The metaverse is one of the most fascinating and polarizing industries in the stock market today.

On one side, you have some on Wall Street who argue that the “Metaverse is Dead!”

And on the other, those who believe that it will change the foundation of reality as we know it.

Regardless, it is clear that the metaverse’s potential knows no limits, and if successful, it will transform our lives in ways that we cannot fathom.

But be careful, not all metaverse stocks are created equal.

The Best Metaverse Penny Stocks to Buy Aren’t Penny Stocks at All

Finding a great Metaverse penny stock may seem tempting right now, but we think they’re too risky to invest in at the moment. Therefore, it is best to stick with large established companies to make the most of this exciting investment opportunity.

In this article, we’ll explore this captivating market and provide you with actionable information to make informed investment decisions.

If you are an investor seeking to enhance your portfolio with emerging opportunities in the stock market, then continue reading below.

What Are Metaverse Stocks?

Before we jump into the best metaverse stocks to buy, let’s first understand what the metaverse is and what metaverse stocks are.

The metaverse refers to a virtual world where users can interact with other participants and artificial intelligence in a computer-generated environment.

It is a collectively built, virtual shared space that encompasses a wide range of digital experiences, including virtual reality (VR), augmented reality (AR), social platforms, gaming, virtual commerce, and more.

The easiest way to think of it is like a three-dimensional digital world (an open-world video game) where you can explore, interact, and create anything in your own virtual universe.

Therefore, the metaverse sector includes any business that is creating or operating a company using this next-generation technology.

A few examples of businesses in this industry are Alpha Metaverse Technologies (formerly Alpha Esports Tech Inc), a digital entertainment company, and augmented reality education platforms like Nytra or Catchy Words, which are reinventing the way we educate children.

