Spatial computing is a rapidly growing technology that combines real-world objects and environments with virtual and digital information. It is transforming industries such as healthcare, education, and entertainment, and has the potential to change the way we interact with the world around us. As this technology becomes more ubiquitous, investors are looking to capitalize on its potential by investing in spatial computing penny stocks.

In this article, we will explore the exciting world of spatial computing and how it is creating a high-growth investment opportunity. We will provide a brief overview of what spatial computing actually means and discuss its real-world applications, including examples of how it’s being used in industries such as gaming, retail, and real estate.

Next, we’ll dive into the current state of spatial computing penny stocks and highlight some of the companies that are poised to experience significant growth in the near future. We’ll provide analysis and insights on why these stocks are a good investment opportunity and how investors can take full advantage of this emerging industry.

Finally, we’ll discuss the future of spatial computing and what investors can look forward to in the coming years. With the expectation for continued growth and expansion, spatial computing is a promising technology that has the potential to revolutionize the way we work, play, and live. And for investors, it offers an industry with untapped potential with superior investment returns.

What is Spatial Computing?

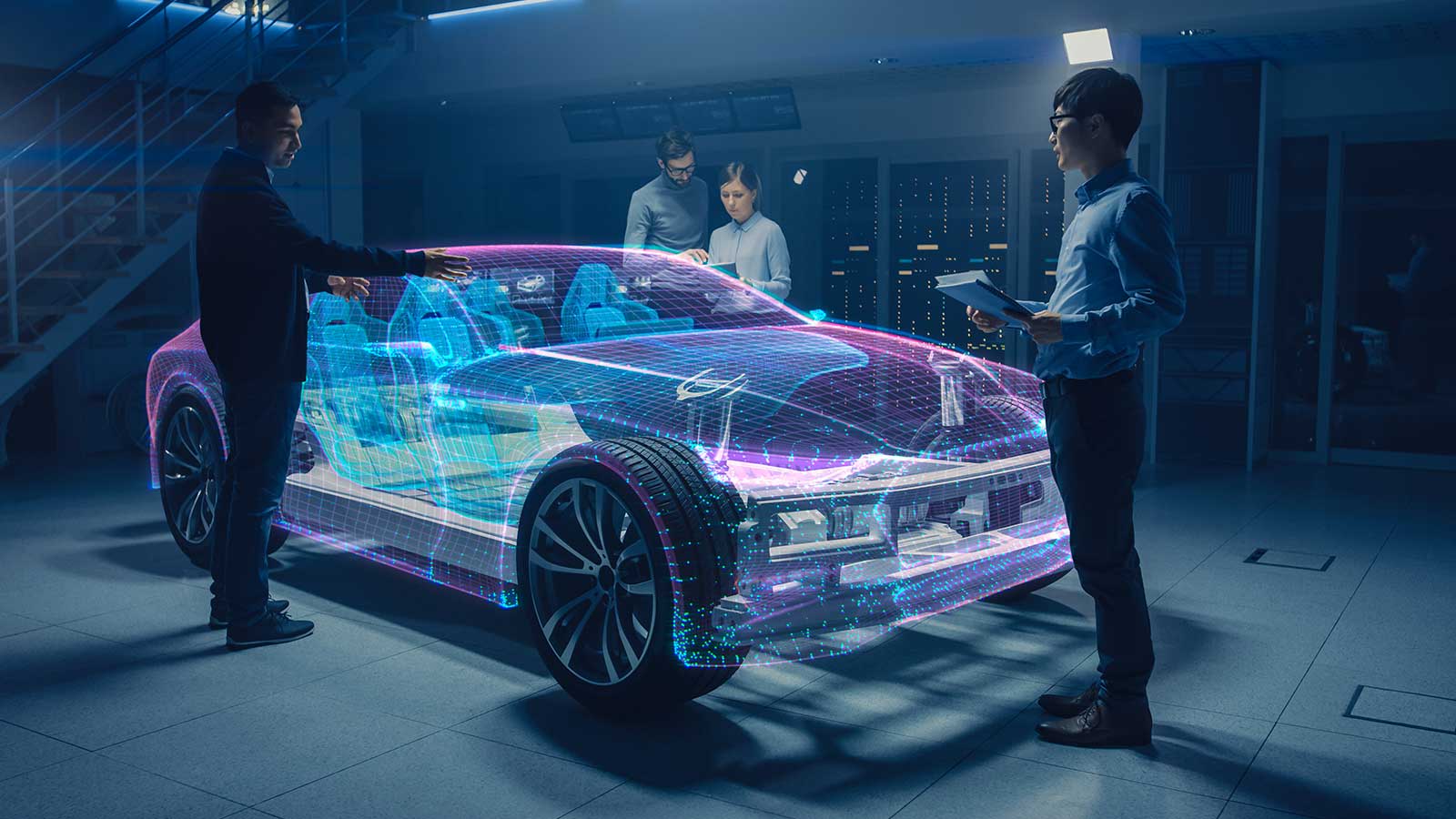

Spatial computing refers to the integration of digital information into the physical world to create immersive and interactive experiences for users. It involves using a combination of hardware, software, and data to create an environment in which users can interact with virtual objects and information in real-time.

At its core, spatial computing relies on the use of technologies such as virtual reality (VR), augmented reality (AR), artificial intelligence (AI), and mixed reality (MR) to create these experiences. These technologies allow users to interact with virtual objects and environments in a way that feels natural and intuitive, blurring the lines between the physical and digital world.

One of the key concepts driving the development of spatial computing is the idea of the Metaverse, a term used to describe a fully immersive digital environment that allows users to interact with each other and with virtual objects in a seamless and realistic way. The Metaverse is often referred to as the next evolution of the internet, where users can move beyond the limitations of traditional screens and keyboards and engage with digital content in a more natural way.

