The thrill of picking stocks and watching their share price rise dramatically is one of the most satisfying feelings in the investment world.

However, as any seasoned stock picker will tell you, not every investment choice you make will pan out.

Before anyone begins their investing journey (especially if you’re determined to pick individual stocks), you should thoroughly understand the risks, outcomes, and different options you’ll have when a stock in your portfolio inevitably goes negative.

Image Source: Forbes

What Determines a Stock’s Price?

Sit through any intro to economics class, and one of the first things you’ll learn is that the price of all goods and services is driven by supply and demand.

And just like economics, the price of a company’s stock is also driven by the very simple principle of supply and demand.

More specifically, publicly traded companies offer shares to investors through financial markets. This is where both individual and institutional investors buy and sell shares to one another.

When multiple investors want to buy a company’s stock, it drives demand up and supply down, causing an increase in the company’s stock price. Conversely, when investors sell shares of a company, this decreases demand and increases supply, thereby driving down the company’s share price.

What causes these fluctuations in supply and demand?

Typically, a company’s financial performance, as well as other related news (such as a company signing a new customer or developing a new product), will influence whether investors want to buy or sell a company’s stock. The better the company performs, the higher the demand will be for a company’s stock.

What Happens if a Stock Goes Negative?

Every stock picker eventually picks a few bad eggs. Perhaps the company shows slowing revenue, doesn’t release a favorable earnings report, or loses a big customer; whatever the reason, bad news and underperformance usually mean the company’s stock price will drop considerably.

Watching an investment in your stock portfolio go negative isn’t necessarily the end of the world. It’s normal for stock prices to fluctuate both up and down. And more importantly, if a stock’s price falls a significant amount, it can sometimes be a great buying opportunity for investors who still believe the company will outperform in the long run.

The real problem for investors occurs when a company’s stock price goes to zero.

What Happens if a Stock Goes to Zero?

When a company’s stock declines to the point of hitting zero (which usually only happens when a company goes bankrupt), an investor’s capital becomes worthless.

Though, before a stock price ever reaches zero, most major stock exchanges issue a warning to companies when their shares drop below $1. When this happens, a company’s management team will have 30 days to try and get their share price back above the $1 threshold.

If they fail to do this, their stock becomes delisted, and investors will temporarily lose the ability to buy and sell shares.

The delisted stock will then move to the over-the-counter (OTC) markets, where investors will once again be allowed to buy and sell shares.

At first glance, the move to being traded on the OTC markets may not seem so bad. However, there is a deeply negative stigma for stocks that trade over the counter, as these companies are usually struggling to stay financially viable and may even be close to announcing bankruptcy.

Simply put, long before a stock goes to zero, the shares are usually transferred to OTC markets, which doesn’t automatically mean an investor will lose the capital they invested. However, it is a strong indication the company is struggling to produce cash flow, achieve profitability, or simply stay financially solvent.

Do I Owe Money If a Stock Goes Down?

Answering the question of whether or not you will owe money if a stock in your portfolio goes down is completely dependent on the following two questions:

- Are you using your own money?

- What type of brokerage account do you have?

When setting up a brokerage account, investors will have two options, a cash account or a margin account (don’t worry, we’ll go into more detail about these accounts later).

And while both have their advantages and disadvantages, if you’re using a margin account, that means you’ll have the ability to use borrowed money to purchase shares. And just like any other time when you’re borrowing money, you will be expected to pay the loan back in full (regardless of whether or not your investments go up or down in value).

Let’s take a closer look at these two account types to better understand how these accounts affect an investor’s risk/reward profile, as well as whether or not you will owe money if a stock goes down.

Overview of a Cash Account

A cash account is the most common type of brokerage account available to investors.

Stock trading through a cash account requires you to purchase shares using available cash or settled proceeds from selling other securities. You won’t have access to margin loans or other forms of financing to purchase shares.

When you decide to transfer money or sell current positions in your cash account, the money won’t be available right away. Rather, cash accounts must abide by settlement rules, meaning when you buy, sell, or transfer money, you must wait a period of time (which can be as long as 3 days and as short as a few minutes) before the funds will become available. These settlement rules limit an investor’s ability to make trades quickly. However, they also mean investors don’t have to worry about owing money if a stock goes negative.

To be clear, you can still watch your investments fall to zero in a cash account. However, you will never be caught in a situation of owing money, receiving a margin call, or losing more money than you originally invested.

Advantages of a Cash Account

- Limited Risk: A cash account limits an investor’s risk by allowing them to use only the capital they themselves transferred into their account.

- Simplicity: With a cash account, buying and selling stocks is a simplified process. You can hold stocks for as long as you like, and at no point in time must you worry about owing money.

- Great for Beginner Investors: Cash accounts don’t typically allow investors to partake in more complex investment strategies such as options trading or short selling. For this reason, a cash account is a great option for beginner investors.

