Canada is home to many profitable ventures and is quickly becoming a technology hub in the modern world.

One industry in particular that is experiencing a massive upswing is the Canadian fintech space whereby the likes of Shopify, Lightspeed Commerce, and other tech companies are making their mark.

What makes this industry so fascinating is that it is in direct competition with a traditional financial system that has stood for centuries.

But by going digital, businesses and households are quickly discovering new ways to save money and manage their finances more efficiently.

As such, the adoption of fintech products is growing exponentially, increasing from 18% in 2017 to 50% in 2019.

And with new opportunities being discovered every day, it may soon become the standard of financial infrastructure for many years to come.

Luckily, you have an opportunity to take advantage.

In this article, we will explore the Canadian fintech landscape and offer you 10 of the best Canadian fintech stocks available in the stock market today.

If you wish to be a part of the future of finance, then continue reading below to see what these Canadian companies have in store.

It is only a matter of time before civilization goes fully digital, and this is a great way to capitalize on it.

What are Fintech Stocks

Fintech stocks are publicly traded companies that operate in the financial technology industry.

The term “fintech” refers to any company that uses technology to provide financial services like payments, lending, investments, insurance, and banking.

These businesses tend to be at the forefront of innovative technology, leveraging tools like artificial intelligence to disrupt traditional financial services.

They can do so because financial technology requires less labor and capital, thus making it more affordable and efficient for customers to make smarter financial decisions.

However, fintech companies can be considered riskier than other equities since this sector is constantly evolving and under scrutiny from regulators.

That is why it is important to understand growth stocks like these if you want to make the most of your money.

Overall, there are many opportunities to be had in this market, but only if you have a high degree of confidence in the stocks you own

Types of Fintech Stocks

There are six types of fintech stocks, each operating in its niche.

However, there tends to be overlap between the types of fintech services a company will offer, therefore, a business may operate in multiple segments at once.

Here are the six main types of fintech stocks available in the market today:

- Payment Processors: These companies allow consumers and businesses to conduct electronic transactions and accept payments online (ex. PayPal).

- Online Lenders: These companies provide loans to customers and small businesses via an online lending platform (ex. SoFi).

- Digital Banks: These companies are online banks that operate entirely online, offering financial services, like personal finance, that you typically expect to receive from a traditional bank. In most cases, this is how major financial institutions operate today (ex. Neo Financial or TD Bank).

- Insurtech: These companies leverage data analytics and artificial intelligence to conduct Insurance Services like underwriting and risk management (ex. Policygenius).

- Wealth-tech: These companies offer investment services like portfolio and wealth management, robo-adviso-s, and access to financial markets (ex. Questrade).

- Cryptocurrency: These companies allow customers to actively trade in-store digital assets like Bitcoin and Ethereum (ex. Coinbase).

Top 10 Canadian Fintech Stocks

Without further adieu, here are the top Canadian fintech stocks in the market today.

Propel (PRL.TO)

Market Cap (CAD): $223.801 Million

Propel is a Canadian fintech company offering consumers and businesses proprietary credit solutions.

Through its brands, MoneyKey, CreditFresh, and Fora, the company offers a robust and automated online platform that makes lending convenient and accessible.

With a heavy emphasis on customer service and support, the company ensures that it establishes trusted long-term relationships with clients.

Coupled with a diverse and innovative product offering, Propel is in a position to serve a wide range of customers and businesses, all the while benefiting from a profitable business model.

Over the past few years, propel has grown consistently, achieving revenues of USD 157 million and net earnings of USD 10 million in the first three quarters of 2022 alone.

This in turn has produced an operating margin of 13.45% and a return on Equity of 19.27%.

While it is profitable based on its most recent Financial data, one should be cautious given that the company has over USD 150 million in debt and just over USD 7 million in cash on hand.

Since it is still in its growth stage this may not have a huge impact but it is still worth being cautious about.

All-in-all the company has a proven business model and is worth exploring further.

