7 Strong Buy Stocks That Are Bargains Right Now | InvestorPlace

While saving money can definitely put you on the right track to building a successful future, those who really want to take their wealth to the next level need to invest money in the stock market.

From dividend income, mutual funds, capital gains, and keeping your purchasing power, building an investment portfolio is, without a doubt, the most accessible, efficient, and powerful way to build lasting wealth.

However, most don’t fully know or understand all the reasons and benefits that stock market investing gives.

To clear things up and explain the most important reasons why investing in stocks is worth your hard-earned capital, this article is going to cover the top 10 reasons to invest in stocks.

The Top 10 Reasons to Invest in Stocks

1.) Accessibility

Unlike other forms of investment that might demand substantial initial capital or intricate understanding, investing in stocks offers a remarkably simple way to buy assets.

The stock market provides a level playing field where both seasoned investors and newcomers can participate with relative ease.

The creation of online brokers has further democratized the stock market, allowing anyone with an internet connection and a bank account to buy and sell shares of companies they believe in.

Whether you’re a college student with a modest savings account or a working professional looking to expand your financial portfolio, stocks offer a welcoming gateway.

This accessibility not only empowers individuals to take control of their financial futures but also encourages learning and engagement within the world of finance.

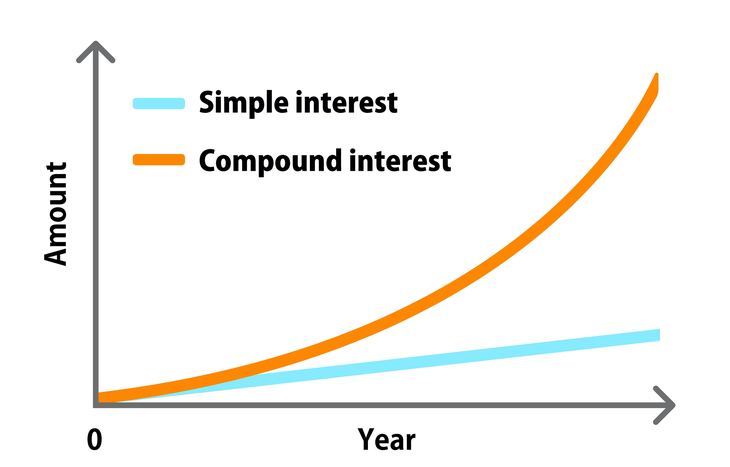

2.) Compounding Interest

Simple Interest vs. Compound Interest | Investment U

The concept of compounding interest operates as a silent force with remarkable potential.

More specifically, imagine you invest $10,000 in a company’s stock, which gives an average annual return of 8%. In the first year, your investment would grow by $800 (8% of $10,000).

Now, in the second year, that 8% return is applied not only to your initial investment of $10,000 but also to the $800 you earned in the first year. This means you’d earn $840 ($800 + 8% of $800) in the second year.

As the years go by, this compounding effect starts to accelerate. After 10 years, your initial $10,000 investment could potentially grow to around $21,589. By year 20, it could be worth about $46,610, and by year 30, it could reach approximately $100,626 – all assuming the consistent 8% annual return.

The magic lies in the fact that your returns start generating their own returns, creating a snowball effect. The longer your money remains invested, the more pronounced and profound this compounding becomes.

Starting early allows you to maximize the impact of compounding interest, demonstrating how even modest investments can flourish into substantial wealth over time.

3.) Investment Income

While stock investing is often associated with the potential for capital appreciation, it also offers an avenue for generating consistent investment income. This dual benefit sets stocks apart as a versatile asset class that caters to both growth-oriented and income-focused investors.

One of the primary sources of investment income from stocks comes in the form of dividends. When you invest in certain companies’ stocks, they may distribute a portion of their profits to shareholders in the form of dividends.

Companies pay dividends to distribute cash earned from operations back to investors, and these payments can provide a sizeable stream of income that can complement your overall financial portfolio.

Unlike some other investment types, which may require you to sell stocks to generate income, dividends and interest income can offer a reliable source of cash flow without liquidating your investments.

