Video games have evolved from humble beginnings to become a cultural phenomenon, captivating the hearts and minds of millions.

From the Nintendo Entertainment System (NES) to mobile gaming, no longer is it considered a mere distraction or mindless pursuit.

Rather, video games are a vibrant form of art, storytelling, and interactive experiences that defy convention.

Today, people have made a career of playing and developing video games, proving even the biggest skeptics wrong.

In this article, we’ll explore the thrilling world of video game stocks investing, uncovering the best businesses in the industry and teaching you how to make the most of this opportunity.

To all our hardcore gamers and those wishing to capitalize on this bustling market, this one is for you.

What Are Gaming Companies?

Image by: World Economic Forum

Gaming companies encompass a broad range of businesses involved in the development, publishing, and distribution of video games, mobile games, online gaming platforms, and related services.

They include game developers, game publishers, hardware manufacturers, esports organizations, and more.

What’s more, technologies like generative artificial intelligence and cloud gaming are quickly transforming the way games are developed, making them more engaging than ever before.

As these revolutionary technologies become more available to the market, many new businesses will likely emerge, thus reinventing the industry altogether.

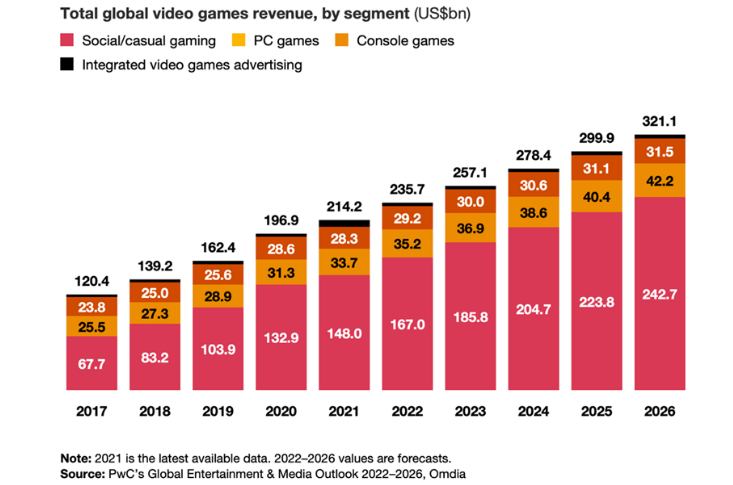

However, for the time being, the global gaming industry is expected to be worth $545.98 billion by 2028, with a compound annual growth rate of 13.20%, thus making gaming companies a worthwhile investment in the present and beyond.

Benefits of Investing in Gaming Companies

Investing in gaming companies offers investors many unique advantages.

Here are three of our favorite reasons why you should invest in gaming stocks:

-

Explosive Growth Industry

The gaming market has experienced remarkable growth in recent years, driven by technological advancements, expanding global reach, and the rising popularity of esports.

No longer is video gaming a simple hobby or fad, it’s a viable source of income that is empowering many to pursue a career in gaming altogether.

With the industry arguably still in its early stages, the gaming industry is subject to many economic tailwinds that are bound to help fuel and sustain growth for many years to come.

In other words, this is only the beginning.

