From the big screen to business, Ashton Kutcher’s talents know no limits.

Whether it’s acting in Two and Half Men, That 70s Show, or investing in Uber during its early days, Ashton Kutcher can do it all.

With a knack for tech startups, Kutcher and his partners have built multiple successful venture capital and private equity funds.

Now, these firms manage more than $1 billion in assets, owning some of the best tech companies in the world today.

In this article, we’ll explore Ashton Kutcher’s successful companies, some of their most fascinating investments, and their keys to great investments.

If you want to learn more about one of the most versatile actors alive, check out what Ashton Kutcher and his VC firms have in store.

What is Ashton Kutcher Investment Company All About?

Image By: A-Grade Investments

Building a successful venture capital firm is no easy feat.

It takes time, dedication, a strong network, and the right strategy to create an investment company that upholds investor values, while also generating superior returns.

Fortunately for Ashton Kutcher and Co, this isn’t their first rodeo.

Kicking things off, Kutcher co-founded an early-stage tech fund called A-Grade Investments in 2010, alongside entertainment manager Guy Oseary and billionaire Ron Burkle.

The fund’s investment philosophy was to find companies solving real problems for people and disrupting traditional industries.

To do so, A-Grade searched for technology startups with a strong mission and a passionate team, while working closely with the companies they invested in to help them grow and succeed.

This philosophy proved quite successful as the fund was able to turn $30 million into $250 million in just six years by investing in notable companies like Skype, Spotify ($3 million), Airbnb ($2.5 million), and Uber ($500,000).

Now, Kutcher’s firm has names like Mark Cuban, Y Combinator, and Andreessen Horowitz, joining him on the hunt.

But there’s more to the story.

What is Sound Ventures About?

Image By: Sound Ventures

Following the success of A-Grade, Kutcher founded a new firm in 2015 called Sound Ventures, located in Beverly Hills.

Similarly, Sound Ventures focuses on discovering early-stage technology companies spanning a variety of industries including fin-tech, enterprise software, healthcare, and more.

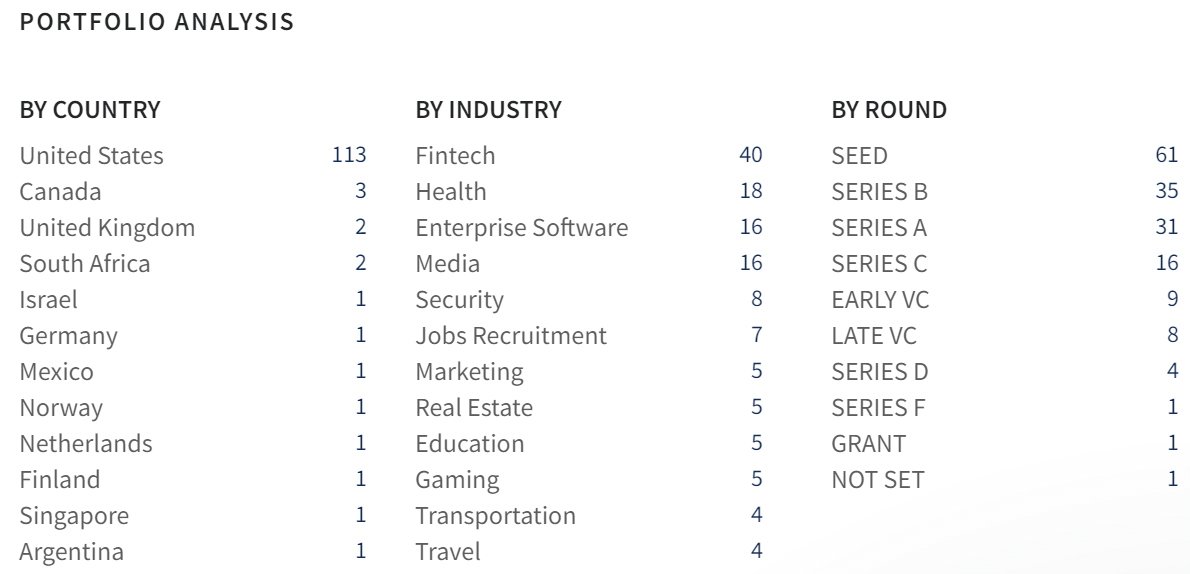

According to Dealroom, Sound Ventures holds a diversified portfolio with more than 100 assets.

