“By far, the greatest danger of Artificial Intelligence is that people conclude too early that they understand it.” – Eliezer Yudkowsky

2023 is quickly becoming the year of artificial intelligence.

Out of nowhere, AI seemingly wiggled its way into our reality, and now, it is our reality, changing the way we think, operate, and feel.

Though artificial intelligence has been around for quite some time, decades even, it seems like only recently that it hit the mainstream.

With chatbots like ChatGPT, digital artists like Dall-E, and operating systems like KOSM, anyone, regardless of their experience, is becoming equipped to master AI and its applications.

Hell, even kindergartners are finessing their way out of homework by asking chatbots to whip up an essay.

But that is our new reality whether we like it or not.

So, rather than worrying about it destroying jobs, disrupting the school system, or going full Terminator on us, why not learn to embrace its potential and its ability to change the world?

And why not invest in the companies that are going to make it happen?

In this article, we will explore five of the most promising AI stocks in the stock market today and explain why it is worthwhile investing in AI.

Since we are all familiar with the big tech artificial intelligence stocks like Microsoft, Alphabet Inc (Google’s parent company), and Meta, we will focus primarily on up-and-coming businesses so that you can make the most of your investment.

After all, how cool would it be to boast that you found the next Apple?

Top AI Stocks to Buy In 2023

-

Magic Software Enterprises

Ticker: MGIC

Market Cap: USD 637.23 million

One of the best AI stocks out there, Magic Software Enterprises is a force to be reckoned with.

The company is a global provider of innovative end-to-end business integration and application development solutions.

This includes proprietary and cutting-edge software platforms like:

- Magic xpa for developing and deploying business applications;

- AppBuilder for building and deploying high-end and mainframe-grade business applications,

- Magic xpi for application integration;

- Magic SmartUX for cross-platform mobile business applications.

In addition to its software solutions, Magic offers a variety of informational technologies (IT) services to help facilitate clients with their personalized and automated software development.

What is particularly interesting about the company is that 80% of its revenue comes from long-term engagements with existing clients, which is a reflection of its customer loyalty and satisfaction.

This is highly valuable for any AI business as it means that it will have predictable and sustainable revenues for many years to come, especially during an uncertain economy.

Not only that, but by having consistent cash inflows, Magic can strengthen its relationships further as it reinvests capital back into the business, thus strengthening its competitive advantage.

Overall, Magic Software Enterprises is a strong player in the artificial intelligence market.

With a healthy balance sheet, a sustainable business model, and the stock down nearly 20% YoY, you can’t find an AI stock much better than this.

To learn more, check out our original article on Magic Software Enterprises.

-

VERSES AI

Ticker: OTCQX: VRSSF; NEO: VERS

Market Cap: USD 48.68 million

VERSES is an excellent business and one of the only pure-play AI stocks on the market.

Through its KOSMOS™ operating system, VERSES is developing a Spatial Web platform that combines Internet of Things (IoT) capabilities, like AI, machine learning, and robotics, and contextualizes them in an easy-to-understand, highly intuitive, and fully integrated network.

This allows its customers and developers to create artificial intelligence-driven applications that enable brand-new use cases across any industry and well beyond what is possible today.

To demonstrate KOSMOS’ abilities, VERSES developed a proof-of-concept app, called WAYFINDER™, which uses spatial intelligence to deliver optimal efficiency and accuracy in any retail space or warehouse.

Already, WAYFINDER is improving its clients’ productivity by 30% to 50% and helping them save millions of dollars in operational costs in the process.

For their efforts, the company has secured multiple long-term agreements with major retail, supply chain, and logistic businesses like NRI Distribution, Blue Yonder, and more; for reference, the NRI deal is worth 10 years, USD 26.5 million (assuming NRI renews at the 5-year mark).

Recently, the company also announced the world’s first General Intelligent Agent, codenamed GIA™, which is designed to offer a new human-centered way for businesses and individuals to interact with technology, by learning about its users to better organize, manage, and optimize their digital life; VERSES is planning an international beta rollout of GIA beginning in the summer of 2023.