-

Global Appeal

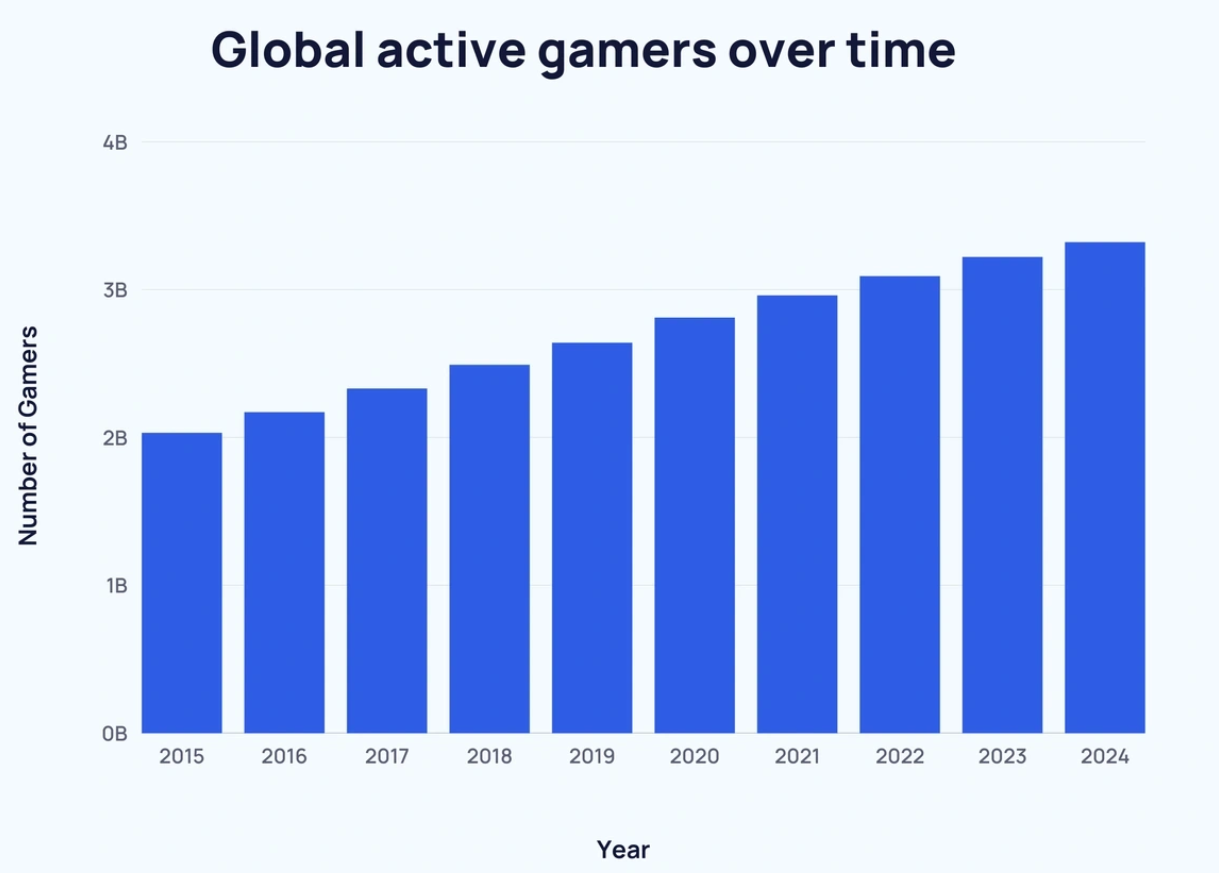

Image by: Exploding Topics

Gaming is not a one-size fits all type of market.

All around the world, developers and gamers are creating and playing games that are creating a culturally significant gaming community.

Today, there are roughly 3.09 billion active video gamers worldwide.

Even more astounding is the fact that the number of gamers has risen by over 1 billion in the past seven years alone.

As we trend toward a more digital economy, one can argue that this will be even more significant in the years to come.

-

Innovation & Technology

If you want to understand how far gaming has come, simply watch this video demonstrating Epic Games Unreal Engine 5.2 capabilities.

This hyper-realistic experience is just one example of how gaming is evolving and merging closer and closer to reality.

As we begin merging gaming technology with virtual reality hardware, artificial intelligence, e-commerce, cloud computing, and more, gaming’s technological potential will only strengthen.

Soon, we may even build fully functional ecosystems inside of a game whereby we can live and operate within a digital world just as we do in the real world—think of it like living within a more complex and advanced version of Minecraft.

Are Gaming Companies’ Stocks Risky?

While the gaming industry offers a lot of potential, not all gaming companies are created equal.

Here are some of the main risks that gaming stocks face today:

-

Intense Competition

The gaming industry is one of the most competitive markets today with over 2,400 video game companies worldwide.

Developers and publishers are constantly competing for customers’ time and money, doing whatever it takes to capture a gamer’s attention.

Sometimes this means investing hundreds of millions, even billions of dollars into a game so that it stays relevant and enjoyable.

However, if a game flops, developers can lose nearly as much time and money as they put into its development.

For a gaming company to be successful, it must create a reputation for quality and consistency.

Moreover, they need to find effective ways to generate recurring revenues so that they can follow up their last game with an even better one.

Otherwise, it is unlikely that a gaming company will survive for more than a couple of years.

-

Highly Disruptive Market

Building on the first risk, the gaming industry is also highly disruptive due to the constant development of new games and technologies.

Developers must be able to anticipate where the industry is headed and how they can leverage the most cutting-edge technology.

In some instances, a game can become obsolete even before it reaches the masses, thus significantly impacting a company’s bottom line.

To mitigate this, larger gaming companies own and develop multiple different titles at once and consistently release new products to keep their customers happy.

Another effective solution has been to update the existing titles to keep them fresh and exciting for their audience.

Either way, they must be able to create new offerings constantly if they wish to succeed in this industry.