Sylogist (SYZ.TO)

Market Cap (CAD): $121.779 Million

Sylogist is a software as a service (SaaS) company providing customers with a wide range of software solutions that help them manage their operations more efficiently through financial management, human resources, and customer relationship management software.

It offers comprehensive ERP, CRM, fundraising, education administration, and payment solutions that allow its customers to carry out their operational objectives.

The company has over 2,000 customers globally that include various levels of government, nonprofit and non-governmental organizations; this includes educational institutions and publicly funded companies as well.

With over 30 years of experience, the company has built a strong reputation for serving the public sector, focusing on high-quality software solutions that help it foster a loyal customer base.

In recent years, Sylogist has demonstrated steady financial performance achieving revenues of CAD 50 million TTM and earnings of CAD 2.8 million TTM.

Moreover, the company has managed an operating margin of 9.06% and a return on equity of 6.53%.

With just over CAD 26 million in debt on its balance sheet and CAD 13 million in positive operating cash flows in the last year, the company is in a great position financially, overall.

That being said, at this time, Sylogist may be overvalued given that it is currently trading at a price-to-earnings ratio of 43.82.

Therefore, the best thing you can do before investing is to evaluate the current position of the company and determine whether the business is trading at a justifiable market valuation.

If you’d like to learn more about how we value growth like Sylogist, check out this article.

Nuvei (NVEI.TO)

Market Cap (CAD): $7.976 Billion

Coming in at 3rd on our list, Nuvei is a payment technology company that provides payment processing and payment gateway services to merchants all around the world.

The company offers a wide range of solutions that includes processing credit and debit cards, electronic check conversion, online payment processing, mobile payments, point-of-sale systems, and more.

With a massive global presence and operations in over 200 markets and 600 payment methods, the company is one of the largest providers of payment solutions in the world.

As such, it has been able to create valuable partnerships with other notable payment technology providers like PayPal and Visa, thus allowing it to expand its services even further.

On top of that, Nuvei achieved exceptional growth in recent years going from USD 246 million in revenue in 2019 to over USD 981.01 million in the TTM, implying a compound annual growth rate of 48.47%.

Though it has only been profitable for two out of the four most recent years, it made over USD 19.90 million and produces an operating margin of 12.96%, thus making it the most profitable company on our list.

However, Nuvei is in a similar position to Sylogist given that it is trading at a PE ratio of 88.80.

At such a high valuation, an investment at this time would most likely perform poorly, therefore it is best to sit patiently and wait for this fintech company to fall in price before buying shares.

But, as one of the best Canadian fintech stocks on our list, its success should not go dismissed either.

Goldmoney (XAU.TO)

Market Cap (CAD): $114.47 million

Possibly the most interesting company on our list, Goldmoney is a fintech company providing precious metal-based investment and payment solutions.

The company offers a range of precious metal investment opportunities including metals like gold, silver, platinum, and palladium.

Through its platform, Goldmoney allows customers to buy, sell, and store these precious metals in various forms, including coins, bars, and digital currency.

What’s more, the company offers Goldmoney prepaid credit cards that allow customers to spend their gold, and other precious metals, at stores where Mastercard is accepted.

To facilitate these transactions, the company leverages blockchain technology to provide customers with real-time access to their holdings, ensuring that the integrity of every transaction remains intact.

With such a unique value proposition, it is no wonder why the company made over CAD 337.78 million in sales in the TTM.

But, given that its assets are highly correlated with the precious metals markets, Goldmoney’s financial performance may be more volatile, thus making its future less predictable than other fintech stocks on this list.

That being said, it has still proven to be profitable in the past making it an interesting choice, especially with it trading below its book value, at a price-to-book of just 0.67.

And with only CAD 219 thousand in debt as of 2023, Goldmoney is certainly worth considering as a potential investment.

Payfare (PAY.TO)

Market Cap (CAD): $248.19 million

Another one of the larger companies on our list, Payfare is a Canadian financial technology company providing mobile banking and payment solutions for gig economy workers in North America.

