How Intelligent Machines Are Reshaping Investing | Forbes

Investors are always on the lookout for the new technology, system, or strategy that promises the opportunity to make more money.

So naturally, asset managers and retail investors alike have begun to utilize the revolutionary technology of machine learning (ML) to better manage risk, find hidden patterns, and use complex algorithms to enhance investment outcomes.

Traditional investment strategies that once relied solely on intuition and human experience are making way for more sophisticated and data-driven approaches. However, how exactly ML algorithms are being used in the investment world today is still largely unclear.

With this in mind, today we will explain the fundamental principles of machine learning, explore how it is reshaping the investment landscape, and what the future of ML in investing will look like.

Machine Learning Simplified

Machine Learning Simplified | LinkedIn

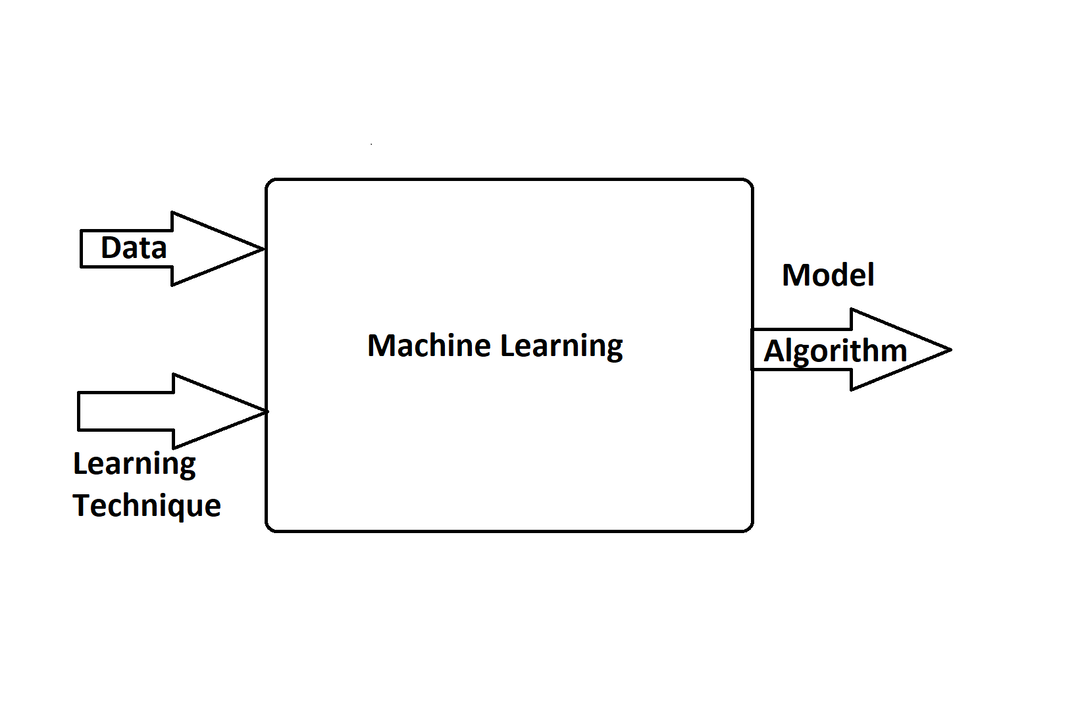

Machine learning is a subfield of artificial intelligence that focuses on developing algorithms and statistical models capable of allowing computer systems to learn from data and improve their performance over time without explicit programming.

In essence, it is a process by which machines learn from past experiences or historical data to make predictions or decisions in new situations.

At the core of machine learning lies the idea of pattern recognition and statistical analysis. Instead of relying on predefined rules or human-coded instructions, machine learning systems automatically identify patterns and relationships within the data they are exposed to.

By recognizing these patterns, they can then generalize and make predictions or take action in new, unseen scenarios.

The process by which machine learning algorithms operate can be broadly categorized into three different types:

Supervised Learning:

In supervised learning, the algorithm will get a variety of different examples with labels telling the computer what is supposed to happen. (Think of it like like giving the computer training wheels to help it learn.)

Through using this initial data set, the algorithm’s job is to then figure out a way to predict the right answers for new scenarios it hasn’t seen before seen.

This method of ML is often used to predict market movements based off previous market data.

Unsupervised Learning:

In unsupervised learning, the algorithm is given an unlabeled dataset and is tasked with finding patterns and structures within the data.

The objective is to discover relationships or groupings in the data without specific guidance. Unsupervised learning is frequently used for clustering similar data points together or reducing the complexity of the data.

Reinforcement Learning:

Reinforcement learning involves training a machine learning model to interact with an environment and learn from feedback in the form of rewards or penalties. The models objective is to maximize the amount of rewards it receives over time by taking the desired actions in different environments.

Overall, and especially in the context of investing, machine learning algorithms are incredibly powerful at analyzing vast quantities of financial data, historical market trends, economic indicators, and even unstructured data like news sentiment to uncover valuable insights to help influence investment decisions.

By harnessing the potential of machine learning, investors can gain a significant competitive edge, through identifying hidden opportunities, managing risk more effectively, and navigating the complexities of modern financial markets with increased precision and adaptability.

How is Machine Learning Used in the Investment World?

How to invest in the artificial intelligence rally | Wealth Professional

AI and machine learning has expanded to nearly every corner of the investment world, transforming traditional investment approaches into data-driven and sophisticated strategies.

And investors who want to ensure they keep up with the most cutting edge investment approaches and techniques must ensure they understand how machine learning is being used in the stock market today.

