We all know someone that somehow seems to be able to invest in startup companies (specifically, pre-IPO companies. Investing has never been easier, with access to publicly traded companies being simpler than ever. However, the public stock market is not the only place that an investor can look to to buy company shares.

Often, companies in the pre-IPO stage may issue shares that offer an alternative to traditional equities. The vehicles and methods with which you can invest in pre-IPO stocks are many and vary depending on situation (among other factors).

No fear, I will guide you through the (sometimes) convoluted world of private companies. In this article, I will cover:

- What is a pre-IPO share?

- Who is buying pre-IPO stocks

- Why would I buy pre-IPO stocks

- How could I buy pre-IPO stocks

Now, before we get started, you might need a refresher on investing in small caps; we got you here.

What are Pre-IPO Companies & pre-IPO Stocks

At the most basic level, pre-IPO stocks are shares of private companies. This means that those shares are not trading on any public exchange (such as the New York Stock Exchange).

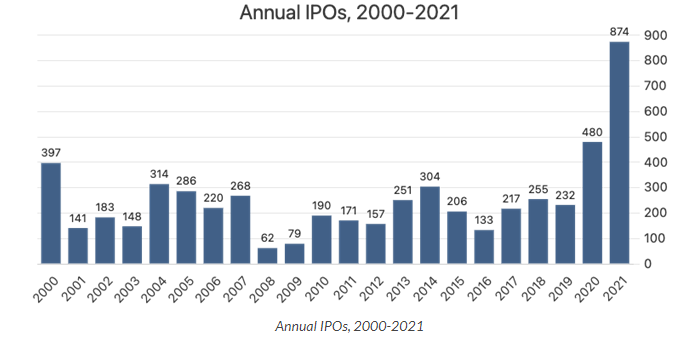

Typically, since the 2000s dot-com crisis companies have opted to stay private much longer. For example, in 1980, the median age of a company sat around 6 years; as opposed to a median age of 11 by 2021. The pandemic years, however, were a statistical blip as they saw a flood of companies rushing to the markets (partly due in part to the availability of funds, insane valuations, and insane retail participation).

Annual IPOs, 2000-2021 | Equifund.com

This policy of staying private longer has be supported by the rise of private investors and venture capital funds. This allows the company to retain control much longer, and not be at the whims of the mass psychology inherent in the public markets.

A small history lesson: Obama & Pre-IPO offerings

Privately held companies will offer pre-IPO stocks via pre-IPO placement (private placement as it is often referred to). These shares tend to come at a steep discount due to the risk at this stage.

Prior to 2012, buying pre-IPO shares was limited to institutional investors, accredited investors, hedge funds, and private equity firms. The average retail investors (losers like you and I) were systemically kept away from these investments, to essentially protect them from themselves.

:max_bytes(150000):strip_icc()/GettyImages-1051659174-0deb811504364fbd9749b4dfb976f4ca.jpg)

Jumpstart Our Business Startups (JOBS) Act Overview | Investopedia

The prevailing belief was that normal individual investors lacked the sophistication and knowledge to make the informed decisions early investors would make.

This all changed when the Obama administration signed the JOBS act which was meant to open up differing vehicles available to startups looking to raise funds.

What does a pre-IPO stock look like?

The shares a private company sells tend to embody a few characteristics (or at least a combination of them). These include being more opaque, less regulated, limited historical data, often higher fees, redemption restrictions, specific legal/tax implications, etc.

Having so many facets to them has previously made investors balk and honestly, just confused. Fear not, new platforms and good old technology has shed some light on these private investments.

Why even go the pre-IPO stock route?

Often, private companies purse pre-IPO placements and offer pre-IPO shares for a variety of reasons (some better than others).

You need money to grow (duh)

Let’s say you and your (totally not annoying) finance friend decide that you need to raise money for growth. Typically, the IPO route (which essentially relies on a combination of accredited investors and wildly unsophisticated retail investors at a small cap level) is the chosen course.

What is economic growth? | McKinsey

However, an initial public offering opens up the value of your company to wild fluctuations, often due to factors out of your control.

Now, when you issue pre-IPO stocks it allows you to raise a quasi-predictable amount of money (and yes, predictable is a dubious term to use here, in this market), often coming from more sophisticated actors (large investment firms, private equity funds, maybe an accredited investor or two…good job).

Are you a control freak?

Maybe you and your friend are concerned with losing control over your business, and having to answer to the demands of investors who may view your company as little more than a portion of their investment strategy.

As well, even going with traditional fund raising routes (even for private companies) like turning to venture capitalists, hedge funds, private equity funds, etc. may have the same problem. Often these cousins of traditional financial institutions (they just have cooler names and beers on tap) are not really concerned with aligning their goals with that of your company.

How does a Hedge Fund work | WallStreetMojo

Instead they care mostly about the rate of return they can get from private companies, even if that means pushing for actions antithetical to the company.

Maybe you need advice

Let’s not just bash private equity funds, hedge funds, etc., they can be useful to a private company issuing pre-IPO shares.

