In the dynamic world of investing, understanding the fundamental concepts is crucial for building a robust portfolio.

Common stock, often at the forefront of investment conversations, is a subject that demands clarity.

Is a common stock asset truly an equity, and what does this mean for your investment strategy?

In this comprehensive article, we will dive into the world of common stocks, breaking down complex concepts into digestible insights for you.

By the end of it, you’ll be ready to take your investing game to the next level by making informed decisions about your investment portfolio portfolio.

What is a Common Stock?

To understand common stocks, you first need to grasp the concept of stocks themselves.

A common stock represents a residual ownership stake in a company meaning that when you purchase a stock, you become a shareholder or a part-owner of that company–the more shares of stock you own, the greater your ownership stake is in that company.

Common stock is the most widely recognized form of stock ownership, giving shareholders certain rights and claims on the company’s assets and earnings.

What Are the Features of Common Stocks?

As a common stockholder, you will have rights to the following features:

Ownership: As a common stockholder, you now own a portion of that business. As such, the company owes you a portion of its earnings and you have a say in corporate matters such as electing board members.

Dividends: While not guaranteed, some companies pay dividends, which are a portion of the company’s retained earnings or profits that are distributed to shareholders. The amount of dividends can vary and is determined by the company’s board of directors.

Capital Gains: Common stockholders can profit from their investments when their shares appreciate in value. This occurs when the stock’s market price increases, allowing shareholders to sell their shares at a higher price than they initially paid.

Image By: Little John Law

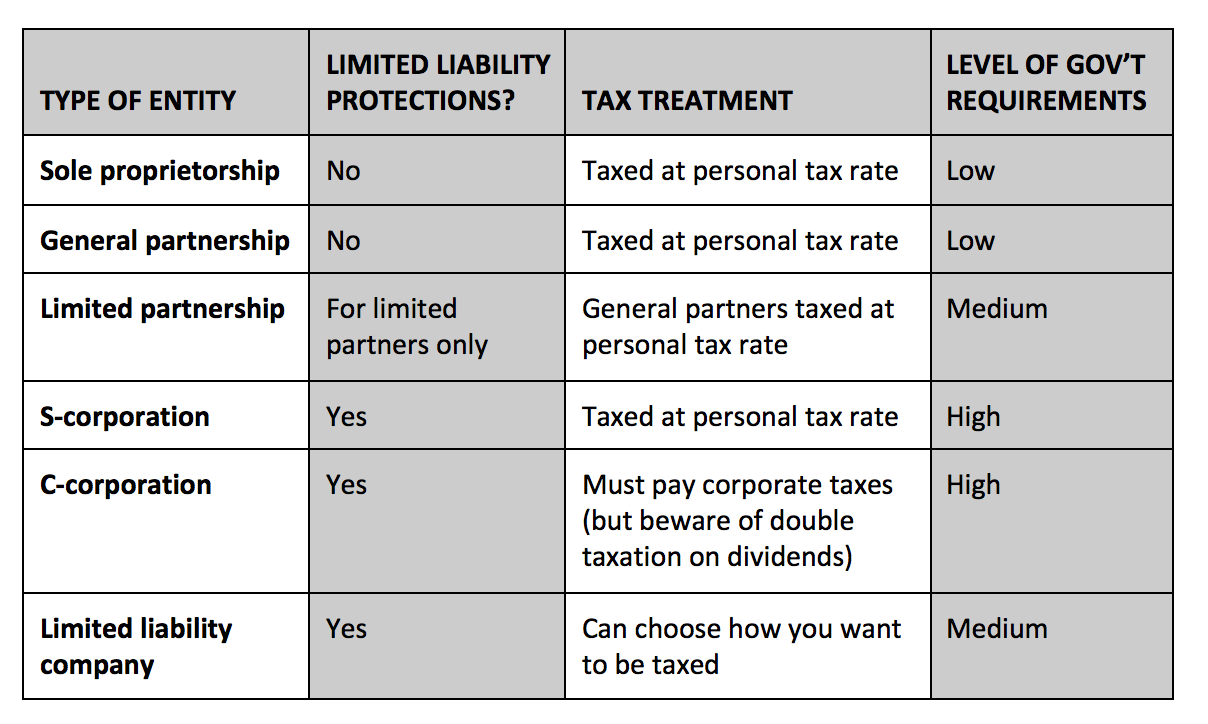

Limited Liability: One of the advantages of common stock ownership is limited liability. Shareholders are typically not personally liable for the company’s debts or legal obligations. On the other hand, private business owners, especially sole proprietors (i.e. small business owners) are fully liable, meaning that they must adequately compensate their loan obligations.

