In the world of investing, the term “equity” is a familiar one.

It represents ownership in a company, and investors often seek to acquire more of it to expand their stakes in promising ventures.

However, the concept of “Non-Dilutable Equity” is a bit less common but holds immense potential for savvy investors wanting to improve their investment returns.

In this guide, we will explore what non-dilutable equity is, its remarkable benefits, the different types of non-dilutive financing, and how to take advantage of it through your investment strategy.

Get ready to level up your investing game with non-dilutive equities.

What is Non-Dilutable Equity?

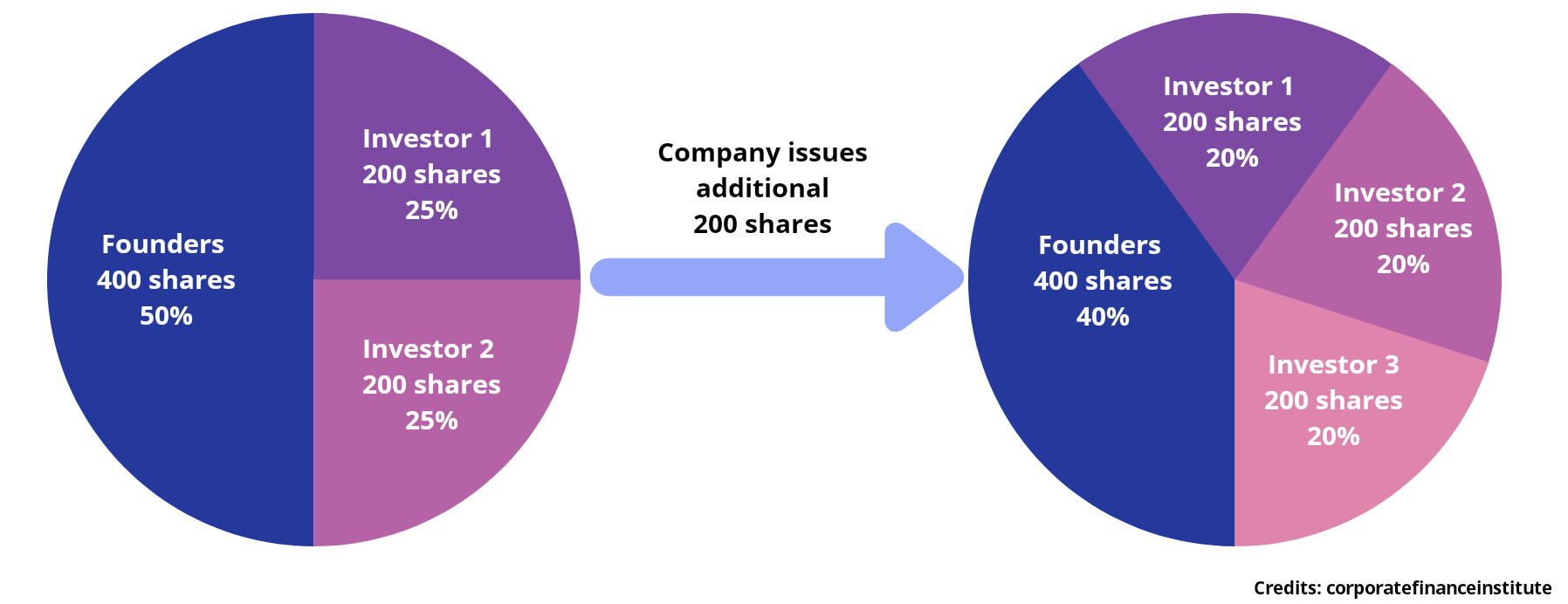

Image By: Alcor Fund

First things first, let’s unravel the concept of non-dilutable equity.

Simply put, non-dilutable equity refers to ownership in a company that doesn’t get watered down, or diluted, over time.

Traditional stock ownership through common shares can be sometimes diluted when a company issues new shares via equity financing, thereby reducing your proportional ownership stake.

This happens when a company is seeking to raise capital to grow or preserve the existing business, and typically occurs when it is not yet profitable on its own.

On the other hand, non-dilutive capital preserves your ownership percentage, which means your piece of the pie remains constant regardless of additional equity offerings.

It can be in the form of preferred shares, convertible notes, or other financial instruments that shield your equity from dilution.