They tend to have a wealth of industry knowledge and experience that a privately held companies may be missing. As such, bringing them on with “skin in the game” (I roundly despise that euphemism, by the way), allows private companies to benefit from them.

What is industry knowledge? | The Functional BA

Specifically, in the transition period from being a pre-IPO company to a publicly traded stock, their guidance and experience can be nothing short of transformative. You’ll just have to sit through them hiring their golf buddy as a “subject matter expert consultant”.

Who is Buying Pre-IPO Stocks

A multitude of different parties can purchase pre-IPO stock (which we have mentioned above):

Individual investors: typically via some sort of crowdfunding campaign, one of many pre-IPO investing platforms, or via pre-IPO brokers in that investor’s network.

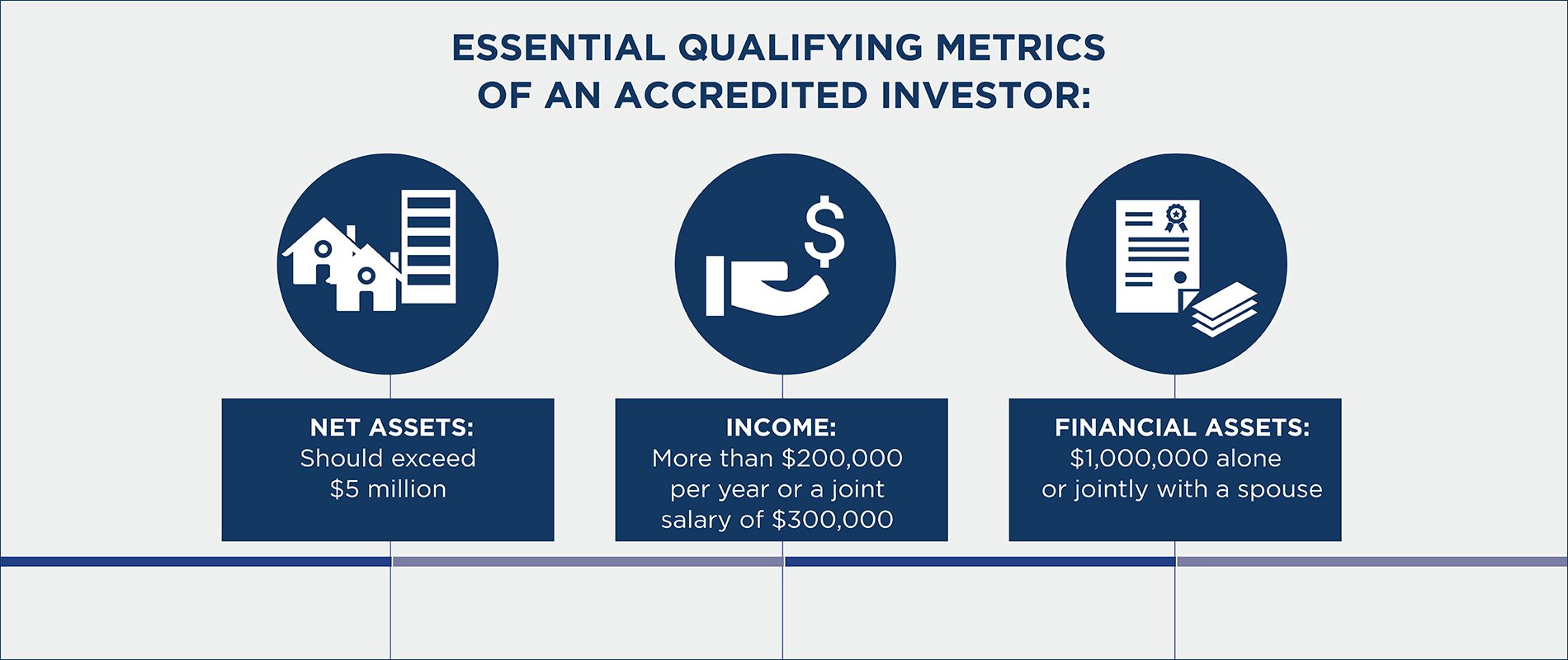

Accredited Investors: An accredited investor is an individual that due to a combination of net worth and qualifications, meets a certain bar allowing them to participate in investments that the typical person cannot. Sometimes these are done via a secondary marketplace, sometimes employees looking to sell insider shares, another accredited investor looking to sell, etc.

What is an Accredited Investor in Canada? | CMI MIC Funds

Institutional Investors: Typically these entities like to invest in primary capital raising rounds. They include private equity, venture capital (become a venture capitalist with $100, we got you), etc.

Your pals: yes, sometimes people in the founder’s network (like friends and family) will buy pre-IPO stock during the early start-up stage. This is often still accredited investors but exception and work arounds are possible (just ask any small-cap broker in junior mining).

Why Would I Buy Pre-IPO Stocks

I bet by now you are absolutely transfixed by this article (I mean who doesn’t want to talk about the structure of private companies) and are wondering one thing:

Is there a good reason I should buy pre-IPO stocks? Are there reasons to not buy pre-IPO stock and disengage from all pre-IPO investments?