-

Market Cyclicality

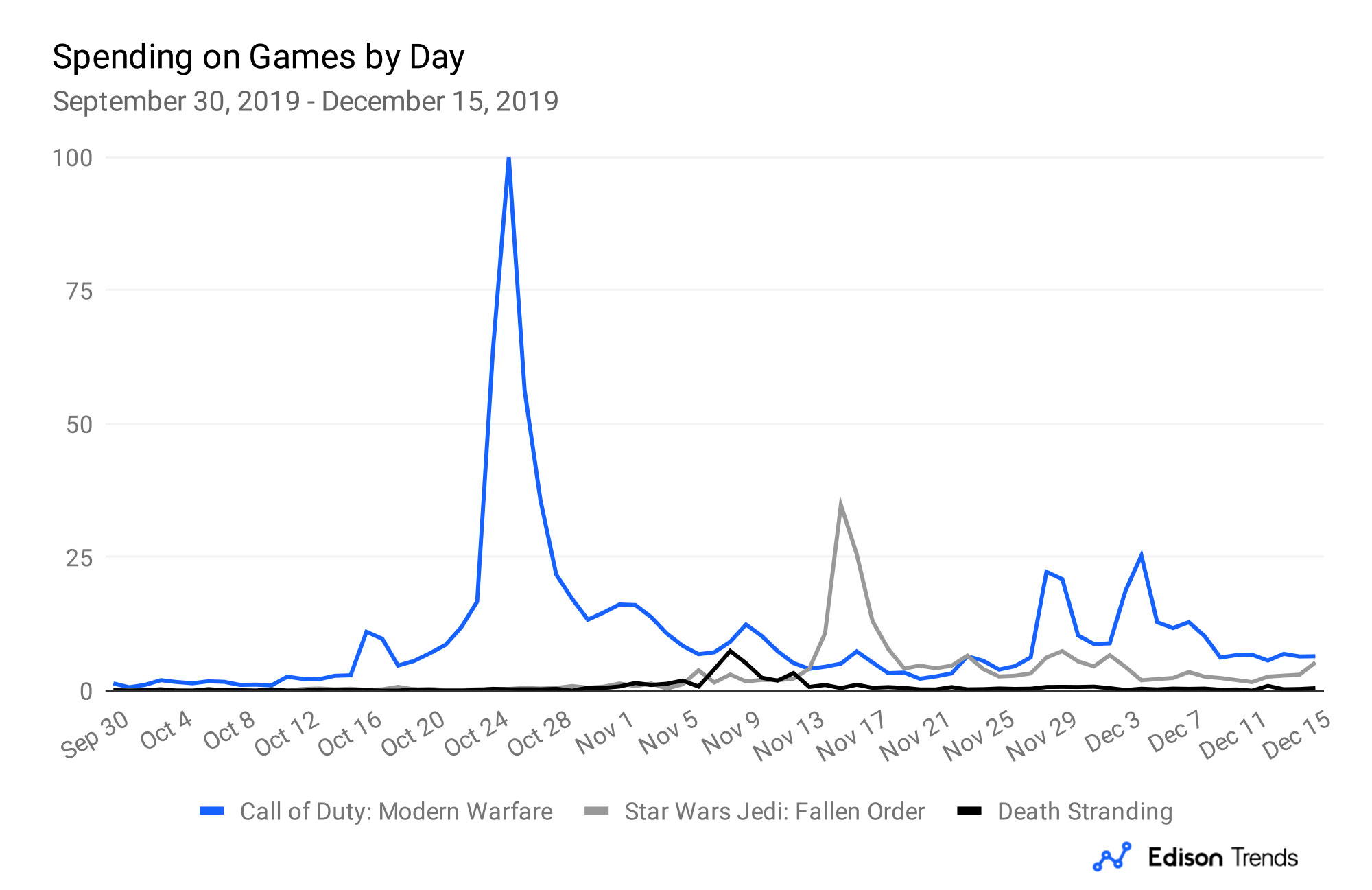

Image by: Edison Trends

Typically when a new game is released, it experiences a sudden surge of interest shortly after its release as gamers flock to acquire the latest title.

However, this jump is quickly followed by a significant and stagnating decline that carries on throughout the lifetime of its existence.

That is why historically it has been very important for new games to be a megahit following their release, because otherwise, it may greatly impact the success of the game altogether.

However, to overcome the seasonality of games developers have found new ways to prolong the sales that its titles generate.

A few successful examples of this are Fortnite, Call of Duty Warzone, Minecraft, and Grand Theft Auto V, which are all raking in profits to this day despite them being released years ago.

While their sales are nothing compared to when they first started, these games and others continue to offer new in-game products, while the games themselves have a lot of depth.

This, coupled with some games being free to download (ie. Fortnite), has enabled these companies to sustain success much longer than most and this is greatly impacting the industry at large.

If a company can replicate this model effectively, then it may result in them spending less capital on developing new games.

Instead, they can simply add a few new in-game offerings or update the world every once in a while, and reap the benefits of these cash cows for many years into the future.

To counter the cyclicality of gaming companies, check out these non-cyclical stocks to diversify your portfolio.

How to Analyze Gaming Companies’ Stocks

Now that we’ve covered the basics of the gaming space, it’s time to shift our attention to analyzing individual video game stocks.

Here are a few key factors to consider when analyzing a gaming stock:

-

Financial Performance

Video game companies sometimes spend massive amounts to develop high-caliber games.

Not only can this be a costly endeavor, but it also means that they need to create or raise recurring cash flows to ensure that they can pursue and create future titles.

When analyzing video game stocks, it is a good idea to focus on those who are consistently growing revenues and profits while maintaining very little debt on their balance sheet.

Moreover, a video game company that has ample cash is in a great position to continue growing given that they can reinvest it back into the business by creating new games or acquiring successful titles.

In general, a business that possesses strong financials is a good sign that the management team is working effectively and setting the company up for success over the long run.

-

Competitive Advantages

Competitive advantages are a key indicator of success in the video game industry.