How to Analyze Metaverse Stocks

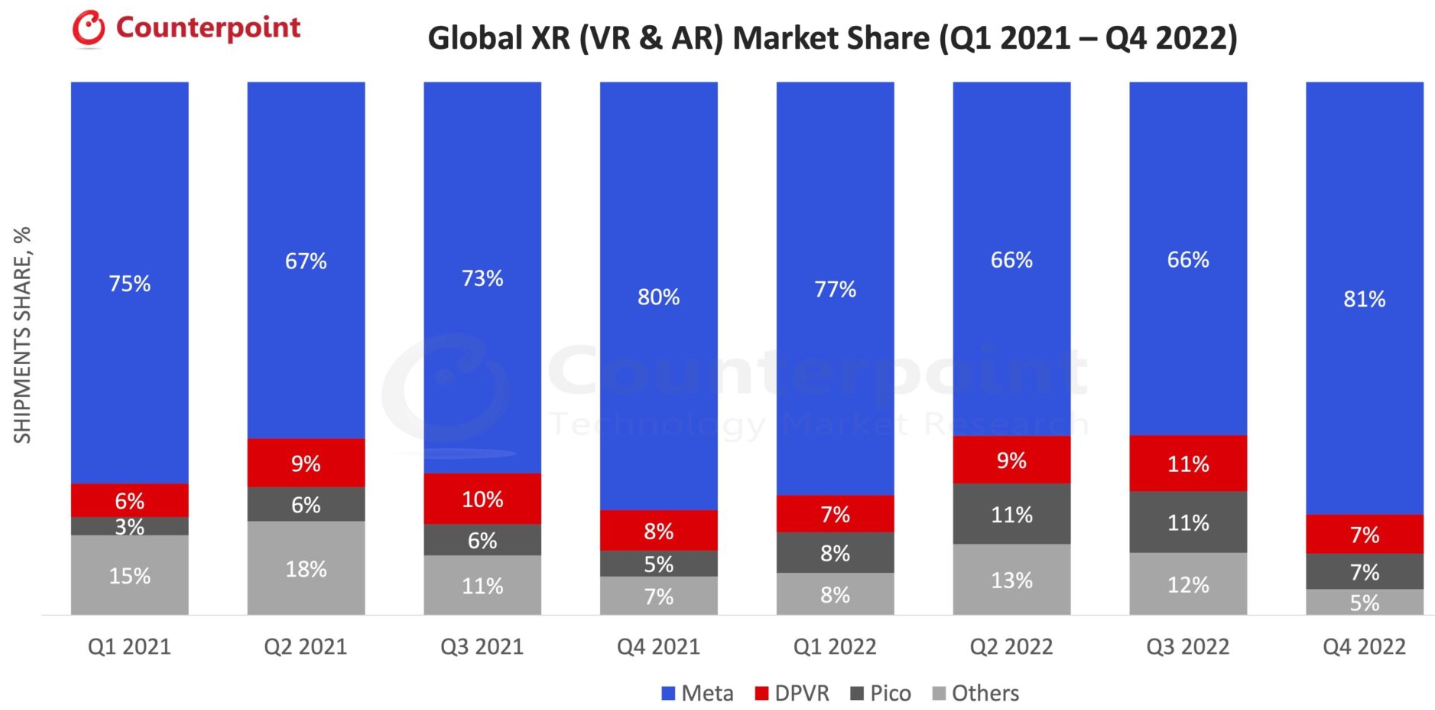

Image courtesy of Counterpoint Research

The fate of the metaverse has yet to be determined.

With so much uncertainty in a market like this, the key is to find profitable and predictable businesses with many different routes to success.

It also means that it is likely too risky to invest in smaller companies like hot metaverse penny stocks for the time being.

In most instances, this means investing in a business that has exposure to the metaverse but may be invested in other projects and revenue streams as well.

Take Meta Platforms, for example, the posterchild of the metaverse.

Meta is heavily invested in the metaverse through its Reality Labs segment, which is developing virtual reality (VR) and augmented reality (AR) technologies, such as its Meta Quest VR headsets.

While the company successfully dominates the Global XR Market with an 81% share of the market as of Q4 2022, Reality Labs lost over $13.7 billion in 2022 alone, making it quite a costly endeavor overall.

Of course, the investments they are making today are expected to strengthen the value of Meta’s business over the long run, with even Zuckerberg stating that it could be a decade before the business starts to truly make money.

But in the meantime, the company remains highly profitable in other segments (its family of apps), which have allowed it to rake in over $23.2 billion in profits in 2022.

These high-margin, cash-flow-producing services are what allow Meta to pursue such ambitious projects in such a highly uncertain marketplace.

And that is the key.

For now, an investor should be analyzing technology stocks based on their ability to produce cash and the amount of cash they have available.

Since this technology race is burning capital quite quickly, at this time, you will want to find a business that can sustain itself for many years into the future.

The best way to do that is by investing in something that can organically produce cash no matter what market environment they are in.

As such, this eliminates many metaverse companies right off the bat, leaving only those that have the capital and customers to survive and thrive over the next ten-plus years.

So, with that being said, here are the five best metaverse stocks to add to your watchlist.

The Best Metaverse Stocks to Buy

5. Tencent (TCEHY)

Market Cap: $435.100 Billion

Tencent is a money-making machine.

The Chinese tech giant is a master at creating and copying high-value opportunities and incorporating them into its digital ecosystem.

Some of its biggest successes include the social media platform WeChat, which has over 1.3 billion users, and Tencent Games, its video game and mobile gaming segment, which owns 15% of the world’s total gaming revenue (#1 in the world).

From a metaverse standpoint, its gaming business, combined with its cloud computing, artificial intelligence, e-commerce, social media, and video game engine market, put Tencent in quite a unique and advantageous position.

With an all-encompassing digital ecosystem, the company can essentially create its own metaverse without the need for any additional players while constantly providing its customers with new experiences.

And given that it owns a stake in over 700 businesses, including Epic Games, developers of Fortnight and Unreal Engine, LinkedIn, and others, the company is a perpetually compounding machine that is likely to be one of the key players in this market for many years to come.

