Tesla (TSLA) is perhaps one of the most well-known, controversial, highly debated, and covered companies in the financial world. Current CEO Elon Musk often perplexes Wall Street with his unorthodox management style and grandiose personality. From recently buying Twitter to asking his followers whether or not he should sell more Tesla stock, Musk is not the typical leader investors expect to run a multi-billion dollar company.

Further, Tesla’s impressive market capitalization reflects investors’ optimism about its potential to achieve exponential growth. Nevertheless, failing to meet these high expectations could pose a significant risk for investors who buy today, as any misstep in company performance could result in a steep drop in the company’s share price. And to top it all off, competitors are stepping up their efforts to improve their technology and are heavily investing in the electric vehicle market, narrowing the technological advantage Tesla currently enjoys.

In other words, at current prices, buying Tesla stock offers both immense potential reward as well as significant risk for investors.

And with this backdrop in mind, we’ll be giving our readers an unbiased analysis of the company, so you can decide for yourself whether or not Tesla stock is worth buying.

What Does Tesla Do?

Tesla is often called an electric vehicle manufacturer. However, the truth is that the company is so much more.

Founded in 2003 and based in Palo Alto, California, Tesla is better defined as a vertically integrated sustainable energy company that aims to transition the world to electric mobility by making electric vehicles and other sustainable energy products.

Tesla sells solar panels and solar roofs for energy generation, plus batteries for stationary storage for residential and commercial properties. However, Tesla’s main product offering is their EV line, which has multiple vehicles in its fleet, including luxury and midsize sedans and crossover SUVs. The company plans to begin selling more affordable sedans and small SUVs, a light truck, a semi truck, and a sports car in the near future.

Current State of Tesla

In 2023, Tesla (like many other companies) has had their fair share of troubles. The wait times for customers to receive their Tesla car have shrunk from three months to nothing. Delivery growth is now behind its own internal targets, and production has exceeded deliveries since the beginning of the year – leading to Tesla making the strategic decision to reduce prices.

In short, Tesla is showing signs of decreasing demand mainly due to the possibility of a recession materializing in the mid to late 2023 calendar year. Additionally, Musk’s behavior since taking over Twitter has also raised questions from both consumers and investors alike, which could create unknown headwinds for the company to deal with moving forward.

All this presents what some may believe is a bleak picture for the $569 billion company. However, troubling times present the opportunity to show investors just how resilient their business model is and why now could be a great time to scoop up more shares.

The Bullish Case for Tesla

When looking at why Tesla stock could be a potentially good investment, it’s critical to understand the company’s competitive advantage and financials.

More specifically, Tesla has the advantage of being able to manufacture vehicles at a significantly lower cost than its rivals, allowing the company to reduce prices and boost demand during difficult times – which is something its competitors cannot do to the same degree. And while investing in Tesla stock is undoubtedly risky, the current price of shares at $178.93 represents a significant drop of 72% from their record high. Moreover, with a 12-month forward earnings ratio of approximately 24 times, compared to 201 times two years prior, the potential opportunity of buying today may be too good to ignore.

Further, the current problems Tesla is experiencing aren’t company-specific, but rather across the entire auto industry. This should give investors some reassurance Tesla’s business model isn’t under fire, but rather significant macro headwinds are an unfortunate reality that all businesses are currently coping with.

Tesla’s recent announcement of price reductions for its cars in China highlights the current predicament faced by the company. Tesla has been primarily focused on increasing production, with plans to manufacture 2 million cars in 2023, up from 1.4 million in 2022. However, this has raised concerns that the company may overproduce and subsequently be forced to lower prices to sell all of its vehicles.

This is most notably happening in China, where Tesla has slashed prices by 14% for its Model 3 and 10% for its Model Y. These price cuts, which could very well be implemented in the United States, will negatively impact the company’s profit margins. As a result, Wall Street’s earnings estimates for Tesla in 2023 have already decreased by 10% since the end of September. In simple terms, this situation places Tesla in a difficult position.

