Do you have unrealized gains or losses in your investment portfolio?

Are you trying to figure out whether it is worth it to sell your stocks at a loss?

Maybe you are hoping to make the most of your capital gains.

Whatever your reason for selling stocks, it is good to know the difference between an unrealized gain/loss and a realized capital gain/loss and how to leverage them to your full advantage.

In this article, we explain what are unrealized gains and losses, how to calculate them, and what you can do to make the most out of your capital gains/losses through a variety of tax hacks.

Why not make the most out of your money?

What are Unrealized Capital Gains and Losses?

Gains and losses are part of the day-to-day emotional rollercoaster that is investing.

While we all strive to achieve massive returns over the long run, sometimes, in the short run, our stocks can swing from green to red in an instant without us ever knowing.

With that being said, it is important to realize that unless you sell your stocks, your gains and losses go “unrealized” because they are only present on paper and have not been realized through the sale of the asset.

Therefore anytime you view your investment returns on a screen and you start to feel extra wealthy (or in the gutter), remember that until you close out the position, it means nothing.

One morning you could wake up with millions, and the next, with nothing.

Because only when those gains or losses are converted into cold hard cash are your investment returns (or losses) actually realized.

How to Calculate Unrealized Gains and Losses

To calculate unrealized gains and losses, all you need to do is follow this simple formula.

- Figure out your average purchase price of a stock, the number of shares you’ve acquired, and the current stock price.

- Enter this formula: % unrealized gain or loss = ((stock price x # of shares) – (average purchase price x # of shares)) / (average purchase price x # of shares)

- Then, if you want to know the monetary value of these gains or losses, simply multiply the formula in step 2 by the average purchase price of the stock and the # of shares purchased, and you will see the total amount of money you have either gained or lost.

Examples of Unrealized Gains and Losses

Here are a few examples to lean on when learning how to calculate unrealized gains and unrealized losses.

To speed up the process and make your life easier, we recommend using a tracking tool like Google Sheets or Microsoft Excel because they can automatically calculate your return on investment without much hassle.

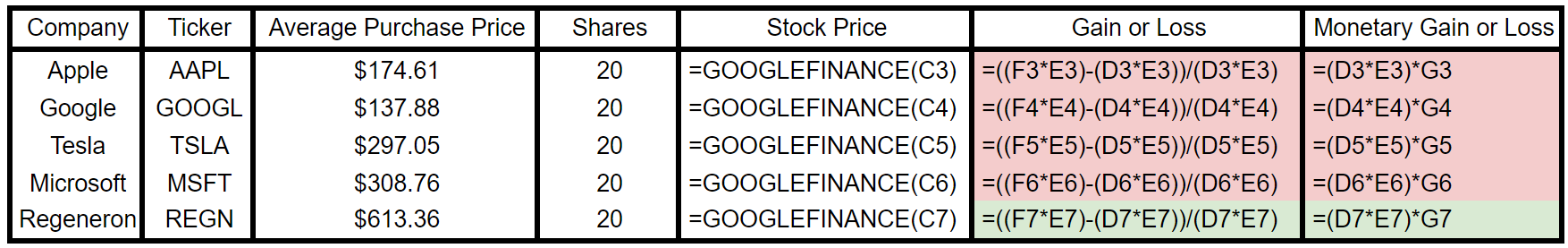

To begin, you want to start by filling in all the important information, including the formulas mentioned in the previous section.

In this case, I am using Google Sheets, which offers a pretty unique tool that will automatically update the stock price of any publicly-traded company listed on either the New York Stock Exchange or the Nasdaq.

To access this tool, simply enter the formula “=GOOGLEFINANCE()” and enter the cell or ticker symbol of the stock you would like to track.

For example, if I wanted to follow Apple, all I would need to do is enter “=GOOGLEFINANCE(AAPL),” and it will give you the current stock price.

That said, here is the Google spreadsheet with all the appropriate information filled in.

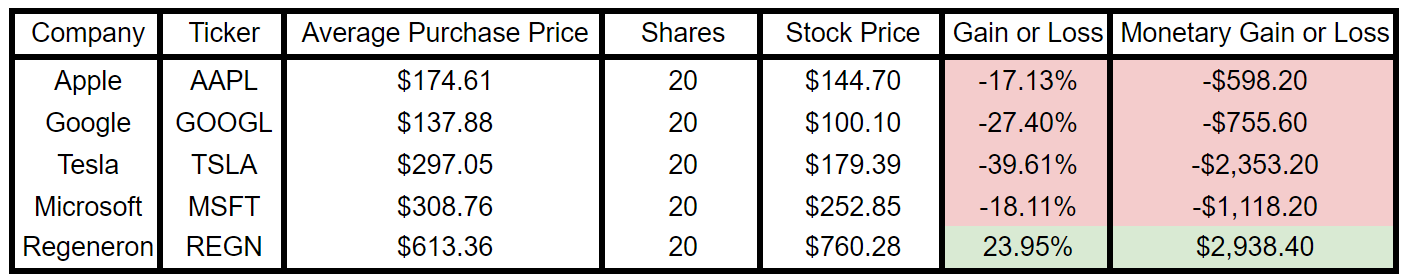

After the spreadsheet is filled out correctly, with the appropriate information and formulas, you will now have an unrealized gain and unrealized loss tracker that requires very little maintenance at all.

