There is something truly remarkable about discovering a business before the rest of the world finds out.

After months of digging, moments of frustration, and a trickle of doubt, it all seems worth it, when that seemingly small investment turns into a life-changing sum of money.

But to get there requires a level of patience and devotion that few are willing to embrace.

Fortunately, however, you are making an important first step by studying this small-cap investing beginner’s guide.

For within this article, there is everything you need to know about small-cap stock investing and what it takes to be a successful small-cap investor. From discovering how much to invest in small-cap stocks, to how you should go about investing in small-cap cannabis biotech stocks.

If you are ready to find small-cap stocks that have the potential to change your life, continue reading below.

What is a Small-Cap stock?

Before we begin learning about how to find small-cap stocks, we must first understand what they are and why it is valuable for an investor to add them to their stock portfolio.

Essentially, a small-cap stock is a publicly traded company that has a market capitalization between $300 million and $2 billion.

This distinguishing factor separates them from large-cap and mid-cap companies (market capitalization of $2 billion and beyond) and from penny stocks (market capitalization of less than $300 million).

Aside from that, small-cap companies tend to be newer businesses with fewer years under their belt and often receive less attention and coverage than larger companies because of their relative size within the stock market.

Interestingly, this presents us, retail investors, with many juicy opportunities since most big banks, mutual funds, and hedge funds overlook these seemingly insignificant stocks.

But more on that later.

For now, we will focus on the pros and cons of small-cap investing.

To learn more about other growth investing opportunities like small caps, check out our “Growth Stock Investing: a Beginner’s Guide”

Advantages of Small Cap Investing

Higher Potential gains.

As a smaller business, relative to the likes of Apple ($AAPL) or Tesla ($TSLA), your money holds greater buying power when you invest in small-cap stocks because you are able to acquire more shares of the company, for less.

For example, if you were to buy one share of a company worth $1 billion at $10 per share, and the company grew to a $10 billion market cap by the end of the year, that one share would now be worth $100, meaning you realized a 900% return on investment.

On the other hand, if you were to buy one share of a company worth $250 billion at $10 per share, and the company grew to a $500 billion market cap by the end of the year, that one share would now be worth $20, meaning you realized a 100% return on investment.

As you can see, even though the large-cap company grew more than $240 billion compared to the small-cap company, your personal investment only doubled because the size of your stake was significantly smaller than it was with the bigger business.

Why invest in small-cap stocks you may ask. Small-cap stocks are extremely valuable for this reason because you are likely to realize superior returns, the longer you hold.

Big Investors don’t buy SMALL-CAP stocks.

As your portfolio grows, it becomes more difficult to find worthwhile investments at the early stages of a business’s life cycle.

Because of this, institutional investors, managing billions of dollars like mutual funds, hedge funds, and banks tend to stay away from small-cap companies because their gains would be minuscule in comparison to their larger holdings.

Fortunately for us retail investors, this is advantageous because it means that we have an opportunity to buy in before the big money is able to.

Although this does tend to make these stocks less liquid, Edge Investments’ goal is to find incredible small-cap stocks that we can hold for the long haul, meaning that the stock’s trading volumes will increase when it is eventually worthwhile for the institutional funds to buy in.

Not only that, but you will also be owning a small-cap business before the big money floods which leads to greater returns in your portfolio.

Disadvantages of Small Cap Investing

Lack of liquidity in the small-cap stock market.

As mentioned before, small-cap stocks tend to be less liquid than large cap companies because they receive less exposure from the media and institutional investors tend to avoid them.

Since the number of daily trades and the volume of shares traded is lower, this means that the price of a small-cap stock may swing more violently than a large-cap if a bigger investor was to buy or sell their position.

While this will not affect retail investors planning to hold for the long run, it may cause problems for someone planning to trade the stock with a shorter time horizon.

This is because the bid-ask spread is wider for small-cap companies, meaning that the buy and sell prices are quite different from one another and a trader may be surprised to find that the price of their transaction was much different from their expectations.