Since the consumption of a game is largely dependent on its brand reputation, those that possess multiple high-quality titles are bound to find more success than those who are attempting to break through the saturated market with their first breakout title.

But that’s not all.

Economies of scale are also particularly important to a video game stock since more money means larger development teams, better software and server capabilities, as well as the number of projects that can be developed at once.

This alone is a tremendous competitive advantage as it mitigates risks and increases the likelihood that a title is embraced by the market.

Not to mention you can market it more effectively as well.

-

Market Positioning

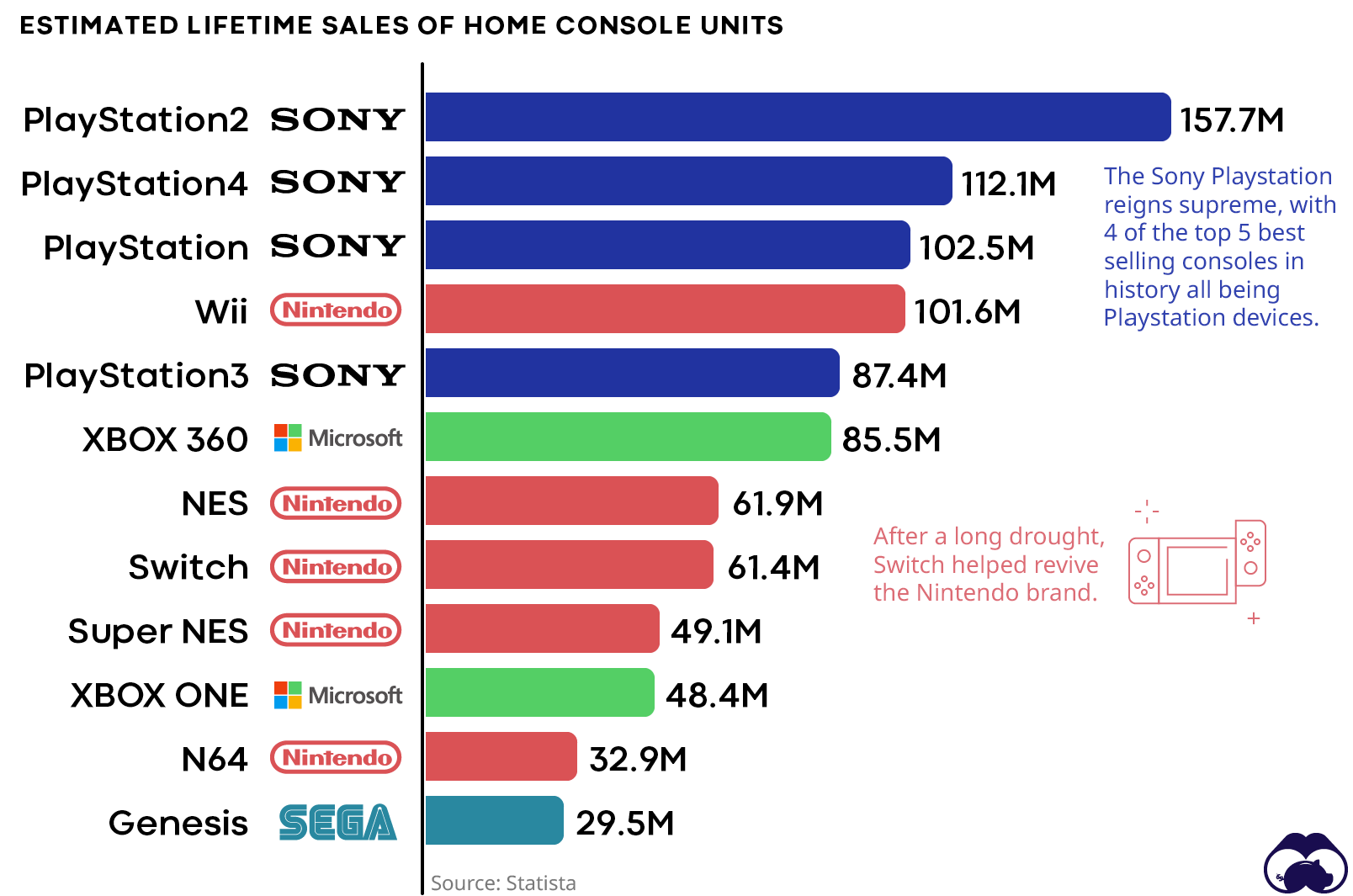

Image by: Visual Capitalist

While we have largely leaned on the video game development market in this article, there is much diversity within and beyond this segment.

Understanding which market or niche a company chooses to target will largely determine its success.

For example, it would be nearly impossible to penetrate the video game console market given that Sony, Microsoft, and Nintendo outright dominate it.

Furthermore, many developers have found it difficult to penetrate the first-person shooter genre due to the success of the Call of Duty franchise.

As such, understanding the markets a company chooses to operate in is essential if you want to make the most of your investments.

The good news is that there are many markets to explore including esports, consoles, cloud gaming, streaming, pc gaming, and more, so there are ample opportunities to find success.

