Chat GPT is perhaps the most fascinating invention of the early 21st century.

In just a few months, the generative artificial intelligence agent built by Open AI broke the internet when it surpassed 100 million users.

Now, at least 1.8 billion people visit the platform every month.

Due to the hyper-fast adoption of this generative AI technology, Open AI has transcended beyond the typical startup, acting as the poster child of an artificial intelligence explosion.

Everywhere you look, businesses and investors are proclaiming the use of AI technology that is helping them achieve unprecedented results.

But as the euphoria builds, one must ask themselves, has all this AI hype gone too far, or is the beginning of something special?

In this article, we’ll break down the company behind the AI madness, offering you its pros and cons, ways that you can take advantage, and whether you can buy ChatGPT stock or not.

Whether you believe that AI will change the world or it is simply a fad, this analysis will help you better understand one of the most fascinating companies to ever exist.

What is ChatGPT?

You may have heard of, or perhaps, even used ChatGPT, but what is it exactly?

ChatGPT is a large language model, a form of generative artificial intelligence, that is designed to understand and generate human-like text.

These models have been trained on vast amounts of text from the internet, which helps them learn about the world and how language works.

They can understand written instructions or questions and generate relevant responses based on that understanding.

ChatGPT, an AI chatbot built on the LLM, was created by Open AI, an organization focused on creating AI technology that benefits all of humanity.

OpenAI was founded in 2015 by Elon Musk, Sam Altman, Greg Brockman, Wojciech Zaremba, Ilya Sutskever, and John Schulman.

The company first made headlines in 2018 following the release of its first language model iteration, GPT (Generative Pre-trained Transformer).

It had 117 million parameters and was trained on a massive dataset of web pages and books.

Since then, Open AI has continued to develop its GPT architecture and is now on its fourth iteration.

But the crazy thing is how quickly it is evolving.

To put it into perspective, GPT went from 117 million parameters (GPT-1) to 1.5 billion parameters (GPT-2) to 175 billion parameters (GPT-3) to more than 1 trillion parameters (GPT-4)—in just six years!

This unprecedented growth speaks to the unique scalability and adaptability of not only Open AI’s GPT but artificial intelligence in general.

Interestingly, Chat-GPT 4 is only one of Open AI’s hit products, as the company also broke the scene with the introduction of Dall-E 2, the AI-based realistic image generator.

Combined, these two platforms are transcending Open AI into a new realm of fortune and possibilities.

How to Invest in ChatGPT Stock?

Unfortunately, ChatGPT, or Open AI for that matter, is not a publicly traded company, meaning that it does not openly trade in the stock market.

Instead, the best way to own OpenAI is through Microsoft (MSFT), which announced in January 2023 that it would invest as much as $10 billion into the company.

The Open AI and Microsoft partnership is a massive deal creating major opportunities for both businesses.

On one hand, Microsoft is helping Open AI with capital injections and exclusive access to the tech giant’s cloud computing services.

This allows Open AI to scale its business and strengthen its competitive advantages a lot quicker than it otherwise would.

On the other hand, the tech giant is gaining exposure to one of the most promising companies in the world while also being able to integrate OpenAI’s AI into Microsoft’s Bing search engine.

Based on a report by Semafor, the deal is structured to provide Microsoft with 75% of OpenAI’s profits until it recuperates its investment, then a 49% stake in the company afterward.

With Open AI allowing its employees and early investors, like venture capital firms, to sell their shares at a valuation of $29 billion, it is clear that there is significant upside potential for the company.

Pros and Cons of Chat GPT Stock

While Open AI may be a private company, one should still consider the potential opportunities and risks tied to the business or AI stocks like it.

Here are a few…

Pro: The Artificial Intelligence Industry Has Huge Upside Potential

It is no surprise that artificial intelligence is sweeping the globe, and businesses are taking advantage.

Whether it is semiconductor businesses building graphics processing units, biotech companies creating new life-changing drugs, or EV manufacturers creating self-driving cars, there are plenty of opportunities to capitalize on this generational technology.