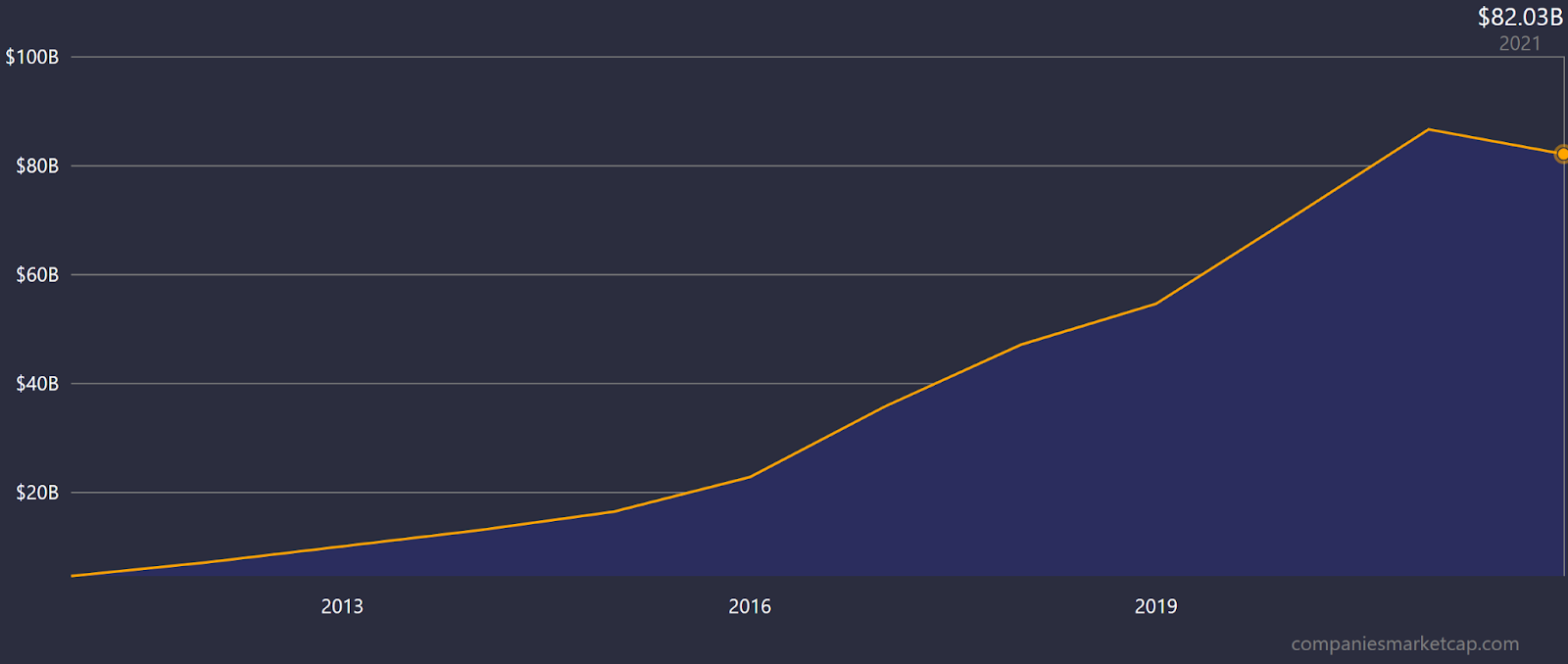

In 2022, Tencent achieved revenues of $82.03 billion, net profits of $26.98, and free cash flows of $13.65.

The company operates with 33.95% profit margins and a 22.74% return on equity.

4. Adobe (ADBE)

Market Cap: $170.370 Billion

Next up is Adobe, another fantastic company poised to benefit from the many opportunities created by the metaverse.

Broadly speaking, Adobe is a software development company that offers a wide range of applications and services that make it easier for professionals and individuals to create, manage and deliver digital content.

Unsurprisingly, many of these software tools fit well within the metaverse market, including Adobe Substance 3D and Adobe Aero, which enable designers to create and manipulate 3D assets in a hyper-realistic and immersive environment.

What’s more, Adobe’s Creative Cloud and Experience Cloud make it so that users can effectively collaborate, distribute, and store projects in an efficient manner and across multiple platforms simultaneously.

Lastly, Adobe is taking steps to integrate its technologies on existing metaverse platforms, creating a seamless experience no matter what system you are on.

