Semiconductors, the tiny electronic components that power everything from smartphones to cars, are at the heart of the digital revolution.

As our world becomes more connected and reliant on technology, the demand for semiconductors is only increasing. In fact, the global semiconductor market is expected to reach $1 trillion by 2030, driven by the growth of artificial intelligence, 5G networks, the Internet of Things (IoT), and electric vehicles.

If you’re looking to invest in an industry with long-term growth potential, the semiconductor sector should be at the top of your list. Companies in the space have robust financials, solidified business models, and great catalysts for further growth. However, with nearly 500 semiconductor firms in the world, determining the winners from the losers is easier said than done.

To help our readers build a winning semiconductor portfolio, today we’ll be explaining what semiconductors are and why they matter, explore the tailwinds that are propelling the industry forward, and highlight seven investment opportunities investors should have on their watchlists.

We’ll also discuss who should be investing in semiconductor stocks and what to keep in mind when building a diversified portfolio. By the end of this article, you should have a better understanding of how to invest in semiconductor stocks, as well as which specific chip makers and manufacturers present the greatest buying opportunity today.

What Are Semiconductors and Why Should We Invest in Them?

Semiconductors are electronic components made from materials such as silicon, germanium, and gallium arsenide that can conduct electricity under certain conditions. They are used to create microchips, which are the building blocks of modern electronics.

The key to understanding semiconductors lies in their ability to be precisely engineered to have specific electrical properties. By manipulating the electrical properties of the semiconductor material, engineers can control the flow of electrical current and create tiny circuits that can perform complex calculations and store information. This ability to create intricate circuits with microscopic components has led to the development of powerful computers, smartphones, and other electronic devices that we use every day.

While some investors might think the semiconductor revolution has far passed, new technologies such as artificial intelligence, cloud computing, and the Internet of Things, are demanding further innovation and renewed demand for these tiny pieces of tech hardware. This presents an even brighter future for the semiconductor industry and a great investment thesis for growth investors to capitalize on.

More specifically, the importance of semiconductors has only increased in recent years as our world has become more connected and reliant on technology. The COVID-19 pandemic has accelerated the trend towards remote work and online commerce, further driving demand for more powerful and efficient semiconductors. As a result, the semiconductor industry is experiencing rapid growth with many of the largest firms in the industry investing heavily into increasing production capacity and focusing on new research and development projects.

Tailwinds for the Semiconductor Industry

Image Source: Auto.economictimes

The semiconductor industry is experiencing a surge of growth that is expected to continue in the years (and decades) ahead. This growth is being driven by several tailwinds that are worth covering for semiconductor investors.

One significant tailwind for the industry is the rapid growth of emerging technologies such as 5G networks, artificial intelligence (AI), the Internet of Things (IoT), and autonomous vehicles. In simple terms, these new technologies are consistently requiring smaller and more powerful semiconductors to power increasingly complex commands and functionality.

For example, 5G networks require semiconductors that are capable of handling higher data rates and faster speeds, while AI requires semiconductors that can handle complex computations at lightning-fast speeds. Similarly, IoT devices require semiconductors that are low-power and can connect to the internet wirelessly, while autonomous vehicles require semiconductors that can process large amounts of data in real-time. As these emerging technologies continue to gain traction and adoption, the demand for next gen semiconductors will only increase.

Another tailwind for the semiconductor industry is the shift towards remote work and online commerce, which has accelerated due to the COVID-19 pandemic and push from employees to work offsite. This shift has led to increased demand for semiconductors used in cloud computing, online transactions, and remote collaboration tools. As more people work from home, the demand for laptops, tablets, and other devices that rely on semiconductors has increased. Similarly, the rise of e-commerce has led to increased demand for data centers and cloud computing services, which require more powerful and efficient semiconductors.

Lastly, government infrastructure spending is a significant tailwind for the semiconductor industry. Governments around the world are investing heavily in infrastructure and manufacturing plants, including upgrades to 5G networks and smart city initiatives, which will require significant amounts of semiconductors. For example, the U.S. government recently passed the CHIPS act, which is a $52.7 billion subsidy bill that extends to companies in the research, development, and manufacturing of semiconductors.

Additionally, countries like China and South Korea are investing heavily in smart city initiatives, which will require semiconductors to power everything from traffic lights to public transportation systems.

