In the dynamic world of investing, where market trends fluctuate and investment opportunities come and go in the blink of an eye, having a reliable, comprehensive, and user-friendly investment research platform can be a game-changer. This is where Simply Wall St, or Simply Wall Street, comes into the picture, a stock research platform designed to empower investors by providing them with in-depth stock analysis and market insights. Through this article, I’ll dive deep into the workings of Simply Wall St, compare it with other market competitors, and explore whether it’s worth the subscription. By the end, you’ll be equipped with all the necessary information to make an informed decision about subscribing to Simply Wall St.

How does Simply Wall St work?

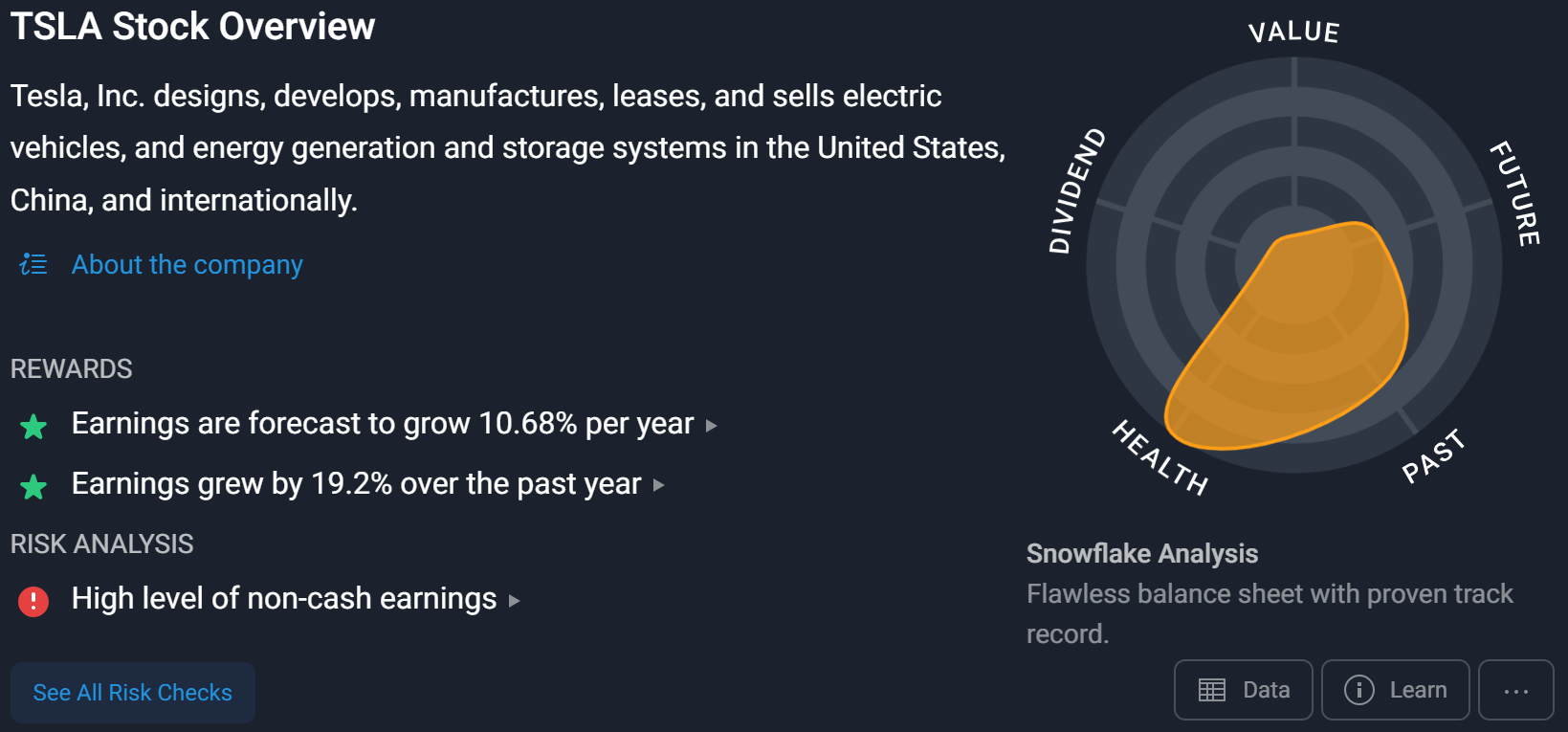

Simply Wall St revolutionizes the way individual investors approach stock market research by simplifying complex financial data into an intuitive and visually engaging format. At the heart of its platform is the innovative snowflake analysis model, which evaluates stocks across five crucial dimensions: Value, Future Growth, Past Performance, Financial Health Analysis, and Dividend. This model distills intricate financial information into an easy-to-understand visual graph, making it accessible even to those with minimal financial knowledge.

But Simply Wall St goes beyond just visual analysis. It aggregates vast amounts of institutional quality data from various trusted sources to compile detailed company reports. These reports offer insights into a company’s financial health, including earnings forecasts, dividend information, and ownership breakdowns. Whether you’re looking to dive deep into a company’s financial statements or understand its market position at a glance, Simply Wall St equips you with the tools needed for both.

Simply Wall St’s Top Five Features

1. Snowflake Analysis

Image by: Simply Wall St

At the heart of Simply Wall St’s offering is the Snowflake Analysis. This proprietary tool visualizes a company’s investment appeal across five key metrics: Value, Future Performance, Past Performance, Financial Health, and Dividend. It’s a quick, intuitive way to gauge whether a stock fits your investment strategy.

2. Comprehensive Company Reports

Dive deep into detailed reports that cover everything from fundamental stock analysis to dividend information and insider transactions. These reports are constantly updated, ensuring you have the latest stock data at your fingertips.