This can be especially appealing during market downturns when capital appreciation might be uncertain.

4.) Inflation Hedge

The erosion of purchasing power due to inflation remains a significant concern for investors. However, stocks have historically proven to be an effective hedge against the erosive effects of rising prices.

When inflation takes hold, the value of currency diminishes, causing the cost of goods and services to increase. This phenomenon can erode the real value of cash savings over time.

However, stocks possess an inherent advantage in this scenario. Companies that issue stocks are often positioned to adjust their prices in response to inflation, allowing them to maintain profitability even in an inflationary environment.

Furthermore, the value of stocks has the potential to appreciate over time, often outpacing the rate of inflation. As a result, investing in stocks can offer the opportunity not only to protect your purchasing power but also to grow your wealth in real terms.

While it’s important to note that the stock market can experience volatility in the short term, over longer time horizons, the historical resilience of stocks as a successful inflation hedge remains intact.

5.) Professional Guidance

One of the distinguishing attributes that sets stocks apart is the ability of investors to leverage the guidance and management of investing professionals.

More specifically, investors can choose to partner with a financial advisor who can help guide their decisions when looking for investment opportunities or can choose to invest in various mutual funds and ETFs that are managed by professional money managers.

This allows regular investors to leverage the knowledge, experience, and expertise of investing professionals when trying to decide where to put their capital.

Where other investments force individuals to make their decisions mostly on their own, investing in stocks makes it easy for investors to let professionals make the majority of their investment decisions for them. This is a great option for those who don’t have the time or energy to do their own research or those who don’t have the confidence to make their investment decisions on their own.

6.) Ownership in Great Companies

Top FAANG Stocks To Watch This Week? 3 In Focus | Stockmarket.com

Investing in stocks goes beyond being a mere financial transaction; it’s an opportunity to become a part-owner of some of the world’s most influential and successful companies.

When you invest in stocks, you’re purchasing a share of ownership, or a “stake,” in the company.

This means that as the company prospers and its value increases, so does the value of your investment. Your fortunes become intertwined with the company’s performance, giving you a personal stake in its successes.

From global tech giants revolutionizing industries to local companies making meaningful impacts in their communities, your stock investments can reflect your values and interests.

This ownership also grants you the right to participate in corporate decisions by voting on important matters during shareholder meetings.

7.) Flexibility and Liquidity

Stock markets operate with high liquidity, meaning that buying and selling shares can happen quickly and efficiently. This flexibility empowers investors to adjust their portfolios in response to market trends, economic shifts, or personal financial goals.

Unlike some investments that may involve lengthy processes or restrictions, stocks can be bought and sold on trading platforms with relative ease. This agility provides investors with the ability to capitalize on emerging trends, pivot their investment strategies, or simply access their funds when needed.

The liquidity of stocks also contributes to the transparency of their value. Real-time pricing information is readily available, allowing investors to make better decisions based on the current market conditions.

8.) Global Market Exposure

Many companies listed on stock exchanges are multinational corporations with operations spanning across continents. When you invest in these companies, you gain direct access to their global business operations. As economies evolve and industries expand, your investments can ride the waves of international growth.

Global market exposure also adds a layer of diversification to your investment strategy. By investing in companies from different countries and industries, you can mitigate risks associated with regional economic fluctuations or industry-specific challenges.

This diversification helps to create a more balanced and resilient portfolio.

9.) Risk & Reward Balance

Passive Income: How to Reduce Risk and Still Earn High Yields in a TFSA | The Motley Fool Canada

Investing inherently involves a balance between risk and reward, and stocks exemplify this delicate equilibrium. The stock market’s potential for both significant gains and losses makes it a world where careful consideration and strategic decision-making thrive.

Stocks offer the possibility of substantial returns that can outpace other traditional forms of investment. However, this potential for reward is inherently tied to an element of risk.

The value of stocks can fluctuate based on a multitude of factors, including economic conditions, industry trends, and company performance.

It’s important to note that while stocks can experience volatility in the short term, over longer time horizons, historical trends demonstrate their potential to provide impressive returns. Diversification, research, and a long-term perspective are among the strategies investors can use to navigate this risk-reward balance.