Tesla continuing to reduce prices to stoke demand is inevitable. And although the price cuts will have a negative impact on Tesla’s profit margins, the company has room to spare. In 2023, Tesla is projected to report operating margins of 18%, while the rest of the industry is anticipated to be around 8%. Even if Tesla were to sacrifice about 10 percentage points of its margins, it could still be as profitable as BMW, for example. Ultimately, Tesla has the ability to prioritize undercutting its competitors on price over profitability.

In addition, Tesla is one of only two car manufacturers that generate a profit from electric vehicles, with the other being BYD. All other companies are losing money, including General Motors (GM), which sells a Hummer priced at $110,000 and aims to achieve EV profitability by 2025. Meanwhile, some companies, such as Toyota Motor (TM), seem to be hesitating in their efforts to fulfill the demand for EVs in fears that greater demand moving forward may never materialize.

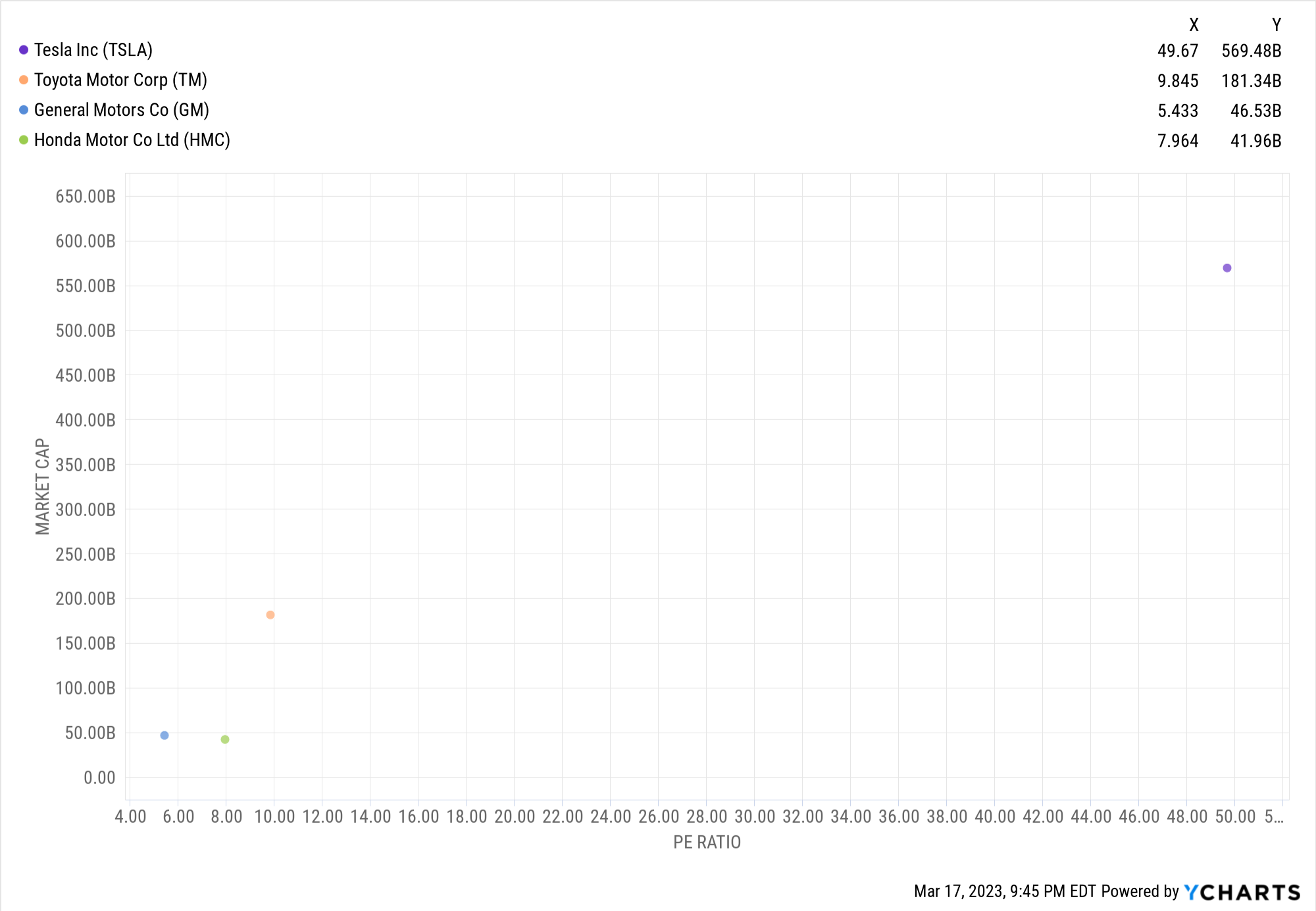

The majority of electric vehicle start-ups, such as Rivian Automotive (RIVN) and Lucid Group (LCID), are not yet profitable and lack the necessary scale to compete effectively. This puts them in a vulnerable position, especially as investors are increasingly focused on profitable growth, rather than just growth at all costs. And despite a 69% decline over the past 12 months, Tesla remains the most valuable car company in the world, with a market capitalization of approximately $569 billion. Figures such as these highlight the strength of Tesla’s position in the industry.

Tesla expects production will produce the highest amount of free cash flow among all car manufacturers in 2023, estimated at $12.2 billion, and up from $9 billion in 2022, which is yet another reason why Tesla is years ahead of their industry counterparts. Toyota, the second most valuable car company, is expected to generate free cash flow of approximately $10 billion in both 2023 and 2024.

