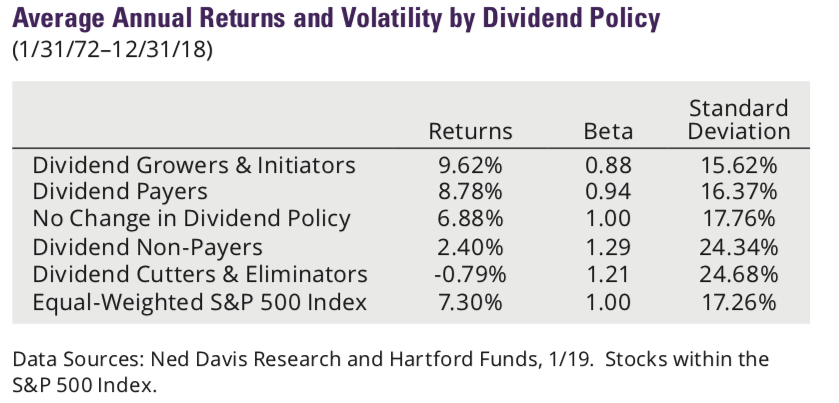

Dividend investing is a powerful investment tool that can help you generate passive income with ease.

However, it may not always be the most effective strategy based on your financial situation.

Moreover, dividends can sometimes negatively affect your company’s financial condition and performance depending on how the company chooses to distribute dividends and whether they maintain their declared dividend policies.

In that case, it may adversely affect the stock price in ways you could not anticipate.

For that reason, it is important to understand how dividends affect the stock share price and your investment performance overall.

In this article, we will help explain how dividends affect stock prices and ways that you can limit the negative impact that they sometimes impose.

Get ready to master the art of dividend investing with this comprehensive guide.

What is a Dividend?

Want to generate more passive income? Dividend income is a great way to make it happen.

When a company earns a profit, it has a few choices on how to use that spare cash.

For example, it could reinvest that cash back into the business, buy back stock, acquire another company, or pay a dividend.

Typically, a company and its management team will choose the latter when they have built up a massive cash pile and there is no better alternative available to them.

The result is a distribution of profits to shareholders that is provided in the form of dividends–the amount of cash you receive per dividend depends on the number of shares you own and the amount declared by the company per share.

Generally, dividend-paying companies pay their dividends every quarter (3 months), though there are some instances where a business or exchange-traded fund (ETF) will choose to do so on a more or less frequent basis.

If you are someone seeking out dividend stocks, it is a good idea to check out each company’s dividend history and schedule to ensure that aligns with your goals.

What is a Dividend Yield?

Image by: WallStreetMojo

You can think of the dividend yield ratio as a valuable yardstick for measuring the income you receive from an investment.

It is expressed as a percentage and it’s calculated by dividing the annual dividend payment per share by the stock’s current market price per share.

This gives you a clear idea of how much return you’re getting on your investment relative to its current market value.

In general, a higher dividend yield often suggests that you’re receiving a healthier income stream compared to the investment’s price.

However, it’s not all about just picking the highest number because a high dividend yield could suggest that the company is facing financial struggles, which could lead to dividend cuts in the future.

Therefore, it is always a good idea to look at more than just a company’s dividend yield to determine the attractiveness of the investment.

For example, you may also want to consider its dividend payout ratio, which is the proportion of a company’s earnings that are paid out as dividends to its shareholders, and its future cash flows.

How Do Dividends Work?

Dividend payments follow a predictable pattern from profit generation to payment.

Here is a quick outline of that process from start to finish:

- Profit Generation

In the realm of business, revenue generation stands as a pivotal achievement for any company because it is a testament to the value created by its product or service offering.

To get there, a business must invest in a variety of operational expenses like hiring employees, and then researching, developing, manufacturing, and marketing products, among others. Once accounted for, the company can determine if it sold more than it invested, and if it did, what emerges is the net income or profit that it earned.

Through these retained earnings, a company can then choose to reinvest the profits back into the business or distribute it to shareholders in the form of dividends.

