I recently sat down to talk with an old man; he began reminiscing about the good old days. “You know, son, when I was a boy, you could get a handful of penny candies for just a few cents. Now you can barely get a single piece for the same price,” he exclaimed.

As he spoke, I realized the old man was describing the impact of inflation on his childhood memories. What was once a trivial expense had become a significant burden over time.

Image by Yahoo Finance

In economics, inflation is a phenomenon that can significantly impact the stock market, affecting both individual stocks and broader indices. As prices for goods and services rise, companies may experience changes in their revenue and expenses, and investors may see changes in their stock market returns.

Inflation can directly and indirectly affect the market, whether it is the rising interest rates or the cost of raw imports.

Understanding the relationship between inflation and stocks is essential for investors looking to make informed decisions. In this post, we will explore the effects of inflation on the stock market and how to leverage your investment decisions in a way that protects you from inflation.

What is inflation?

Inflation is a complex economic occurrence that can have a great impact on the stock market and individual stocks. It is known as sustained increases in the general price levels of goods and services over time. This change is often measured by the Consumer price index (CPI).

Image by CBC

When inflation occurs, the purchasing power of the given currency decreases, affecting the value of stocks and other assets.

What is the CPI?

The Consumer Price Index (CPI) measures the average price change of household goods and services over time, AKA. inflation.

Image by Investopedia

A CPI is calculated by collecting prices for a “basket” of goods and services commonly purchased, such as food, housing, clothing, transportation, medical care, and education.

The prices are then weighted according to the share of spending on each item in the basket. The CPI can estimate the overall inflation rate by tracking changes in the cost of this basket of goods and services over time.

Factors that influence inflation

Several factors can cause inflation. Here are a few:

Increased demand for goods and services

When the economy is growing and people have more money to spend, demand for goods and services increases along with it. This can lead to higher prices of these items as businesses try to capitalize on the increased demand.

Image by Investopedia

Supply chain disruptions

If there are shortages of raw materials or when there are logistical issues with getting goods to market, it may disrupt the supply chain. These disruptions can drive up the cost of goods and services, leading to higher inflation.

Changes in government policy

An excellent example of how inflation relates to government policy would be if the government increased spending on infrastructure or social programs. This essentially puts more money into the economy, leading to increased demand for goods and services and potentially driving up prices. Similarly, changes in bank rates or other monetary policies can also impact inflation, as they can affect the amount of money that is available in the economy.

Image by Bermanscall

Understanding the causes and effects of inflation is an important consideration for investors and anyone wanting to make informed decisions about their finances.

The relationship between inflation and interest rates

The relationship between inflation and interest rates can be explained by the fact that inflation erodes the value of money over time. Central banks, responsible for maintaining price stability and promoting economic growth, may use bank rates to manage inflation.

Image by Access Wealth

For example, banks may raise interest rates when inflation rises to discourage borrowing and spending. Higher interest rates make borrowing more expensive, which can reduce consumer and business spending and investment. This can help to slow down the economy and reduce inflation.

Conversely, during periods of low inflation, banks may lower interest rates to encourage borrowing and spending, which can stimulate economic growth.

The relationship between inflation and interest rates is particularly relevant for investors, as changes in interest rates can impact the returns on various investments.

When interest rates are high, bonds and other fixed-income investments may become more attractive than stocks, offering a higher return without as much risk. On the other hand, when interest rates are low, stocks and other riskier investments may become more attractive as investors seek higher returns.

Click here to read about what to do with your stock portfolio when bank rates rise.

How inflation can affect the stock market

Inflation can have various impacts on the stock market, as it affects the overall economy and the profitability of companies. Here are some ways that inflation can impact the stock market:

Valuations

When inflation rises, investors may demand higher returns to compensate for the reduced purchasing power of their money. This can lead to a decrease in the price-to-earnings (P/E) ratios of stocks, as investors may be willing to pay less for a given level of earnings. Lower P/E ratios can lead to lower stock prices.

