There are many ways to invest your money. You could buy stocks, trade bonds, or own art, among many other things.

However, few investment opportunities offer the reward potential that pre-IPO investing brings—let alone pre-IPO tech. When you get in on the ground floor of an exponential business before the world discovers its name, you set yourself up for the highest returns possible.

Of course, this investing strategy doesn’t come without risk. But if you could improve your odds of success, wouldn’t it be all worth it?

In this article, you will delve into the world of pre-IPO tech companies. This includes an overview of the market, how to become invested, what to watch out for, and a whole lot more.

Pre-IPO investing was once exclusive to the ultra-rich, but now, it is your time to take advantage. So what are you waiting for?

What Are Pre-IPO Companies?

Imagine discovering a hidden treasure chest before it’s unveiled to the world—an opportunity reserved for the select few in the know. That’s precisely the allure of pre-IPO (Initial Public Offering) companies, the unpolished gems of the financial world.

Picture this: you’ve heard whispers about a groundbreaking private company—a tech unicorn or a disruptive innovator—about to embark on its journey into the IPO market. These companies, although not yet available for public trading, have garnered substantial investor interest and attention due to their potential to redefine industries and revolutionize markets.

Now, why the hype? Pre-IPO companies are like secret gardens, blossoming away from the scrutinizing eyes of the stock market. They’re in the phase where they’ve proven their concept, fine-tuned their strategies, and are gearing up to make their grand entrance into the world of public trading.

But why the excitement? Well, being in on a pre-IPO opportunity offers a slice of the investment pie usually reserved for big institutional players and private investors. It’s a chance for individual investors—like you—to potentially reap significant gains before the company goes public. And who doesn’t love the idea of getting in on the ground floor of the next big thing?

However, the road to pre-IPO investing is less like a leisurely stroll and more like an exhilarating roller-coaster ride. It comes with its fair share of risks and challenges. These companies often lack extensive public financial records, making it harder to predict their future performance. Furthermore, the success or failure of a pre-IPO company can be influenced by a multitude of factors, from market conditions to unexpected industry shifts.

But isn’t the thrill of risk what makes an investment truly exhilarating? For those willing to take the plunge, the potential rewards can be enormous. If the company skyrockets post-IPO, early investors might find themselves with a nest egg that they could live on for the rest of their lives.

So, pre-IPO may not be for the faint of heart. But, it is designed for those who seek to be a part of something transformative. It’s about uncovering the next Amazon, Google, or Facebook and a chance to say, “I believed in them when they were still taking their first steps toward greatness.”

What Are the Advantages of Pre-IPO Investing?

Are you tempted yet? If not, here are five more reasons to consider investing in pre-IPO business:

1. Potential for Monumental Gains

Imagine catching a shooting star before it lights up the sky. Pre-IPO investing offers the potential for astronomical returns. Being an early investor means you secure a stake in a company poised for explosive growth. Think of it as owning a piece of the next big success story—before the world even knows it exists.

2. Access to Exclusive Opportunities

Picture yourself in an exclusive club, where access is granted to a select few. Pre-IPO investing offers a rare chance to invest in companies not yet available to the general public. This coveted entry provides an edge, allowing you to snatch up shares before they hit the public market and potentially at a more favorable price.

3. Alignment with Visionary Innovations

Ever dreamt of supporting groundbreaking innovations? Pre-IPO investing allows you to stand alongside visionaries and pioneers shaping the future. You become a part of the narrative, supporting companies with disruptive technologies or groundbreaking ideas and sharing in their journey toward reshaping industries.

4. Potential for Early Influence and Network Building

Beyond financial gains, being an early investor in a company can offer more than just returns—it can grant you a voice. Early investors often have opportunities to engage with company leadership, providing insights or guidance that could shape the company’s trajectory. Additionally, connecting with other early investors builds a network within the industry, presenting potential collaborations or future opportunities.

5. Flexibility and Control

Pre-IPO investing empowers you with more control over your investments. Unlike publicly traded companies subject to market fluctuations, pre-IPO investments allow for a more patient approach. You have the flexibility to hold onto your shares until the company goes public or, if desired, sell them in secondary markets.