As WAYFINDER and GIA are just a small sample of what KOSMOS and VERSES are capable of, it is clear that the company is one of the best artificial intelligence stocks in the market today and well suited to capitalize on this industry and beyond.

If you’d like to learn more about VERSES, check out our recent video interview with Co-Founder and CEO Gabriel Rene.

-

AbCellera Biologics

Ticker: ABCL

Market Cap: USD 2.13 billion

Changing course a little, AbCellera Biologics is a fascinating biotech company that is using its AI-powered antibody discovery technology to find natural antibodies used to develop life-changing drugs.

Through its advanced AI system, AbCellera sorts through trillions of antibodies and locates the optimal solution for fighting harmful antigens in less than 90 days.

So far, the company has delivered multiple suitable antibodies, alongside its partners, with one of the most impressive being a Covid-19 antibody that was created in partnership with Eli Lilly & Co and distributed to millions of people worldwide.

As a result, AbCellera earned over $500 million in revenue from this discovery in less than two years of distribution.

One thing that separates AbCellera from other biotech companies is that it is not in the drug development game, which can be extremely costly, and often results in failure (over 90% of pharmaceuticals that enter FDA clinical trials fail).

Instead, the company focuses on partnering with the most established pharmaceutical businesses and offers them a highly useful deep-learning technology that improves their efficiency and success rate when developing drugs.

Not only is this better for the bottom line, but it also allows it to attach itself to some of the most successful and influential companies in the industry, meaning that they benefit directly from their success.

With names like Moderna, Pfizer, Merck, and others as part of its clientele, it is no wonder why notable investors like Bill Gates and Peter Thiel invested in them.

Until recently, the company has consistently grown its top and bottom lines, with revenue sitting at USD 181.03 million TTM, and net losses at USD 50.16 million as demand from Covid-19 falls and economic conditions worsen.

This has translated to a return on equity of -10.62% and an operating margin of -10.62%.

While AbCellera has been knocked to down, it is not out for the count.

If you are interested in one of the most impressive biotech and AI companies around, you should definitely consider this company.

To learn more, check out our featured article on Abcellera Biologics.

How to Evaluate AI Stocks?

There is a lot of hype surrounding artificial intelligence and AI stocks at the moment, and it makes sense why.

But as retail investors, we must learn to differentiate between excellent businesses and bad ones.

To do so, we need to focus primarily on the fundamentals of a business, its competitive advantages, and the price at which we pay for it.

This is in contrast to those who choose to speculate on favorable industry trends, positive news, or potential fluctuations in the stock price.

In other words, it is time to start thinking as a long-term business owner when we invest, and not as a buy-low, sell-high stock trader.

Step #1: Analyze its Financial Statements

To evaluate artificial intelligence stocks, the first thing we must do is analyze a company’s financial statements.

Within it, we want to see that the business is earning money from its products and services, and doing it in a way that is scalable for many years into the future.

When assessing this aspect of an AI business, check that its revenues, net income, shareholder equity, and free cash flow are all growing year-over-year or, at least, staying consistent.

On top of that, we also want to ensure that the company is using little debt to fund its operations since debt can be harmful to a business’s development if it is overused or the economy starts to slow down.

Having a healthy balance sheet is a clear indication that is not only producing value but also doing so in a way that maximizes shareholder value.