Best Gaming Companies’ Stocks to Invest In

To help you get started on your video game stock investing journey, here are a few of our favorites, including key franchises that have dominated the market for decades.

-

Activision Blizzard (ATVI)

Market Cap: Activision was acquired by Microsoft for $69 billion.

Known for popular franchises like Call of Duty, World of Warcraft, and Candy Crush, Activision Blizzard is a dominant force in the gaming world.

With a strong portfolio of successful games and a loyal player base, this video game company is one of the best players in the market today.

That being said, the company recently faced scrutiny for failing to address workplace conduct complaints.

Though settled now, this could raise questions over the integrity of its culture.

Financially speaking, Activision Blizzard is in a strong position, generating $7.53 billion in revenues, $1.51 billion in profits, and free cash flows of $2.13 billion in 2023.

It has obtained a profit margin of 22.82% and a return on equity of 9.79% over the trailing months while possessing $3.61 billion in total debt.

Based on its key assets and financial position, it is fair to say that Activision Blizzard is one of the best video game stocks.

Perhaps this is why Microsoft was so adamant about buying the company for $68.7 billion in 2023.

-

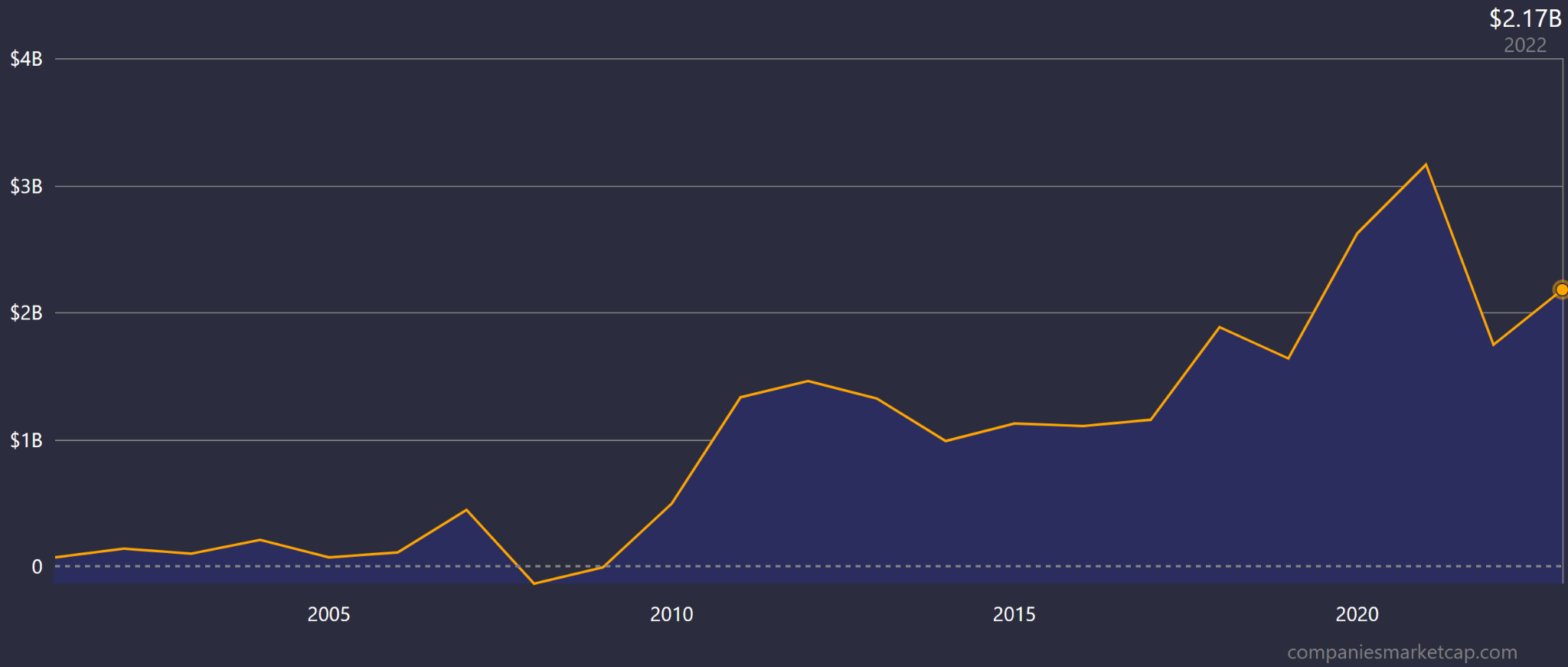

Electronic Arts (EA)

Market Cap: $33.60 billion

Another household brand, Electronic Arts is a leading global interactive entertainment company, known for franchises like FIFA, Madden NFL, and The Sims.

With a focus on high-quality games and a strong presence in the sports genre, EA has consistently delivered solid financial performance and sustainable growth.

Aside from owning a massive stake in the sports gaming market, EA has found success elsewhere in the mobile gaming sector with titles like Plants vs. Zombies and first-person shooters like Battlefield.