How to Analyze Pre-IPO Tech Companies

Analyzing private businesses is not the same process as your run-of-the-mill tech stock. For this venture, you must dive deeper than ever before. Here are six steps to analyzing tech startups:

Step #1: Understand the Technology

To analyze a pre-IPO tech company, you must decipher its technological prowess. Delve into the core of their innovation. What problem does their technology solve? How revolutionary is it? Understanding the technology’s uniqueness and potential impact is the compass guiding your assessment.

Image By: LMSYS ORG

OpenAI’s GPT-4 is ahead of its time. It ranks #1 on the Chatbot Arena Leaderboard, proving to be more efficient than any other large language model (LLM) out there. This puts it at the forefront of generative AI technology and, thus, the de facto LLM for most users. With GPT-4, businesses and individuals are achieving new levels of productivity and creating more than ever before.

Step #2: Assess Market Potential

A critical aspect of analyzing pre-IPO tech companies is assessing the market they aim to conquer. Is there a growing demand for their technology? What’s the market size and potential for expansion? Knowing the lay of the land helps gauge the company’s scalability and market penetration prospects.

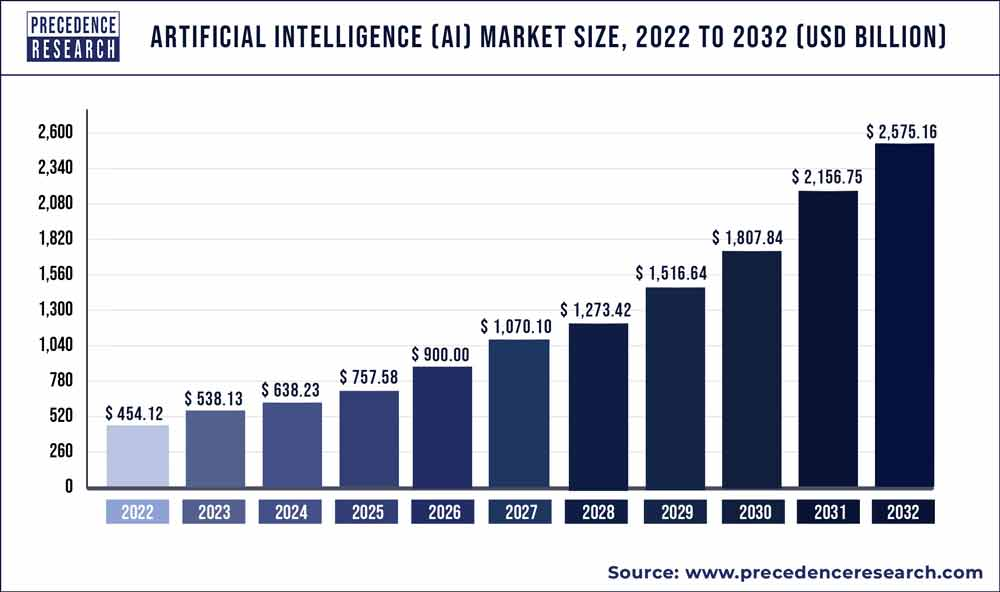

Image By: Precedence Research

The battery market is set to benefit tremendously from the boom in electric vehicles and energy storage. It is expected to reach $475.27 billion by 2032, growing at a CAGR of 16.03%. On its own, the global battery market seems like a top pick.

But compared to the artificial intelligence market that is expected to grow 19% annually and hit $2.575 trillion by 2032, it now seems less attractive. Though both are promising, these are the types of considerations you must make before investing in one market versus another. There is an opportunity cost to every investment decision.

Step #3: Evaluate Leadership and Team

A company’s leadership and team play a pivotal role in its success. Scrutinize the management’s experience, vision, and track record. Are they industry veterans with a history of successful ventures? A stellar team can steer a company toward success even in turbulent seas.

Before the hospitality technology platform, Airbnb was an $85 billion behemoth, it was a fledgling startup that required outside capital to survive. To do so, founder and CEO Brian Chesky needed to raise venture capital funding; otherwise, the business would go bust.

With charismatic leadership, unwavering determination, and brilliant decision-making, Airbnb was able to raise more than $2.5 billion before hitting the public markets. Eventually, the company would make its debut at an IPO price of $68 and a valuation of more than $100 billion.

