Renewable energy is creating hope for a cleaner and more sustainable future.

With strong backing from top institutional investors and greater initiative by governments, it seems like the only way for renewable energy stocks is up.

But that doesn’t mean that they don’t come with serious risks as well.

In this article, we’ll help explain the renewable energy market, the opportunities and risks within, and a few things that you should know before analyzing and buying clean energy penny stocks.

If you like ESG-compliant markets and innovative technologies, then get ready to ride the green wave and take your investment journey to electrifying heights!

What Are Renewable Energy Penny Stocks?

Renewable energy penny stocks (or green energy penny stocks) are small, publicly traded companies that operate in the renewable energy industry without carbon emissions.

These companies produce, distribute and develop clean and sustainable energy sources like solar, wind, hydro, geothermal, and biomass (i.e. renewable natural gas).

Renewable energy stocks are at the forefront of the global shift towards clean energy alternatives, largely driven by the need to reduce greenhouse gas emissions and combat climate change.

These stocks offer investors a great opportunity to participate in this movement as they invest in businesses tackling the problem head-on.

In other words, green energy stocks allow an individual to align their investment portfolios with their values and contribute to a more sustainable future for us all.

How to Analyze Renewable Energy Penny Stocks

The renewable energy sector comes with unique risks that may limit a company’s success.

Therefore, we need to pay close attention to the businesses we own so we don’t fall victim to owning a crummy company.

Here are some key factors to watch for when analyzing renewable energy stocks.

Also, check out our complete stock analysis guide for greater insights.

1. Does It Have a Competitive Advantage?

Renewable energy companies operate in a commodity-driven economy.

This means the market sets the price for how much will be paid per supply.

Under these conditions, it’s very difficult to build a unique product or brand since the customer doesn’t really care about who the energy comes from.

However, one of the most effective ways for a business in this industry to excel is by creating some form of cost advantage.

This may come from patented technology, economies of scale, and strategic partnerships with governments and distributors.

Whatever it is, if a business can maintain a cost advantage over its competitors, then it is likely to outperform the sector as a whole.

Aside from that, green energy companies can also achieve a competitive advantage based on their geographical positioning.

If they have access to a key water supply, are strategically located near world-class infrastructure, or own the optimal land for a solar energy field or wind farm, then this can also be quite advantageous.

Either way, you want to find some legitimate competitive advantage so that you can be confident that the business can sustain itself over many years.

2. Is The Company Healthy (Financially)?

Energy businesses are typically quite capital-intensive due to the technology and infrastructure maintenance and development required (ie. solar panels, storage facilities, wind farms, etc.).

Therefore, it is important to ensure that a renewable energy company is in a strong position financially so that the risk of default is minimal.

Usually, these types of businesses use debt to finance their growth since it is easily accessible and doesn’t need to be repaid immediately.

However, if a company takes off too much debt, this can be disastrous for investors as they likely will lose everything.

For this reason, you will want to make sure that the company has ample cash flow and multiple ways to generate cash. In these early stages, where it’s likely that business is losing money to fuel growth, cash is always king.

To measure how much cash a business has left in the bank and how long they’ll be able to support their current growth strategy, divide the cash & cash equivalents by the quarterly net losses.

Whatever number you see after running the calculation is the number of quarters the company has before it runs out of money.

3. What’s the Market Outlook?

Not all green energies are created equal.

