In today’s fast-paced financial landscape, staying ahead in the trading game requires a blend of strategic prowess and cutting-edge technology.

This is where emerging new AI tools like ChatGPT could potentially swing the tide in your favor.

While ChatGPT has created tremendous value for its users, there are limitations to its uses, making it essential to understand the artificial intelligence language model before allowing it to influence your investment decisions.

If you do, then ChatGPT can be an incredibly powerful asset that will take your investment game to the next level.

In this article, we will explore the good, the bad, and the ugly when using ChatGPT trading strategies.

Let’s explore how AI-powered automated trading systems and strategies might transform your trading skills forever.

What Is the Most Profitable Trading Strategy?

The quest for the most profitable trading strategies is a pursuit as old as trading itself. But it’s important to understand that there isn’t a one-size-fits-all solution.

Different strategies work for different traders, and profitability depends on a variety of factors, including risk tolerance, market conditions, and individual skill sets.

Some notable trading strategies include:

- Day Trading

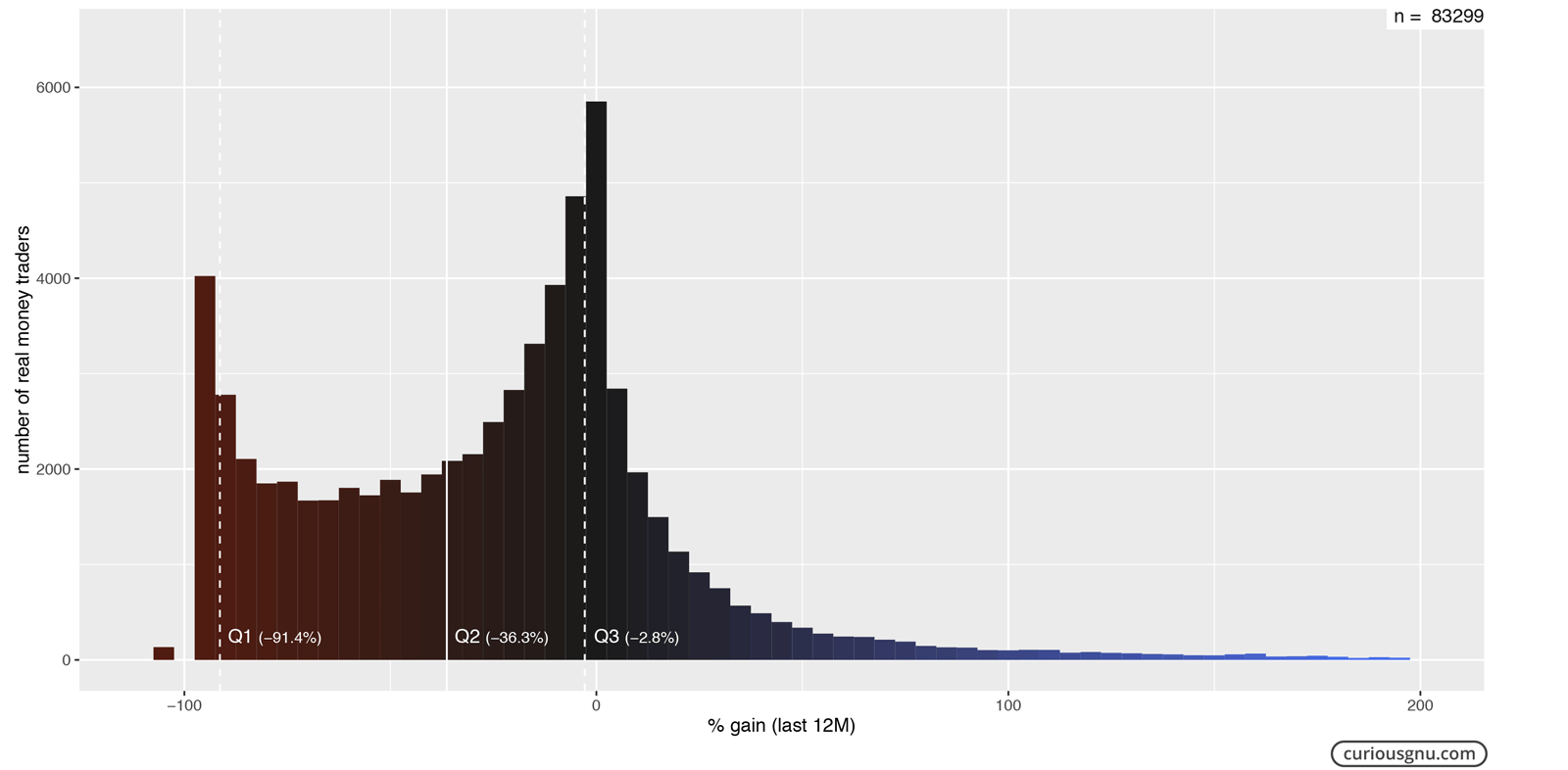

Image by: CuriousGuru

Day trading is a dynamic trading strategy where active traders buy and sell financial instruments, such as stocks or currencies, within the same trading day.

These traders use technical indicators and capitalize on short-term price movements, aiming to profit from fluctuations in asset values.

With its fast-paced nature and potential for quick gains, day trade investing offers an exhilarating opportunity for those seeking to engage actively in the financial markets.

- Swing Trading

Don’t want to watch your screen all day? Swing trading is another technical investing approach where traders aim to capture short to medium-term price swings in financial markets, holding positions for a few days to a few weeks.

By identifying trends and capitalizing on price movements, swing traders seek to achieve gains within a defined time frame.

This method offers a balanced combination of active involvement and flexibility, making it an appealing choice for individuals looking to navigate the markets with a bit more time on their side.

