Investing is generally categorized into two styles; value and growth. Any portfolio has room for both, but knowing their differences is essential. Value investors focus on finding companies in the stock market that are trading below their intrinsic value, while growth investors lean more toward growth companies with a high expansion potential.

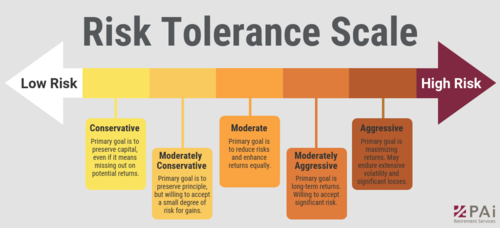

Both value and growth stocks have significant potential for success. Choosing the right one depends on one’s goals, risk tolerance, and investment philosophy.

Whether you are an investor stacking up dividends or looking in the market for prospects with the best earnings growth, utilizing these styles to their fullest potential is a tangible way to make gains in bull or bear markets.

Value Investing Defined

Value investors believe the overall market tends to “overreact” to good and bad news. Thus, the current stock price of a given company does not necessarily reflect its value.

The goal of value investing is to identify companies trading below their intrinsic value that might also pay dividends. To do this, investors use several forms of analysis to determine whether or not a company is at a stock price that is comfortable for them.

Warren Buffet is a well-known value investor who believes in buying stocks at a reasonable price or within a “margin of safety.”

:max_bytes(150000):strip_icc()/buffetts-road-to-riches-05f95062a9554d688bab91b1c3515a5d.png)

What models of analysis do value investors use?

Some of the analysis models used in value investing include:

- Fundamental: This model analyses a company’s financial statements to determine its value. When value investing, investors typically look for consistent earnings growth, strong cash flow, and low debt.

- Discounted Cashflow: A discounted cashflow analysis model calculates the projected future cashflows of any given company. It uses data from financial statements such as revenue, book value, operating cash flow and earnings to predict a company’s future results. These projections are then discounted back to the company’s present value to determine whether it is overpriced or underpriced compared to the market.

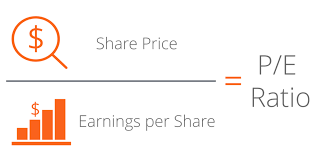

- Price to Earnings: Value investors believe that if a company’s price-to-earnings ratio is low in comparison to its competitors, it suggests that the stock is undervalued.

These analysis models help value-based investors decide whether to buy a company or wait until it is priced within a margin of safety.

How do you invest in growth companies?

Investing with a growth mindset involves finding companies with solid growth potential.

Investors interested in growth stocks tend to look for younger companies growing at an extreme rate. They seek stocks with innovative products, a large market, and a competitive advantage.

The goal of investing in growth stocks is to exponentially grow capital through companies that are expected to expand at a faster rate. Venture capitalists do this by funding early-stage start-ups for a stake in the companies they invest in; however, venture capital has many advantages and disadvantages.

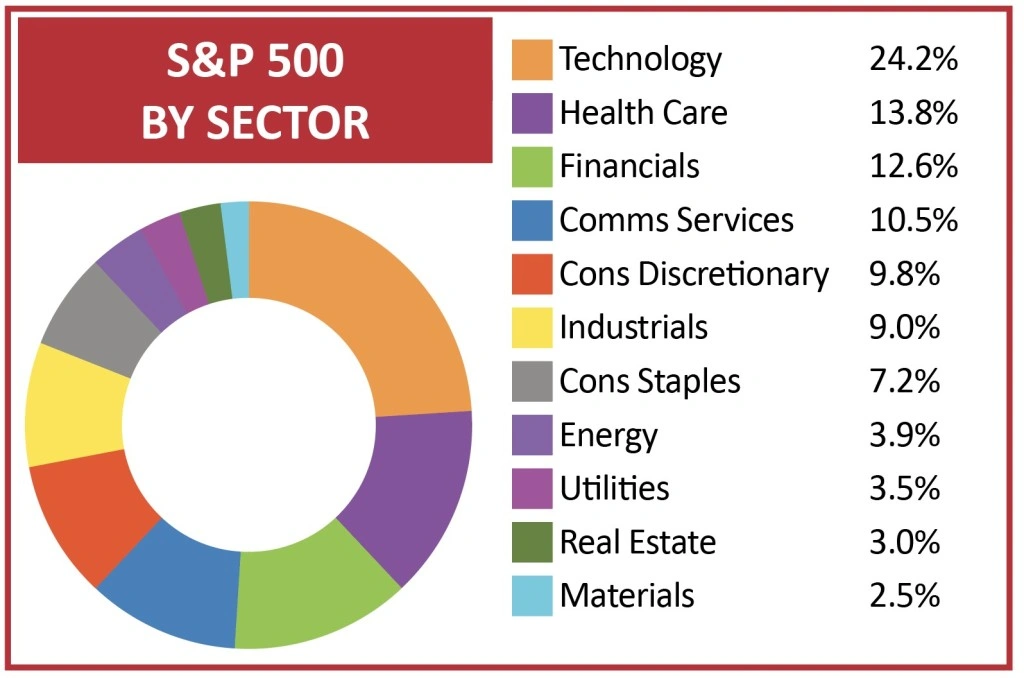

The growth investing style is often associated with the technology and healthcare industries, which are known for their disruptive business models and the tendency for innovation. However, investing in emerging companies of other sectors can also provide significant returns.

