Image Source: Reg CF in the U.S. Created 300,000 Jobs and Boon for Local Economies, Women. and Minorities Seeking Funding | NCFA Canada

When exploring the world of startup investments and fundraising, one term that frequently emerges is “Reg CF Offering.”

This method of raising capital has gained significant traction in recent years due to its accessibility to both entrepreneurs and investors.

But what is a Reg CF Offering? And how does it differ from traditional funding options?

In the simplest terms, Reg CF stands for Regulation Crowdfunding, which is a form of crowdfunding defined by the Securities and Exchange Commission (SEC) that allows companies to raise up to $5 million per year from the general public.

Today, we’re going to be taking an in-depth look into the mechanics of Reg CF Offerings, exploring their benefits, limitations, and the impact they have on business owners and investors.

We will look at the legal framework that governs them, the pros and cons of a Reg CF campaign, and what it means for investors looking to diversify their portfolios with startup equity.

Who can Invest in a Reg CF Offering?

Image Source: Want to Invest in a Startup? Here’s What You Need to Know. | Entrepreneur

Investing in a Regulation Crowdfunding Offering is a path that is remarkably open compared to traditional investment opportunities. It’s designed to be inclusive, allowing almost anyone to become an investor in emerging companies.

However, there are nuances around who can invest in equity crowdfunding, depending on whether you are an accredited investor or not.

Below, we’ll break down the differences between these two classifications so investors can understand if (and how much) they can invest.

Investment Caps for Non-Accredited Investors:

To start, a non-accredited investor is defined as someone who:

- Does not meet the net worth requirement of over $1 million.

- Does not have an annual income of at least $200,000 for the last two years (or $300,000 with a spouse).

Reg CF takes into account the financial situation of non-accredited investors to protect them from overexposure to risk. The SEC (which is the financial industry regulatory authority overseeing Reg CF offerings) has set investment limits based on a combination of a non-accredited investor’s net worth and annual income. These limits include:

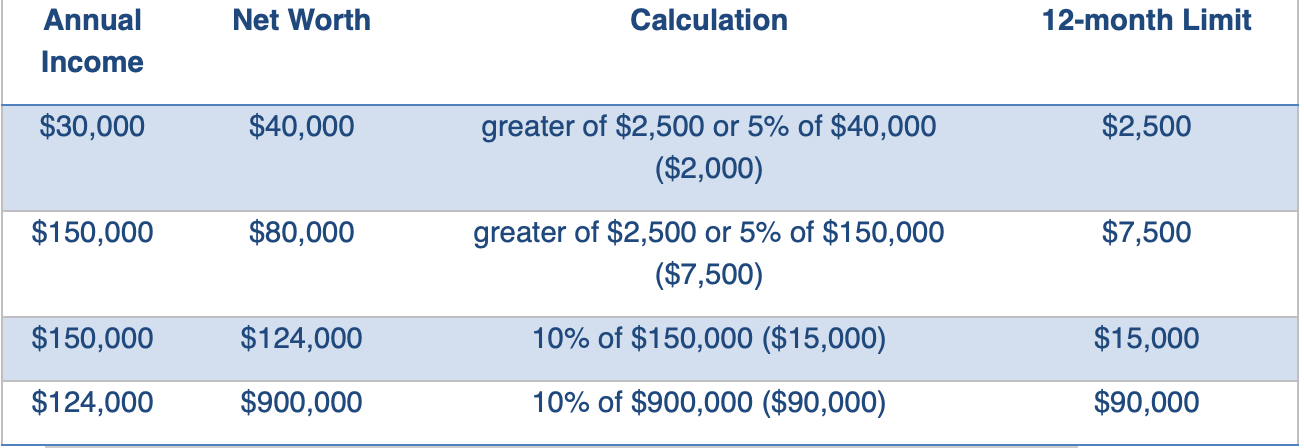

- If either net worth or annual income is below $124,000, individuals can invest up to either $2,500 or 5% of their annual income or net worth (whichever is greater).

- If both annual income and net worth are at least $124,000, individuals can invest up to 10% of the greater of their annual income or net worth, with a maximum of $124,000 annually.

To provide some examples as to how these requirements work, below is a chart provided by the SEC outlining how much non-accredited investors could invest based on their annual income and net worth:

Image Source: Non accredited investors investment examples | SEC

Accredited Investors:

Those who are classified as accredited investors have no imposed limits on how much they can invest in Reg CF offerings. An accredited investor is defined as somebody who:

- Has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years and expects the same for the current year or

- Has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence) or

- Holds in good standing specific financial licenses such as Series 7, 65, or 82.

So, while the equity crowdfunding process is open to all, crowdfunding platforms are required to take reasonable steps to verify that investors comply with these investment limits. This ensures that investors are participating within the bounds set by the SEC and align with their financial capabilities.

Understanding the Legal Framework of Reg CF Offerings

Image Source: Reducing regulatory burden: An ongoing priority | Investment Executive

The legal framework of Reg CF is designed to protect investors while providing a structured and transparent process for startups and small businesses to raise capital.

At its core, Reg CF is governed by a set of SEC rules that define how equity crowdfunding should operate. It is essential for both companies seeking funding and potential investors to understand these rules to navigate the Reg CF landscape effectively.

Eligibility for Companies

Under Reg CF, only U.S.-based private companies are eligible to raise funds, and they must comply with a range of requirements. Before launching a campaign, a company must file a Form C with the SEC, which includes details about the business, the terms of the offering, the intended use of funds, and audited financial statements.

