Investing your money can be scary, especially if you’re not well-versed in the financial world.

Stocks and mutual funds are two investment strategies that have become increasingly popular among individual investors. And while both can offer the potential for high returns, they also come with their own unique set of risks and rewards.

This can lead many newer investors to wonder is it better to invest in stocks or mutual funds?

In this article, we’ll look at the differences between stocks and mutual funds, exploring their pros and cons, with the intent to help you determine which investment choice may be better suited for your individual financial goals and risk tolerance.

Difference Between Stocks and Mutual Funds

Image Source: Postic & Bates

When it comes to investing in the stock market, there are two primary ways to do it: buying individual stocks or investing in equity mutual funds. While both options offer the potential for high returns, they also differ in several key ways.

Stocks represent ownership in a single company, meaning that investors who purchase stocks own a portion of the company itself. The value of the stock is based on the company’s performance, which means that if the company does well, the value of the stock will increase.

Conversely, if the company struggles, the value of the stock will decrease. As a result, investing in individual stocks can be a riskier strategy than investing in mutual funds because an investor’s entire investment is dependent on the success of a single company.

On the other hand, mutual funds are investment vehicles that pool money from multiple investors together to buy a diverse range of assets, such as stocks, bonds, and other securities.

The purpose of this diversification is to spread the risk of the investment across a range of different assets, thereby reducing the overall risk. In this way, mutual funds can be less risky than individual stocks because an investor can achieve instant diversification, reducing the impact of any one company’s performance.

Another key difference between stocks and mutual funds is the level of involvement required from the investor. When an investor buys individual stocks, they are responsible for monitoring the company’s performance and making decisions about when to buy or sell.

In contrast, mutual fund investors don’t have to make these decisions themselves. Instead, a professional fund manager makes investment decisions on behalf of the investors, based on the fund’s investment strategy. (Investors will still have to decide when to buy or sell the actual mutual fund, however, the assets that make up the fund will be monitored and changed based off the decisions of the professional money manager.)

Lastly, the costs associated with investing in stocks and mutual funds can differ significantly. Buying and selling individual stocks can incur brokerage fees, while mutual funds charge other fees such as expense ratios and load fees. Typically, choosing to invest in stocks yourself comes with significantly less costs than mutual funds, however, this also means you will be responsible for managing the portfolio yourself.

Essentially, the primary difference between stocks and mutual funds lies in the level of risk, involvement required, and costs. While stocks offer the potential for high returns, they are also riskier and require more involvement from the investor.

Mutual funds, on the other hand, can offer less risk and require less involvement, but may also have lower potential returns. As an investor, it is crucial to understand these differences and consider your financial goals and risk tolerance before choosing between stocks and mutual funds.

Pros and Cons of Stocks

Stocks can be a great option for those looking to take a more active approach in their investing strategy and want to avoid the higher fees associated with actively managed mutual funds. However, there are also some drawbacks investors should be aware of as well.

Here’s a for and against breakdown for investing in stocks:

Pros of Stocks:

- High Potential Returns: Stocks can offer some of the highest potential returns of any investment option available. Historically, the stock market has provided an average return of around 10% per year over the long term, outpacing inflation and other investment options handily.

- Ownership in a Company: Buying stocks means that you own a portion of the company, giving you the ability to vote on important decisions and potentially earn dividends if the company chooses to pay them out.

- Flexibility: Investing in stocks offers a high degree of flexibility, allowing investors to buy and sell individual stocks whenever they choose. This means that investors have the ability to adjust their portfolio as their financial goals and risk tolerance change over time.

- Accessibility: With the advent of online trading platforms and robo-advisors, investing in stocks is widely accessible to investors regardless of their income level or background.

Cons of Stocks:

- High Risk: Investing in individual stocks can be riskier than other investment options, such as mutual funds, because the success of the investment is dependent on the performance of a single company. If the company experiences financial difficulties, the value of the stock can decline significantly.

- Volatility: The stock market is known for its volatility, meaning that the value of stocks can fluctuate rapidly in response to economic, political, or other external factors. This makes investing in stocks difficult for those who might need the money in a short period of time or who are unable to cope with large swings in price.

- Time and Expertise Required: Investing in stocks requires a significant amount of time and expertise to research individual companies and make informed decisions about when to buy and sell. This can be a barrier for individual investors who do not have the time or knowledge to research companies thoroughly.

- Brokerage Fees: Buying and selling individual stocks can be expensive, with brokerage fees charged on each transaction. This can eat into potential returns and make it harder for investors to profit.

Pros and Cons of Mutual Funds

Mutual funds are a popular alternative investment option for those looking to diversify their portfolio and reduce the risk associated with investing in individual stocks. And while they offer several advantages, they also come with their own set of pros and cons.