Step #4: Financial Due Diligence

Although pre-IPO companies might not disclose extensive financial records, analyze what’s available. Look for revenue growth, burn rate, and the path to profitability. Assess their funding rounds, cash flow, and the need for future financing.

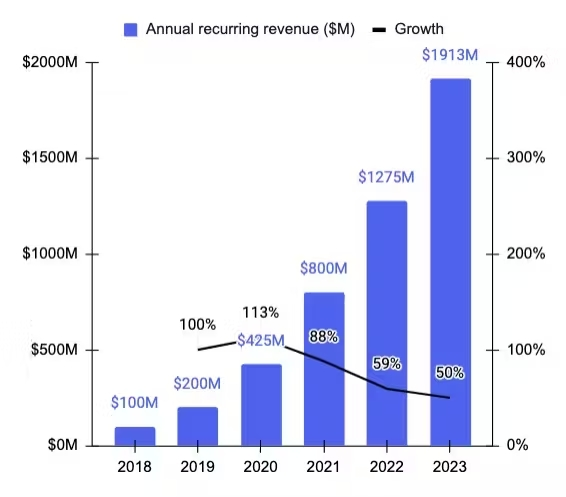

Image By: Sacra

The numbers don’t lie when buying startups. A sign of a durable business model is when a company can make money on its own and sustain growth. The first thing to look for is an improved valuation. If a business or the private equity firm that owns it raises the overall value, it shows that they believe it is worth more than before. On the flip side, if the valuation gets slashed or the revenue starts to tank, tread with caution, as it may mean the business is struggling to stay afloat.

Step #5: Competitive Landscape

Envision yourself as a strategist surveying the battlefield. Assess the company’s competitive position. Who are their competitors? What’s their unique selling proposition? Analyze their competitive advantage—be it through technology, patents, or market positioning—to ascertain their ability to thrive in a competitive environment.