Well, lucky for you, we have a few answers here.

Investing in Pre-IPO Secondaries for Advisors | WallStreetMojo

Returns, returns, and more returns

Now, typically when you buy pre-IPO stock, the associated company has to compensate the investor for that risk. As such, pre-IPO companies tend to issue pre-IPO stock at a steep discount to investors.

First, most pre-IPO shares typically can come with other features and privileges such as warrants, for example, that have tremendous upside potential.

As well, if all goes well, that private company will eventually look to retail investors and will go public. When this happens, it is likely that the IPO price is significantly higher than what early investors paid for the pre-IPO shares. So when an investor goes to sell those shares or some sort of redemption vehicle, they will earn a significant return.

Diversify that investment portfolio

The private markets represent another asset class, like the public markets. A healthy investment strategy can include investing in both public and private companies (might help that retirement portfolio of yours).

One can even still use the public markets and get access to private companies via private equity ETFs.

Business Diversification – When, Why and How it’s done | Shorts UK

Ground floor access

Assuming that the company grows in value over time, the earlier you get in, the higher your upside. As well, even from a more emotional or cerebral standpoint, pre-IPO investing can give a sense of purpose and adventure that may be lost in the public market.

There is a satisfaction in knowing you made a bet on your convictions and macro-economic understanding…and you were right!

Risks with pre-IPO Investments

Pre-IPO investing is not without significant risk, dear investor. In fact, pre-IPO stocks offer a unique set of risks that should give an investor some pause. Typically institutional investors have access to much more data and measures helping mitigate risk, the retail investor should proceed with a great degree of caution and never invest more than they are willing to lose.

Increased downside risk

There exists the risk that you could lose part of or your entire investment. This can happen if the company simply does not perform well or actually fails.

Illiquidity

If you do purchase pre-IPO stocks, you will find that they are not easy to trade like publicly traded stocks. As these shares belong to private companies, and private company shares are not traded on public exchanges, selling a position may take significant time and there may be a myriad of rules discouraging this.

:max_bytes(150000):strip_icc()/GettyImages-628134206-5bcdd1a7c9e77c007c0c7ce8.jpg)

Liquidity: Definition, Ratios, How It’s Managed | The Balance

Financial Opaqueness

Publicly traded companies are required by law to disclose their financial statement in a specific and regulated fashion. This gives investors a general sense of certainty and clarity as to what and how the company is fairing.

However, pre-IPO companies, given their private structure, are not required to disclose that level of detail financially.

It is then difficult for investors to make informed decisions or trust that numbers are not, at best, inflated, and at worst, completely wrong.

The sheer amount of rules

If you do invest in pre-IPO stocks, you will find that there is an insane amount of red tape and regulatory scrutiny.

At its heart, these are safeguards to protect investors and maintain trust in new and emerging companies, thus facilitating cashflows to them and the wider economic landscape (and who doesn’t love that, right).

However, for example, restrictions on who can buy pre-IPO stock might mean that different groups of would be investors may be left out in the cold; to invest on the public market like everyone else.

As well, pre-IPO investors may be subject to lockup periods imposed by the company, meaning that the investor will have to hold the security regardless of what they want, for said period. Other restrictions and rules may be imposed as part of buying pre-IPO stocks.

What if they never IPO?

When you buy pre-IPO shares, you are essentially making a bet that the company will eventually run to their favorite IPO underwriter, and go public.

This may never actually happen or can be delayed past a point that the investor is comfortable with.

Pre IPO Investing: The How

If you have made this far (congratulations), you should be wondering how to actually buy pre-IPO stock. No fear, there are few different ways, depending on who you are and what resources you have.

Have money? Be an angel investor

Angel investors invest their own personal capital into early stage and mid stage companies in exchange for equity.

However, not anyone can be one…you need to have that accredited investor status typically.

Getting Started With Angel Investing | Entrepreneur

Go indirect

You can get access to pre-IPO stocks as a retail investor by investing in entities that are publicly traded and own shares of private companies.

ETFs that are linked to private debt markets, venture capital, etc. as well as public venture capital firms may be good routes to go.

ETFs explained – ETFs simplified | iShares – BlackRock

Become friends with a broker

These professionals often have insights to private companies that are looking to raise capital from investors. Even for normal investors, some brokers can help them invest and buy pre-IPO stock.

Marketplaces

Whether that is primary market places where you purchase pre-IPO shares directly from issuers or secondary marketplaces.

Note, pre-IPO shares on secondary marketplaces often di not have to go through underwriting, meaning the actual value of the security is speculation.

A Final Word

With that said, now that you armed with this knowledge, go out and be the best investor you can (maybe even make Buffet proud).

As you see, pre-IPO investing and buying pre-IPO stock is a complex process and requires rigorous research and safe guards for success.

As always, this does not constitute investing advice, and you should always do your own genuine research before investing.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.