Investing in edge computing opens up a compelling avenue for forward-thinking investors.

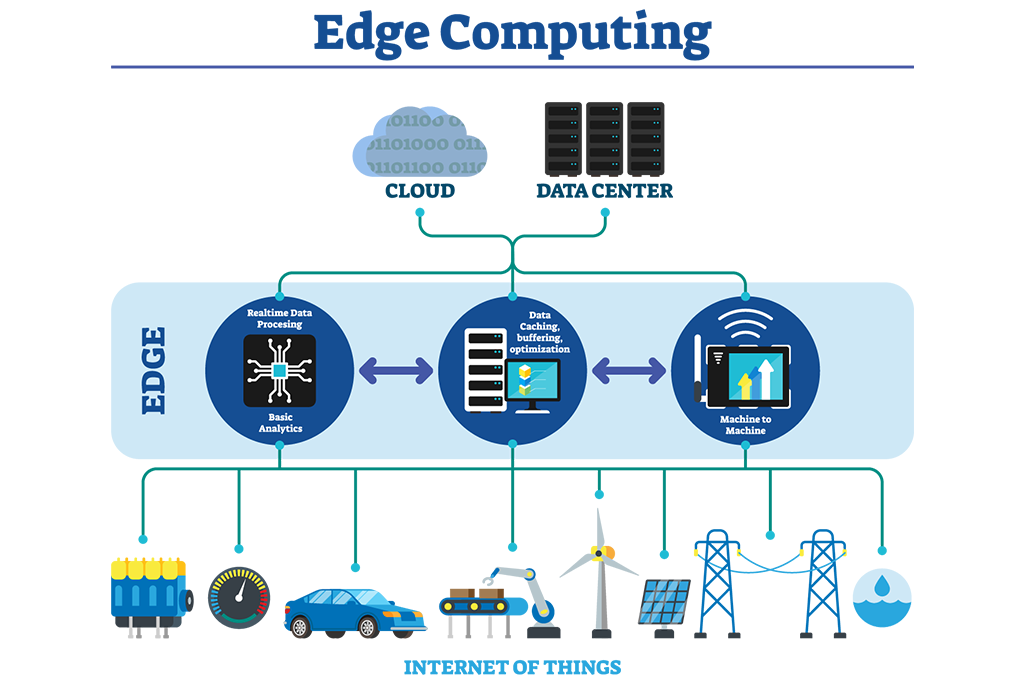

It represents a paradigm shift in how data is processed and managed, bringing computation closer to the source of data generation rather than relying solely on centralized cloud servers. This decentralized approach offers significant advantages in reduced latency, improved efficiency, and enhanced privacy.

Real-Life Use Cases for Edge Computing | IEEE Innovation at Work

As industries embrace the transformative potential of edge computing across sectors such as IoT, autonomous vehicles, healthcare, and more, investors can position themselves strategically in this rapidly evolving landscape.

Understanding the nuances of edge computing, identifying key players, and staying up to date with technological advancements are pivotal steps for investors seeking to capitalize on this high-potential segment of the technology sector.

How edge computing works

Imagine you’re into gaming and have a powerful gaming setup. Typically, when you play online, your commands and data go to a central server located far away, and the server sends back the game’s response.

Now, think about edge computing as if your gaming setup had its mini server right there with it. This mini-server is like a local brain, handling some of the processing and decision-making on the spot instead of relying solely on the faraway central server.

Gaming | Konica Minolta DX Solutions Development Centre

So, when gaming with edge computing, your commands get processed faster. The mini server on the network edge of your setup can handle specific tasks without waiting for approval from the distant server. It’s like having a quicker and more responsive gaming experience because the decisions are made closer to you, at the “edge” of the network.

In a broader sense, edge computing extends beyond gaming. It’s about bringing computing power closer to where it’s needed, reducing latency, and enabling quicker responses. It’s like having localized intelligence that can enhance various applications, from smart devices to industrial processes, making things more efficient and responsive.