Less information, means greater uncertainty.

Although this isn’t always the case for small-cap stocks, it does apply to most.

In general, small-cap stocks often have less than ten years of public trading history, meaning that investors have less information on a company to work with.

Information like financial statements and annual reports are crucial for successful investing because it improves your understanding of the business and gives you a clearer picture of where they are headed.

The more years under a company’s belt, the better idea you have about how the business performs during poor economic conditions, whether the management team executes its outlined objectives, and whether the business is growing consistently or periodically based on the cyclical nature of its industry.

All in all, the more information you can acquire about a company, the better off you will be because you understand how the company operates and if it aligns with your investment goals.

Are Small Caps Riskier than Large Cap Stocks?

There is a common misconception amongst investors that small-cap stocks are inherently riskier than large-cap stocks because of the size of the company and the lack of liquidity circulating in these markets.

However, it may shock some investors to learn that small-cap stocks are in fact not riskier than their larger counterparts.

Instead, a stock’s risk should be measured by its likelihood of losing money, not by the size of the company or the number of years that it has been trading in the public market.

To gauge the riskiness of a business, an investor should zoom inward, and focus solely on the company’s financial strength and the value it brings to its customers, rather than basing it on what other investors think it is worth.

After assessing both the quantitative (ex. financial statements, valuation) and qualitative (ex. management team, competitive advantage) characteristics, if you have a high degree of confidence that investing in a business will not lose you money, then it is likely that this investment is less risky than an alternative investment opportunity.

A common way to treat risk amongst investors is to ask yourself, “if I were to put all of my life savings into this company, would I be able to sleep peacefully at night knowing that my money is in good hands?”

If you are able to answer “Yes” to this question then you are likely investing your money in a wonderful company.

An investor should treat every stock investment, no matter the size, like it’s the only business they will ever own.

In doing so, you will prioritize finding only the best businesses to own, and avoid individual stocks that pose a higher degree of risk and uncertainty.

Want to learn more about how small-cap stocks compared to large-caps?

Check out our article “What is small cap vs. large caps?”

How to Find Small-Cap Stocks to Invest In

When thinking about how to find small-cap stocks to invest in, as stock investors, our strategy emphasizes avoiding losses over high-risk, high-reward scenarios.

Under these circumstances, we prefer small-cap stocks that offer predictable financial performance, healthy balance sheets, smart management teams, and a purchase point well below the stock’s intrinsic value.

To accomplish this feat, we analyze businesses that are easy to understand; consistently grow their revenue, net income, and free cash flow; generate high-profit margins and return on investment capital; and lastly, by stocks when they are on sale relative to their value.

Since many small-cap stocks fail to meet these criteria, it is important for investors to say “no” to most of the investment opportunities that come our way.

In doing so, we focus only on the best small-cap stocks in the market, and are more likely to avoid losses, while also achieving superior returns.

Unlike what most investors will tell you, there are wonderful investment opportunities in the stock market where a stock offers low risk and higher returns.

To illustrate this, here is an example.

How to Evaluate Small-Cap Stocks

Step 1: Stock Screeners

In this beautiful small-cap universe, there are thousands of stocks to choose from, so how does an investor find the best small-caps to invest in?

Well, there is no simple answer, but one of our favorite tools for discovering small-cap stocks is by using a stock screener to help filter our search.

There are many useful and free stock screening tools available today, however, our favorite is Macrotrends.net because it gives us relevant and extensive financial information, for all of the companies we wish to explore.

By using the criteria set earlier, we can apply filters that align with our strategy, so that we only view stocks that fit our investment strategy.