These include unicorns like Warby Parker, Wefox, EquipmentShare, and others, as well as unicorn exits like Affirm and Lemonade.

More recently, the firm opened an AI Fund to capitalize on the emergence of artificial intelligence, whereby they were able to raise nearly $240 million.

Through it, the fund aims to invest in AI companies, particularly generative AI, as they believe it “is potentially the most significant technology we will experience since the advent of the internet.”

What’s more, co-founder Guy Oseary argues that the “companies we are backing will be at the forefront of this powerful innovation.”

Putting their money where their mouth is, Sound Ventures currently owns positions in some of the hottest AI companies today including OpenAI, Anthropic, and StabilityAI.

As you can see, Sound Ventures is determined to get on the ground floor of emerging technology, thus capitalizing on some of the fastest-growing markets today.

But you might be wondering, are Sound Ventures and A-Grade making blind bets, or is there more to their success than meets the eye?

What Makes Ashton Kutcher’s Investment Companies So Successful?

With so many notable investments at such a young age, it is clear that Ashton Kutcher’s investment companies have a knack for discovering high-value early-stage businesses.

But how exactly do they do it?

Well, there are a few key reasons why these firms have found so much success thus far.

The Kutcher Effect

Image By: The Economic Times

It pays to have a knowledgeable investor who also happens to be an A-list celebrity.

With Kutcher at the helm, Sound Ventures can attract notable investors and firms to partner with that are then able to help start-ups reach new markets and opportunities.

What’s more, Kutcher has built a strong network and reputation within the tech industry, thus making him and his business worth further consideration.

Not to mention, Kutcher can easily promote these companies in a way that few investors can.

As such, Kutcher’s funds are a valuable partner to have, from the perspective of early-stage companies, given that they not only receive the celebrity’s backing but also because the firm and its team have a track record of success growing tech startups.

A Sound Investment Philosophy

As mentioned earlier, Kutcher’s funds operate on the investment philosophy of finding companies that are solving real problems and disrupting traditional industries.

By having this model guide their decision-making, the company ensures that it focuses on highly competitive companies that are providing valuable services to their customers.

In turn, they avoid making the costly mistake of investing in businesses built on a dream rather than a proven business model.

This is similar to the way we invest here at Edge Investments given that we focus on stocks with durable competitive advantages and sound fundamentals.

Oftentimes, investors fall victim to the allure of a speculative investment that is being pumped on the premise of hype.

However, by focusing on healthy companies that are producing organic cash flows and tangible value, you can prevent significant risk simply by purchasing companies that are solving real problems.

All-in-all, Sound Ventures has a strong investment philosophy that is dictated by rational investing and knowledgeable foresight.

Diversification is Key

Image By: Dealroom

Given the highly risky nature of early-stage investing, it is important to be well-diversified to prevent one or two bad picks from ruining the entire fund.

As mentioned earlier, Sound Ventures has over 100 investments within its portfolio.

Not only does this mitigate risk, but it also increases their chances of success in finding a few great businesses that eventually turn into unicorns.

As Jeff Bezos once said, “Given a 10% chance of a 100 times payoff, you should take that bet every time.”

When it comes to venture capital, all you need is a few good picks to make millions.

What is the Most Interesting Investment Ashton Kutcher’s Investment Company Made?