Moreover, a business can buy back its shares in the open market which not only preserves your stake but also increases it in the process.

This is why it pays to find companies that are either offering non-dilutive financial instruments or are performing stock buybacks to maintain their current ownership structure.

What is Non-Dilutive Funding?

In that case, what exactly is non-dilutive funding and why might a company choose to use it over traditional financing strategies?

Non-dilutive funding refers to an innovative strategy for securing capital without relinquishing ownership or control over your business.

This can include a range of options including grants via government assistance, loans, tax credits, awards, licensing agreements, and other financial instruments that do not erode your share of the company.

As a result, the business’s existing owners can preserve their ownership and control in the company, while reducing its risk of failing through additional funds.

Dilutive vs. Non-Dilutive Funding: What’s the Difference?

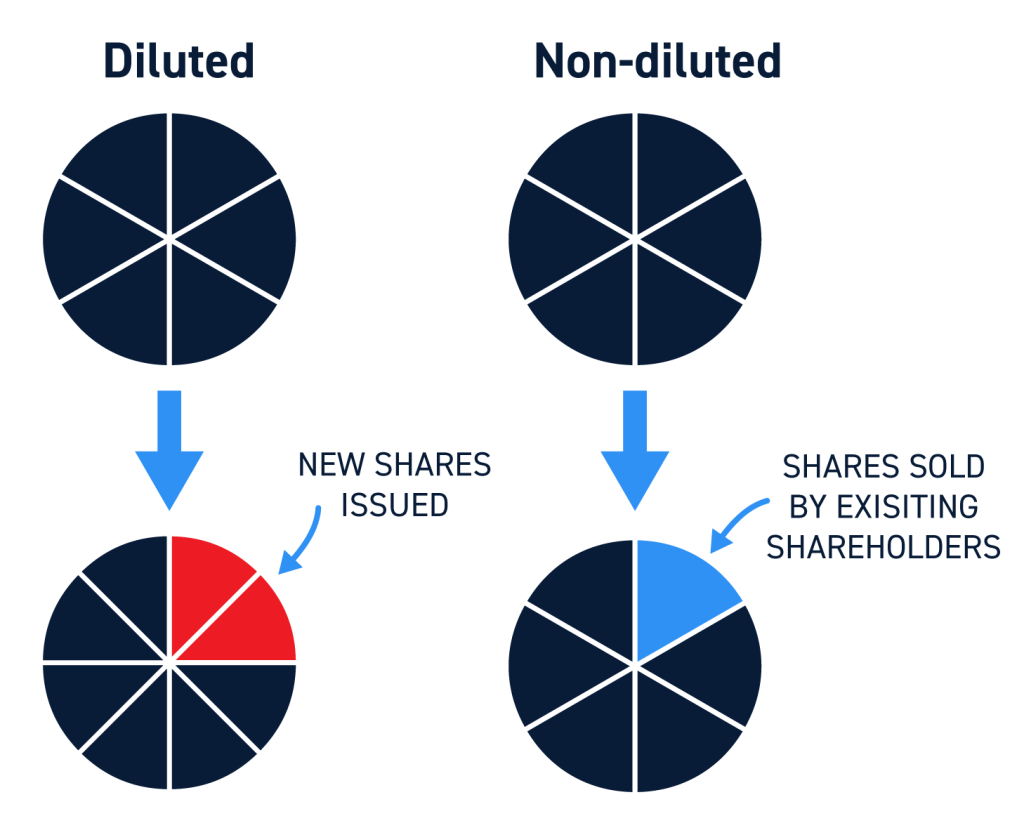

Image By: Centerpoint Securities

The difference between the two funding methods is that dilutive funding usually involves equity-based financing, like common shares, while non-dilutive financing aims to protect your equity stake either through preferential treatment or financial instruments with conversion features.

As mentioned before, when a company issues new common shares, this reduces the total amount of the business that you own if you were an existing shareholder.

This means more profits to spread about, and therefore less cash in your pocket.

If the company is publicly traded and does not pay a dividend, this can sometimes be hard to conceive because you don’t receive a portion of the income directly.

However, the rules still apply given that you are technically entitled to these retained earnings even though they remain within the company.

To illustrate this, let’s say that a publicly traded company has 100 million shares outstanding and earned $1 billion in profits last year.

This would imply an earnings per share of $10—if you owned 100,000 shares, you would be entitled to $1,000,000.