In addition, spatial computing solutions are being developed for an even wider range of industries beyond that of the Metaverse, including healthcare, education, and entertainment.

For example, in healthcare, spatial computing can be used to create virtual training simulations for medical students or to assist surgeons in complex procedures. In education, spatial computing can be used to create interactive learning experiences that allow students to explore historical sites or scientific concepts in a more immersive way. And in entertainment, spatial computing can be used to create virtual worlds and experiences that allow users to interact with their favorite characters and stories in new and exciting ways.

Examples of Real-World Spatial Computing Applications

Image Source: Ultra Leap

Spatial computing isn’t some fairytale tech that may one day happen in the real world. Rather, the technology is already being used in a variety of different industries to improve efficiency, enhance customer experiences, and create new business opportunities.

Here are some of the most recent real-world examples of how spatial computing is being used right now:

- Retail: Many retailers are using spatial computing to create immersive shopping experiences for customers. For example, Walmart has developed a virtual reality training program for its employees that allows them to learn how to manage the store more efficiently. In addition, companies like Ikea and Sephora have developed AR apps that allow customers to visualize furniture or makeup products in their own homes before making a purchase.

- Healthcare: Spatial computing is being used in healthcare to improve patient outcomes and reduce costs. Surgeons can use AR headsets to superimpose virtual images onto the patient’s body during a procedure, giving them a better view of the patient’s anatomy and reducing the risk of complications. In addition, healthcare providers are using VR to create immersive training simulations for medical professionals, allowing them to practice complex procedures in a risk-free environment.

- Real Estate: Virtual reality is also being used in the real estate industry to create virtual tours of properties, allowing potential buyers to explore a property without physically being there. Companies like Zillow and Matterport are using 3D scanning technology to create virtual models of properties that can be viewed using VR or AR headsets.

- Gaming: Spatial computing is transforming the gaming industry, allowing players to immerse themselves in fully-realized virtual worlds. Games like Pokemon Go use AR technology to superimpose virtual creatures onto the player’s real-world environment, while games like Minecraft and Roblox allow players to build and explore their own virtual worlds.

