So you are a penny stock investor seeking to join a platform that maximizes your penny stock trading potential.

You have been searching for quite some time but have yet to find a brokerage that meets your needs.

However, you are open to new suggestions and determined to find one that has access to the best-hidden gems in the market.

Perhaps you might consider Robinhood?

In this article, we’ll explore Robinhood, the pros and cons of buying penny stocks on the platform, and how you can take advantage of its tools.

If you are still searching for that perfect penny stock trading platform, check out what Robinhood offers.

What is Robinhood?

Are you searching for an effective stock trading platform that allows you to buy penny stocks?

Look no further than Robinhood.

Robinhood is a fintech company that offers commission-free trading for a variety of financial assets.

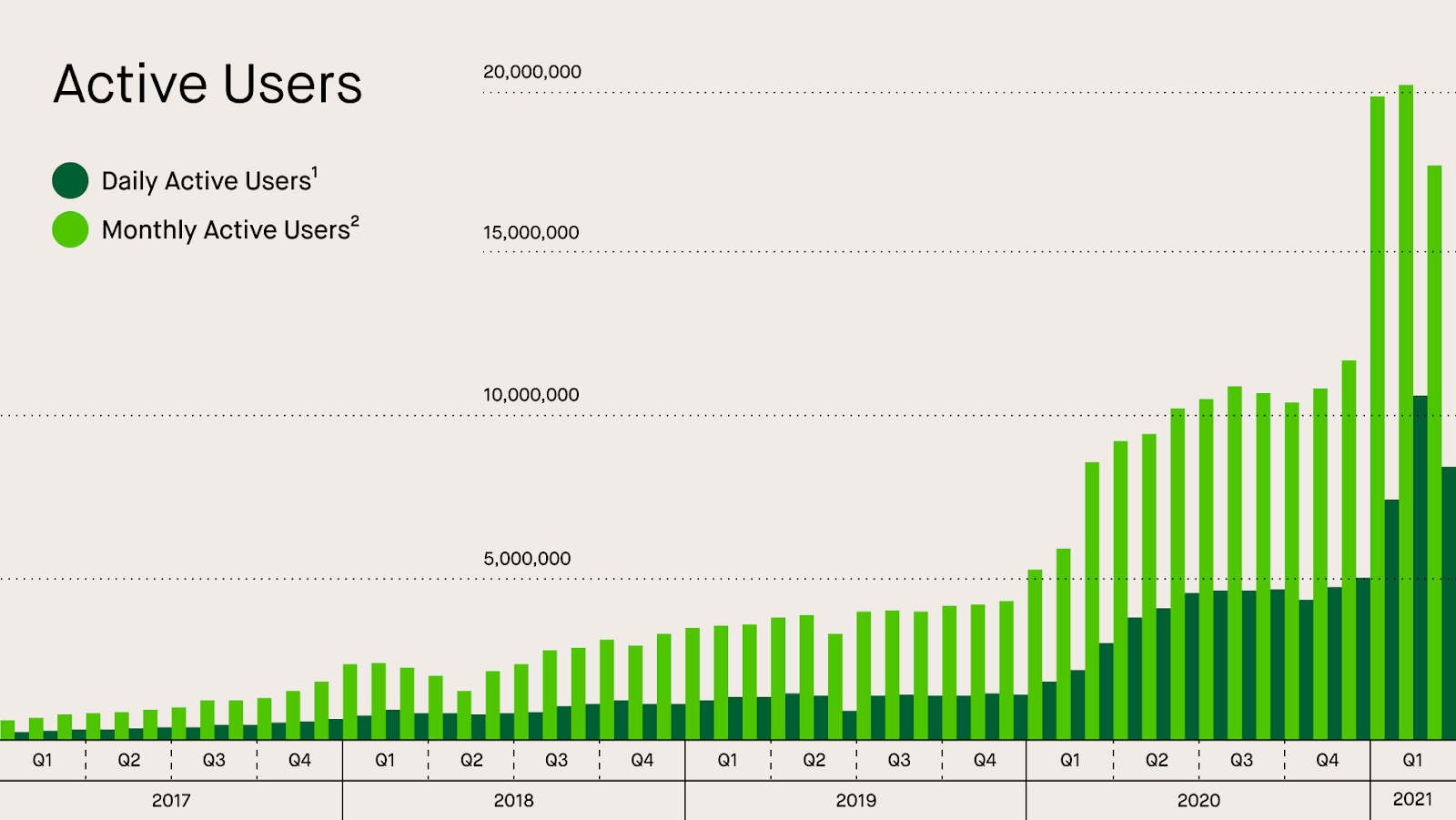

The company gained significant popularity with retail investors during the meme stock era as it allowed them to buy and sell these volatile stocks for free and with ease.