With this in mind, we have highlighted the 5 most prominent areas of investing that is being re-shaped through ML models:

Predictive Modeling

One of the primary applications of machine learning in investing is predictive modeling and building quantitative investment models.

By analyzing historical market data and identifying hidden patterns, investment managers can leverage machine learning algorithms to forecast future market trends with a level of accuracy that surpasses human intuition.

Algorithmic Trading

In algorithmic trading, machine learning plays a pivotal role in creating automated trading systems that can execute trades at incredible speeds and volumes. These algorithms can process vast amounts of alternative data, including historical price movements, order book data, and macroeconomic indicators, to make split-second decisions.

By employing machine learning techniques, such as time series analysis and pattern recognition, algorithmic trading models can identify new opportunities, exploit market inefficiencies, and manage risk more efficiently.

Portfolio Optimization

Portfolio optimization is another area where machine learning has proven its worth. By analyzing the historical performance of various assets and their correlations, machine learning algorithms can design optimal portfolios that balance risk and return.

These models can also adapt to changing market conditions and rebalance portfolios in real-time, ensuring that investments remain aligned with predefined objectives.

Sentiment Analysis & Risk Management

Sentiment analysis, powered by natural language processing (NLP) algorithms, is utilized to gauge public sentiment and news sentiments related to specific stocks, industries, or markets.

By analyzing news articles, social media posts, and financial reports, machine learning models can assess the sentiment surrounding certain assets, influencing investor behavior and market movements.

Risk management is also critical in finance, and machine learning aids in building robust risk models. By analyzing historical market volatility, correlations, and macroeconomic factors, machine learning algorithms can identify potential risks and model stress tests to evaluate portfolio resilience under adverse scenarios.

Fraud Detection

Finally, machine learning is being leveraged for fraud detection in financial markets. Detecting anomalies in market behaviors, unusual trading patterns, and potential insider trading can help safeguard against fraudulent activities and ensure fair and transparent markets.

All told, the integration of machine learning in the investment world is a transformative force. As the availability of data continues to grow and computer power improves, machine learning will further refine its predictive capabilities and solidify its position as an invaluable tool for investors seeking to navigate the complexities of today’s dynamic and ever-evolving financial landscape.

What Will the Future of Machine Learning in Investing Look Like?

The future of machine learning in investing holds tremendous promise, fueled by continuous advancements in technology, data availability, and algorithmic sophistication.

As we look ahead, several key trends and developments are poised to shape the industry of investing and revolutionize how financial decisions are made:

- Enhanced Predictive Power: The ability for MI algorithms to find meaningful patterns in extensive data sources will continue to improve, yielding more accurate and timely market predictions.

- Explainable AI: Transparency in AI-driven decisions will undoubtably rise, which will require the development of clear explanations for model predictions to aid investor understanding.

- Human-AI Synergy: Human expertise and machine learning insights will become increasingly intertwined, enabling well-informed investment choices that leverage domain knowledge and data-driven insights.

- Reinforcement Learning in Portfolios: Reinforcement learning will optimize portfolios dynamically, learning from market feedback to maximize returns and manage risk effectively.

- Ethics and Regulation: Ethical and regulatory concerns will grow, emphasizing fairness, transparency, and bias prevention in algorithmic models to build trust.

- Democratization of Investing: Personalized wealth management via robo-advisors and AI-driven platforms will offer accessible and cost-effective investment strategies to a broader range of investors.

- Continuous Model Refinement: Investment firms will prioritize ongoing research to keep machine learning models effective and up-to-date in ever-changing market conditions.

- Cross-Asset and Global Reach: Machine learning’s scope will extend beyond traditional assets and borders, with integration into various investment vehicles and global markets.

- Responsible AI for Sustainability: Machine learning will aid in analyzing ESG data, helping investors make socially conscious decisions alongside financial goals.

As this revolutionary technology continues to mature, the asset management industry will gain a new level of insight for their clients, delivering better outcomes and navigate the complexities of global financial markets with heightened precision and foresight.

However, with the incredible achievements machine learning offers to investors, these advancements also come with the responsibility to address ethical, regulatory, and transparency considerations to ensure the technology’s responsible and sustainable integration into the investment industry.

Key Takeaway

How Can Financial Institutions Prepare for AI Risks? | Wharton

Machine learning is revolutionizing how asset management firms and the entire financial industry drive returns for their clients, offering investors powerful tools to analyze vast amounts of data, predict market trends, optimize portfolios, and make data-driven decisions. This transformative technology is reshaping the traditional investment process, enabling the creation of sophisticated algorithms for trading, risk management, and sentiment analysis.

Looking to the future, the potential of machine learning to revolutionize how investment management is done is enormous. Enhanced predictive capabilities, data science, explainable AI, and the integration of human expertise with AI will drive advancements.

Reinforcement learning will play a large role in portfolio management, while ethical and regulatory considerations will become even more important than in previous years. The democratization of investing and the continuous refinement of machine learning models will bring personalized investment solutions to a broader range of investors.

The responsible and sustainable integration of machine learning in investing will be vital for building trust and mitigating potential risks. As the technology continues to evolve, asset managers that embrace machine learning and adapt to these changing dynamics will be poised to deliver better outcomes for their clients through greatly improved risk adjusted investment returns.

With machine learning as a powerful ally, investors can unlock incredibly valuable insights and confidently navigate the path from data to dollars in this new world of modern investing.

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, and extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your own research.

Copyright © 2023 Edge Investments, All rights reserved.