- Education: In education, spatial computing is being used to create interactive learning experiences for students. For example, Google Expeditions allows students to take virtual field trips to different parts of the world, while companies like zSpace create immersive learning experiences for STEM subjects like science and engineering.

- Manufacturing: Spatial computing/virtual reality are being used by manufacturing companies to create digital twins of their manufacturing facilities. By doing this, firms can experiment with changes, alterations, and new equipment to existing plants digitally before implementing in the real world. This helps reduce costs, increase efficiency, and limit risk of making changes to existing operations.

Overall, spatial computing is being used in a wide range of industries to create new business opportunities, improve efficiency, and enhance customer service. As the technology continues to develop, it is likely that we will see even more innovative use cases emerge in the coming years.

Spatial Computing Stocks to Buy Right Now

Investing in spatial computing stocks presents an exceptional opportunity for investors to participate in a burgeoning industry that is expected to grow significantly as the technology continues to improve.

Further, the spatial computing market is poised for substantial market growth, fueled by the rising demand for immersive and interactive experiences across a broad range of sectors and the ability for organizations to utilize this technology in new and innovative ways.

In this section, we’ll highlight five spatial computing stocks that offer compelling investment opportunities. These companies are leaders in the spatial computing domain, leveraging cutting-edge technology and exhibiting strong growth potential.

Unity Software (U)

Image Source: Market Watch

Unity Software is a leading provider of real-time 3D development software and is a pioneer in the spatial computing industry. Its proprietary platform enables creators to build and publish interactive 3D experiences, including video games, AR/VR applications, and simulations, leading to some of the world’s largest and most innovative companies (including Coca-Cola, BMW, and Google) implementing Unity’s spatial computing solutions into both operations and marketing efforts.

Additionally, Unity also has a fast-growing digital advertising segment to their business which allows customers to place ads in their digital worlds in a more natural and enticing way. In essence, Unity is quickly becoming a technology firm (that originally focused on virtual reality software only) to a tech-based media and entertainment company centered around the development and design of immersive digital worlds.

Company Facts:

Market Cap: $11.54 billion

Trailing Twelve Month Revenue: $1.39 billion

Total Debt: $2.85 billion

Total Cash Position: $1.59 billion

Matterport (MTTR)

Image Source: Matterport

Matterport specializes in spatial data capture and visualization solutions. Its proprietary technology allows users to create immersive and interactive 3D models of real-world spaces, including homes, offices, and retail spaces. These models can be used for a variety of applications, including real estate, construction, and insurance.

Matterport has established a strong foothold in the real estate industry, with its technology used by some of the largest real estate development companies in the world, including Redfin and Sotheby’s. The company has also expanded into other industries, including construction and insurance, and has a robust pipeline of new products and services in development.

Looking forward, Matterport is well-positioned to benefit from the continued growth of the spatial computing market. With its innovative technology and strong partnerships in key industries, the company is poised for further growth and expansion as company’s continue to look for new ways to reduce costs and improve the service experience of their customers. As such, Matterport represents a compelling investment opportunity as their currently serving multiple multi-billion-dollar industries who are showing a strong appetite in utilizing their spatial computing tech on a regular basis.

Company Facts:

Market Cap: $806 million

Trailing Twelve Month Revenue: $136 million

Total Debt: $1.27 million

Total Cash Position: $472 million

Snapchat (SNAP)

Image Source: Google Play

Snapchat is a well-known media platform that has made significant strides in the spatial computing space, mainly through its augmented reality technology. The company’s AR features allow users to superimpose virtual objects and animations onto the real world, creating an interactive and immersive experience unique to the social media world.

Snapchat’s AR technology has been widely adopted by users, with over 200 million users engaging with AR experiences on the platform every day. The company has also partnered with numerous brands, including Nike, to create branded AR experiences that drive engagement and brand awareness.

From a financial perspective, Snapchat has seen impressive revenue growth, however the company has yet to show operating profit on a consistent basis (this however, is a common feature in spatial computing stocks, as these firms are focused more on capturing market share than profitability).