- Trend Following & Momentum Trading

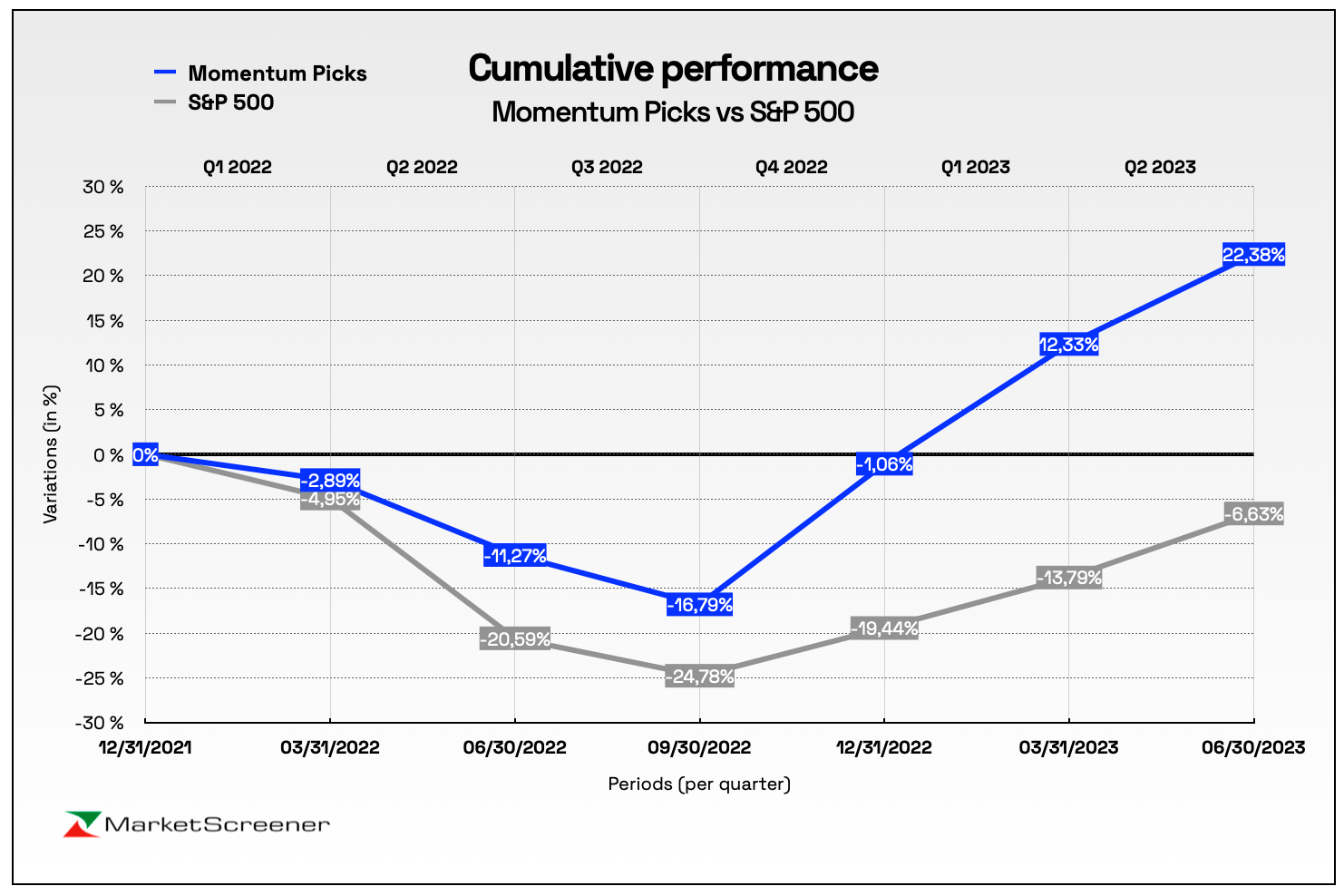

Image by: MarketScreener

Trend following, or momentum investing, is an investing strategy where investors identify and ride existing market trends using a combination of technical indicators and financial models.

Generally, traders buy when the trend direction is upward and sell when it’s downward, aiming to profit from the prevailing momentum.

This strategy leverages the principle that markets often exhibit trends, providing a systematic and disciplined way to potentially capture profits while navigating the ever-changing currents of the financial world.

- Value Investing

Value investing is a fundamental investing approach where investors seek out stocks that they believe are undervalued by the market.

By analyzing a company’s fundamentals, such as earnings, assets, and growth potential, value investors aim to find hidden gems that have the potential to appreciate over time.

This patient and methodical philosophy is the same strategy has been embraced by legendary investors, like Benjamin Graham and Warren Buffett, emphasizing the wisdom of buying into quality companies at a price that offers a margin of safety and the promise of long-term growth.

- Growth Investing

Image by: Finscreener

