Meta Platforms (formerly known as Facebook) has been a stock market winner for the last decade and more.

The social media company that first started out as a fun way for individuals to stay in touch with their friends has blossomed into a tech behemoth that excels in digital advertising, social media, and more, recently expanding into augmented reality opportunities.

Over the past decade, the company has returned over 1,000% to shareholders as Meta continuously found new ways to spur revenue growth and proved to investors how incredibly profitable their business model was.

Today, however, is a different story for the company. Meta has recently seen immense competition from up-and-comers like TikTok. And their digital advertising business – which has traditionally been untouchable – is now also under threat as new ad-tech technologies and firms begin to challenge the status quo that Meta has previously set.

All this brings into question Meta’s current valuation. Is the company a hidden gem whose valuation presents considerable upside for investors? Or will their business model and strong competitors ultimately lead to today’s price being considered overvalued to a declining business?

In this article, we’ll take a detailed look at Meta Platforms to help our readers decide whether or not the company is an undervalued firm worthy of an investor’s capital or a company whose valuation is above its intrinsic value.

Meta Platforms Valuation

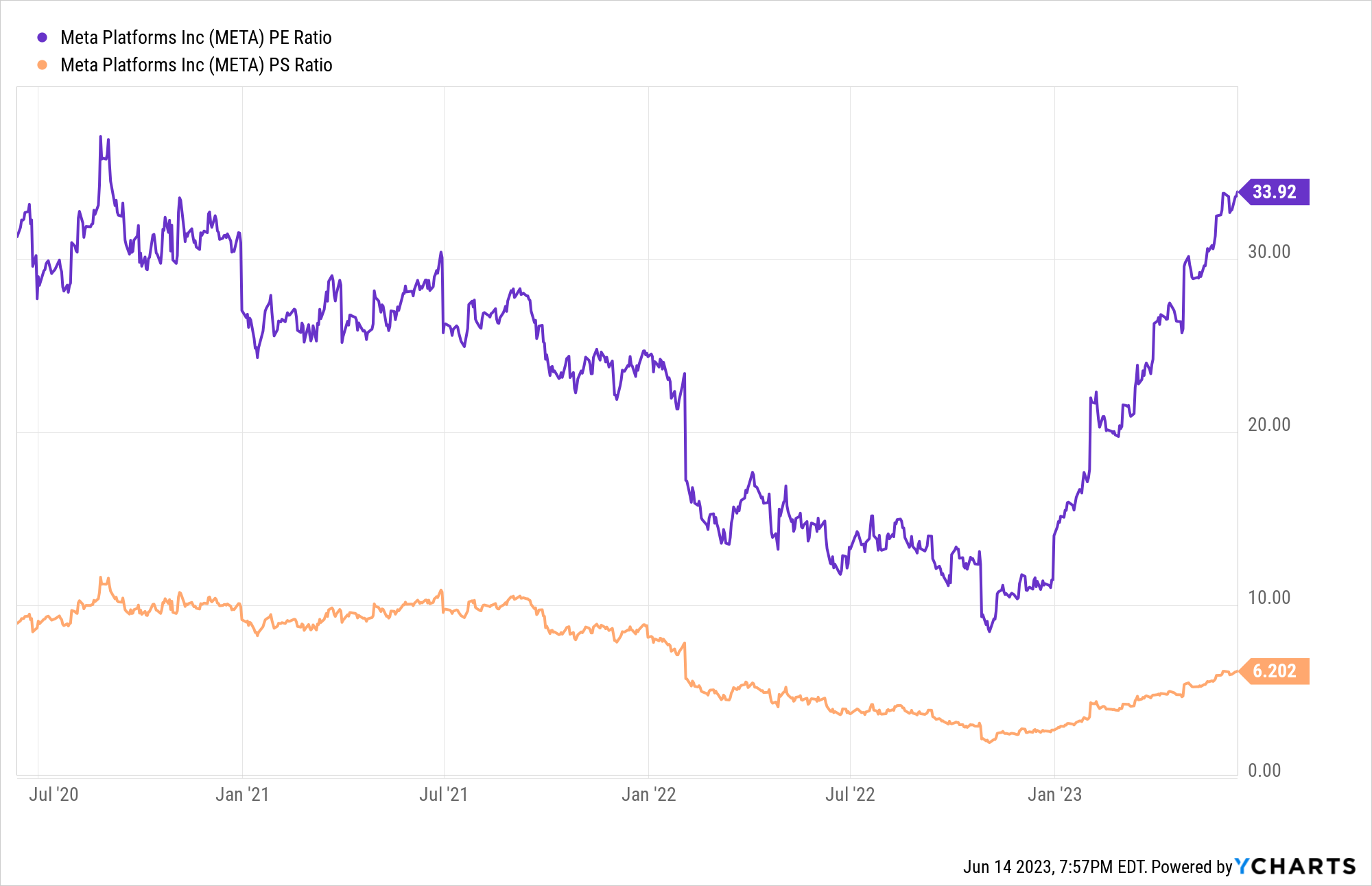

The chart below shows Meta stock has a price-to-sales ratio of 6.2 and a price-to-earnings ratio of 33.92. When looking closer at the price-to-sales ratio and comparing it to the company’s historical performance within the last decade, Meta is trading near an all-time low in terms of their PS ratio. Additionally, with a PE ratio of only 33, this is well below where the company was trading 6-7 years ago.

So what does this tell us about Meta’s valuation?

At first glance, the company’s market capitalization of roughly $700 billion looks like a very fair price when looking at its historical valuation. As well, with a current cash position of $37.44 billion and total debt of only $28.26 billion, the company has a very strong balance sheet, great profit margins, and a diversified business. Although the PE ratio – at 33 – is far above what most value investors look for in potential investment opportunities, Meta is typically lumped together with growth stocks which trade at far higher valuations.

From a strict valuation perspective, Meta looks to be trading at or near their fair value. The company’s market cap and high PE ratio mean investors expect strong growth from Meta moving forward, with a great track record of success justifying the premium valuation.

Meta’s Business Model

The ad-based business model: Would Facebook change it? | Ad Guardians Plus

While Meta’s valuation looks reasonable through analyzing common valuation metrics, trouble begins to appear when looking at the company’s current business model and future growth prospects.