Furthermore, even with price reductions, Tesla should not be significantly affected from a financial strength perspective. Analysts predict that Tesla’s free cash flow for 2023 will reach nearly $11 billion, even with factoring in vehicle prices dropping by 8% compared to 2022.

Tesla’s ambitions do not stop with its current offerings, however. The company plans to finally release its long-awaited Cybertruck in 2023 and may also unveil several software improvements, as well as more affordable vehicle options in the coming year. As well, Tesla is not solely a car manufacturer anymore. Its self-driving software, despite not completely living up to its name yet, is making significant progress, and customers are willing to pay a premium of $15,000 for its advanced driver-assistance features. This represents a unique product and revenue stream that no other car maker currently offers.

Tesla’s non-automotive business is worth $12 billion and is expanding quickly. Its focus is on renewable power generation and battery storage technologies. In 2022, Tesla opened a “megapack” facility in Lathrop, California, that can produce up to 40 gigawatt-hours of utility-scale battery storage annually. This expansion could potentially generate an additional $3 billion in operating profit each year, according to Gary Black, co-founder of the Future Fund Active ETF.

Finally, the electric vehicle industry is not as gloomy as it may seem. In China, EV sales grew by about 90% in 2022 and accounted for 25-30% of all new car sales. In the U.S., sales of battery-powered EVs increased by 70% in the first three quarters of 2022, and George Gianarikas, an analyst at Canaccord, anticipates that tax credits will boost sales growth further in 2023.

Tesla certainly has their challenges to overcome in 2023 and beyond, however, with a significantly a reduced price tag, industry leading margins, and consistent technological innovation gives them the ingredients needed to create lasting shareholder value for investors who are willing to invest today.

