Are you looking to boost your stock portfolio returns with some potentially profitable investment opportunities?

Well, pink-sheet stocks may be the perfect solution!

Pink sheet stocks are a fascinating and potentially lucrative addition to your portfolio.

Though they tend to be riskier than large-cap or mid-cap stocks, their ability to generate seismic returns can sometimes far outweigh the risk.

In this article, we’ll break down these interesting assets, evaluate the pros and cons, and teach you how to analyze these early-stage companies.

So, if you want to generate life-changing returns, let’s dive in and discover what pink-sheet stocks are all about!

What are Pink Sheets Penny Stocks?

Image courtesy of Business Insider

Pink sheet penny stocks refer to stocks that are traded over-the-counter (OTC) and are priced at a relatively low value, typically below $5 per share.

They are called “Pink Sheets” because, historically, stock quotes were printed on pink paper and compiled into a document known as the Pink Sheets.

However, nowadays, the term encompasses OTC stocks traded electronically.

Unlike stocks listed on major exchanges like the New York Stock Exchange or NASDAQ, pink sheets do not meet the stringent listing requirements of these exchanges.

These include certain financial (i.e. revenue, net income, etc.), governance, and market value standards, as well as others.

As a result, these stocks are traded on less regulated platforms, such as the OTC Markets Group or the Pink OTC Market, which provide a venue for buying and selling these stocks.

To learn more about penny stock investing, check out this video.

Pros and Cons of Trading Pink Sheet Penny Stocks

Trading over-the-counter stocks has its own set of advantages and disadvantages. Here are a few of the biggest pros and cons of investing in these assets.

Pink Sheet Penny Stock Pros

- Affordability: OTC stocks are often priced at a few cents to maybe a couple of dollars, thus making them easily accessible to most investors. What’s more, these companies tend to be less known and in their early stages, which means that most of their value has yet to be realized. You can think of it like buying into Tesla or Google before everyone knew what they were.

- Potential for Rapid Gains: Since pink sheet stocks trade at low prices, even a small increase in value can result in significant percentage gains. This potential for rapid growth and the ability to acquire a larger position in a company is what really attracts investors to this market.

- Diverse Investment Opportunities: The OTC market offers a wide range of companies across various sectors, allowing you to diversify your portfolio and potentially tap into emerging industries. Moreover, it can be a great way to add a few more high-growth stocks, thus increasing your chances of beating the market.

Pink Sheet Penny Stock Cons

- Higher Risk: Pink sheet penny stocks are nothing like your steady large-cap company. As smaller and less established businesses, these stocks’ futures are less certain and predictable, making them much riskier than most assets. To overcome this, you will need to spend extensive time researching the business and ensuring they have what it takes to succeed over the long term.

- Lack of Information: One of the biggest challenges investors face when investing in pink sheet stocks is that there is a lack of financial and regulatory information. This makes it difficult to tell whether a company is financially healthy or not and if the management team truly understands the market that they are competing in. In general, the more info you have on a company and its industry, the better off you’ll be.

- Potential for Fraud: Given that pink sheets are less regulated, they sometimes can attract unscrupulous individuals who may engage in fraudulent activities, like pump-and-dump schemes. The best example of this is from everyone’s favorite movie, The Wolf of Wall Street, whereby Stratton Oakmont fooled unsuspecting investors into buying fundamentally poor or even fake shell companies. Overall, it is always important to do your research, and if a stock seems questionable, it probably is.

How to Analyze Pink Sheet Penny Stocks

Now that we’ve covered pink sheets and evaluated their pros and cons, it’s time to learn what you should look for when analyzing these high-risk, high-reward assets.

No matter what company you are exploring, analyzing stocks requires a diligent and thorough approach.

Here are a few steps to consider when evaluating these stocks:

Step 1: Company Information

To begin your analysis of pink sheet penny stocks, start by researching the company’s background, management team, business model, and any relevant news or developments. It is a great idea to familiarize yourself with the companies you own so that you can determine more effectively where the stock is headed. On the flip side, if a business seems difficult to understand, don’t worry; there are many options out there and it is probably best to move on to something else. Even the best investors like Warren Buffett, have a “Too Hard” pile where they toss complex companies.