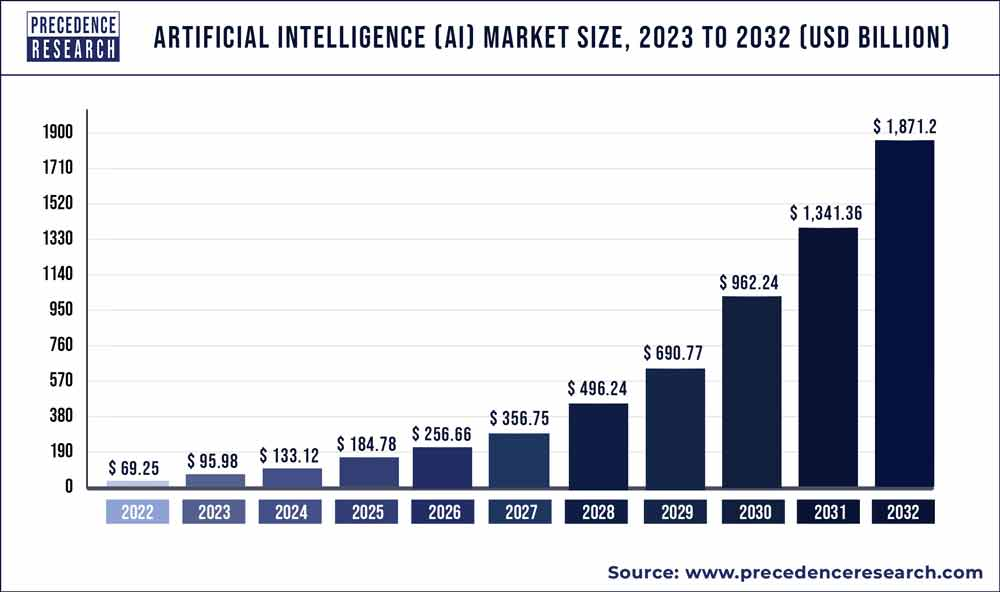

In all, the global artificial intelligence market is projected to hit $1.812 trillion by 2030 and grow at an annual rate of 37.3%.

Though you cannot invest in Open AI directly, don’t be discouraged, as there are plenty of promising publicly traded companies out there. Check out these stocks to help you get started.

Pro: AI Companies Generate High Margins

One of the most effective ways to compound your capital quickly is by investing in high-margin businesses.

AI software is the perfect example of this because these companies require very little additional capital to fuel or sustain growth.

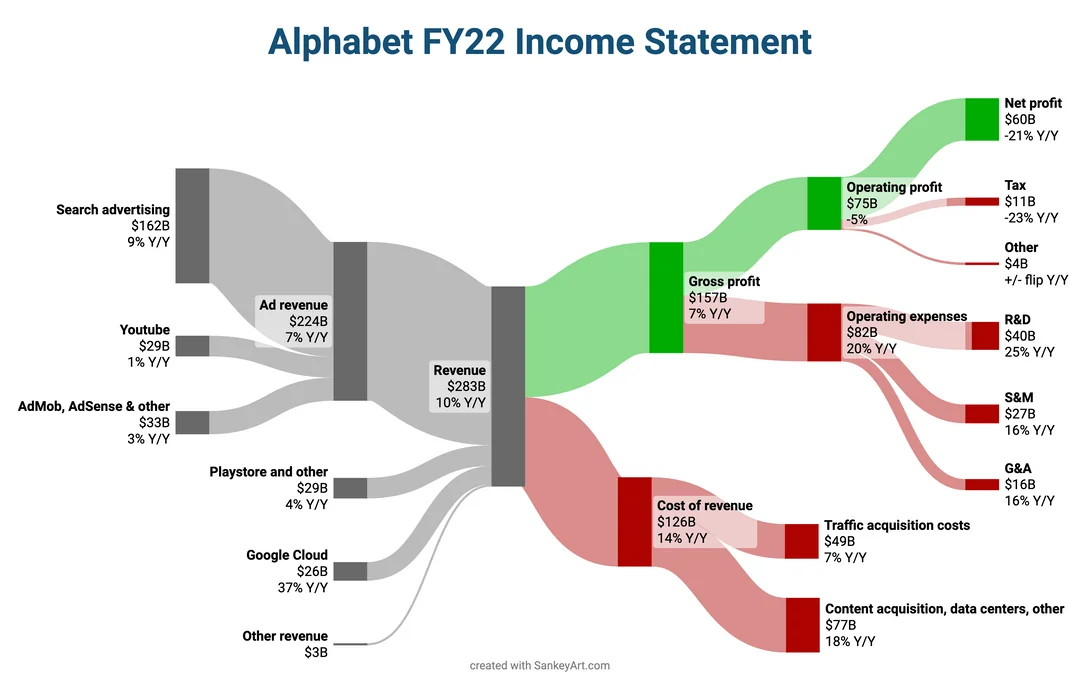

Take Meta’s social media platforms or Alphabet’s (Google’s parent company) search engine business, for example.