Disadvantages of a Cash Account

- Less Capital to Invest With: Using a cash account means you will have limited capital to invest with; so you’ll have to prioritize where you invest your capital or risk not having enough cash to purchase additional shares.

- Upside is Limited: Limited capital means smaller trades, which means smaller potential investment returns. Cash accounts, although great for lowering risk, also lower your ability to make outsized investment gains.

- Only Allowed to Buy/Sell Common Shares: Cash accounts typically don’t allow investors to purchase other forms of investment vehicles, such as call or put options. Experienced investors who want more optionality may be better suited for a margin account.

Overview of a Margin Account

Although similar to a cash account, a margin account allows investors to borrow money through a margin loan to buy and sell stocks.

Further, choosing a margin account helps investors increase their available capital, allowing them to place bigger trades and (potentially) make more money. However, the risk involved with purchasing stocks through margin is considerably higher.

More specifically, all margin accounts have strict policies and guidelines surrounding how much capital you must have in your account at all times and how much of your margin loan you’re allowed to use to purchase shares.

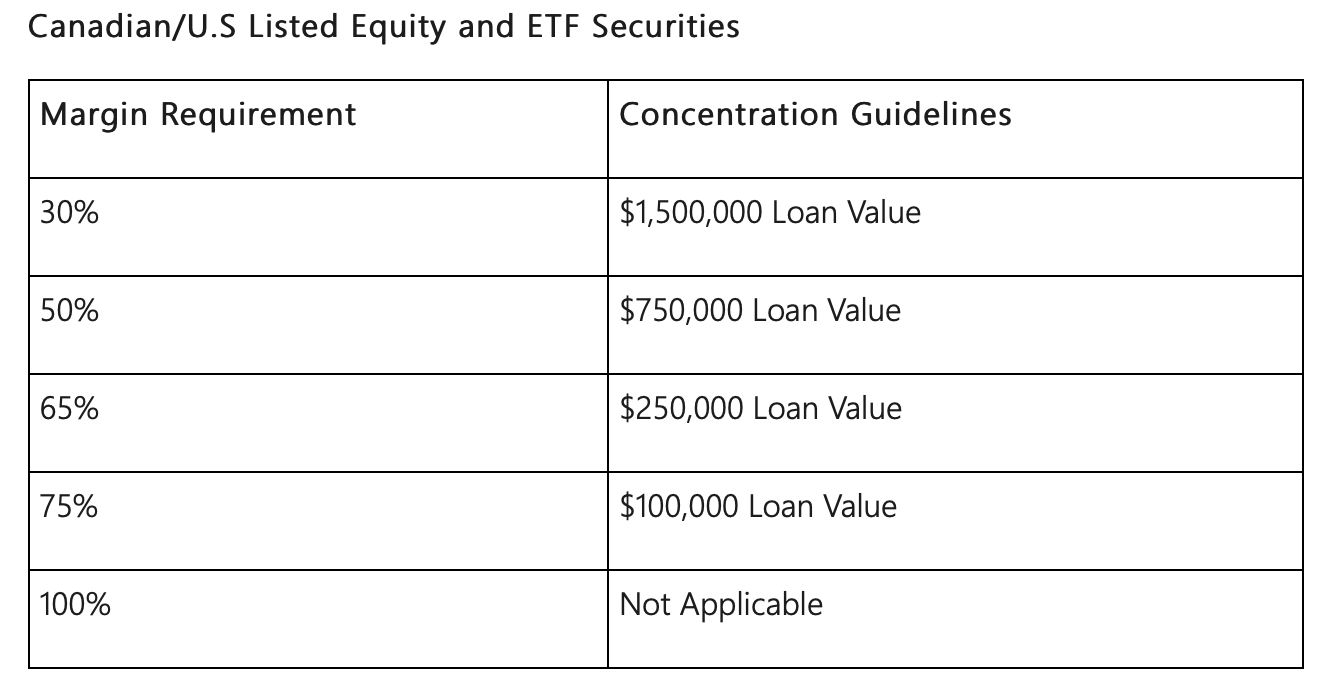

For example, the chart below shows the margin requirements at popular bank TD Canada Trust. If an investor is looking to begin margin trading and wants to buy a stock with a 30% margin requirement, this means TD will lend you 70% of the purchase price up to an amount of $1.5 million.

Once you successfully buy shares through margin, you must then monitor the performance of the individual stock, as well as how much margin you’re currently utilizing.

If you end up using too much margin, or if a stock price drops too far below the initial purchase price, you run the risk of receiving a margin call. Should this happen, you will need to add additional capital into your account (to fall back within your predetermined margin limits) or risk having the money in your account seized by the bank.