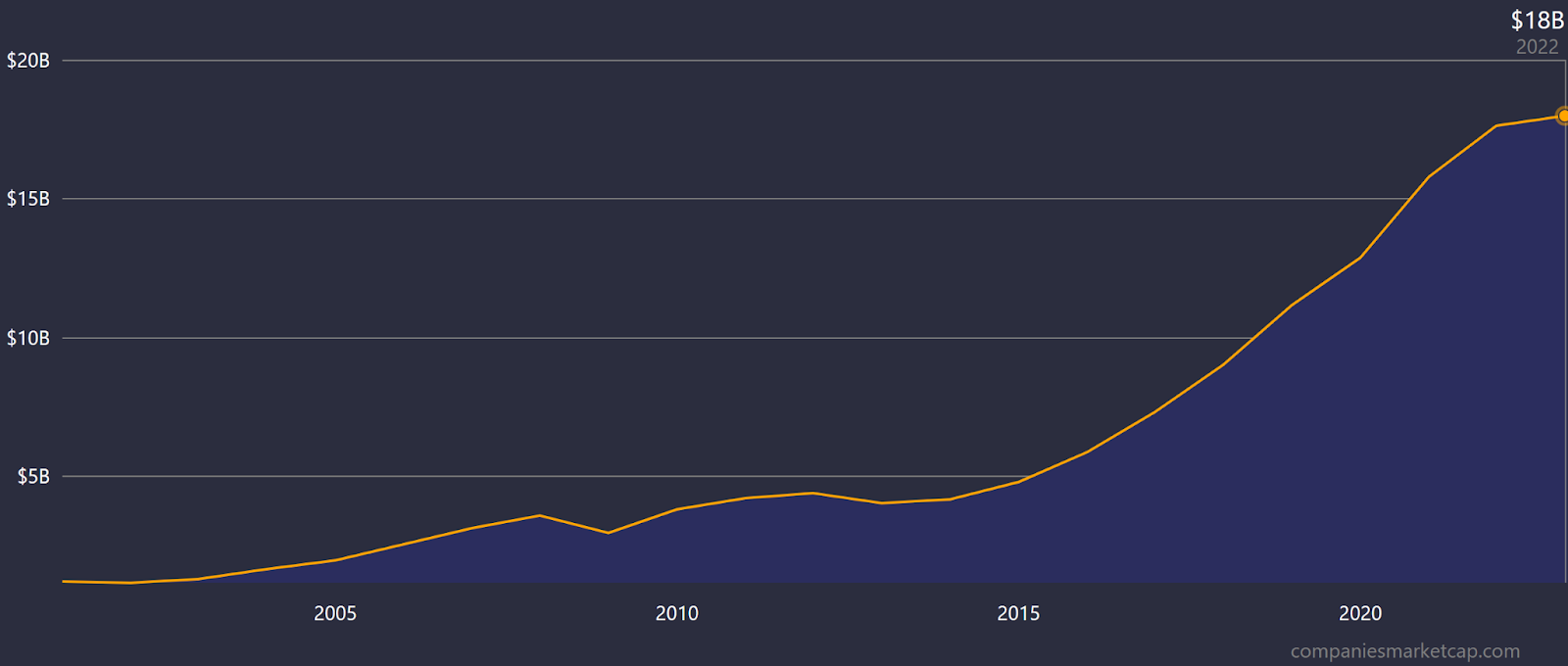

Overall, this business model has been highly successful, given that it operates with profit margins of 26.32% and an ROE of 33.86%.

Moreover, the company was able to generate revenues of $17.61 billion, net profits of $4.76 billion, and free cash flow of $7.40 billion.

If you are searching for a high-margin business with multiple products catered to the metaverse, you can’t go wrong with Adobe.

3. Nvidia (NVDA)

Market Cap: $746.654 Billion

Have you ever wondered why computer graphics can operate at such a high quality compared to video game consoles?

It probably has to do with Nvidia, a master at building graphics processing units (GPUs) and other related hardware and software solutions.

Nvidia’s focus on developing advanced graphics, artificial intelligence, and high-performance computing technologies has allowed it to build a strong reputation with its customers.

As of Q4 2022, Nvidia owned 17% of the global GPU market and is quickly becoming a key player in the AI and machine learning markets as well.

Through its products, Nvidia is in a position to create high-quality, realistic graphics that can be used in metaverse devices like virtual reality and augmented reality headsets.

This, coupled with its expertise in AI, enable it to create intelligent and interactive elements, such as virtual characters who seem astoundingly real.

Beyond that, the company also offers its Omniverse Platform and CloudXR streaming platform, which allow for real-time development and functionality across any platform at any moment.