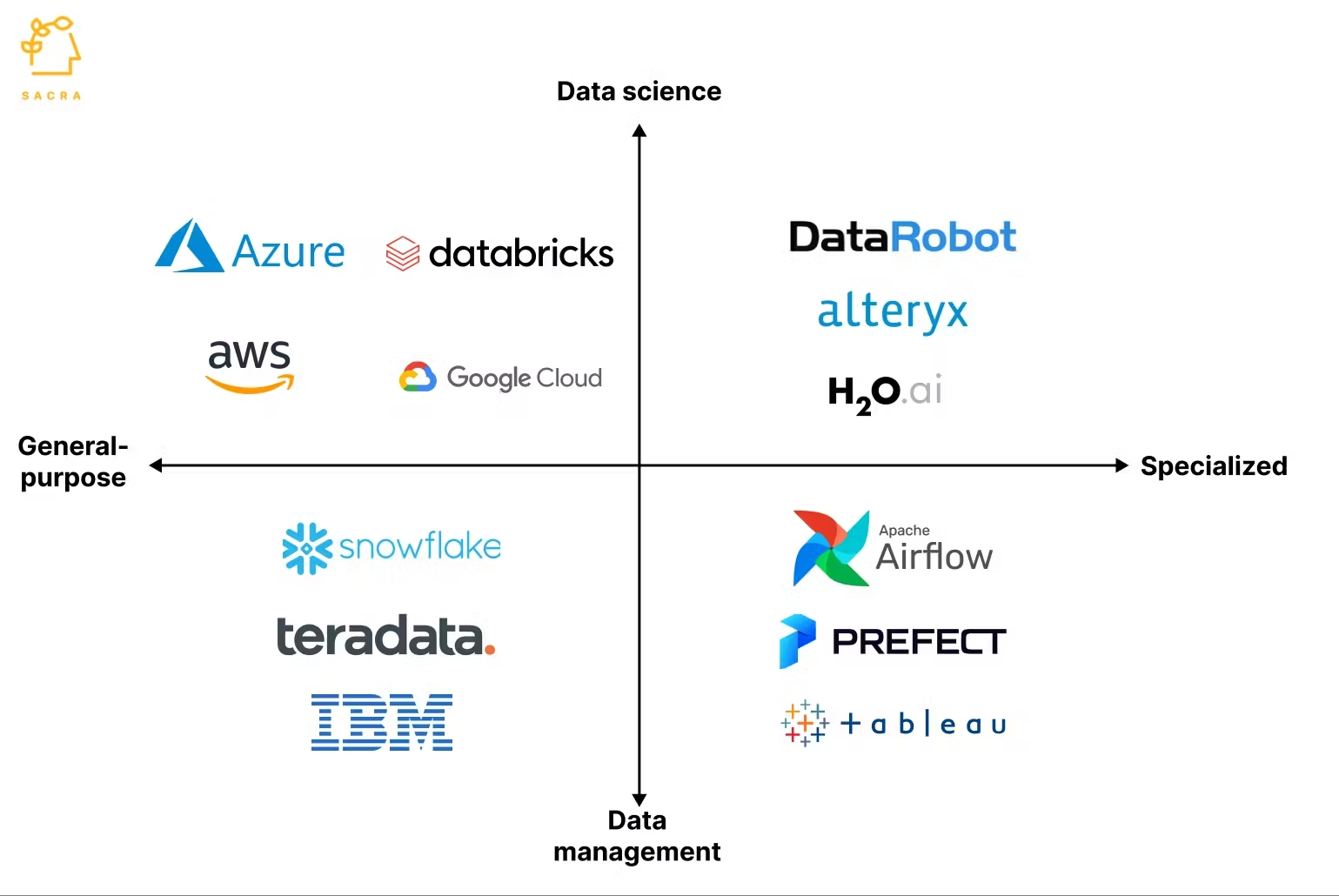

Image By: Sacra

Databricks competes directly with juggernauts like Google Cloud and Amazon AWS. You can imagine that these businesses hate when a competitor takes a chunk of their businesses. Therefore, you should expect that they will do whatever it takes, within the confines of the law, to disrupt or steal that market share back.

If you were to invest in a company like Databricks, then you would need to ensure that it can duke it out with competitors of this caliber. So far, this team has managed to do just that!

Step #6: Regulatory and Legal Considerations

Imagine yourself as a legal advisor interpreting complex codes. Investigate any regulatory hurdles or legal challenges the company might face. Assess compliance issues, intellectual property rights, and any potential legal liabilities that could impact the company’s future.

Artificial intelligence is becoming increasingly scrutinized as it grows more sophisticated. Just recently, the US government released its Executive Order on AI outlining what they plan to do to protect individuals and businesses from rogue machines. If you plan on investing in a business that leverages AI, you must make sure that it complies with these rules and regulations. Otherwise, you might lose your stake quicker than you expected.

Top Pre-Ipo Tech Companies to Watch

These startups are sure to make a bang upon entry into the public markets.

1. Databricks

Valuation: $38 billion

Revenue: $1.5 billion

Total Funding: $3.5 billion

Discover the big data analytics market, where Databricks stands as a towering force. Valued at a staggering $38 billion, this isn’t your run-of-the-mill pre-IPO investment—it’s a heavyweight contender with an established track record. Imagine a company with over 11,000 satisfied customers and a robust 15.74% stake in the fiercely competitive data analytics market.