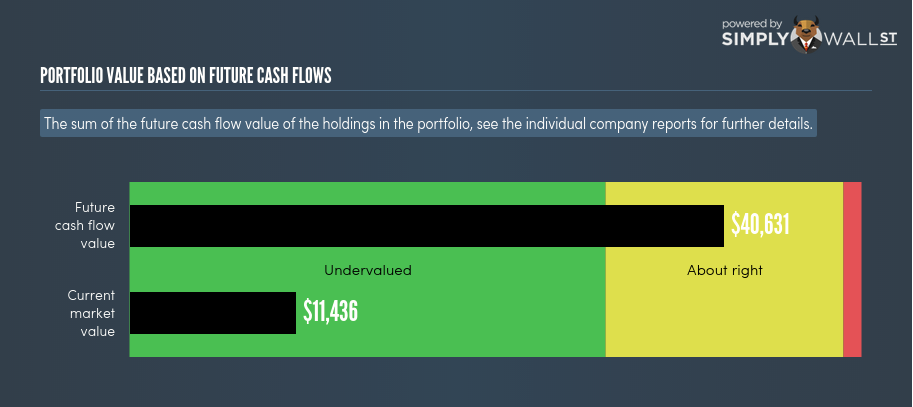

3. Portfolio Analysis

Image by: Seeking Alpha

Simply Wall St doesn’t just help you find the best stocks; it also helps you manage them. The platform offers a portfolio analysis feature that reviews your holdings, providing a health check based on the same criteria used in individual stock analysis.

4. Stock Ideas

Through its curated lists and sectors, Simply Wall St surfaces investment ideas that might not be on your radar. Whether you’re interested in high-growth potential or seeking stable dividend payers, the platform has suggestions to help you find the particular stock you are looking for.

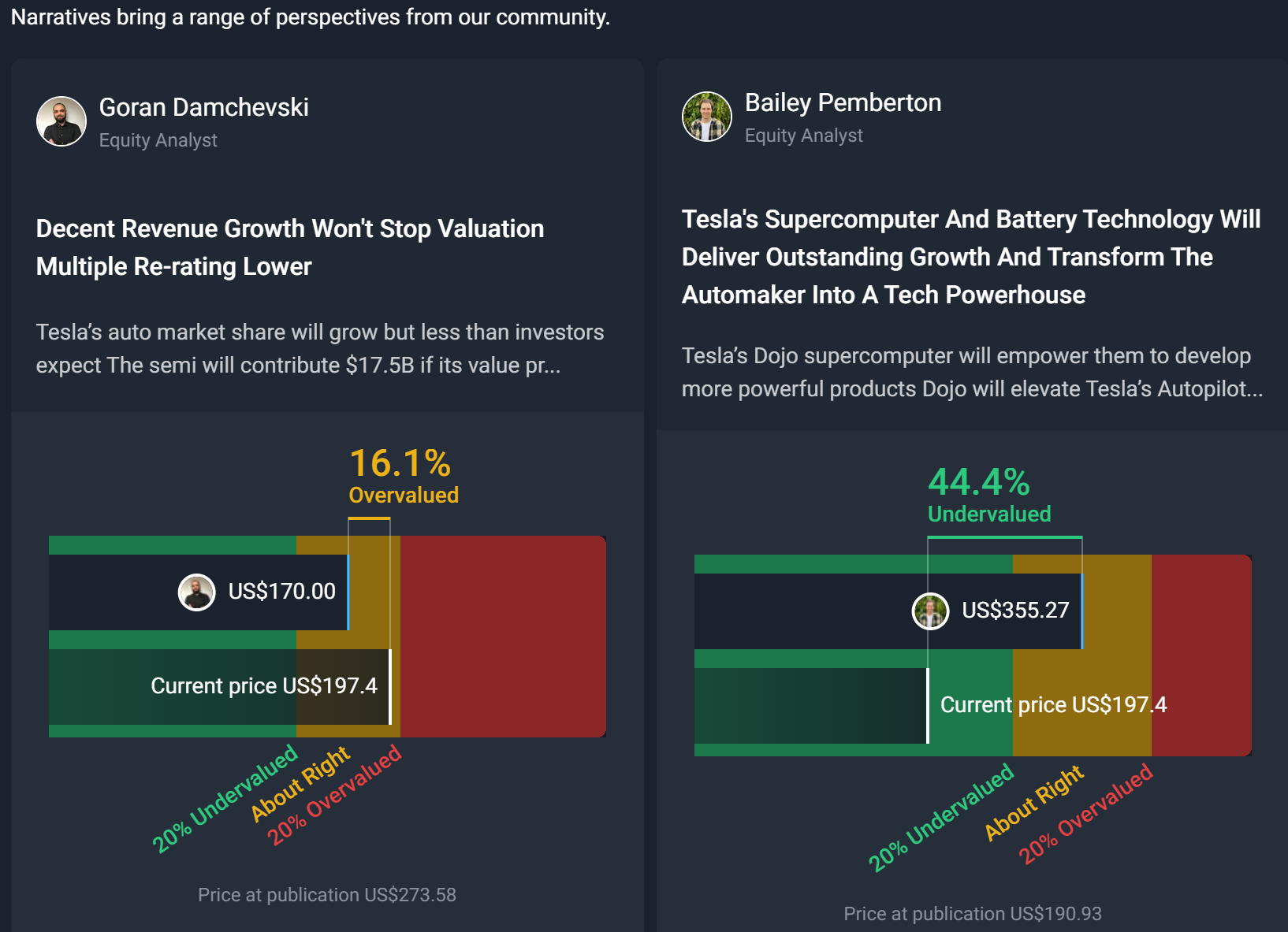

5. Narratives (BETA)

Navigating the complex world of stock analysis is daunting. Simply Wall St’s Narratives expose investors to a wide range of investing ideas and perspectives by allowing analysts to provide their personal investment thesis on a stock. No longer will you be blinded by overly optimistic valuations and speculative bets.

How does Edge Investments leverage Simply Wall St?