Through its platform, Payfare, clients gain access to earnings, as well as banking services such as ATM withdrawals, fund transfers, bill payments, and savings wallets.

This mobile business model appeals to gig workers because it provides them with a convenient way to manage their finances on their own, without the need for a traditional banking service.

What’s more, Payfare’s proprietary technology makes financial and expense management a user-friendly experience, allowing users to track earnings in real-time, while also being able to manage expenses effectively.

Coupled with its partnership programs that include the likes of Uber and Lyft, Payfare is making it easier for gig workers to manage their finances and earnings in one place.

In terms of financial performance, Paper has been growing rapidly in recent years, Going from just CAD 6 million in revenues in 2019, to over CAD 162.16 million in the trailing twelve months.

This has helped the company achieve profitability as it has now earned CAD 5.48 million over the TTM.

Plus, with no debt debt and over CAD 17.41 million in operating cash flows, Payfare is demonstrating what it takes to become a high-performing Canadian fintech company.

Overall, Payfare is one of the higher-quality fintech businesses on our list.

Shopify (SHOP.TO)

Market Cap (CAD): $76.58 billion

Moving on to everyone’s favorite Canadian company, Shopify is a leading e-commerce platform that enables businesses of all sizes to create online stores and sell products or services to customers around the world.

The company provides a wide range of tools and features that help businesses of all sizes create and customize their online stores, manage inventory, process payments, and track sales and customer data.

Its platform was designed to be super user-friendly, allowing businesses to conduct all of their operations online without the need for extensive technical expertise.

As such, Shopify’s customers have benefited greatly from its services as they expand the reach of their businesses and even the playing field against larger corporations.

This in turn has made it one of the most recognizable brands in the world, serving over 1 million businesses in over 175 countries, including the likes of Mr. Beast and Kylie Cosmetics.

Though Shopify is certainly a valuable business, it is difficult to justify investing at its current market cap valuation of CAD 76.58 billion.

Given that the company posted a USD 2.02 billion loss, it is unlikely that it can maintain its market value unless the economic conditions improve drastically.

But, with the threat of a recession looming, the probability of that happening in the next couple of years is slim to none.

Therefore, the best thing you can do is keep Shopify on your radar and wait for its price to correct.

That way, you can achieve a margin of safety by purchasing the stock at a lower valuation.

In this instance, Shopify is a great example of an excellent business that is overvalued.

While you may argue that the quality of the asset is enough, legendary investor Howard Marks puts it best when he says, “investment success doesn’t come from “buying good things,” but rather from “buying things well.”

In other words, for an investment to be successful, it primarily depends on the price you are willing to pay.