According to Forbes, “Edge computing represents another step in the evolution of the internet.”

What is Cloud Computing?

Unlike edge computing, cloud computation occurs in a super-powered data center located far away. It’s like a massive warehouse filled with computers and storage systems. When you use cloud computing, you tap into the resources and services that these distant data centers offer.

So, for example, imagine you have a document on Google Drive. When you access that document, you’re not opening it from your computer; instead, you’re connecting to Google’s servers in the cloud where the document is stored. Cloud computing allows you to store, access, and process data without relying solely on your local device’s resources.

Cloud Vs Edge | Medium

The connection between cloud and edge computing is like a dynamic partnership. The cloud provides the heavy lifting—computation and data storage, advanced processing, and large-scale computations. At the same time, edge computing handles tasks closer to the end user or device, ensuring faster responses and reduced reliance on the distant cloud.

In real-world scenarios, cloud and edge solutions are often used together. The whole cloud infrastructure manages big-picture tasks, while edge computing handles time-sensitive and location-specific operations. It’s a tag team that maximizes efficiency, responsiveness, and overall performance in the vast landscape of modern computing.

If you’d like to learn more about investing in cloud computing, click here!

Where to Find Edge Computing Stocks

There are many different avenues that investors like yourself can use to find stocks in the niche sub-sector of security and edge computing.

It’s optimal to start by looking at the tech companies that you use on a day-to-day basis. As you dive deeper into your search, try out some of these methods below:

Research Edge Computing Companies

Start by identifying companies that are actively involved in edge computing. Look for firms that develop hardware or software solutions for edge computing applications, provide networking equipment, or offer services related to edge computing infrastructure.

Computing Call | Research Luxembourg

Industry News and Reports

Stay informed about the latest developments in the edge computing industry. Industry news, reports, and analysis can help you identify key players and potential investment opportunities. Websites, financial news outlets, and industry publications are all valuable sources.

These Are the Top Newspaper Stocks | The Motley Fool

Company Filings and Reports

Explore the official filings and reports of companies. Publicly traded companies are required to submit regular reports to regulatory authorities. You can find these reports on the Securities and Exchange Commission (SEC) website in the United States or equivalent regulatory bodies in other countries.

SEC Reporting | Bridgepoint Consulting

Stock Screeners

Use stock screeners provided by financial websites or brokerage platforms. These tools allow you to filter stocks based on specific criteria, such as industry sector, market capitalization, or financial metrics. One could also use artificial intelligence to screen for stocks in specific industries. If you’d like to learn more, check out our post on using Chat GPT to invest.