However, Robinhood has been somewhat riddled with controversy after it made headlines in 2021 for temporarily restricting trading on certain stocks, including GameStop and AMC.

This move led to accusations of market manipulation and raised questions about its practices and regulatory oversight.

Since then, the company has been working hard toward restoring its reputation by adding attractive features like 24-hour trading and an AI-powered portfolio mentor.

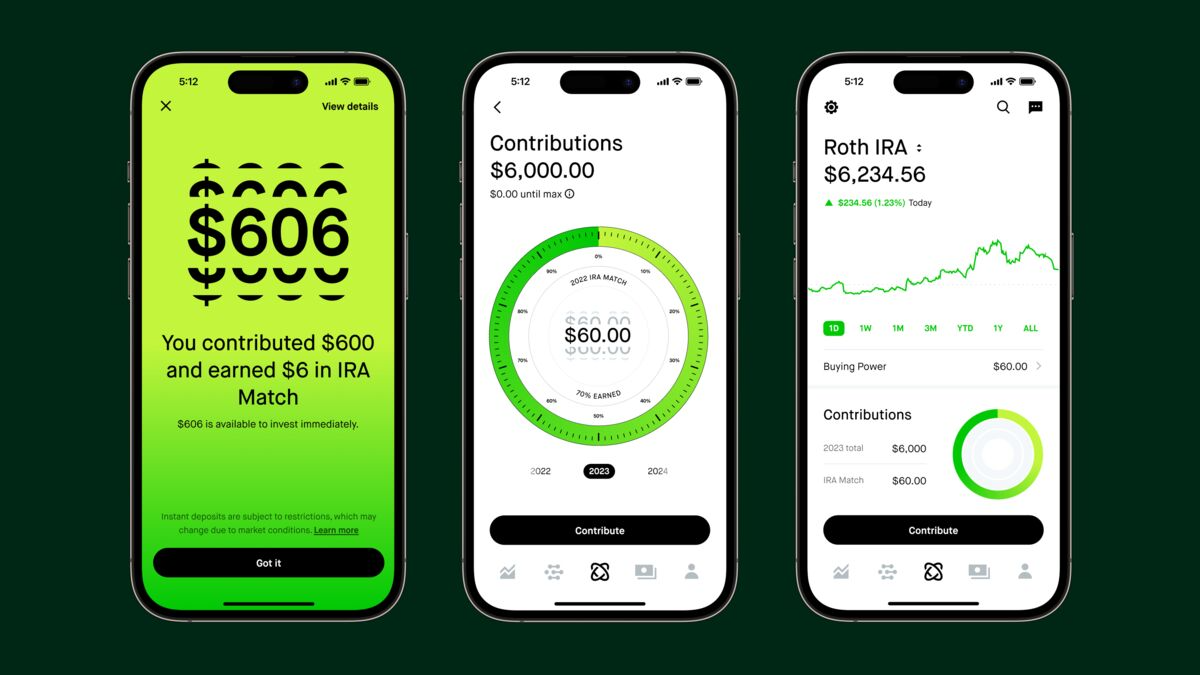

Robinhood is a user-friendly mobile app and website that allows users to trade stocks, exchange-traded funds (ETFs), options, and cryptocurrencies.

It has significantly impacted the financial industry by making investing more accessible to a wider audience due to its revolutionary commission-free trading system.

Does Robinhood Do Penny Stocks?

Good News! Robinhood allows you to buy and sell penny stocks on its platform.

In general, penny stocks are considered to be companies whose stock price trades below $5 per share.

These penny stocks tend to be riskier than large caps or small-cap stocks since they are less established and more volatile.

If you plan to invest in penny stocks on Robinhood, be aware that you can only trade penny stocks that are listed on major exchanges such as the New York Stock Exchange and NASDAQ.

While more limited compared to other penny stock trading apps, since they do not provide over-the-counter or pink sheet stocks, this is not necessarily bad as these exchanges offer greater protection for investors against fraud.

That being said, most penny stocks trade on these lower-tier exchanges, given that they fail to meet the strict requirements imposed by the NYSE, NASDAQ, and Securities and Exchange Commission.

As such, if you seek greater optionality, you may be inclined to register with a different brokerage that offers more penny stocks.

Overall, Robinhood satisfies the basic needs of investors seeking to invest in penny stocks.

Is Robinhood Good for Penny Stocks?

Robinhood is a popular online brokerage amongst retail investors, though its suitability as a penny stock trading platform may be debated.

Here are a few factors to consider before signing up with Robinhood.

-

Optionality

As mentioned above, there are a few limitations to the types of penny stocks you can trade.