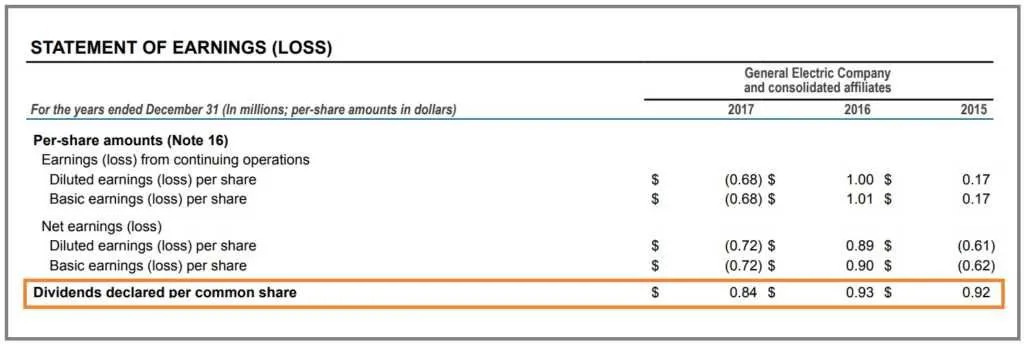

Image by: Corporate Finance Institute

- Declaration Date

When a company’s board of directors decides to distribute profits to shareholders as dividends, they will announce it on the declaration date, along with other important information about the dividend. This will include the dividend amount, as well as the ex-dividend, record, and payment dates for future dividends.

- Ex-Dividend Date

Once a dividend is declared, there is only so much time an investor has to buy shares in the company before they are cut off from that dividend. If they do not buy before the ex-dividend date, then they will be blocked from that dividend and must wait until the next.

- Record Date

Following the ex-dividend date, the record date is the day that determines all of the shareholders who will be entitled to the pre-declared dividend. Typically the record date happens two days after the ex-dividend date.

- Payment Date

Finally, on the designated payment date for qualified dividends, the company will distribute the dividend payments to its shareholders either through cash payments or additional shares of stock via dividend reinvestment plans (DRIPs).

Cash vs. Stock Dividends

You may be wondering whether it is better to receive dividends in the form of cash or stock compensation.

Well, here are three pros and a con for choosing to acquire cash or stock dividends:

Cash Dividends

Pro #1: Tangible Reward

Cash dividends offer a direct and tangible reward for your investment in a company. When a company distributes cash dividends, it’s a clear demonstration of your participation in its success. Receiving these dividends provides you with a real, spendable income stream that you can use to meet immediate financial needs or allocate as you see fit.

Pro #2: Predictable Income

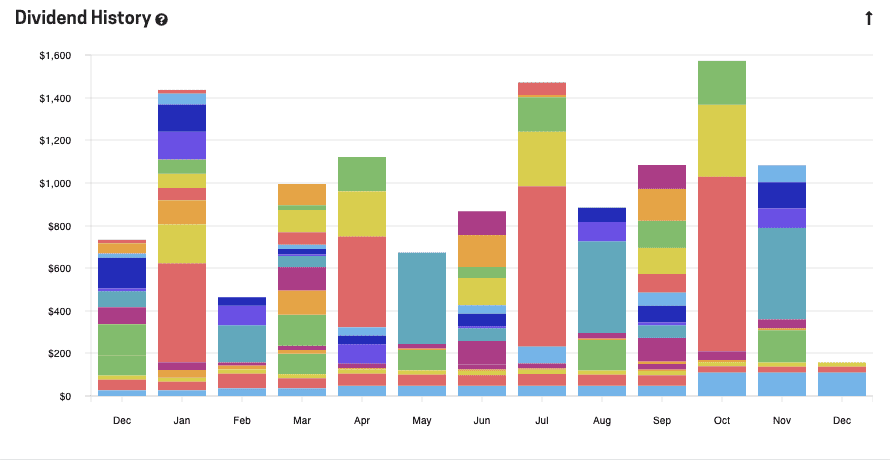

Image by: Genymoney.ca

Cash dividends provide a level of predictability in your investment returns. Companies that consistently pay dividends often have a history of stable performance. This means you can rely on a regular income stream, which is particularly beneficial for retirees or investors seeking consistent supplemental income alongside their capital appreciation

Pro #3: Flexibility and Choice

Cash dividends empower you with the flexibility to make your own financial decisions. Unlike other forms of reinvestment, where you might automatically purchase more shares, cash dividends allow you to decide how to allocate the funds. This flexibility lets you adapt your strategy based on your financial goals, whether it’s reinvesting in the same company, diversifying into new opportunities, or even using the cash for personal use.

Con #1: Opportunity Cost

Now that you have received your cash dividend, you must decide what to do with that money. You could invest it, spend it, or save it, and whatever you decide to do, there is an opportunity cost associated with it. This is where stock dividends can sometimes be beneficial because, through a DRIP, you are immediately putting your money to work, rather than letting it sit or go to waste.

