7 Millionaire-Maker Lithium Stocks to Buy Before the Window Closes | Yahoo Finance

As the modern economy focuses on building sustainable solutions, lithium has emerged as a star player in the clean energy revolution.

This lightweight metal is not only a vital component in our daily lives through batteries in smartphones and laptops, but it is also incredibly important in the transition to cleaner transportation and renewable energy sources.

As we near the end of 2023, the global appetite for lithium continues to grow, making it an enticing industry for investors to focus on in terms of environmental impact and financial gain.

But navigating the maze of lithium investments can be daunting. From electric vehicles to renewable energy storage, lithium is a key piece of countless technologies poised to shape our future. To harness its investment potential, one must possess not only a keen understanding of the industry but also a forward-thinking perspective.

Today, we will be answering the question of how to invest in lithium commodity in 2023. We will explore the forces driving the lithium market, dive into emerging trends, and provide actionable insights regarding the best lithium stocks, including well-known lithium mining companies and lithium ETFs to invest in today.

Lithium Market Outlook

Tesla May Soon Have a Battery That Can Last a Million Miles | WIRED

The year 2022 witnessed a dramatic surge in demand for lithium, primarily driven by the accelerating adoption of electric vehicles. This surge sent lithium prices soaring, only to see the price settle back down for the majority of 2023.

But what lies ahead for the lithium market, and which factors will steer the course of demand, supply, and pricing?

Below are the biggest determining factors and trends that will continue to shape the lithium industry for the coming decade and more.

1. A Bumpy But Upward Ride in the Lithium Market

Lithium, often characterized by its fluctuating supply balance, mirrors the traits of an emerging market. Its rapid ascent can be attributed to the dominant role of rechargeable batteries, which now command around 85% of global demand. The surge in EV adoption during 2021 and 2022 drove this demand to new heights.

Nonetheless, the development of essential infrastructure, including lithium producers and refining operations, necessitates substantial investments in both time and capital. Consequently, supply struggled to keep pace with this surging demand.

This supply-demand imbalance propelled lithium prices to unprecedented heights in 2022, exceeding $70,000 per tonne. However, as the growth in demand tapered off with reductions in EV subsidies, prices have moderated in 2023.