If the company’s profits remained constant, but they issued another 50 million shares, the earnings per share would decrease to $6.67, meaning that you would now be entitled to diluted earnings of just $666,667, a 33% decrease.

So, even though the company performed just as well as last year, in terms of profits made, you as an owner took a hit because your stake in the company fell from 0.10% to 0.067%.

It is for this reason that many investors prefer non-dilutive financing options, especially if they are investing in early-stage companies or venture capital.

Different Types of Non-Dilutive Financing

There are many different ways a business can raise money and access non-dilutive funding.

Here are a few of the most common methods:

1. Grant Funding

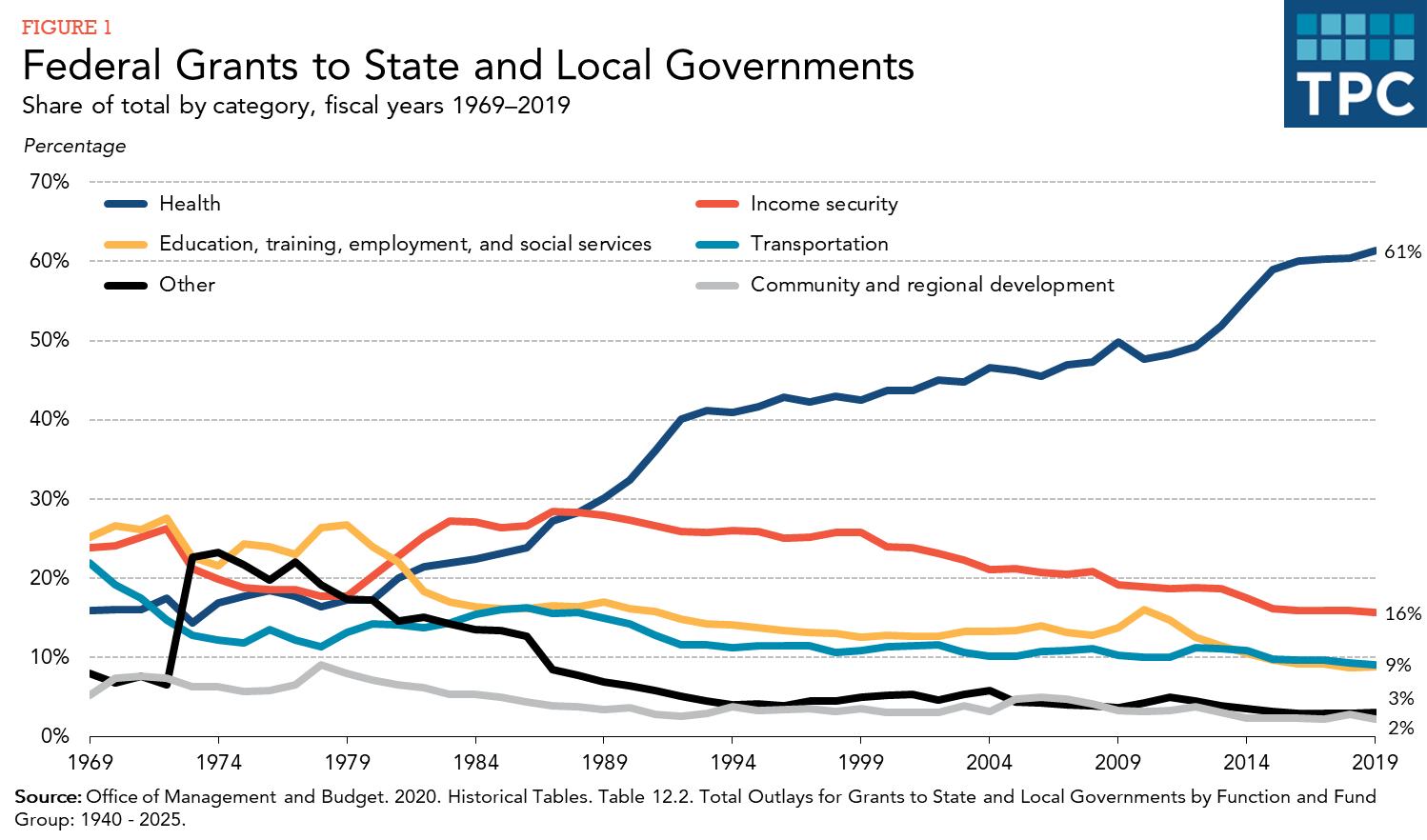

Image By: Tax Policy Center

Grants are financial lifelines given to businesses, entrepreneurs, and innovators to pursue their ventures.