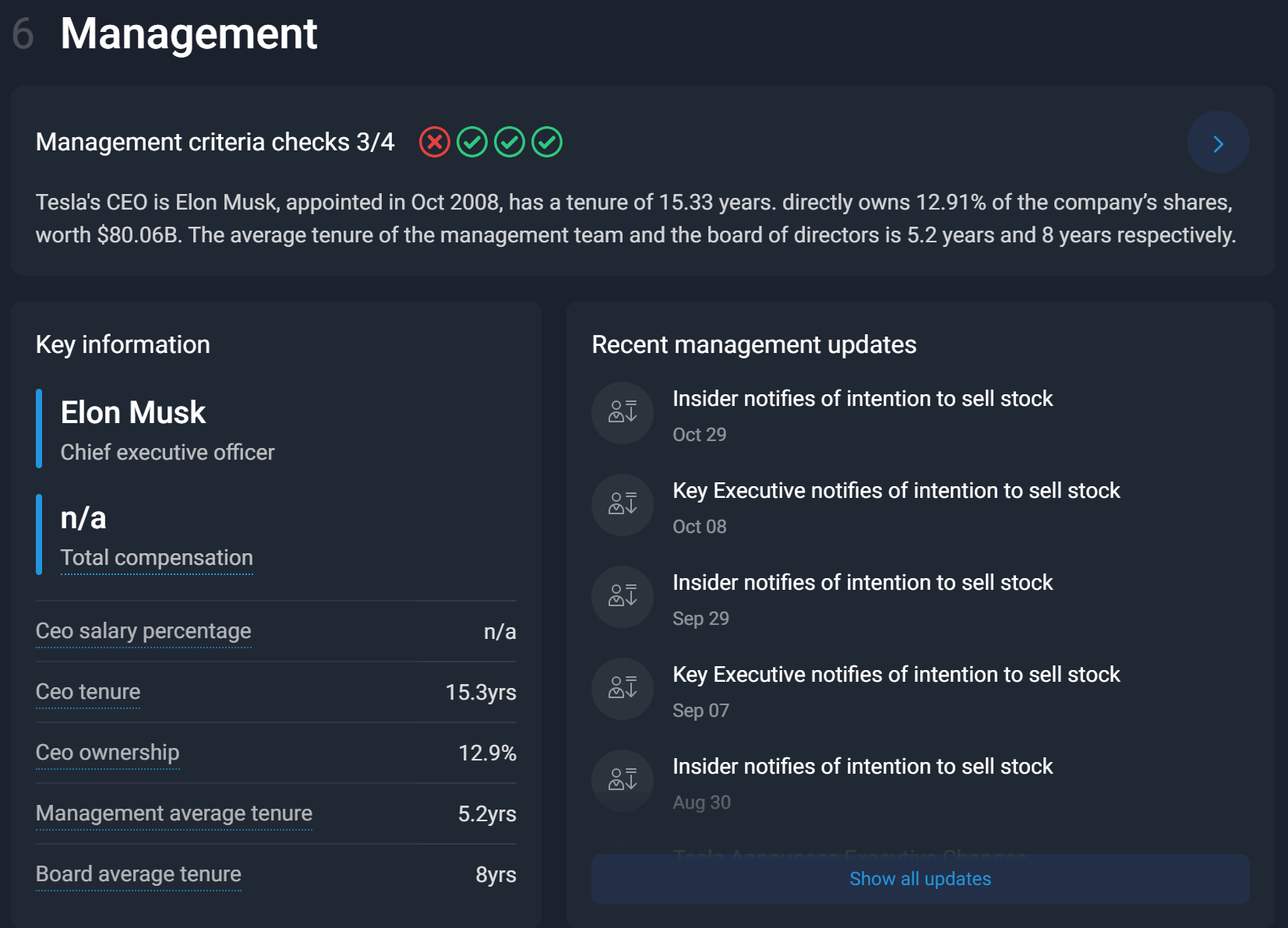

Simply Wall St is a fundamental component of our investment research process. We use the platform for critical information like management ownership and compensation, insider trading, intrinsic valuation, and financial performance. This data provides insights into whether a stock’s management team is behaving in the best interest of its shareholders and whether it is overvalued, undervalued, or priced just right.

In addition, Simply Wall St is an effective tool for comparing your thesis to theirs. For example, when I perform a discounted cash flow analysis, I like to see how my intrinsic value compares to Simply’s. This gives me perspective on whether I may be too bullish or bearish on a stock.

Ultimately, the platform provides valuable insights for those who prefer a fundamental investment strategy. Not only will you see how a stock compares to other businesses, but you will also discover new information that could help propel your financial success.

How to Sign Up for Simply Wall Street

Signing up for Simply Wall Street is a breeze. To help you get started, here is a step-by-step guide on how to get signed up.

Step 1: Click Our Exclusive Affiliate Link

To kickstart your journey with Simply Wall St, click on our exclusive affiliate link. This not only ensures you’re on the right track but also supports our platform, at no additional cost to you!

Sign Up for Simply Wall Street Here!

Step 2: Explore the Simply Wall St Homepage

Once you’re on the Simply Wall St homepage, you’ll be greeted by an intuitive interface designed to make your investing experience effortless. Take a moment to explore the platform’s features, understanding how it empowers you with visually engaging data and insights.

Step 3: Click on “Sign Up”

Ready to dive in? Look for the “Sign Up” button, usually prominently displayed on the homepage. Click on it to initiate the registration process and join the thriving community of smart investors leveraging Simply Wall St’s expertise.

Step 4: Choose Your Membership Plan

Simply Wall St offers different membership plans to cater to various needs. Whether you’re a casual investor or a seasoned pro, there’s a plan for you. Select the membership that aligns with your goals, and get ready to unlock a treasure trove of investment wisdom.

Step 5: Fill in Your Details

Complete the registration form by providing the necessary details. This ensures that Simply Wall St tailors its insights specifically to your investment preferences, making the platform a personalized and invaluable resource.

Step 6: Confirm Your Email

After registering, check your email for a confirmation link from Simply Wall St. Click on it to verify your account and gain full access to the platform’s robust features.

What is Simply Wall St investment philosophy?

At its heart, Simply Wall St’s investment philosophy is built on the foundation of long-term, value-driven investing. The platform champions the idea that the best investment strategy is one that is patient, informed, and focused on company fundamentals rather than short-term market fluctuations. This philosophy is deeply embedded in every aspect of Simply Wall St, from its analytical tools to its comprehensive reports.

The Pillars of Quality Investments According to Simply Wall St

1. Value Over Price

The Simply Wall St team places a significant emphasis on distinguishing between a company’s price and its value. In their view, a quality investment is one where the intrinsic value of the company exceeds the price at which its stock is currently trading. This approach encourages investors to look beyond temporary market sentiments and focus on the underlying fundamental analysis of the business, such as its earnings, debt levels, and growth prospects.