People using a growth strategy are usually willing to pay a higher price for stocks with convincing growth potential. These growth stocks are generally younger, making them a much riskier investment due to their lack of history.

If you’d like to learn more about growth stocks and how to capitalize on undervalued stocks, check out this video on The Truth About Growth Stocks and Why They’re Down Today.

Key differences between value and growth stocks

Comparing growth and value stocks emphasizes the variation in their respective investment approaches. Here are some of the major differences between the two:

- P/E ratio: Many growth stocks tend to have a higher price-to-earnings ratio than their peers, whereas a value stock typically shows the opposite.

- Risk: Value stocks are perceived as less risky than growth stocks, primarily because they are older and more established.

- Return: A value stock does not offer the same potential for high return as a growth stock.

- Time: growth investment strategy is more likely to realize its potential in a shorter time than buying undervalued stocks.

Growth and Value stocks

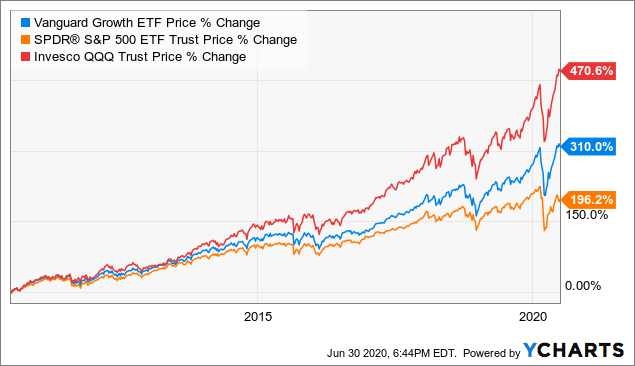

In order to enhance your own personal finance, growth or value stocks are viable options for a superior investment portfolio. However, growth stocks are believed to outperform value stocks over the long term.

Value stocks have considerably less risk over time, especially when economic conditions are favorable.

The past performance of growth and value investing has indicated that they are on relatively equal grounds.

According to Investopedia, value investing outperformed growth for the first ten years of the 2000s with the help of dividends; however, the growth investment style has exceeded value in the last decade.

Some quality examples of value and growth stocks are companies like the Royal Bank of Canada (RY) and Meta Platforms Inc (META).

Are value or growth funds better for the long term?

There is no definite answer as to whether value or growth funds are better for long-term investors. However, understanding your goals and risk tolerance is a great way to decide which is better for your portfolio.

When making an informed investment decision, assessing whether growth or value is the correct choice for you is essential.

Growth funds

Growth funds are mutual funds or ETFs that invest in companies with above-average earnings and revenue growth. They allow you to invest in growth stocks without the guesswork. Many growth companies in these funds are disruptive industry leaders with a strong competitive advantage. Such stocks outperform their competitors and have promising indications for future potential. These funds can be highly advantageous in bull markets; however, there is a risk they could suffer due to their volatile nature when future expectations are unmet.

A riskier approach is investing in aggressive growth mutual funds, mainly consisting of newer stocks that have yet to prove they can be profitable. Learn more about aggressive growth mutual funds here.

An excellent example of a growth fund would be the Vanguard Growth Index Fund (VUG), which includes many growth stocks such as;

Value funds

Value indexes and funds focus on undervalued shares within current market conditions. They follow the principles of Warren Buffet and Benjamin Graham, whose investment strategies are based on the inefficiencies of the stock market. These funds generally consist of well-established companies that pay a dividend. Value funds are often broken down into varying categories, such as market capitalization. Finding a fund family that utilizes small-cap, mid-cap, and large-cap companies is easy. Some examples of value funds are:

What percentage of the S&P 500 is Growth or Value stock?

The S&P 500 does not break down into growth and value stocks specifically. A quick look at the industries within the S&P 500 will show that upwards of 40% of the index includes technology, healthcare, and consumer discretionary, which are growth industries.

Growth vs. Value: Which one is best for you?

The best approach for any investor will depend on their personal investment goals, risk tolerance, and investment time horizon. You may like to diversify your portfolios by investing in a growth stock and a value fund to balance potential risks and rewards. Ultimately, you should carefully evaluate your options and research adequately before moving forward in your investment journey.

There are many stocks out there for you to look at. Deciding the type of portfolio you want involves researching what works best for you.

If you have a high-risk tolerance and a substantial income, look into higher-priced companies with innovative products and a competitive advantage.

If your interest is more dividend-focused, find the true value of a stock with a high dividend yield and buy it within a margin of safety.

If your style is more hybrid, deciding to invest in funds with both types of stock is a reasonable option.

Either way, expanding your knowledge and refining your investment decisions via thorough analysis and market research is optimal for achieving your personal finance goals.