Interest Rates

Banks may raise interest rates to combat inflation, making borrowing more expensive for companies. Higher bank rates can reduce corporate profits and lead to a decrease in the stock prices of companies. Additionally, higher interest rates may also lead to a decrease in consumer spending, which can have a negative impact on companies that rely on consumer spending.

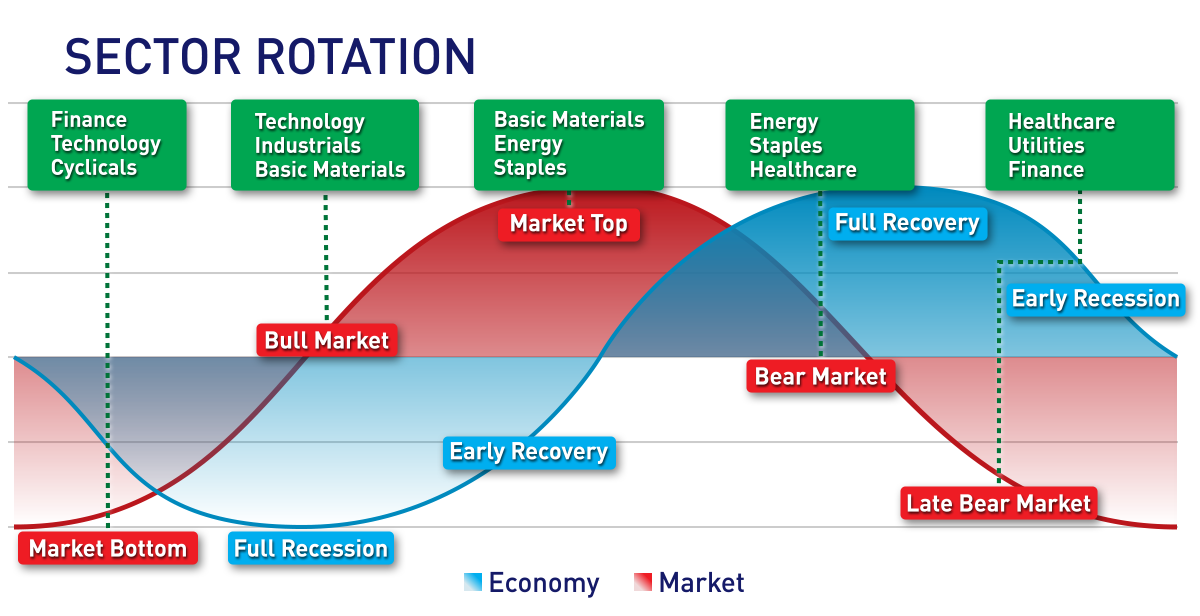

Sector Rotation

Some sectors, such as energy and materials, may benefit from inflation as the prices of commodities rise. On the other hand, sectors such as technology and consumer discretionary may be negatively impacted by inflation, as they may experience reduced demand due to higher prices for goods and services.

Image by The Market Made Easy

How does inflation affect stocks?

Inflation can influence the returns that investors can expect to receive from stocks. So how does inflation affect stocks?

It can reduce the purchasing power of investors, which means that the returns they receive from their stocks may not be worth as much in real terms. This can make stocks less attractive compared to other investments that are less impacted by inflation, such as commodities or real estate.

Inflation can also affect companies that issue stocks. Rising input costs, such as raw materials or labour costs, can decrease company profit margins. This can lead to lower earnings, which can cause the stock price to fall.

Growth and value stocks dealing with inflation

The influence of inflation on different types of stocks, such as growth and value stocks, can vary. Let’s take a look at how inflation can affect these two categories of stocks.

Growth Stocks

Growth stocks are companies that are expected to have high earnings growth rates in the future. These companies typically have high price-to-earnings ratios, which means that investors are willing to pay a premium for these stocks because of their growth potential.