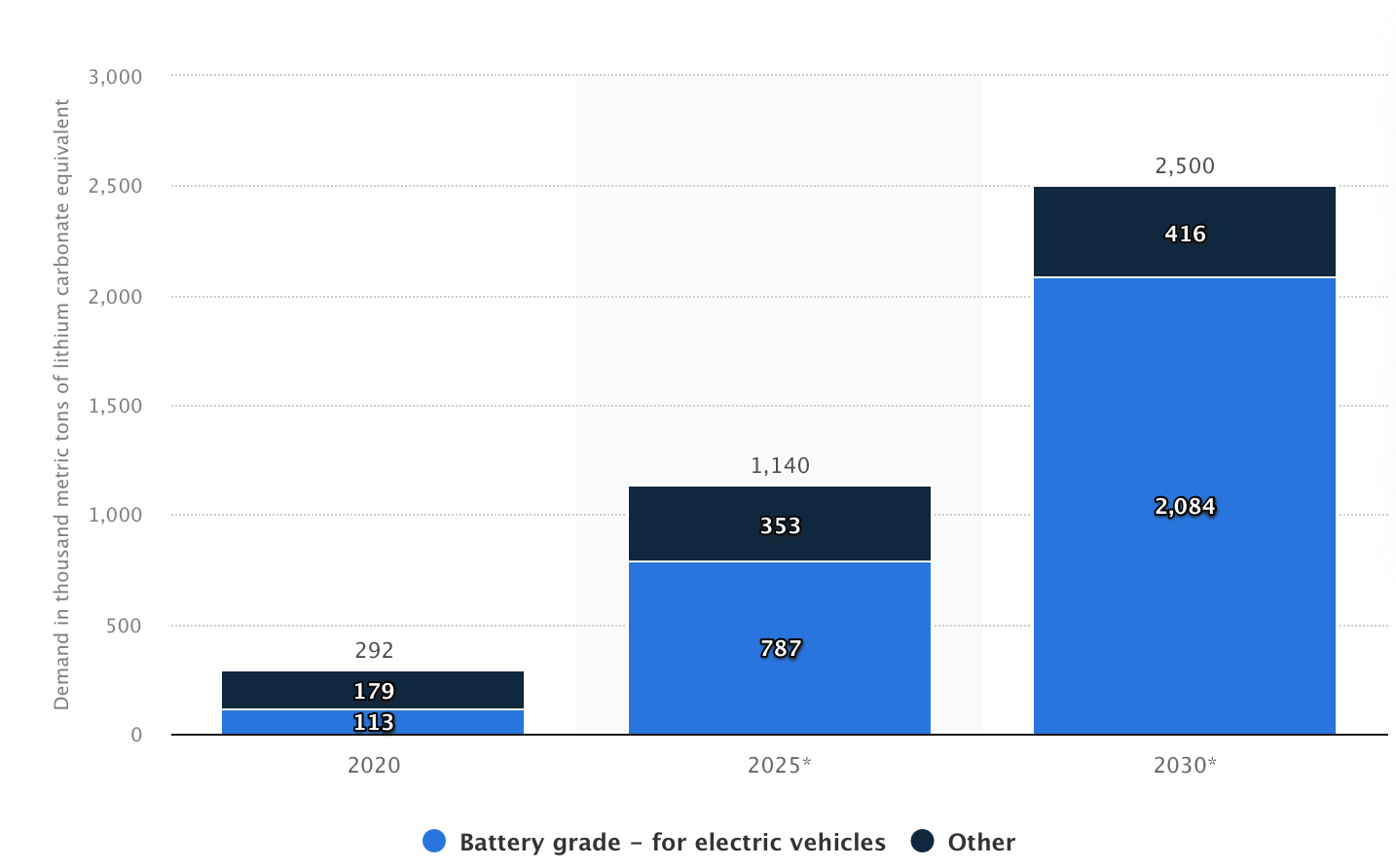

Looking forward, the increase in automakers using lithium for electric vehicles (paired with other trends) means the demand for the precious metal should increase exponentially in the coming decade. Furthermore, the chart below shows the predicted demand for lithium from 2020-2030, showing by the end of the decade, demand for lithium should be near 10 times what it is at today’s levels.

Demand for lithium worldwide in 2020, with a forecast for 2025 and 2030 | Statistica

2. Quality Matters as Batteries Dominate

Lithium’s journey into rechargeable batteries brings to the forefront a crucial aspect: not all lithium is created equal. Battery-grade lithium must meet stringent standards of quality and purity, making its production a complex process. Typically, new refineries commence production with lower-quality, technical-grade lithium, which is unsuitable for direct use in batteries.

As refinery operators gain experience and optimize their processes, the refined lithium’s purity improves, making it viable for battery production.

All this means that despite many companies working to increase the supply of lithium, there will continue to be a shortage of the high-quality lithium used in lithium ion batteries and other important products.

In other words, the shortage of lithium is expected to continue in the medium term as companies work towards improving their operational processes to create battery-grade lithium.

3. Increased Competition in the Lithium Industry

In 2022, over half of all lithium compounds originated from just five companies. However, a significant shift is happening right now where smaller firms are beginning to contribute more meaningfully to the global lithium supply, leading to a decline in the market share of these major players.

As such, the overall competition in the market is increasing, leading to firms looking to reduce costs and potentially distribute their lithium at cheaper prices. This trend is unlikely to materially impact the price of lithium in the long term. However, it will have a significant effect on the supply chain process and industry dynamics, leading to the potential of greater volatility in the short to medium term.

In conclusion, the three main factors affecting lithium prices include growing demand, the ability of companies to produce high-quality lithium, and the increase in players within the market.

Combined, these trends should continue to put upward pressure on lithium prices, meaning now is an opportune time for investors to consider investing in lithium stocks before the price of this commodity marches higher.

Best Lithium Stocks in 2023

11 Lithium Stocks Betting on Direct Lithium Extraction | Investing News

Above, we’ve covered three of the most prominent trends that will influence the lithium market in the coming years.

And in this section, we’re highlighting the companies that are poised to benefit the most from the growing demand for lithium.

From lithium battery stocks to the world’s biggest lithium producers, this list should give readers a head start in building a strong and forward-looking lithium-focused stock market portfolio.

Livent (LTHM)

Livent Releases First Quarter 2023 Results | LTHM Stock News

Livent operates as a global leader in lithium production, boasting manufacturing facilities across North America, South America, Europe, and Asia.