Past Financial Performance & Opportunities for Growth

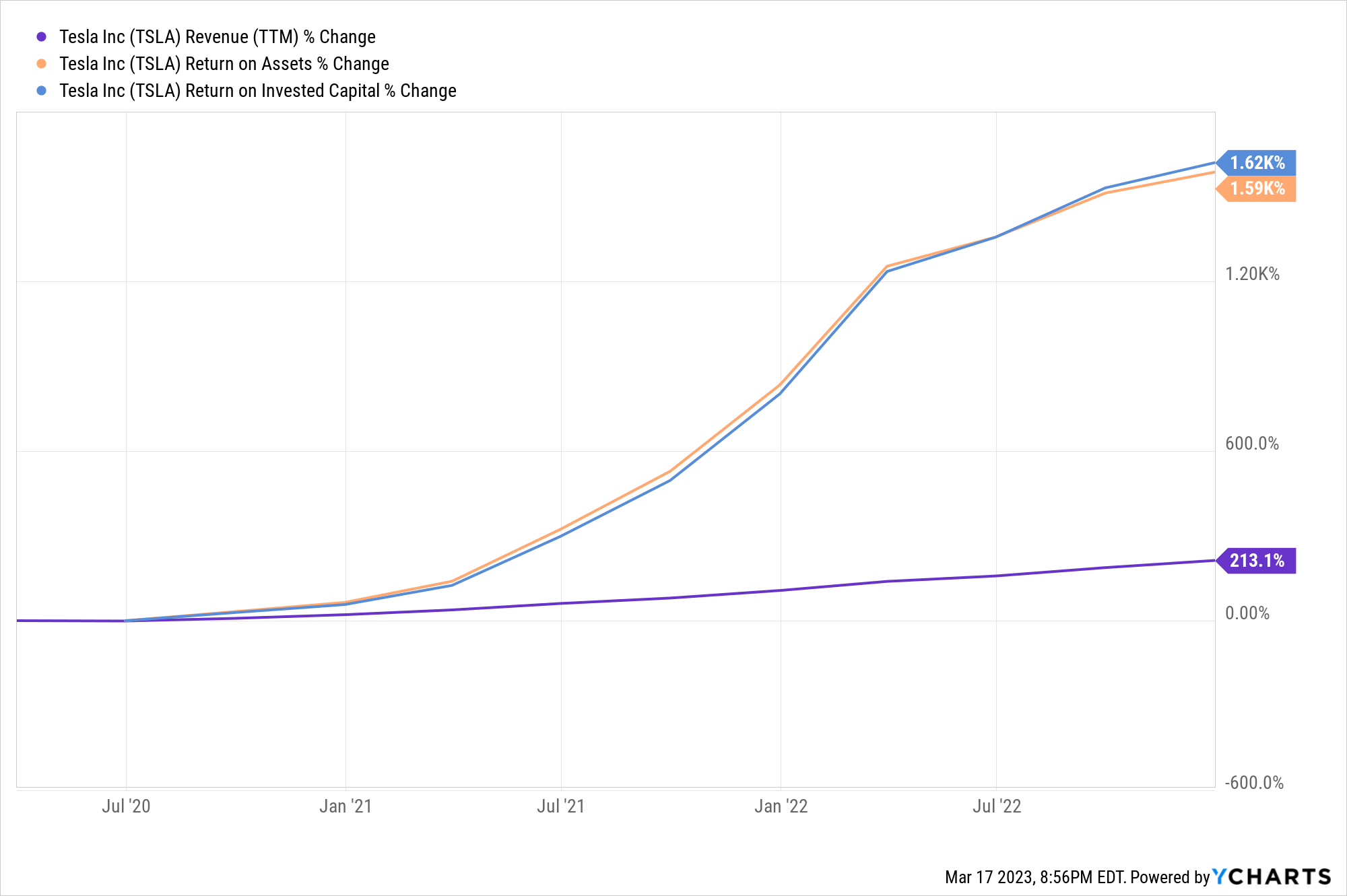

Tesla has done a remarkable job in not only growing its revenue but also improving how the company spends its money and the return on new opportunities. The chart below shows Tesla increasing its revenue by over 200% in the last three years, though even more impressively, the company has also increased its Return on Assets and Return on Invested Capital by over 1000%.