Further, the company has a young and diverse user base, and is currently trading at only 3 times sales, making it an attractive valuation compared to some of its peers.

Snapchat’s continued investment in AR technology and its strong user base make it a compelling investment opportunity, however investors should ensure to monitor the company’s financials and look for continued improvement towards both lasting profitability and positive free-cash flow from operations.

Company Facts:

Market Cap: $16 billion

Trailing Twelve Month Revenue: $4.6 billion

Total Debt: $4.18 billion

Total Cash Position: $3.94 billion

Meta Platforms (META)

Image Source: Youtube

Meta Platforms, formerly known as Facebook, is a global leader in the digital world and has made significant strides in the spatial computing space through its virtual reality technology. The company’s Oculus VR headset has become one of the most popular VR devices on the market, with millions of units sold worldwide.

In addition to its VR hardware, Meta Platforms has also invested heavily in the development of VR and AR software, including social and gaming applications, as well as social networking virtual worlds. The company’s R&D department is spending nearly $10 billion a year on virtual reality technology, which will hopefully translate into meaningful revenue generation in the years coming.

Although Meta doesn’t meet the description of a spatial computing penny stock, the firm is still a major player in the industry and can provide great balance to a tech investors portfolio who could benefit from the reduced volatility and already profitable business model Meta currently enjoys.

Company Facts:

Market Cap: $544 billion

Trailing Twelve Month Revenue: $116.61 billion

Total Debt: $27.28 billion

Total Cash Position: $40.74 billion

Nvidia (NVDA)

Image Source: Nvidia

Nvidia is a technology company that designs and develops advanced semiconductors. The company has been at the forefront of technological innovation for several years, and its products are used in a range of applications, from gaming to artificial intelligence.

One area in which Nvidia has made significant progress is spatial computing. The company’s advanced processors and graphics cards are used to power a range of spatial computing applications, including virtual reality, augmented reality, and smart guided systems for autonomous vehicles.

Nvidia’s strong reputation in the technology industry and its commitment to research and development make it a compelling investment for investors seeking exposure to the spatial computing market.

Nvidia really is a “top of the supply chain” play on spatial computing, as almost every company on this list will rely on the microchips Nvidia produces to power their technology. Again, Nvidia’s market cap is far above that of your average penny stock, however, the importance of their tech to the industry and ability to shape spatial computing applications make it a worthwhile addition to any spatial computing portfolio.

Company Facts:

Market Cap: $671 billion

Trailing Twelve Month Revenue: $26.97 billion

Total Debt: $12 billion

Total Cash Position: $13.3 billion

What Will Spatial Computing Look Like in the Future

As we look to the future, it is clear that spatial computing will continue to play an increasingly important role in a wide range of industries. The potential applications of this technology are vast, and we are only scratching the surface of what is possible.

One area in which we can expect to see significant growth is in the field of smart guided systems for autonomous vehicles. As self-driving cars become more common, the demand for advanced spatial computing solutions will increase, providing opportunities for companies like Nvidia and Matterport to expand their market share.

In addition, we can expect to see spatial computing solutions become more prevalent in areas like the public sector, financial services, and law enforcement, all of which can benefit from the cost savings and versatility spatial computing tech has to offer.

From a stock market perspective, the spatial computing industry is also expected to experience significant growth in terms of revenue and industry adoption.

According to a recent report by Future Market Insights, the global spatial computing market revenue is projected to grow from $87.5 billion in 2021 to $544.6 billion by 2032, representing a compound annual growth rate of 18.2%.

In conclusion, the spatial computing industry represents a high-growth investment opportunity for investors seeking exposure to a dynamic and rapidly expanding market. With a range of companies, including Unity Software, Matterport, Snapchat, Meta Platforms, and Nvidia, offering proprietary technologies and innovative solutions, there are ample investment choices for investors to capitalize on right now.

As spatial computing continues to evolve and mature, it is poised to blur the lines between the real and virtual world, unlocking new opportunities for businesses and consumers alike.