While it does own multiple high-value assets, one thing that may hinder the company’s performance moving forward is its lack of innovation in recent years.

For the most part, EA’s intellectual property consists of franchises that have existed for several years.

Though customers continue to enjoy their products, the lack of product innovation and development may affect the business negatively if they cannot find success with new franchises.

That being said, EA continues to have strong support from its fans given that it has achieved solid revenue growth over the years, going from $5.54 billion in 2020 to $7.43 billion in 2023.

Moreover, the company earned $802 million in profits and $1.34 billion in free cash flow, while producing a profit margin of 11.78% and a return on equity of 11.93%.

If you prefer a cash cow with a durable brand, Electronic Arts is a great pick.

-

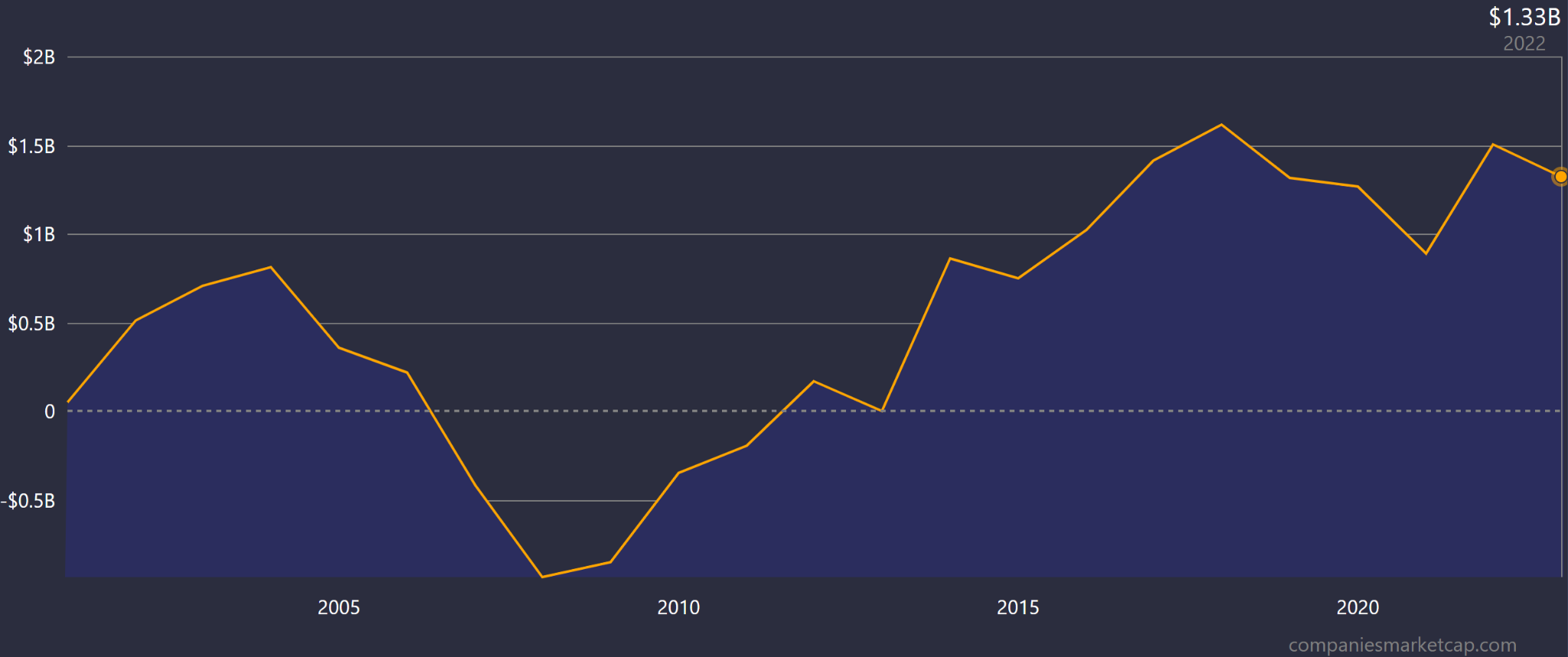

Take-Two Interactive Software (TTWO)

Market Cap: $22.66 billion

Take-Two Interactive is the company behind blockbuster franchises like Grand Theft Auto, NBA 2K, and Red Dead Redemption.

Its commitment to creating immersive, story-driven games has earned it a dedicated fan base and significant financial success.

However, you may be surprised to see how volatile its earnings have been in the past given the success of its hit-selling titles.

While this is alarming, Take-Two is one of the few gaming companies to successfully build a long-term franchise support model that provides recurring and diversified revenue streams for many years after a game is first launched.

Take GTA V for example, which is raking nearly $1 billion in revenue per year despite it being launched in 2013.

This is a testament to the level of quality and creativity the take-two team has and continues to in with its leading franchises, but it is also their biggest risk.

Since they tend to publish fewer games, the company is heavily reliant on staples like GTA V to generate cash.

During a tough economic time like the one we are currently facing, these in-game sales models can take a massive hit as consumers pinch their pockets a little tighter.