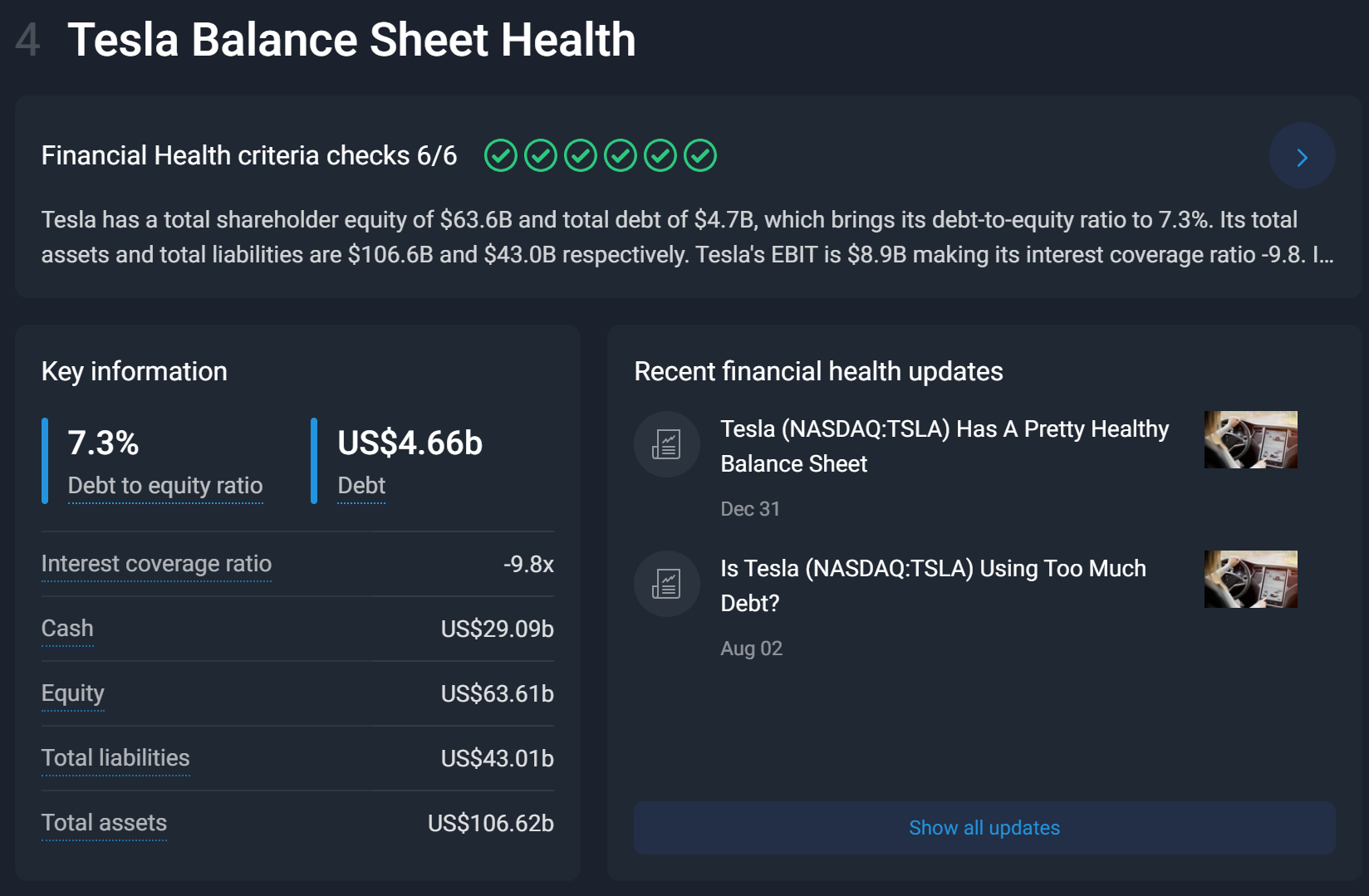

2. Financial Health and Stability

A cornerstone of Simply Wall St’s philosophy is the importance of investing in companies with solid financial health. This includes assessing factors like debt levels, cash flow, profitability, and other key financial indicators. A company that boasts a strong balance sheet is often better equipped to weather economic downturns, sustain its operations, and capitalize on growth opportunities, making it a more attractive long-term investment.

3. Growth Potential

Another critical aspect Simply Wall St looks for in quality investments is growth potential. This isn’t limited to historical performance but extends to future prospects. The platform utilizes a variety of metrics and analyst forecasts to evaluate whether a company is on a trajectory for sustainable growth. By focusing on growth, investors can identify companies that are not just surviving but thriving and expanding, whether through increasing revenues, expanding market share, or innovating in their industry.

