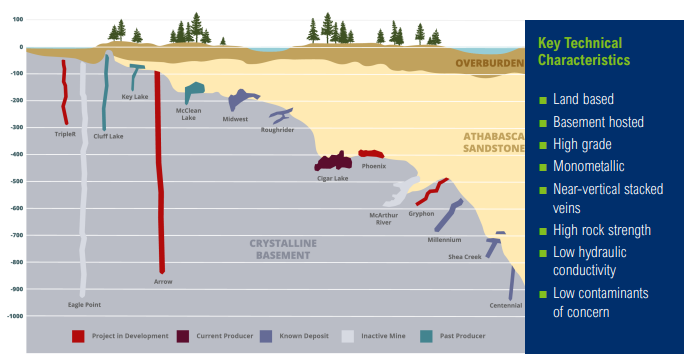

The company has a flagship project (Rook I Project) in the Athabasca Basin, located in Saskatchewan, Canada, which they believe to be one of the largest and highest-grade deposits globally. They also own a variety of prospective exploration properties around the same region.

NexGen Energy expects continued growth on the back of a healthy industry, and the stock is an attractive growth investment for those looking to invest in the industry. Some things to keep in mind include:

- An increase of total assets YoY between 2022 and 2021 due to the development of the companies resource properties and the timing of equity offerings

- Continued development of the flagship Rook I Project

- Median analyst price target is at $7.91

- All analysis is essentially speculative (pre-sales), mostly based on the Rook 1 Project speculation

Denison Mines Corp (TSX: DML) (NYSE: DNN)

872.88M Shares Outstanding | $1.92B Market Cap

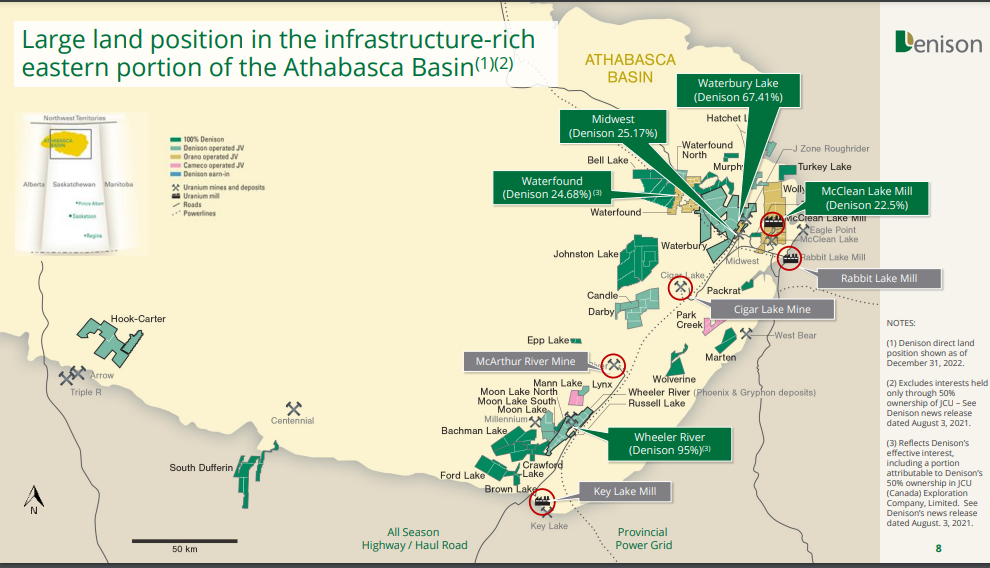

Denison is an exploration and development company focused on the Athabasca region.

Denison Mines also has other projects engaged in mining, processing, and sale via ownership of a processing facility in Northern Saskatchewan (capable of processing 24M lbs/year).

Their strategic portfolio includes:

- 95% interest in their flagship Wheeler River project

- 22.5% interest in McClean Lake Mine

- 67.41% interest in the Waterbury Lake project (currently in the Preliminary Economic Assessment phase)

- “Participating” interest in development-stage operated by major industry players

- Over 300,00 hectares of prospective exploration ground in the region

Some things for investors to keep in mind here:

- The flagship Wheeler River site is said to have about 109.4m lbs of uranium ore, which has an expected lifetime of 6 years

- The median price target sits at around $2.46 (which is over +50% of the current price)

- Compare this to a peer like Energy Fuels (TSX: EFR) (NYSE: UUUU), which currently sits at $10.85

- Success on the market hinges on the Wheeler River site, and as such, the stock is high risk with incredible upside

Final Word: Investing in Nuclear Energy & Nuclear Technology

This sector will continue to be bolstered by a desire to produce energy fuels and curb climate change. Geopolitical pressures have this natural gas sector poised to power forward.

Despite nuclear plants being around for over 70 years, nuclear plants are having a renaissance of technologies (all around the world). From more efficient nuclear energy fuels to smaller nuclear power plants and beyond.

Next time you come across a company that is a uranium producer (or something adjacent), take a look at the competitive edge, their projects, and the growth of those clean energy projects.

Not every stock in this sector will be a home run, but you might be up to bat when the next one is ready is fly. If you need some help, we got you.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Skyharbour Resources and are compensated for content creation, amounting to twelve thousand dollars. Edge Investments and its owners reserve the right to buy and sell shares in Skyharbour Resources without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.