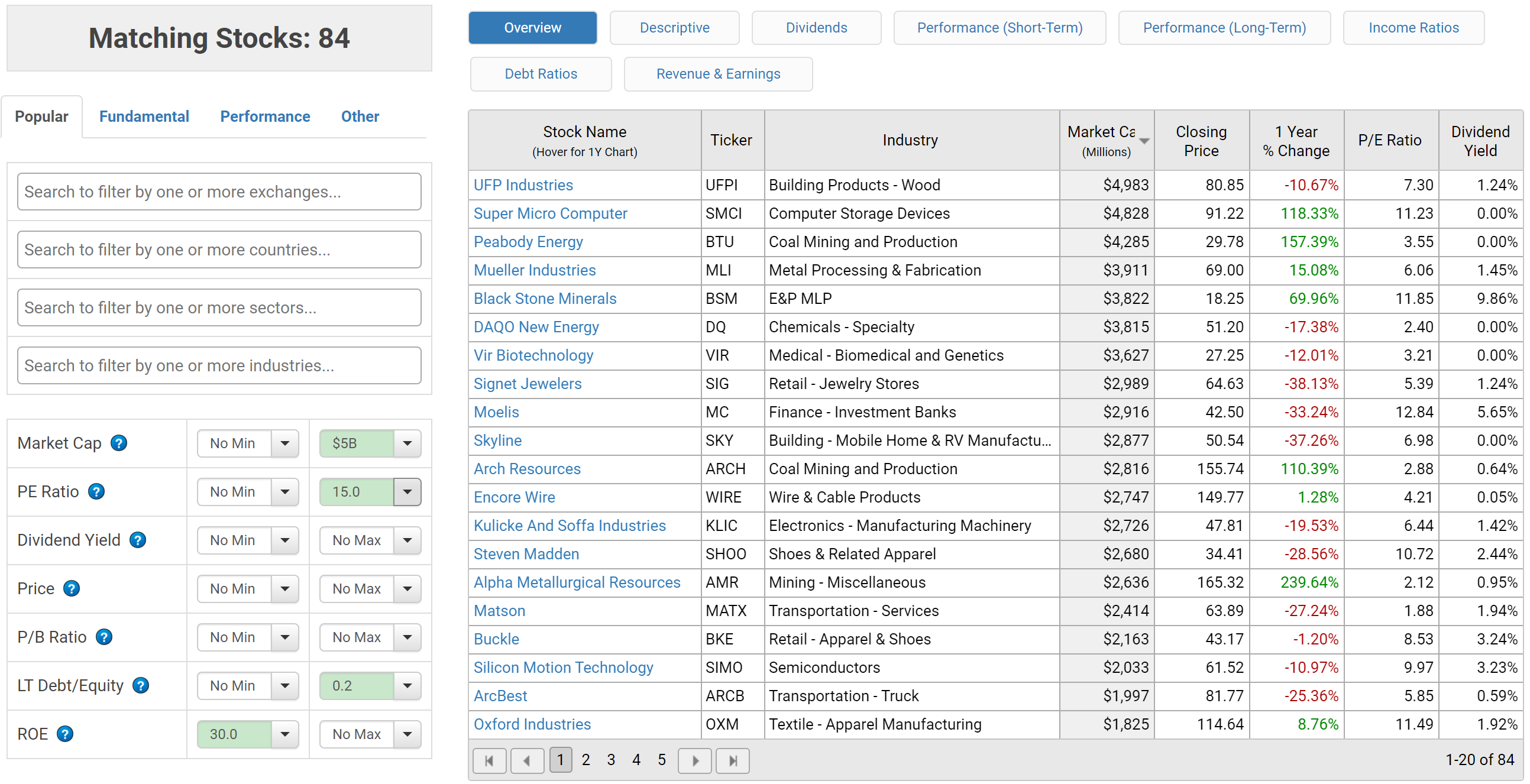

In this instance, we were able to narrow down our search from 5102 small-cap stocks to just 84 by using these filters on the left-hand side of the screen:

While we certainly enjoy using the filters set above, we encourage you to play around with the stock screening tool and figure out what works best for you.

Investing is a dynamic process filled with many different ways to create wealth.