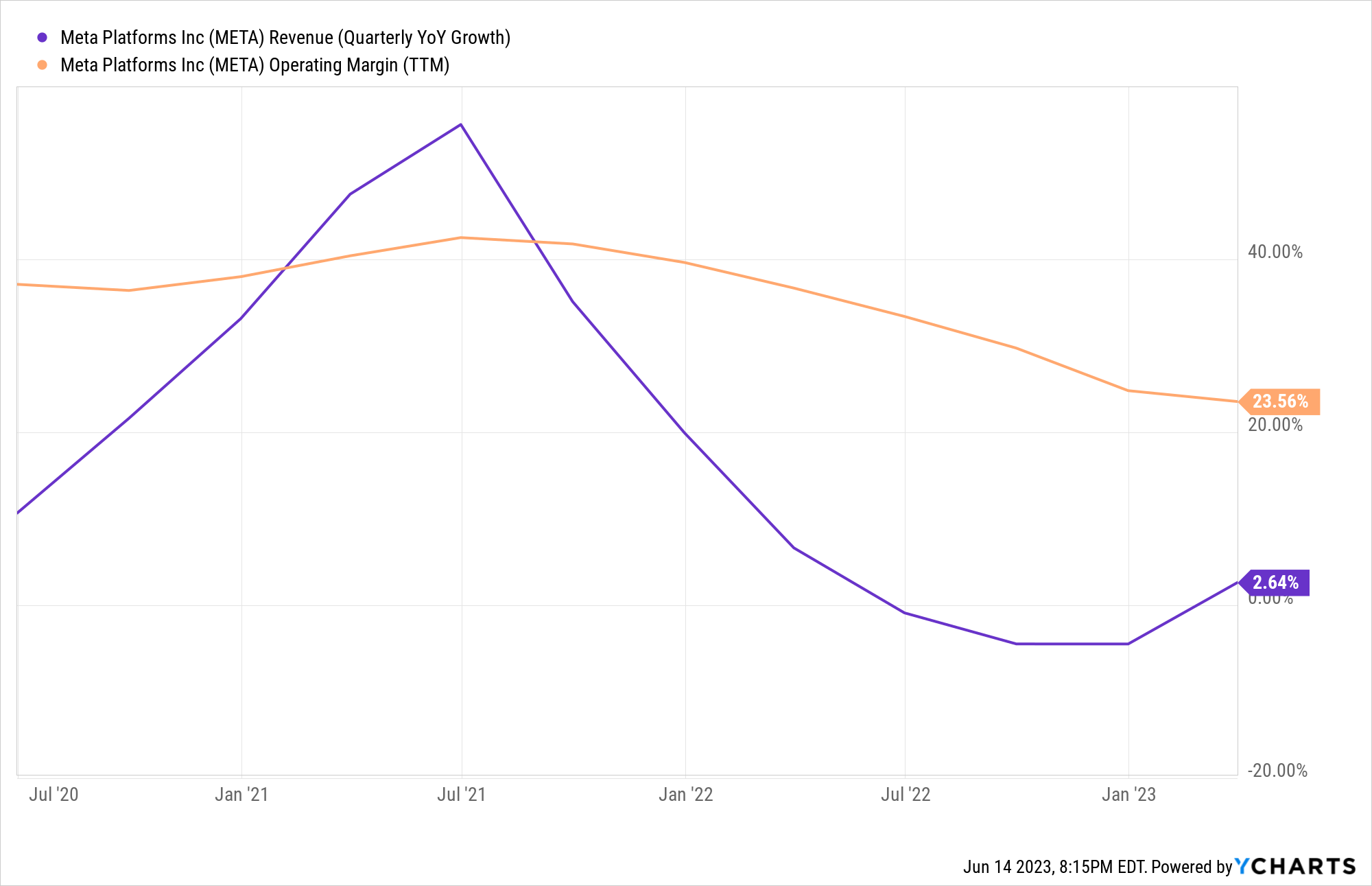

The chart below shows the company’s operating margin and quarter-over-quarter revenue growth over the last three years. Meta’s revenue growth peaked in June of 2021, and its operating margin is slowly declining.

As well, CEO Mark Zuckerberg has been what many consider to be too frivolous in spending within the company’s Reality Labs division. This has led to depressed profitability in an area that is far outside their core business.

Another reason for the decline in Meta’s financial metrics comes from the increased competition from other social media firms and advertising companies. More specifically, Meta’s apps segment, which includes Instagram, has begun to see a strong decline in monthly active users as consumers have shifted their attention to popular video app TikTok. Additionally, Meta’s digital advertising business is facing stiffer competition each day as other ad-tech firms, such as The Trade Desk, Pubmatic, and Perion, offer more customization and greater efficiency compared to Meta’s legacy systems.