Growth investing is a strategic approach where investors focus on companies with the potential for rapid expansion and substantial earnings growth.

These companies typically reinvest their profits into innovation, expansion, and market dominance rather than distributing dividends.

By identifying such high-potential ventures early on, growth investors aim to ride the wave of innovation and capitalize on the exciting journey of companies as they scale to new heights.

- The Edge Investments Strategy

Edge Investments uses a combination of value and growth investing to find high-quality compounders trading at a discount.

We seek out businesses that are reinvesting their profits to generate superb growth and patiently wait to buy them when they are trading at a meaningful discount to their intrinsic value.

By using this approach, our goal is to leverage the best of both strategies, thus improving our odds of beating the stock market over the long run.

What Is the Best Proven Trading Strategy?

There is no perfect strategy, however, some methods have more profitable trades than others.

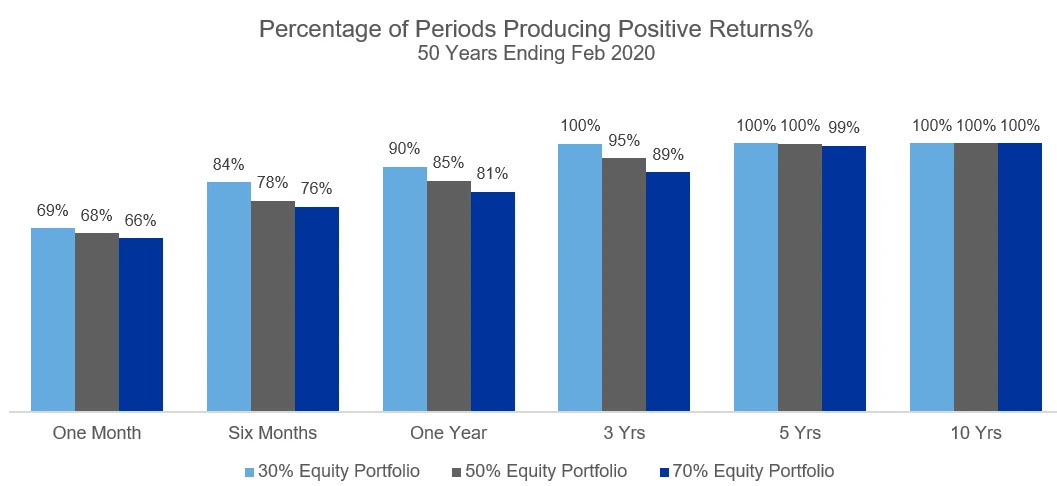

For one, long-term investing (i.e. greater than one year) is a profitable strategy that has clearly demonstrated its ability to achieve higher success rates than those strategies whose holding periods are much shorter.