These gifts, typically offered by government agencies, philanthropic organizations, and research institutions, do not require repayment and serve as the ultimate testament of faith in your vision.

The cool thing about government grants is that they not only provide crucial financial support but also offer a stamp of approval, enhancing your credibility in the eyes of investors and stakeholders.

You can learn more about receiving grants via the US Small Business Administration website—this includes grants under the Small Business Innovation Research (SBIR) and the Small Business Technology Transfer (STTR) programs.

2. Awards

Awards, on the other hand, are celebrations of your achievements.

They are often accompanied by monetary prizes, acknowledging your contributions to your field or community.

While not a direct infusion of capital, awards provide both recognition and financial support, which can be reinvested in your business, project, or personal growth.

This acts as a catalyst for motivation and can open doors to further non-dilutive funding opportunities in the future.

Some of the most notable entrepreneurship awards include the XPRIZE Foundation and The CANIE Awards.

3. Debt Financing

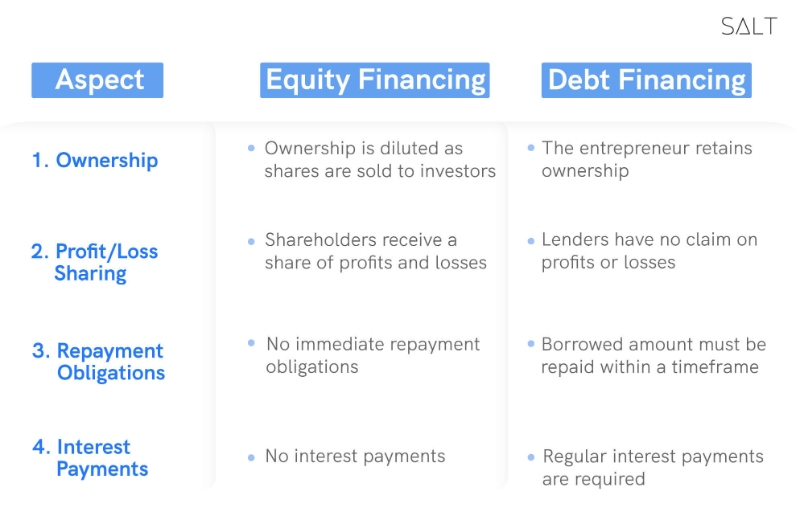

Image By: Salt

Debt financing is a powerful yet often overlooked tool in the world of non-dilutive funding.

It encompasses a variety of financial instruments, including traditional bank loans, venture debt, lines of credit, and peer-to-peer lending.

While these options involve repayment with interest, they don’t dilute equity ownership.

Instead, they offer a structured approach to acquiring capital that can be tailored to your business’s specific needs and growth plans.

Debt financing empowers you to secure funds without surrendering a portion of your hard-earned ownership.

4. Revenue Sharing Agreements

Revenue-based financing is a dynamic form of non-dilutive funding, creating a win-win situation for both businesses and investors.

In this arrangement, businesses agree to share a percentage of their revenue with investors for a defined period.

This method not only provides investors with a source of income but also allows them to partake in the success of the business.

For entrepreneurs, revenue-sharing agreements offer a financial boost while preserving their equity.

This dynamic funding option aligns the interests of both parties, fostering a sense of partnership and collaboration.

5. Licensing Agreements

Image By: Dependable Solutions

Licensing agreements are a compelling way for businesses to monetize their intellectual property, such as patents, copyrights, or trademarks.

By permitting other entities to use their proprietary technology or content, companies can generate revenue through licensing fees or royalties.

The beauty of licensing agreements is that they provide a consistent stream of income without diluting ownership.

Businesses retain their intellectual property rights and are free to explore additional licensing opportunities.

This form of non-dilutive equity funding leverages the value of your innovations, turning them into financial assets while maintaining your control and influence.

The Benefits of Non-Dilutive Funding

We have touched briefly on what makes non-dilutive funding so attractive, but there is more to the story.