These tailwinds create a favorable environment for the semiconductor industry, making now an opportune time for investors to focus on the industry. As well, semiconductor firms tend to be less volatile than other technology stocks, making them a great choice for investors looking for growth opportunities while also limiting their risk.

Best Semiconductor Stocks to Buy Today

With the promise semiconductor stocks pose to investors, it can be easy to get too excited when looking at the (almost) overwhelming number of companies promising to drive the semiconductor revolution further.

Today, we’ve identified 7 investment opportunities for our readers to consider within the industry. These companies (and one semiconductor ETF) are showing strong competitive advantages, unique market positioning, and clear catalysts for further growth.

ASML (ASML)

Founded in 1984 and based in the Netherlands, ASML is the top supplier of photolithography systems used in the manufacturing of semiconductors. More specifically, ASML is the only supplier of photolithography systems that are used to produce the most advanced microchips in the world today.

Given that ASML is the only company in the world that can produce the machines required to manufacture advanced chips gives them an incredible competitive advantage and a clear driver for further growth in the next decade. (Management recently stated they are a minimum of 10 years ahead of their competition for producing the machines required to produce next-generation chips).

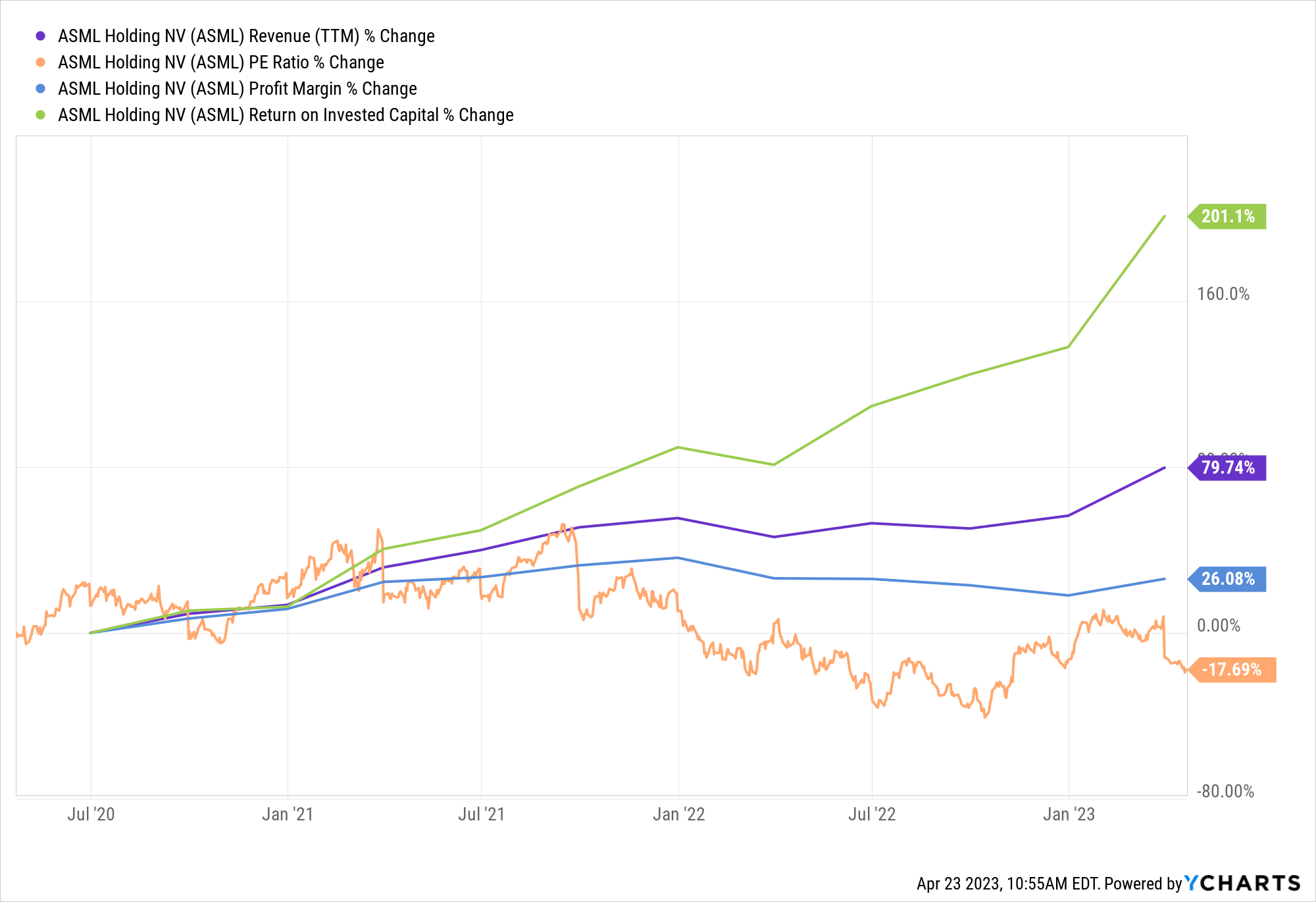

The chart below covers four important metrics for the company. Over the last three years, ASML has seen their return on invested capital increase by over 200%, their profit margin increase by 26%, revenue increase by almost 80%, and their PE ratio decrease by 17%. All this makes ASML a very attractive buying opportunity at a favorable price for investors who want to invest at the top of the semiconductor supply chain.

Aehr Test Systems (AEHR)

Image Source: Trading View

Founded in 1977 and headquartered in Fremont, California, Aehr Test Systems (AEHR) is a leading provider of semiconductor testing equipment and related services. AEHR is known for its advanced test and burn-in systems that cater to the rigorous demands of high-growth markets such as automotive and 5G.