That’s because over a long period, stocks have an increased likelihood of trading near their fair value, which tends to improve over time as the company reinvests its profits and improves its fundamentals.

On the other hand, when you invest for shorter periods, you tend to leave your success up to unpredictable factors, such as emotional responses, that have very little to do with the fundamentals of the business.

As Benjamin Graham puts it, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Image by: Russell Investments

In addition to a long time horizon, it is also better to own excellent businesses with sound fundamentals as opposed to weak, and sometimes highly volatile companies.

Look for those stocks with enduring competitive advantages, rational and trustworthy management teams, as well as predictable financial performance.

In general, these businesses are much easier to own because there is a higher degree of certainty that they will exist for many years to come.

If you can buy them at a discount to what they are worth, you may even find yourself owning an asset that generates consistent market-beating returns for your portfolio.

Though we are clearly biased toward this investment approach, there are few methods as proven and time-tested as the long-term fundamental investing strategy.

If you don’t believe me, check out these legendary investors’ strategies to learn more.

Image by: ValueSider

Can ChatGPT Help With Trading Strategies?

With the various trading strategies in mind, it is time to discuss how ChatGPT can be used as a financial instrument to help elevate your investment game.

Whether you’re new to trading or an experienced investor, this AI language model can provide you with risk management tools, insights, information, and analysis that can enhance your decision-making process.

Here is how:

- Market Research

ChatGPT can help you stay updated on market risk, trends, news, historical price data, and events that might impact your trading decisions. It can quickly sift through vast amounts of information and present you with relevant insights, allowing you to make well-informed choices.

When using ChatGPT, I will ask it to perform SWOT analyses on companies, while searching for market catalysts as well. These provide me with an in-depth look into the businesses I am considering as potential investments.