For raises over $107,000, financial statements must be reviewed by an independent accountant, and for those over $535,000, audited financials are required (with some exceptions for first-time issuers).

Investment Limits

As we’ve previously covered, Reg CF sets clear limits on how much money an individual can invest across all crowdfunding offerings in a 12-month period based on their net worth and annual income.

Disclosure and Reporting Requirements

Companies are required to provide a comprehensive set of disclosures to potential investors and the SEC, typically through a Form C.

This includes describing the business, business plan, the use of proceeds, price of the securities, the target offering amount, and financial condition of the company. After the offering, companies must also file annual reports with the SEC and provide them to investors.

Role of Intermediaries

A critical aspect of Reg CF is the requirement to use an SEC-registered intermediary, either a broker-dealer or a funding portal. These intermediaries provide a platform for the offerings and are tasked with ensuring that companies and investors comply with Reg CF regulations. They also conduct some due diligence on the companies and provide educational materials to investors.

Communication Channels

Under Reg CF, companies are encouraged to openly communicate with potential investors. This is often done through the intermediary’s platform, which provides a channel for Q&A and distribution of additional information.

However, companies must be cautious to avoid making misleading statements and must comply with advertising and promotional rules.

Investor Protections

Reg CF contains several provisions to protect investors. These include limits on advertising by issuers, restrictions on reselling securities, and the requirement that intermediaries ensure investors understand the risks associated with crowdfunding investments.

The Reg CF framework is a significant step toward democratizing access to capital markets, but it also imposes a considerable responsibility on companies and intermediaries to ensure that the process is carried out with transparency and integrity.

For investors, understanding this regulatory environment is crucial in making better decisions about where to allocate their funds.

Pros and Cons of Reg CF for Startups and Investors

Regulation Crowdfunding has become a vital part of the startup funding landscape, offering unique opportunities and challenges for both startups and investors. Let’s touch on some of the major pros and cons to provide a deeper understanding of the implications and practicalities of Reg CF.

For Startups:

Pros:

- Broader Access to Capital:

- Startups can tap into a more extensive network of potential investors beyond what’s available from more traditional venture capital firms and angel investor routes.

- This is particularly beneficial for businesses that may not have access to venture capital hotspots or industry connections.

- Marketing and Exposure:

- The campaign itself can generate buzz and marketing momentum, which not only raises capital but also attracts customers and brand advocates.

- Successful campaigns can increase a startup’s visibility and credibility in the market.

- Validation and Feedback:

- Early market validation of the product or service can be gauged from the interest and investment received through the campaign.

- Feedback from a diverse group of investors can be invaluable for refining business strategies.

- Customer Engagement:

- By investing, customers become more engaged and have a vested interest in the company’s success, potentially leading to stronger customer loyalty.

Cons:

- Cost and Time Investment:

- Preparing for and managing a Reg CF campaign can be resource-intensive, requiring significant time and money.

- The cost of legal compliance, accounting, and platform fees can add up, reducing the net amount raised.

- Potential for Dilution:

- Equity-based crowdfunding can lead to dilution of ownership and control, particularly if a large number of investors come on board.

- Ongoing Reporting Obligations:

- Startups must meet ongoing reporting requirements, which can be burdensome for smaller businesses without dedicated compliance teams.

- Risk of Failed Campaigns:

- A failed campaign can not only be a setback in terms of funding but can also negatively impact a startup’s brand and market perception.

For Investors:

Pros:

- Lower Barriers to Entry:

- Reg CF opens up investment in startups to non-accredited investors, allowing them to participate in early-stage investment opportunities with smaller amounts of capital.

- Diversification:

- Investors can potentially diversify their portfolios by adding a mix of startups across different industries and stages of growth.

- Potential for High Returns:

- Early-stage investments carry the potential for high returns if the companies experience significant growth.

- Direct Impact:

- Investors can support businesses they believe in and have a direct impact on the growth of new ventures.

Cons:

- High Risk of Loss:

- Startups are inherently risky, and there is a significant chance of losing one’s investment if the business fails.

- Liquidity Issues:

- Investments in private companies through Reg CF are not easily liquidated; investors should be prepared to have their capital locked in for an extended period.

- Limited Information:

- While Reg CF requires certain disclosures, the level of detail is often less than what is available for publicly traded companies, making thorough due diligence more challenging.

- Risk of Fraud:

- Although the SEC regulates crowdfunding platforms and offerings, there is still a risk of fraud or business mismanagement, which can lead to investment losses.

Understanding these pros and cons is essential for both startups and investors when deciding if Reg CF would be right for them.

For startups, it’s about weighing the benefits of broadened access to capital and market exposure against the costs and potential loss of control. For investors, it involves balancing the potential for high returns and portfolio diversification against the risks of illiquidity and possible total loss of investment.

Conclusion

Image Source: Letter: Policy implementation shouldn’t be a partisan issue | Investment Executive

Regulation Crowdfunding stands out as a landmark shift in the way business owners can raise capital for their business and how individuals can make an exciting investment commitment into a promising and growing business model.

However, participating in a Reg CF is not a substitute for professional investment advice. Investors still need to conduct their due diligence and understand the risks before executing any type of crowdfunding transaction.

As with any financial decision, careful consideration and detailed planning are not just suggested but are required steps toward being successful in the space.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.