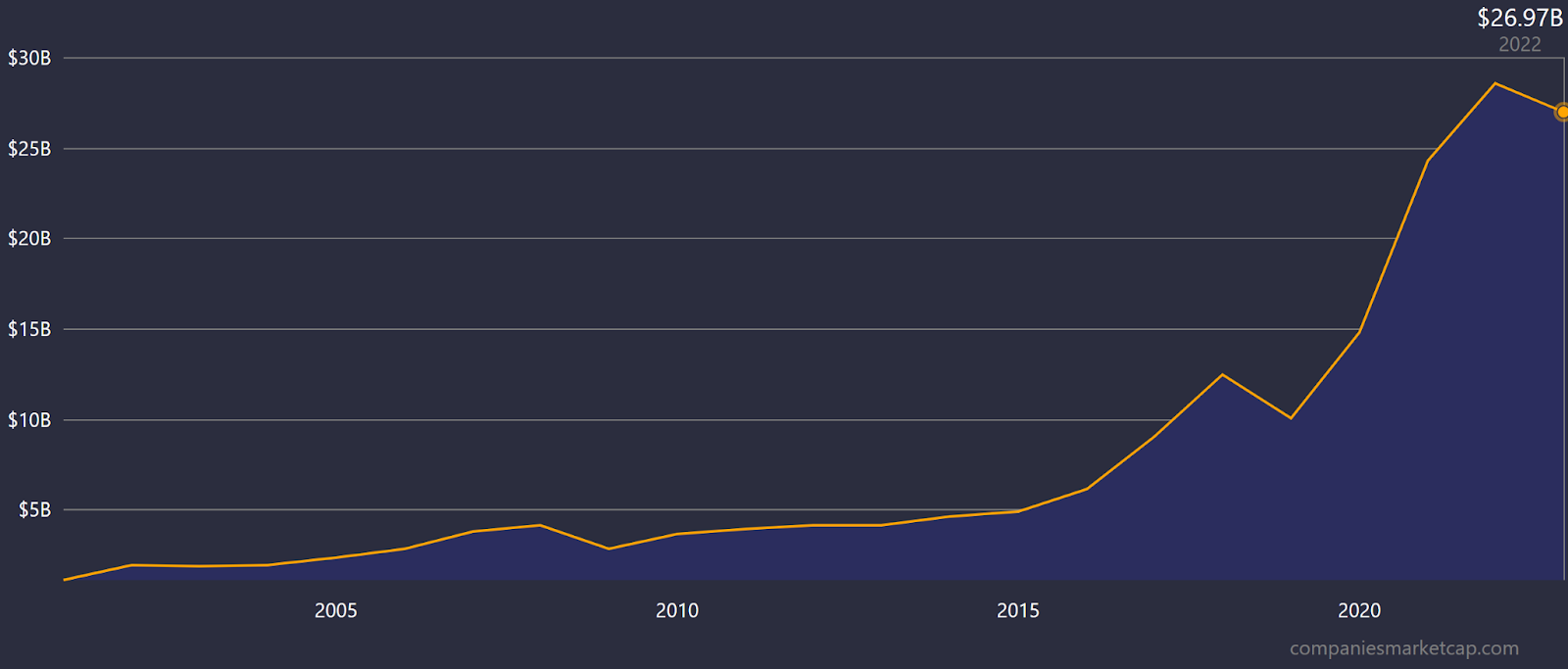

While Nvidia is certainly impressive, one thing to keep in mind is that the stock currently trades at a P/E north of 170.

Though it is expected to continue growing and strengthening its moat in the near future, it has hard to justify investing in it at its current price point.

That being said, the company is as dominant as ever, raking in $26.97 billion in revenue, $4.37 billion in profits, and $3.81 billion in free cash flow, as of 2022.

2. Qualcomm (QCOM)

Market Cap: $121.180 Billion

While Meta may be the poster child for the metaverse, it is Qualcomm’s Snapdragon processors that allow for Meta’s Meta Quest XR headsets to come to life.

These processors feature advanced graphics rendering, AI capabilities, and efficient power consumption, needed to effectively operate these intricate XR devices.

Not only that, but its semiconductors and 5G technologies are used in a variety of smartphones as well, putting it at the forefront of two of the most advanced hardware markets to date.

In Q1 2023, Qualcomm made $7.94 billion alone from its QCT chips segment, thus further demonstrating the strong demand for its products.

And with a consumer base that includes names like Apple and Meta, the company is in an excellent position to innovate and develop cutting-edge technology alongside some of the best businesses in the world.

But it doesn’t stop there.

Financially speaking, Qualcomm is one of the most fundamentally sound companies in the world.

With profit margins of 25.67% and a return on equity of 64.36%, it is generating capital that is uncharacteristic of hardware manufacturing businesses.