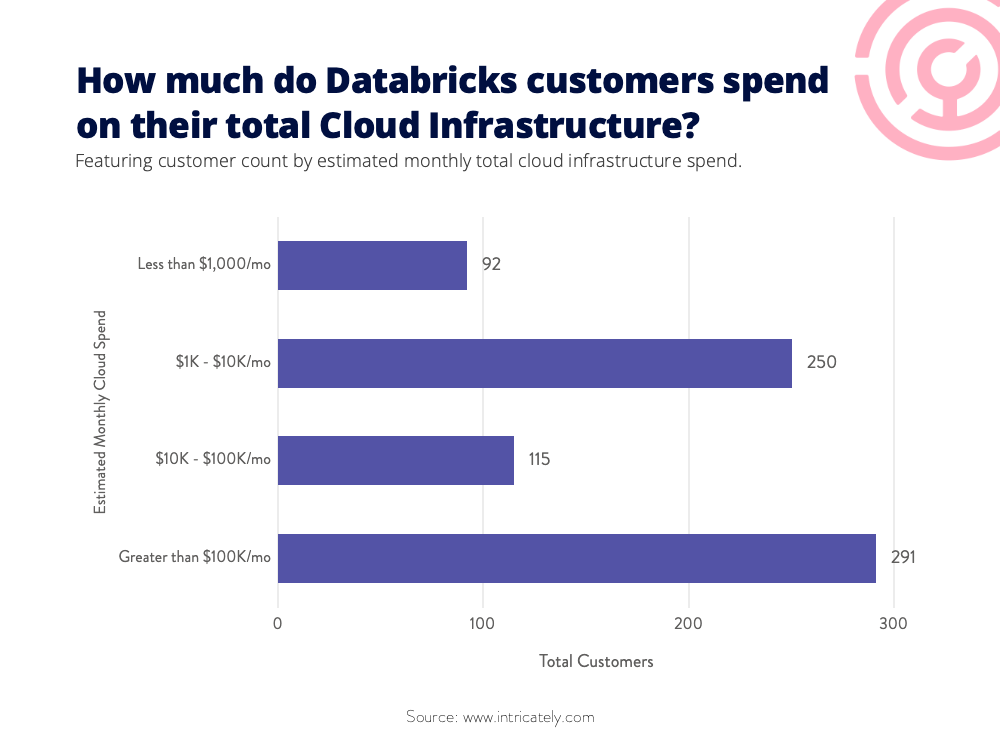

Image By: Intricately

But what’s the buzz surrounding Databricks? It’s more than just another tech company; it’s a cloud-based open analytics platform empowering users to craft, deploy, share, and manage top-tier data, analytics, and AI solutions.

In today’s data-centric universe, where information reigns supreme, Databricks’ expertise in AI and machine learning holds immense value. Businesses globally are scrambling to harness the power of data analytics, and Databricks sits at the forefront of this revolution. Impressively, the company has crossed the $1.5 billion sales mark annually, showcasing consistent revenue growth of over 50% year on year.

While Databricks hasn’t yet unveiled plans for an IPO, it’s undoubtedly on the radar as a prime contender. In the interim, its valuation has soared from $33 billion in October 2022 to $38 billion a mere year later. The burning question now: How much higher can this star rise?

2. OpenAI

Valuation: $90 billion

Revenue: $1.3 billion

Total Funding: $11 billion

OpenAI stands as an electrifying beacon in the realm of artificial intelligence. It is a cutting-edge organization that transcends conventional boundaries, captivating the imagination of technologists, innovators, and dreamers alike.