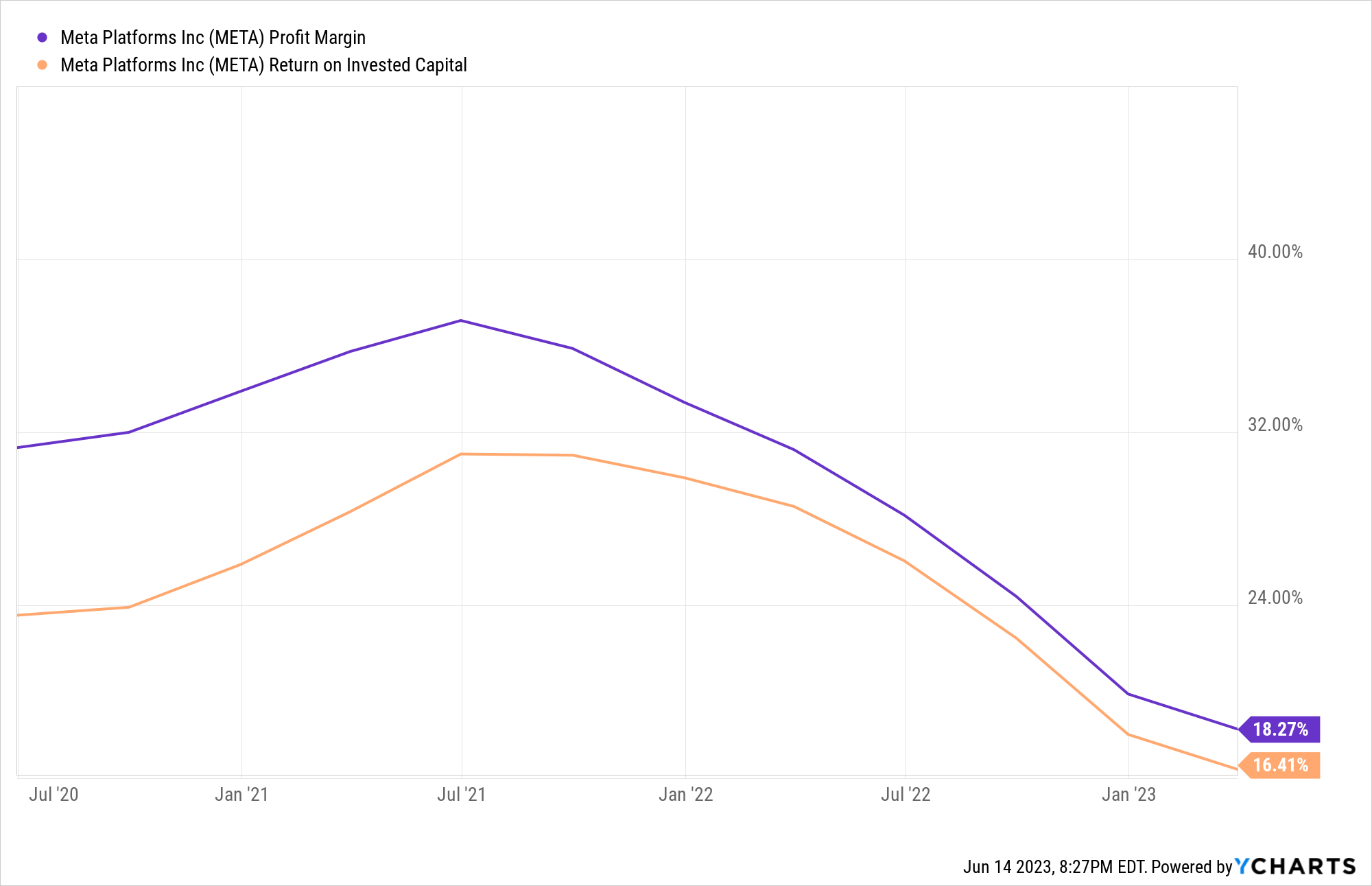

This picture of a business that is currently struggling amidst competition and a declining audience is further shown in its profit margin and return on invested capital. The chart below shows Meta’s profit margin declining from a peak of 35% in July 2021 to less than 20% today. And their return on invested capital going from a high of 37% to just 16% today.

Meta, the once uncontested advertising and social media juggernaut, has seen a strong turn of events in the last three years. This, in large part, is the main contributing factor to the company’s lower valuation. The company’s earnings have yet to reach new highs as Meta has yet to formulate a new strategy as to how it will reignite its growth. This leads us to our next section, focusing on the future of Meta from today.

Outlook From Here

It’s no secret that Meta’s success from here is reliant on virtual reality and the ability to take new technologies like VR and artificial intelligence and translate them into meaningful revenue.

Meta has seen decent progress in this regard, implementing AI technology into their advertising business and being a first mover in the development of VR headsets.

However, their Oculus VR headset now has stiff competition from Apple and has yet to be adopted by the greater population. The company’s family of apps related to social media has seen minimal innovation as of late, and it is still unclear how Meta’s VR development will mesh with social media.

A bright spot in the company’s future outlook is the potential to implement AI into operations. Meta has already shown their AI algorithms work in terms of optimizing a client’s ad spend and tailoring content to the preferences of their users. As AI develops further, there should be ample opportunity for Meta to become an AI powerhouse.