10.) Reduce Taxable Income

Investing in stocks can also serve as a strategic tool for managing your taxes. With proper planning and execution, certain investment strategies can help reduce your taxable income by a considerable amount.

One such strategy involves investing in tax-advantaged accounts like individual retirement accounts (IRAs), employer-sponsored 401(k) plans, or a Retirement Savings Plan (RSP). Contributions made to these accounts are often tax-deductible, reducing your taxable income in the present.

Additionally, any capital gains or dividends earned within these accounts are typically tax-deferred, allowing your investments to grow without immediate tax consequences.

Another tax-efficient strategy involves tax-loss harvesting, which entails strategically selling investments that have experienced losses to offset capital gains, potentially reducing your tax bill.

By incorporating tax-efficient investment practices, you will not only preserve more of your hard-earned money but also position yourself to make the most of your investments within the context of your overall financial plan.

Best Ways to Invest in Stocks

How To Build An Investment Portfolio | Forbes Advisor

When it comes to investing in stocks, there’s no shortage of avenues to explore.

Each approach comes with its own set of benefits and considerations, catering to different investor preferences and goals.

Here are some of the best ways to invest in stocks:

Mutual Funds:

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks. This approach spreads risk across multiple companies and industries, making it an attractive option for those seeking broad exposure without the need for extensive research.

Exchange-Traded Funds (ETFs):

Similar to mutual funds, ETFs offer diversification by tracking an index or a specific market segment. ETFs are traded on stock exchanges and can be bought and sold throughout the trading day (similar to stocks), providing flexibility, transparency, and immediate diversification.

Individual Stocks:

Investing in individual stocks allows you to choose specific businesses that align with your values, interests, or strategic outlook. While this approach requires more research and monitoring, it can offer the potential for higher returns if the selected companies perform well.

Indices:

Indices, such as the S&P 500 or the Nasdaq, track the performance of a pre-set group of stocks. Investing in indices can provide exposure to a broad market segment and is often seen as a great investment option for those who are investing for the long term and do not want to monitor their investments on a daily basis.

Robo-Advisors:

Robo-advisors utilize automated algorithms to create and manage investment portfolios tailored to your risk tolerance and financial goals, making investing more accessible and convenient.

DRIPs (Dividend Reinvestment Plans):

Some companies offer DRIPs, allowing you to automatically reinvest dividends to purchase additional shares, facilitating the power of compounding.

Fractional Shares:

Platforms offering fractional shares enable you to invest in stocks with smaller amounts of money, making it easier to diversify even with limited capital.

The biggest takeaway from this list is that there are no shortage of options for those looking to begin investing in the stock market.

Selecting the best approach depends on your investment goals, risk tolerance, and personal preferences. Additionally, combining multiple strategies will provide an even more well-rounded and diversified portfolio, which will better align with your unique circumstances and objectives.

Conclusion

In conclusion, investing in stocks remains one of the most powerful wealth-building strategies available to individuals today. While it’s important to acknowledge that the stock market carries inherent risks, the potential rewards are equally substantial.

The top 10 reasons to invest in stocks outlined in this article highlight the numerous benefits, including the potential for long-term capital growth, passive income through dividends, diversification opportunities, and the ability to beat inflation. Stocks not only provide a means to participate in the success of leading companies but also offer a chance to align your investments with your values through socially responsible investing.

Moreover, with the increasing accessibility of online trading platforms and the availability of educational resources, the barriers to entry have significantly lowered, making stock market participation more inclusive than ever before.

Remember, successful investing requires careful research, patience, and a long-term outlook. It’s crucial to have a well-thought-out investment strategy that aligns with your financial goals and risk tolerance.

By leveraging the advantages of stock market investing and staying informed about market trends, you can harness this powerful machine of wealth creation and financial security, setting yourself on a path toward a better and brighter future.

Happy investing!

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Braxia stock and are compensated by Braxia for Investor Relations Services. Edge Investments and its owners reserve the right to buy and sell shares in Braxia without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.