How does Common Stock Differ from Preferred Stock?

While common stock is the go-to choice for most investors, it is worth noting that you can buy preferred shares as well.

Preferred stock is a type of equity security that exists in a unique space between common stocks and bonds.

As preferred stockholders, you receive additional benefits including fixed dividends that are typically distributed before common shareholders.

What’s more, in the event of a company’s liquidation or bankruptcy, you will be compensated before common shareholders given that you have a higher claim on the company’s assets

In exchange for this preferential treatment, preferred shareholders typically have limited to no voting rights in corporate matters.

On top of that, many preferred stocks are callable, meaning that an issuer (i.e. the company) has the right to redeem the shares at a predetermined price which could result in you losing your shares and the dividend income stream they provide.

In all, if you plan on choosing preferred shares over common stock, it is likely because you desire consistency and predictability from your investments.

Otherwise, it is probably best to stick with the common shares of the company because there is no chance that you lose your shares (unless you sell), and you will have more opportunities to make your voice heard in the event that you are displeased with the current direction that the business is headed.

Why Do Companies Issue Common Stocks?

Now that you know what a common stock is, you might be curious to learn why a company would sell a chunk of its business in the form of shares.

A publicly traded business may issue common stock for several reasons, including capital generation, acquisitions, and employee compensation, among other things.

Let’s dive into each of these a little further to outline why a company might choose to issue common shares.

1. Capital Generation

One of the primary reasons companies issue common stocks is to raise additional capital. By selling shares to investors, they can secure funding to finance growth, expand operations, invest in research and development, or pay off debt. This often happens with early-stage companies when they are not profitable yet, and require more cash to stay afloat. Similarly, if a business begins losing money after being profitable, it may opt to issue shares to build up its cash reserves to prevent itself from defaulting.

2. Public Listing

Image by: Medium

Going public through an initial public offering (IPO) is a common way for private companies to issue common stocks to the public. To go public, a company will work with corporate finance professionals, typically in investment banking, who will underwrite shares that are sold to the secondary market via a stock exchange (i.e. Nasdaq, New York Stock Exchange, etc.). This provides liquidity to existing shareholders and allows the company to access a broader pool of investors. Moreover, it is one of the most effective ways to generate a significant amount of cash in a short period of time.

3. Ownership Diversification

Founders and early investors may choose to issue common stock to diversify ownership and reduce their exposure to the business. With greater liquidity from the increase in shares outstanding, it is easier for investors to buy and sell the stock since there are more participants in the market. Moreover, it means that new investors may participate in the company’s upside, especially if the business has historically traded at a lofty price.

4. Acquisition and Expansion

Sometimes, common stock is used as a currency for business deals including mergers and acquisitions. For example, a company can acquire other businesses by offering their stock as part of the deal. However, there are two negative caveats to using stock as a currency, as opposed to using cash or debt financing. First, issuing new shares dilutes existing shareholders meaning that their ownership stake becomes smaller after the shares are issued. Second, by giving away shares, if the business and its stock price appreciate in value, existing shareholders will miss out on potential gains given the dilution of their shares.

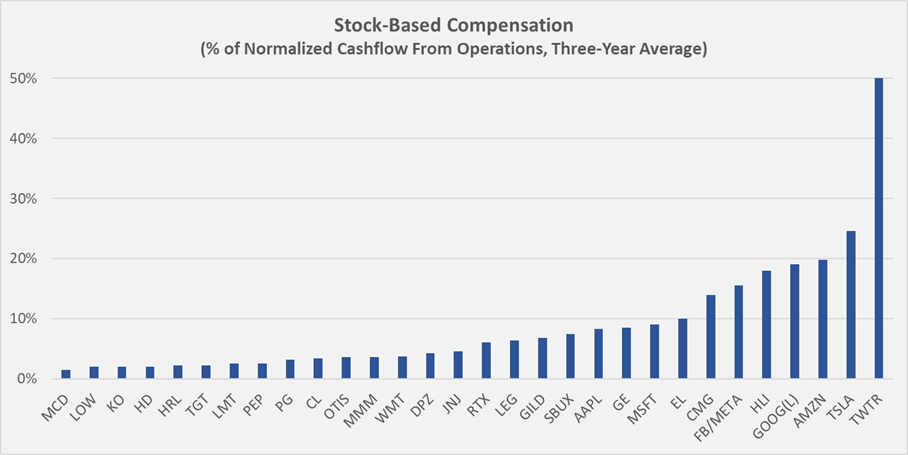

5. Employee Compensation

Image by: Seeking Alpha

Many companies offer stock options or restricted stock units (RSUs) to employees as part of their compensation packages. This aligns the interests of employees with the company’s performance and incentivizes them to contribute to its success. It is also an effective way to attract new talent, especially if the business has a reputation for performing well.