Fortunately, Take-Two is planning to release the next version of its GTA series in the coming years which should help bolster its sales and profitability over the next decade or so.

For shareholders, this means that they are likely to perform well in the near term as Take-Two’s golden goose returns to the market.

In 2023, the company produced $5.35 billion in sales, a net loss of $1.12 billion, and free cash flows of $112 million.

-

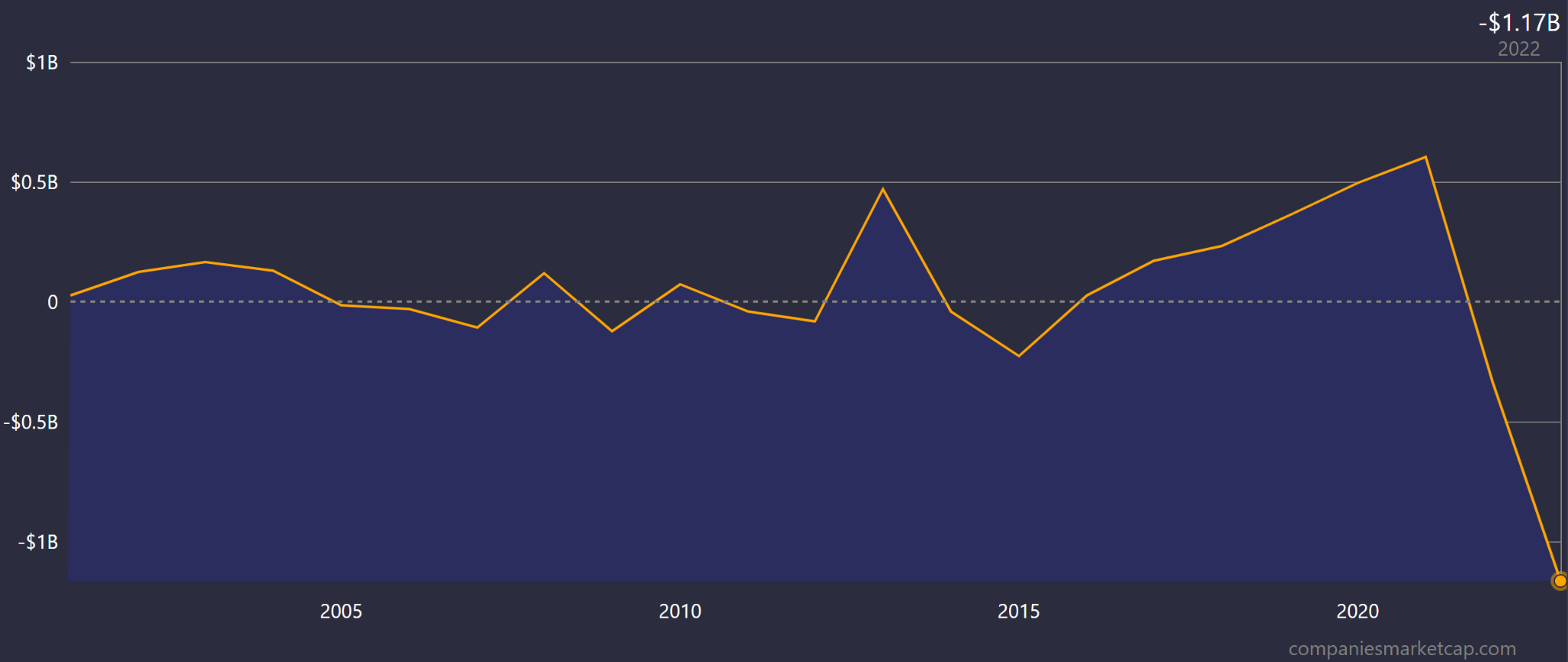

NVIDIA Corporation (NVDA)

Market Cap: $996.89 billion

Although not a gaming company per se, NVIDIA is a key player in the gaming industry through its graphics processing units (GPUs).

If you have ever seen cutting-edge graphics from a video game, it is likely due to these GPUs as they have proven to be the superior choice for gamers everywhere.

This is demonstrated by its 17% share of the global GPU market overall.

Plus, as gaming graphics, artificial intelligence, and cloud gaming continue to evolve, NVIDIA’s technology will remain at the forefront, making it an essential component in many gaming devices.

While quite impressive and clearly a top-notch company with high-quality management and an impenetrable moat, one thing investors should be cautious about is the company’s current valuation.

At a market cap of $996.89 billion and a P/E ratio of 97.72, it appears that NVIDIA shares are quite overvalued at the moment; largely due to the hype surrounding AI.

To put this in perspective, NVIDIA earned $26.97 billion in revenues, $4.37 billion in profits, and $3.81 billion in free cash flow.

On the other hand, Meta Platforms, a company valued at nearly $350 billion less than NVIDIA, earned $116.61 billion in revenues, $23.20 billion in profits, and $19.04 billion in free cash flow.