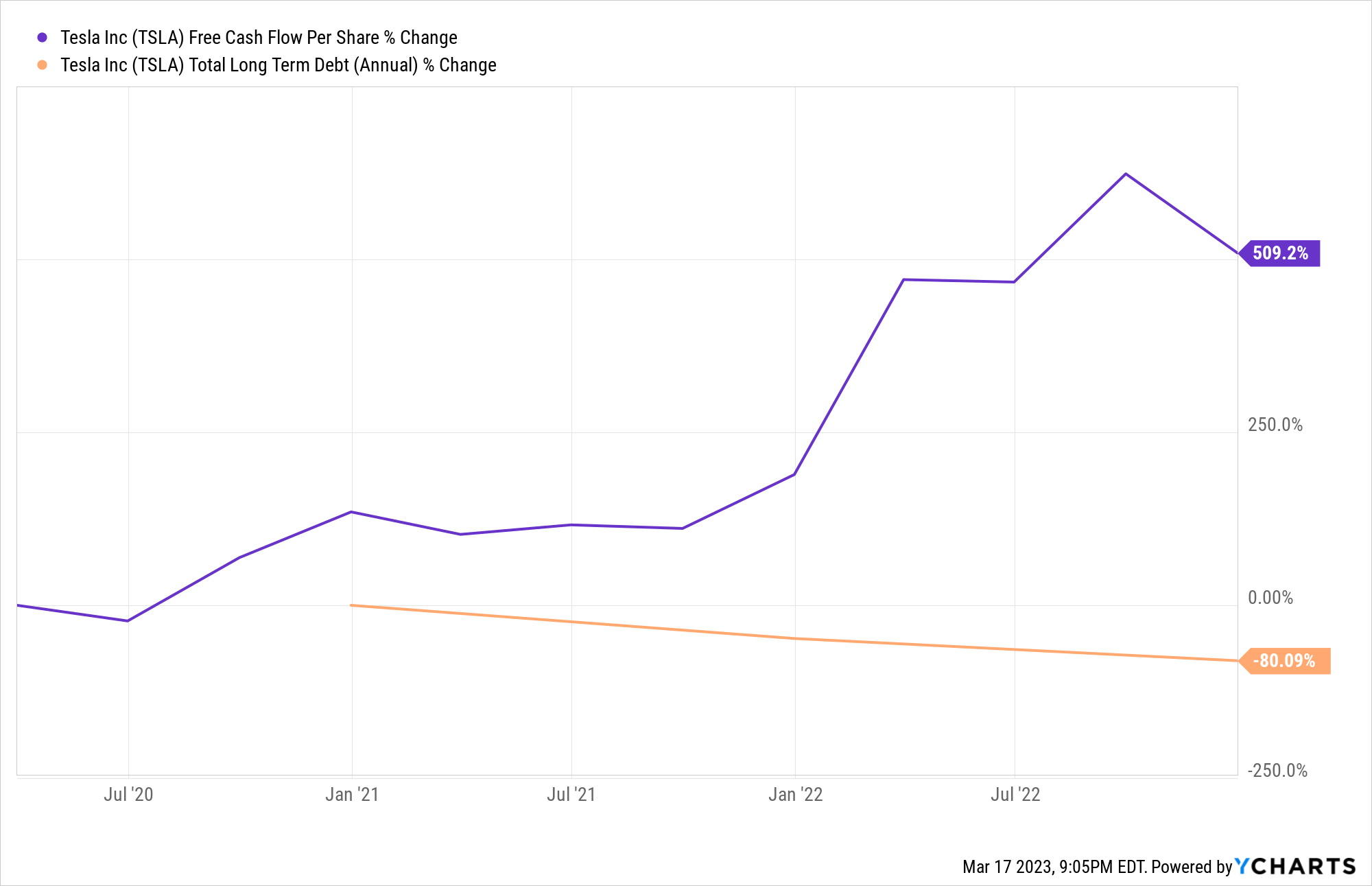

This goes to show the mass improvements in Tesla’s business model as the company has been able to scale their operations quite profitably. Further, Tesla has also been able to generate large sums of cash from operations while simultaneously reducing their total debt load. The next chart shows the company’s free cash flow per share increasing by over 500% and their total debt level decreasing by 90% within this same 3-year time frame.