Image by Suttle-Straus

However, rising inflation can influence growth stocks in a few ways. Increasing rates can cause investors to shift their money away from growth stocks as the future earnings of these companies become less valuable.

Additionally, higher bank rates can make it more expensive for growth companies to borrow money to finance their growth, which can slow down their expansion plans.

Value Stocks

Value stocks are companies that are undervalued by the market. These companies typically have lower price-to-earnings ratios than growth stocks, but they may still have solid fundamentals and potential for growth. Inflation may have less of an impact on value stocks because these companies have already experienced a price decline.

As inflation pushes up the prices of goods and services, value stocks may become more attractive to investors who are looking for cheaper investments. In addition, value stocks may be less sensitive to rising bank rates, as their earnings are already priced at a discount

Image by Forbes

The consequences of inflation on stocks depends on a variety of factors, including the type of company and the current economic environment. Growth stocks tend to be more susceptible to the effects of inflation, as their future earnings are priced at a premium. On the other hand, value stocks may be less impacted by inflation, as their earnings are already priced at a discount. It is crucial for investors to consider these factors when making investment decisions and to diversify their portfolios to manage risk.

If you’d like to learn more about the differences between growth and value stocks, click here.

Why inflation is bad for stocks:

Throughout this post, there have been three main points as to why investors hate inflation:

Reduced Purchasing Power

Inflation can reduce the buying power of investors, making stocks less attractive compared to other investments. When inflation increases, the value of money decreases, which means that the returns received from stocks may not be worth as much. This can lead to a decrease in demand for stocks, causing stock prices to fall quickly.

Increased Costs for Companies

Companies that issue stocks may experience changes in their costs due to inflation. Rising input costs can lead to decreased profit margins for companies. This can, in turn, lead to lower earnings, which can cause stock prices to fall.

Impact of Interest Rates

Higher inflation can also lead to increased bank rates. Central banks may raise rates to combat inflation, which can make borrowing more expensive for companies. This can negatively impact stocks, as companies may find it more challenging to access capital or may have to pay higher rates on their debt. This eventually leads to lower earnings and a lower stock price.

Image by Forbes

While inflation may be bad for investors, there are still ways for you to invest your money and receive a significant return while reducing your exposure to the negative impacts of inflation.

Investing to resist inflation

Certain companies and sectors are considered more inflation-resistant than others. These companies and sectors tend to have pricing power, meaning they are able to increase prices without experiencing a significant decline in demand. Here are a few examples:

Consumer Staples

Companies that produce essential goods such as food, beverages, and personal care items tend to be less impacted by inflation, as demand for these products remains relatively stable regardless of economic conditions.

Utilities

Utility stocks, such as water and electricity providers, tend to have stable revenue streams that are less impacted by inflation. This is because consumers tend to prioritize basic utility services over other discretionary expenses.

Healthcare

Healthcare companies, particularly those that produce essential medicines and medical devices, tend to be less impacted by inflation as demand for these products remains strong.

Natural Resources

Companies that produce natural resources such as oil, gas, and precious metals may benefit from inflation, as rising prices for these commodities can increase their revenue and profits. Mining companies are a great way to invest in natural resources; check out this video to learn five simple steps to pick a winning mining stock!

Investing in these sectors is a great way to diversify your stock portfolio in a way that works around the rising rates of inflation.

Image by Schroders Investment Management

Inflation’s influence on investors, companies, and the economy as a whole is quite profound. The repercussions of inflation on stock market investments can be both direct and indirect, affecting returns, valuations, and sector performance.

Reduced buying power, rising bank rates and supply chain disruptions are just a few of the ways that inflation affects stocks.

Whether you’re reminiscing on the good old days of cheap candy or frustrated by the lack of buying power your money has, inflation will always be a factor that changes our everyday lives. As such, investors must be aware of inflation and its potential influences on their portfolios to make informed investment decisions for their own financial security. Remember to always be diligent with your research and choose a strategy that caters to your risk tolerance as well as your investment philosophy.

For now, enjoy the prices of candy while you can.