Stock Dividends

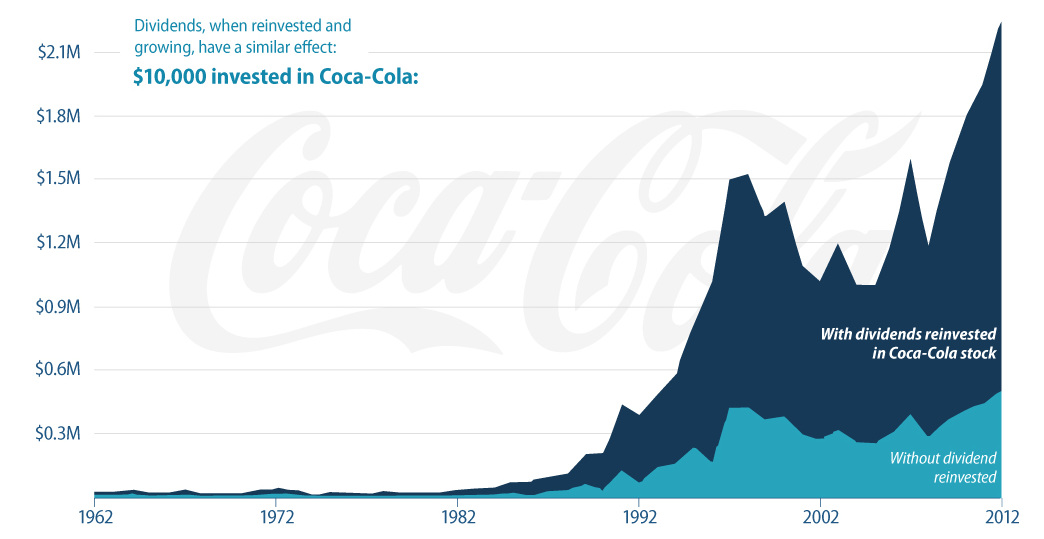

Image by: Visual Capitalist

Pro #1: Compound Growth Potential

Stock dividends contribute to a remarkable phenomenon known as compound growth. When you receive additional shares through stock dividends, you’re essentially reinvesting in the company without spending extra money. Over time, these reinvested dividends can accumulate, leading to exponential growth in your investment. It’s like a gift that keeps on giving, multiplying your ownership stake and potential returns.

Pro #2: Long-Term Wealth Accumulation

Stock dividends align perfectly with a long-term investment strategy. By reinvesting your dividends, you’re positioning yourself for gradual yet powerful wealth accumulation. This patient approach allows you to harness the full potential of a company’s growth trajectory, tapping into its capacity to generate greater value over the years.

Pro #3: Diversification Boost

Stock dividends can bolster your portfolio’s diversification. As you accumulate more shares through dividends, your holdings in various companies increase. This diversification reduces the risk associated with being heavily reliant on a single company’s performance. It’s a prudent way to spread your investment across different sectors and industries, enhancing your resilience in the face of market fluctuations.

Con #1: Lack of Control

While stock dividends have many benefits, one issue that can arise is the lack of control you’ll have over your newfound capital. Since the stock dividend is immediately being reinvested by accumulating shares, you no longer have input on when it is a good time to buy. For example, if you believed that the stock was overpriced, yet you had a DRIP set up, then those new shares would’ve been bought at a premium, and thus your returns on those shares would be affected. This is why it is sometimes better to receive cash dividends over stock dividends.

The Effect of Dividend Declaration

Dividend investing is one of the most popular investment strategies in the world.

As such, there are many investors excitedly waiting for their favorite companies to announce dividends so that they too can benefit from the profits.