Highlighting these figures is important, as Tesla has earned a lofty valuation over the years based on the fact the company will continue to facilitate double digit growth over the next decade. These financial metrics have begun to deteriorate (for the reasons mentioned above). However, they show how the company, historically, has been able to adapt to varying demand and shows investors that these near term headwinds could be a great buying opportunity.

When looking at the future growth prospects of Tesla, the most obvious comes from expanding their reach of current offerings in new and existing markets. The company is currently working on developing more affordable options from their EV line, which will open the possibility of expanding into parts of Asia, as well as appeal to lower income consumers in America. China is already an area of focus for Tesla, though they face stiff competition from other EV firms like BYD and NIO (NIO).

Additionally, the self-driving market is expected to increase at an annual growth rate of 13.3% from now to 2030, giving Tesla a new market to capitalize on as they continue to develop their own self-driving software. This also opens the possibility of self-driving taxis, a prospect that offers billions in further revenue if the company can continue its technological advantage and enter the market before competitors. Given their history of technological innovation and current head start in developing software and collecting data, Tesla stands a very good chance of grabbing a large portion of this future market.

Without question, Tesla’s opportunities for growth paired with their ability to adjust margins and cash flows based off macroeconomic conditions means the company is extremely flexible and adaptable in its current state. The payoff from self driving software or driverless taxi’s is far off from today, however, Tesla is currently years ahead of the competition in developing these new era technologies and show no signs of giving up their number one spot any time soon.

Valuation

With a market cap of $569 billion and a trailing price-to-earnings ratio of 47 makes Tesla shares some of the most expensive in the entire stock market. The company’s stock price is perhaps the biggest risk investors face when considering buying Tesla stock.

Current Tesla investors aren’t shy in highlighting the growth verticals and impressive margins the company currently has, however the reality is Tesla trades at over 20 times the valuation of other companies in the auto industry.

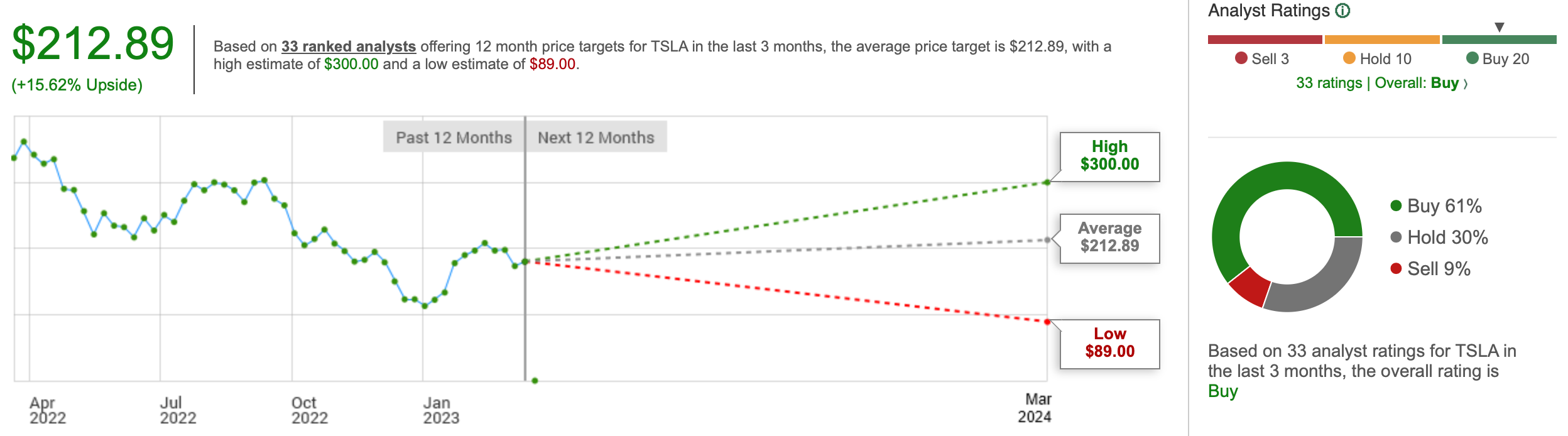

However, even with the company’s valuation above their peers, now may still be a good time to consider starting a position. Analysts covering the stock have an average price target of $212, implying upside of 15% from current prices.