As you can see, it seems that the market may be overreacting to NVIDIA at this time given the unbalanced relationship between its stock price and business fundamentals.

Therefore, it is likely best that one waits on the sidelines until its market cap more accurately reflects its intrinsic value.

-

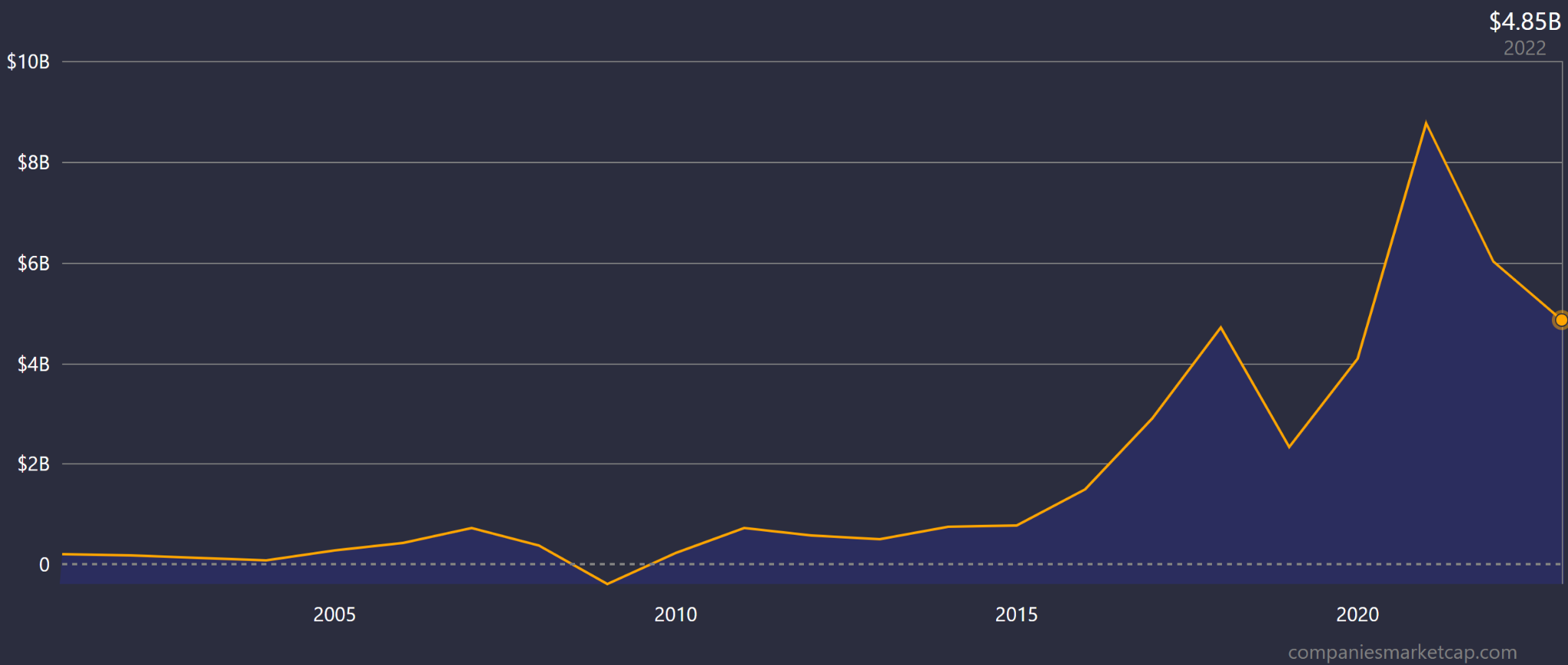

Nintendo (NTDOY)

Market Cap: $47.60 billion

Last, on our list, Nintendo is a legendary name in the video game industry, known for creating iconic franchises and innovative gaming consoles.

With a rich history that spans decades, Nintendo has captured the hearts of millions of gamers worldwide through its Mario and Pokémon franchises, among others.

Though much older than all of the companies mentioned (Nintendo was founded in 1889), Nintendo has found a way to adapt and innovate toward changing times, making it a key player still to this day.

Whether it is its gaming consoles, legacy brands, or enjoyable movies, the company always finds a way to stay relevant and create value.

While its high growth stage is likely behind it, Nintendo remains a prominent cash cow and an excellent choice if one is seeking exposure to the video game market.

In 2023, it earned $12.17 billion in revenues, $3.43 billion in profits, and $2.02 billion in free cash flow.

With the lowest P/E ratio of all the companies on our list (14.20), Nintendo is a solid choice if you are looking to build exposure to this fascinating market.

Final Thoughts: When is a good time to invest in gaming companies?

The video game industry offers investors an exciting opportunity to take advantage of one of the most promising markets.

However, it is always important to pay attention to the companies you buy and the price you pay.

As such, the best time to buy gaming stocks is when a fundamentally excellent company is trading at a discount for what it’s worth.

If you can sit patiently and wait for those prime moments, not only will you open yourself to massive upside potential, but you will also protect your downside risk in the process.

That being said, one thing is for certain… Gaming is here to stay!