To put in perspective how much value it creates, Qualcomm produced $44.20 billion in revenues and $12.94 billion in net income, in 2022.

And although it does operate with more debt than most metaverse stocks on this list, with $15.99 billion in total debt, Qualcomm more than makes up for it by achieving $8.06 billion in free cash flow at an annual rate.

All-in-all, this is a top-notch pick with multiple tailwinds supporting its growth.

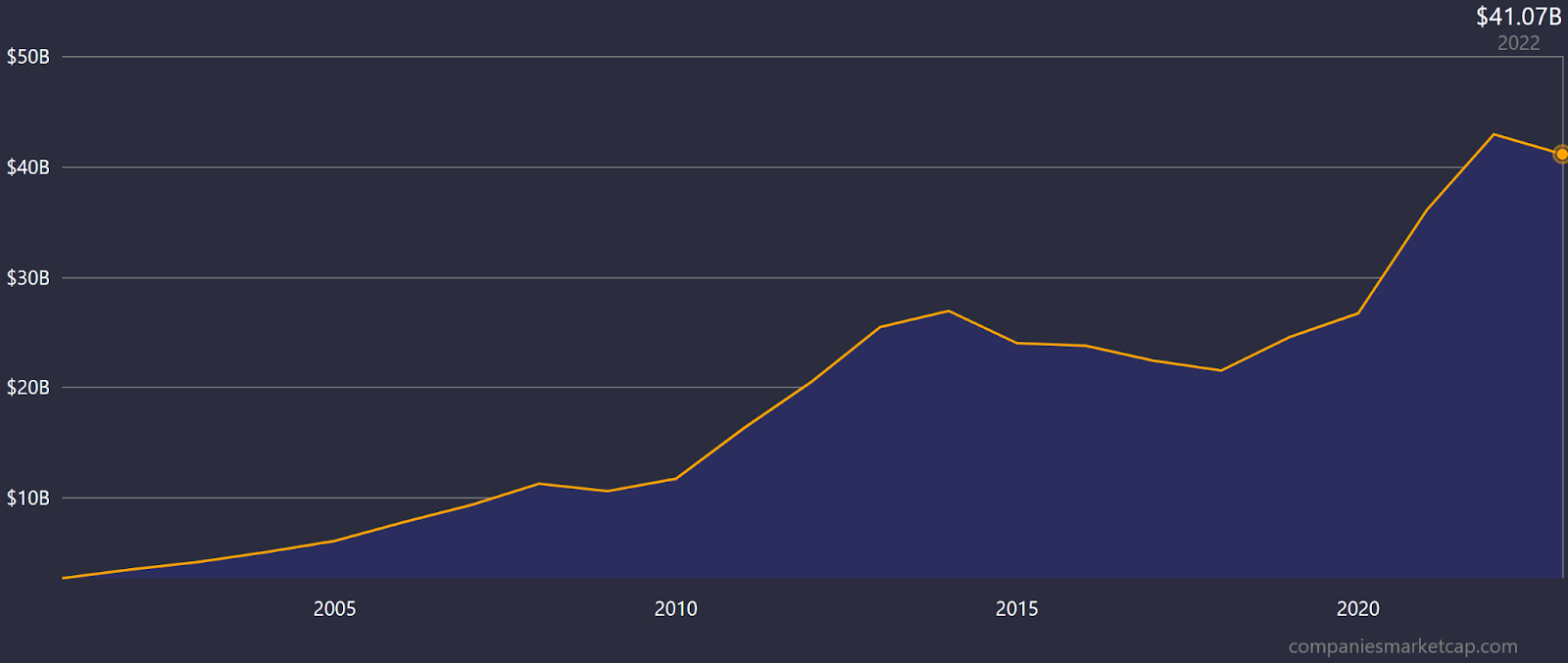

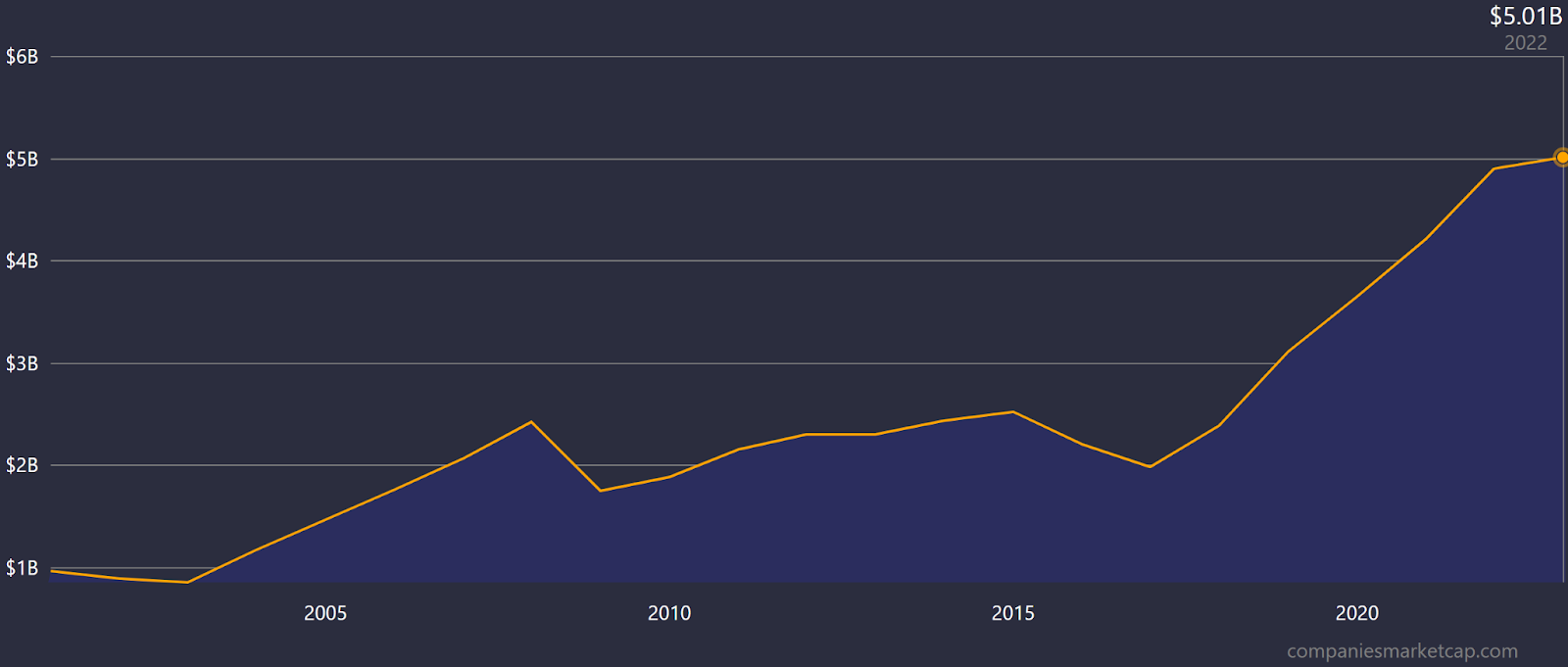

1. Autodesk (ADSK)

Market Cap: $42.151 Billion

Perhaps the most surprising company on our list, Autodesk is another fundamentally strong business with a favorable position that will benefit from the development of the metaverse.

Essentially, Autodesk is a software company specializing in providing design, engineering and entertainment software solutions.

Its products are tailored for architecture, engineering, construction, manufacturing, media, and entertainment professionals who use its tools to create and visualize 2D and 3D designs, animations, simulations, and virtual environments.

For example, Autodesk’s VRED, Maya, and 3ds Max software tools are widely used for 3D design, modeling, simulations, and animations that enable developers to create expansive digital worlds.

Also, the company offers customers a cloud-based solution, Autodesk Platform Services, that promotes collaboration and interoperability amongst designers thus making it an all-encompassing metaverse development platform.

From a financial standpoint, Autodesk is quite promising as well given that it was able to produce $5.01 billion in revenues, $823 million in net profits, and $2.03 billion in free cash flow in 2022.

Moreover, the company achieved a return on equity of 82.55% over the trailing twelve months, with profit margins of 16.44%.

One thing to keep in mind is that Autodesk’s stock currently trades at a P/E of 52.09.

While the company is bound to continue growing due to its strong position in the marketplace, it is difficult to tell whether this current valuation is sustainable over the long term.

Regardless, it is an excellent business that is worth keeping on your watchlist.

What Does the Future of Metaverse Stocks Look Like?