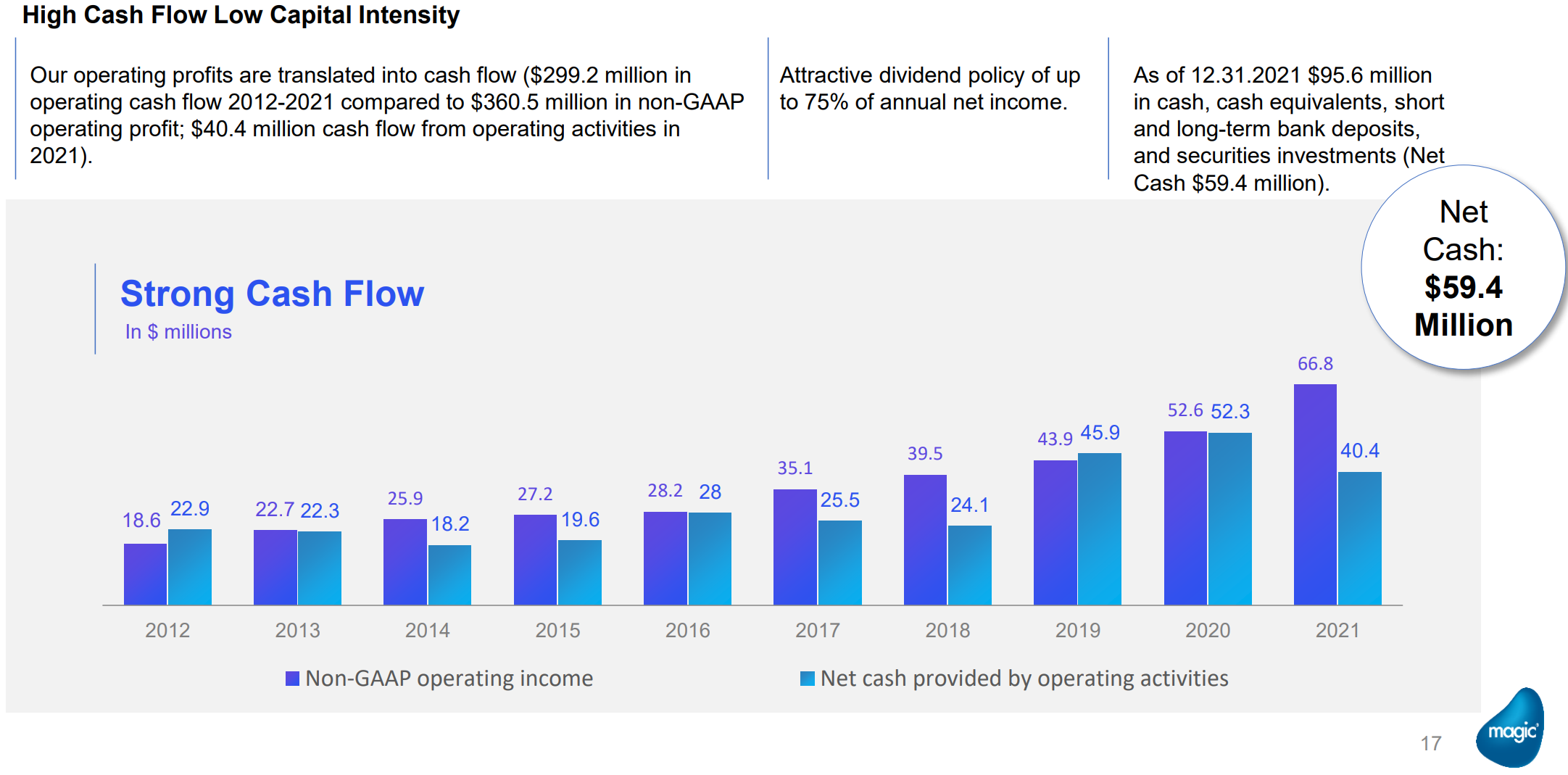

Here is an example from Magic Software’s investor presentation to demonstrate:

Step #2: Determine the Business MOAT

After analyzing the financial statements, we can infer that a company has at least one competitive advantage when they demonstrate consistent growth over an extended period and are increasing its market share.

While this is a good start, we can’t just stop there as we must determine all of the competitive advantages and any potential threats a business might have to better understand the company.

By learning about our investments and the potential threats to their success, we better equip ourselves to make sound and rational decisions, especially during volatile episodes or economic uncertainty.

Moreover, the more competitive advantages a company has, the more likely it is to thrive over the long run, making us more bang for our buck.

To demonstrate this, here are a few of VERSES’ competitive advantages:

- Switching MOAT: as developers and customers familiarize themselves with KOSMOS, they will be less likely to switch to another operating system since it already satisfies their AI needs, especially as the user base grows.

- Network Effect: as more developers and customers adopt KOSMOS, this will incentivize others to use the system, thus resulting in more users and developers joining the network.