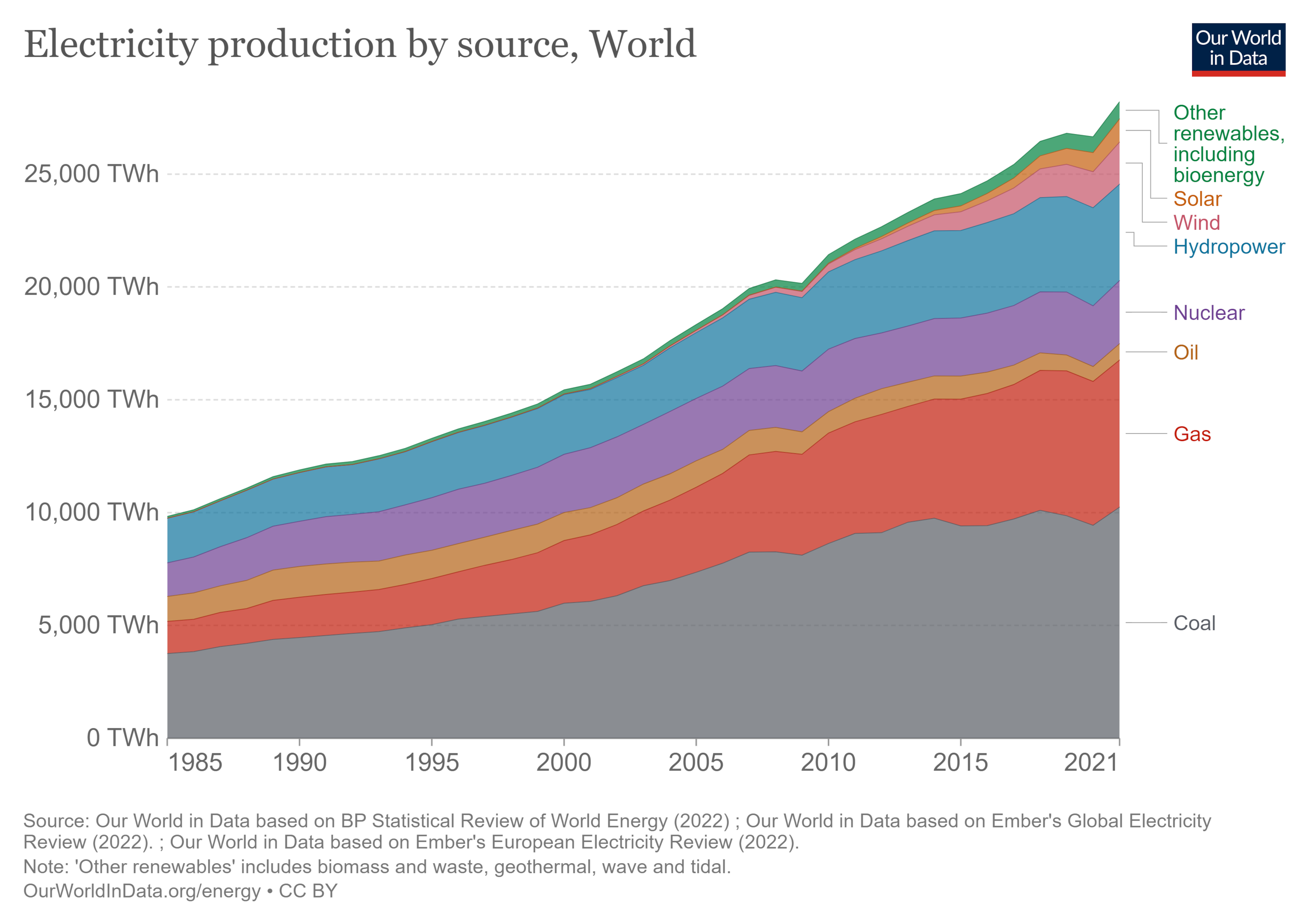

Some are more efficient, requiring less capital and energy storage to produce, while others are extremely inefficient and only generate a limited amount of power.

Here is a breakdown of efficiency levels for common renewable energy sources:

- Solar Power Average Efficiency = 15% to 20% (GreenMatch)

- Wind Power Average Efficiency = 30% to 45% (EDF Energy)

- Hydropower Average Efficiency = Over 90% (Canada Hydropower Association)

- Geothermal Energy Average Efficiency = Over 90% (Department of Energy)

- Biomass Energy Average Efficiency = 20% to 40% (IEA)

Considering this data when analyzing clean energy stocks is a good idea since it will largely affect the amount of capital a business spends and generates.