Once you have your stock portfolio tracker up and running, all you need to do in the future is update the “Average Purchase Price” and the number of shares you own (if they change), and everything else will be taken care of for you.

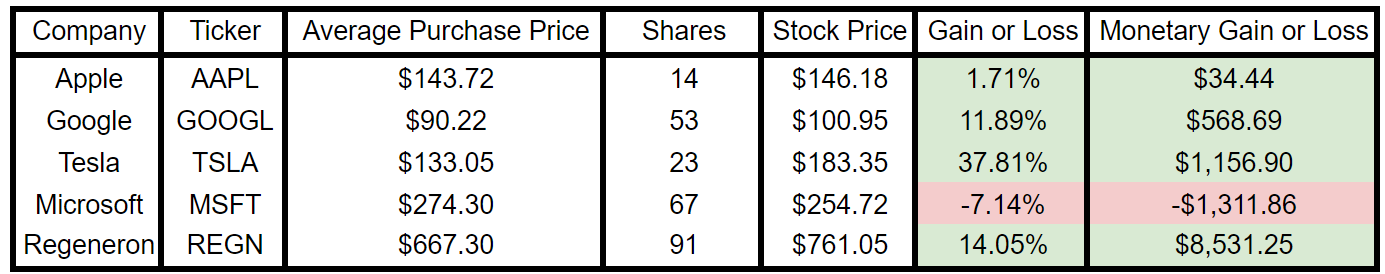

For this example, we chose to buy more shares of all the stocks listed.

As you can see, all we did to change the spreadsheet was manually update the number of shares we own and the average price of all the shares we purchased.

On the other hand, the “Stock Price,” “Gain or Loss,” and “Monetary Gain or Loss” were all updated automatically without having to adjust anything.

Also, notice that even in the short amount of time between creating this, Google has already updated the stock price of the stocks in our investment portfolio.

If you don’t want to do the work and would prefer a less complicated solution, we also highly recommend using portfolio tracking apps like Blossom, Personal Capital, Morningstar, and others, to help measure your stock gains and losses.

Plus, if you use the “EDGE” referral code when registering for free on Blossom Social, you can earn $5 upon completion.

Are Unrealized Capital Gains Taxed?

No, since unrealized gains are simply the day-to-day fluctuations of unrealized investment returns, and not realized capital gains, they are not taxed unless you turn a profit and close out the position by selling your shares.

Nevertheless, it is important to understand how realized gains are taxed so that you can ensure your payments are made and that you avoid receiving an unwelcome tax bill from the Internal Revenue Service (IRS) or Canadian Revenue Agency (CRA).

Ever wondered how billionaires avoid taxes through investing? Check out this article.

How are Capital Gains Taxed?

An investor is taxed on capital gains when they earn a profit from the sale of an asset like stocks; in other words, a realized gain.

However, not all capital gains taxes are the same, given that the amount of tax you pay on capital gains depends on a variety of factors, including the type of asset you sold, how long you held the asset, and your tax bracket.

For example, in the United States, long-term capital gains (gains on capital assets held for more than a year) are taxed at lower rates than short-term capital gains (gains on capital assets held for a year or less).

In this instance, the long-term capital gains tax rates for the 2023 tax year are 0%, 15%, or 20%, depending on your filing status and taxable income.

That said, if you are earning short-term capital gains, like a day trader, you may face higher tax rates given that these types of investments are taxed as ordinary income and not capital gains; short-term rates can reach as high as 37%, depending on your tax bracket.

Similarly, in Canada, investors will be required to pay a capital gains tax rate anywhere from 7.50% to 16.50% depending on your filing status and taxable income; this is calculated by dividing the marginal tax rate of your income level by 2.

But unlike in the United States, where the tax rate is fixed, Canadians are only required to pay capital gains on 50% of capital gains, meaning that you retain more of your investment returns when you choose to sell.

Unfortunately for day traders, however, the same rules do not apply since the CRA will consider 100% of your capital gains as ordinary income, which means less money in your pocket over the long haul.

In wrapping this section up, if there is any takeaway from all of this, it is that long-term investing is not only a more successful investment strategy, but it also helps you save a ton of money on taxes.

Therefore, even though it may be exhilarating to time trades and speculate on the market, the reality is that it is much smarter to invest in stocks for the long term if your goal is to make the most of your money.

For more information on Edge Investments’ long-term investment strategy, check out our article here.

How are capital gains reported?