- Scalable Business Model: as demonstrated by the WAYFINDER app, KOSMOS is highly scalable with an infinite number of applications. This will prove highly lucrative for VERSES as they will increase their value exponentially without bearing any additional costs.

Step #3: Buy at a Reasonable Price

We never want to overpay for an investment.

Therefore, the key to a successful stock pick is by purchasing the AI stock at a discount.

There are many ways to determine what a business is worth, but the most common methods are a Discounted Cash Flow analysis or a comparable model.

To learn more about how to value growth stocks like artificial intelligence, check out our Valuing Growth Stocks article.

As legendary investor Howard Marks once said, “It’s not what you buy, it’s what you pay. And success in investing doesn’t come from buying good things, but from buying things well. And if you don’t know the difference, you’re in the wrong business.”

What Kinds of AI Businesses are There?

While we touched on a few of the best AI stocks in the stock market today, there are many others we did not discuss.

Moreover, it is likely that as AI technology advances, there will be even more businesses and opportunities that have yet to be discovered in the AI industry.

In most cases, artificial intelligence companies will use a combination of these technologies to maximize their value.

Here are four of the most common ways companies use artificial intelligence technology.

-

AI Software Companies

These businesses specialize in developing software that incorporates artificial intelligence technology, like machine learning, natural language processing, computer vision, and other AI techniques, to create software applications that are capable of performing advanced tasks once only reserved for human intelligence.

AI software can be anything from chatbots, virtual assistants, recommendation systems, fraud detection systems, predictive analytics, and speech recognition systems.

In most instances, these applications will then be sold to other businesses, who will then integrate them into their products and use them to optimize their operations.

Examples of AI Software Companies include OpenAI, IBM Watson, and Amazon Web Services AI.

-

AI-powered Product & Service Companies

These businesses use their expertise in artificial intelligence to create products that utilize AI technology to provide unique and innovative experiences for their customers.

AI services and products can be hardware, software, or a combination of both, and often use machine learning, natural language processing, data centers, and cloud computing to create an intuitive and personalized experience.

Some of the most notable AI-powered products are devices like Google Home and Amazon Echo, autonomous vehicles like Tesla, or virtual assistants such as Siri, Alexa, and Cortana.

-

AI Consulting Firms

These companies offer AI consulting services to other businesses seeking to implement AI technology in their operations.

They often have a deep understanding of the latest AI techniques, algorithms, and technologies, as well as experience deploying AI solutions in a variety of industries.

Some of these businesses’ services are identifying use cases for AI, developing proof-of-concept projects, designing and building AI systems, training employees, and providing ongoing support and maintenance.

A few of the most well-known AI consultants include Capgemini, Accenture, and Deloitte.

-

AI Research Labs

These are specialized organizations that focus on innovation and advancing artificial intelligence by developing new technologies, algorithms, and AI applications.

Through their research, they explore a wide range of topics like cloud computing, natural language processing, computer vision, deep learning, robotics, and human-computer interaction.

AI research labs have made significant contributions to the field of AI, and have developed some of the most groundbreaking technologies in the industry.

A few of the most meaningful contributors are Google Brain, Microsoft Research, DeepMind, Facebook AI Research, and OpenAI.

Final Thoughts: Why Invest in Artificial Intelligence?

There is no doubt that artificial intelligence is here to stay.

At a forecasted compound annual growth rate of 38.1%, from 2022 to 2030, the AI industry is one of the most profitable and high-growth markets out there, meaning that now is the perfect time to invest.

Though we are only scratching the surface, AI is already changing the way we live, think, and do business, therefore it only makes sense to embrace it.

So, if you find an AI company with strong earnings and revenue growth, a decent market share, and a durable competitive edge, why not consider investing in it so that you too can capitalize on the AI boom?

After all, what if you happen to find the next AI tech giant of tomorrow?

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Verses AI stock and are compensated by Verses for Investor Relations Services, amounting to eighty-nine thousand seven hundred sixty dollars. Edge Investments and its owners reserve the right to buy and sell shares in Verses AI without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.Copyright  2023 Edge Investments, All rights reserved.

2023 Edge Investments, All rights reserved.