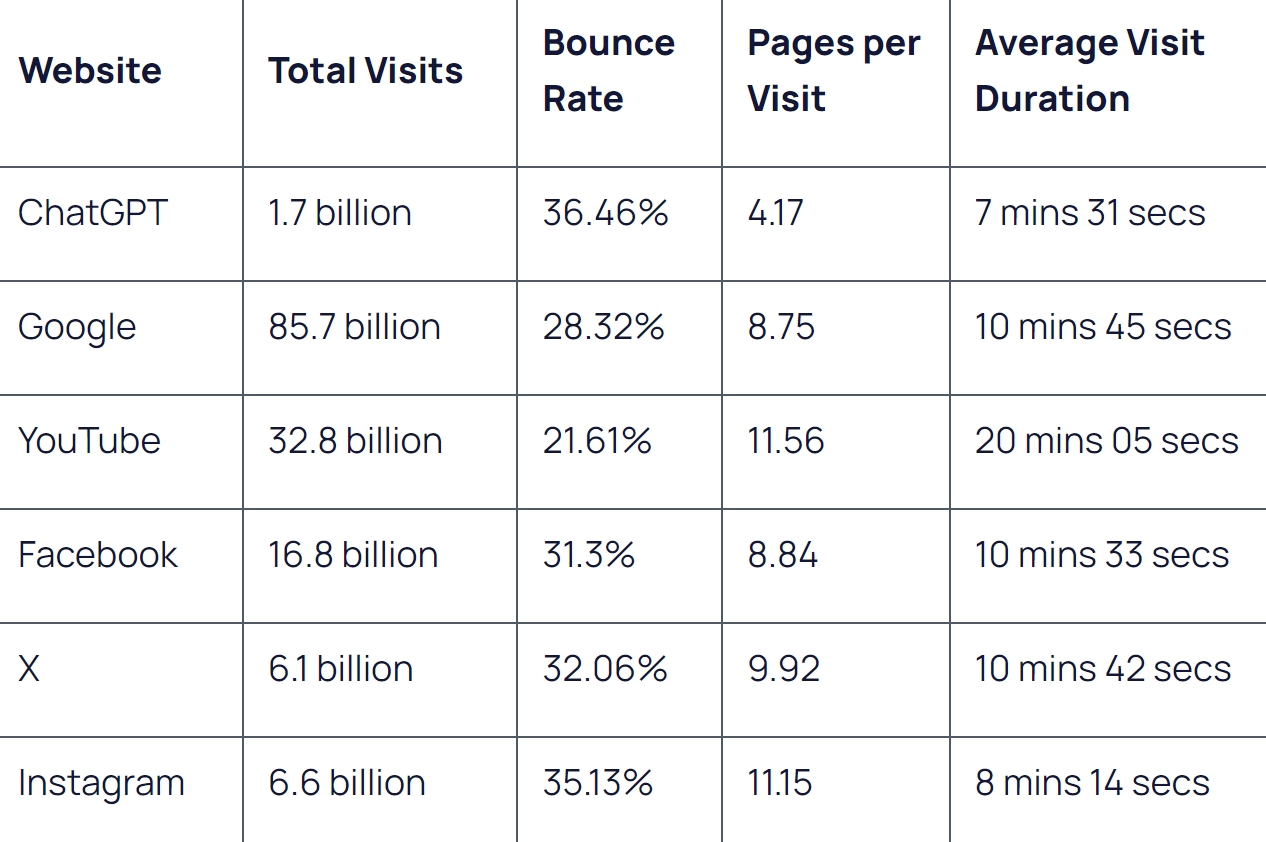

Image By: Exploding Topics

Picture a collective of brilliant minds converging to unravel the mysteries of AI, seeking to unlock the full potential of this transformative technology. OpenAI isn’t just a company; it’s a global initiative—a powerhouse of research and innovation dedicated to advancing AI responsibly and ethically.

But what truly sets OpenAI apart? It’s a trailblazer in the pursuit of artificial general intelligence (AGI)—a concept that aims to imbue machines with human-like cognitive abilities.

Yet, its commitment extends beyond scientific discovery. OpenAI passionately advocates for the ethical development and deployment of AI, ensuring its benefits are wielded for the betterment of humanity.

Through groundbreaking research, state-of-the-art models like GPT-4, and initiatives focused on democratizing AI access, OpenAI envisions a world where the transformative power of AI isn’t confined to a select few but enriches lives across the globe. With more than 180 million users and $1.3 billion in annual revenue, this company sets the standard for generative AI development.

3. Stripe

Valuation: $50 billion

Revenue: $14 billion

Total Funding: $8.7 billion

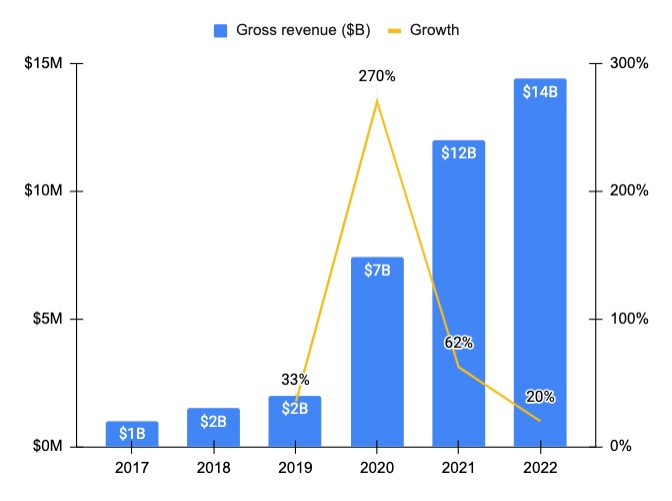

Looking for a business bound to disrupt online payments and financial institutions everywhere? This startup might be the perfect pick. Despite halving its valuation, Stripe stands tall as a robust contender, displaying a remarkable business model that raked in a staggering $14 billion in sales in 2022. This isn’t just a company; it’s a force to reckon with, firmly established and poised for sustained growth on the horizon.