In simple terms, because a margin account allows you to borrow money to fund investment decisions, it opens the possibility that you may end up owing money to your bank. If a stock price declines in value, not only will you lose money from the investment, you will also have to pay back the amount you borrowed on margin (including interest).

Needless to say, margin accounts offer substantially more risk, as well as more reward for investors. By borrowing money, you significantly increase your working capital. However, if a stock declines past a certain point or too much margin is used, you run the risk of losing the entire investment amount while also having to repay your creditors.

Advantages of a Margin Account

- Access to More Capital: Utilizing margin gives investors incredible leverage to purchase more shares and make bigger trades. This allows margin traders to take advantage of stock market downturns quickly and efficiently.

- Better Potential Returns: Having access to more capital means the ability to make more frequent and larger trades, which hopefully leads to a higher investment return.

- More Investing Options: Margin accounts also allow for options trading and short selling, giving users more optionality and opportunity to profit from (both up and down) price movements.

Disadvantages of a Margin Account

- Exponentially More Risk: No doubt about it, margin accounts come with exponentially more risk than cash accounts, as using margins gives one the ability to lose significantly more money than they originally invested.

- Your Account May Become Suspended: When failing to meet a margin call, banks typically freeze the funds in one’s account and may even take any remaining capital as payment for money borrowed.

- Interest Payments: Just like any other loan, using margin to buy stocks means you will have to keep up with interest payments. This increases one’s trading costs and can eat into an investor’s profits substantially.

What is Short Selling?

Similar to investing using margin, short selling can be an extremely lucrative yet also extremely risky investment option.

More specifically, short selling (which is usually only available through a margin account) is when an investor bets on a stock price going down instead of up.

In order to profit from the share price falling, the investor creates a contract in which they borrow shares and then immediately sells them to another buyer. This contract allows for the short seller to re-purchase these shares back at a lower price and return it to the lender.

The difference between the price the investor sold the shares for initially and the price they later bought the shares back for is their profit.

Taking a short position can be extremely risky and is yet another way that investors may end up owing money if the investment doesn’t work out.

This can happen when a short position is initiated, but the stock price moves up instead of down. In this scenario, you will be assigned (or obligated to purchase) the shares at the higher price.

Whatever the price of shares is by the date specified in the initial short contract will be what you must buy the shares back for. This means your potential losses through short selling are unlimited.

For example, if you shorted a stock that was worth $100 and instead of dropping to $75, it rises to $125, you must buy this stock for $125 and return it to the lender. In this scenario, you lose $25 (or the difference between $100 and $125).

However, let’s say next time you purchase another stock, again at $100, but this time it rises to $1,000! Now, you must re-purchase these shares at the sky-high price of $1,000 and immediately return them to the lender. This time you lost $900.

As the two examples above show, partaking in short selling presents unlimited risk and the potential to owe money, as well as lose much more than originally invested.

Choosing to initiate short positions should only be done by experienced investors who understand and accept the risks of this type of investment strategy.

How to Minimize Risk From Your Investments

Whether you have a cash account or margin account, there are many things investors can do to limit their risk when investing in the stock market:

- Build a Diversified Portfolio: Having a diversified portfolio will help smooth out volatility and ensure investors aren’t overexposed to specific industries or other areas of the market. Regardless of whether you’re buying stocks through margin or with simple cash, a properly diversified portfolio will limit losses while optimizing return.

- Educate, Educate, Educate: Understanding the difference between cash and margin accounts, what short selling is, and how margin requirements work will help investors make better financial decisions. Investing is complicated, and educating oneself on the nuances of different styles, strategies, and account types will help investors limit their risk exponentially.

- Hold More Cash: Especially true for those with margin accounts, holding more cash in one’s account allows for greater flexibility and allows investors to capitalize on trending financial news and/or major price movements in a company’s share price.

- Utilize Your Stop Loss: A stop loss lets investors set a specific price where their shares will be automatically sold. Should a stock’s price suddenly drop in value, investors can rely on their predetermined stop loss limits to limit their potential downside risk.

- Create Long-term Financial Goals: Having well-thought-out investment goals will help investors gain more confidence in their investment decisions and help determine the level of risk their willing to accept.

Key Takeaway

Answering the question of what happens if a stock goes negative is completely dependent on the account type and investment strategy used.

For the most part, watching a stock decline isn’t the end of the world. Depending on whether or not you have a margin or cash account, your obligations and level of risk will vary substantially.

For those with margin accounts as well as those who are short selling, you not only could lose money from your investments, you may end up losing more money than you originally invested or even owe money to your bank.

Regardless of your strategy or brokerage account type, investors should be sure to understand their risk exposure and what could happen to their portfolio in different scenarios.

Whether it’s buying penny stocks in your cash account, margin trading, or even short selling, the best way to mitigate the risk of a stock going negative is to understand how different investing styles and account types create different consequences for investors.