Step 2: Financial Health

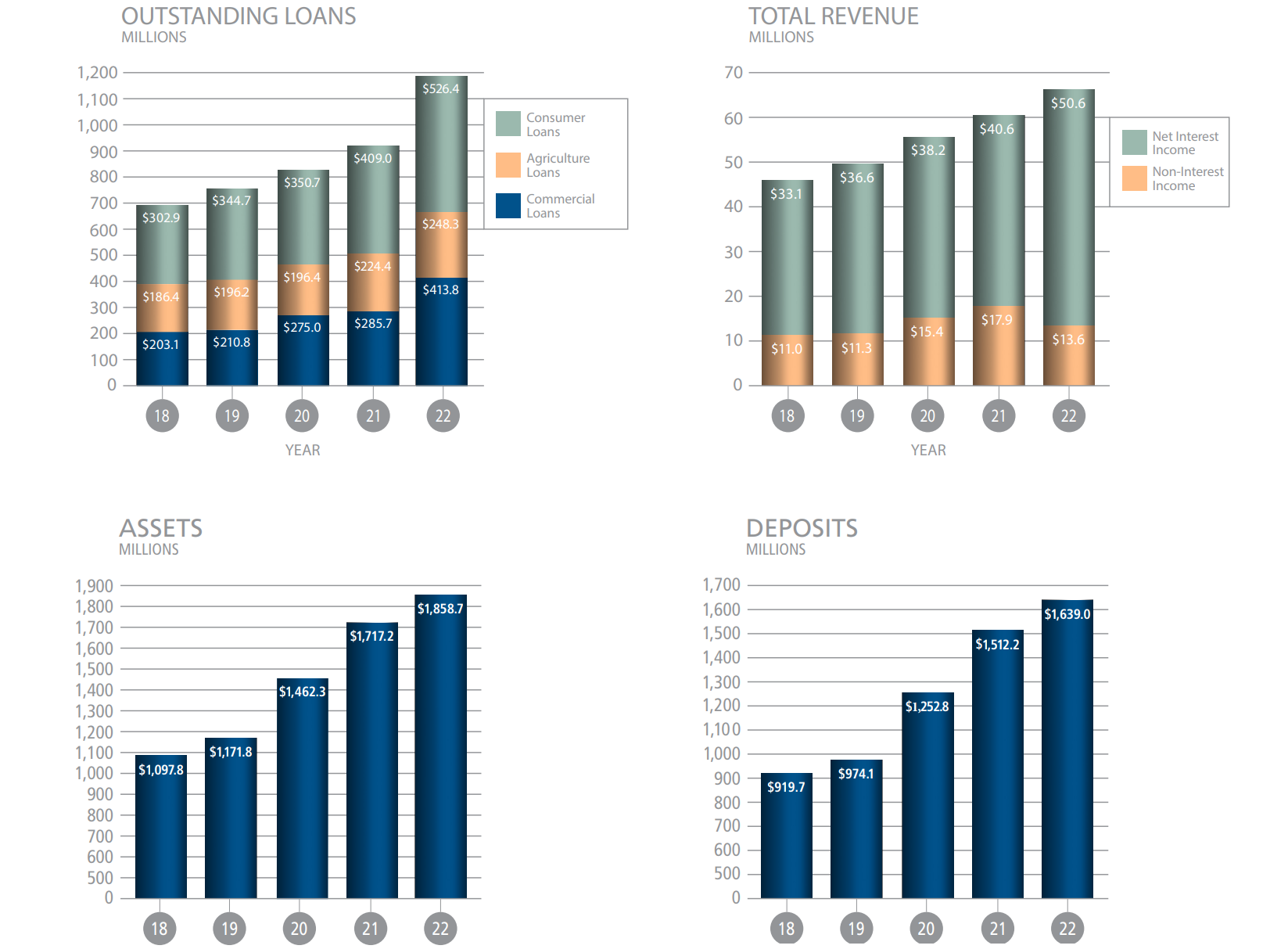

Image courtesy of ENB Financial

An important aspect of understanding a business is also knowing its financial health. To do so, assess the company’s financial statements, including revenue, earnings, debt levels, and cash flow to determine whether it is fit to survive and thrive for many years to come. Also, look for positive growth trends that will help strengthen the business and avoid companies with excessive debt or consistent losses. As a general rule of thumb, you want to see that company’s revenues, profits, equity, and cash flows are trending upward year over year.

Step 3: Competitive Position

Once you’ve determined that you can easily understand a company and that its financials are in order, the next step is to evaluate its competitive position, market share, and potential for future growth. Since we are all investing for the future, you’ll want to ensure that a stock’s business model is sustainable and can outperform its competitors over the long run. For pink sheet stocks, this can be difficult to do since they are less established, but it is still important to measure what value they bring and how they differentiate themselves. The best way to do this is by being a customer or employee yourself and assessing your relationship with the company first. If you love their product or service and plan to keep using it, this is a great sign that the business is here to stay since other stakeholders are probably thinking the same thing.