- Idea Generation

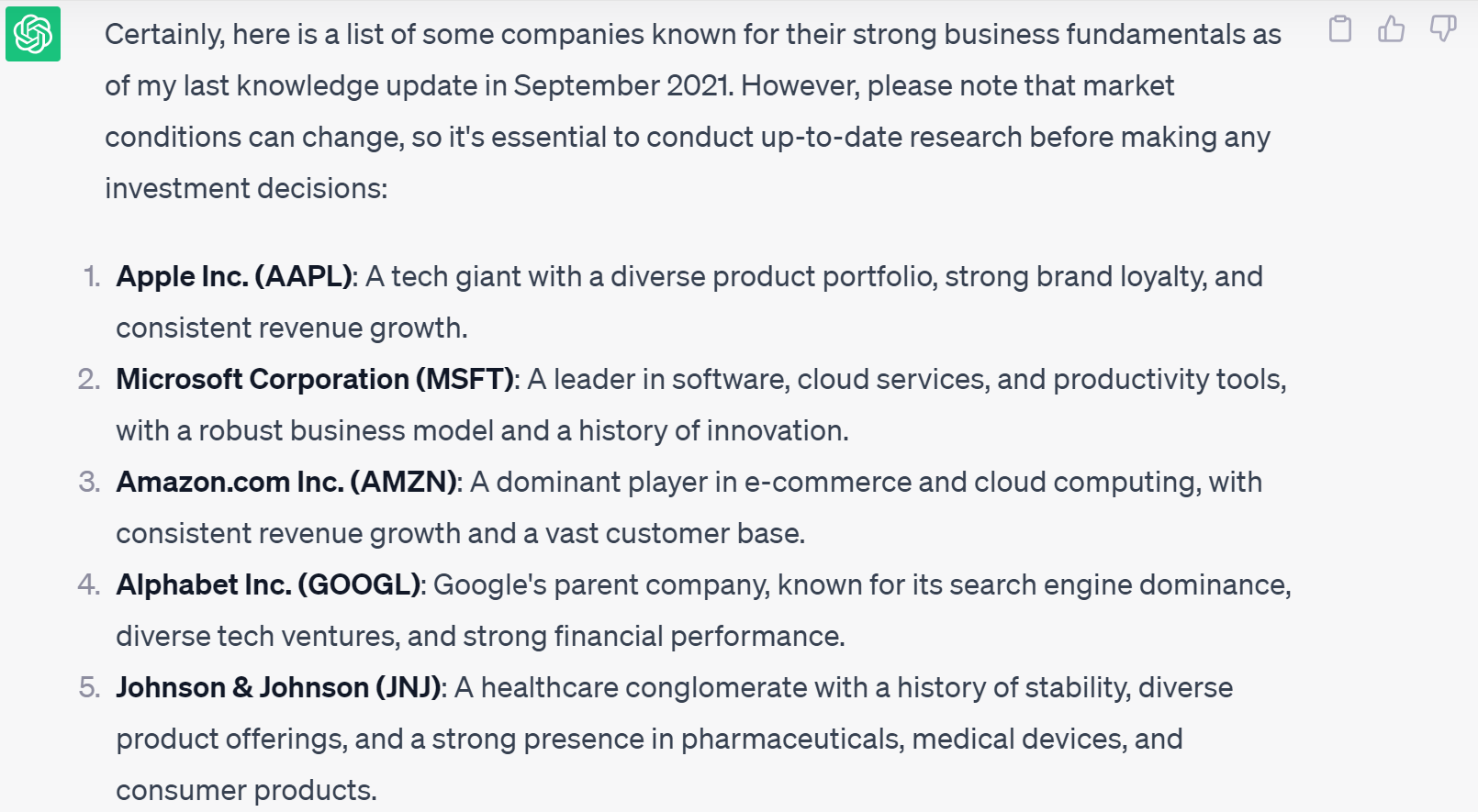

Image by: ChatGPT

ChatGPT is a great tool for brainstorming and generating potential trade ideas based on your preferences and current market conditions. It can consider technical and fundamental indicators to propose strategies worth exploring.

Personally, I have found it most useful when I want to learn more about a company’s main competitors. This helps me gain insight into the industry and figure out which business has the greatest potential for long-term success. As such, I expose myself to new potential buying opportunities that I may have overlooked.

- Risk Management

Managing risk is crucial in trading. ChatGPT can assist you in understanding the risks and fundamental flaws associated with various trades, helping you determine appropriate position sizes and stop-loss levels to protect your investments.

In my process, I use ChatGPT to assess the risks associated with individual stocks. This brings to light many of the potential red flags I may have overlooked. As such, I can adjust my portfolio accordingly based on how likely I believe these risks will come into effect.

- Educational Resource

If you’re new to trading, ChatGPT can serve as a knowledgeable mentor, explaining trading concepts, terminology, and strategies in a simple and approachable manner. This educational aspect can empower you to make more confident decisions.

ChatGPT has been quite instrumental in teaching me about various markets and industries. Moreover, it is a great tool for discovering legendary investors and their philosophies for success. Though I still do my own digging, ChatGPT sets me on the right path for discovery as new questions pop into my mind.

- Technical Analysis

For technical traders, ChatGPT can be helpful in assisting with technical analysis by interpreting charts, patterns, and indicators. It can identify potential entry and exit points for trades, enhancing your ability to time the market effectively. Additionally, it can be a price behavior explorer, pinpointing stocks with abnormal volatility.

Though useful, be sure to conduct your own analysis as well because there are limitations to what ChatGPT can do. In general, it is best to use ChatGPT as a supplemental tool rather than an absolute decision-maker. You’d hate to find yourself making the wrong decision based on one of its recommendations.

- Scenario Analysis

Curious about how different events could impact your portfolio? ChatGPT can help you perform scenario analysis by considering various hypothetical situations and their potential outcomes depending on your settings and trades.

I personally enjoy the doomsday scenario where I explain to ChatGPT the historical financial performance of a business, and then see how a significant decline in revenue and increase in operational costs affects the short and long-term outlook of the company. In doing so, I can gauge more clearly how a business will perform in turbulent times.