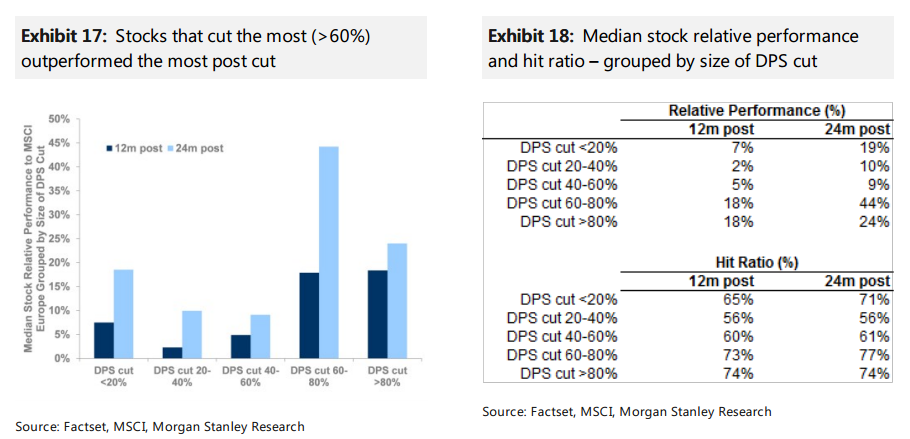

But dividend investing is a double-edged sword. On one hand, a dividend is a great way to generate passive income. On the other, it can quickly cause a stock to tumble if a company changes its policy or cancels its dividend altogether.

Therefore it pays to be aware of these three dividend stock effects:

- Market Perception

Image by: Dividend Power

Pro: Regular dividend payments can signal stability and confidence in a company’s financial health. A company that consistently pays dividends implies that it’s generating steady cash flows and is less likely to encounter financial turbulence. This can boost share prices and investor confidence and attract new investors looking for reliable opportunities.

Con: When a company suspends its regular dividend, it may signal that the company is strapped for cash. If so, investors tend to react negatively quite quickly which usually causes a meaningful sell-off.

- Discipline in Capital Allocation

Pro: Declaring dividends requires careful consideration from a company’s management. It encourages them to evaluate various investment opportunities and allocate capital efficiently. This discipline can lead to better decision-making regarding projects, acquisitions, and other financial endeavors.

Con: Investors often perceive that they can compound their capital more effectively through dividends since they can reinvest the cash they receive. However, dividend investing is quite inefficient due to double taxation (i.e. taxed as a company, taxed as an investor) and the opportunity cost of searching for a new investment. Therefore, if a company can reinvest the cash themselves through project development, acquisitions, or share buybacks, it is often a better option than distributing a dividend.

- Enhanced Reputation

Pro: Did you know TD Bank has paid a dividend since 1857? Companies, like TD, that have a history of responsibly managing their finances and rewarding shareholders through consistent dividends, often build a strong reputation in the market. This reputation can extend to potential customers, business partners, and even employees, contributing to a positive overall image.

Con: Things may not always appear as good as they seem. While a long track record of dividend payments often enhances a company’s reputation, it can also be misleading. For instance, if a company uses debt to pay or maintain its dividend, this is an indication that a well-established company is not as healthy as it looks. A good example of this is General Motors (GM) which paid dividends up until its bankruptcy during the 2009 recession. When looking back, maybe that cash could’ve been spent more effectively elsewhere.

Why Do Stock Prices Go Down After Dividends?

Image by: Seeking Alpha

Stocks can take a dip after dividends are distributed for a variety of reasons, though there are very few you should pay attention to.

For example, a stock could fall because investors mistakenly bought after the ex-dividend date, or perhaps the company is making adjustments to its future dividend payout policy.

While it is good to be aware of these possibilities, it should rarely influence your decision-making.

Instead, reevaluate your investment objectives and focus on the long-term fundamentals of a company.

If your goal is to generate as much passive income as possible, search for those businesses with a large dividend yield and healthy financial statements.

Similarly, seek out those dividend-paying stocks that are fundamentally sound with enduring competitive advantages.

If you do, short-term fluctuations due to dividend distribution will have very little effect on the stock over the long run.

Is It Better to Sell Stock Before or After the Dividend?

Since we pay very little attention to the short-term fluctuations in stock prices, it does not really matter if you sell before the dividend distribution, or after the dividend is paid.

Just make sure to buy the outstanding shares well before the ex-dividend date if you want to guarantee that you receive the dividend. If not, it will be the seller who receives it, not you.

Overall, it is generally better to hold on to a stock for the long run and not try to time the market. For compounding to work its magic, you must allow a business to invest, grow, and develop over years, not months or days.

The Bottom Line

Dividend investing is a great way to generate passive income with very little risk.

Though they can often affect a stock’s price in the short run, they will have very little effect over the lifetime of the company.

As such, rather than focusing on how dividends affect the stock price, prioritize the company’s fundamentals, financials, and valuation first since these factors will play a much larger and more influential role.

In the end, you want to own businesses that you comfortably own for at least ten years knowing that they are doing everything they can to create the most value for you as a shareholder.

If you do, you will not only benefit from the company’s dividend but its fast-growing business model as well.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.