Although Robinhood permits users to trade penny stocks on major exchanges, it does not offer those that have low liquidity or struggle to meet certain regulatory requirements.

However, where Robinhood lacks penny stock options, it does make up for it with small-cap, mid-cap, and large-cap stocks, as well as ETFs, derivatives, and crypto.

So, even though you may not find all the hidden gems you hoped for, you can still build a strong portfolio with the assets they offer.

-

User Interface

One of the primary reasons Robinhood is so appealing to individual investors is due to the simplicity of its interface.

With a user-friendly and visually appealing interface, novice investors gain as much confidence trading penny stocks as those with greater experience.

What’s more, Robinhood offers investors the ability to buy and sell fractional shares, making it much more accessible than some platforms.

Overall, you’d be hard-pressed to find a platform offering a more simplified trading experience.

-

Fees

Robinhood’s commission-free trading model is something to be admired.

Given that penny stocks trade at low share prices, below $5 per share, a traditional fee structure can be quite harmful to your investment returns.

As such, $0 on trades is an excellent way to mitigate costs and make the most of your investments since you’ll retain all of the capital put in—especially if you plan to buy and sell stocks often.

-

Research & Education

One potential drawback investors might experience with Robinhood is the platform’s lack of research and educational resources.

Penny stocks typically require thorough due diligence, as they can be associated with higher risks and limited information.

However, Robinhood only offers basic stock information, meaning that an investor may be forced to search elsewhere to acquire more details on a company before investing.

Depending on the type of investor you are, Robinhood’s research and education tools may fail to meet your needs.

-

Limitations

Building on factor #4, Robinhood’s platform is primarily designed for individual investors who may not have as much technical knowledge as more experienced investors.

For this reason, those looking to day trade penny stocks may find that the platform is limited in terms of the types of trading tools and resources an investor can access.

If you are someone who requires more advanced trading tools like advanced order types, in-depth technical analysis tools, or access to more sophisticated trading features, it’s likely that a more suitable platform exists elsewhere.

How to Find Penny Stocks on Robinhood

Now that we’ve covered important considerations before opening a Robinhood brokerage account, it’s time to discover how to find penny stocks on the platform.

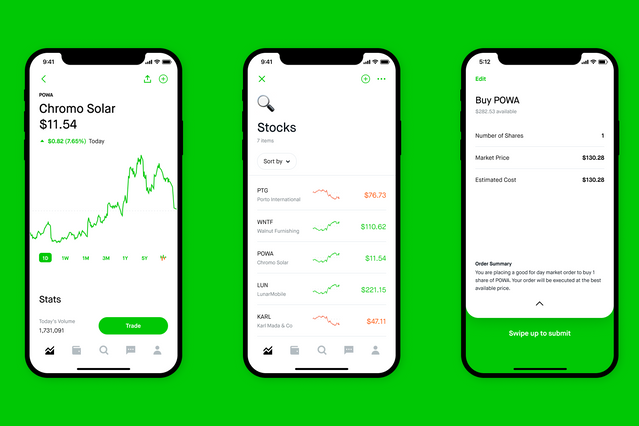

To find penny stocks on Robinhood, open and login into your Robinhood trading account.

Then, on the home screen, you will notice a search bar at the top of the page where you can search for individual stocks, like penny stocks.

When searching for a specific stock, type in its ticker symbol (i.e. $HOOD), and Robinhood will provide you with the relevant stocks based on your query.

If you don’t have a particular stock in mind, you can also search for terms like “penny stocks” or “stocks under $5” to explore a list of available options.

In addition, you can refine your penny stock search by using Robinhood’s custom filters which allow you to filter options like market cap, price, sector, and other criteria.

After that, click on a specific stock to view its details, including the current price, price charts, company information, and other relevant data.

Once you have found a stock that meets your criteria, all you need to do is click on the “Trade” button and enter the number of shares you want to purchase.

Shortly after the trade is executed, you will be the proud owner of a new penny stock.

Robinhood Penny Stocks to Add to Your Watchlist

To help you get started with your penny stocks trading on Robinhood, here are ten of the best penny stocks to explore on the trading platform:

-

Tilray Brands (TLRY)

Price (05/29/2023): $1.86

Market Cap: $1.149 billion

Industry: Drug Manufacturers—Specialty & Generic

Overview: Tilray Brands is a collection of cannabis brands that provide a variety of cannabis products catering to different consumer preferences and needs.

-

Sunshine Biopharma (SBFM)

Price (05/29/2023): $0.59

Market Cap: $0.014 billion

Industry: Drug Manufacturers—Specialty & Generic

Overview: Sunshine Biopharma is a biotechnology company focused on developing innovative drugs for the treatment of various diseases, including cancer.