- Decision Support

Sometimes, trading decisions can be emotionally driven. ChatGPT offers an unbiased perspective, helping you evaluate your choices based on logic and data rather than emotions.

This is the most important insight ChatGPT has to offer. Though it’s great to discuss investments with other investors, they may not always give you an honest or critical answer because they don’t want to force you into making an emotional decision based on their opinion. However, if you were to ask the same hard questions to ChatGPT, it would give you a blunt and honest response that is solely based on logic and the information available to it. This is monumental as it takes the emotion out of investing which is oftentimes the biggest reason why investors fail to beat the market.

Can ChatGPT Predict Stock Trends?

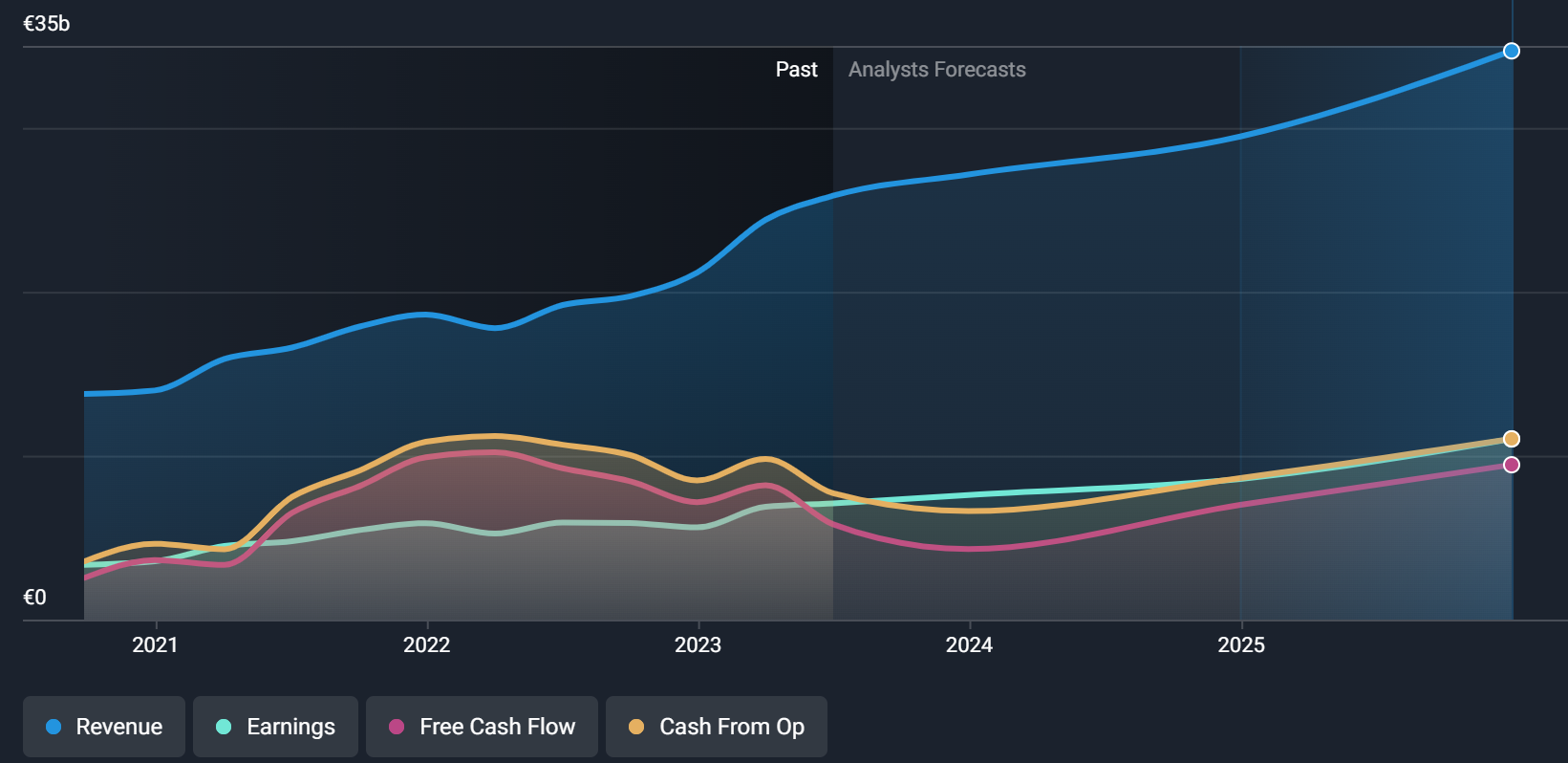

Image by: SimplyWall.St

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – John Kenneth Galbraith

While ChatGPT can provide valuable insights, including sentiment analysis and information on stocks, I would be highly skeptical of anything (i.e. trading bot) or anyone that can accurately predict market trends consistently.