Here are five reasons why you should consider using non-dilutive funding as a business owner:

1. Preserved Ownership

The primary reason for using non-dilutive funding is the preservation of ownership.

For entrepreneurs, this ensures that your ownership percentages remains untouched, safeguarding your control and influence over your business.

This means that you can chart your course and make critical decisions without the fear of losing your grip on your venture.

As such, your vision remains intact, and your equity ownership remains undiluted.

2. Reduced Risk

A non-dilutive funding round typically comes with terms that are more favorable for businesses and investors, thus making them less risky.

These terms can include fixed interest rates, structured repayment schedules, and various financial covenants that are often absent in equity investments.

For businesses, fixed repayment schedules offer predictability and allow for better financial planning.

As for investors, it provides them with a level of certainty about their returns, reducing the uncertainty in their investment portfolios.

3. Diverse Sources

Non-dilutive funding sources are as diverse as the businesses and projects they support.

This diversity provides a valuable advantage by enabling business owners to pick the funding source that aligns most closely with their specific needs and growth plans.

From grants and subsidies that serve as a financial boost and a testament to your vision to revenue-sharing agreements that establish dynamic partnerships, the variety in non-dilutive funding allows you to accomplish your ambitious goals in a variety of ways without giving up your equity.

4. Attraction for Investors

Non-dilutive funding is not only beneficial for businesses but also highly attractive to investors.

When a company demonstrates its commitment to preserving the value of its equity, it becomes a compelling proposition for investors who are seeking to invest in companies that prioritize their stakeholders’ interests.

Not only that but investors are naturally drawn to those companies that share their vision of long-term growth and financial stability.

As such, if you exercise all options before selling shares, it is a testament to your focus on shareholder well-being.

5. Enhanced Control

The final piece of the puzzle is the enhanced control that non-dilutive funding offers.

This control is critical for making strategic decisions that drive businesses forward.

With equity ownership intact and ownership percentages preserved, businesses can make pivotal choices without external interference.

Moreover, it empowers business leaders to pursue their vision, execute growth strategies, and adapt to market dynamics with confidence.

How to Know if Non-Dilutable Equity is Right for You?

As for investors, non-dilutable equity can be a game changer if you understand it well and know how to use it to your advantage.

However, it is essential to evaluate whether this strategy aligns with your unique financial goals, risk tolerance, and investment preferences.

Therefore, here are some considerations to help you decide if non-dilutable equity is right for you:

1. Income Focused Strategy

If you’re seeking a consistent source of income from your investments, non-dilutable Equity has much to offer.

Instruments like preferred shares often come with regular dividend payments, while revenue-sharing agreements offer a portion of a company’s earnings for a set period.

These provide you with a steady stream of income, that can help you achieve your financial objectives while preserving your ownership stake in the process..

2. Ideal for Risk Tolerant Investors

Non-dilutable equity often comes with preferential treatment, such as payouts or liquidation preferences.

These terms are designed to mitigate risk and offer a level of security that is not always present in traditional equity investments.

This is ideal for risk-averse investors or those looking to balance their investment portfolio and value stability in their investments.

3. Long-Term Investing

If you have a vision that extends well into the future and prefers stability over time, non-dilutable equity is a wise choice.

With consistency and preservation of ownership at the forefront, this strategy will allow you to build and safeguard your wealth over time, making it easier to secure a foundation for long-term financial growth.

4. Influence and Control

If maintaining control and influence over the companies you invest in is a critical consideration, then non-dilutable equity should be at the top of your list.

This strategy ensures that your ownership stake remains untouched, allowing you to make critical decisions and influence the direction of the business without external interference.

Whether you’re an entrepreneur who values strategic control over your venture or an investor (i.e. venture capitalist, angel investors, etc.) who seeks a say in the companies you support, there is no better opportunity to maintain your influence and control than through non-dilutable equity.

The Bottom Line

Non-dilutable equity is an effective way for a business to raise capital without diluting existing shareholders or reducing their influence.

This is extremely important if plan on building long-term wealth for yourself and your stakeholders because it creates stability and control within the business.

Therefore, even if you are unsure whether non-dilutive equity is right for you, it is certainly worth considering given the many advantages it has to offer.

Ideally, a business can sustain itself on its own through the generation of organic profits through the products and services it provides.

However, if a company requires more capital to achieve its goals, there may be no more cost-effective strategy than non-dilutive equity in the market today.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.