Depending on the country you reside in, the rules may vary slightly.

In the United States, if you sell a stock, mutual fund, or other securities, you will receive a Form 1099-B from the broker that executed the sale, and you will be required to report your capital gains on your federal income tax return.

Within this form, the sale price, cost basis, and any commissions or fees related to the sale are made available to the reader.

You will need to use this information to calculate your capital gain or loss, which you will then report on Schedule D of your Form 1040.

Like in the US, Canadians who sell a stock, mutual fund, or other securities will receive a T5008 slip from the broker that executed the sale and be required to report it on their federal income tax return.

In a similar fashion, you will need to calculate your capital gains using the same information provided earlier.

No matter where you live, it is important to keep accurate records of all of your sales transactions, including the date of the sale, cost basis, and any related expenses, so that you can correctly report your capital gains or losses.

If you have any questions or concerns about how to properly report your taxes, it is always a good idea to speak with a tax professional to receive the proper guidance.

For more information on capital gains taxes in the United States, visit the Internal Revenue Service website for the most accurate and up-to-date information.

For more information on capital gains taxes in Canada, visit the Government of Canada website for the most accurate and up-to-date information.

Can I Invest My Capital Gains to Avoid Paying Taxes?

Yes, in some cases, you may be able to finesse the tax man if you invest the proceeds from the sale of an asset into a new investment.

This strategy is known as a “Tax-Deferred Exchange” or a “1031 Exchange” in the US and is a great way to make the most out of your investments.

Here’s how to make it happen:

First, you will need to move the money you received selling your original asset into a new “like-kind” asset within 45 days.

This new investment should be similar to the original one, and you’ll need to keep it for at least as long as you held the original.

If you meet these requirements, you can delay paying capital gains taxes until you sell the new investment, but just keep in mind that 1031 exchanges can be complex and have lots of rules and restrictions.

In Canada, there is a similar program called a “Rollover,” which allows you to defer paying capital gains taxes on the sale of an asset by rolling over the proceeds from the sale into a new qualifying asset.

But no matter where you are, once again, it is always a good idea to get personalized advice from a tax professional so that you can learn how to minimize capital gains taxes based on your circumstances.

Can Capital Gains Tax be Avoided?

Unfortunately, you won’t be able to avoid capital taxes when investing in stocks completely.

However, there are a few strategies out there that can help you minimize the amount of taxes you owe.

Here are a few of the top strategies to consider, including some of the strategies we mentioned earlier:

- Holding onto Stocks for a Long Time (Over 1 Year): When you keep your stocks for over a year, you may end up paying less in taxes compared to investors who trade more frequently. That is because long-term capital gains are taxed at a lower rate than short-term gains in both Canada and the United States.

- Tax-Deferred Exchanges or Roll-Overs: If you plan to sell a stock and invest the proceeds into a new investment, you may be able to defer paying capital gains taxes.

- Tax-Advantaged Accounts: Investing in accounts like IRAs and HSAs (in the US) and RRSPs and TFSAs (in Canada) can lower your taxable income and reduce your capital gains taxes; sometimes, you may not even have to pay taxes on your capital gains at all!

- Offsetting Capital Gains with Losses: If you have realized losses from selling other stocks, you can use them to offset capital gains, which can lower your overall tax bill. This investment strategy is commonly called tax-loss harvesting and is a great way to reduce your tax liability at the end of the year.

- Charitable Giving: By donating appreciated assets to a qualified charity, you may be able to take a charitable deduction for the full value of the asset and avoid paying capital gains taxes on the appreciation.

Though these are a few of the best tax hack strategies an individual can use, you must understand that the tax rules that pertain to your specific region or country.

If you don’t, it would suck to find out that you owe more than you originally planned for.

Want to make the most out of your investments? Check out our guide here.

Final Thoughts: How to Deal with Unrealized Gains and Losses

So you have unrealized gains and losses and are unsure what to do with them?

Well, the best way to deal with an unrealized gain or loss is to pay very little attention to them on a daily basis.

Though it may feel exhilarating to watch your stocks go up and down, the reality is that it won’t help your investment performance whatsoever.

Even worse, it may end up hurting your returns.

As the legendary value investor Benjamin Graham once said, “In the short run, the stock market is a voting machine, but in the long run, it is a weighing machine.”

In other words, the stock market is one of the few places where an investor can know the price of a business at all periods of the day and act on it.

On the surface, this can seem helpful, but it can also be distracting and detrimental if it leads you to make a poor decision based on emotions, especially if the stock you own is down badly.

Therefore, it is a better idea to only check your unrealized gains and losses every once in a while so that you give yourself enough time to make an informed and rational decision.

Nonetheless, if you do plan on selling your stocks and realizing the gains or losses, keep in mind the various strategies that we mentioned in this article.

After all, our goal as investors is to make the most out of our investment opportunities, so why not incorporate any tricks and hacks that will help you there?