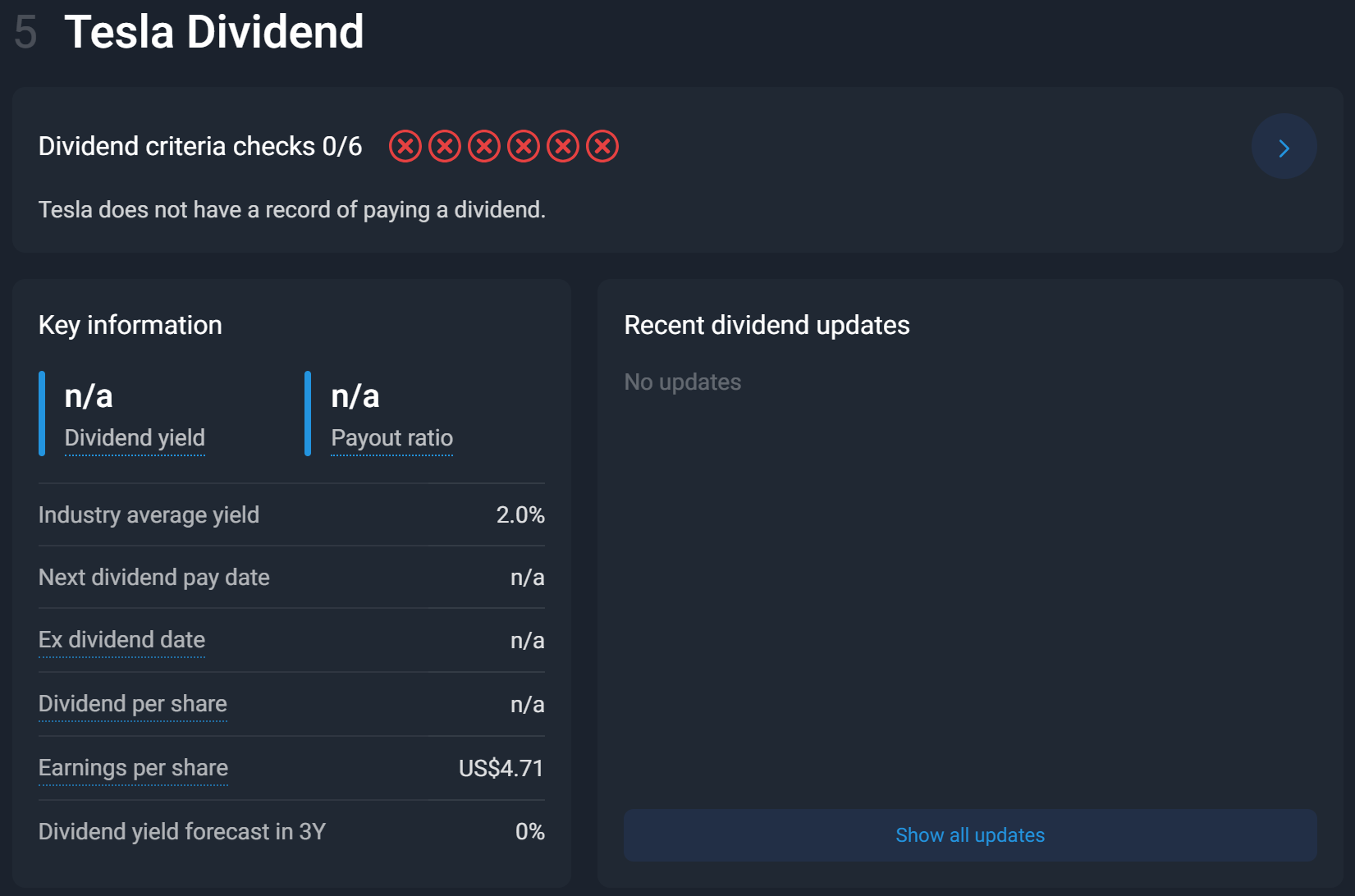

4. Dividends

For many investors, dividends are a sign of a company’s health and a source of regular income. Simply Wall St evaluates dividend history and sustainability, favoring companies that not only pay dividends but have a track record of maintaining or increasing them. This approach aligns with the philosophy of generating steady returns over time, adding an additional layer of attractiveness to a quality investment.

5. Market Position and Competitive Advantage

Lastly, Simply Wall St considers a company’s position within its industry and its competitive advantages. Companies that hold a leading market position or possess a unique competitive edge are viewed as more resilient and capable of delivering sustained returns. This could be through brand strength, proprietary technology, or other factors that create barriers to entry and set the company apart from its competitors.

How are Simply Wall St stocks graded?

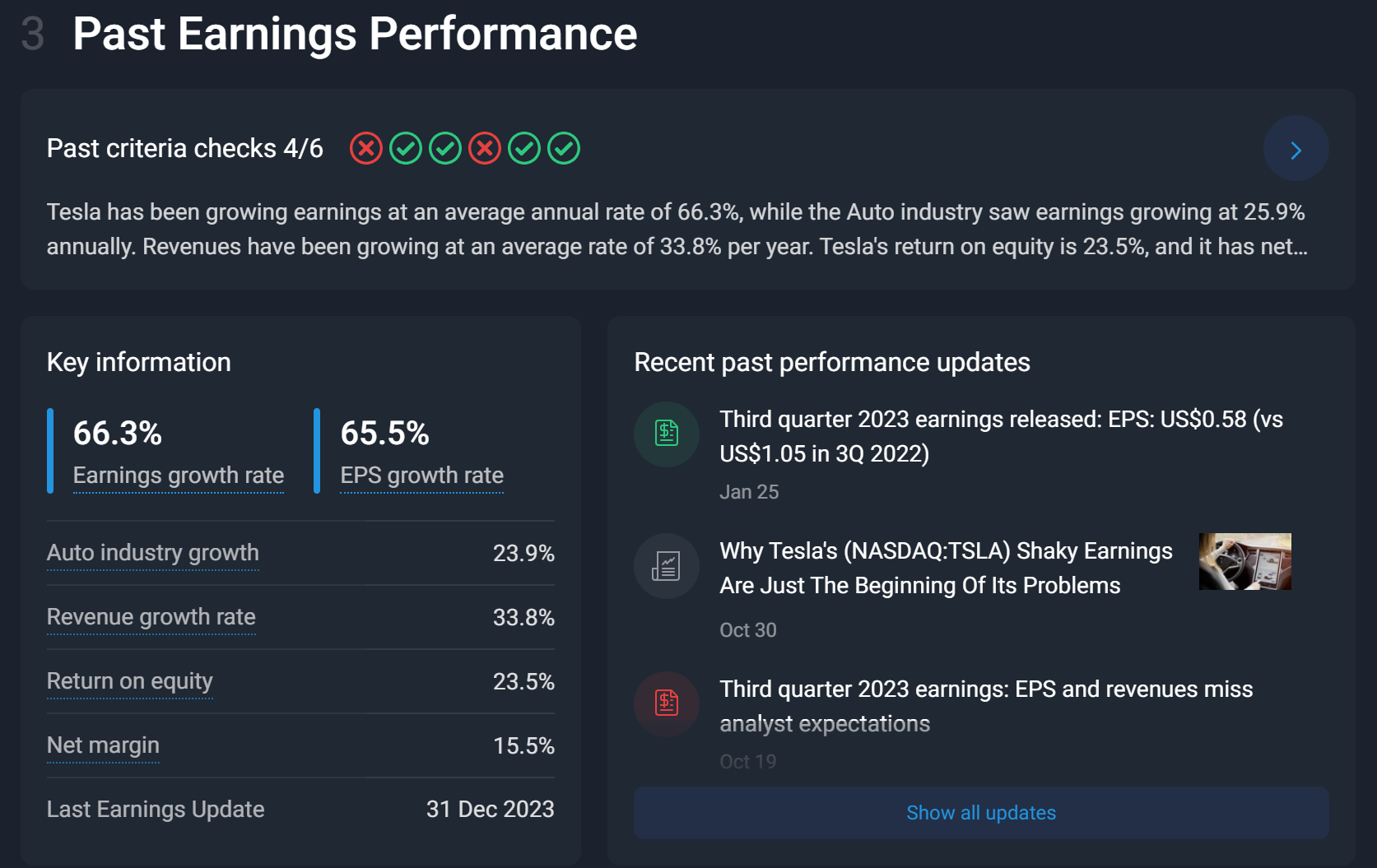

At the heart of Simply Wall St’s stock analysis is the Snowflake model, a visually intuitive diagram representing a company’s investment profile across five key areas: Value, Future Performance, Past Performance, Financial Health, and Dividend. This model simplifies complex financial data points into an easy-to-understand format, allowing you to gauge a stock’s potential quickly.