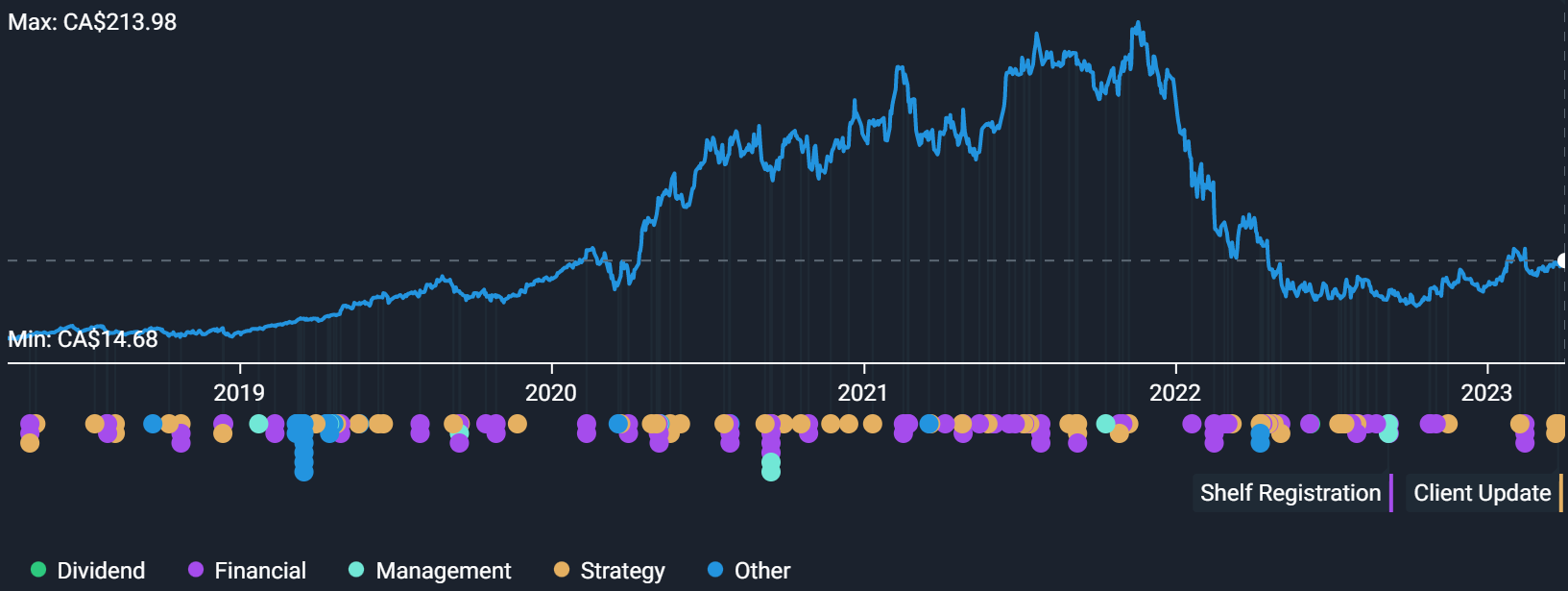

Lightspeed Commerce (LSPD.TO)

Market Cap (CAD): $3.02 billion

Lightspeed Commerce is a Software as a Solutions (SaaS) platform that enables small and midsize businesses to engage with consumers, manage operations, and accept payments conveniently and reliably.

The company’s cloud-based platform is designed to help its customers manage their retail operations by providing a suite of software tools that enable them to sell online, in-store, and on the go.

With a user-friendly and customizable design, it is a popular choice for businesses and now serves customers in over 100 countries worldwide.

By offering a comprehensive suite of software tools, Lightspeed Commerce allows its customers to streamline their operations and consolidate their software into a single platform.

This not only helps to mitigate costs but also improves the value a business creates since its customers gain insight from the data that Lightspeed collects which they can then use to refine their model.

As for its financial performance, Lightspeed Commerce has been increasing its sales year over year, going from USD 121 million in 2020 to USD 765.71 million in revenue in the TTM.

That being said, the company has yet to turn a profit and its losses appear to be increasing quickly, growing from USD 57 million in 2020 to over USD 1.02 billion in the trailing twelve months.

Fortunately, Lightspeed Commerce is sitting on a massive cash pile of USD 780.28 million.

But, if the company continues to try and grow at its current rate, it may run into difficulties thus requiring it to raise additional capital which can be tough in a challenging market.

However, given that its total debt is only USD 24.46 million, the risk of bankruptcy is quite low, making it a viable candidate for additional funding.

Plus, with a price-to-book ratio of just 0.77, it appears that there may be a worthwhile opportunity to invest in Lightspeed Commerce at this time.

That being said, it is a good idea to conduct your own research so that you are fully aware of the risks involved when investing.

The last thing you want is to be shocked if your investment falls 50% in the short run.

But all-in-all, Lightspeed Commerce is another quality asset.