Stock Screener | AInvest

ETFs and Funds

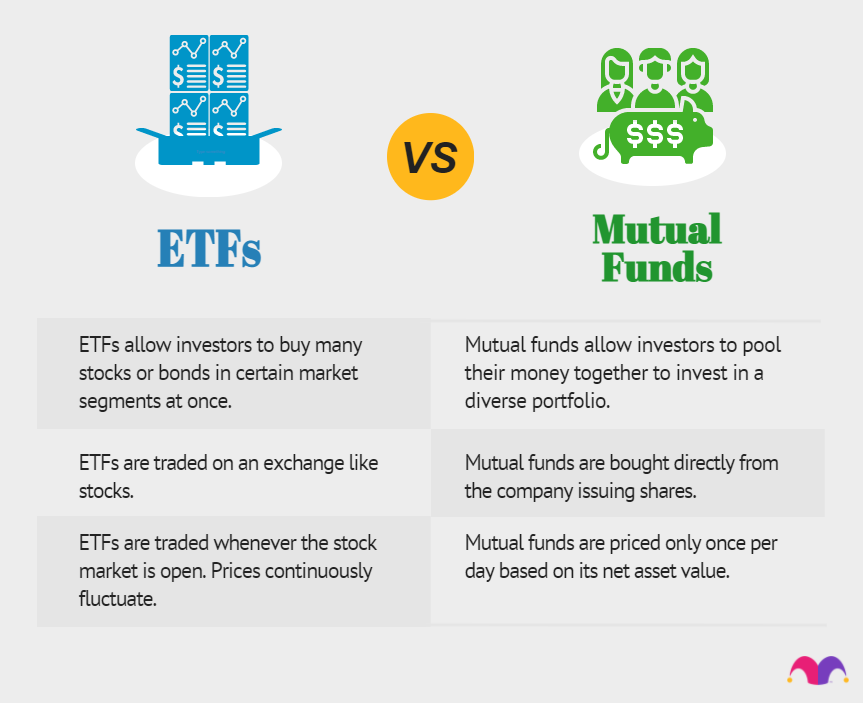

Consider looking into exchange-traded funds (ETFs) or mutual funds focused on disruptive innovations. Some funds may specifically target companies involved in edge computing. This can provide diversification across multiple stocks within the industry.

How to Invest in ETFs (Exchange-Traded Funds) |The Motley Fool

Follow Conferences and Events

Attend or follow industry conferences and events related to edge computing. These events often feature key players in the field, and you may discover emerging companies with growth potential.

Academic Conference | AKCongress

Once you have a list of potential companies, check the stock exchanges where they are listed. Many tech companies are listed on major stock exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq.

Investors typically use online brokers like Questrade or Interactive Brokers to buy edge computing stocks found during their search.

Remember that investing in stocks carries risks, and you must do your research or consult with a financial advisor before making investment decisions. Additionally, the availability of specific stocks and market conditions may have changed since my last update in January 2022, so it’s advisable to check the latest information.

How to analyze an edge computing company

Analyzing edge computing companies involves evaluating their business, financials, industry position, and growth prospects. Here’s a guide on how to analyze edge computing companies:

Understand the Industry

Gain a comprehensive understanding of the edge computing industry. This includes trends, market drivers, challenges, and the competitive landscape. Stay updated on technological advancements and regulatory changes affecting the industry.

Questions to Ask to Understand Your Industry | Jobs

Business Model

Examine the company’s business model. Understand how it generates revenue, its target market, and the uniqueness of its edge computing services and solutions. Consider whether the company provides hardware, software, services, or a combination.

:max_bytes(150000):strip_icc()/businessmodel-85ce9a0a59e642cd941204a92ee873de.png)

Business Model | Investopedia

Financial Performance

Evaluate the company’s financial statements, including income statements, balance sheets, and cash flow statements. Look for revenue growth, profit margins, and overall financial stability. Pay attention to any signs of financial distress.

Analyze the company’s earnings and profitability metrics. Look at net income, earnings per share (EPS), and return on equity (ROE). Assess whether the company is consistently profitable and has a positive outlook.

Competitive Positioning

Assess the company’s position in the market relative to its competitors. Consider factors such as market share, customer base, partnerships, and competitive advantages. A solid competitive position can be a positive indicator.

How Competitive Is the Tech Industry? | Disruptive Competition Project

Technological Innovation

Evaluate the company’s technology and innovation capabilities. Consider whether it has a robust research and development (R&D) department and a history of introducing innovative edge computing technologies and solutions. Technological leadership is crucial in this rapidly evolving field.

Partnerships and Collaborations

Investigate the company’s partnerships and collaborations. Strong alliances with other technology companies, industry leaders, or strategic partners can indicate a positive outlook and potential for growth.

:max_bytes(150000):strip_icc()/Partnership-V3-78bb6f640fa34c828167ce2328b839d7.jpg)

Partnership | Investopedia

Regulatory Environment

Consider the regulatory environment and how it may impact the company’s operations in the near future. Be aware of any compliance issues and how the company is positioned to navigate regulatory challenges.

Future Growth Prospects

Analyze the company’s growth prospects. Consider factors such as the expansion of the edge computing market, the company’s pipeline of products or services, and its ability to adapt to emerging trends.