-

Aurora Cannabis (ACB)

Price (05/29/2023): $0.54

Market Cap: $0.184 billion

Industry: Drug Manufacturers—Specialty & Generic

Overview: Aurora Cannabis is a prominent cannabis company known for cultivating, producing, and distributing a wide range of cannabis products.

-

Nokia (NOK)

Price (05/29/2023): $4.02

Market Cap: $22.761 billion

industry: Communication Equipment

Overview: Nokia is a multinational technology company that specializes in telecommunications, networking equipment, and digital services.

-

fuboTV (FUBO)

Price (05/29/2023): $1.61

Market Cap: $0.470 billion

Industry: Broadcasting

Overview: FuboTV is a streaming platform that offers live sports, entertainment, and news channels to subscribers over the Internet.

-

Magic Empire Global (MEGL)

Price (05/29/2023): $1.99

Market Cap: $0.040 billion

Industry: Capital Markets

Overview: In Hong Kong, Magic Empire Global provides corporate financial advisory services and underwriting services, like IPO sponsorship.

-

Sidus Space (SIDU)

Price (05/29/2023): $0.20

Market Cap: $0.010 billion

Industry: Aerospace & Defense

Overview: Sidus Space is a space-as-a-service company that designs, manufactures, launches, and collects data on commercial satellites worldwide.

-

Guardforce AI (GFAI)

Price (05/29/2023): $5.24

Market Cap: $0.036 billion

Industry: Security & Protection Services

Overview: Guardforce AI is a security services company offering various solutions to protect individuals, businesses, and properties.

-

Versus Systems (VS)

Price (05/29/2023): $0.56

Market Cap: $0.006 billion

Industry: Software—Application

Overview: Versus Systems is a technology company that provides an in-game prizing and engagement platform, allowing players to compete and win rewards while playing video games.

-

Immunic (IMUX)

Price (05/29/2023): $1.71

Market Cap: $0.076 billion

Industry: Biotechnology

Overview: Immunic is a clinical-stage biopharmaceutical company developing innovative therapies for chronic inflammatory and autoimmune diseases.

What To Consider When Buying Robinhood Penny Stocks

Penny stocks are generally riskier than most stocks due to higher volatility, lack of liquidity, and a less established presence in the marketplace.

As such, conducting proper research and analysis before investing is important.

Here are a few things to consider before trading penny stocks on Robinhood.

-

Company Fundamentals

No matter what company you evaluate, analyzing a business’s financial health is a good idea.

Look for companies that possess ample cash, limited debt, and growing revenues.

Ultimately, our goal as investors is to own profitable, predictable companies that can generate consistent growth over the long term.

If a company has poor fundamentals, it either indicates that its business model is weak or there is a better alternative in the market.

In general, avoid investing in companies that are consistently losing money or have taken on too much debt in relation to the cash flows they are generating.

-

Management

When analyzing a penny stock, search for companies with a proven and transparent management team.

As investors, the last thing we want to do is give our money to someone who is going to spend it unwisely.

Therefore, it is necessary to buy companies whose managers are focused on creating value for shareholders over the long run.

To find managers of this caliber, seek out those who own a large stake in the business, are willing to be compensated appropriately, and have a solid track record for building successful companies.

Also, pay attention to insider tractions so you can be aware of a management team’s stance toward the company.

One of the best tools for gathering this information is the financial platform Simply Wall St.

-

Price Vs. Value

Though penny stocks appear cheap, given that they trade below $5 per share, this does not necessarily mean they are.

In investing, value, and price are two different things, and it’s important to know the difference between them.

While it’s more difficult to know the value of penny stocks since very few penny stocks are profitable, the simplest way to do so is by comparing the company’s historic revenues and growth trajectory to its market cap.

If it appears that the market cap is well below what the company may potentially earn, then it’s a good indication that it’s undervalued and a worthy investment.

-

Liquidity

A particular characteristic of penny stocks is that they are traded less often than larger companies because fewer investors know about them.

Their stock prices tend to be more volatile since the bid-ask spread is much wider.

To avoid so much volatility, search for those penny stocks that have a higher three-month and daily trading volume.

Otherwise, expect a company’s stock price to swing up and down frequently.

Final Thoughts

If you are looking for a platform to trade penny stocks on, Robinhood can be a suitable option for most investors.

Although it doesn’t offer over-the-counter or pink sheet stocks, it offers penny stocks listed on major exchanges, making it a valuable choice for those wanting greater security.

Robinhood is perfect for novice and amateur investors with a user-friendly interface, commission-free trading, and fractional share options.

But remember, with any asset you explore, it’s a good idea to conduct proper research so that you can make the most out of your investment journey and increase your chances of getting rich trading penny stocks.

Overall, you can’t go wrong with trading penny stocks on Robinhood.