Moreover, it is also worthwhile to see what experts are forecasting in terms of growth.

Here is a breakdown of the expected global returns and market value for specific green energy markets:

- Solar Power = 6.90% CAGR; $373.84 billion by 2029 (Fortune Business Insights)

- Wind Power = 8.40% CAGR; $151.47 billion by 2030 (Spherical Insights)

- Hydropower = 5.16% CAGR; $371.80 billion by 2030 (Precedence Research)

- Geothermal Energy = 6.30% CAGR; $62.65 billion by 2029 (Fortune Business Insights)

- Biomass Energy = 5.73% CAGR; $210.50 billion by 2030 (Precedence Research)

By coupling this data with specific company data like revenue, profit, and cash flow growth, you can get a pretty clear picture of how a stock will likely perform in the coming years.

As you can see, renewable energy stocks will probably achieve annual growth between 5.16% and 8.40%.

The next step would be to find a business that exceeds these metrics and demonstrates abnormal returns.

If you do, it may be an indication that that company possesses a unique competitive advantage whereby it will outperform the rest of the green energy sector.

How to Buy Renewable Energy Penny Stocks

To buy renewable energy stocks, you must open an online brokerage account.

But be careful!

Not every brokerage account allows you to buy and sell penny stocks, and not every penny stock trades on a specific exchange.

As such, you will want to make sure that you can actually purchase shares of the desired company on the brokerage platform.

To help you get started, we provided a list of the best penny stock trading apps so that you can introduce yourself to the different types of brokerages out there.

After choosing a brokerage and setting up your account, all you need to do is search for the green energy penny stock you desire and place an order.

Renewable Energy Penny Stocks FAQ

Q: Are renewable energy stocks risky?

A: Yes, renewable energy stocks are risky. As mentioned before, green energy companies operate in a commodity-driven economy, meaning they have limited control over how they price their products.

This can be detrimental to a business if they cannot create competitive advantages elsewhere such as through a more efficient cost structure.

Moreover, renewable energy stocks tend to use a lot of debt to relieve the capital-intensive nature of these businesses.

If a company takes on too much debt and is unable to pay back its loan, it can go bankrupt, leaving investors with nothing.

Overall, these are two of the more common risks that green energy companies face.

Q: How do I stay updated on renewable energy trends?

A: Staying on top of the latest renewable energy trends is an important factor for success.

To stay updated, regularly explore reputable websites, blogs, webinars, social media accounts, and research institutions.

What’s more, be open to different opinions and even consider the perspectives of those who oppose green energy development.

That way you have a broader perspective that allows you to see the complete picture. To help you get started, here are a few of our favorite green energy platforms:

Q: How long should I hold renewable energy penny stocks?

A: There is no perfect answer to this question since everyone is different, however, as a general rule of thumb, you should hold onto a stock as long as your thesis holds.

This means that regardless of whether your stock doubles or gets cut in half, you should hold on as long as the business continues to grow, operate with its competitive advantage, and make smart investments.

On the other hand, if the company starts taking on a ton of debt, is losing market share, or the management team makes a bunch of dumb decisions, then it is probably a good time to sell.

Ultimately, the best way to find success investing is when you allow your assets to compound for a long period of time.

Final Word: Are Renewable Energy Penny Stocks Worth It?

The renewable energy market is certainly an interesting one.

With communities around the world arguing for more sustainable energy sources, it is clear that these companies have a lot of backing and support.

However, from an investment standpoint, you may have a difficult time finding a business that can differentiate itself and generate superior returns.

Because not only will they compete with other green energy companies, but they will also be duking it out with the mega-cap oil and gas companies as well.

Therefore, if you want to succeed in this market, you must buy only the best green energy stocks that possess unique business models that can easily cut costs and sustain production simultaneously.

If you do, you may end up with a valuable asset that continues to compound for decades to come.