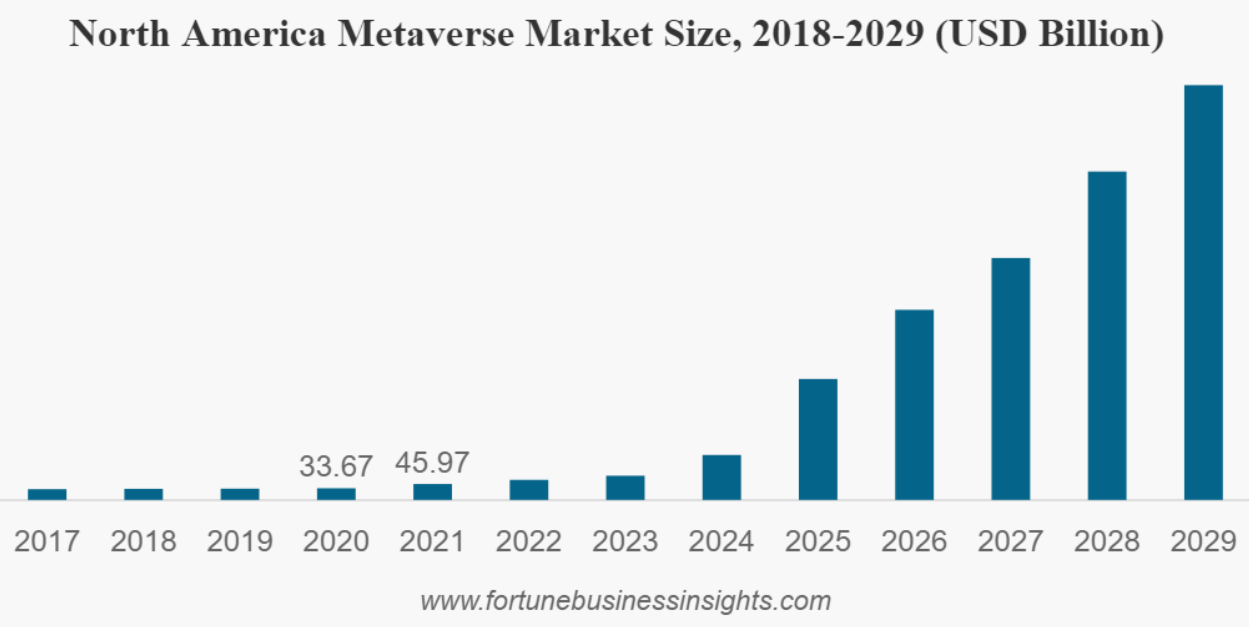

Image courtesy of Fortune Business Insights

The metaverse is not going anywhere.

As society continues to evolve into a more digital-based economy, integrating artificial intelligence, IoT, and software into almost every aspect of our lives, the quality and capabilities of metaverse offerings will only grow stronger.

That being said, it is difficult to predict when it will be universally adopted and what exactly it will do to transform the world as we know it.

And, much to the dismay of wishful thinkers, it appears that it is likely to take longer than one might expect.

Therefore, the best thing an investor can do is to buy metaverse stocks that are already creating value and generating capital.

In doing so, not only will you benefit from its current money-making endeavors, but you will also capitalize on any new opportunities that come about because of the metaverse.

Ultimately, our first goal as investors is to not lose money, then to own fundamentally sound businesses that expose us to the best opportunities that the market has to offer.

If we do that, it is nearly impossible to fail.

Final Thoughts: Are Metaverse Stocks Worth It

In short, yes they are.

With the metaverse exposed to many of the cutting-edge technologies that drive our world today, including artificial intelligence, semiconductors, e-commerce, cloud gaming, and more, it is clear that it will play some role in civilizations’ future.

But as we’ve mentioned throughout this article, it ultimately comes down to the metaverse stocks you invest in.

If you purchase fledgling early-stage companies, like a metaverse penny stock, it is too difficult to know how long it will take for the business to become profitable and whether it can sustain itself over the next decade.

Instead, the easiest, safest, and most sure-fire way to capitalize on the metaverse industry is to buy businesses that are leveraging metaverse technologies, while also running profitable endeavors elsewhere.

This way, you can still make the most of this exciting market, without jeopardizing your hard-earned money in the process.

Overall, metaverse stocks are worth it, but it comes down to the business you buy and the price you pay.