Growth | TipRanks

Management Team

Evaluate the leadership and management team. A capable and experienced management team is crucial for navigating the challenges and opportunities in the edge computing industry.

Management Team | Entrepreneur

Risk Assessment

Identify and assess potential risks, including technological risks, competition, market volatility, and geopolitical factors. A thorough risk analysis is essential for making informed investment decisions.

Risk |Risk Academy

Investing involves risks, and conducting thorough research or consulting with financial professionals is advisable before making investment decisions. Remember that market conditions and the competitive landscape can change over time.

Top Edge Computing Stocks to add to your list

Here are some of the best edge computing stocks to buy or add to your watchlist for the year 2024

Amazon (AMZN)

Amazon is a multinational tech and e-commerce company based in Seattle, Washington, USA. Founded by Jeff Bezos in 1994, Amazon started as an online bookstore but rapidly expanded its business to become one of the world’s largest and most diversified technology and retail companies.

Amazon | Amazon

Amazon Web Services (AWS), Amazon’s cloud computing arm, offers a range of services related to edge computing. Edge computing involves processing data closer to the generation source, reducing latency and improving response times.

Microsoft (MSFT)

Microsoft Corporation, commonly known as Microsoft, is a multinational tech company based in Redmond, Washington, USA. It was founded by Bill Gates and Paul Allen in 1975 and has since become one of the world’s largest and most influential technology companies. Microsoft is renowned for its software products, operating systems, cloud services, hardware, and contributions to the tech industry.

Microsoft | Microsoft

Microsoft is actively involved in the field of edge computing, offering a range of solutions and services that empower businesses to deploy and manage applications at the edge of their networks. Products like Microsoft Azure offer wide solutions to data and network problems, as well as artificial intelligence and machine learning.

Nvidia (NVDA)

NVIDIA Corporation is a multinational technology company that is widely recognized for its graphics processing units (GPUs) and contributions to the field of graphics processing. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA has evolved into a prominent player in various technology domains.

Nvidia | Nvidia

NVIDIA plays a significant role in the field of edge computing by providing hardware and software solutions that empower developers and businesses to deploy high-performance computing capabilities at the edge of networks. Edge computing involves processing data closer to the generation source, reducing latency and enabling real-time processing.

Alphabet Inc. (GOOG)

Google is a multinational technology company specializing in a wide range of internet-related products and services. It was founded in 1998 by Larry Page and Sergey Brin while they were Ph.D. students at Stanford University. Google has become one of the most influential and dominant technology companies globally.

Google | CBC

Google is actively involved in edge computing, offering solutions and services that enable businesses to deploy applications and process data closer to the network’s edge. Edge computing is critical for applications that require low latency, real-time processing, and the ability to handle data at the generation source.

How To Invest In Edge Computing

According to Yahoo Finance, the market for edge computing has the potential to surpass 158B by the year 2030. Delving into edge computing offers a compelling prospect for forward-thinking investors amidst a paradigm shift in data processing. This decentralized approach, reducing latency and enhancing efficiency, finds application across diverse sectors.

To strategically position in this evolving landscape, investors must grasp the nuances of edge computing, identify key players, and stay updated with technological advancements. As you continue your research, check out our podcast to learn more about the key aspects of the tech industry.

Best Edge Computing Stocks of 2023 | The Motley Fool

The partnership between cloud and edge computing, exemplified in scenarios like gaming, highlights the modern computing dynamics. As outlined in the guide, a comprehensive research approach is crucial for those eyeing edge computing stocks. Notable choices for 2024 include Amazon, Microsoft, NVIDIA, and Alphabet, each contributing significantly to the transformative potential of edge computing.

As the digital era continues to unfold, investments in edge computing stand as a testament to the ongoing evolution of technology and the potential for innovative solutions to reshape the way data is processed and utilized.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.