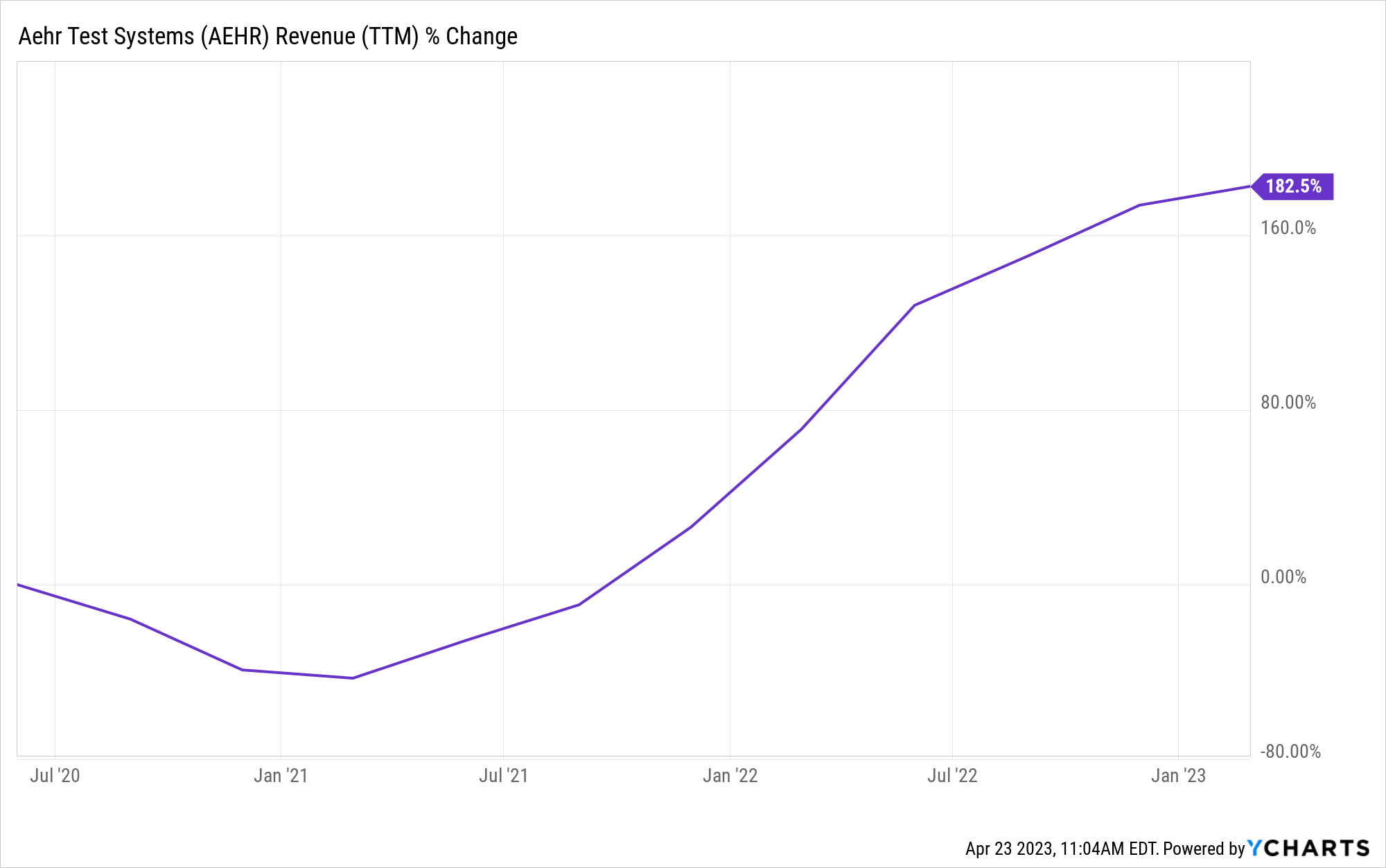

One of the reasons why AEHR is a compelling investment opportunity is its strong financial performance. The company has delivered consistent revenue growth in recent years, with the chart below showing the company has grown their topline by nearly 200% within the last three years. Moreover, the company has maintained a mostly debt-free balance sheet and a robust cash position, providing ample financial stability and flexibility to fund its growth initiatives.

Another factor that makes AEHR an attractive investment is its strategic focus on high-growth markets. The company’s products are designed to meet the complex and stringent testing requirements of industries that are expected to experience exponential growth in the coming years, such as electric vehicles and 5G networks. This positioning puts AEHR in an excellent position to capitalize on the tailwinds driving these markets.

Taiwan Semiconductor Manufacturing Company (TSM)

Image Source: CNBC

Taiwan Semiconductor Manufacturing Company is the world’s largest semiconductor foundry, headquartered in Hsinchu, Taiwan. The company produces chips for major technology companies such as Apple, Qualcomm, Nvidia, and many others.

TSM’s investment thesis is underpinned by several key factors. Firstly, the company has a dominant position in the semiconductor industry, with a greater than 50% market share. This gives TSM significant pricing power and the ability to negotiate favorable contracts with its customers, as well as highlighting the importance of TSM on the world stage.

Secondly, TSM has consistently invested in the latest semiconductor manufacturing technologies, which allows it to produce chips with higher performance and lower power consumption. This has led to TSM being at the forefront of emerging technology trends such as 5G, artificial intelligence, and advanced mobile devices, which are all expected to drive significant growth in the coming years. TSM is also investing heavily into new manufacturing plants in preparation for the increased world demand for advanced-level chips.