Whether or not the AI opportunity will be enough to spark new life into this beaten-down tech stock is still unclear. However, the potential, the technology, and the innovation are there. What’s unclear is if the company will be able to successfully execute as their competition surrounds them.

Conclusion

/cdn.vox-cdn.com/uploads/chorus_image/image/71852304/02b.0.jpg)

What Meta employees think about the company after layoffs, falling stock prices | Vox

Meta Platforms, with a market capitalization of $700 billion, a PE ratio of 33, and a PS of 6, currently trades at or near their intrinsic value.

However, the company’s current business model and future growth prospects present significant challenges. Increased competition from social media firms like TikTok and ad-tech companies poses a threat to Meta’s dominance in both social media and digital advertising. The decline in revenue growth, operating margin, and profitability indicators reflect the company’s struggle to adapt and maintain its position in the market.

Additionally, the success of Meta’s future hinges on its ability to effectively integrate virtual reality and artificial intelligence into its business operations. While there is potential in these technologies, it remains uncertain whether Meta can successfully execute its strategy amidst fierce competition.

Investors must carefully consider these factors before determining if Meta Platforms is undervalued or overvalued.

While the company’s valuation metrics may appear reasonable at first glance, the underlying challenges and uncertainties surrounding its business model and future growth prospects warrant caution. Long-term investors who are willing to take a chance on Meta could be handsomely rewarded should they find new catalysts for growth based on their current low valuation when compared to previous years. However, as it stands today, we’re considering Meta to be fairly valued based on a clouded future and an unclear path to future revenue growth.