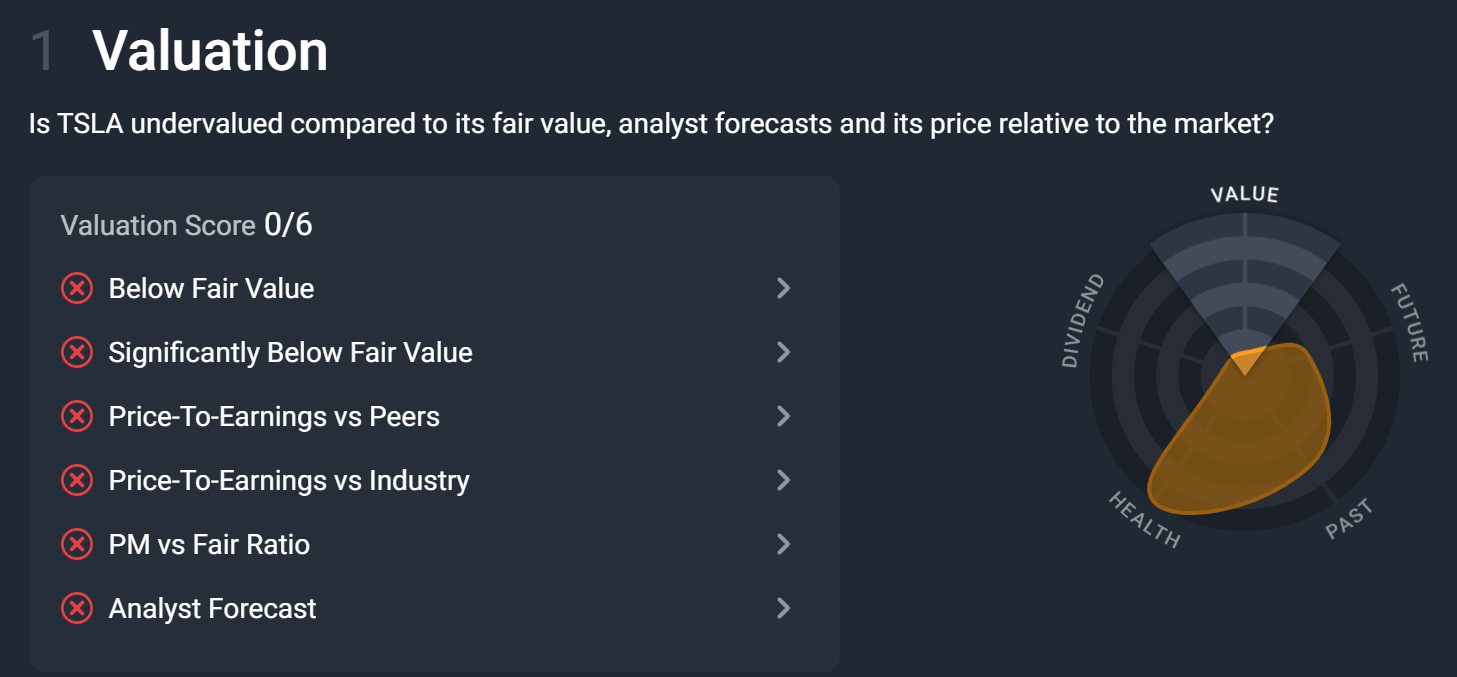

- Value: This criterion assesses whether a stock is undervalued or overvalued based on traditional valuation metrics such as Price to Earnings (P/E), Price to Book (P/B), and Price to Sales (P/S) ratios. A stock scoring high in this area suggests it may be undervalued, offering a potentially attractive investment opportunity.

- Future Performance: Here, Simply Wall St looks at analyst forecasts and industry trends to predict a company’s future earnings and revenue growth. Stocks with strong growth prospects score higher, indicating potential for capital appreciation.

- Past Performance: This dimension evaluates a company’s historical performance, focusing on profitability, revenue growth, and earnings stability over time. A consistent track record can signal a robust business model and operational efficiency.

- Financial Health: Simply Wall St analyzes a company’s balance sheet strength, examining financial ratios like debt levels, cash flow, and liquidity metrics. Companies in strong financial health are less risky, making them more reliable investments.

- Dividend: For income-focused investors, dividend yield and consistency are crucial. This area assesses a stock’s dividend payout history and stability, offering insights into its suitability as an income-generating investment.

- Management and Ownership: Every business requires a good leadership team. Simply Wall St considers a management’s compensation structure, tenure, and incentives to gauge the quality of leadership and whether they are acting in the best interests of shareholders.

The Snowflake model stands out for its ability to distill vast amounts of financial data into a digestible and actionable format. Its effectiveness lies in its comprehensive approach, considering both quantitative factors (like financial health and past performance) and qualitative forecasts (such as future performance). This holistic view enables investors to make well-rounded investment decisions based on a spectrum of critical financial metrics.

However, like any model, the Snowflake system has room for improvement. While it excels in providing a snapshot of a company’s investment merits, it may oversimplify complex investment decisions. For instance, the model could be enhanced by incorporating more dynamic factors such as the complexity of business operations, integrity of management, or sector-specific trends, which can significantly impact a stock’s long-term performance.

What does Simply Wall St cost?

Simply Wall St has designed its subscription model with the understanding that investors come from different levels of experience, needs, and engagement. This is reflected in their tiered subscription options, ensuring there’s a fit for everyone—from those just dipping their toes into the investment waters to seasoned sailors of the stock market seas. To learn more about Simply Wall St’s offerings, you can access the platform here.