After both companies launched their respective products, all they had to do was sit back and relax as they watched their networks compound exponentially without any additional investments.

Of course, these businesses want to protect their moats and exploit new opportunities, so they reinvest, but the business model principles hold true.

For context, Meta and Google’s average net profit margin over the past five years is 30.59% and 23.29%, respectively.

Con: AI is Dangerously Competitive

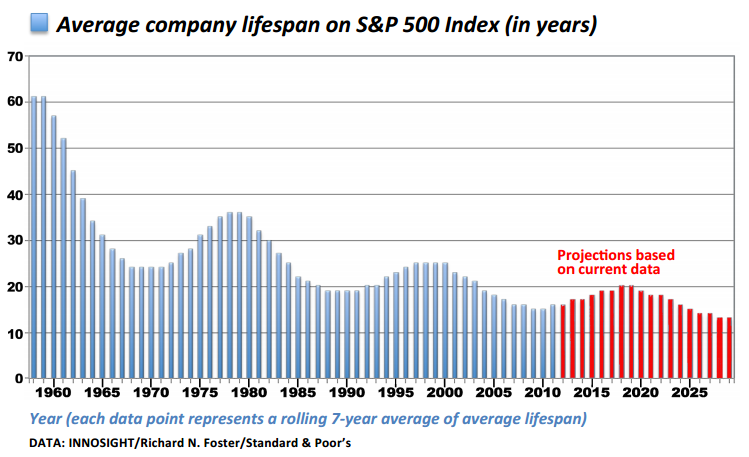

In 1958, the average lifespan of companies listed in Standard & Poor’s 500 was 61 years.

Today, it is less than 18 years. With the emergence of new technologies, the stock market has grown exponentially more competitive, making it significantly more difficult to sustain long-term success.

This is even more true when it comes to artificial intelligence stocks since the technology is quite young and constantly evolving.

Maintaining your position as the top dog requires constant innovation and investment.

But oftentimes, even that is not enough since there is always something new and exciting lurking around the corner.

Hell, even Jeff Bezos said that Amazon will inevitably die.

Con: Young Companies Burn Cash, Fast

To reach the top, it requires a brilliant team, a phenomenal product, and a whole lotta cash.

OpenAI is a prime example of this, as the company spent over $540 million last year, with costs expected to grow even higher in the coming years.

To mitigate this, the company launched its $20 per month subscription plan, ChatGPT Plus, which provides users with access to its more advanced AI technologies.