Nvidia Corporation (NVDA)

Image Source: Nvidia

Nvidia has solidified its position as the leading designer of Graphics Processing Units (GPUs) and is showing continued value by expanding into new markets with significant growth prospects. More specifically, the company’s GPUs were originally designed for high-end computer game graphics but have since found applications in AI, machine learning, self-driving cars, and much more.

With a focus on developing a robust software library and cloud computing platform, Nvidia has created an ecosystem that makes it easier for customers to utilize its chips for novel uses. The company has been making significant strides in the AI space, with a big head start on designing semiconductors specifically made for artificial intelligence functions and making strategic acquisitions to further increase its technology portfolio.

With a solid foundation in GPU design and a strong focus on AI, Nvidia is well-positioned to continue expanding into new markets and should continue to reward shareholders with strong returns as they hold their competitive advantage within the semiconductor sector.

Advanced Micro Devices (AMD)

Image Source: AMD

Advanced Micro Devices is a semiconductor company (very similar to Nvidia) that designs and manufactures microprocessors, graphics processors, and other computer hardware components.

One of the primary reasons that AMD is a compelling investment opportunity is its innovative product lineup. The company’s Ryzen and EPYC processors have been widely praised for their performance and power efficiency. Many industry experts predict that AMD’s chips could soon surpass that of their main competitors (I’m looking at you Nvidia). Additionally, AMD has made significant investments in developing its graphics processing technology, which has helped the company gain market share in the lucrative gaming and data center markets.