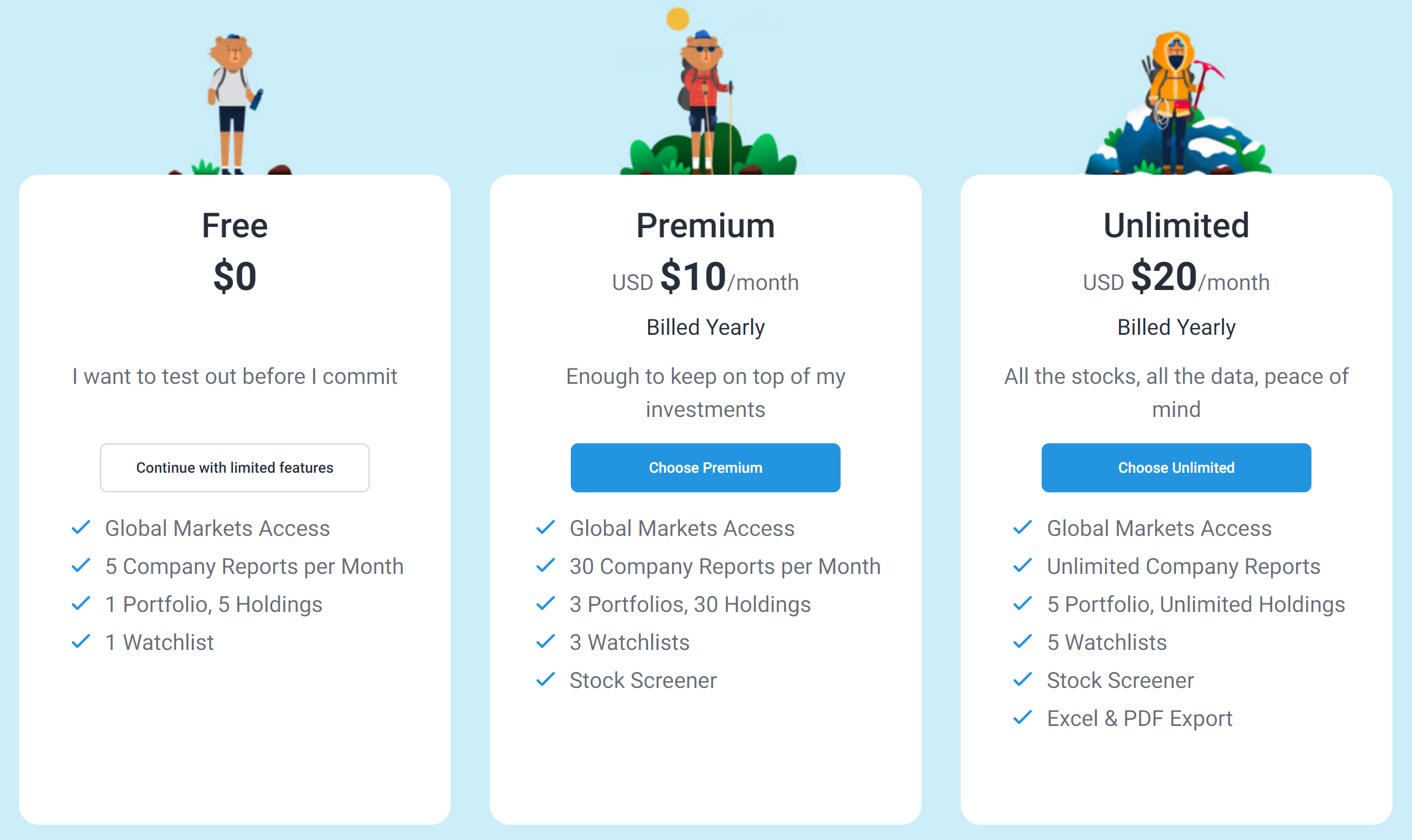

Free Plan: Your Gateway to Investment Insights

Starting with the most accessible option, Simply Wall St offers a Free Plan. This isn’t just a trial; it’s a permanently free tier that allows you to get a taste of what the platform has to offer. With the Free Plan, you gain access to a limited number of company reports and portfolio stocks, making it an excellent starting point for beginners or those with a casual interest in the stock market. It’s a fantastic way to familiarize yourself with Simply Wall St’s unique Snowflake analysis and comprehensive company data without opening your wallet.

Premium Plans: Unlocking the Full Potential

For those ready to dive deeper, Simply Wall St unveils its Premium subscription options, designed to cater to more engaged investors seeking thorough insights and analyses. The Premium plans come in two flavors: Premium and Unlimited subscriptions, each unlocking the full suite of features Simply Wall St has to offer.

- Premium Subscription ($10/month): For those who prefer flexibility or wish to test the waters before committing fully, the Premium subscription option provides you with a good taste of what Simply Wall St has to offer. This includes access to the global market, 30 company reports per month, three portfolios, three watchlists, and its stock screener.

- Unlimited Subscription ($20/month): This is the most comprehensive way to access Simply Wall St, ideal for the committed investor. The Unlimited plan offers unlimited access to all company reports, detailed portfolio analysis tools, and advanced screening features that allow you to sift through stocks based on specific criteria. On top of that, you can pull company reports into Excel and PDF allowing you to integrate them into your investment process.

Why Consider the Premium Subscription?

Investing in a Premium Simply Wall St subscription is not just about paying for a service; it’s about investing in your financial education and decision-making process. The platform’s detailed analyses, presented through easy-to-understand visuals and comprehensive reports, empower you to make informed investment choices. Whether it’s uncovering hidden gems in the stock market or understanding the financial health of potential investments, Simply Wall St’s tools are designed to give you a competitive edge.

Moreover, the time saved by having all this information readily available and easily digestible cannot be overstated. For serious investors, this time is better spent on strategic decision-making rather than navigating through complex financial data. Sign up for Simply Wall Street or test it for free here!