Finally, with the company’s latest earnings report showing growth is still happening (albeit at a potentially slower rate) means further price appreciation is possible considering the company’s ability to perform despite headwinds in the EV market and consumer demand slowing. Finally, Cathie Woods, manager of the Ark Innovation ETF, bought over 17,000 shares on March 9, signaling large institutional investors may also consider Tesla’s current valuation as favorable in the long term.

Key Risks

Since Elon Musk acquired Twitter in late October, Tesla’s brand has suffered a reputational blow, as shown by a December YouGov poll in which more respondents had an unfavorable view of the company than a positive one. This has translated into an operational hit, as two-thirds of respondents in an unrelated Morgan Stanley poll believe that Musk’s Twitter behavior is negatively affecting Tesla’s fundamentals.

Tesla’s fourth-quarter deliveries, announced on Jan. 2, made it clear the company is facing hard times. Analysts had predicted around 420,000 deliveries, but Tesla only delivered 405,278 vehicles. As a result, on Jan. 3, the company’s stock fell 12%, marking its worst start to a year ever. Although there were various obstacles, such as lockdowns in China and inflation putting pressure on potential car buyers, Musk received most of the blame.

Adding to the company’s woes, many economists expect a recession in 2023, which typically results in a one-third drop in new car sales. In the US, sales are already 20% lower than pre-pandemic levels due to persistent parts shortages. Nevertheless, a recession may give Tesla the time it needs to develop a more affordable car model, particularly if other automakers decide to cut back on their EV efforts. And although a recession could hinder Tesla in 2023, the company is in a strong position to weather tough times. In other words, and as one analyst covering Tesla described it, “Recent concerns are overstated.”

What is Likely to Influence Tesla’s Stock Price?

Before rushing to buy Tesla shares, investors should be sure to understand what is likely to influence the company’s share price moving forward.

Looking short term, earnings estimates, as well as broader macroeconomic news is likely to cause large swings in price movements. Tesla has already voiced concern over an uncertain macro environment and consumers beginning to decrease spending, both of which will negatively affect the company’s share price if consumers feel they can no longer afford Tesla’s high quality yet higher price tag EV’s.

In parallel to a deteriorating macro environment, Elon Musk and his ability to juggle managing both Tesla and Twitter will undoubtedly influence Tesla’s share price. Musk has already said he plans on finding his replacement for running the social media company; however, Tesla investors are sure to be less than thrilled should Twitter take up any more of the entrepreneur’s time.

Longer term, Tesla’s stock price will be influenced mostly by the ability to perform and the ability to continue to grab market share. Success in China is paramount, as it currently offers the largest market size and room for Tesla to grow, though China also presents the biggest risk from competitor BYD which is quickly showing they are catching up to Tesla’s technological advantage.

Other Tesla initiatives, such as their multi-use battery and solar panel business, will continue to be a main focus for investors as the green revolution continues to be a top priority amongst countries. Here again, competitors such as SunRun (RUN) are quickly grabbing market share within America and becoming a valiant competitor for Tesla in the sustainable energy sector.

Without question, Tesla’s share price is set to see swings in both directions as the company enters what is perhaps the most uncertain macroeconomic environment in their history. Investors will find solace in understanding the factors that are likely to influence the company’s share price, to better identify potential buying opportunities and when to consider trimming their positions.

Buy or Sell Today: Where is Tesla Stock Going?