Another key factor that makes AMD attractive is the company’s superior financial performance. In recent years, AMD has consistently posted impressive revenue and earnings growth, driven in part by its strong product lineup and expanding customer base. With a solid balance sheet and even stronger market position, AMD is well-positioned to continue delivering value to its shareholders in the years ahead.

iShares PHLX Semiconductor ETF (SOXX)

Image Source: Trading 212

The iShares PHLX Semiconductor ETF (SOXX) is a fund that invests in a diversified basket of semiconductor companies, offering investors exposure to the entire industry. The ETF has roughly $7 billion in assets under management and is composed of 30 different companies, including major semiconductor players such as Intel, NVIDIA, and Texas Instruments.

For investors looking to minimize their risk, semiconductor ETFs can be a great alternative to individual stock picking. This specific iShares semiconductor ETF will cover a wide range of investment opportunities, including companies that make their own chips, design firms, semiconductor manufacturers, and many others.

Finally, with a low expense ratio of 0.46%, this ETF is a very cost-effective way for investors to gain exposure to the semiconductor industry while keeping their risk tolerance in check.

Lam Research (LRCX)

Image Source: Semiconductor Engineering

Lam Research (LRCX) is a leading supplier of wafer fabrication equipment and services to the entire semiconductor industry. The company provides equipment and services for all aspects of the chip-making process, from deposition to etching to cleaning.

Lam Research has also forged a strong partnership with ASML. Together, the two companies are working to develop next-generation chip-making technologies, including extreme ultraviolet lithography (EUV). More specifically, Lam and ASML have produced:

“a new dry resist technology that will help to extend the resolution, productivity, and yield of EUV lithography. Lam’s dry resist solutions offer significant EUV sensitivity and resolution advantages and thus an improved overall cost for each EUV wafer pass”.

All this means Lam has partnered itself with one of the most valuable semiconductor companies in the world, which should provide a strong tailwind for the company moving forward.

Lam’s focus on innovation and its partnership with ASML makes it a strong investment opportunity moving forward. They are in a unique position to help develop the machines needed for next-generation chips. Lam Research’s leading position and technological capabilities should support strong share price appreciation as the industry continues to grow.

Who Should Invest in Semiconductor Companies

Semiconductor stocks and focused exchange-traded funds offer promising rewards as the technology sector requires smaller and more advanced chips to power more complex systems and products. For this reason, semi-companies can (and should) be a part of every investor’s portfolio.

However, what’s most important to remember is that proper allocation and diversification are key. Investors should be careful not to have all of one’s eggs in the semiconductor chips basket but rather to spread investments across different industries and asset classes.

Investors who have a longer time horizon and higher risk tolerance shouldn’t hesitate to allocate a bigger chunk of their capital to the industry. Those who want to limit their risk are most likely better suited for an ETF and a more diversified portfolio.

Regardless of the strategy you decide to use, semiconductors are supporting the revolution of countless industries, and investors willing to make calculated risks within the space today could surprise themselves with how well their investment pays off in the future.

Key Takeaway

In light of the growing demand for technological advancements, investing in semiconductor companies has become an increasingly popular option for many investors. By harnessing the power of cutting-edge technology, semiconductor firms play a vital role in shaping the future of various industries.

When considering investing in the semiconductor space, it’s essential to conduct thorough research and analysis to make informed decisions. Factors such as financial health, market position, and future growth prospects should all be taken into account.

Today we’ve identified 7 top investment opportunities in the semiconductor space for investors to consider. Each investment has its own pros and cons, though each has a unique positioning in the market that could very well make it a long term winner as the industry continues to evolve. Depending on your investment strategy, time horizon, and appetite for volatility will dictate which of the companies mentioned above will be right for you and your portfolio.

It is important to note that investing in semiconductor companies requires a long-term outlook and a willingness to navigate the ever-changing landscape of the tech industry. However, for those who are willing to do so, there is great potential for growth and investment gains.

In conclusion, investing in semiconductor companies can be a (exponentially) rewarding opportunity for investors who are prepared to do their due diligence and embrace the dynamic nature of the tech industry. With careful consideration and a disciplined approach, investors can potentially reap the benefits of this rapidly evolving industry.