It is important as investors to understand what strategy best fits your personal needs because only you can truly understand what you are hoping to accomplish.

For more ways to find small-cap stocks to invest in, we recommend exploring online articles, blogs, small-cap ETFs, small-cap funds, small-cap indexes (ex. Russell 2000) and more.

The more small-cap businesses you can expose yourself to, the better idea you will have about whether or not a stock is worth investing in.

Step 2: Choosing a Small-Cap Stock

Now that we’ve narrowed down our search to just 84 small caps, our goal is to find a few businesses that best fit our investment criteria.

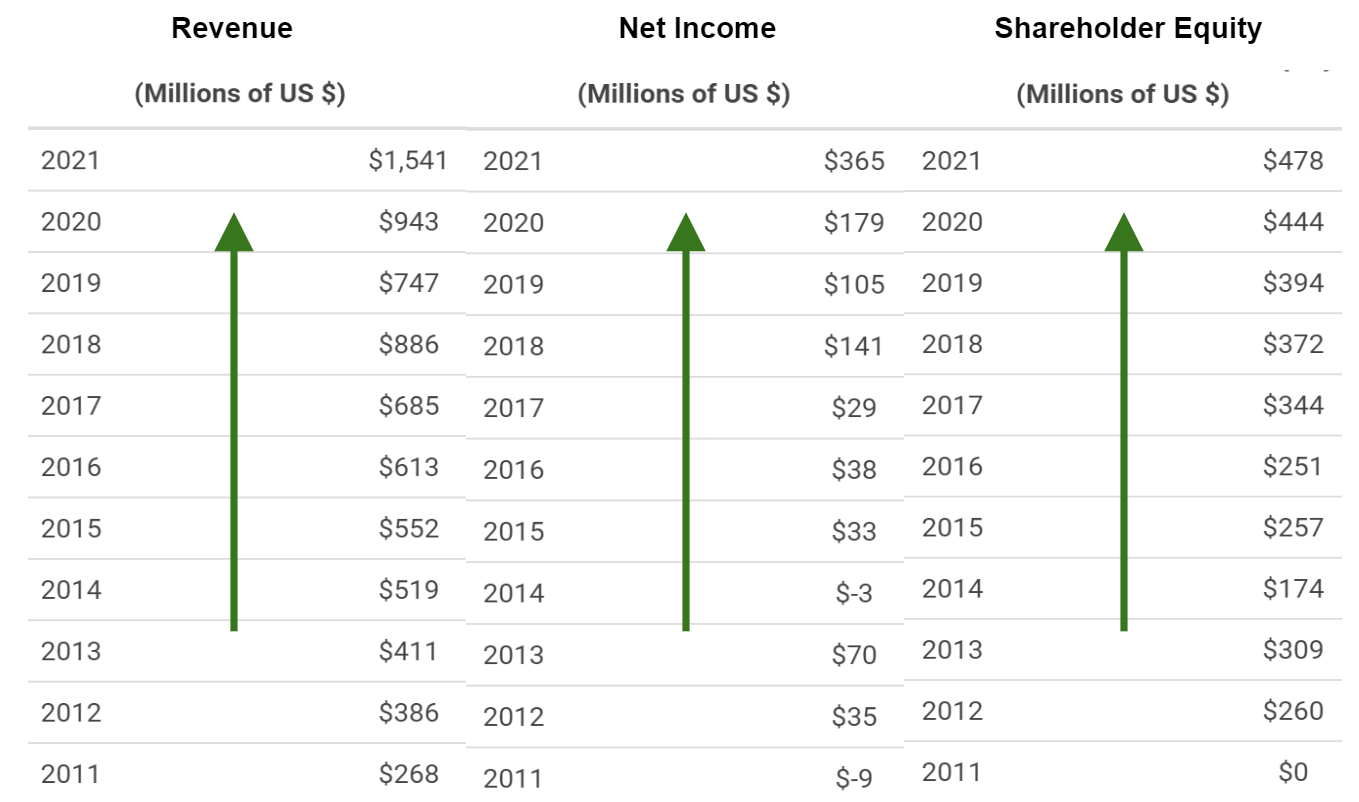

To do so, you will want to focus on businesses that are consistently growing in these four areas and are operating with very little debt on their balance sheet:

- Revenue: The total sales made by the business during the fiscal year.