The company specializes in crafting lithium-based products tailored to a wide array of markets, including energy storage and battery systems, polymers, aerospace, and pharmaceuticals. Additionally, Livent holds a 50 percent ownership stake in Nemaska Lithium, a company actively advancing its Whabouchi mine and Bécancour lithium hydroxide facility in James Bay, Quebec.

The company currently trades at a suppressed PS ratio of 3.94 and boasts an operating margin of 48.86%. Combine this with a very small debt load of $249 million, quarterly earnings growth of 50% year-over-year, and cash on hand of $167 million, and you have a company with a winning business model, profits from operations, and a very bright pipeline of future projects that will contribute to impressive revenue growth for years to come.

Albemarle (ALB)

Albemarle (ALB) Stock Price, News & Info | The Motley Fool

The stock price of Albemarle has experienced a notable decline since the start of 2023.

This downturn has pushed the stock into technically oversold territory, finding support levels dating back to early 2022. Additionally, this dip presents an enticing opportunity, particularly considering the company’s promising current projects.

More specifically, Albemarle has emerged as a top contender in the lithium production space, with ongoing discussions with Exxon Mobil regarding potential supply agreements.

This agreement would be on top of the already lucrative contract they have with Panasonic and shows how Albemarle is able to attract some of the biggest companies in the world to use their lithium supply.

For the full fiscal year of 2023, Albemarle has revised its forecasts upward to reflect the resilience of the lithium market. It now anticipates net sales to surge by 40% to 55%, with adjusted EBITDA projected to increase by 10% to 25% year-over-year. The company is cash flow positive, trades at only 2 times earnings, and just saw their quarter-over-quarter revenue growth eclipse 60%.

It is highly unlikely this company will stay at such a low valuation for much longer, given their future prospects and increasing revenue.

Lithium Americas Corp (LAC)

LAC Stock Price and Chart — NYSE:LAC | TradingView

For investors looking for a more speculative yet more rewarding play on lithium stocks, Lithium Americas is a Canadian-based company that is showing tremendous promise in becoming a major player within the industry.

The company, despite its promising prospects, is currently not generating any revenue. Lithium Americas is actively engaged in establishing lithium extraction facilities in Argentina in collaboration with its partner, Ganfeng Lithium. Additionally, it has completed a feasibility study for another project located in northern Nevada and has commenced construction at that site. Furthermore, Lithium Americas has secured an offtake agreement for raw lithium with General Motors.

Obviously, investing in a pre-revenue company presents a considerable amount of risk. However, this is a company that is making great strides in becoming a high revenue-generating mining company, and if they are able to execute their strategic plan, they should see their stock price soar.

For investors who are willing to take on extra risk, Lithium Americas Corp is a great risk/reward play as lithium demand continues to increase.

Global X Lithium & Battery Tech ETF (LIT)

Global X Lithium & Battery Tech ETF | Youtube

The Global X Lithium & Battery Tech ETF is an attractive investment opportunity amidst the ongoing electrification of the world. With the global shift towards EVs and other renewable energy solutions, LIT offers investors a diversified portfolio of companies at the forefront of lithium and battery technology, making it a strategic play in the electric revolution.

What makes LIT so special is the ability for investors to gain exposure to the entire lithium supply chain.

This ETF not only holds mining companies but also consumer-focused firms such as Tesla and BYD, who are relying on lithium to power their electric vehicles. This ETF is a great way for investors to limit their risk but still enjoy the returns that lithium promises.

Key Takeaway

Lithium demand is set to increase in the coming years as more and more companies transition to technology that utilizes this precious metal. Trends such as lithium ion batteries in electric vehicles are showing this commodity is highly valuable in today’s economy and should continue to be an important piece of many companies’ supply chains as new use cases emerge.

However, what lithium investors should remember is that this market can be highly volatile based on a variety of factors, including supply chain issues and large swings in overall supply and demand.

To combat these risks, we’ve identified the top publicly traded lithium companies (and one ETF) for our readers to consider.

From companies specializing in direct lithium extraction, improving the lithium supply chain, or companies building the lithium batteries different firms rely on, the list above will give investors direct exposure to the lithium industry without taking on the inherent risk that some companies carry.

Lastly, take our list as a starting point and consider adding lithium stocks as a complement to a balanced portfolio that will be able to weather the risks and lithium price volatility that are common in the industry.

Those who can successfully mitigate their risk while finding great companies to invest in should be well-rewarded as this metal continues to shape new technologies and transform old industries.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.