Pros of Mutual Funds:

- Diversification: Mutual funds invest in a range of assets, such as stocks, bonds, and other securities, thereby reducing the risk associated with investing in individual stocks. By spreading investments across a range of assets, mutual funds offer investors the ability to reduce risk while still enjoying the benefits of investing their capital.

- Professional Management: Mutual funds are managed by professional fund managers who have the expertise and knowledge to make informed investment decisions on behalf of their investors. More specifically, mutual fund investors don’t have to spend their time and effort researching individual companies, as the fund manager takes care of this for them. Additionally, because mutual funds are a type of pooled investment, the fund has strong buying power and the ability to own large percentages of many different companies.

- Low Initial Investment: Mutual funds often have a low initial investment requirement, making them accessible to a wide range of investors.

- Easy Access: Mutual funds have become a very common investment strategy, and as such, have become extremely easy to find and invest in by individuals. As well, mutual funds are required to disclose their holdings, fees, and any other important information, making it easy for investors to understand the funds past performance, goals, and risk tolerance.

Cons of Mutual Funds:

- Fees: Mutual funds charge fees, such as expense ratios, load fees, and ongoing management fees, which can eat into potential returns and reduce the overall profitability of the investment. It’s essential for investors to understand these fees and consider them when evaluating the potential return on investment.

- Lack of Control: Mutual fund investors do not have control over the individual securities that the fund manager invests in. Meaning investors cannot choose which stocks or bonds to buy or sell, and must rely on the fund manager’s decisions to drive performance.

- Lower Returns: While mutual funds offer lower risk, they often come with potentially lower returns compared to investing in individual stocks.

- Over-Diversification: Investing in too many mutual funds can result in over-diversification, leading to an unbalanced portfolio and the inability for an investor to understand what assets they currently own.

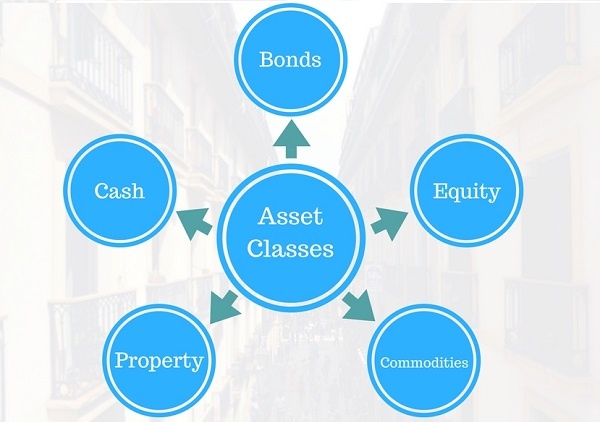

Other Assets to Consider

Image Source: Aesinternational

In addition to stocks and mutual funds, there are several other investment options that investors can consider when building their investment portfolio. Here are some of the most popular options:

Real Estate Investment Trusts (REITs)

REITs are a type of investment that allows investors to own a portion of real estate assets without the hassle of property management. REITs generate income by leasing or selling properties and distributing a portion of the profits to investors in the form of dividends.

Cryptocurrency

Cryptocurrencies are digital assets that use cryptography to secure transactions and control the creation of new units. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have become increasingly popular in recent years and offer investors the potential for even higher returns than stocks, although they also come with an elevated level of risk.

Exchange-Traded Funds (ETFs)

ETFs or index funds are similar to mutual funds in that they offer investors access to a diversified portfolio of assets. However, unlike mutual funds, ETFs are typically less expensive and have been shown to outperform actively managed funds over the long term.

Crowdsourced Real Estate Investments

Crowdfunding platforms like Fundrise and RealtyMogul allow investors to pool their money to invest in commercial and residential real estate projects. These investments offer the potential for high returns, but also come with long holding periods and varying initial investment requirements.

Bonds

Bonds and bond funds are debt securities issued by companies or governments. They offer investors a fixed income stream and lower risk compared to stocks, although they also come with lower potential returns.

To wrap up, it’s essential for investors to consider their financial goals, risk tolerance, and investment horizon when selecting any investment option.

Each asset class above offers unique advantages and disadvantages, and investors should diversify their portfolio across several different types to reduce risk and increase their chances of achieving their financial goals.

So Which One is Better?

Image Source: Forbes

The decision between investing in stocks or mutual funds ultimately depends on your individual investment goals, risk tolerance, and financial situation.

Stocks offer the potential for higher returns but also come with greater risk, while mutual funds offer diversification and professional management but usually have higher fees.

It’s important to do your research, consult with a financial advisor if needed, and carefully consider your options before making any investment decisions.

Ultimately, a well-diversified portfolio that aligns with your long-term financial goals is the key to successful investing.