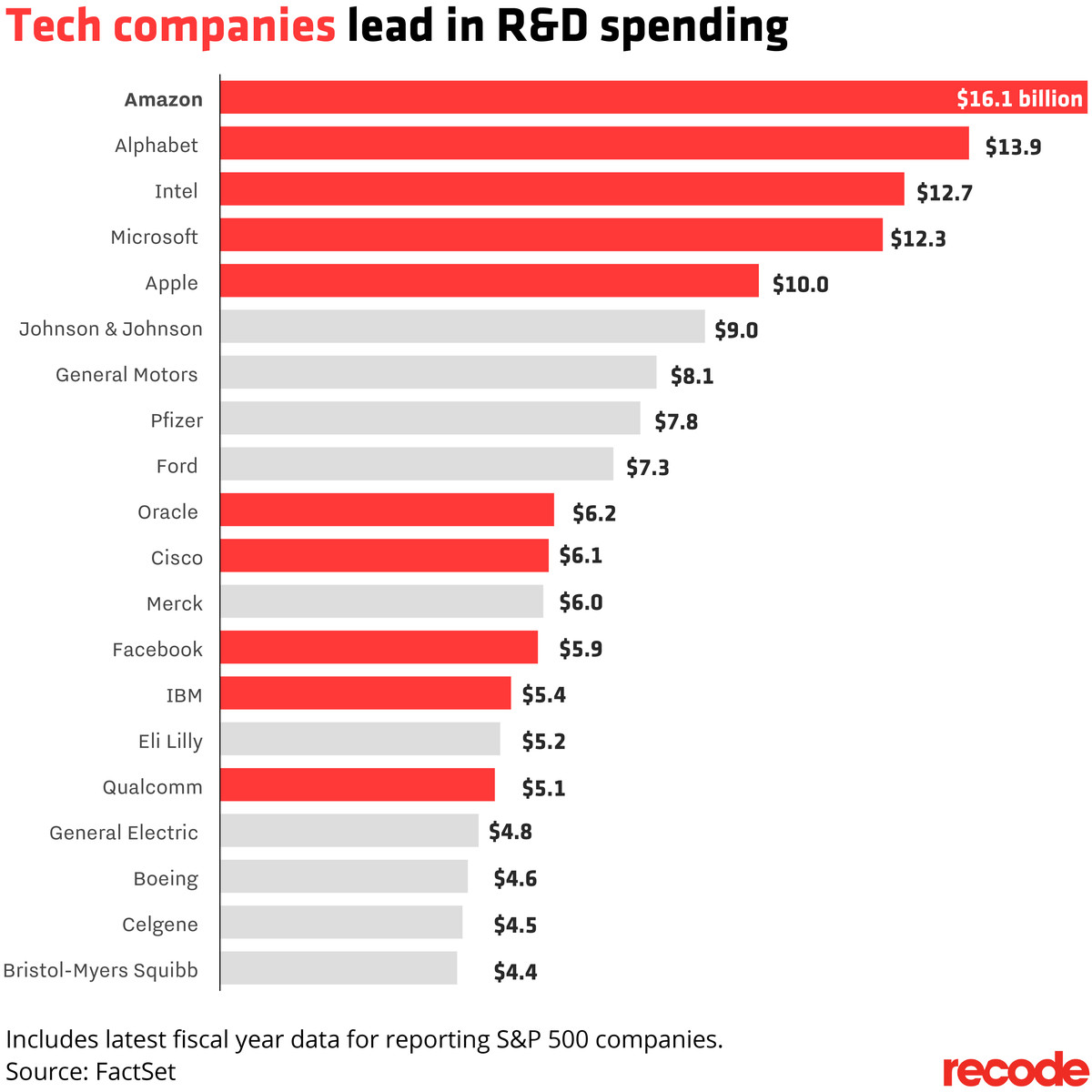

However, given that OpenAI is trying to win the artificial general intelligence (AGI) race, it will require consistent investment into research and development, human capital, etc.

Not to mention that companies with massive reserves and positive cash-flow generating products, like Google, are nipping at its heel.

Ultimately, Open AI must create an impenetrable competitive edge. Otherwise, it may already be too late.

How to Analyze ChatGPT Stock Performance

While you are unable to invest in Open AI stock directly, you can evaluate Microsoft or other publicly traded AI companies like it.

In 2023, largely due to the success of ChatGPT, AI stocks experienced a massive stock price surge.

This catalyst helped drive companies like Nvidia to all-time highs.

While it seems that AI stocks can only go up from here, it is wise to be cautious as the exuberance is likely over.

Oftentimes, industry hype like this gets blown way out of proportion, causing the stock price chart to explode and market valuations to become significantly overvalued.

Though it may be difficult to ignore the FOMO, it is essential that you do if you want to be successful.

To overcome this, focus on a business’s fundamentals, including its financial status, competitive advantages, management team, and intrinsic value.

More importantly, learn how to effectively value companies and apply a margin of safety to protect you from your own emotions and biases.

If you focus solely on those businesses with the best fundamentals and only purchase them at a price below their intrinsic value, it is very likely that you will do well investing in this revolutionary industry.

The key is to have patience and to wait for Mr. Market to come to you with an offer you can’t refuse.

Final Thoughts: Should you buy ChatGPT Stock?

It may be tempting to buy AI stocks right now due to all of the catalysts and benefits they bring.

However, be wary of the price you are paying and the businesses you are buying.

Though most AI stocks are overpriced and unlikely to achieve their lofty promises, there are a few making a real difference and creating immense value for customers.

Seek out those companies and be prepared to buy them at a better discount down the road.

In the meantime, take this moment to better understand the AI industry while also researching and valuing AI companies.

If you do, not only will you find better opportunities, but you will also protect yourself from naivety.

In the end, it pays to be the one who takes the time to understand this revolutionary technology.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Verses AI stock and are compensated by Verses for Investor Relations Services, amounting to eighty-nine thousand seven hundred sixty dollars. Edge Investments and its owners reserve the right to buy and sell shares in Verses AI without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright ©️ 2023 Edge Investments, All rights reserved.