Investing in stocks has long been heralded as a pathway to financial growth and prosperity.

Yet, behind the excitement of large potential returns lies a complex landscape where rewards are intertwined with risks.

Many investors fail to truly understand the market risk they are exposing their portfolios to when choosing to invest in the market. Picking risky investments, putting all your money into too few assets, or not holding enough cash can significantly alter an investor’s risk profile without them even knowing it.

That’s why today, we will be asking the question, “What exactly are the biggest types of risk when investing in the stock market?” From inflation risk, liquidity risk, and systematic risk, we will simplify what is happening when building your investment portfolio and what investors can do to limit their risk while maximizing their potential upside.

The Proper Definition of Investment Risk

Are Risk and Volatility One In the Same? | Forex Academy

As we navigate the intricacies of investment risk, it’s crucial to address a common misconception that often leads investors astray – the confusion between risk and volatility.

While these two concepts are related, they are not synonymous, and mistaking one for the other can have significant implications for your investment strategy.

Investment Risk Defined:

Investment risk refers to the uncertainty surrounding the outcomes of an investment. It encompasses a range of factors, including market fluctuations, economic conditions, industry trends, and company-specific challenges (also known as business risk).

True investment risk acknowledges the potential for both gains and losses, as the actual returns of an investment can deviate from the expected returns.

Volatility’s Role:

Volatility, on the other hand, reflects the degree of price fluctuations that an investment or the entire market experiences over a specific period. In essence, it measures the speed and magnitude of price changes. While high volatility can indicate rapid price swings – often associated with heightened emotions and uncertainty – it doesn’t necessarily mean that stocks with high volatility are higher risk.

The Volatility Misconception:

Many investors misunderstand risk by solely equating it with volatility. They assume that if an investment experiences significant price fluctuations, it must be inherently risky. This misconception can lead to reactionary decision-making, where investors might buy or sell assets based solely on short-term price movements. In reality, this approach often fails to account for the underlying fundamentals and long-term potential of an investment.

Example:

Imagine two stocks: Stock A experiences relatively consistent and modest price movements, while Stock B displays higher volatility with frequent and substantial price swings. An investor might assume that Stock B is riskier due to its higher volatility. However, upon closer examination, it becomes evident that Stock B operates in a fast-growing industry with solid financials, while Stock A operates in a stagnant sector facing declining demand. In this case, despite Stock B’s volatility, Stock A might actually carry more investment risk due to its industry challenges.

Understanding the distinction between risk and volatility is crucial to making successful investments. Recognizing that volatility is only one aspect of risk empowers you to consider a broader range of factors when evaluating potential investment opportunities.

Biggest Risks When Investing in the Stock Market

Investing in the stock market offers opportunities for building significant wealth, but it also exposes investors to an array of risks that can substantially impact their financial situation. Understanding these risks is essential for making better investments and implementing effective risk management strategies.

Let’s go over some of the most significant risks that investors face when participating in the stock market:

1. Market Risk:

Market risk, also known as systematic risk, is the risk associated with the overall performance of the stock market. Factors such as economic downturns, interest rate fluctuations, geopolitical events, and global market trends can impact all stocks collectively. Even a well-diversified portfolio can be affected by broad market movements.

2. Company-Specific Risk:

Company-specific risk includes risks that are unique to a specific company. These risks include management issues, competitive challenges, regulatory changes, product recalls, and other factors that can directly impact a company’s financial health and stock price.

3. Financial Risk:

Financial risk relates to a company’s financial structure and stability. High levels of debt, poor cash flow management, and inadequate liquidity can expose companies to financial difficulties. Such challenges can lead to stock price declines and, in extreme cases, even bankruptcy.

4. Industry Risk:

Industry risk refers to risks inherent to a particular sector. Industries can face technological disruptions, changing consumer preferences, regulatory shifts, and other industry-specific challenges that can affect the performance of all companies within that sector.

5. Liquidity Risk:

Liquidity risk arises when an investment cannot be quickly sold or converted into cash without significantly impacting its price. Stocks with low trading volumes and limited market participants can be subject to liquidity risk, potentially leading to difficulties in selling shares at desired prices.

6. Currency Risk:

For international investments, currency risk emerges due to fluctuations in exchange rates. Changes in currency values can impact the returns of investments denominated in foreign currencies, introducing an additional layer of uncertainty.

7. Political and Regulatory Risk:

Political instability, changes in government policies, and shifts in regulations can have profound effects on the business environment and, consequently, on stock prices. Investors must consider the potential impacts of political and regulatory changes on their investments.

8. Interest Rate Risk:

Interest rate risk arises from changes in current interest rates. Rising interest rates can impact borrowing costs for companies and influence consumer spending, which in turn can affect corporate earnings and stock prices.

9. Inflation Risk:

Inflation risk refers to the potential erosion of purchasing power over time due to rising inflation. Inflation can significantly erode the real value of your investment when it remains too high for an extended period of time.

10. Emotional Bias and Behavioral Risk:

Emotional biases such as fear, greed, and herd mentality can influence investment decisions. Succumbing to these biases can lead to impulsive actions that might not align with long-term investment goals.