As mentioned earlier, it is best to use ChatGPT as a supplemental tool as opposed to a decision-maker.

For one, the stock market is a highly unpredictable place with an infinite number of factors affecting its day-to-day fluctuations.

Moreover, it is driven by humans who are inherently emotional creatures.

This combination of unpredictable events and human emotion makes it nearly impossible to forecast where a given stock is headed in the next hour, day, or year.

However, over the long run, it may become easier to predict how a business will perform based on its history of success, valuation, and prevailing market conditions.

To put it simply, a good business, with an intelligent and loyal management team, a sustainable moat, and profitable financial characteristics is likely to outperform one with a dishonest management team, weak fundamentals, and negative cash flows.

Use ChatGPT to help you find businesses with attractive characteristics and avoid those that are unlikely to survive over the long term.

How to Create a Trading Strategy Using ChatGPT

Now that you’re armed with insights into how ChatGPT can elevate your trading strategy, let’s dive into a comprehensive guide that empowers you to harness its full potential.

Step 1: Define Your Objectives and Risk Tolerance

Begin by crystalizing your investment goals. Are you seeking rapid gains, long-term growth, or a balanced approach? Gauge your comfort level with potential losses—assess your risk tolerance. Tailoring your strategy to align with your financial aspirations and risk appetite is a crucial foundation.

Step 2: Gather Historical Data

Embrace the power of historical data. Whether your interests lie in stocks, commodities, or cryptocurrencies, amass a treasure trove of historical information. This treasure trove will be the cornerstone for identifying patterns, correlations, and trends that will steer your trading strategy.

Step 3: Research Market & Business Fundamentals

Leverage ChatGPT’s prowess to unravel the fundamental forces at play. Dive deep into economic indicators, industry dynamics, global events, business financials, competitive advantages, and management teams to shape the assets worth keeping on your radar. With ChatGPT’s insights, you’ll comprehend the underlying significance of these factors, enriching your strategic perspective.

Step 4: Formulate Trading Hypotheses

Forge a dynamic collaboration with ChatGPT to craft intelligent hypotheses. Blend your research and analytical prowess with AI-generated insights. This combination will help create a balanced perspective that will propel you to new levels of understanding.

Step 5: Invert the Story

Now, flip your hypothesis on its head. Use ChatGPT to nitpick every detail of your hypothesis to ensure that you’ve uncovered every possible risk that could undermine your investment. By challenging your assumptions, not only will you protect yourself, but you’ll also understand the business better than anyone else.

Step 6: Stay Disciplined

Investing can be overwhelming so master the art of discipline. Emotional impulses can steer you astray, but ChatGPT can be a great anchor helping you adhere to your well-thought-out strategy. More importantly, it will ensure that you never make ill-informed decisions purely based on emotion. In investing, it is those who control their emotions that find the most success.

Step 7: Monitor and Review

Last but not least, forge an unbreakable cycle of improvement. Continually monitor your strategy’s performance, inviting feedback from seasoned traders and financial advisors. ChatGPT’s insights will delve into performance data, guiding you toward potential enhancements. The world of investing is always changing so it pays to embrace new information and evolve your thinking.

Final Thoughts

Trading with ChatGPT is a great way to take advantage of the world’s most modern AI technology.

But remember, the stock market is very unpredictable and nothing is for certain.

Therefore, ChatGPT should primarily be used as a supplemental tool that can help elevate your research process, not as a financial decision-maker.

In the end, you want to figure out a strategy that works best for you and leverage the data and insights that ChatGPT can offer.

In doing so, you’ll create a productive process that maximizes both your and AI’s unique skillsets.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.