So far in 2023, Tesla stock has gained 46%, leaving many to wonder if they missed a buying opportunity or if the stock is set to go higher throughout the rest of the year. Stock markets have certainly been volatile as of late due to banking concerns, inflation, rising interest rates, and the possibility of an incoming recession. However, even with this market turbulence, Tesla has shown remarkable strength and the ability to produce results in a less-than-favorable macro environment.

Competition in the EV market is heating up, though no other company has the margin, cash flow generation, and technological advantage that Tesla holds. And in an environment where companies are likely to cut prices to help stoke demand, having ample profit margins and strong free cash flow will further separate the company from its competition.

Analysts seem to be in support of Tesla stock gaining from here, with an average price target of $212 and major funds buying large amounts of shares within the last few weeks.

Long term, the future looks very bright for Tesla as they continue to be the premier EV maker in North America and continuously expand their reach into new markets. The company is set to open two new giga factories this year, which should help them gain further control of their supply chain and allow them to vary production based off demand more efficiently.

However, Tesla is also known to have an extremely volatile stock price, meaning investors may see a better entry price in the near future. For long term investors, who are willing to wait out near term volatility, today’s prices looks very appealing based on the company’s strong market positioning and financial health.

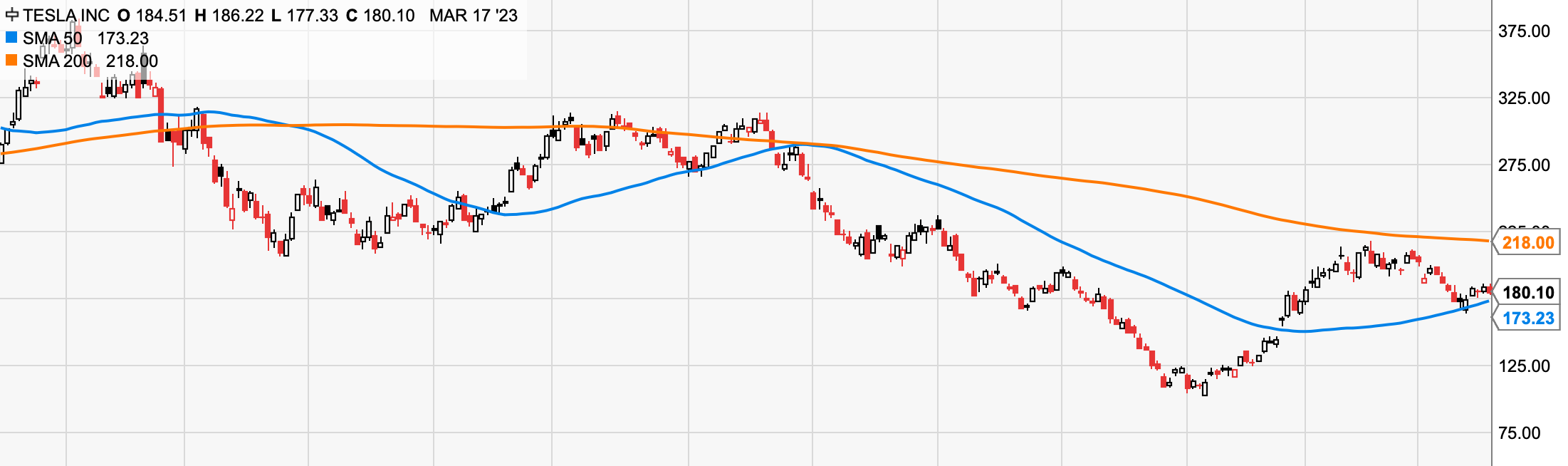

Shorter-term traders may wish to see Tesla stock break through their 200-day moving average (the orange line), as in 2023, the stock has been rejected multiple times within those levels.

In conclusion, Tesla could make a great addition to any investor’s portfolio as they continue to hold both a strong competitive advantage and multiple catalysts for further growth.

Those who are content to withstand long bouts of volatility should consider adding shares today, though short-term traders might do well to see more encouraging technicals from Tesla stock before adding shares.