11. Timing and Opportunity Cost Risk:

Timing risk arises from poor market timing, where investments are bought or sold at unfavorable moments. Additionally, the risk of missing out on other investment opportunities due to tying up funds in a particular investment is known as opportunity cost risk.

Do the Benefits of Investing Outweigh the Risks?

Investing in the stock market, when approached with the right perspective, can yield substantial benefits that far outweigh the uncertainties.

While it’s true that the world of investing carries inherent risks, one of the most compelling reasons to embrace these risks is the steady historical performance of market indices over time.

S&P 500 Returns | Macro Trends

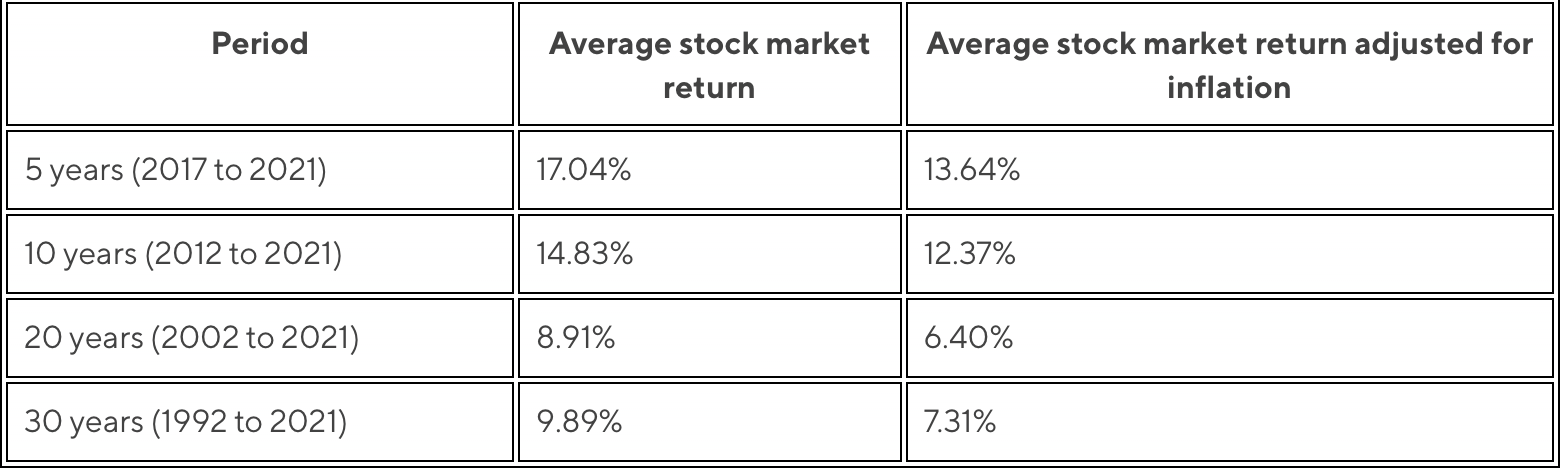

The table above shows the impressive return of the S&P 500 over 5, 10, 20, and 30-year time periods.

The stock market (as reflected in various indices like the S&P 500) has consistently demonstrated an upward trajectory, delivering returns that have historically outpaced other forms of saving or low-risk investments. This steady upward movement is a testament to the enduring resilience of well-diversified portfolios, even in the face of occasional market downturns.

Furthermore, the phenomenon of compound returns adds a powerful layer to the argument for embracing investment risk. Through reinvesting dividends and capital gains, investments can experience exponential growth over time. This compounding effect can substantially boost the value of your investments and act as a source of passive income as your investments begin to make money for you.

The enduring appeal of investing in the stock market is also evident in its role as a hedge against inflation. Inflation has the potential to erode the purchasing power of money over time, but investing in well-performing stocks can counteract this effect. The historical ability of stocks to appreciate over the long term positions them as a viable strategy for preserving and growing wealth in the face of inflationary pressures.

All told, while investment risk is a reality, it’s important to recognize that the potential benefits far outweigh the challenges.

By investing in a diversified portfolio of stocks, you’ll make losing money very unlikely. And more importantly, you gain an accessible way of generating significant investment returns that will put you on a path to financial freedom later in life.

Conclusion

In the stock market, the interplay between risk and reward defines every move. And while there is undoubtedly the potential to lose money when investing, if investors are aware of the most common risks, actively take steps to mitigate them, and are willing to accept that risk is an inevitable part of investing, we drastically improve the odds of making money over the long term.

More specifically, investing requires a calculated strategy, which combines research, diversification, and a patient approach.

Diversification, through investing in a basket of different stocks or mutual funds, mitigates risk while benefitting from the collective strength of different sectors. And compounding interest amplifies your returns even more, making patient investors much more likely to succeed and build a significant retirement savings account with enough time.

So, rather than worry about all the risks associated with the stock market, instead, focus on the benefits that investing brings so you can build a properly constructed portfolio that will hold up against any and all market conditions.

Disclosure/Disclaimer:

We are not brokers, investment, or financial advisers; you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Edge Investments and its owners currently hold shares in Braxia stock and are compensated by Braxia for Investor Relations Services. Edge Investments and its owners reserve the right to buy and sell shares in Braxia without further notice, which may impact the share price. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. The company provided information in this profile, extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright ©️ 2023 Edge Investments, All rights reserved.