- Net Income or EBITDA: The money that remains after all expenses are paid for.

- Share Holder Equity: The value of assets after all liabilities are paid for.

- Free Cash Flow: The cash that remains after all maintenance and reinvestments are made.

To speed up the process, we have found a business from this list that fits our criteria wonderfully.

However, rather than revealing who it is, we encourage you to analyze them yourself and use this company’s financial metrics as a baseline when comparing other small caps to invest in.

As you explore more small-cap stocks yourself, you will begin to notice that the stocks with more financial information available to you, the better idea you have about what it is worth and where it is headed.

Although there are exceptions to this rule, small caps with fewer years under the belt, inherit more uncertainty because we won’t have a clear idea about how they perform during times of economic instability.

If our goal is to find great companies, that we are confident will grow our wealth in the long run, then we as investors prefer businesses that are predictable and capable of overcoming adversity.

The best investments are those that you have the highest degree of confidence in when the going gets tough.

Step 3: Understanding a Small-Cap Stock

Congratulations!

You have found a small-cap stock that looks promising, and possibly worth your money.

However, your small-cap evaluation doesn’t stop there.

To truly understand the business, you must go beyond the numbers and dig deeper.

When analyzing an individual small-cap stock, ask yourself these questions:

- Do I know how this business works, and am I able to understand how they make money?

- What is it that my business does better than the competition?

- Are they able to maintain this competitive advantage for years to come?

- What are the major risks threatening the success of my business?

- Who is the management team (ex. CEO, CFO, CIO, etc.)

- Do they own a large stake in the company themselves?

- Have they found previous success elsewhere or are they new to the industry?

While these are just a few examples, it is important to incorporate questions like these into your small cap evaluation because they not only improve your understanding of the business but also help reveal any weaknesses in your own investment practice.

Question everything in investing because the more you know about a business, the greater your chance of success you will create.

Step 4: How to value a small-cap stock

Learning how to value individual stock is one of the most important skill sets you can acquire as an investor.

If you understand what something is worth, then you will know whether you are overpaying or underpaying for a business at its current price point.

Hint, we want to buy businesses when they are trading below what they are worth.

It is like buying a Ferrari at $100,000 when we know that it is worth $250,000.

To value a small cap, there are two common approaches used by investors.

- Discount Cash Flow Model

- The Comparables Approach

If a business is able to produce positive free cash flow, then our best bet for valuing a business is to use the Discount Cash Flow Model.

This is because the DCF pulls financial information directly from the business’s financial statements and uses it to value the business with relative accuracy.

Essentially, what the DCF allows us to do is project what future cash flows will be, and discount them back to the present so that we know what the company is worth.

While we could go into greater detail about the DCF, Investopedia has written a great article explaining the model in detail.

If we are unable to forecast future cash flows because the business has yet to produce them, then our next best alternative is to use the comparables approach.

At its simplest level, the comparables approach uses common financial metrics like EV/EBITDA, P/E, P/S, P/BV, and others, to help gauge what a business is worth by comparing it to similar businesses within the same industry.

If the small-cap stock you are evaluating possesses financial metrics well below the comparable companies, then it is likely that the business is undervalued.

As you can see, this is less accurate than the DCF but it does provide some insight into what a business is worth.

Keep in mind, no matter what method you use for valuing a stock, the price of a business is not a fixed number, meaning that there can be discrepancies about how much a company is worth.

Instead, the goal for investors is to find small caps that are so obviously undervalued, that it is a no-brainer for you to invest in them.

When you combine this framework and apply it to exceptional businesses, your likelihood of success improves tremendously.