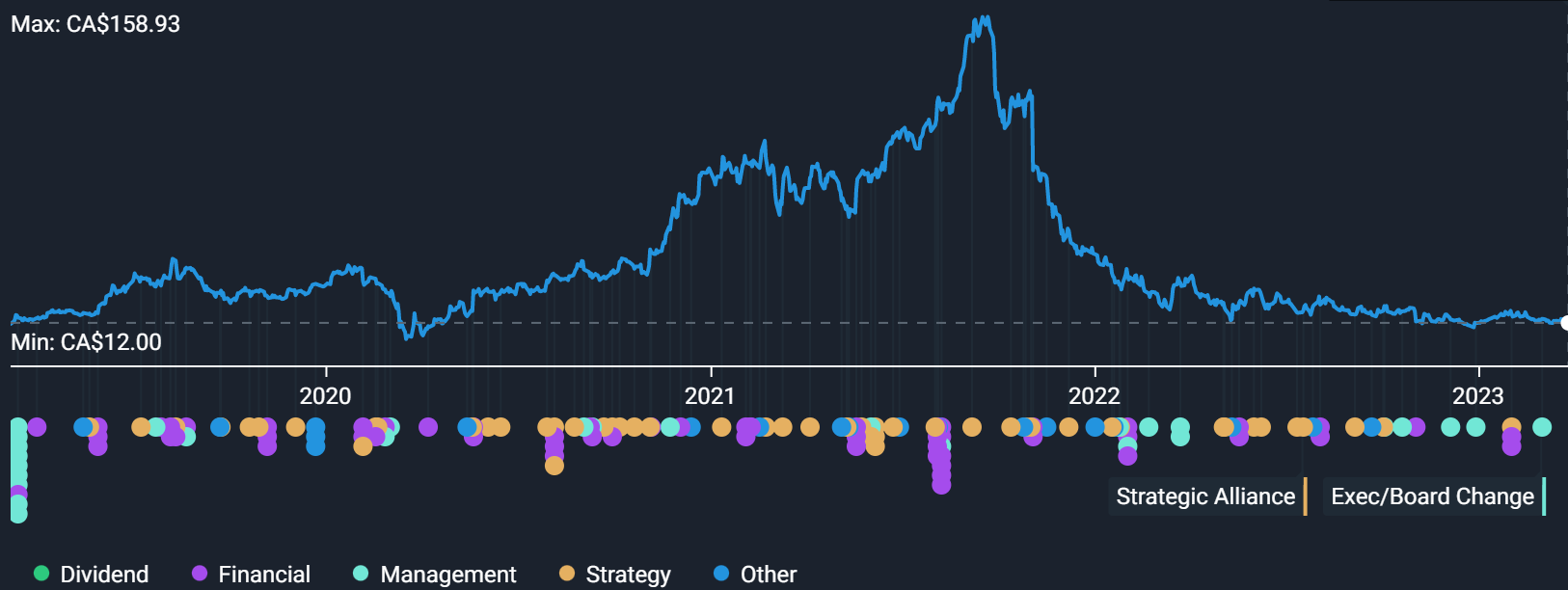

WonderFi Technologies (WNDR.TO)

Market Cap (CAD): $81.18 million

If you are an investor seeking to diversify into cryptocurrency and blockchain technologies, then WonderFi Technologies could be the best way for you to increase your exposure.

WonderFi is a financial tech company with a primary focus on decentralized finance solutions (DeFi) and is backed by Dragons’ Den’s Kevin O’Leary, as well as other notable institutional investors.

The company uses blockchain technology to offer fast, secure, and transparent financial services such as lending, borrowing, staking, yield farming, and more.

WonderFi’s goal is to make DeFi accessible to everyone by providing a user-friendly platform that enables easy participation, without the need for extensive technical knowledge.

In addition, the company uses a competitive pricing strategy for its products and services which helps to attract and retain users.

In doing so, WonderFi has created one of the most reputable DeFi platforms on the market.

This in turn has resulted in it achieving revenues of CAD 6.48 million in the TTM.

However, even though the company has created some value for the marketplace, it is susceptible to greater risk compared to the other fintech stocks on our list, making it a less worthy investment candidate overall.

If you have been following any of the recent news surrounding crypto-based assets, then you are fully aware of the intense government scrutiny that these companies are facing.

What’s more, cryptocurrencies are inherently risky since they are unproven and extremely volatile, making WonderFi’s future earnings unpredictable.