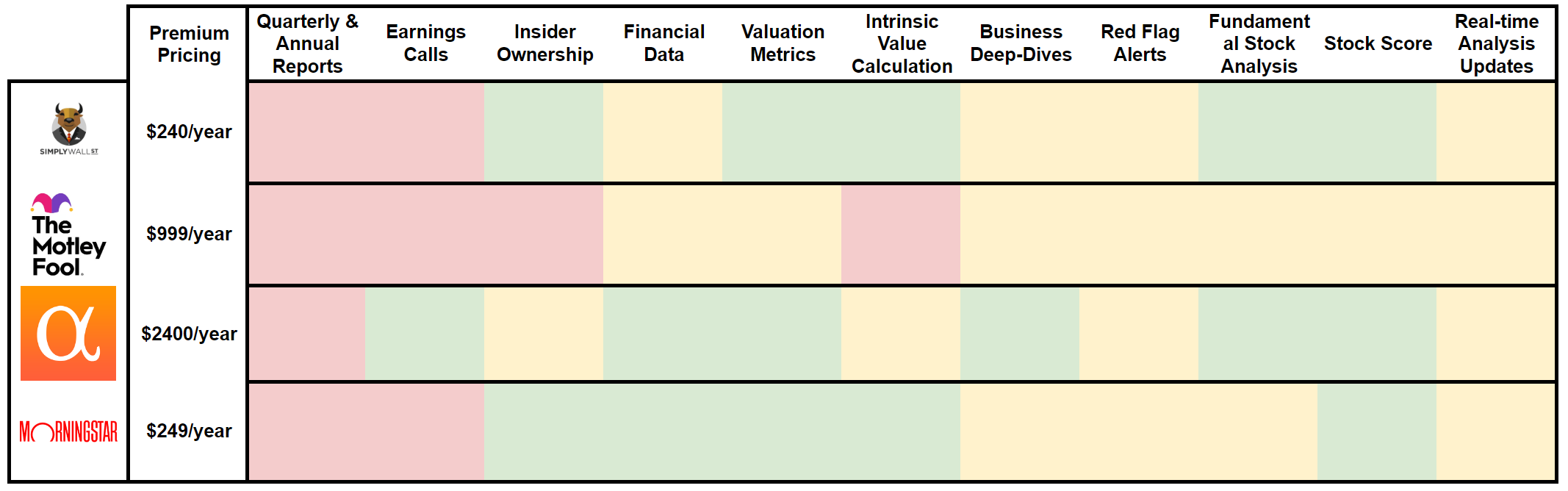

Simply Wall St vs. The Competition

Simply Wall St vs. Motley Fool

Simply Wall St is celebrated for its unique approach to investment analysis, primarily through its visually engaging “Snowflake” model which simplifies complex financial data into an easily digestible format. It’s a platform designed not just to inform but to empower investors by providing comprehensive data analysis tools and personalized portfolio insights.

Motley Fool, on the other hand, is best known for its stock-picking service. The platform has built a reputation around its investment advice, with a focus on long-term stock picks backed by thorough research. Motley Fool is for those who prefer to follow expert recommendations rather than dive deep into personal research.

Key Differences:

- Approach to Investment: Simply Wall St emphasizes self-guided investment research with tools and data, whereas Motley Fool offers expert-driven stock recommendations.

- User Engagement: Simply Wall St engages users with interactive tools and a wealth of data for personal analysis, appealing to those who enjoy a hands-on approach to investing. Motley Fool caters to users who prefer to rely on expert advice with less emphasis on personal research.

Simply Wall St vs. Seeking Alpha

Seeking Alpha takes a community-driven approach, offering a platform where users can access a wide range of investment opinions, analyses, and stock ratings from both professional and amateur analysts. It’s a hub for those who appreciate the breadth of perspectives and the lively discourse on stock performance and market trends.

Key Differences:

- Source of Information: Simply Wall St relies on algorithmic analysis and data visualization to provide insights, whereas Seeking Alpha offers a mix of professional analysis and crowd-sourced opinions.

- Analysis Depth: Simply Wall St provides a consistent, data-driven analysis model across all stocks, offering a uniform approach to evaluating investment opportunities. Seeking Alpha’s strength lies in the diversity of opinions and the depth of analysis, which can vary widely from one contributor to another.

Simply Wall St vs. MorningStar

MorningStar is a titan in investment research, known for its comprehensive data, analysis tools, and the MorningStar Rating system. It caters to a broad audience, from individual investors to financial professionals, offering detailed reports, portfolio management tools, and investment advice across various asset classes.

Key Differences:

- Research and Ratings: MorningStar offers detailed research reports and a proprietary rating system for mutual funds and stocks, making it a go-to for investors looking for in-depth analysis. Simply Wall St focuses on visual data representation and simplifies complex financial information into an understandable format for everyday investors.

- Toolset: MorningStar provides a suite of professional-grade tools for portfolio analysis and investment planning. Simply Wall St’s toolset is designed with the individual investor in mind, prioritizing ease of use and the ability to quickly assess investment opportunities.

Making the Right Choice

Choosing between Simply Wall St, Motley Fool, Seeking Alpha, and MorningStar boils down to your investment style, how much you value expert opinions versus independent research, and the type of analysis you prefer.

- If you’re a visual learner who appreciates a hands-on approach to dissecting financial data, Simply Wall St offers an innovative and engaging platform to conduct your research.

- For those who prefer to lean on expert stock picks and investment advice, Motley Fool provides valuable insights to help guide your investment decisions.

- Investors who value a wide array of opinions and a community-focused platform will find Seeking Alpha to be a rich source of diverse investment perspectives.

- If detailed reports, professional-grade tools, and a trusted rating system are what you seek, MorningStar stands as a comprehensive resource for in-depth investment research.

In the end, your choice should align with your investment philosophy, the level of involvement you wish to have in the research process, and the types of tools and information that best support your investment decisions. Whether you’re drawn to the visual and data-driven simplicity of Simply Wall St, the expert recommendations of Motley Fool, the community discourse of Seeking Alpha, or the in-depth analysis of MorningStar, ensure your platform of choice resonates with your investment strategy and goals.

Simply Wall St FAQ

Is Simply Wall St reliable for beginners?

Absolutely! One of the platform’s greatest strengths is its ability to demystify stock market data for beginners. With intuitive visuals and straightforward explanations, Simply Wall St can help you gain confidence in your investment decisions, no matter your starting point.

How does Simply Wall St’s ‘Snowflake’ work?

The Snowflake is a unique visual tool that evaluates stocks based on five key criteria: Value, Future Performance, Past Performance, Financial Health, and Dividend. It presents this analysis in an easy-to-understand graphic, allowing you to quickly assess a stock’s potential.

Can I track my investment portfolio with Simply Wall St?

Yes, you can. Simply Wall St offers its own portfolio tracking and analysis features, enabling you to see how your investments are performing over time. You can also receive personalized insights and recommendations based on your portfolio’s composition.

How often is Simply Wall St’s data updated?

Data on Simply Wall St is regularly updated to ensure you have access to the most current information. The platform aims to provide real-time data where possible, giving you a timely overview of the stock market and an individual stocks performance.

How can I start using Simply Wall St?

Getting started is as simple as visiting the Simply Wall St website and signing up for an account. You can begin with the free plan to explore what the platform has to offer and upgrade to a premium subscription whenever you’re ready to dive deeper into the world of investment analysis. I found Simply Wall St while seeking info on Tesla!

Final Thoughts: Is Simply Wall St Worth the Investment?

Deciding to subscribe to Simply Wall St comes down to your investment goals, the level of detail you require in your research, and how much you value the convenience of having comprehensive, easy-to-understand financial analyses at your fingertips. For many, the cost of a Premium subscription is a small price to pay for the depth of insight and potential returns on more informed investment decisions.

In the end, whether you choose to start with the Free Plan or dive straight into a Premium subscription, Simply Wall St offers a platform that grows with you. As you become more familiar with the market and more confident in your investment choices, Simply Wall St stands ready to provide the data and analysis you need to navigate your investment journey with confidence.