Image By: Sacra

But what sets Stripe apart? It’s an essential player in the payment management realm, enabling businesses to execute transactions at an unrivaled pace. For example, over 250 million API requests flood Stripe’s domain every day, showcasing its ability to scale seamlessly in a digital economy’s relentless whirlwind. With a formidable 36.61% market share, it sits just behind PayPal’s 40.23%, asserting its dominance in the payment management landscape.

Now, here’s the twist: Stripe’s youthfulness and lightning-fast growth. In a mere six years, from 2015 to 2020, it catapulted its payment volume from $10 billion to an astounding $350 billion.

If this meteoric rise persists, its current $50 billion valuation might appear as a mere drop in the ocean of its potential. While its competitors struggle to keep pace, Stripe is sprinting ahead, painting a portrait of promise and unparalleled growth. Though no IPO date is set, this is a must-have on your watchlist regardless.

4. Reddit

Valuation: $10 billion

Revenue: $689.9 million

Total Funding: $1.3 billion

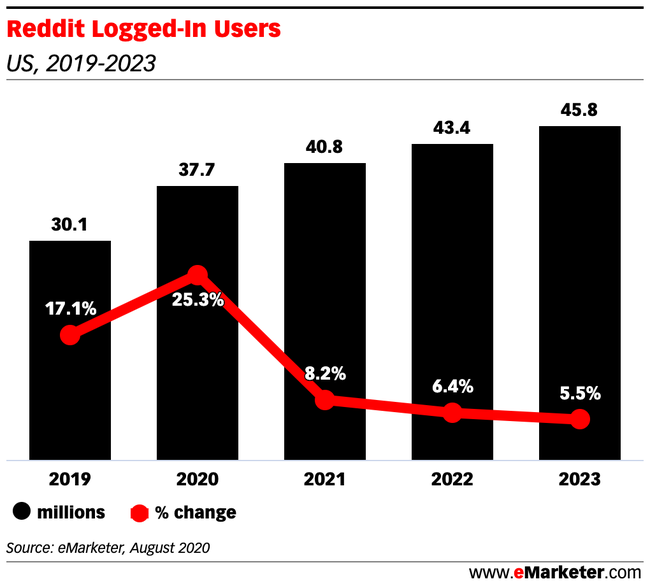

Despite its past controversies, Reddit remains a formidable force in the realm of social media. Boasting a staggering 430 million monthly active users, the company proudly holds the 16th largest user base among social platforms globally.

Image By: Insider Intelligence

But what sets Reddit apart from the social media crowd? It is the formation of niche communities where individuals immerse themselves in discussions tailored to their passions and interests. Unlike the conventional, red-tape-laden platforms of our era, Reddit stands as a beacon of user-moderated communities, fostering a distinct sense of customer engagement and authenticity.

As for the financials, Reddit has grown its sales from a mere $8 million a decade ago to a staggering $690 million in 2023. That’s an astounding compound annual growth rate of 63.56%! However, amidst this exhilarating growth, the pressure intensifies to turn a profit as Reddit grapples with losses while ambitiously scaling its operations.

But fear not, for Reddit is not navigating this journey alone. With the backing of esteemed businesses and venture funds like Tencent, Fidelity, and Sequoia, it has amassed a war chest of over $1.3 billion in funding. This support enables Reddit to sustain its growth trajectory and navigate the intricate landscape of social media dynamics.

With an IPO seeming inevitable, the stage is set for it to grow significantly larger in the coming years.