Lastly, WonderFi is in direct competition with much larger players like Coinbase and Binance, thus making it difficult for the company to maintain a sustainable competitive advantage over the long run.

This is reflected by the company’s poor financial position, though to be fair, it is still a relatively young business.

But, with poor economic conditions, and too much uncertainty surrounding crypto assets, it is probably best that you hold off from investing until WonderFi’s business model is more proven.

In general, if you are planning to invest in Canadian fintech, there are better candidates on this list than WonderFi at this time.

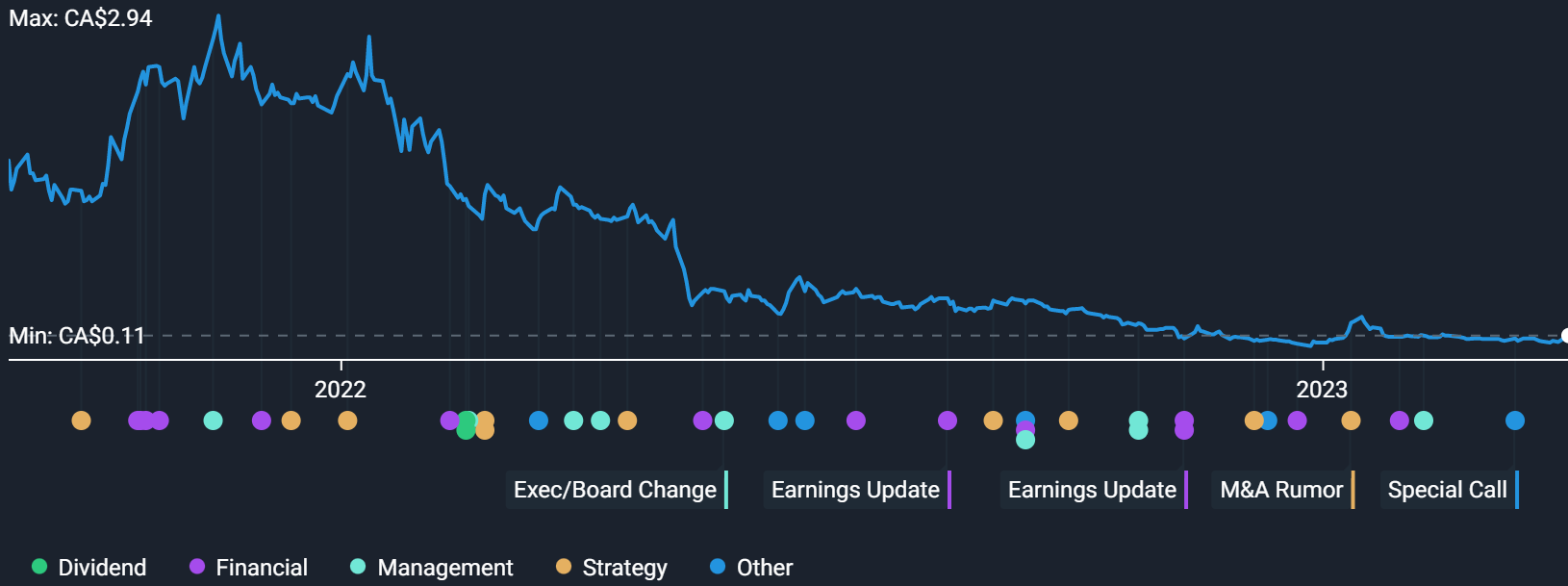

Tenet Fintech (PKK.CN)

Market Cap (CAD): $22.796 million

Tenet Fintech Group is the parent company of a wide array of fintech and artificial intelligence subsidiaries.

Through its subsidiaries, Tenet provides AI-based services to small and medium businesses through its Business Hub platform.

Business Hub is a global ecosystem where artificial intelligence and analytics are used to create opportunities and facilitate B2B transactions among its members.

For example, its Cubelar AI and analytics engine matches lenders and borrowers to provide access to financing solutions across a variety of industries.