Step 4: Risk Factors

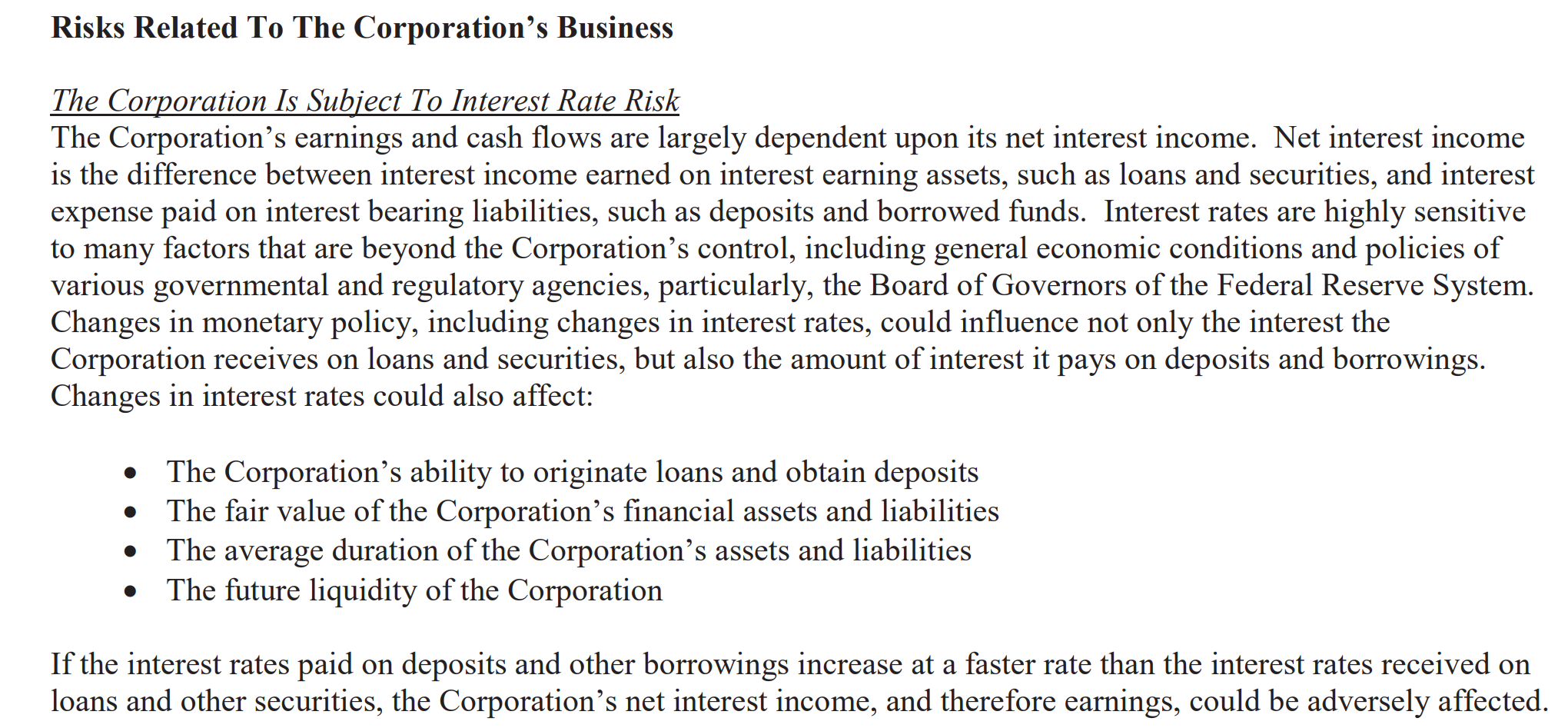

Image courtesy of ENB Financial

Every business has specific risks that relate only to its company and industry. As such, it is a good idea to identify and evaluate these risks so that you can better anticipate what factors may affect its success. In general, consider factors like regulatory changes, competition, and market conditions. However, many companies list their specific risks in their regulatory filings, thus making your job a whole lot easier. If you push yourself to understand these risks and how they impact the business, it will put you at a significant advantage over other investors since you can take advantage of low prices when others are fearful.

Step 5: Trading Volume and Liquidity

One of the more important factors to consider when investing is that many pink sheet stocks have lower trading volumes and less liquidity than other assets. Since these companies are less known and don’t trade on major stock exchanges, this means that fewer investors are buying and selling pink sheet stocks. As such, they tend to be more volatile whereby the stock price fluctuates up and down more frequently. For example, if there are fewer shares for sale on the open market, but the stock is in high demand, this will drive the price up significantly—the opposite is true when there are many sellers and few buyers. So, if you are someone that prefers stability, search for those pink-sheet listings with higher trading volumes and greater coverage.

How to Buy Pink Sheet Stocks

If you are looking to buy pink sheet stocks you’re in luck!

Today, most online brokerages offer investors the ability to buy and sell these lesser-known companies.

However, there are often limitations when it comes to what companies and OTC markets you can trade on.

Therefore, it is worthwhile to determine your objective and conduct research before choosing an online trading platform.

To help you out, we’ve compiled a list of the best penny stock trading apps available in the market!