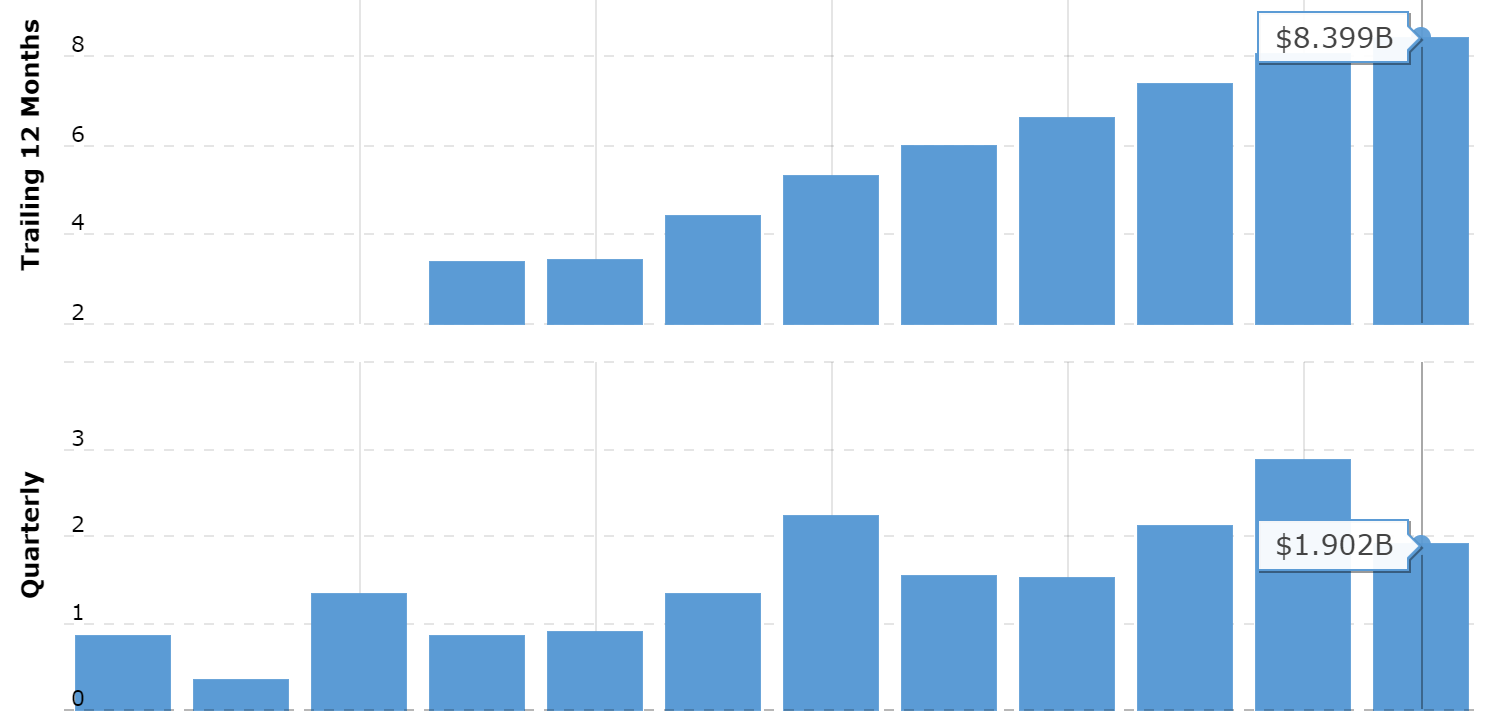

Image By: Macro Trends

You may be curious about what propelled Ashton Kutcher and his investment companies to so much success.

Well, one of his most interesting investments is in Airbnb, the online marketplace and hospitality service that allows people to rent their properties while helping travelers save money on accommodations.

In 2011, during an early funding round, Kutcher invested $2.5 million into the company.

Today, that position is worth nearly $90 million, meaning that they essentially 35x their bet.

Fundamentally, Airbnb is a solid business with a proven business model.

It has effectively grown its revenues year over, going from $4.81 billion in 2019 to $8.40 billion in 2022, a 20.46% annual increase.

What’s more, the company turned profitable last year, raking in a staggering $1.89 billion in 2022.

Plus, with over $9.6 billion in cash on hand and just $2.34 billion in total debt, AirBnB is in a very healthy financial position which will enable it to penetrate new markets while also strengthening its competitive advantages.

Overall, this is just one example of the many successful and interesting investments Ashton Kutcher’s venture capital firms have made.

An honorable mention goes to Thorn: Digital Defenders of Children, which aims to end the sexual exploitation of children and human trafficking.

With Sound Ventures now pursuing investments in revolutionary companies like OpenAI, it will exciting to see what moves they make next.

Final Thoughts

Based on everything we have learned about Ashton Kutcher and his venture capital firms, it is obvious that he and his team are excellent at finding highly successful startups.

A focus on companies solving problems and disrupting traditional industries, coupled with Kutcher’s network and reputation, means the funds are in a great position to capitalize on these lucrative opportunities for many years to come.

Now, Kutcher can chase happiness given that he is financially free and “can just worry about playing roles that [he] wants to play.”

This is a tremendous feat for the star actor and entrepreneur, who will profit well beyond what money provides him.

All-in-all, there is a lot that can be learned from him and his approach to life and early-stage investing.