Since its business ecosystem is AI-enabled, it can collect vast amounts of data and learn from it, thus providing optimal solutions for clients in real-time.

This not only increases its value exponentially, but it also means that Tenet’s products will be more applicable to a wider range of businesses as its database grows.

From there, Tenet should be able to increase its value offering as long as competitors cannot replicate its platform and ecosystem.

So far, Tenet is proving to be a success given that the company was able to grow its revenues from CAD 11.7 million in 2019 to over CAD 121.80 million in the trailing twelve months.

But, with mounting losses of CAD 67.97 million in the trailing 12 months, and only CAD 1.09 million cash on hand, it seems that it will be difficult for Tenet to continue growing at its current rate unless it can raise additional capital or become profitable.

That being said, at a price-to-book of just 0.30, there may be an opportunity to acquire this business at a discount, as long as Tenet finds a way to improve its cash position.

Overall, an investor should remain cautious when investing in Tenet given its underwhelming financial position, however, it is at least worth exploring further.

Mogo (MOGO.TO)

Market Cap (CAD): $30.2 million

Taking up the last spot on our list, Mogo is a Canadian fintech business providing a wide range of digital financial services, including personal loans, mortgages, credit monitoring, and digital payments.

The company strives to help its users take control of their financial health by offering a variety of easy-to-use, low-cost, and innovative financial products and services.

Through its user-friendly technology, Mogo attracts customers that prefer a simple and intuitive user experience.

Coupled with a comprehensive suite of financial products, the company is essentially a one-stop shop for people looking to resolve a variety of personal financial needs.

This in turn enabled Mogo to create a strong presence and one of the most recognizable brands in the Canadian fintech market.

While Mogo Has become a household name, this does not mean that it is a worthwhile investment.

Since 2019, the company has struggled to grow its market share YoY, posting revenues of CAD 59.8 million in that year, and only CAD 66.29 million in the TTM.

On top of that, Mogo’s losses continue to rise to go from CAD 10.8 million in 2019 to over CAD 111.83 million in the TTM.

Although it does have a decent cast position of CAD 21.09 million, it also has a significant debt burden of CAD 84.97 million.

For these reasons, it is probably best to avoid investing in Mogo until it improves its financial status and demonstrates a more competitive position in the marketplace.

Why Invest in Canadian Fintech Stocks

While the Canadian fintech industry is still relatively young, there are many reasons to believe that it will eventually become a foundational piece of the Canadian economy.

For one, 78% of Canadian consumers use at least one fintech payment or money transfer service today, demonstrating its high adoption and usefulness in the Canadian Market.

In addition, Canada boasts a skilled and educated labor force meaning that Canadian fintech companies can attract and retain top talent compared to competitors elsewhere.

On top of that, it also means that these companies will be paid more dollars given that Canada is one of the most developed countries in the world, and its citizens earn an above-average income.

This is reflected by the higher total transaction values achieved in the market’s largest segment, Digital Investment, which is forecasted to reach $3.8 billion in 2023.

Lastly, the global fintech market as a whole is ripe for growth.

According to EMR, global fintech is to reach USD 492.81 billion by 2028, growing at a compound annual growth rate of 16.8%.

With such high growth internationally, coupled with strong domestic demand, it is no wonder why Canadian fintech achieved so much buzz.

In general, Canadian financial technology companies are worth consideration as a component of your portfolio.

Final Thoughts

The Canadian fintech market is a promising sector with ample opportunity for growth.

But, as demonstrated by the companies on our list, your success investing in this market ultimately depends on the companies you invest in and the price you are willing to pay.

So, if you want to make the most out of Canadian fintech stocks, focus on those that are both profitable and increasing their market share.

Not only will you protect yourself from any unforeseen risks, but you will also own assets that are better equipped to endure tough market conditions.

As investors, our goal first and foremost should be to not lose money.

The best way to do so is by investing in stocks that are highly productive and do not require outside capital to stay afloat.

For the most part, Canadian fintech achieves just that.