5. Epic Games

Valuation: $31.5 billion

Revenue: $2.5 billion

Total Funding: $7.1 billion

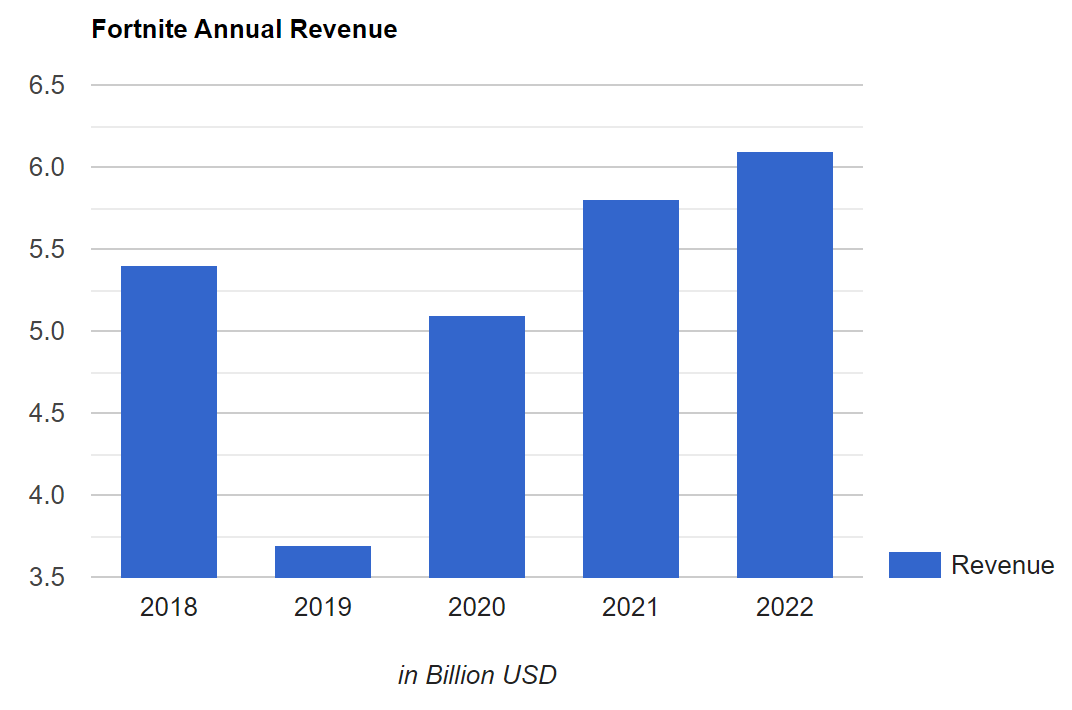

As a video game developer and software company, Epic Games has etched its name in the hall of fame with its magnum opus, Fortnite—a battle royale sensation boasting a staggering 350 million accounts and an incredible 2.5 billion friend connections spanning the globe. The game’s monumental success has propelled Epic Games into the stratosphere of gaming history, amassing a jaw-dropping $26 billion in lifetime sales, solidifying its status as one of the best-selling games of all time.

Image By: Active Player

But Epic Games isn’t a one-hit wonder. Its arsenal boasts an array of stellar titles, including “The Matrix Awakens,” the acclaimed “Gears of War” series, and the iconic “Infinity Blade.” This diverse portfolio establishes Epic Games as a titan among game developers, wielding a suite of games that resonate with audiences across the gaming spectrum.

However, Epic Games is more than a mere developer. Beyond its gaming prowess, the company possesses Unreal Engine 5, a groundbreaking programming and design software. This cutting-edge technology empowers developers to craft visually stunning, next-generation games. By leveraging unrivaled physics and animation systems, Unreal Engine 5 crafts digital worlds that blur the line between reality and imagination. This has helped Epic achieve a commanding 16.15% share in the game development market.

And with backing from industry titans like Tencent, Sony, and Kirkbi (the illustrious holding company behind the Lego Group), Epic Games is primed for an era of sustained triumph. Now, all it needs to do is IPO so we can all benefit from its success.

The Bottom Line: Is it Risky to Invest in Pre-IPO Tech Companies?

Investing in startups that are typically unprofitable always comes with its risks. There is a possibility that the company will run out of money or struggle to grow quickly enough to build a sturdy position in the market.

Yet, amidst this risky landscape, owning a stake in pre-IPO companies with a battle-tested business model and ample funding is the golden ticket. If you have the means and authority to invest in these businesses, make sure that they are built to prosper well beyond their years.

Dive deep into the financial statements, pay close attention to what management is saying, and only buy at an attractive valuation.

Sure, these investments may stir the waters of uncertainty, but their potential to yield exponential returns is unmatched. The secret to unlocking these riches lies in identifying businesses that boast a blend of rock-solid fundamentals, a visionary leadership squad, and a massive addressable market. Once this trifecta aligns, pieces of the puzzle should seamlessly fit into the picture-perfect scenario you’ve envisioned.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.