Who Can Invest in Common Stocks?

Common stocks are accessible to a wide range of people, including both amateur and professional investors.

Here is a complete breakdown of who can invest in common stocks:

Individual Investors: Any individual, regardless of their level of expertise or financial resources, can invest in common stocks. This inclusivity makes it an attractive option for amateur investors looking to build their wealth over time.

Institutional Investors: Professional investors, such as mutual funds, hedge funds, and pension funds, often include common stocks in their portfolios. These institutions pool the resources of many investors to achieve diversified and potentially high-return investments.

Retirement Accounts: Common stocks can be held in various retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans. This allows individuals to invest in common stocks while benefiting from tax advantages. Moreover, it is an effective way to create additional wealth while working for an employer that offers contributions to your retirement account.

International Investors: With the advent of online trading platforms, international investors can easily invest in U.S. common stocks and vice versa, increasing the global accessibility of this asset class. But be careful, if you plan to invest internationally, some markets limit your rights as an owner if you do not reside in the area you are buying and selling from. For example, a variable interest entity (VIE), commonly used by publicly traded companies in China, allows you to have a controlling interest in the business (i.e. a right to its profits), without the right to vote on corporate matters. While not drastically important, one of the main benefits of owning equities is the ability to vote. Therefore, if having that right is valuable to you, it’s probably best you look elsewhere.

What Makes Common Stock an Equity?

So why is common stock referred to as an equity?

Well, it largely has to do with the fact that you own a direct interest in the business.

Let’s explore each of the key characteristics that define common stock as equity:

Ownership Stake: When you own common stock in a company, you have a direct ownership stake in that business, meaning that you are entitled to a portion of the company’s assets and earnings. This ownership stake gives you the right to vote on important corporate matters, making you a bona fide owner.

Image by: Chron

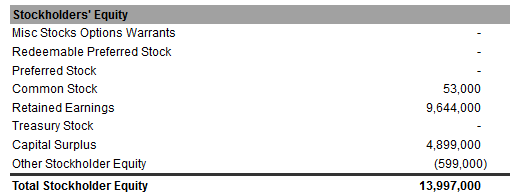

Residual Claim: Common stockholders have a residual claim on a company’s assets and earnings. In the event of liquidation or bankruptcy, common stockholders are entitled to a share of the remaining assets after all debts and obligations are paid off. This is called shareholders equity or book value, and you can find it on any company’s balance sheet. It is this claim on residual assets that underscores the equity nature of common stock.

Risk and Reward: Equity assets, including a company’s common stock, carry a unique risk-reward profile. For example, as a common stockholder, you bear the risk of potential losses if the company’s value declines. On the other hand, you also have the potential for substantial gains if the company’s common stock prices increase. This risk-reward relationship makes stocks an equity by nature.

Voting Rights: Lastly, common stockholders have the right to vote on key corporate decisions, such as the election of the board of directors and major strategic initiatives. This voting power further solidifies their role as equity owners, as opposed to mere creditors. However, keep in mind that if you do not own a meaningful amount of shares, your voting privileges will be quite limited. To have a real say, you will have to build up a large position to be adequately represented.

The Bottom Line

Common stocks are equity instruments that represent an ownership stake in an underlying business.

This unique blend of rights, risks, and rewards is what makes them inherently different from other assets such as bonds.

As you build or refine your investment portfolio, consider the role of common stocks in achieving your financial goals.

While they come with volatility and uncertainties, common stocks have the potential to deliver substantial returns over the long term. It is this potential that makes them an incredibly effective and valuable asset to own.

But remember, not all stocks or equities are created equal.

Therefore, it is important to conduct thorough research on every asset and only invest in those that offer the most value. If you do, these ownership stakes in high-quality businesses could help you achieve your financial goals quicker than you think.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.