Examples of Pink Sheet Penny Stocks

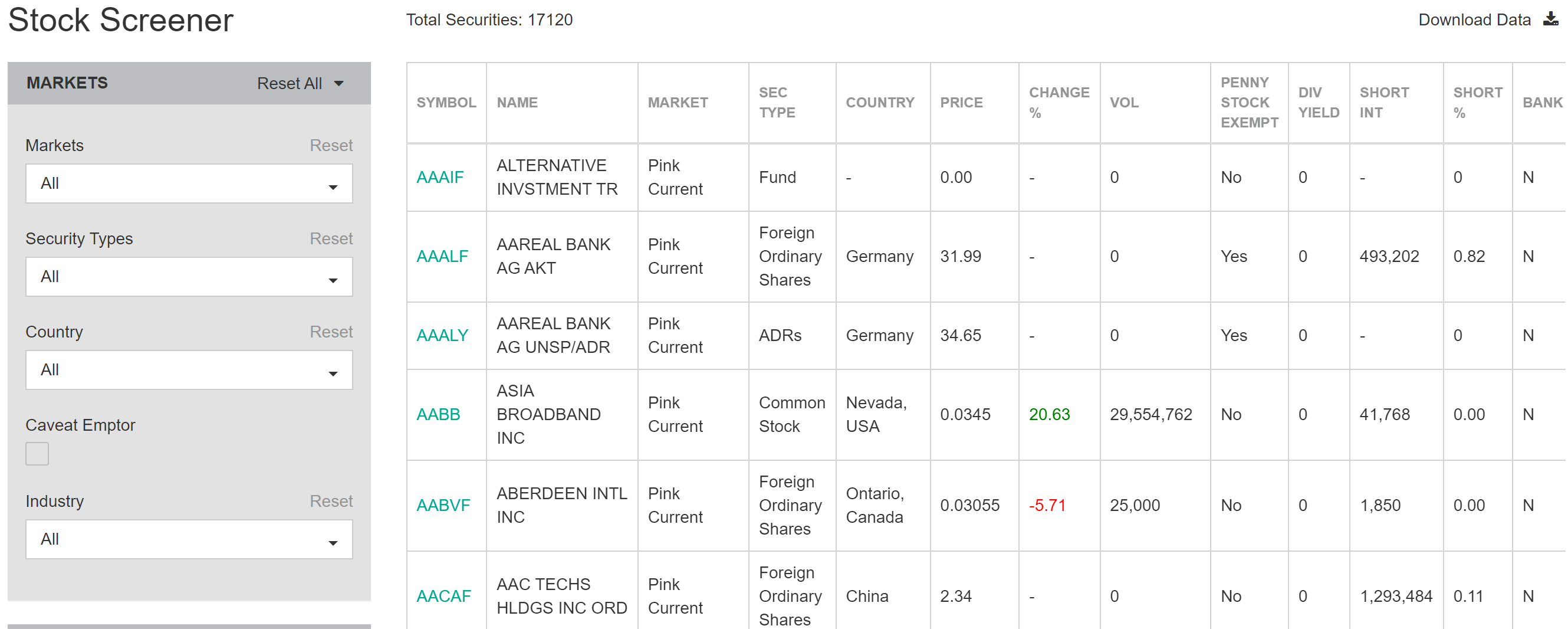

Image courtesy of OTC Markets

While we highly encourage exploring the pink sheets market on your own and determining a few stocks that fit your criteria, here are a few pink sheet stocks to help you get started.

You can learn more about various OTC stocks at OTCMarkets.com.

-

Winland Holdings (WELX)

Market Cap: $8.147 Million

Winland Holdings, through its subsidiaries, specializes in critical condition monitoring devices for the security industry. Its products safeguard customers against asset loss by monitoring temperature, humidity, water presence, and power outages. Over the trailing twelve months, Winland has earned $3.6 million in revenue and a net profit of $239 thousand.

-

ENB Financial (ENBP)

Market Cap: $70.277 Million

ENB Financial Corp is the holding company for Ephrata National Bank. It provides a wide range of financial services to individuals and small-to-medium-sized businesses, including deposit products like savings accounts and time deposits, as well as various loans such as commercial, real estate, and consumer loans. In 2022, ENB achieved revenues of $62.7 million, while also posting a $14.6 million net profit.

-

Inrad Optics (INRD)

Market Cap: $16.757 Million

Inrad Optics, along with its subsidiaries, specializes in the development, manufacturing, and marketing of optical components and sub-assemblies made from glass, crystal, and metal. Their offerings include a wide range of products such as precision custom optics, thin film optical coatings, optical windows, lenses, mirrors, prisms, and wave plates. In 2022, Inrad obtained revenues of $10.6 million, while reaching $152 thousand in profits.

Final Thoughts: Are Pink Sheets Penny Stocks Worth It?

Pink sheet stocks are a great way to spice up your portfolio with a few high-growth, under-the-radar businesses.

However, their risks should never be underestimated.

Therefore, if you are planning to invest in OTC stocks, your best bet is to allocate a small portion of your portfolio toward these companies to begin, and balance the rest out with some more predictable and established businesses.

In doing so, you’ll create a stock portfolio that is sustainable over the long term while also opening yourself up to a few major growth opportunities.

All-in-all, pink sheet stocks are a great way to take advantage of stocks that could potentially become the future Metas and Amazons of the world.